The Bi-weekly Salary Calculation Excel Template for Non-profits streamlines payroll management by accurately calculating employee salaries every two weeks, ensuring compliance with budget constraints typical of non-profit organizations. This template incorporates essential features such as tax deductions, benefits tracking, and overtime calculation tailored to non-profit payroll needs. Utilizing this tool helps non-profit organizations maintain transparent and efficient salary processing while minimizing errors.

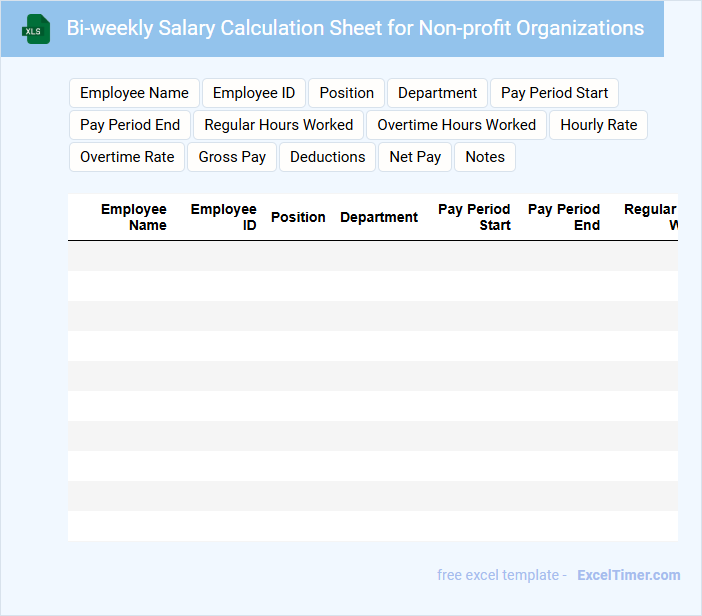

Bi-weekly Salary Calculation Sheet for Non-profit Organizations

What information is typically included in a Bi-weekly Salary Calculation Sheet for Non-profit Organizations? This document usually contains detailed employee salary data, including hours worked, overtime, deductions, and net pay for each two-week period. It serves as a transparent record to ensure accurate and timely compensation while maintaining compliance with organizational policies and labor regulations.

What are important considerations when preparing this type of sheet? It is essential to verify the accuracy of all time entries and deduction calculations to prevent payroll errors. Additionally, including clear labels and maintaining confidentiality of sensitive employee information is critical for both transparency and compliance.

Payroll Tracker with Bi-weekly Calculation for Non-profits

A Payroll Tracker with bi-weekly calculation is an essential document for non-profits to manage employee payments efficiently. It usually contains detailed records of hours worked, pay rates, deductions, and net pay for each employee during the bi-weekly period. Ensuring accuracy and compliance with labor laws is crucial for maintaining transparency and financial accountability.

