The Daily Budget Planner Excel Template for Small Businesses helps track income, expenses, and cash flow efficiently on a daily basis. This template enhances financial management by providing clear visibility into spending patterns and budget adherence. Customizable categories and automated calculations make it essential for maintaining budget control and improving profitability.

Daily Budget Tracker for Small Businesses

A Daily Budget Tracker for small businesses is a financial document used to monitor daily expenses and revenues, ensuring effective cash flow management. It typically contains sections for recording income sources, fixed and variable costs, and daily financial summaries. An important feature is the ability to quickly identify discrepancies and stay within budget limits to maintain profitability.

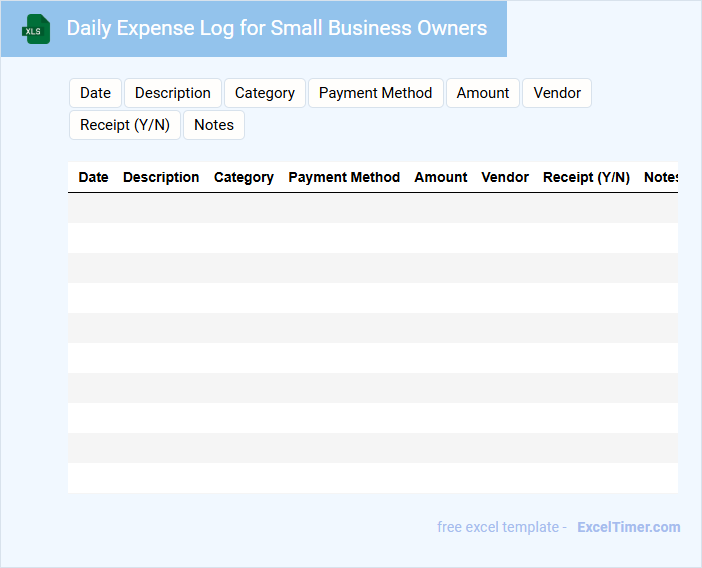

Daily Expense Log for Small Business Owners

A Daily Expense Log for Small Business Owners typically contains records of all daily expenditures including receipts, payment methods, and dates. It helps in tracking cash flow and managing the business budget efficiently.

Maintaining accurate and detailed expense records assists in identifying spending patterns and preparing for tax deductions. Consistency in logging expenses is crucial for financial clarity and decision-making.

It is important to regularly review and categorize expenses to gain actionable insights and ensure compliance with financial regulations.

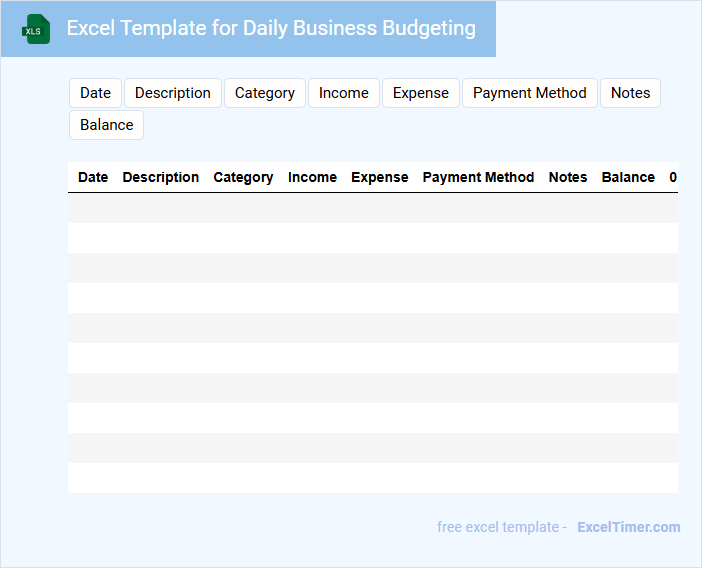

Excel Template for Daily Business Budgeting

An Excel Template for Daily Business Budgeting typically contains structured worksheets designed to track daily income, expenses, and cash flow. It facilitates detailed financial analysis, helping businesses manage their operational costs effectively.

