The Bi-weekly Excel Template for Childcare Center Payroll streamlines payroll processing by accurately tracking employee hours, calculating wages, and managing deductions. It ensures compliance with labor laws and helps maintain financial transparency within the childcare center. Customizable fields allow for easy adaptation to specific payroll needs and employee classifications.

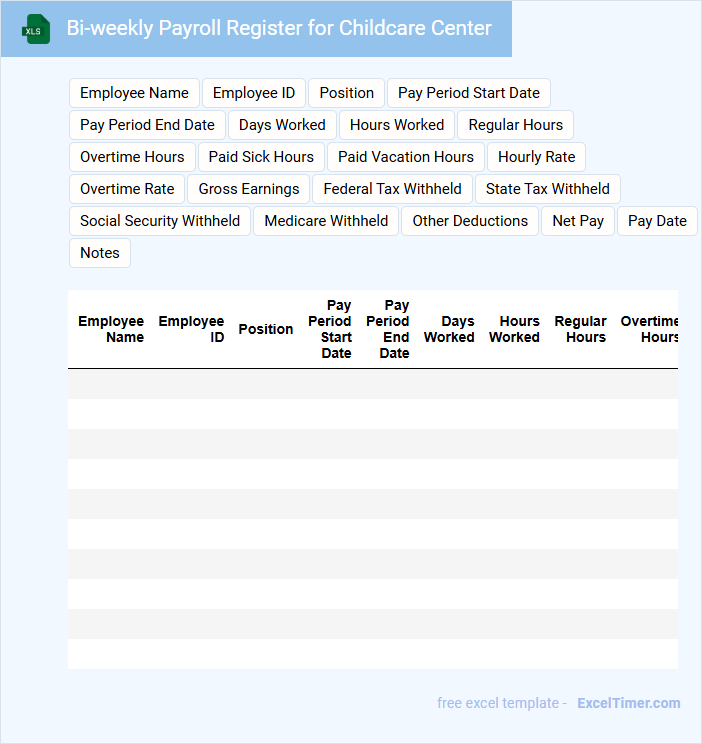

Bi-weekly Payroll Register for Childcare Center

A Bi-weekly Payroll Register for a Childcare Center is a document summarizing employee compensation details for every two-week period. It helps ensure accurate payroll processing and financial tracking.

- Include employee names, hours worked, and pay rates to maintain clear records.

- Record deductions, taxes, and benefits to ensure compliance and accuracy.

- Verify totals and cross-check with attendance for error-free payroll management.

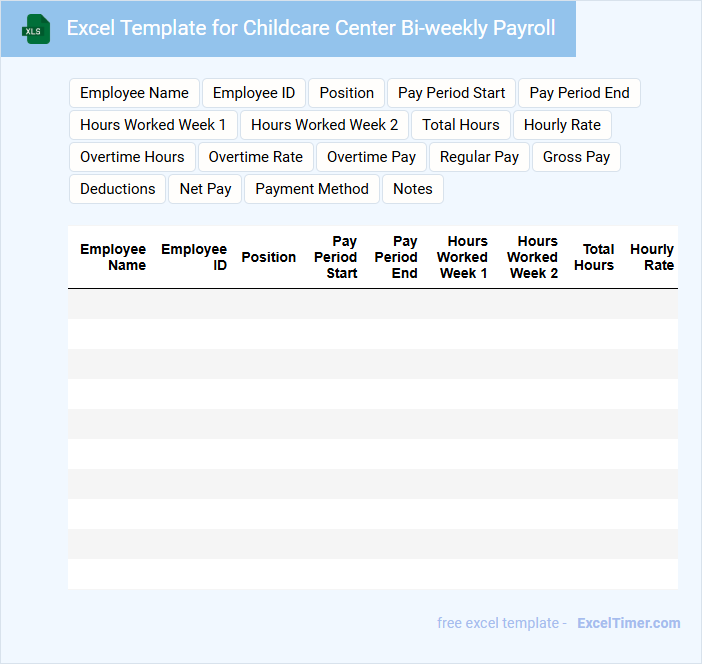

Excel Template for Childcare Center Bi-weekly Payroll

What information is typically included in an Excel Template for Childcare Center Bi-weekly Payroll? This type of document usually contains details such as employee names, hours worked, pay rates, deductions, and net pay. It helps streamline payroll calculation and ensures accurate and timely payments.

