The Annually Cash Flow Projection Excel Template for Consultants provides a streamlined way to forecast income and expenses over a one-year period, helping consultants manage finances effectively. It includes customizable categories tailored to consulting services, enabling accurate tracking of cash inflows and outflows. Using this template ensures improved financial planning and better decision-making for sustainable business growth.

Annual Cash Flow Projection Spreadsheet for Consultants

An Annual Cash Flow Projection Spreadsheet for consultants typically contains detailed monthly income and expense forecasts to help manage finances effectively. It outlines expected revenue streams, operational costs, and anticipated net cash flow throughout the year. This document assists consultants in budgeting, planning for future investments, and ensuring sufficient liquidity. For optimal use, it is important to regularly update the spreadsheet with actual figures and adjust projections based on market changes and client engagements. Including contingency plans for variable income and unexpected expenses ensures financial stability. Additionally, integrating a summary section highlighting key financial metrics can aid in quick decision-making.

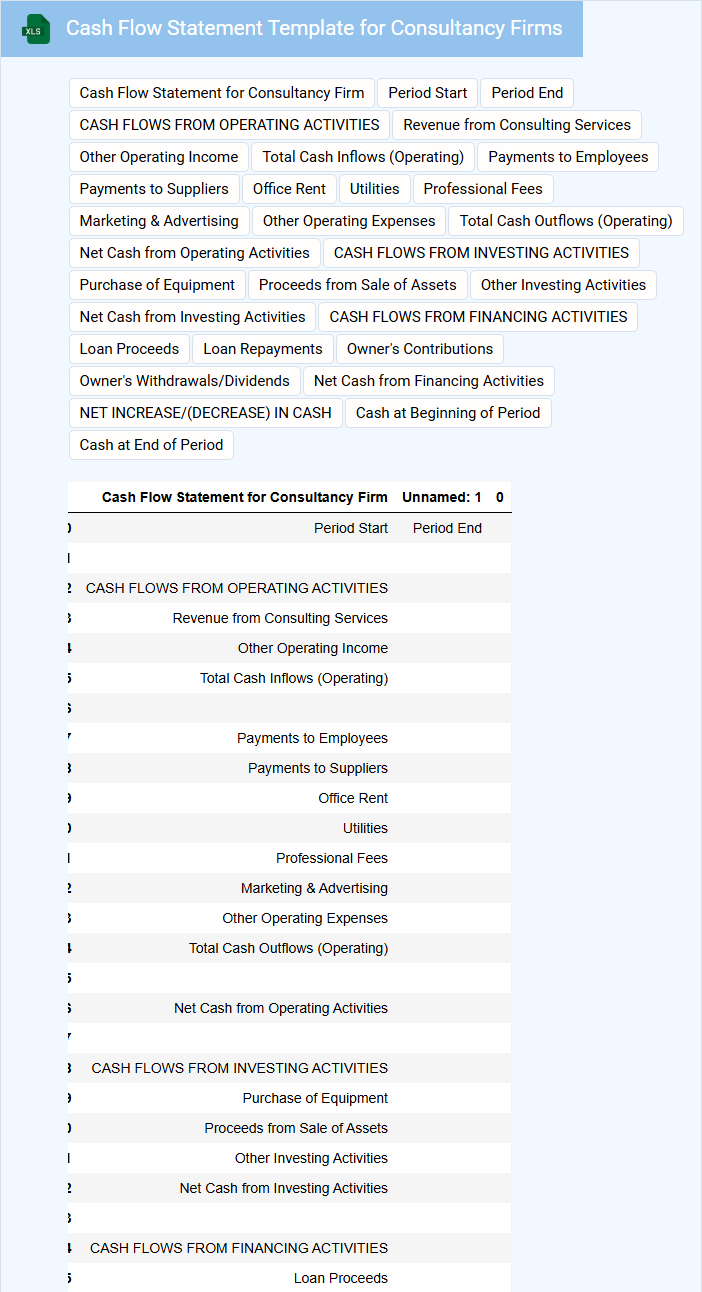

Cash Flow Statement Template for Consultancy Firms

A Cash Flow Statement Template for consultancy firms typically includes sections detailing operating, investing, and financing cash flows. It tracks the inflows and outflows of cash to provide insight into the company's liquidity. This document is essential for ensuring financial stability and planning future expenditures.