This document usually includes pre-formatted tables, customizable categories, and automatic calculations to improve accuracy and efficiency. A key suggestion is to regularly update the template with real-time data to maintain precise budgeting and informed decision-making.

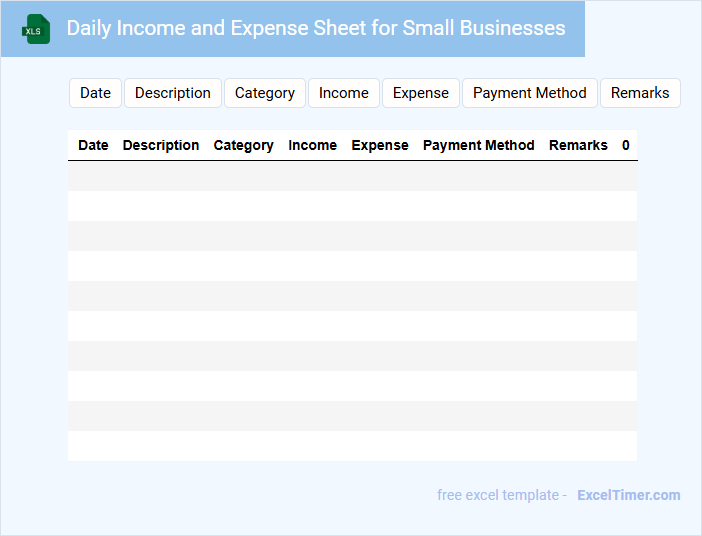

Daily Income and Expense Sheet for Small Businesses

A Daily Income and Expense Sheet for Small Businesses is a document used to record daily financial transactions, tracking money earned and spent. It helps business owners maintain clear financial oversight for better decision-making.

- Include accurate dates and detailed descriptions for each transaction.

- Separate income and expenses to understand cash flow clearly.

- Regularly update and review the sheet to spot trends and discrepancies.

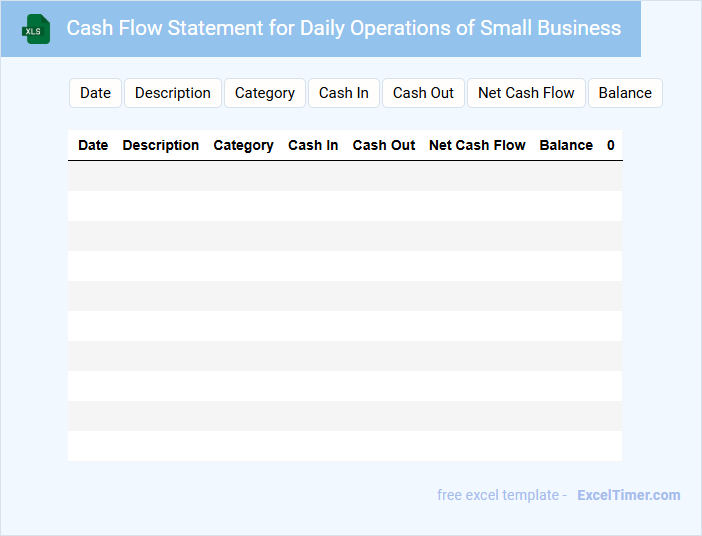

Cash Flow Statement for Daily Operations of Small Business

The Cash Flow Statement for daily operations of a small business typically contains detailed inflows and outflows of cash. It provides insights into the company's operational liquidity, helping track how money moves in and out on a daily basis.

Key components include cash received from customers, cash paid for expenses, and other daily transactions. It's important to regularly monitor this document to ensure sufficient cash availability for operational needs and avoid potential shortfalls.

