The Annually Budget Planner Excel Template for Families helps organize and track household income and expenses efficiently throughout the year. This template provides clear categories and customizable fields to monitor savings, bills, and discretionary spending, ensuring better financial control. Regularly updating the planner empowers families to make informed decisions and achieve their financial goals.

Annual Household Budget Planner with Expense Tracker

An Annual Household Budget Planner typically contains detailed categories for tracking income and various expenses over the year. It helps individuals or families manage their finances by organizing monthly budgets and comparing actual spending against planned amounts.

The document usually includes sections for fixed expenses, variable costs, savings goals, and unexpected expenditures, making it an essential tool for financial planning. To maximize effectiveness, it is important to regularly update the tracker and review spending patterns to adjust the budget accordingly.

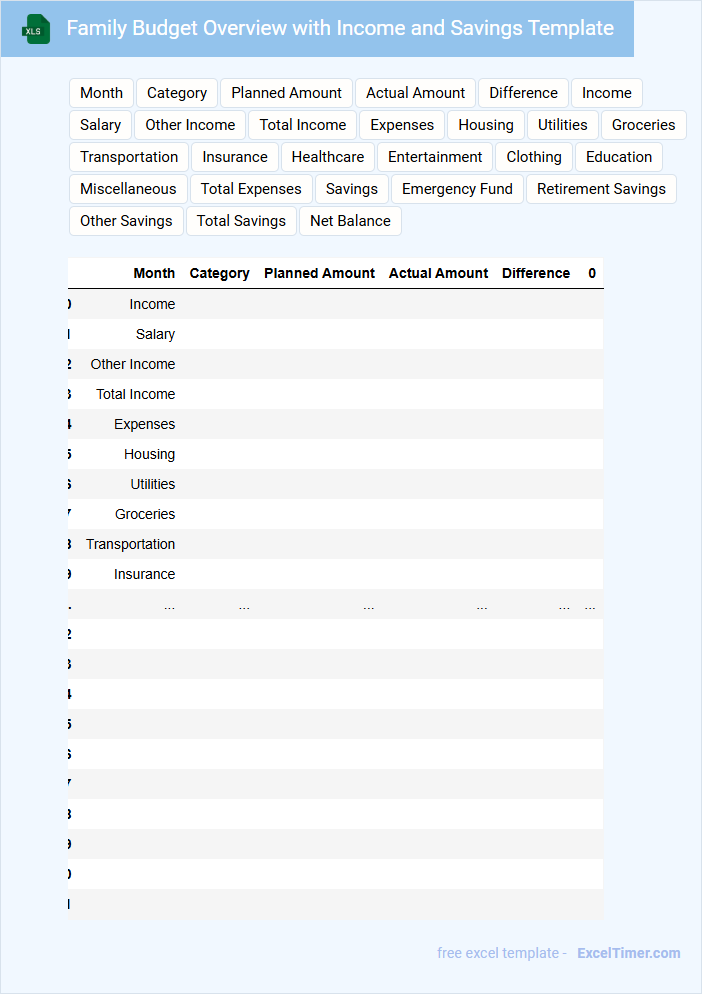

Family Budget Overview with Income and Savings Template

What information is typically included in a Family Budget Overview with Income and Savings Template? This document usually contains detailed records of all family income sources, monthly expenses, and planned savings goals. It helps families organize their finances, track spending patterns, and make informed decisions to improve their financial health.

What is an important consideration when using this template? Ensuring accurate and up-to-date income and expense entries is crucial for realistic budget tracking. Additionally, regularly reviewing savings goals and adjusting the budget accordingly can help families stay on target with their financial objectives.

