The Bi-weekly Excel Template for Academic Staff Payroll streamlines payroll management by automating calculations and tracking employee hours efficiently. This template ensures accurate salary processing every two weeks, minimizing errors and saving time. Customizable fields allow institutions to adapt it to specific academic staff requirements and tax regulations.

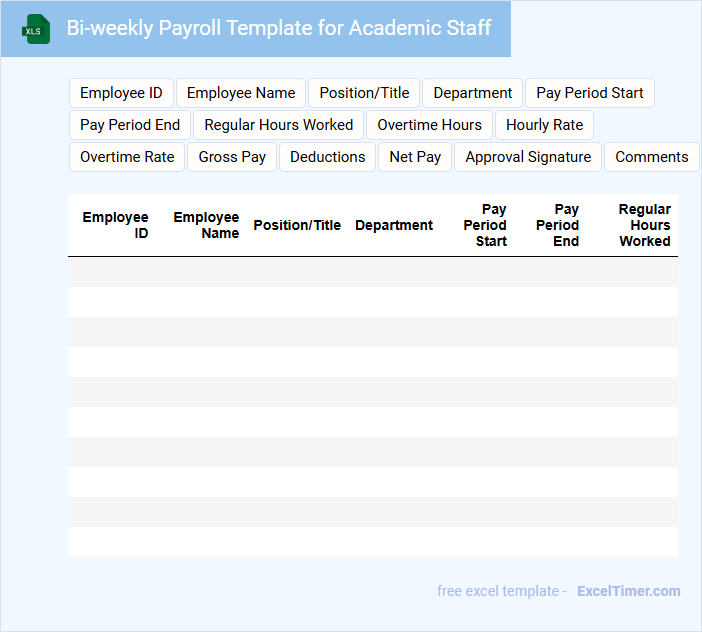

Bi-weekly Payroll Template for Academic Staff

A bi-weekly payroll template for academic staff is a structured document used to calculate and record employee wages every two weeks. It typically includes details on hours worked, deductions, and net pay for faculty and administrative personnel.

- Ensure accurate input of hours and overtime to maintain payroll integrity.

- Include clear sections for tax withholdings and benefit deductions specific to academic staff.

- Regularly update the template to comply with institutional and legal payroll policies.

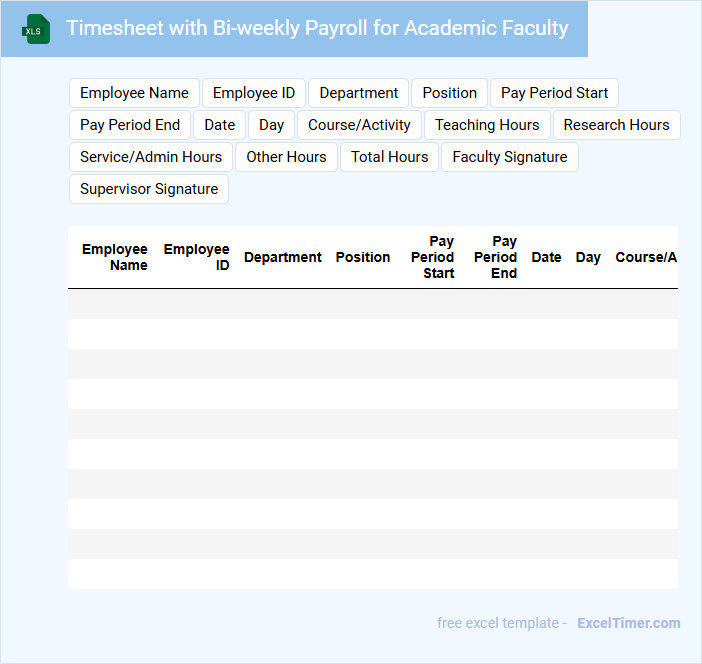

Timesheet with Bi-weekly Payroll for Academic Faculty

This document typically contains detailed records of hours worked by academic faculty over a bi-weekly period to facilitate payroll processing.

- Accurate time tracking is essential to ensure faculty are compensated correctly for their hours.