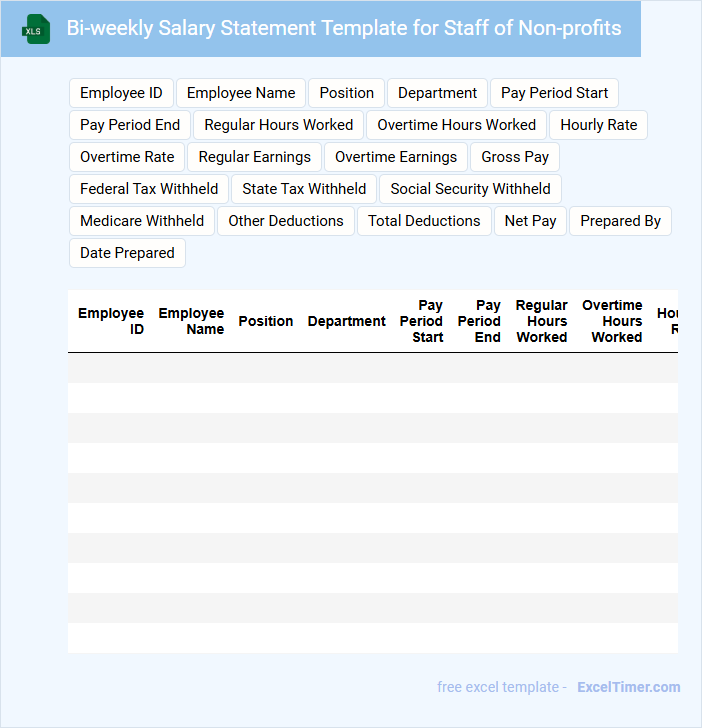

Bi-weekly Salary Statement Template for Staff of Non-profits

A Bi-weekly Salary Statement Template for non-profit staff typically includes detailed information about an employee's earnings, deductions, and net pay for each two-week period. It usually contains sections for gross salary, tax withholdings, and contributions specific to non-profit organizations. Ensuring accuracy in reflecting benefits and compliance with non-profit regulations is crucial for transparency and record-keeping.

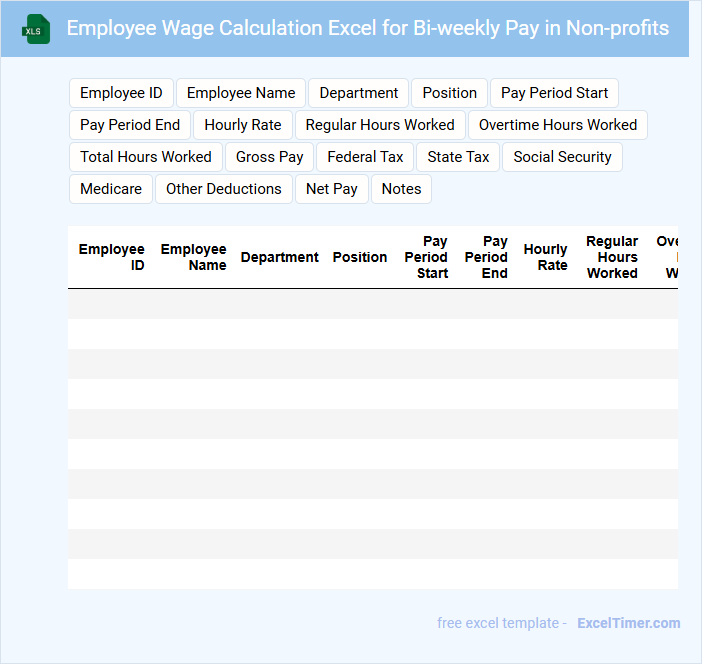

Employee Wage Calculation Excel for Bi-weekly Pay in Non-profits

What information is typically contained in an Employee Wage Calculation Excel for Bi-weekly Pay in Non-profits? This document usually includes employee hours worked, hourly rates, deductions, and total earnings calculated for each bi-weekly pay period. It is designed to ensure accurate and transparent payroll management tailored to the unique financial structures of non-profit organizations.

What are important considerations when creating this document for non-profits? It is crucial to account for varying funding sources, grant-specific restrictions, and compliance with labor laws. Additionally, including detailed audit trails and clear categorization of wages helps maintain accountability and ease reporting requirements.