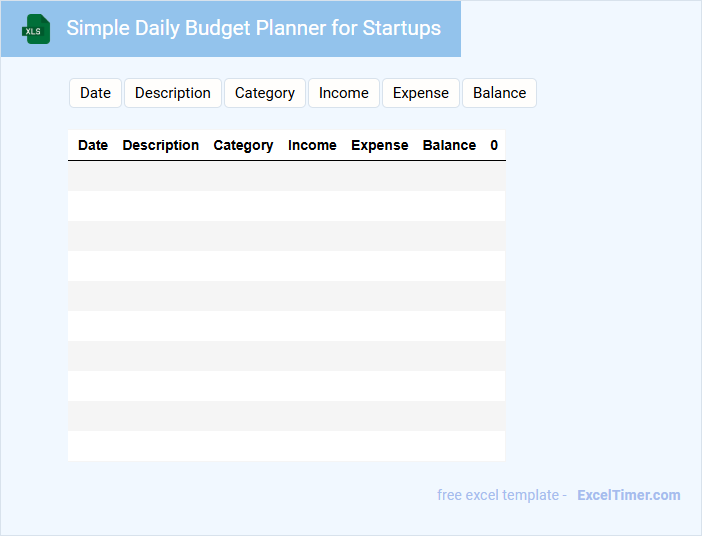

Simple Daily Budget Planner for Startups

A Simple Daily Budget Planner for Startups is a practical tool designed to track daily expenses and revenues, ensuring effective financial management at an early stage. This document typically contains sections for itemized income, fixed and variable expenses, and daily savings goals. Ensuring accuracy and regular updates is crucial for maintaining a clear overview of cash flow and supporting informed decision-making.

Daily Financial Tracker for Small Business Management

A Daily Financial Tracker is a vital document for small business management, providing a detailed record of daily income and expenses. It helps business owners monitor cash flow, identify spending patterns, and make informed financial decisions. Regularly updating this tracker ensures accurate budget planning and financial control.

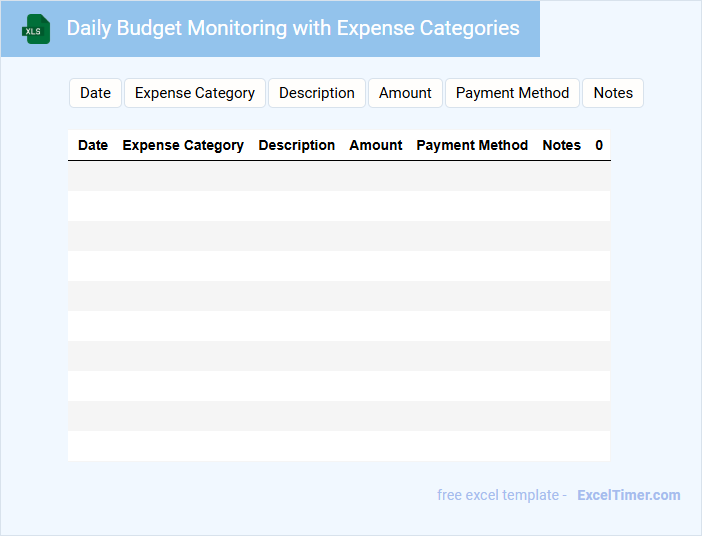

Daily Budget Monitoring with Expense Categories

A Daily Budget Monitoring document typically contains a detailed breakdown of daily expenses sorted by specific categories such as food, transportation, and utilities. It helps track spending patterns and ensures adherence to set financial limits. Consistent monitoring aids in identifying areas for cost savings and financial discipline.

It is important to maintain accurate and up-to-date records for each category to avoid overspending. Setting daily spending limits for each category can prevent budget overruns and keep finances on track. Regular reviews of the recorded expenses help in adjusting the budget as needed for better financial management.

