The Daily Cash Flow Excel Template for Freelancers helps track daily income and expenses efficiently, providing a clear view of financial health. It offers customizable categories to accommodate diverse freelance work, ensuring accurate cash flow management. Using this template enables freelancers to make informed budgeting decisions and maintain steady financial stability.

Daily Cash Flow Tracker for Freelancers

A Daily Cash Flow Tracker for freelancers is a document designed to monitor daily income and expenses, providing a clear overview of financial health. It typically contains sections for recording payments received, outgoing costs, and net cash flow for each day. This tool helps freelancers maintain budget control and make informed financial decisions.

Important elements to include are date-wise entries, category-wise expense tracking, and a summary section for total daily cash flow. Accurate documentation of client payments and billable hours is crucial for effective cash flow management. Incorporating notes for irregular expenses or pending payments can further enhance the tracker's usefulness.

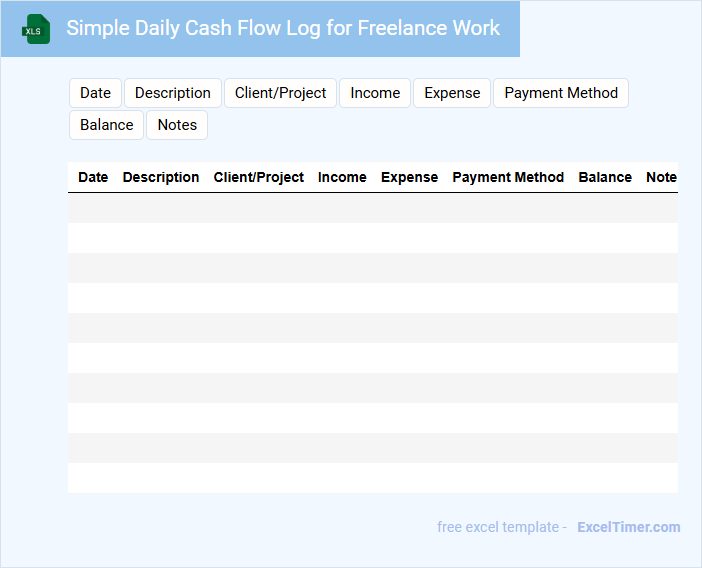

Simple Daily Cash Flow Log for Freelance Work

What information is typically recorded in a Simple Daily Cash Flow Log for Freelance Work? This document usually contains the date, description of the transaction, income received, and expenses paid each day. It serves as a straightforward tool to track daily earnings and outflows, helping freelancers manage their finances efficiently.

Why is it important to maintain accurate entries in this log? Keeping precise records ensures clear visibility of cash flow, aids in budgeting, and simplifies tax preparation. It is crucial to update the log consistently and categorize each transaction properly for better financial analysis.

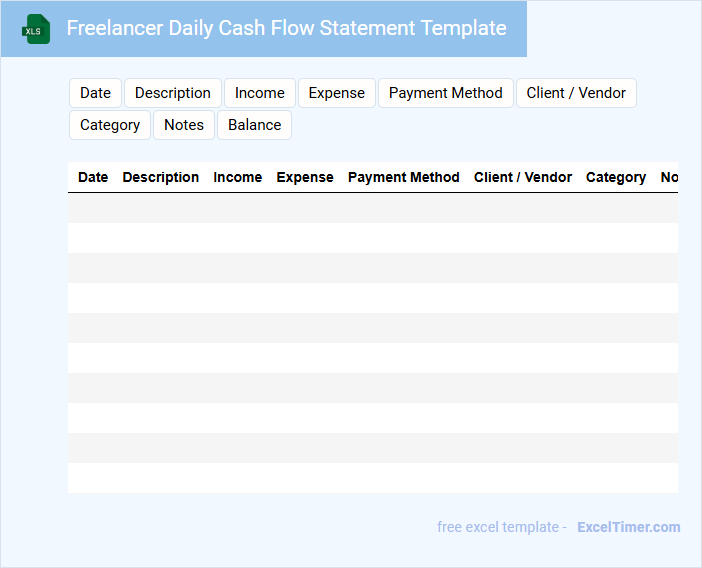

Freelancer Daily Cash Flow Statement Template

The Freelancer Daily Cash Flow Statement Template is a vital financial document that tracks daily income and expenses for freelancers. It helps manage cash flow by providing a clear overview of daily transactions. Maintaining accurate records ensures better budgeting and financial planning.