Important elements to include are clear categorization of cash inflows from consulting fees, outflows related to operating expenses, and investments in office equipment or technology. Additionally, incorporating a forecast section helps predict future cash positions. Maintaining accuracy and regular updates enhances decision-making for consultancy firms.

Yearly Cash Flow Analysis Excel Sheet for Consultants

What information is typically contained in a Yearly Cash Flow Analysis Excel Sheet for Consultants? This document usually includes detailed monthly and yearly summaries of cash inflows and outflows to help track financial health throughout the year. It is designed to provide consultants with clear visibility into their earnings, expenses, and net cash position to support informed decision-making.

What is an important suggestion for using this type of document effectively? It is essential to regularly update the sheet with accurate data to reflect real-time financial status and to include categories for diverse income sources and expense types. Additionally, incorporating formulas to automatically calculate totals and variances can greatly enhance usability and insight extraction.

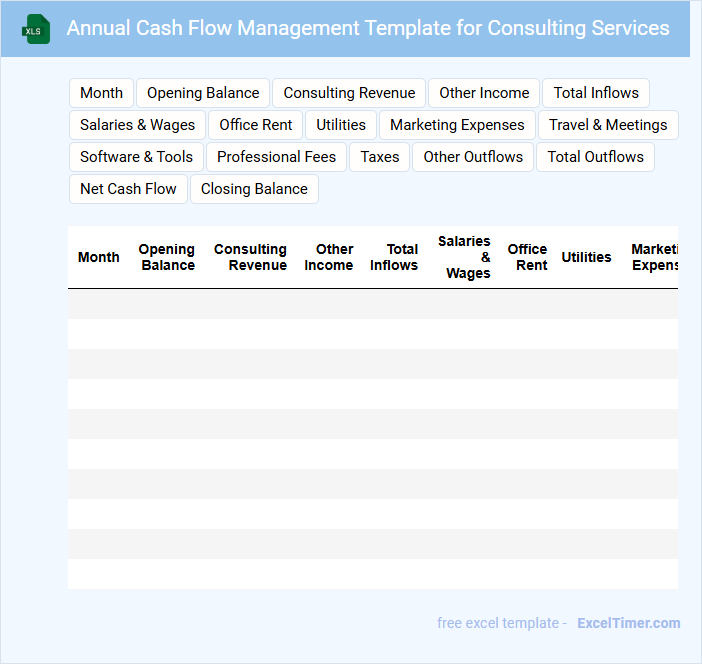

Annual Cash Flow Management Template for Consulting Services

An Annual Cash Flow Management Template for Consulting Services typically includes detailed projections of cash inflows and outflows over the year, helping consultants track revenue and expenses systematically. It often contains sections for client payments, operational costs, and investment expenses to ensure comprehensive financial oversight.

This template is crucial for maintaining positive cash flow and avoiding liquidity issues in consulting businesses. It's important to regularly update the template with actual data to improve forecasting accuracy and make informed financial decisions.

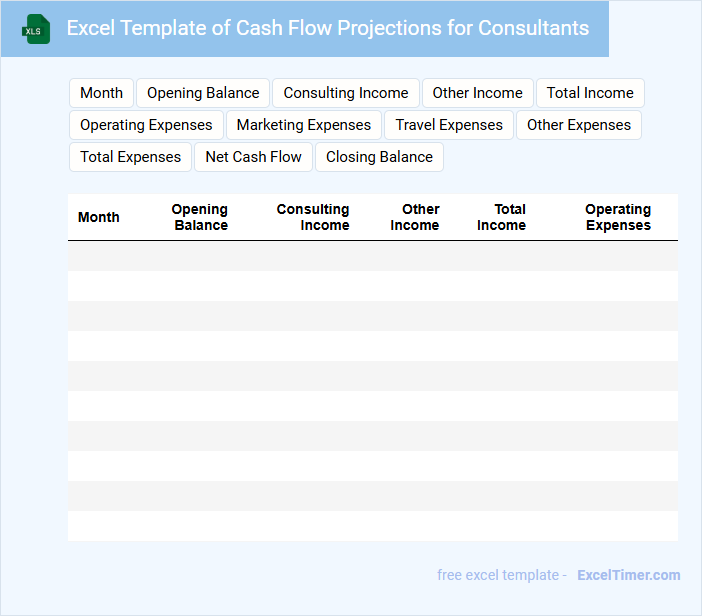

Excel Template of Cash Flow Projections for Consultants

This Excel Template of Cash Flow Projections for Consultants is designed to help track and forecast financial inflows and outflows over a specific period. It provides consultants with clear visibility of their liquidity to make informed business decisions.