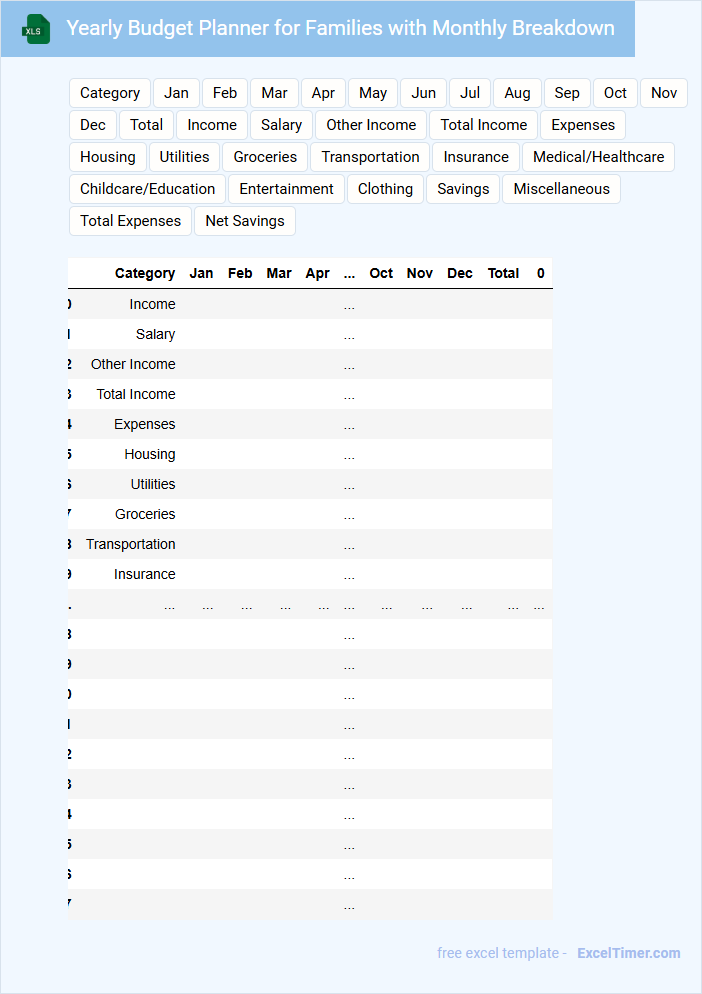

Yearly Budget Planner for Families with Monthly Breakdown

A Yearly Budget Planner for Families is a document designed to help manage and organize household finances throughout the year. It typically contains detailed categories for income, expenses, savings goals, and debt tracking, broken down by month for better clarity. An important suggestion is to regularly update the planner and review spending patterns to ensure financial goals are being met effectively.

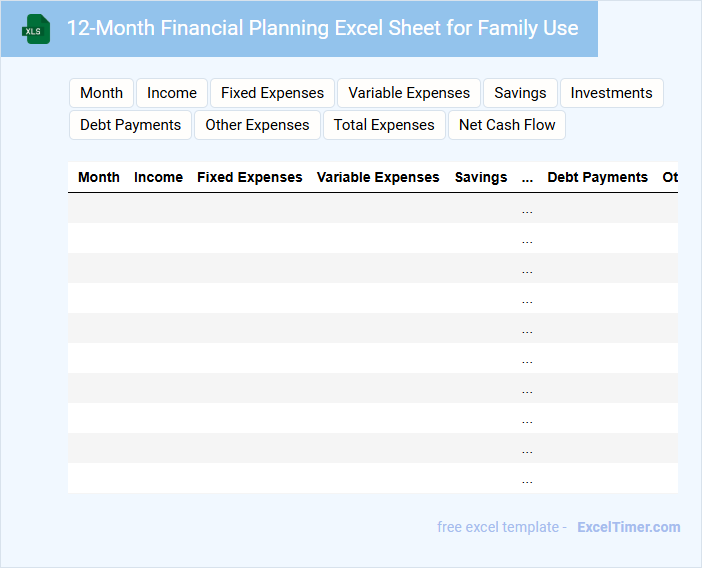

12-Month Financial Planning Excel Sheet for Family Use

A 12-Month Financial Planning Excel Sheet for family use typically contains detailed monthly income and expense tracking, savings goals, and budget analysis over an entire year. It helps families monitor cash flow, manage bills, and plan for future financial commitments effectively. Including categories like emergency funds, debt repayments, and discretionary spending ensures comprehensive financial management.

Annual Family Finance Tracker with Goal Setting

An Annual Family Finance Tracker is a document that typically contains detailed records of all income, expenses, savings, and investments throughout the year. It helps families monitor their financial health and make informed decisions based on actual data.

Goal setting is a crucial aspect, where specific financial targets such as debt reduction, emergency fund building, or vacation savings are clearly outlined. Including realistic milestones and regular reviews ensures sustained progress toward these goals.

