The Daily Cash Flow Excel Template for Market Stall Owners helps track daily sales, expenses, and net profit efficiently. It simplifies financial management by providing clear summaries and automatic calculations to monitor cash inflows and outflows. This tool is essential for market stall owners aiming to maintain accurate financial records and improve budgeting decisions.

Daily Cash Flow Tracker for Market Stall Owners

What information is typically included in a Daily Cash Flow Tracker for Market Stall Owners? This document usually contains detailed records of daily sales, expenses, and cash on hand to help monitor the stall's financial performance. It also includes sections for recording cash inflows and outflows to ensure accurate tracking of the business's liquidity and profitability.

What important aspects should market stall owners focus on when using a Daily Cash Flow Tracker? Owners should consistently update the tracker with every transaction to avoid discrepancies and maintain real-time financial awareness. Additionally, summarizing daily totals and comparing them with projected budgets can help identify trends and improve business decision-making.

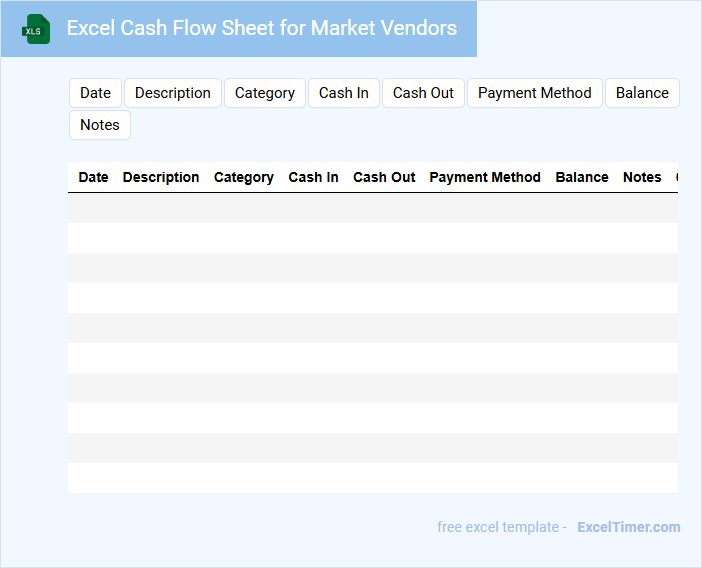

Excel Cash Flow Sheet for Market Vendors

An Excel Cash Flow Sheet for Market Vendors is a specialized financial document designed to track daily income and expenses. It typically contains sections for recording sales, costs of goods sold, and other operational expenses. This tool helps vendors manage their cash flow effectively and make informed business decisions.

Daily Income and Expense Log for Market Stalls

A Daily Income and Expense Log for Market Stalls is a crucial document used to track all financial transactions that occur each day. It typically contains records of sales, purchases, and any other expenses or income related to the market stall operations. Keeping detailed and accurate logs helps stall owners manage cash flow effectively and identify profitable or costly trends.

Market Stall Owner’s Daily Cash Flow Report

A Market Stall Owner's Daily Cash Flow Report typically contains detailed records of all cash transactions made throughout the day. It includes sales revenue, expenses, and cash on hand to monitor daily financial performance.

Important elements to track are daily income sources, expenditures, and opening and closing cash balances to ensure accuracy. Maintaining this report helps in identifying cash discrepancies and managing liquidity effectively.

Daily Financial Record for Market Vendor Excel

A Daily Financial Record for a Market Vendor typically contains detailed income and expense entries. It helps track daily sales, purchases, and cash flow efficiently.

This document is essential for maintaining accurate financial accountability and managing inventory costs. Regularly updating it provides clarity on profit margins and business performance.

Ensure to include categories for sales, expenses, and daily summaries to optimize financial tracking.

Simple Cash Flow Spreadsheet for Market Stalls

A Simple Cash Flow Spreadsheet for market stalls typically contains sections for tracking daily sales, expenses, and net profit. It helps stall owners monitor the flow of money in and out, ensuring financial stability. Keeping accurate records helps identify peak sales periods and control costs effectively. Important elements to include are columns for date, item sold, quantity, sales amount, and expense categories. A running total or summary section highlights overall cash position. Regular updates and reconciliation with actual cash help maintain accuracy and support better financial decisions.