What important features should be included to optimize this payroll template? Key elements include automated formulas for calculating gross pay and taxes, clear formatting for easy data entry, and sections for overtime and leave tracking to ensure comprehensive payroll management.

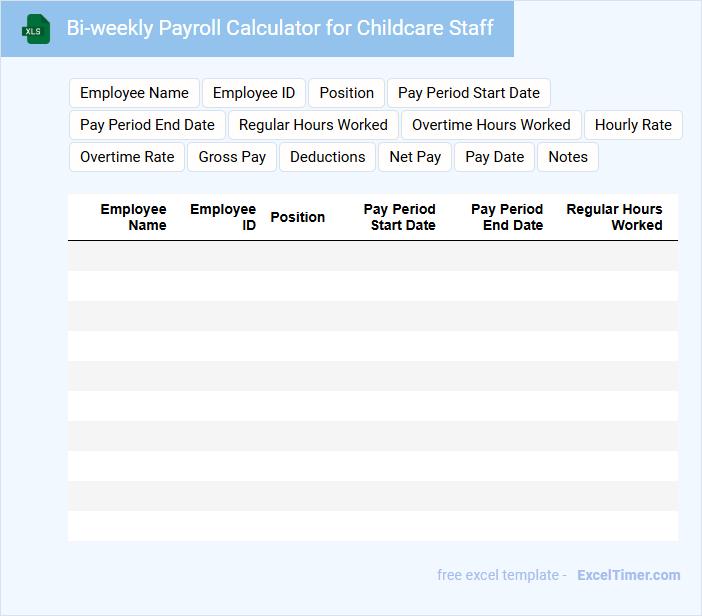

Bi-weekly Payroll Calculator for Childcare Staff

A Bi-weekly Payroll Calculator for Childcare Staff is a document used to accurately compute salaries paid every two weeks. It ensures all earnings and deductions are accounted for in compliance with labor laws.

- Include clear categories for hours worked, overtime, and bonuses.

- Incorporate tax withholdings and benefit deductions specific to childcare employees.

- Provide a summary section showing total pay, deductions, and net salary.

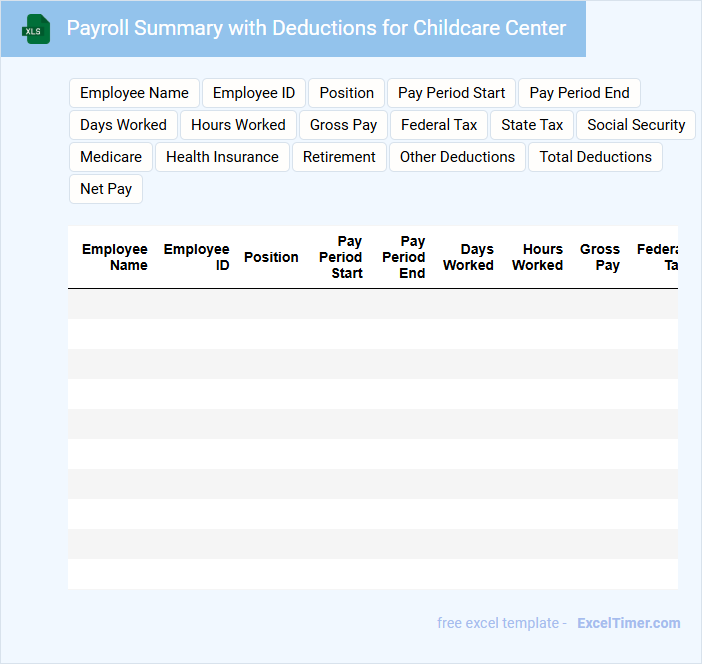

Payroll Summary with Deductions for Childcare Center

Payroll Summary with Deductions for Childcare Center documents the total earnings and deductions for each employee, ensuring accurate financial and tax records.