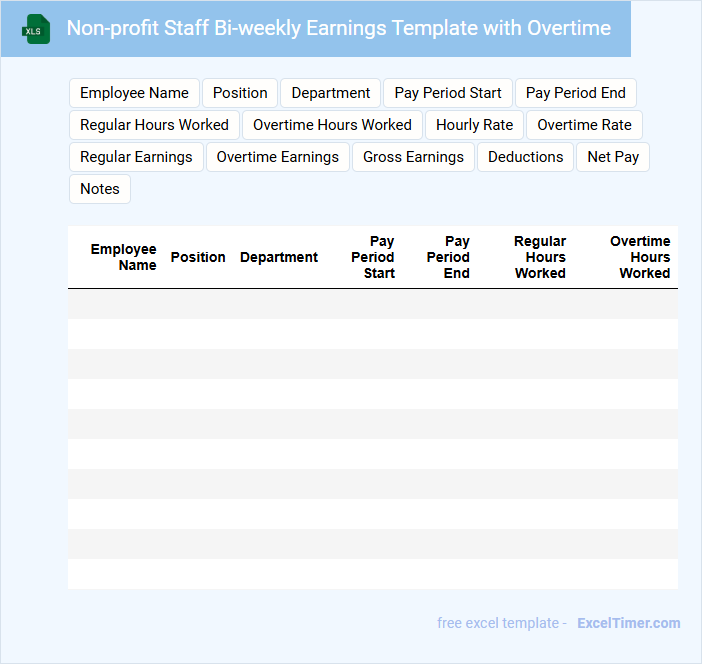

Non-profit Staff Bi-weekly Earnings Template with Overtime

The Non-profit Staff Bi-weekly Earnings Template with Overtime is a crucial document used to accurately record employee wages over a two-week period. It typically contains details such as regular hours worked, overtime hours, pay rates, and total earnings. This template helps non-profit organizations maintain transparent and compliant payroll records.

Important elements to include are employee names, job titles, pay periods, overtime approval, and tax withholdings. Ensuring accuracy in overtime calculations and proper documentation supports fair compensation and legal compliance. Regular updates and clear formatting enhance usability and reduce payroll errors in the organization.

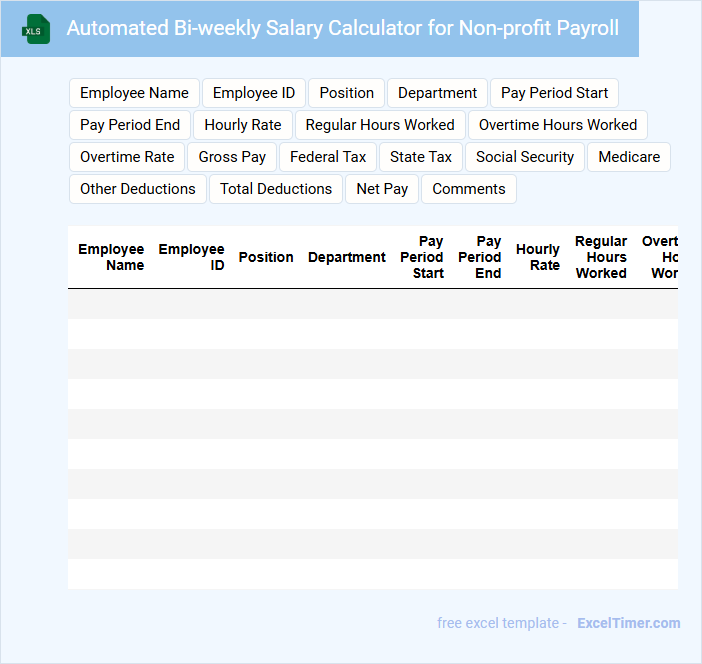

Automated Bi-weekly Salary Calculator for Non-profit Payroll

Automated Bi-weekly Salary Calculator for Non-profit Payroll is a specialized tool designed to accurately compute employee salaries every two weeks, ensuring compliance with non-profit organization policies and tax regulations. It streamlines payroll processing by automating calculations, deductions, and record-keeping to improve efficiency and reduce errors.

- Incorporate tax exemptions and charitable contribution deductions specific to non-profits.

- Ensure compatibility with local labor laws and reporting requirements for non-profit entities.

- Include audit trails and secure data handling to protect sensitive employee information.