Excel Daily Sales and Cash Sheet for Market Stalls

This type of document typically contains detailed records of daily sales and cash transactions for market stalls, helping vendors maintain accurate financial tracking. It is crucial for managing inventory, monitoring revenue, and ensuring accountability.

- Record all sales transactions including item description, quantity, and price.

- Track cash inflows and outflows meticulously for accurate cash balance.

- Include a summary section to reconcile total sales with cash collected daily.

Daily Cash Flow Statement for Market Stall Owners

The Daily Cash Flow Statement is a financial document that records the daily inflow and outflow of cash in a business, helping market stall owners monitor their liquidity. It usually contains detailed entries of sales, expenses, and cash balances for each day.

This statement is crucial for tracking daily financial health and making informed decisions. Market stall owners should ensure accuracy in recording cash transactions and regularly review the statement to identify trends and manage cash effectively.

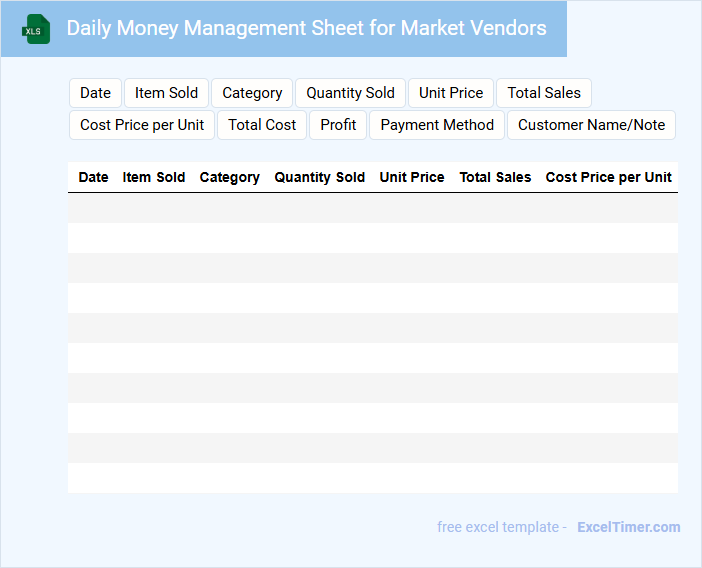

Daily Money Management Sheet for Market Vendors

A Daily Money Management Sheet for market vendors is a crucial document that tracks daily sales, expenses, and profits to ensure accurate financial monitoring. It typically contains sections for recording cash inflows from sales, outgoing payments, and inventory purchases. Maintaining this sheet helps vendors manage their cash flow efficiently and make informed business decisions.