- Include detailed monthly income sources such as consulting fees and bonuses.

- Track recurring and one-time expenses to anticipate cash shortages.

- Regularly update projections to reflect changes in client engagements and payments.

Annual Cash Flow Tracking Sheet for Independent Consultants

The Annual Cash Flow Tracking Sheet is a financial document used by independent consultants to monitor their income and expenses throughout the year. It helps in identifying cash inflows and outflows to maintain a clear financial overview.

This type of document usually contains detailed records of payments received, operational costs, taxes, and other financial transactions relevant to consulting activities. Maintaining accurate entries ensures better budgeting and tax preparation.

It is important to regularly update the sheet and categorize expenses precisely to gain meaningful insights and improve financial decision-making.

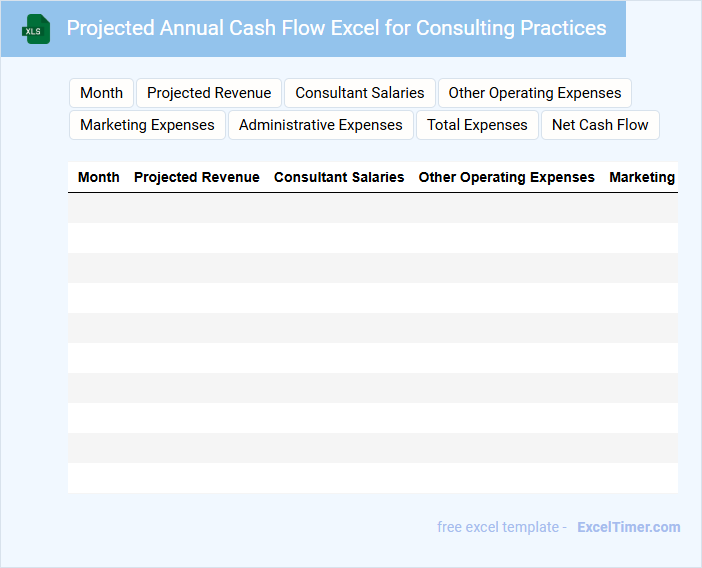

Projected Annual Cash Flow Excel for Consulting Practices

A Projected Annual Cash Flow Excel for Consulting Practices is a financial document used to estimate incoming and outgoing cash over a year. It helps consultants manage finances and plan future growth effectively.

- Include detailed income forecasts based on client contracts and expected projects.

- List all operational expenses such as salaries, rent, and marketing costs.

- Incorporate cash flow timings to predict periods of surplus or shortfall.

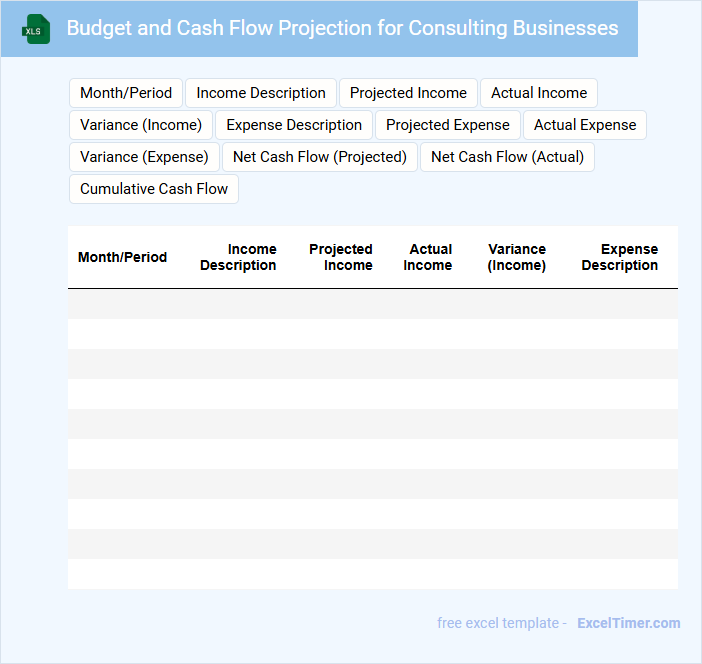

Budget and Cash Flow Projection for Consulting Businesses

Budget and cash flow projection documents for consulting businesses provide a comprehensive overview of the expected financial inflows and outflows over a specific period. These documents typically contain detailed estimates of revenue, operational expenses, and anticipated cash reserves. Ensuring accuracy in these projections is crucial for effective financial planning and sustaining business growth.