- Employee Information: Includes full names, employee IDs, and job positions for clear identification.

- Earnings Breakdown: Details gross wages, overtime, bonuses, and other income components.

- Deductions Specific to Childcare: Lists mandatory deductions like taxes alongside childcare-related benefits or contributions.

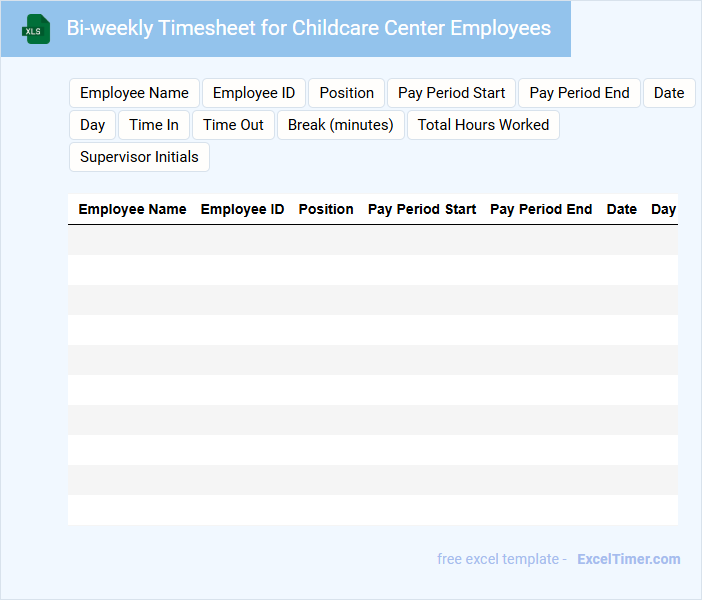

Bi-weekly Timesheet for Childcare Center Employees

The Bi-weekly Timesheet for Childcare Center Employees is a document used to record work hours and attendance over a two-week period. It ensures accurate tracking of employee time for payroll and compliance purposes.

Typically, this timesheet contains employee details, dates worked, hours logged each day, and total hours. Important suggestions include verifying time accuracy and including space for supervisor approval to maintain accountability.

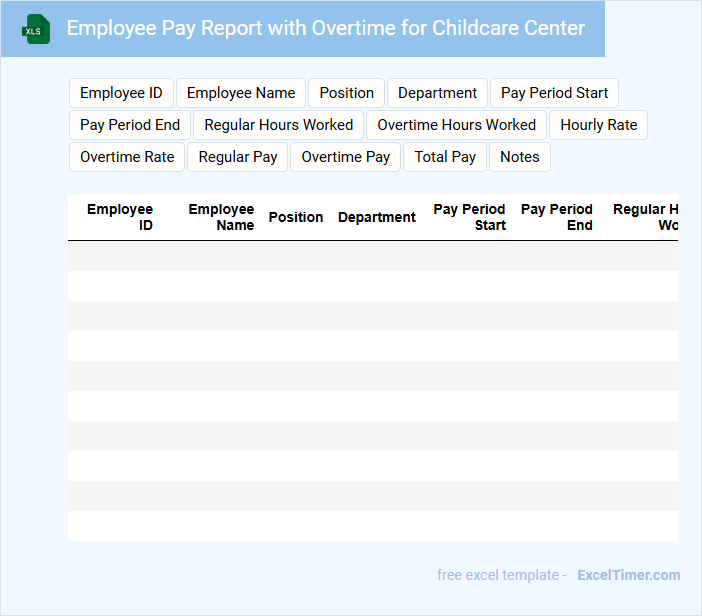

Employee Pay Report with Overtime for Childcare Center

An Employee Pay Report with overtime details typically contains information about each employee's regular hours worked, overtime hours, and total compensation for a specific period. It includes detailed breakdowns to ensure compliance with labor laws and accurate payroll processing. For a childcare center, highlighting overtime is crucial to manage staffing costs effectively while maintaining quality care.