- Clear project or course codes must be included to allocate payroll to appropriate academic departments.

- Regular submission deadlines should be enforced to maintain timely payroll processing and avoid delays.

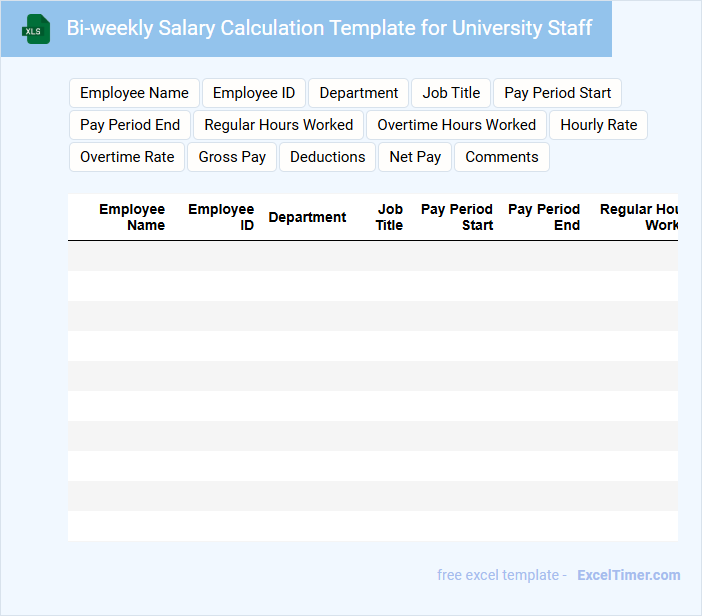

Bi-weekly Salary Calculation Template for University Staff

This document is a Bi-weekly Salary Calculation Template designed specifically for university staff, capturing detailed pay periods and corresponding salary data. It usually includes fields for hours worked, overtime, deductions, and allowances to ensure accurate payroll processing.

Essential elements to consider in this template are clear categorization of pay components and automated calculations to reduce errors. Including sections for tax withholdings and benefits can greatly enhance payroll transparency and compliance.

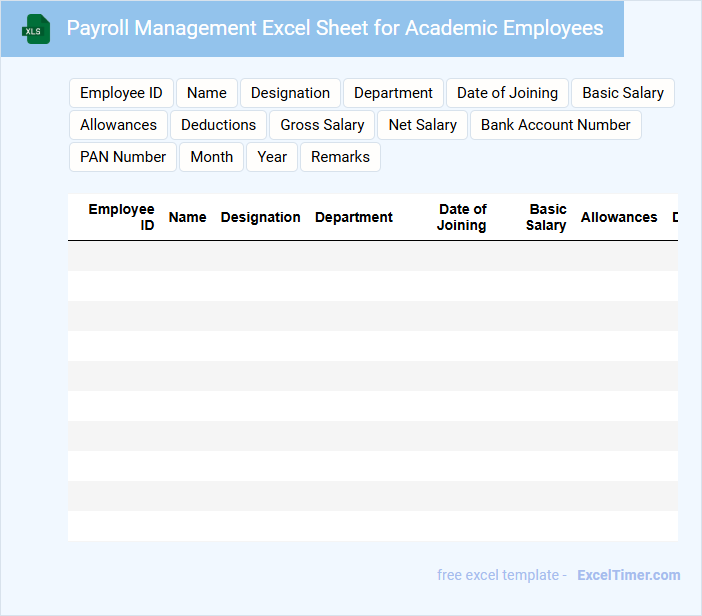

Payroll Management Excel Sheet for Academic Employees

This document typically includes detailed records of employee salaries, deductions, and benefits. The Payroll Management Excel Sheet serves as a centralized tool to track payments and financial transactions efficiently.

It is essential to maintain accuracy in data entry and regularly update employee information. Ensuring confidentiality and proper formula usage helps in minimizing errors and safeguarding sensitive details.

Attendance and Bi-weekly Payroll Tracker for Faculty

The Attendance and Bi-weekly Payroll Tracker for faculty is a crucial document that records the daily presence and work hours of teaching staff. It typically contains detailed entries such as dates, hours worked, leave taken, and payroll calculations for each bi-weekly period. Maintaining accuracy in this tracker ensures proper compensation and helps in monitoring employee attendance trends.