Important elements to include are detailed income sources, expense categories, and daily balances. Using this template regularly helps identify spending patterns and improve cash flow management. Consistency in updating the statement is crucial for accurate financial insights.

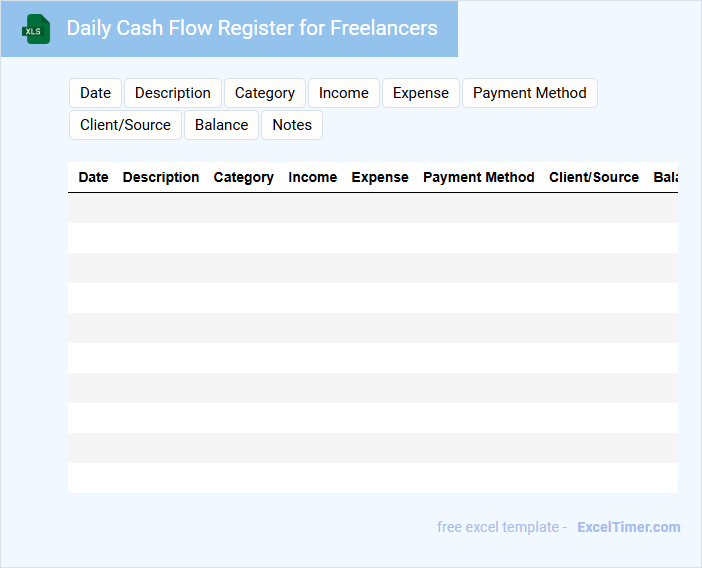

Daily Cash Flow Register for Freelancers

A Daily Cash Flow Register for Freelancers is a document that tracks daily income and expenses to manage personal or business finances effectively. It helps in monitoring cash on hand and planning for future financial needs.

- Record all incoming payments promptly to maintain accurate cash flow records.

- Include detailed descriptions for each transaction to ensure clarity and accountability.

- Review the register regularly to identify spending patterns and optimize budgeting.

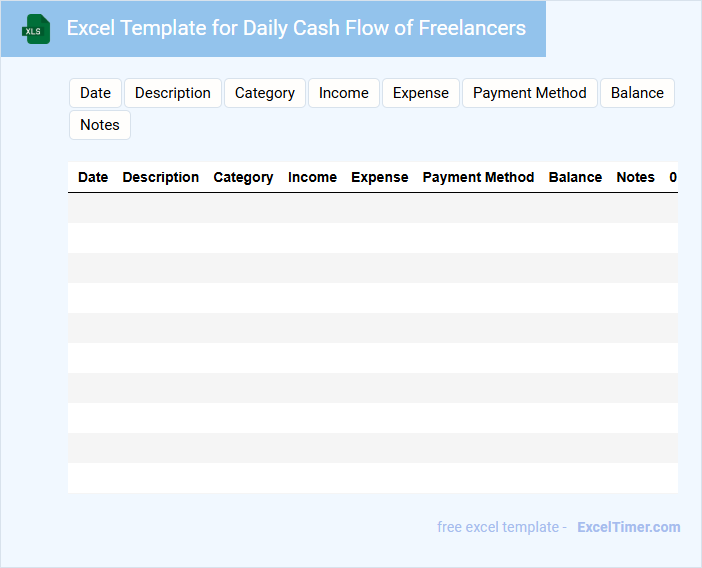

Excel Template for Daily Cash Flow of Freelancers

An Excel Template for Daily Cash Flow of Freelancers is a structured document designed to track income and expenses on a daily basis. It helps freelancers monitor their financial health, ensuring they stay on top of cash inflows and outflows. Such a template typically includes sections for date, description, amount, and category.