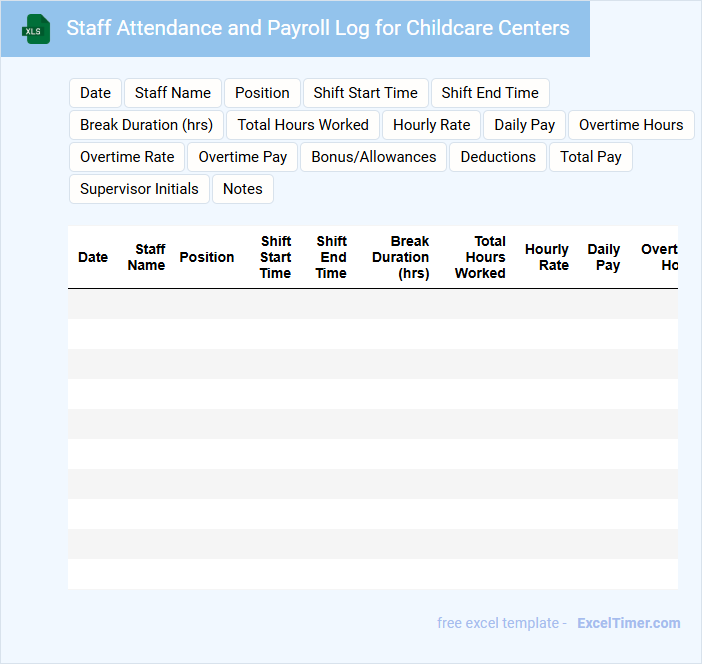

Staff Attendance and Payroll Log for Childcare Centers

A Staff Attendance and Payroll Log for Childcare Centers typically contains detailed records of employee work hours, attendance, and salary information. This document ensures accurate tracking for payroll processing and compliance with labor regulations.

Important elements to include are employee names, clock-in/out times, total hours worked, and compensation details. Maintaining up-to-date and precise logs helps in efficient payroll management and auditing purposes.

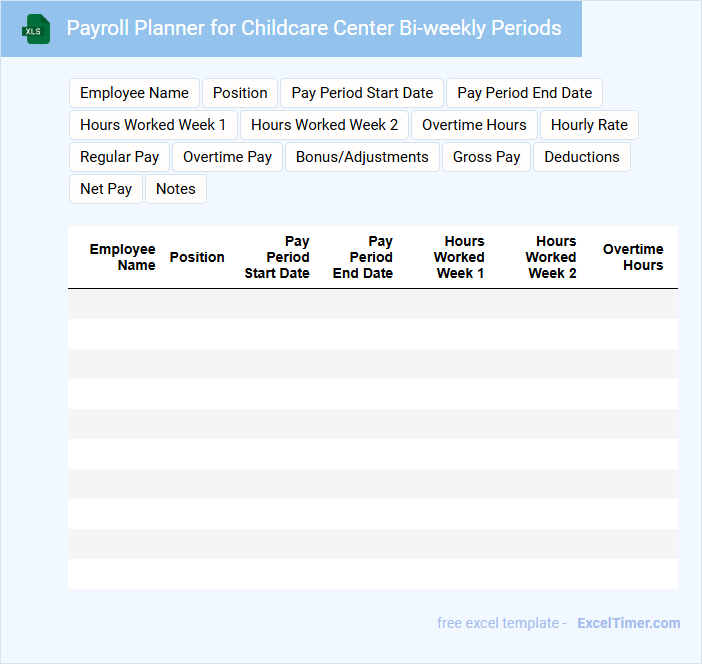

Payroll Planner for Childcare Center Bi-weekly Periods

Payroll Planner for Childcare Center Bi-weekly Periods is a document designed to streamline employee compensation calculations. It organizes work hours, wages, and deductions for accurate bi-weekly payroll processing.

- Include detailed employee attendance and hours worked.

- Incorporate overtime and benefit deductions clearly.