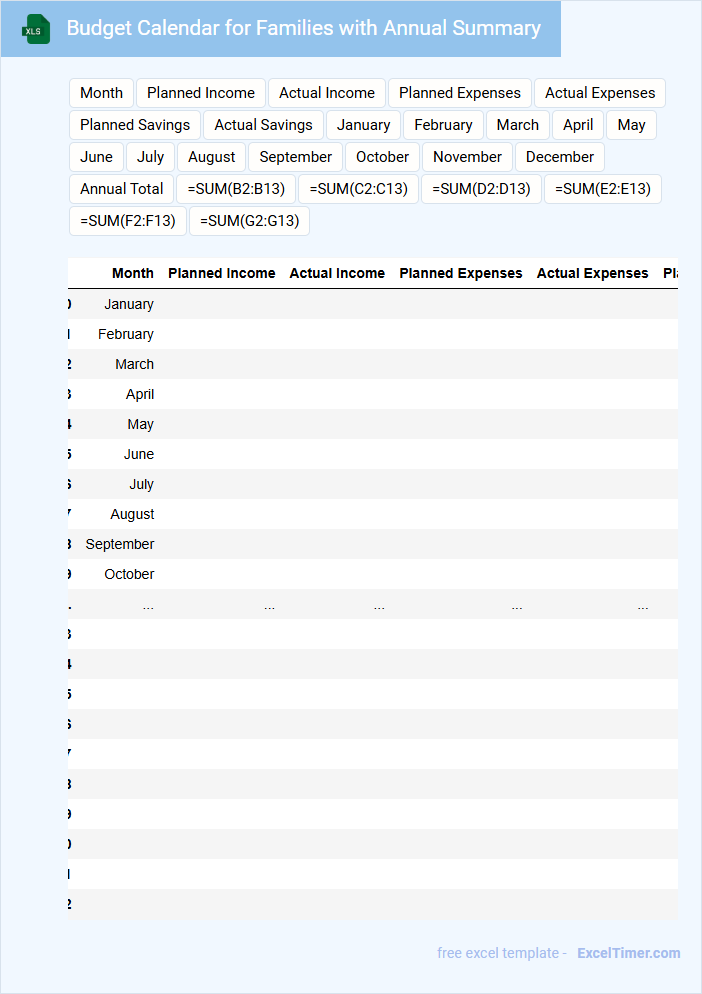

Budget Calendar for Families with Annual Summary

A Budget Calendar for Families with Annual Summary is typically a document that helps track monthly expenses and incomes throughout the year, providing a clear financial overview. It summarizes yearly financial data to assist in planning and managing family budgets effectively.

- Include all sources of income and categorize expenses for better clarity.

- Highlight important financial deadlines such as bill payments and tax dates.

- Provide monthly savings goals aligned with annual financial objectives.

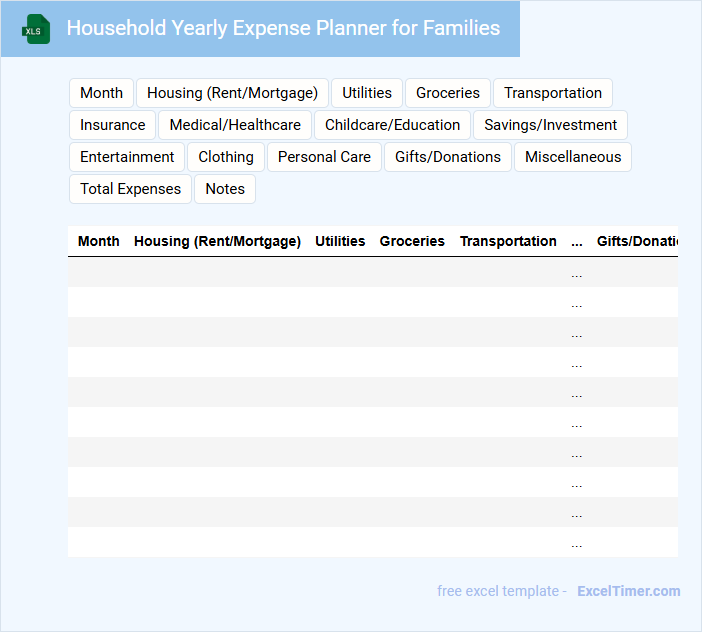

Household Yearly Expense Planner for Families

What typically is included in a Household Yearly Expense Planner for Families? This type of document usually contains detailed categories of annual expenses such as housing, utilities, groceries, transportation, education, and healthcare. It helps families organize and forecast their yearly spending to manage their budget effectively and avoid financial surprises.