Important elements to include are clear categorization of income and expenses, automatic calculations for daily totals, and a summary dashboard for overall financial insights. Additionally, incorporating conditional formatting can highlight critical cash flow trends or potential issues. This ensures freelancers maintain accurate, real-time financial records effortlessly.

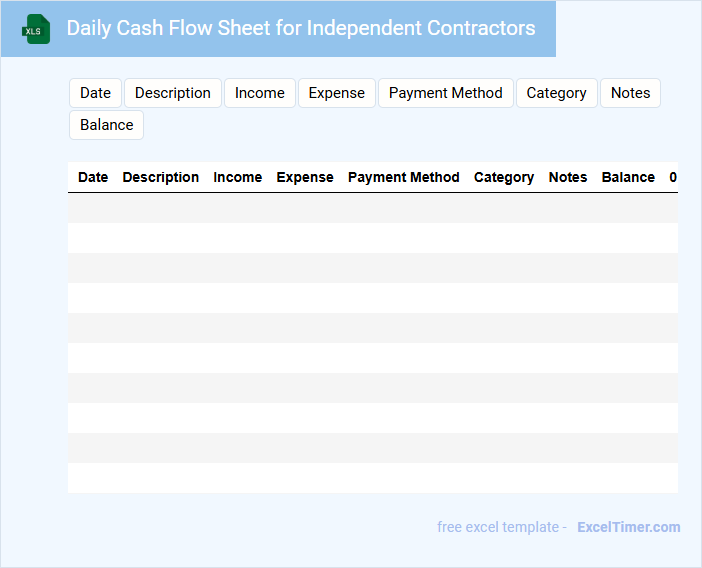

Daily Cash Flow Sheet for Independent Contractors

A Daily Cash Flow Sheet for Independent Contractors typically contains records of daily income and expenses to monitor financial health. It tracks payments received from clients, operational costs, and any cash withdrawals or deposits. Maintaining accurate entries ensures better budgeting and financial planning.

Daily Income and Expense Tracker for Freelancers

What does a Daily Income and Expense Tracker for Freelancers typically contain? It usually includes detailed records of daily earnings from various projects and expenses related to work, such as software, equipment, or office supplies. This document helps freelancers maintain financial clarity and manage their cash flow effectively.

What is an important element to include in this tracker? Consistent categorization of income and expenses is crucial to quickly identify profit patterns and deductible expenses during tax time. Additionally, adding notes for each transaction can provide context for irregular entries or unexpected costs.

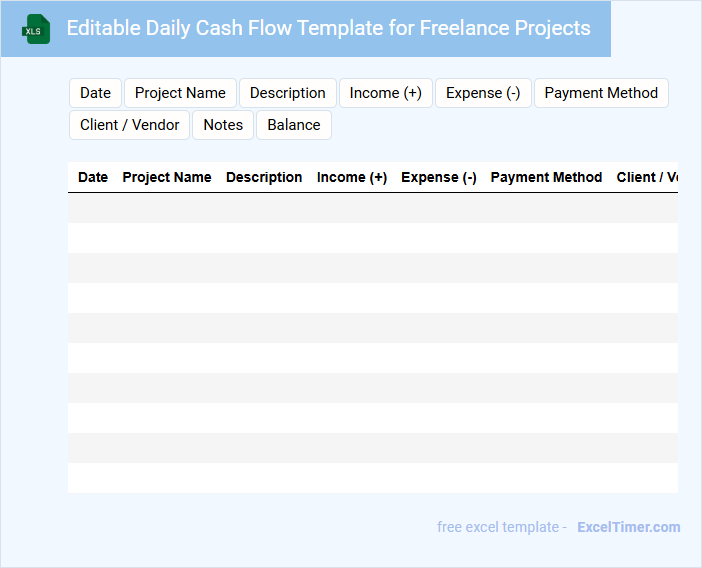

Editable Daily Cash Flow Template for Freelance Projects

This document typically contains a detailed record of daily income and expenses specifically tailored for freelance projects to help manage cash flow effectively. It provides an editable format allowing freelancers to update financial inflows and outflows regularly.