- Ensure compliance with federal and state labor laws.

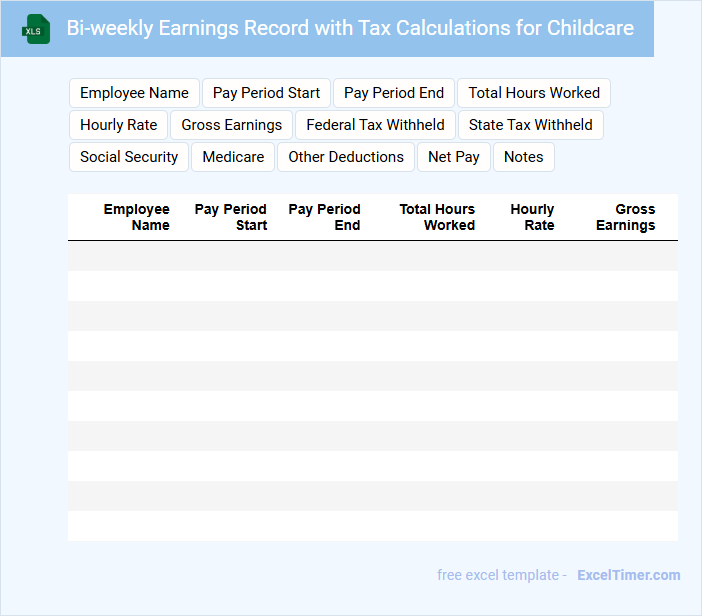

Bi-weekly Earnings Record with Tax Calculations for Childcare

A Bi-weekly Earnings Record typically contains detailed information about an employee's earnings calculated every two weeks, including gross pay, deductions, and net pay. It also captures tax withholdings specifically relevant to childcare expenses and benefits.

Such a document is essential for accurate tax calculations related to childcare credits and deductions, ensuring compliance with legal requirements. It is important to maintain precise records for potential audits and financial planning.

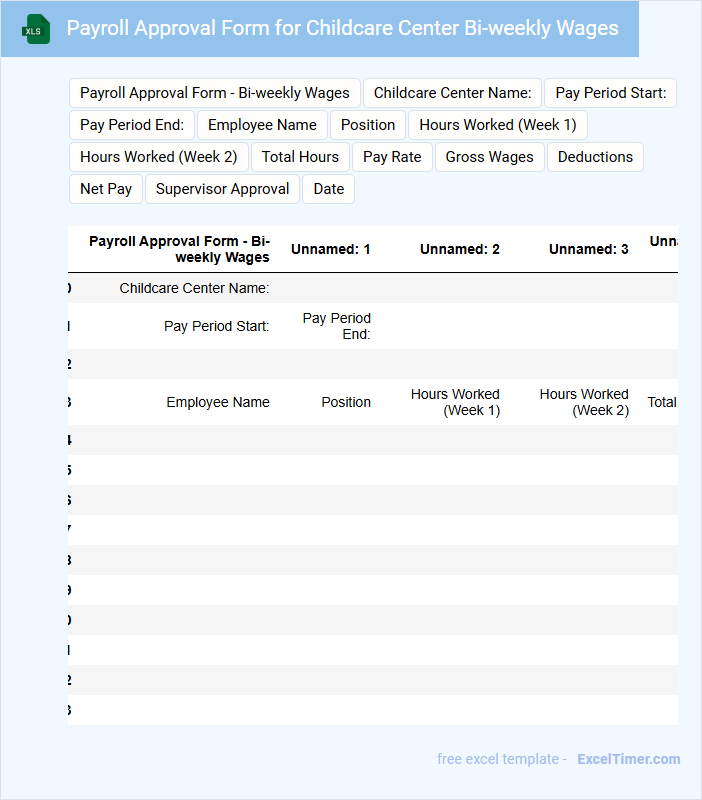

Payroll Approval Form for Childcare Center Bi-weekly Wages

A Payroll Approval Form for a Childcare Center Bi-weekly Wages is a document used to verify and authorize employee wage payments every two weeks. It typically contains employee details, hours worked, pay rates, and total wages for the pay period. Ensuring accuracy in hours and signatures is crucial for timely and error-free payroll processing.