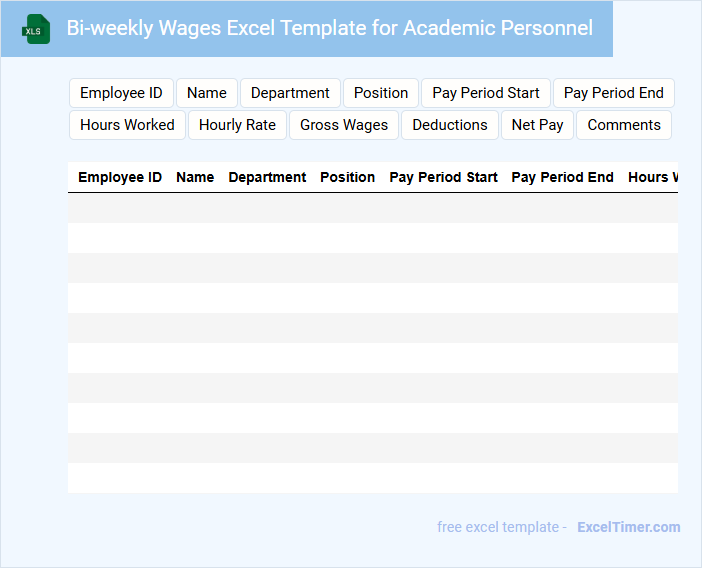

Bi-weekly Wages Excel Template for Academic Personnel

The Bi-weekly Wages Excel Template for Academic Personnel typically contains detailed salary calculations, employee information, and pay period records. It helps streamline payroll processing by organizing data efficiently. Including columns for hours worked, deductions, and net pay is essential.

This document usually features sections for tax withholdings, benefits, and overtime calculations. Consistent formatting and clear labeling ensure accuracy and ease of use. It is important to regularly update the template to comply with institutional policies and tax regulations.

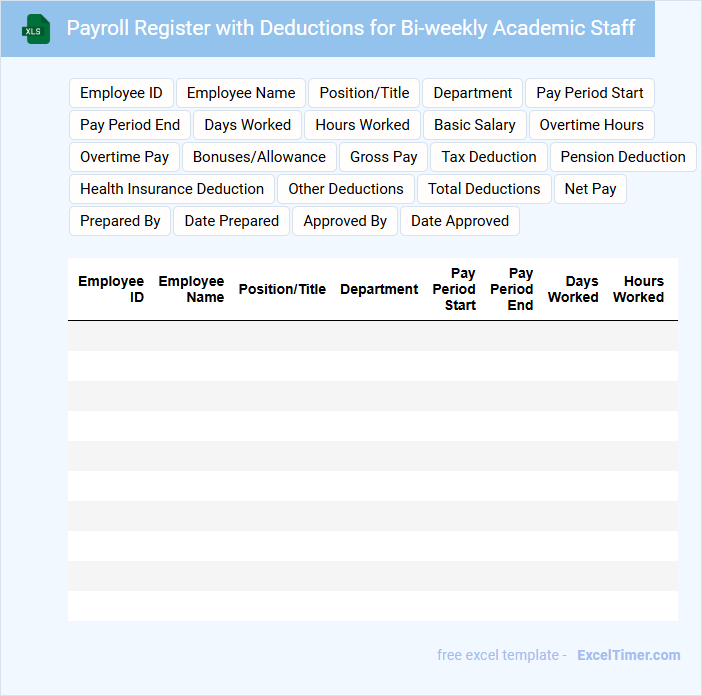

Payroll Register with Deductions for Bi-weekly Academic Staff

The Payroll Register with deductions for bi-weekly academic staff typically contains detailed records of employee earnings, tax withholdings, and benefit deductions. It ensures accurate tracking of gross pay, net pay, and all statutory and voluntary deductions for each pay period. This document is crucial for compliance, financial auditing, and payroll reconciliation purposes.