- Include separate sections for project-specific income and operational expenses.

- Incorporate fields for dates, descriptions, and payment methods for clarity.

- Ensure formulas automatically calculate daily totals and cumulative cash flow.

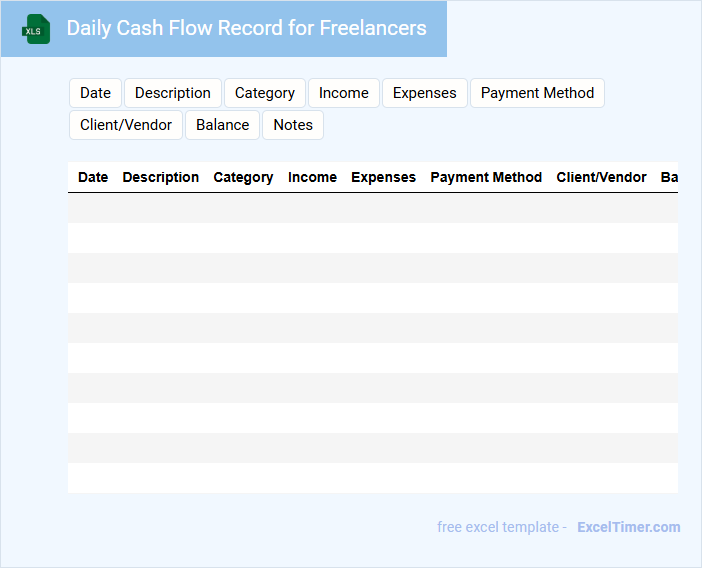

Daily Cash Flow Record for Freelancers

A Daily Cash Flow Record for freelancers is a document that tracks all incoming and outgoing cash on a daily basis. It typically contains details such as the date, description of the transaction, amount received or spent, and running balance. This helps freelancers maintain accurate financial oversight and ensure effective budgeting.

Important elements to include are clear categorization of income and expenses, timestamps for each entry, and an updated balance column. Regularly updating the document minimizes errors and improves cash management. Keeping detailed records also supports tax filing and financial planning.

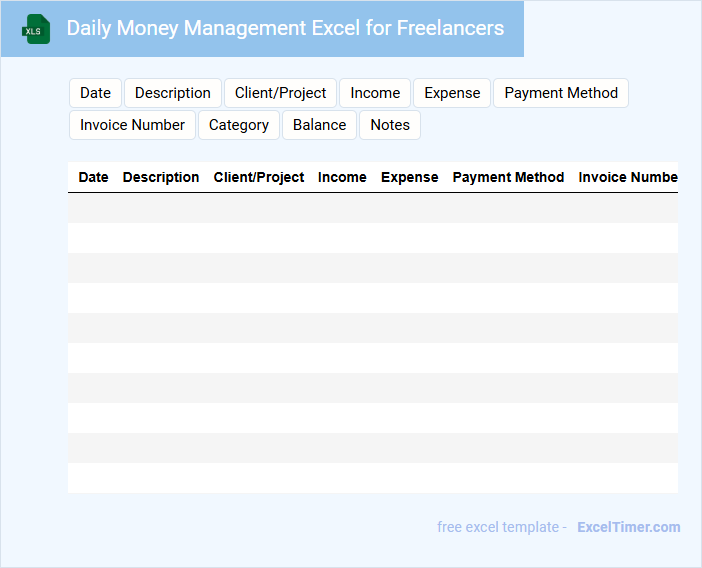

Daily Money Management Excel for Freelancers

A Daily Money Management Excel for Freelancers is a document designed to track income, expenses, and cash flow on a daily basis. It helps freelancers maintain financial organization and make informed decisions about their finances.

- Include separate columns for date, description, category, income, and expenses.

- Incorporate formulas to automatically calculate daily totals and running balances.

- Use categories that reflect typical freelance income sources and common expense types.