What important aspect should families consider when using a Household Yearly Expense Planner? Families should ensure they accurately estimate both fixed and variable expenses, include a savings plan, and regularly update the planner to reflect changes in income or costs throughout the year. This proactive approach supports financial stability and better decision-making.

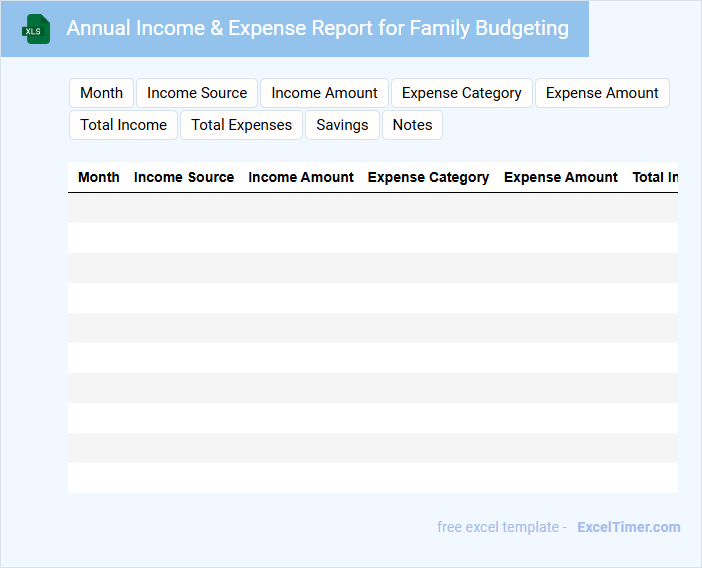

Annual Income & Expense Report for Family Budgeting

What does an Annual Income & Expense Report for Family Budgeting typically contain?

This document usually includes detailed records of all sources of family income and a comprehensive list of expenses incurred throughout the year. It helps in tracking financial patterns and identifying areas to optimize spending and saving.

Why is maintaining this report important for families?

Keeping an accurate report aids in effective financial planning and goal setting by providing clear insights into cash flow. It also assists in making informed decisions to improve financial stability and achieve long-term objectives.

Year-at-a-Glance Budget Sheet with Category Tracking

What information is typically included in a Year-at-a-Glance Budget Sheet with Category Tracking? This document usually contains a summarized overview of income and expenses organized by month and categorized by spending types, such as housing, food, and entertainment. It helps users quickly assess their financial health and plan future budgets by highlighting trends and variances across categories throughout the year.

Why is it important to use category tracking in a Year-at-a-Glance Budget Sheet? Category tracking enables precise monitoring of where money is allocated, making it easier to identify overspending or areas for savings. This approach supports better financial decision-making and encourages accountability by providing clear insights into spending patterns over time.

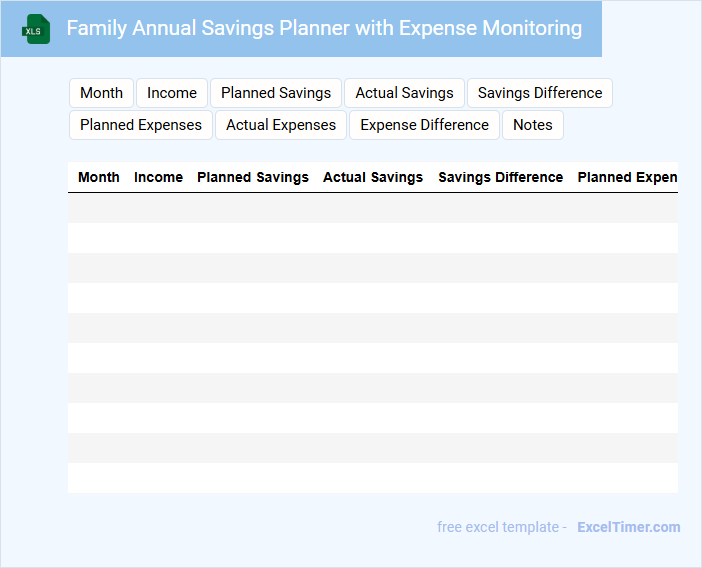

Family Annual Savings Planner with Expense Monitoring

A Family Annual Savings Planner with Expense Monitoring is a document designed to help families manage their finances by tracking income, expenses, and savings goals throughout the year. It provides a structured overview to encourage mindful spending and effective budgeting.