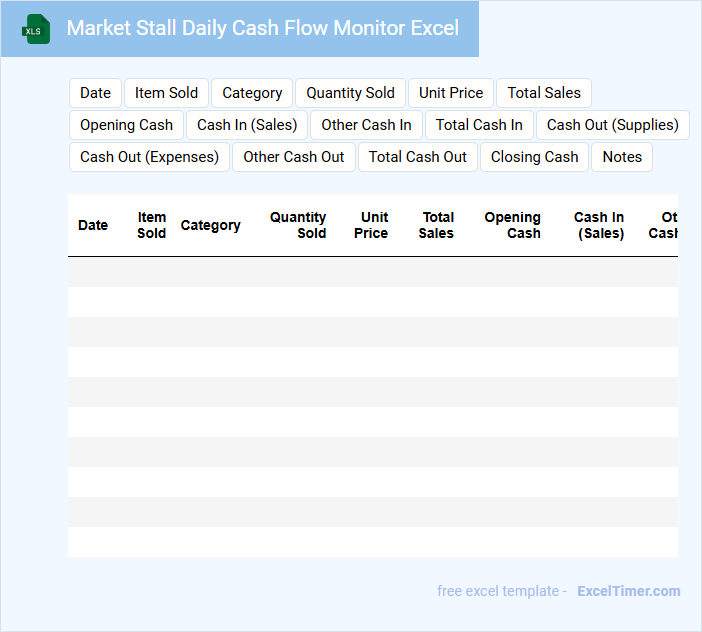

Market Stall Daily Cash Flow Monitor Excel

A Market Stall Daily Cash Flow Monitor Excel document typically contains detailed records of daily sales, expenses, and cash transactions. It helps to track the inflow and outflow of money to maintain accurate financial control.

The document often includes columns for date, item sold, quantity, price, total sales, expenses, and closing balance. Regular updates and reconciliation are important to ensure the accuracy of recorded data.

For effective use, always verify daily entries and review cash discrepancies promptly to maintain financial transparency and avoid errors.

One-Page Daily Cash Flow for Market Stallholders

The One-Page Daily Cash Flow document is a concise record that tracks all income and expenses for market stallholders throughout the day. It typically includes sales revenue, cash inflows, and outgoing payments to help monitor daily profitability. Keeping this document updated is essential for effective financial management and quick decision-making.

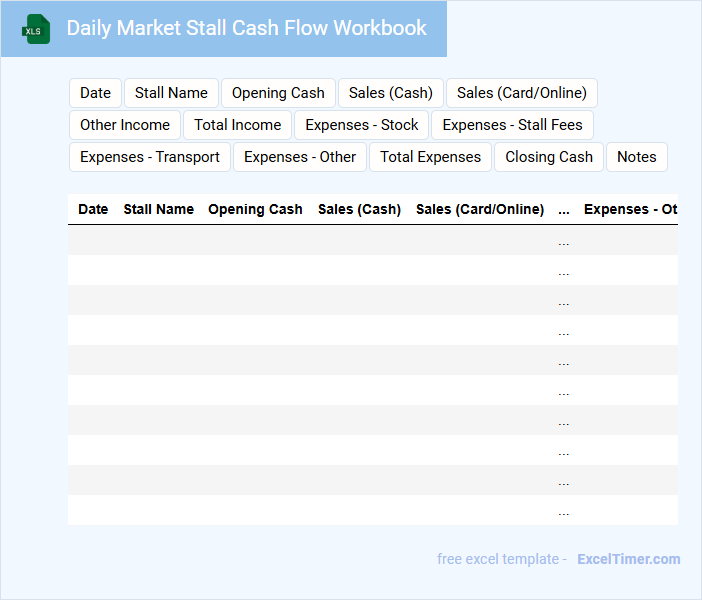

Daily Market Stall Cash Flow Workbook

A Daily Market Stall Cash Flow Workbook typically contains detailed records of daily income and expenses to track the stall's financial performance efficiently.

- Accurate Income Tracking: Record all sales transactions to monitor daily revenue precisely.

- Expense Documentation: Keep detailed entries of all costs including supplies and stall fees.

- Cash Flow Analysis: Regularly review inflows and outflows to maintain positive cash flow and identify financial trends.