Childcare Center Payroll Tracker with Benefits

A Childcare Center Payroll Tracker with Benefits typically contains detailed records of employee wages, hours worked, and associated benefits to ensure accurate and compliant payroll management.

- Employee Information: Includes names, positions, and employment dates for accurate identification and payroll processing.

- Hours and Wages: Tracks hours worked, overtime, and pay rates to calculate total earnings precisely.

- Benefits and Deductions: Records health insurance, retirement contributions, and tax withholdings to reflect net pay and compliance.

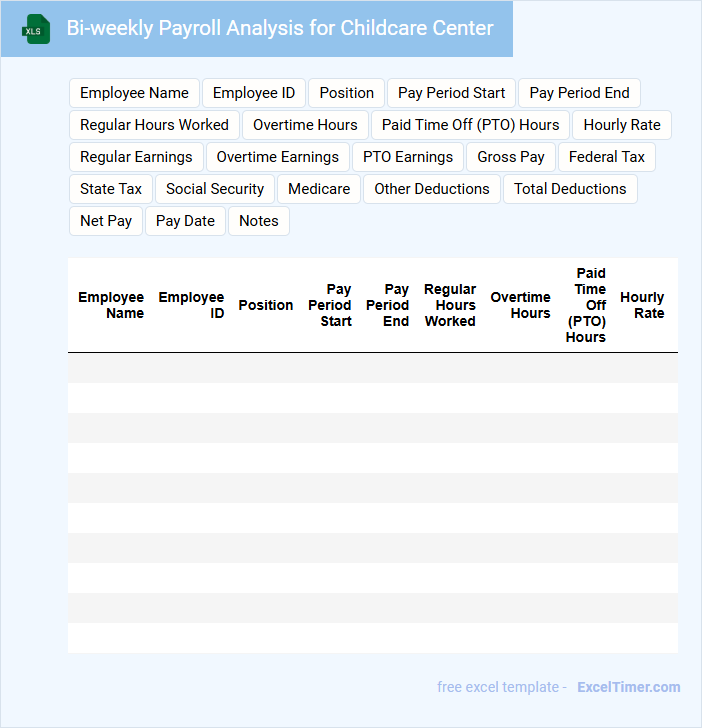

Bi-weekly Payroll Analysis for Childcare Center

A Bi-weekly Payroll Analysis for a Childcare Center typically contains a detailed overview of employee wages, hours worked, and payroll deductions within a two-week period.

- Employee Hours Tracking: Accurate recording of hours worked by each staff member ensures proper payroll calculation and compliance with labor laws.

- Salary and Benefits Breakdown: Clear documentation of gross pay, taxes, benefits, and net pay enhances transparency and financial planning.

- Compliance and Auditing: Regular reviews help maintain adherence to tax regulations and detect discrepancies early for smooth financial operations.