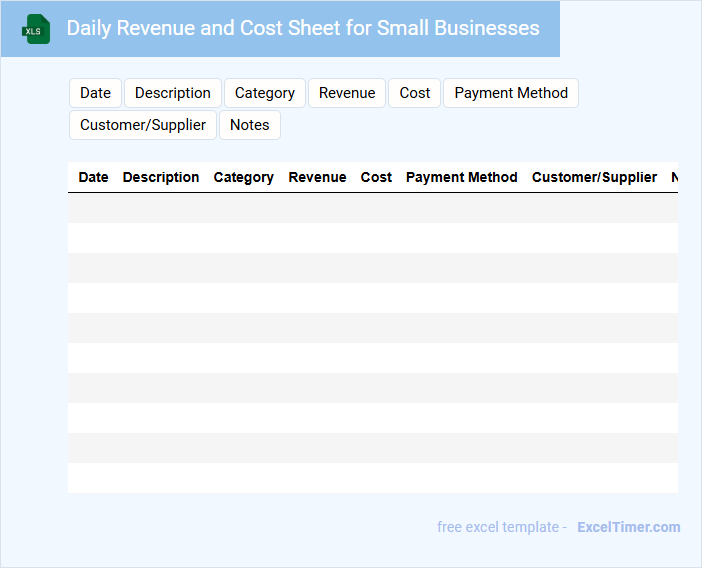

Daily Revenue and Cost Sheet for Small Businesses

The Daily Revenue and Cost Sheet is a crucial document for small businesses, summarizing daily income and expenses. It helps track financial performance on a day-to-day basis, ensuring accurate record-keeping.

Typically, this sheet contains sections for total sales, cost of goods sold, operating expenses, and net profit. Maintaining detailed entries allows business owners to identify trends and make informed financial decisions.

For best results, ensure timely updates and categorize expenses clearly to enhance budgeting and forecasting accuracy.

Excel Template for Managing Daily Business Expenses

An Excel Template for Managing Daily Business Expenses typically contains organized tables and predefined formulas to track and categorize daily expenditures efficiently. It helps businesses monitor cash flow, identify spending patterns, and maintain accurate financial records. Ensuring that expense categories are customizable and formulas are error-free is crucial for reliable data management.

Daily Sales and Expense Tracker for Small Businesses

This document is a Daily Sales and Expense Tracker designed specifically for small businesses to monitor their daily financial transactions. It typically contains sections for recording sales revenue, expenditures, and profit margins.

Including accurate and timely data entries is crucial for effective financial management and decision-making. Regularly updating the tracker helps business owners identify trends and control costs efficiently.

It is important to ensure clarity in categorizing expenses and sales types to maintain organized records and facilitate easy analysis.

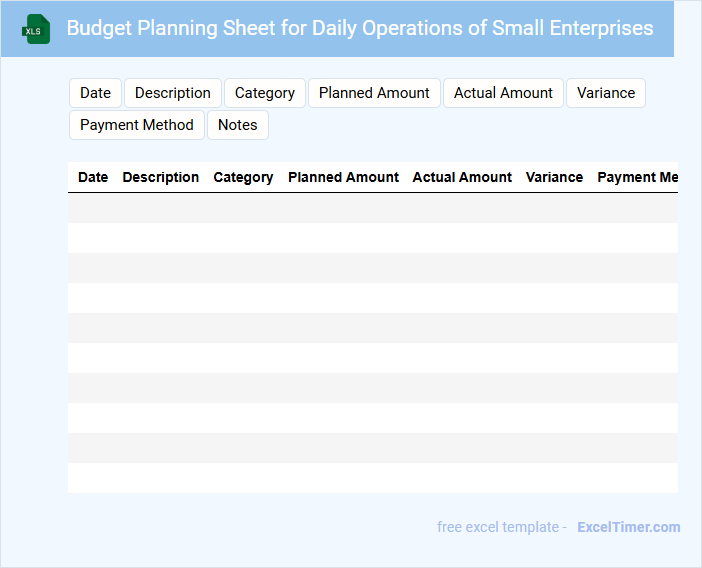

Budget Planning Sheet for Daily Operations of Small Enterprises

A Budget Planning Sheet for Daily Operations of Small Enterprises typically contains detailed records of income, expenses, and cash flow projections to ensure financial stability. It helps business owners allocate resources efficiently and monitor spending patterns.