- Include detailed categories for income sources and monthly expenses to gain clear financial insights.

- Set realistic savings targets based on past spending patterns to motivate consistent progress.

- Regularly review and update the planner to adjust for unexpected expenses and changes in income.

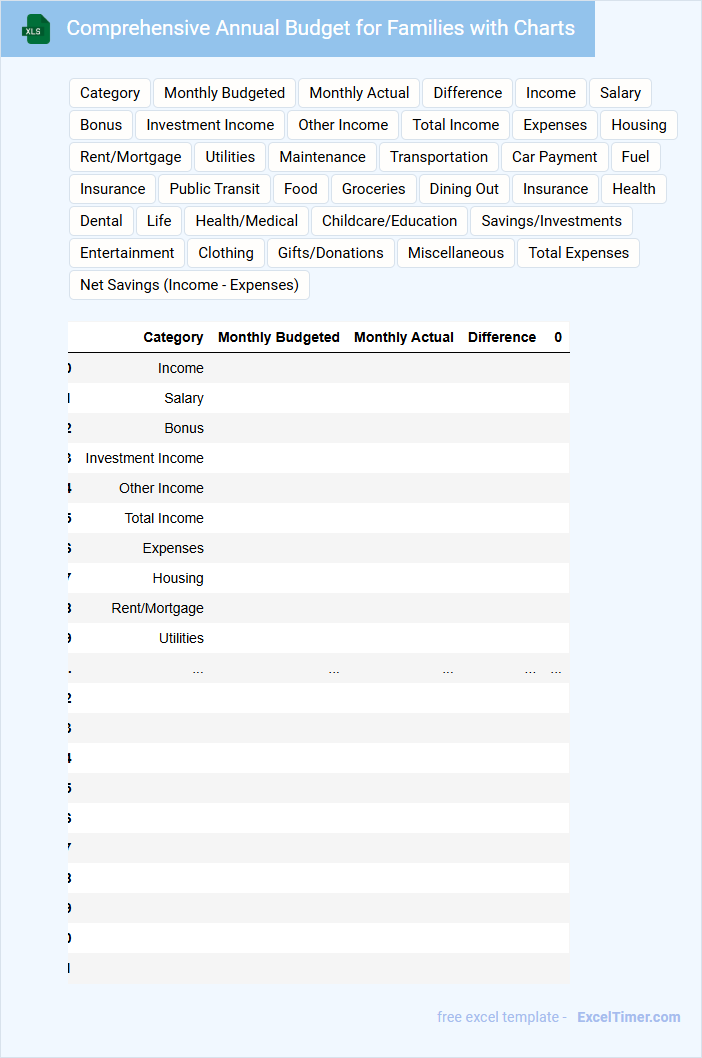

Comprehensive Annual Budget for Families with Charts

The Comprehensive Annual Budget for families typically includes detailed income sources, regular expenses, and savings goals categorized over the year. It often contains visual charts such as pie charts for expense distribution and line graphs tracking savings progress. This document helps families plan finances effectively, ensuring transparency and better money management.