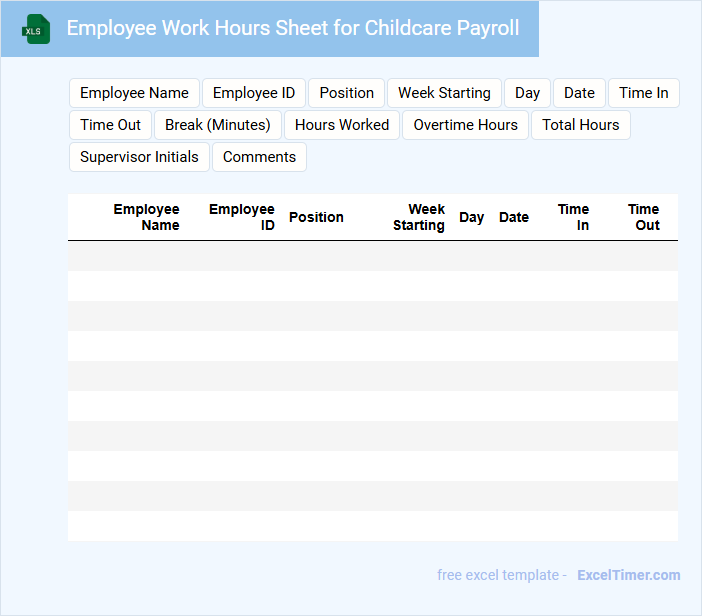

Employee Work Hours Sheet for Childcare Payroll

An Employee Work Hours Sheet for Childcare Payroll typically contains detailed records of hours worked by employees to ensure accurate payroll processing.

- Employee Identification: includes the name and ID number to accurately track individual work hours.

- Daily Work Hours: documents start and end times, as well as breaks, to calculate total hours worked.

- Approval Section: provides space for supervisor verification to ensure accuracy and compliance.

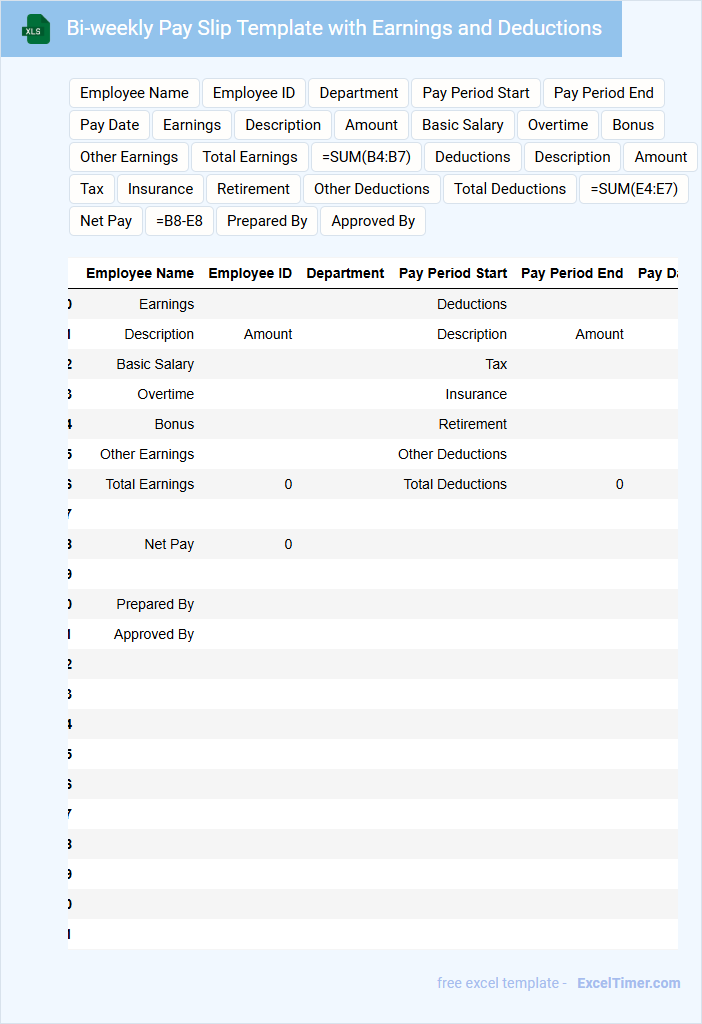

Bi-weekly Pay Slip Template with Earnings and Deductions

A Bi-weekly Pay Slip Template typically contains detailed information about an employee's earnings and deductions for a two-week period. It helps both employers and employees keep track of payroll and ensure transparency.

- Include clear breakdowns of gross pay, taxes, and other deductions.

- Highlight the net pay to show the final amount received by the employee.

- Ensure accurate dates covering the pay period to avoid confusion.