Annual Cash Flow Monitoring Spreadsheet for Consultants

An Annual Cash Flow Monitoring Spreadsheet is a vital tool for consultants to track their income and expenses throughout the year. It provides detailed insights into cash inflows and outflows, enabling better financial management.

This type of document usually contains monthly income entries, expense categories, and summarized totals to show net cash flow. For consultants, it is important to regularly update the spreadsheet and categorize expenses accurately to maintain clear financial visibility.

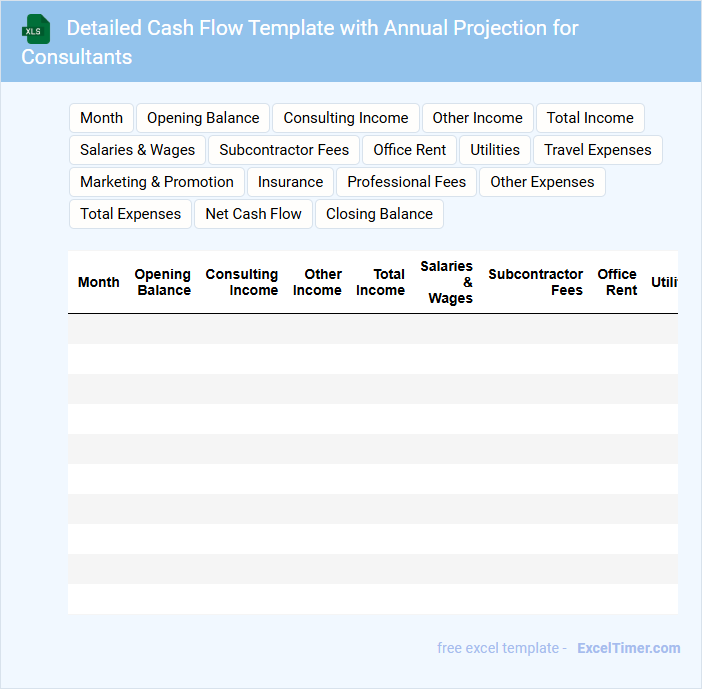

Detailed Cash Flow Template with Annual Projection for Consultants

A Detailed Cash Flow Template with Annual Projection is typically used by consultants to track income, expenses, and net cash flow over a year. This document contains detailed monthly and annual financial entries, categorized by sources of revenue and different types of costs. It helps consultants forecast their financial health and make informed budgeting decisions.

When using this template, it is important to include accurate client payment schedules to predict cash inflows effectively. Additionally, consultants should detail variable and fixed expenses separately for clearer cost management. Regular updates to the template are essential to reflect changes in contracts, rates, or unexpected expenses.

Yearly Cash Flow Forecast Excel for Consultancies

A Yearly Cash Flow Forecast Excel for consultancies typically contains detailed projections of incoming and outgoing cash over a 12-month period. It includes anticipated revenues from client projects, estimated operational expenses, and timing of cash inflows and outflows. This document helps management anticipate liquidity needs, plan investments, and avoid cash shortages.

Important elements to include are accurate client billing schedules, expected payment delays, seasonal variations in consultancy demand, and fixed versus variable costs. Incorporating scenario analysis for best, worst, and most likely cash flow outcomes enhances decision-making. Regular updates and reconciliation with actual cash flows ensure the forecast remains a reliable financial tool.