- Track daily revenue and categorize all operational expenses precisely.

- Include columns for actual versus budgeted amounts to identify variances.

- Update the sheet regularly to reflect changes and support informed decision-making.

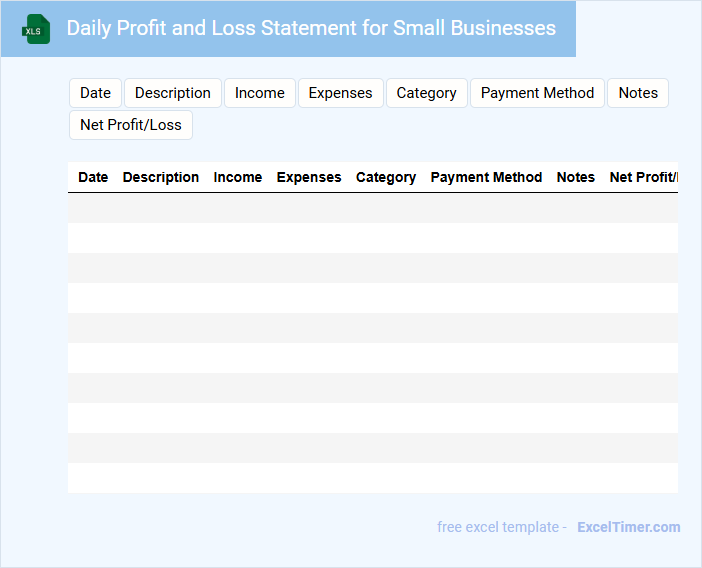

Daily Profit and Loss Statement for Small Businesses

A Daily Profit and Loss Statement for Small Businesses is a financial document that summarizes the daily revenues, costs, and expenses to calculate the net profit or loss. It helps business owners monitor financial performance and make informed decisions on a day-to-day basis.

- Include all sources of daily income and sales revenue accurately.

- Record every expense, distinguishing between fixed and variable costs.

- Review the statement daily to identify trends and adjust operations promptly.

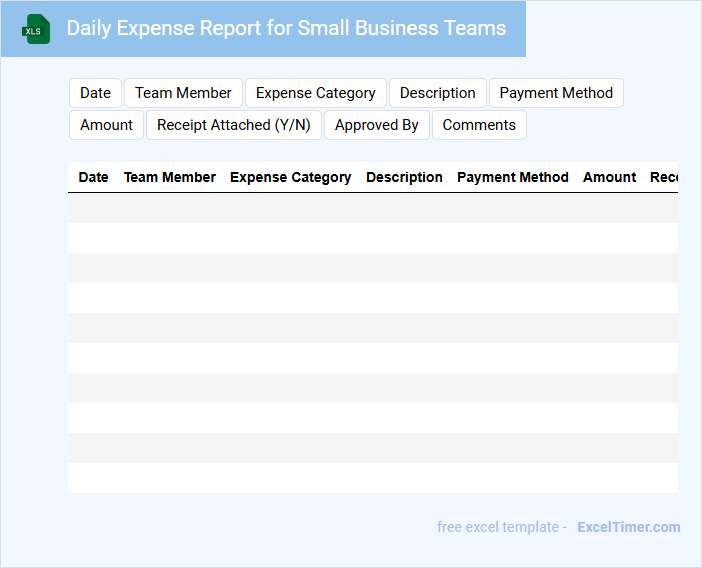

Daily Expense Report for Small Business Teams

A Daily Expense Report for small business teams typically includes detailed records of daily expenditures such as receipts, transaction dates, and payment methods. This document helps maintain financial transparency and control by tracking where and how money is spent. It is essential for budgeting and identifying cost-saving opportunities within the team.