Overtime Tracker and Payroll Template for Academic Staff

An Overtime Tracker and Payroll Template for Academic Staff is a specialized document designed to monitor extra hours worked and calculate corresponding payments accurately.

- Accurate time logging: Ensure all overtime hours are precisely recorded to avoid payroll discrepancies.

- Clear pay rates: Define the overtime compensation rates clearly based on institutional policies.

- Regular updates: Frequently update the template to reflect any changes in work hours or salary structures.

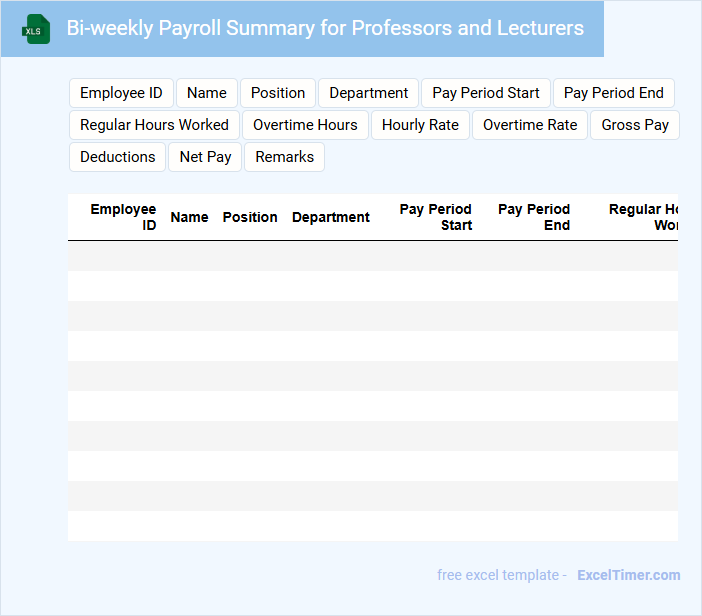

Bi-weekly Payroll Summary for Professors and Lecturers

A Bi-weekly Payroll Summary for Professors and Lecturers typically contains detailed information about salary payments, deductions, and net pay for a specific two-week period. It serves as an essential record for both the institution and the employees to ensure accurate and timely compensation. Key elements often include hours worked, overtime, taxes withheld, and any additional benefits or adjustments.

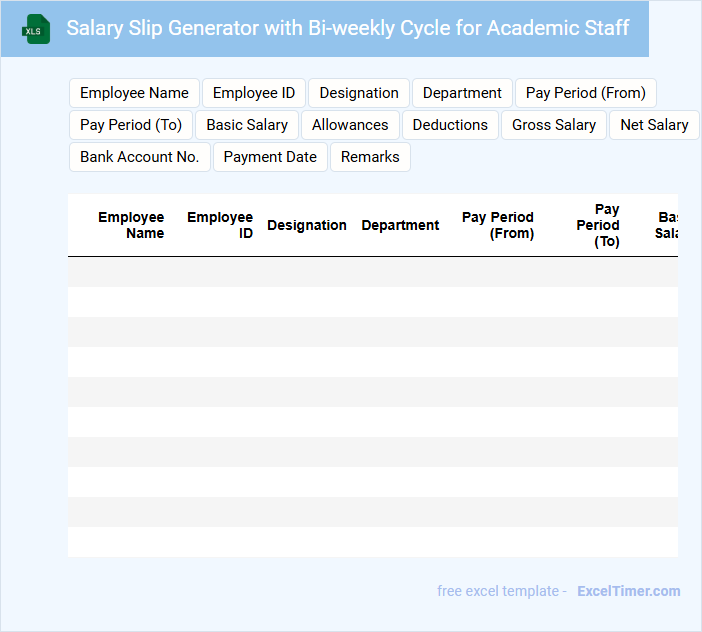

Salary Slip Generator with Bi-weekly Cycle for Academic Staff

A salary slip generator for academic staff is designed to automate the creation of detailed payment statements based on a bi-weekly payroll cycle. It typically includes essential information such as employee details, salary breakdown, deductions, and net pay for each period. Ensuring accuracy and compliance with institutional policies is crucial for maintaining transparency and trust.