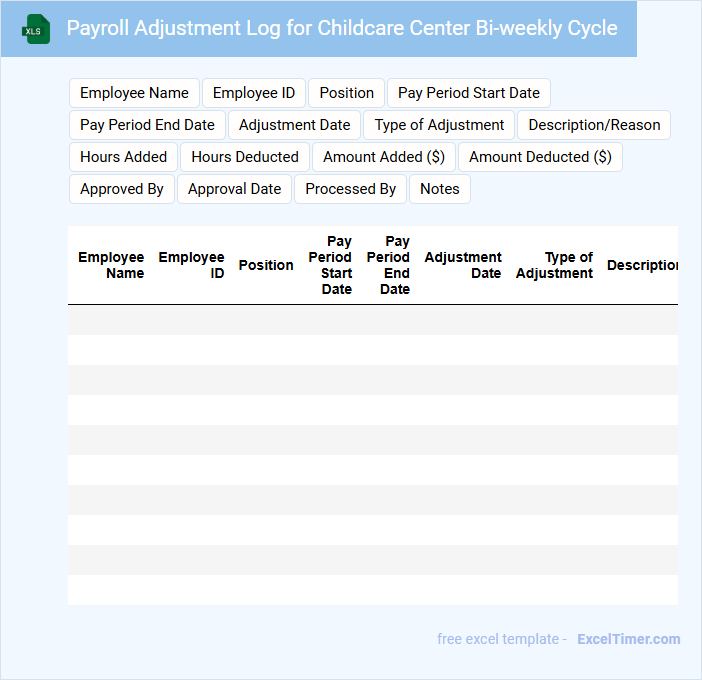

Payroll Adjustment Log for Childcare Center Bi-weekly Cycle

The Payroll Adjustment Log for a Childcare Center Bi-weekly Cycle is a crucial document used to track any modifications made to employee payroll during each pay period. It typically contains details such as employee hours, overtime, bonuses, deductions, and any corrections from prior payrolls. Maintaining an accurate log ensures transparency, compliance, and timely resolution of payroll discrepancies.

How do you set up a bi-weekly payroll schedule in an Excel document for a childcare center?

To set up a bi-weekly payroll schedule in an Excel document for a childcare center, create columns for employee names, pay periods, hours worked, and pay rates. Use formulas to calculate total hours, gross pay, and deductions for each two-week period. You can customize the spreadsheet to track attendance, overtime, and tax withholdings efficiently.

What formulas are essential for calculating bi-weekly gross and net pay in Excel?

Essential Excel formulas for bi-weekly childcare center payroll include =SUM() to total hours worked, =A2*B2 to calculate gross pay by multiplying hours by hourly rate, and =C2-D2-E2 to derive net pay by subtracting taxes and deductions from gross pay. Use =IF() to handle overtime calculations and =VLOOKUP() for tax rate lookups based on employee data. Proper implementation ensures accurate bi-weekly payroll processing and compliance.

How can you efficiently track employee hours and overtime for bi-weekly payroll in Excel?

You can efficiently track employee hours and overtime for bi-weekly payroll in Excel by creating a customized timesheet template that automatically calculates total hours worked and applies overtime rules based on your childcare center's policies. Incorporate formulas such as SUM and IF to differentiate regular hours from overtime hours accurately. Utilize features like conditional formatting and data validation to ensure accuracy and streamline payroll processing.

What columns should be included in an Excel payroll sheet to ensure bi-weekly compliance and documentation?

Include columns for Employee Name, Employee ID, Pay Period Start and End Dates, Hours Worked, Overtime Hours, Pay Rate, Gross Pay, Tax Deductions, Benefits Deductions, Net Pay, and Payment Date. Add fields for Department or Position, Payroll Status, and Notes to track specific payroll details and adjustments. Ensure formulas calculate totals and deductions accurately for bi-weekly payroll compliance in a childcare center.

How do you automate deductions (taxes/benefits) for a bi-weekly payroll in an Excel spreadsheet?

Automate bi-weekly payroll deductions in Excel by creating formulas referencing tax rates and benefit percentages applied to each employee's gross pay. Use consistent deduction cells linked to a centralized tax and benefits table to update values automatically each pay period. Implement functions like IF and VLOOKUP for conditional calculations and ensure payroll data is structured for easy formula integration.