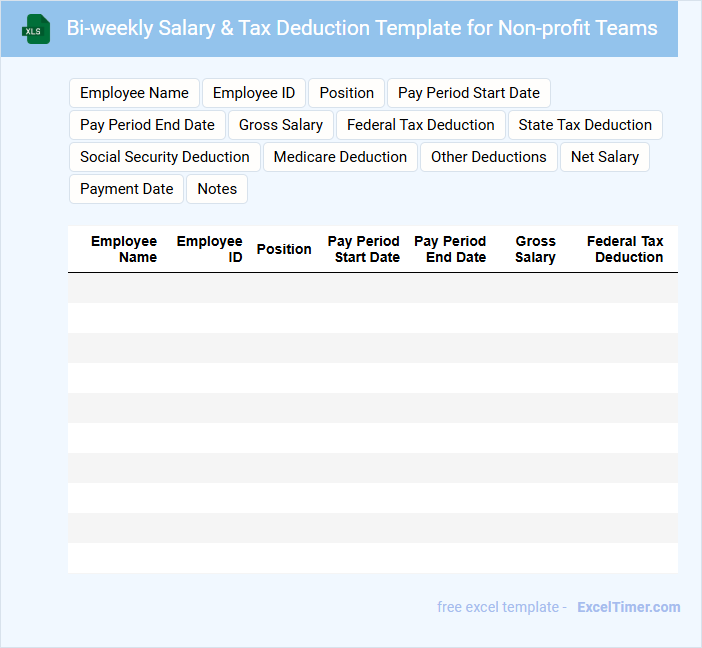

Bi-weekly Salary & Tax Deduction Template for Non-profit Teams

This Bi-weekly Salary & Tax Deduction Template is designed to help non-profit teams accurately track employee earnings and mandatory tax withholdings every two weeks. It typically includes details such as gross salary, various tax deductions, and net pay calculations to ensure transparency and compliance. Utilizing this template streamlines payroll management and aids in efficient financial record-keeping for non-profit organizations.

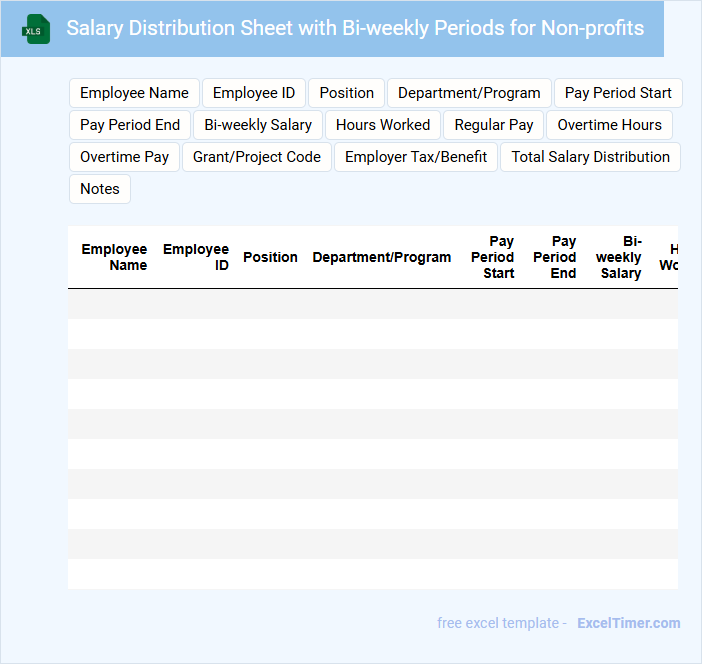

Salary Distribution Sheet with Bi-weekly Periods for Non-profits

A Salary Distribution Sheet for non-profits typically contains detailed records of employee salaries, including gross pay, deductions, and net pay calculated over bi-weekly periods. This document ensures transparent and accurate payroll management aligned with organizational policies.

It is crucial to include donation-related tax deductions and compliance with labor laws specific to non-profit organizations. Regular updates and secure data handling are important to maintain accuracy and confidentiality.

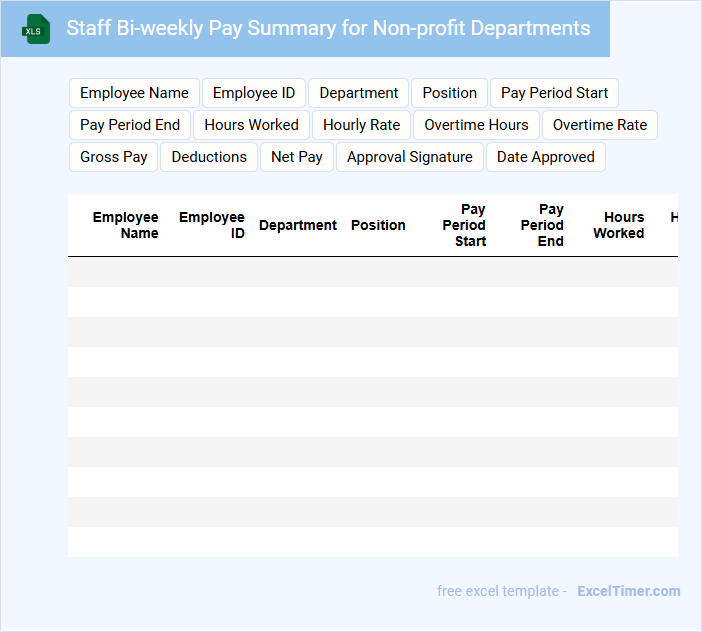

Staff Bi-weekly Pay Summary for Non-profit Departments

The Staff Bi-weekly Pay Summary for non-profit departments is a concise document outlining employee compensation details over a two-week period. It typically includes hours worked, pay rates, and any deductions or bonuses. This summary ensures transparency and accuracy in payroll processing.