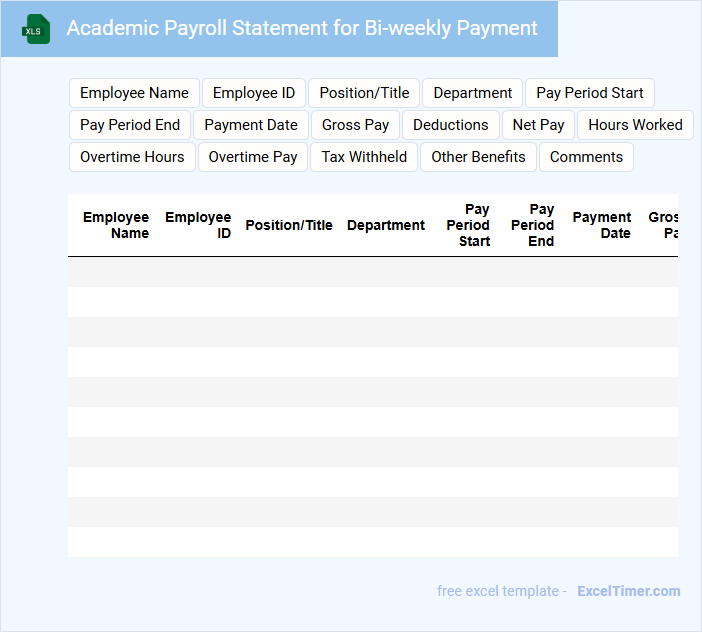

Academic Payroll Statement for Bi-weekly Payment

An Academic Payroll Statement for bi-weekly payment typically contains detailed information about the employee's earnings and deductions within a two-week period. It includes gross pay, taxes withheld, benefit contributions, and net pay. Important details such as pay period dates and employee identification are also present to ensure accurate record-keeping.

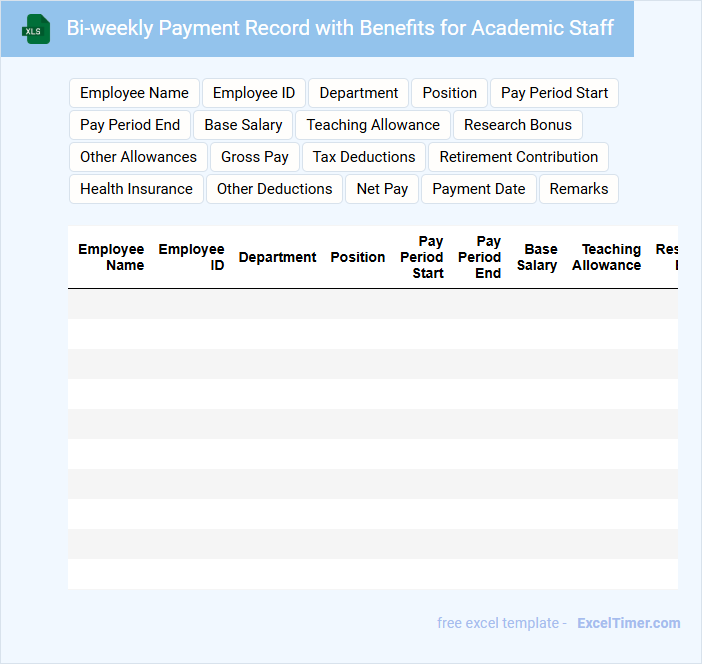

Bi-weekly Payment Record with Benefits for Academic Staff

A Bi-weekly Payment Record with benefits for academic staff typically contains detailed information about salary disbursements made every two weeks, including gross pay, deductions, and net pay. It also itemizes various benefits such as health insurance, retirement contributions, and leave accruals. Accurate documentation ensures transparency, simplifies payroll processing, and aids in financial planning for academic professionals.