Important elements to include are accurate descriptions of each expense, categorization by expense type, and approval signatures to ensure accountability. Consistency in reporting and timely submission are critical for effective financial management. Utilizing digital tools can simplify data entry and improve report accuracy.

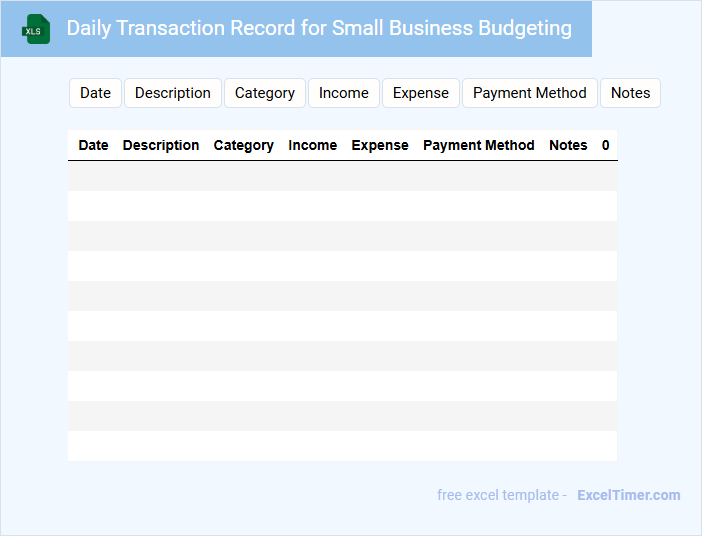

Daily Transaction Record for Small Business Budgeting

A Daily Transaction Record for Small Business Budgeting typically contains detailed entries of all financial transactions made within a day. This document helps track income and expenses to maintain accurate financial control and planning.

- Record the date, description, and amount of each transaction.

- Separate income and expense entries for clear budgeting analysis.

- Review and reconcile records daily to avoid discrepancies.

What key expense categories should be included in a Daily Budget Planner for small businesses?

A Daily Budget Planner for small businesses should include key expense categories such as rent or mortgage, utilities, payroll, inventory purchases, marketing and advertising, office supplies, and transportation costs. Tracking these categories daily helps maintain cash flow and control operational costs. Incorporating tax obligations and miscellaneous expenses ensures comprehensive budget management.

How can you set and track daily spending limits in an Excel document?

To set and track daily spending limits in an Excel Daily Budget Planner for Small Businesses, create a dedicated column for daily budgets and input your spending limits for each day. Use formulas like SUM to calculate total daily expenses and conditional formatting to highlight overspending automatically. Your planner helps you monitor daily cash flow and maintain control over business finances efficiently.

Which Excel formulas are essential for calculating total daily income and expenses?

Essential Excel formulas for calculating total daily income and expenses in a Daily Budget Planner include SUM to aggregate daily income and expense entries, SUMIF to conditionally sum amounts based on specific categories, and subtraction formulas to determine net daily profit or loss. Using SUM establishes the baseline for total calculations by adding all relevant transaction values in designated income or expense columns. Implementing SUMIF allows filtering and summing data according to criteria like payment types or vendor names, enhancing accuracy in daily totals.

What methods in Excel can automate alerts for overspending?

Excel offers conditional formatting to automatically highlight overspending in your daily budget planner for small businesses. Using formulas and data validation, you can create alerts that trigger when expenses exceed set limits. Setting up macros or VBA scripts further enhances automation by sending notifications or locking cells when budget thresholds are crossed.

How can daily budget data be visualized using charts or dashboards in Excel?

Visualize your daily budget data in Excel by creating dynamic charts like pie charts, line graphs, or bar charts to track expenses and income trends. Use Excel's PivotTables and PivotCharts to build interactive dashboards that summarize budget categories and daily spending patterns. Incorporate slicers and conditional formatting to enhance data analysis and improve decision-making for small business financial planning.