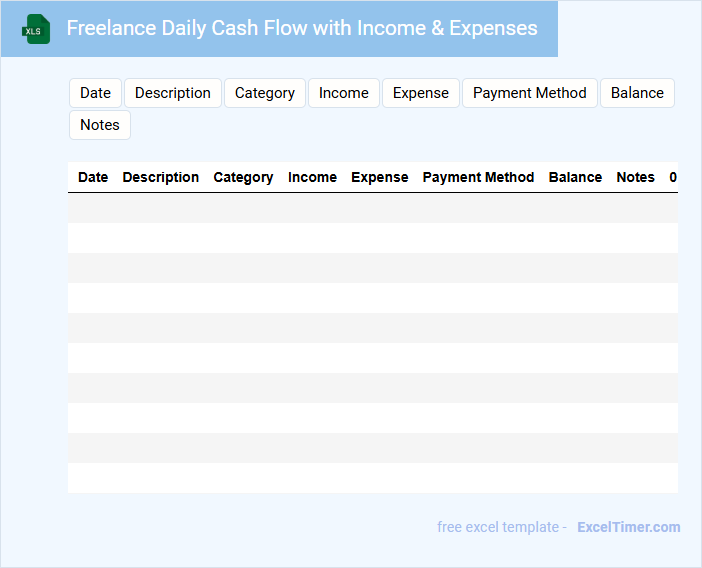

Freelance Daily Cash Flow with Income & Expenses

What does a Freelance Daily Cash Flow document typically contain and why is it important? This document usually includes detailed records of daily income and expenses, helping freelancers track their financial health accurately. Maintaining this cash flow statement ensures they can manage their budget effectively and plan for taxes and future investments.

What is one important aspect to focus on when managing a Freelance Daily Cash Flow? Consistently logging every transaction, no matter how small, is crucial to avoid discrepancies and to have a clear understanding of spending habits and earnings patterns. Additionally, categorizing expenses and incomes helps in identifying profitable projects and areas for cost-cutting.

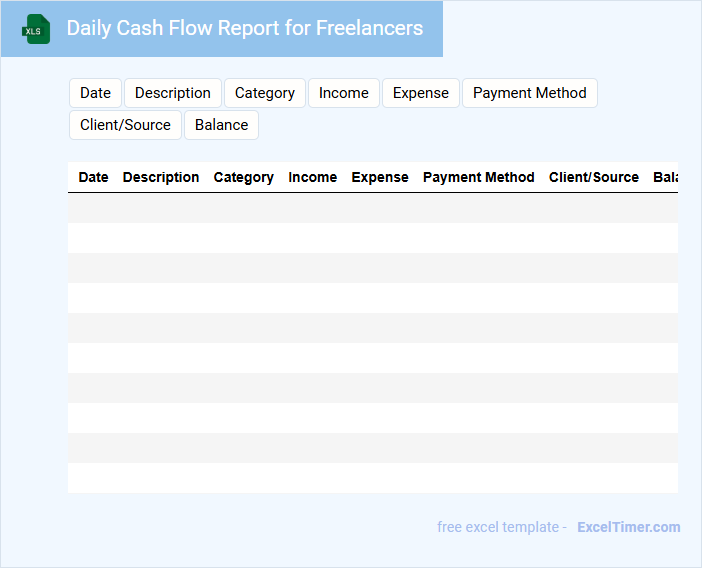

Daily Cash Flow Report for Freelancers

A Daily Cash Flow Report for freelancers typically contains detailed entries of all daily income and expenses. It helps in tracking financial stability and managing personal budget effectively.

This document usually includes categories such as client payments, operational costs, and miscellaneous expenses. Maintaining accurate records is crucial for understanding cash availability and planning future projects.

Suggestion important thing: Always reconcile the report daily to avoid discrepancies and ensure up-to-date financial status.