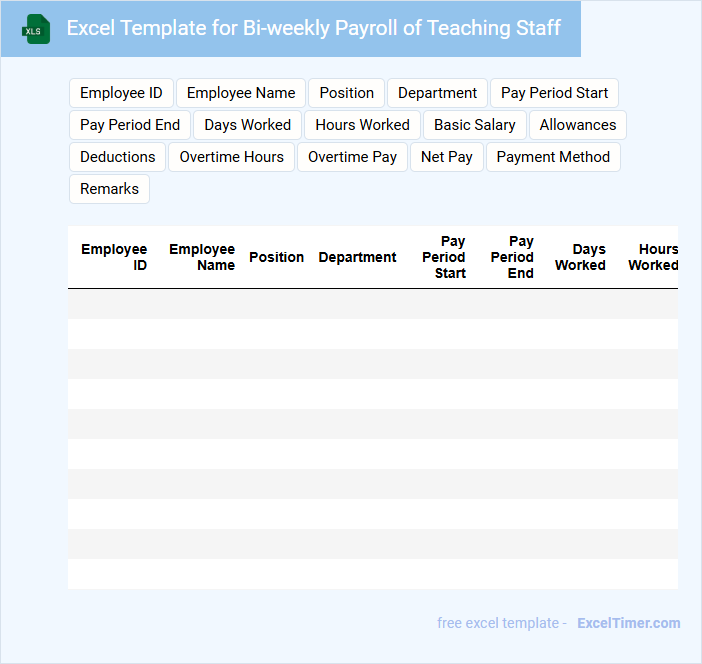

Excel Template for Bi-weekly Payroll of Teaching Staff

This document typically contains structured data for calculating and organizing bi-weekly payroll details for teaching staff.

- Employee Information: It includes staff names, positions, and identification numbers.

- Payroll Calculations: It tracks hours worked, deductions, bonuses, and net pay.

- Reporting Features: It provides summaries and reports for payroll verification and accounting purposes.

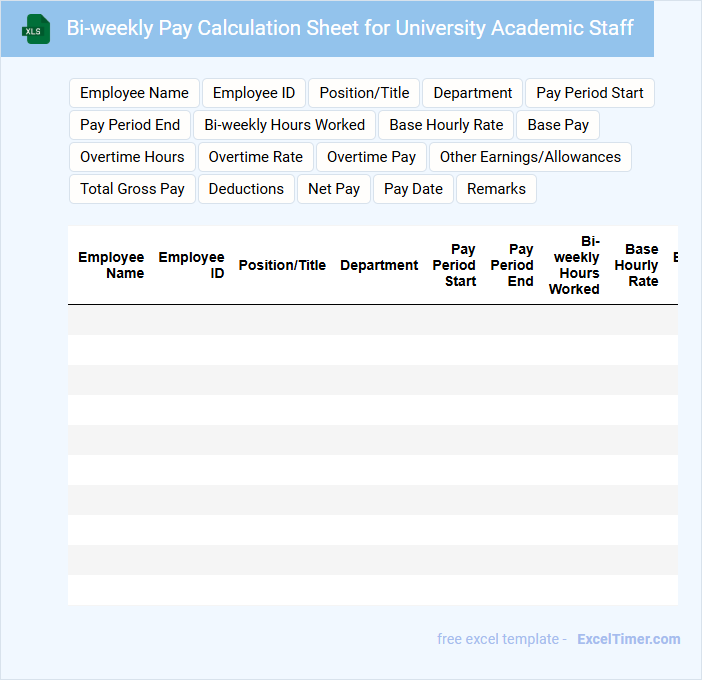

Bi-weekly Pay Calculation Sheet for University Academic Staff

The Bi-weekly Pay Calculation Sheet is a vital document that records the payment details of university academic staff for every two-week period. It typically includes earnings, deductions, and net pay for transparency and financial accuracy.

This sheet ensures timely and precise compensation management, supporting both payroll processing and audit compliance. Including clear identification of staff roles and hours worked is crucial for accuracy.