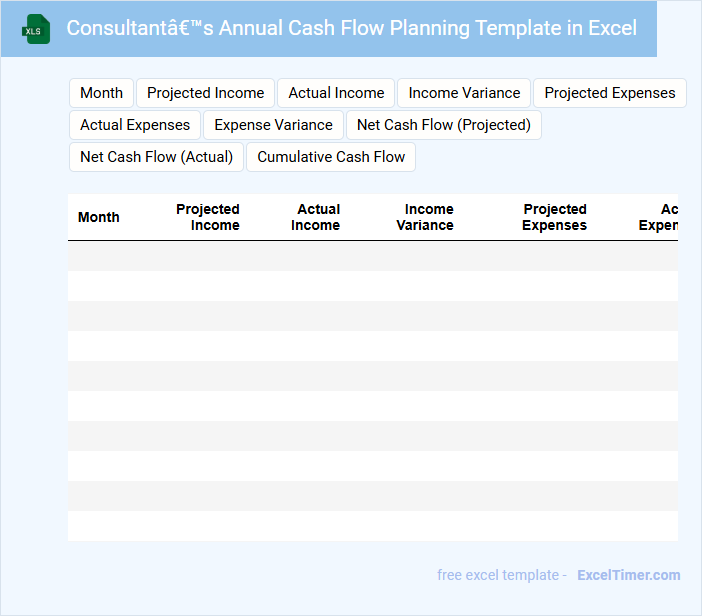

Consultant’s Annual Cash Flow Planning Template in Excel

A Consultant's Annual Cash Flow Planning Template in Excel typically contains detailed projections of income and expenses over a 12-month period. It includes sections for tracking invoices, payments, recurring expenses, and seasonal fluctuations to ensure accurate financial forecasting.

This document is essential for managing liquidity, anticipating cash shortages, and making informed business decisions. An important suggestion is to regularly update the template with actual figures to maintain accurate and actionable cash flow insights.

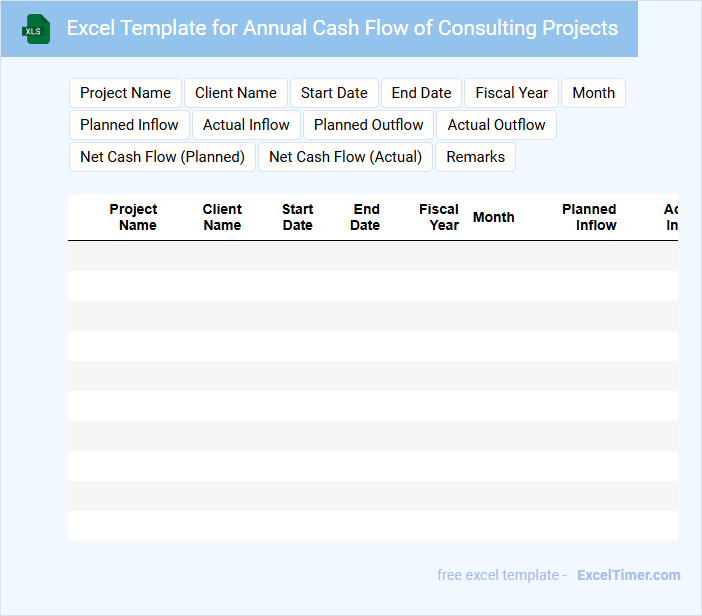

Excel Template for Annual Cash Flow of Consulting Projects

An Excel Template for Annual Cash Flow of Consulting Projects typically contains detailed financial data that tracks income and expenses over the fiscal year. It includes sections for projected revenues, operational costs, and net cash flow to help manage project profitability. Accurate cash flow forecasting is crucial for ensuring sustainable project execution and timely financial decisions.

Annual Consulting Cash Flow Template with Forecasting Features

What does an Annual Consulting Cash Flow Template with Forecasting Features usually contain? This type of document typically includes detailed records of cash inflows and outflows related to consulting activities over a fiscal year, allowing for a comprehensive view of financial health. It also incorporates forecasting tools to predict future cash flows, helping consultants anticipate financial needs and plan accordingly.

Why is accuracy and regular updating important in this template? Accurate data entry ensures reliable cash flow projections, which are critical for making informed business decisions. Regular updates keep the forecast aligned with actual performance, enabling proactive adjustments to strategy and resource allocation.