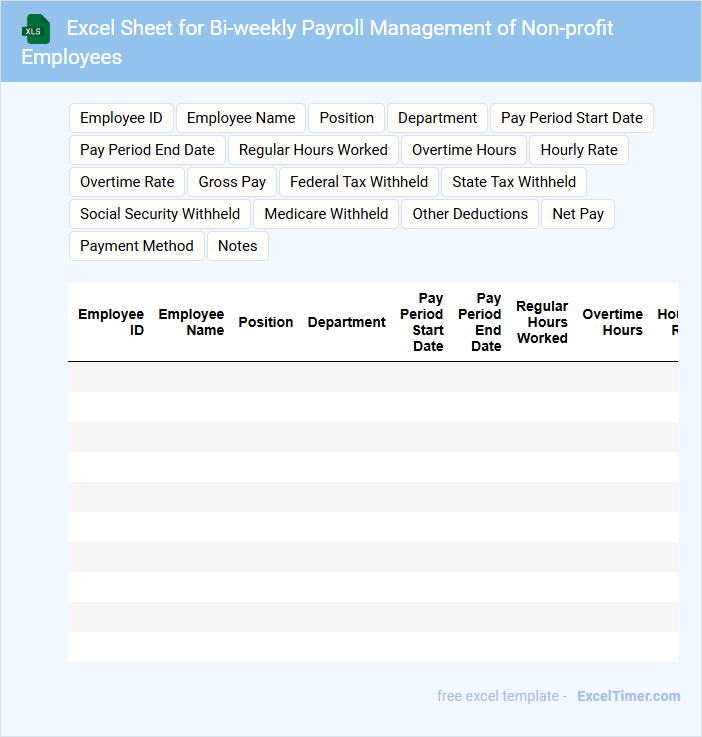

Excel Sheet for Bi-weekly Payroll Management of Non-profit Employees

This document typically contains detailed records of employee compensation calculated on a bi-weekly basis for non-profit organizations.

- Employee Information: Includes names, roles, and employee IDs for accurate tracking.

- Payroll Calculations: Covers gross pay, deductions, and net pay for each pay period.

- Compliance Records: Ensures adherence to legal and organizational payroll policies.

Bi-weekly Compensation Tracker with Benefits for Non-profits

What information is typically included in a Bi-weekly Compensation Tracker with Benefits for Non-profits? This type of document usually contains detailed records of employee wages, including base pay, overtime, and deductions processed every two weeks. It also tracks associated benefits such as health insurance, retirement contributions, and any non-monetary perks offered by the non-profit organization.

Why is it important to include both compensation and benefits in this tracker? Combining both elements ensures accurate overall cost analysis of employee expenses and promotes transparency in budget management. For non-profits, maintaining precise records helps align financial reporting with regulatory compliance and supports strategic workforce planning.