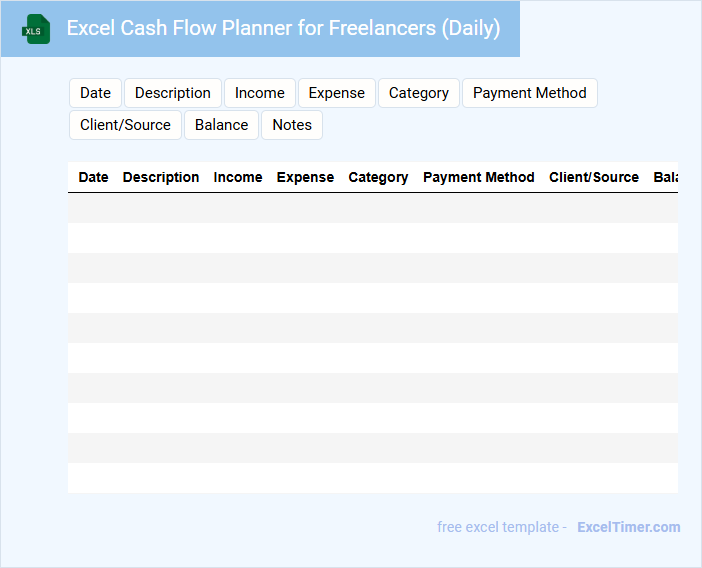

Excel Cash Flow Planner for Freelancers (Daily)

An Excel Cash Flow Planner for Freelancers (Daily) is a document designed to help freelancers track their daily income and expenses. It provides a clear overview of cash flow to manage finances effectively.

- Record daily earnings and expenditures accurately to monitor cash position.

- Track invoice due dates and payment receipts to ensure timely collections.

- Analyze spending patterns and adjust budgets to maintain positive cash flow.

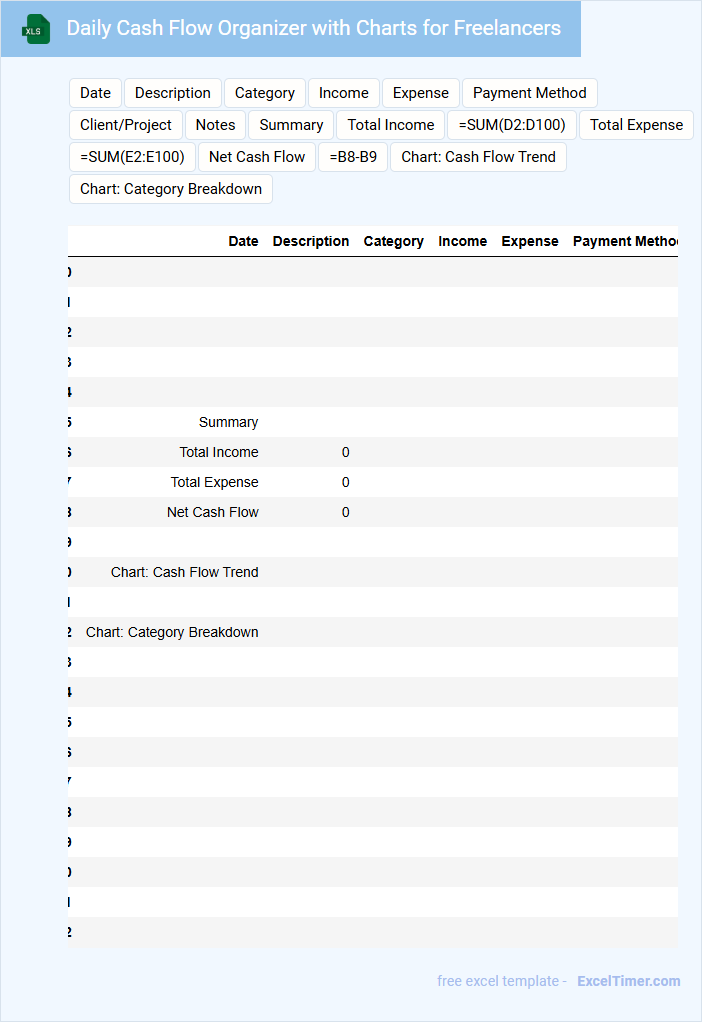

Daily Cash Flow Organizer with Charts for Freelancers

A Daily Cash Flow Organizer for freelancers is a vital document that tracks all daily income and expenses, providing a clear snapshot of financial health. It typically includes entries for payments received, bills paid, and other financial transactions to ensure accurate cash management.