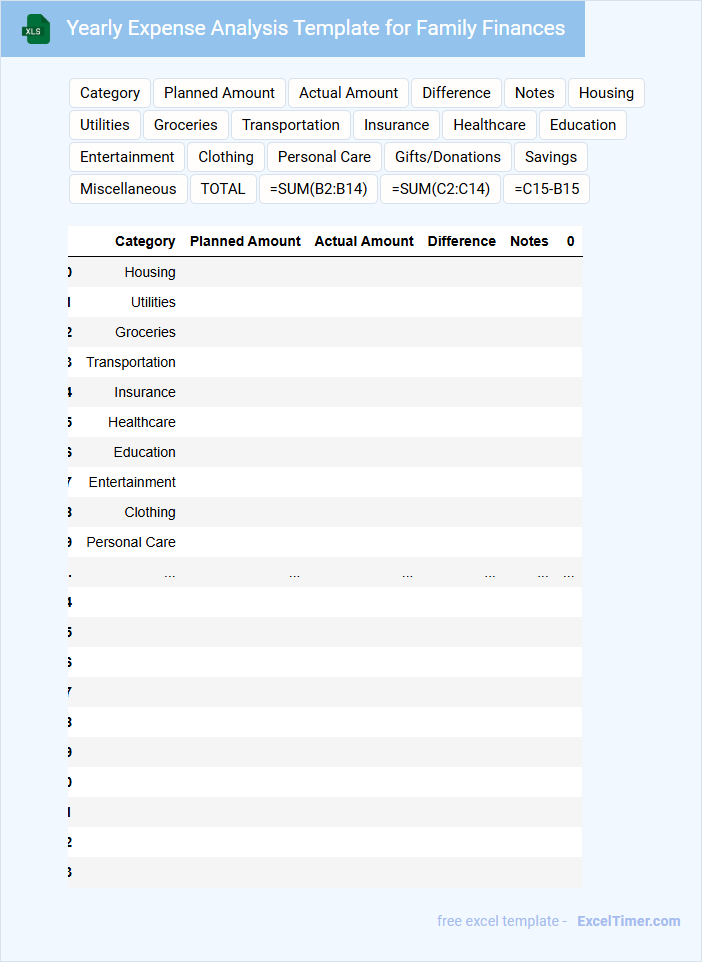

Yearly Expense Analysis Template for Family Finances

What is typically included in a Yearly Expense Analysis Template for Family Finances? This document usually contains detailed categories of family expenses such as housing, utilities, groceries, transportation, healthcare, and entertainment, tracked over a year to monitor spending patterns. It helps families understand where their money goes, identify cost-saving opportunities, and plan better budgets for the upcoming year.

What important factors should be considered when using this template? It's crucial to include all income sources and fixed versus variable expenses accurately, update the data regularly, and review the results critically to detect trends or unexpected spikes in spending. Doing so ensures the family has a realistic financial overview and can make informed decisions to improve savings and financial stability.

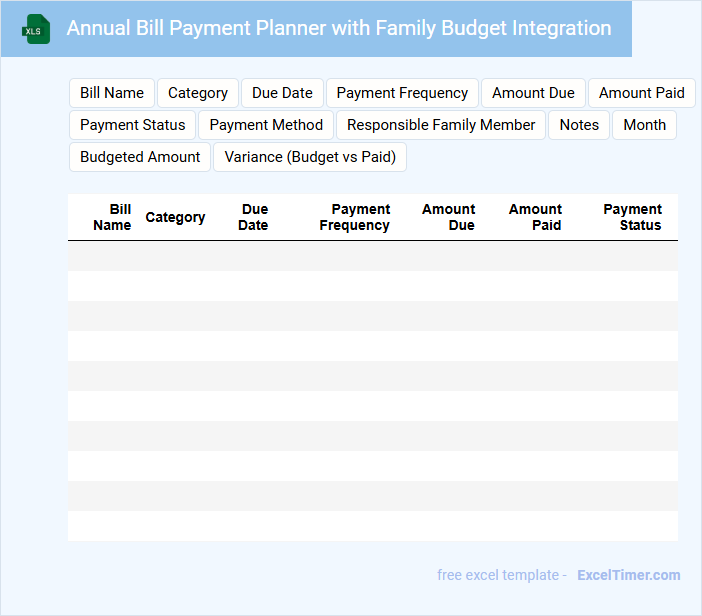

Annual Bill Payment Planner with Family Budget Integration

The Annual Bill Payment Planner is a comprehensive document designed to track and schedule all yearly expenses efficiently. It typically contains detailed sections for monthly bill due dates, amounts, and payment methods to ensure timely payments. Integrating this planner with a Family Budget helps optimize financial management and avoid missed payments.

Family Financial Goals Tracker with Annual Budget Overview

This document typically contains a detailed budget overview that helps families track their annual income, expenses, and savings goals. It categorizes financial data to provide a clear snapshot of the family's financial health throughout the year.

It also includes sections for setting and monitoring financial goals such as emergency funds, debt repayment, and major purchases. Regular updates and reviews ensure the family stays aligned with its long-term financial objectives.

To enhance effectiveness, prioritize consistent tracking and include reminders for quarterly budget reviews.