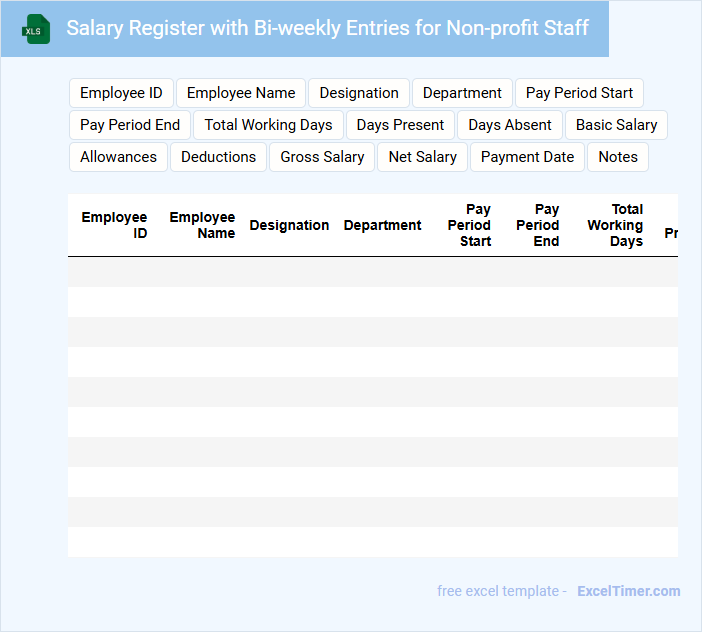

Salary Register with Bi-weekly Entries for Non-profit Staff

A Salary Register with bi-weekly entries for non-profit staff is a crucial financial document that records detailed employee payment information every two weeks. It typically includes staff names, payment dates, gross pay, deductions, and net pay to ensure accurate payroll tracking. Maintaining this register helps organizations comply with legal requirements and ensures transparency in staff compensation.

Important considerations include verifying data accuracy, updating entries promptly, and safeguarding sensitive salary information to maintain confidentiality. Additionally, it is essential to align the register with the organization's budget guidelines and grant reporting standards. Regular review of the salary register can prevent payroll errors and support effective financial management.

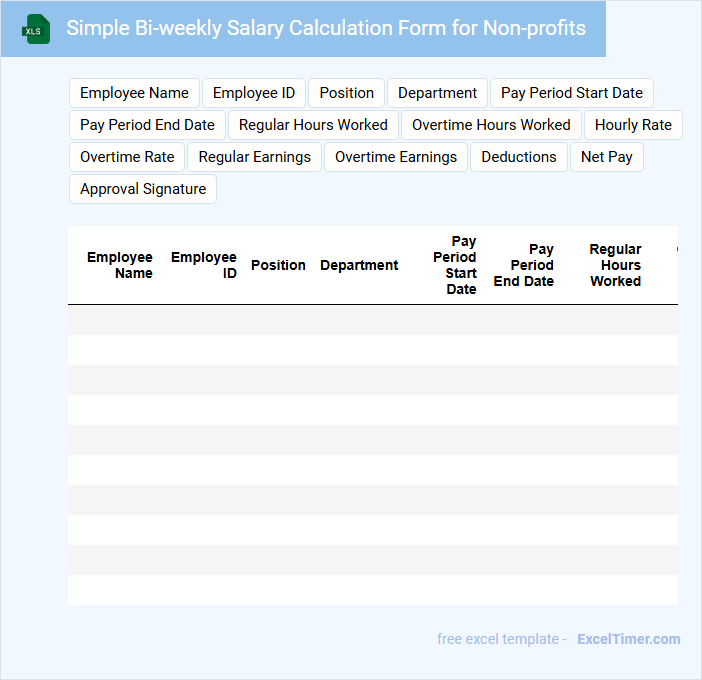

Simple Bi-weekly Salary Calculation Form for Non-profits

A Simple Bi-weekly Salary Calculation Form is typically used in non-profit organizations to accurately track employee wages over two-week periods. This document usually contains fields for employee information, hours worked, pay rates, deductions, and the final net salary. Ensuring clarity and accuracy in this form helps maintain transparent payroll records and compliance with labor regulations.

Important elements to include are clear identification of the pay period, a breakdown of hours worked including overtime, and a section for authorized signatures to validate the calculations. Additionally, integrating a summary of total deductions like taxes and benefits ensures that both employers and employees have a clear understanding of the salary components. It is essential to regularly update this form to align with any changes in tax laws or organizational policies.

Bi-weekly Payroll Budget Tracker for Non-profit Organizations

A Bi-weekly Payroll Budget Tracker for Non-profit Organizations is a document used to monitor and manage payroll expenses every two weeks to ensure financial stability. It helps organizations allocate funds efficiently while staying compliant with budget constraints.

- Include all employee salaries, wages, and benefits for accurate budgeting.

- Track payroll taxes and deductions to avoid unexpected liabilities.

- Update regularly to reflect changes in staffing or compensation rates.