This organizer often features charts to visualize trends, helping freelancers identify patterns and make informed budgeting decisions. Maintaining updated records promotes financial discipline and improves forecasting accuracy.

It is important to regularly update the document, categorize entries precisely, and review charts to spot irregularities or opportunities for saving.

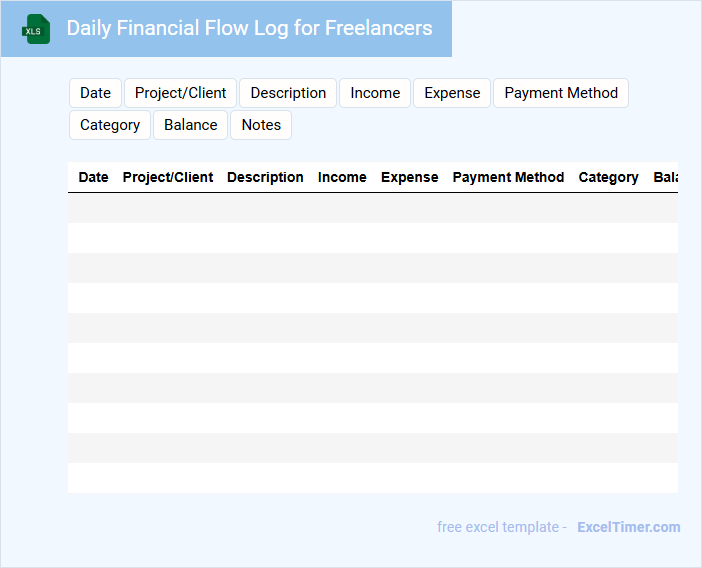

Daily Financial Flow Log for Freelancers

The Daily Financial Flow Log for freelancers is a crucial document that tracks all monetary transactions made within a day. It typically contains entries of income received, expenses paid, and outstanding payments to provide a clear overview of daily cash flow.

This log helps in budgeting effectively and identifying spending patterns to maintain financial stability. Regularly updating this log ensures accurate records for tax purposes and financial planning.

Important suggestions include consistently recording every transaction timely and categorizing expenses accurately to maximize its usefulness.

What are the key components to include in a freelancer's daily cash flow tracking spreadsheet?

A freelancer's daily cash flow tracking spreadsheet should include income sources, expenses, and net cash flow to monitor financial health accurately. Date entries and payment statuses help track daily transactions and outstanding payments efficiently. You benefit from categorizing transactions by client and project for detailed financial insights and better budgeting.

How can freelancers categorize and record daily income and expenses in Excel for optimal cash flow analysis?

Freelancers can categorize daily income and expenses in Excel by creating separate columns for date, description, category (e.g., client payment, software subscription), and amount. Using Excel functions like SUMIF and PivotTables enables efficient tracking and summarizing of cash flow by category and date. Consistent categorization and daily entry ensure accurate cash flow analysis and better financial decision-making.

Which Excel formulas or functions help automate cash inflow and outflow calculations for freelancers?

Excel formulas like SUMIF and IFERROR automate cash inflow and outflow calculations by categorizing income and expenses based on dates or types. Using SUM function helps total daily earnings and expenditures efficiently, while VLOOKUP or INDEX-MATCH retrieves specific transaction details. You can streamline your daily cash flow tracking, ensuring accurate financial analysis with these functions.

How can conditional formatting in Excel help freelancers visually track days with negative cash flow?

Conditional formatting in Excel highlights days with negative cash flow by automatically applying color-coded alerts to your daily cash flow entries. This visual differentiation helps freelancers quickly identify cash deficits without manually scanning each figure. You can customize rules to flag negative values, making financial tracking more efficient and insightful.

What methods can freelancers use in Excel to forecast and project future cash flow trends from daily records?

Freelancers can use Excel functions like FORECAST.LINEAR and TREND to analyze daily cash flow data for projecting future trends. Creating dynamic charts with PivotTables helps visualize cash flow patterns efficiently. Your cash flow forecasting improves by integrating seasonal analysis and scenario-based projections within Excel models.