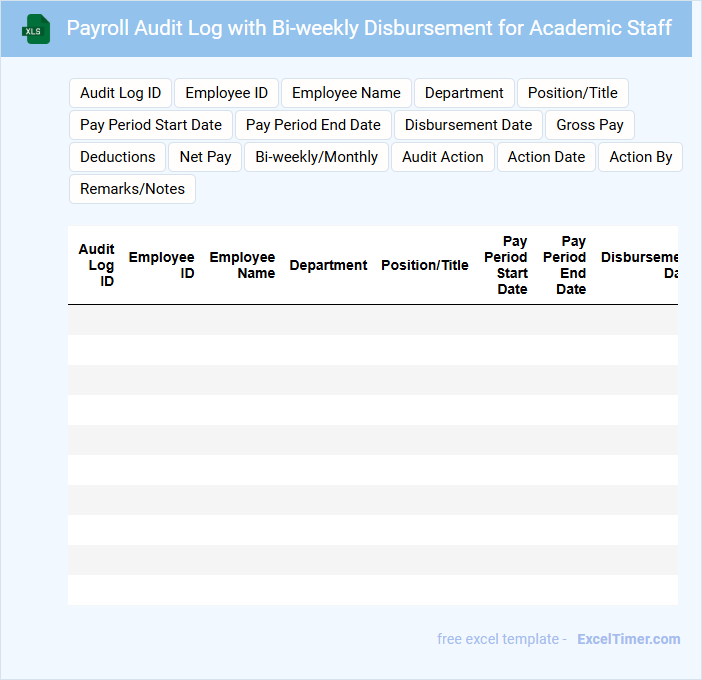

Payroll Audit Log with Bi-weekly Disbursement for Academic Staff

Payroll Audit Log with Bi-weekly Disbursement for Academic Staff typically contains detailed records of salary payments processed every two weeks, ensuring transparency and accuracy in payroll management. This document is crucial for verifying disbursements and reconciling discrepancies related to academic personnel compensation.

- Include precise dates of payroll processing and payment periods to track bi-weekly cycles effectively.

- Record detailed information about each academic staff member, such as name, position, and payment amount.

- Highlight any adjustments, deductions, or bonuses applied during the payroll period for clear audit trails.

What defines a bi-weekly payroll schedule for academic staff in Excel documentation?

A bi-weekly payroll schedule for academic staff in Excel documentation outlines payment processing every two weeks, detailing pay periods, work hours, and deductions. Your payroll data is organized into rows and columns for accuracy and easy tracking. This schedule ensures timely salary distribution aligned with institutional policies and academic calendars.

How are pay periods and pay dates organized and tracked in a bi-weekly payroll worksheet?

Bi-weekly payroll worksheets organize pay periods by listing consecutive two-week intervals with corresponding start and end dates. Pay dates are tracked alongside each pay period, typically showing the exact date employees receive their wages. This structure ensures accurate calculation and timely processing of academic staff salaries.

Which Excel formulas are essential for calculating gross and net pay on a bi-weekly basis?

Essential Excel formulas for calculating bi-weekly gross pay include =SUM(hours_worked * hourly_rate) or =annual_salary / 26 for salaried staff. For net pay, use =gross_pay - (taxes + deductions) where taxes can be computed with formulas like =gross_pay * tax_rate. Combining these ensures accurate payroll calculations tailored to bi-weekly academic staff payments.

How does Excel handle deductions and benefits for academic staff within the bi-weekly payroll cycle?

Excel calculates deductions and benefits for academic staff in a bi-weekly payroll cycle by applying preset formulas to gross earnings, including taxes, insurance, and retirement contributions. The spreadsheet uses dynamic cell references linked to employee data and benefit rates to ensure accurate and timely updates. Conditional formatting highlights discrepancies or missing values, optimizing payroll accuracy and compliance.

What key data columns should be included in an Excel bi-weekly payroll template for academic staff?

An Excel bi-weekly payroll template for academic staff should include columns for Employee ID, Name, Position, Department, Pay Period Start Date, Pay Period End Date, Hours Worked, Overtime Hours, Gross Pay, Tax Deductions, Retirement Contributions, Health Benefits Deductions, Net Pay, and Payment Date. Including these key data points ensures accurate calculation and clear tracking of payroll details. This structure supports compliance with institutional policies and government regulations.