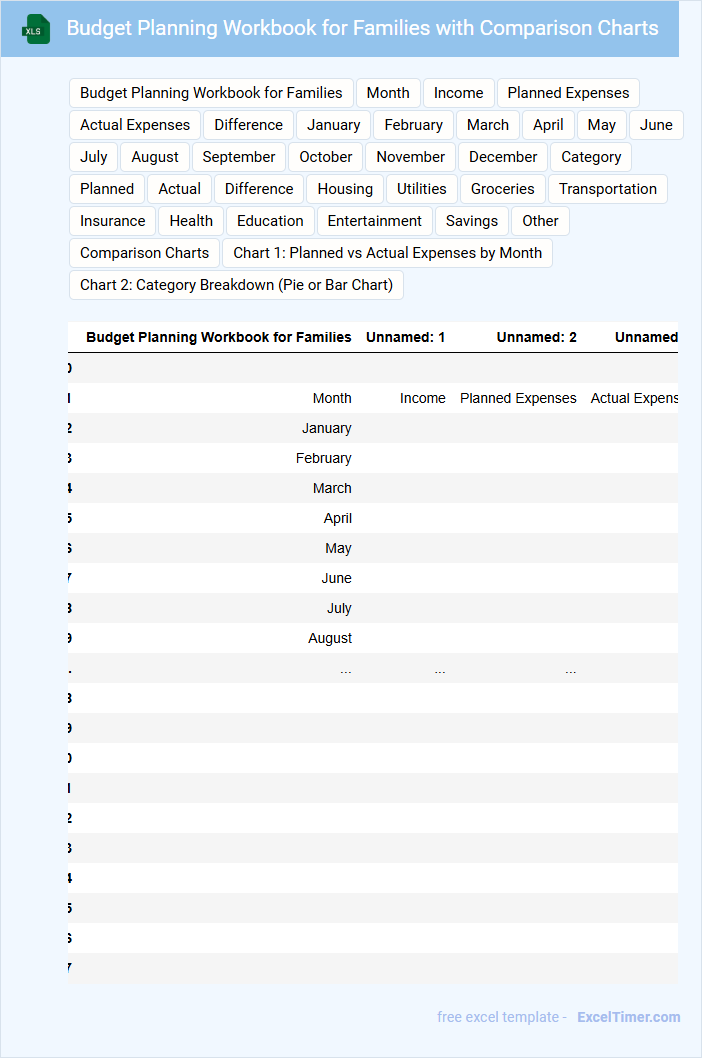

Budget Planning Workbook for Families with Comparison Charts

A Budget Planning Workbook for families typically contains detailed income and expense tracking sheets, savings goals, and debt repayment plans. It also includes sections for monthly and yearly financial overviews to help visualize spending habits.

Comparison charts are crucial elements that allow families to evaluate different spending categories side-by-side, making it easier to identify areas for adjustment. Including recommendation notes and financial tips can further enhance the workbook's effectiveness for better money management.

What are the essential income and expense categories to include in a family annual budget planner?

Essential income categories in a family annual budget planner include salaries, investments, and rental income. Key expense categories cover housing, utilities, groceries, transportation, healthcare, education, and entertainment. Including savings and emergency fund contributions ensures comprehensive financial planning.

How does tracking monthly versus annual spending improve financial planning for families?

Tracking monthly versus annual spending in your Annually Budget Planner helps identify short-term expenses and seasonal trends, allowing more accurate budgeting. This detailed insight enables families to allocate funds effectively and avoid unexpected financial shortfalls. Understanding spending patterns supports better goal-setting and long-term financial stability.

What methods can be used in Excel to automatically calculate yearly savings and overspending?

Excel's SUMIF and IF functions help automatically calculate yearly savings and overspending by categorizing expenses and income based on set criteria. Using PivotTables, you can summarize data to track total yearly income versus expenditure efficiently. You can also set conditional formatting to highlight overspending months, enhancing your family budget planner's visual insights.

How can Excel charts and graphs enhance the visualization of annual budget trends for families?

Excel charts and graphs transform raw budget data into clear visual trends, making it easier to track income, expenses, and savings throughout the year. These visual tools help identify spending patterns and highlight areas for cost optimization. Your family can make more informed financial decisions by quickly understanding annual budget fluctuations.

What formulas or functions are most effective for forecasting future family expenses in an annual planner?

Excel functions like SUMIF and AVERAGEIF help categorize and analyze past family expenses, providing a foundation for future forecasting. The FORECAST.ETS function uses historical data to predict upcoming costs based on seasonal trends. You can integrate these formulas in your annual budget planner to create accurate and dynamic expense projections.