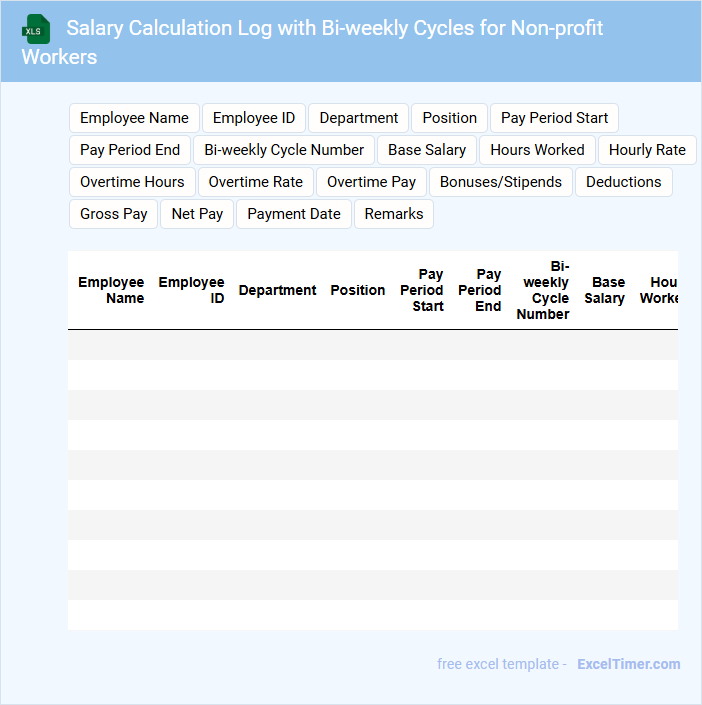

Salary Calculation Log with Bi-weekly Cycles for Non-profit Workers

A Salary Calculation Log typically contains detailed records of employee earnings, deductions, and net pay over specified pay periods. For non-profit workers, this document ensures transparent tracking of compensation aligned with organizational budgets. It is essential to maintain accurate timestamps for bi-weekly cycles and note any adjustments or special payments. This log aids in financial auditing, compliance, and payroll accuracy. Including employee identification, hours worked, and contribution to benefits enhances clarity. Regularly updating and securely storing the log supports accountability and streamlined payroll processing.

How do you accurately input employee work hours for bi-weekly salary calculations in Excel?

To accurately input employee work hours for bi-weekly salary calculations in Excel, create dedicated columns for daily hours and use formulas to sum total hours per pay period. Ensure you format cells for consistent time tracking and apply data validation to prevent incorrect entries. Your spreadsheet will then calculate precise wages by multiplying total hours with the employee's hourly rate.

Which Excel formulas are most effective for calculating gross bi-weekly salary in a non-profit context?

To calculate gross bi-weekly salary for a non-profit in Excel, use the formula =Annual_Salary/26, dividing the annual salary by 26 pay periods. Incorporate additional formulas like =IF() for conditional deductions or =SUM() to total hours and rates. Your spreadsheet can leverage these functions for accurate and automated gross salary calculations.

How do you account for overtime, deductions, and benefits in a bi-weekly salary Excel sheet?

Your bi-weekly salary Excel sheet for non-profits should include separate columns for regular hours, overtime hours, deductions, and benefits to ensure accurate calculations. Overtime pay is calculated by multiplying overtime hours by the applicable overtime rate, while deductions such as taxes and retirement contributions are subtracted from the gross pay. Benefits like health insurance and allowances are added or listed separately to reflect the net bi-weekly salary correctly.

What methods can be used to automate bi-weekly payroll summaries in Excel for non-profit organizations?

Automate bi-weekly payroll summaries in Excel for non-profits using VBA macros to extract and calculate employee hours and salaries. Utilize PivotTables to dynamically summarize payroll data based on dates and employee categories. Integrate Excel formulas like SUMIFS and IFERROR to handle salary calculations and error checks efficiently.

How should tax-exempt and grant-funded positions be handled in Excel-based bi-weekly salary calculations?

In Excel-based bi-weekly salary calculations for non-profits, tax-exempt positions should be flagged with a specific tax code to exclude payroll tax deductions automatically. Grant-funded positions must link salary entries to corresponding grant codes and funding limits to ensure accurate budget tracking. Use conditional formulas and data validation to maintain compliance and prevent errors in salary disbursement.