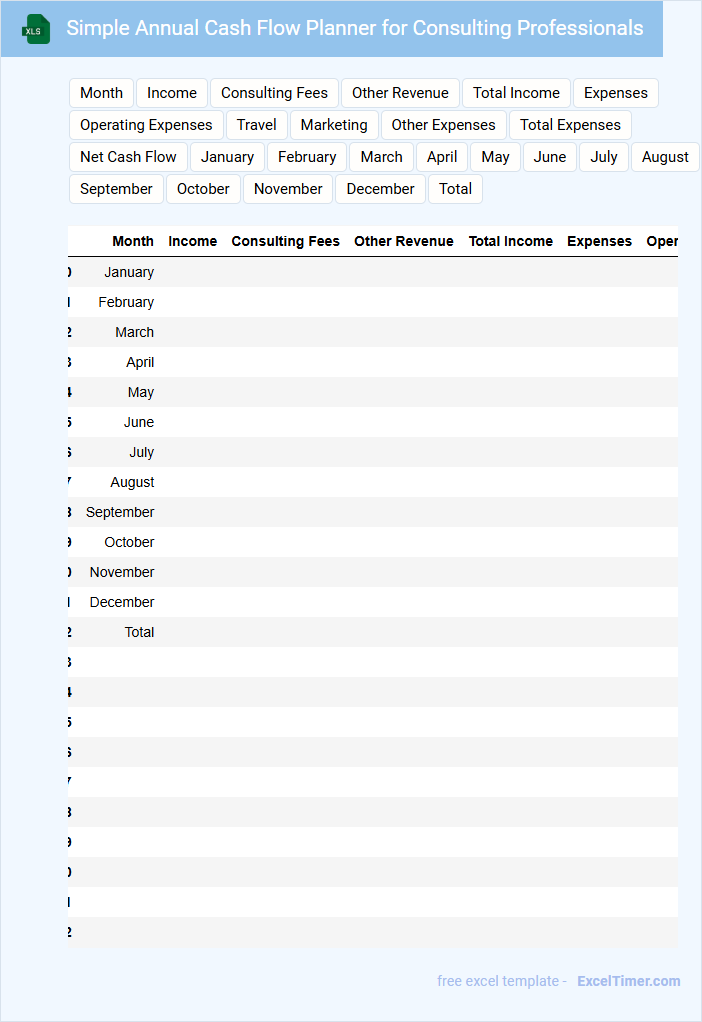

Simple Annual Cash Flow Planner for Consulting Professionals

A Simple Annual Cash Flow Planner typically contains detailed records of income and expenditures over the year, helping consulting professionals manage their finances effectively. It includes sections for projected sales, fixed and variable expenses, and net cash flow estimates. This document is essential for maintaining financial clarity and making informed business decisions.

For consulting professionals, an important aspect of this planner is tracking client payments and seasonal fluctuations in revenue. Including a contingency fund for unexpected expenses is highly recommended. Regularly updating the planner ensures accurate forecasting and financial stability throughout the year.

What key revenue streams should consultants include in an annual cash flow projection?

Consultants should include key revenue streams such as client project fees, retainer contracts, and performance bonuses in an annual cash flow projection. Other important inflows are training sessions, licensing or subscription services, and referral commissions. Accurately forecasting these streams helps maintain financial stability and informs budgeting decisions.

How should consultants estimate and categorize recurring versus one-time expenses in their projection?

Consultants should estimate recurring expenses by identifying regular costs such as software subscriptions, office rent, and utility bills that occur monthly or annually. One-time expenses include infrequent costs like equipment purchases, training fees, or initial setup charges. Categorizing these accurately in the Excel cash flow projection ensures precise forecasting of ongoing cash requirements and potential financial fluctuations.

What assumptions about client retention and new business should be reflected in the annual cash flow projection?

The annual cash flow projection for consultants should assume a client retention rate of at least 85%, reflecting steady recurring revenue from existing clients. New business acquisition projections should be based on a 10-15% growth in client base annually, factoring in market trends and marketing efforts. Accurate forecasting of payment terms, project timelines, and seasonal demand variations are essential for realistic cash flow modeling.

How can consultants account for seasonal variations and payment delays in cash flow forecasting?

Consultants can incorporate seasonal variations and payment delays in your annual cash flow projection by analyzing historical income patterns and identifying peak periods. Adjust projected cash inflows based on typical payment cycles and include buffer amounts for late payments to maintain accurate forecasts. Using Excel's dynamic formulas and scenario analysis improves precision in anticipating cash shortages or surpluses.

Which Excel functions or tools are most effective for automatically updating annual cash flow projections?

Excel functions like SUMIFS and INDIRECT efficiently update annual cash flow projections by dynamically aggregating data based on specified criteria. PivotTables provide powerful data summarization and easy adjustments for consultants to analyze their cash flow trends. Your use of data validation and Excel Tables ensures automatic updates and accuracy in projecting yearly cash flows.