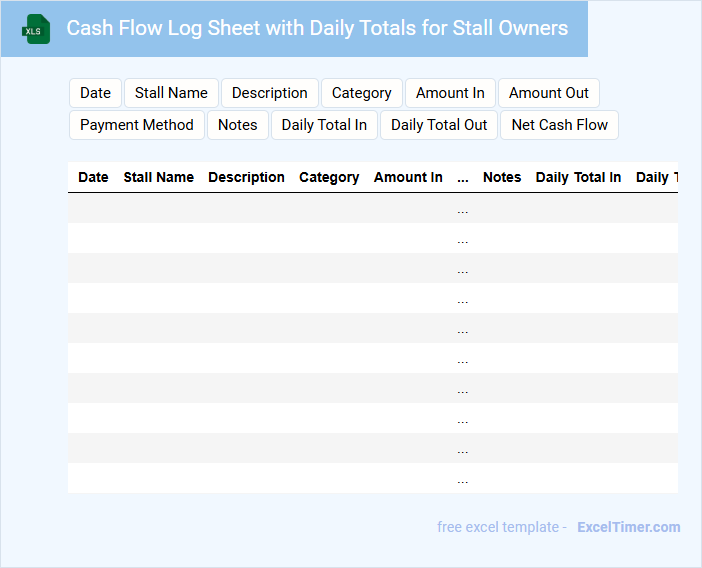

Cash Flow Log Sheet with Daily Totals for Stall Owners

A Cash Flow Log Sheet for stall owners typically contains detailed records of daily financial transactions, including incomes and expenses. This document helps track the movement of cash to ensure accurate financial management and transparency.

It usually includes columns for dates, descriptions, amounts received, amounts paid, and daily totals to provide a clear overview of the daily cash position. Regularly updating this log is crucial for maintaining an accurate financial snapshot and making informed business decisions.

Excel Daily Revenue and Expense Tracker for Market Vendors

This document typically contains detailed records of daily income and expenditures to help market vendors manage their finances effectively. It serves as a practical tool for tracking sales, costs, and profits every day.

- Include columns for date, item description, income, and expense amounts.

- Summarize daily totals and calculate net revenue automatically.

- Incorporate notes for unusual transactions or special activities.

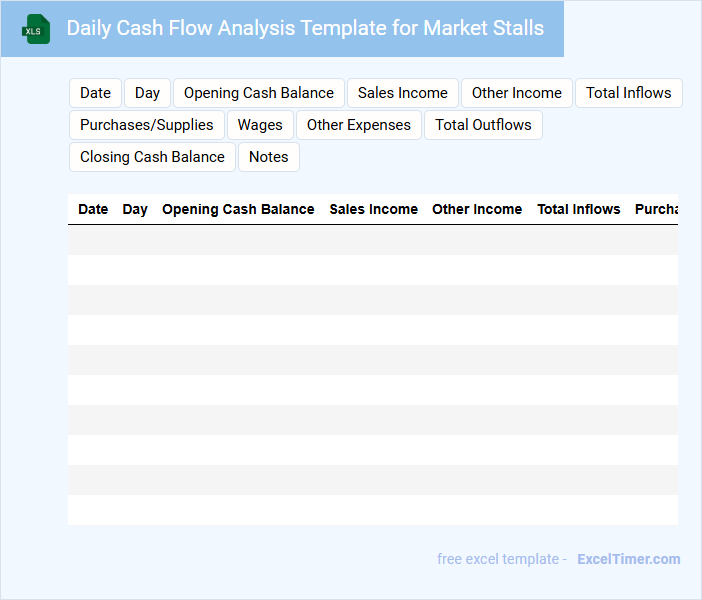

Daily Cash Flow Analysis Template for Market Stalls

A Daily Cash Flow Analysis Template for Market Stalls typically contains sections for tracking daily sales, expenses, and net cash flow. It helps vendors monitor their financial performance and manage cash effectively.

This document often includes columns for date, item sold, quantity, price, and total income, alongside cost details and cash on hand. Regularly updating this template is essential for maintaining accurate financial records and making informed business decisions.

What are the key components to track in a daily cash flow sheet for a market stall business?

A daily cash flow sheet for market stall owners should track opening cash balance, total sales revenue, and daily expenses including inventory and stall fees. Monitoring cash inflow from sales and cash outflow for purchases and operational costs ensures accurate profit calculation. Recording end-of-day cash balance helps manage liquidity and plan for future expenses effectively.

How should income and cash sales be recorded and categorized on an Excel cash flow document?

Income and cash sales should be recorded daily in your Excel cash flow document under separate columns labeled "Income" and "Cash Sales" to ensure clarity. Categorize each entry by source, such as product type or service, for accurate tracking and analysis. Use consistent date stamps to maintain a clear timeline of cash flow for your market stall.

What important expenses must be consistently documented daily to maintain accurate cash flow?

Market stall owners must consistently document expenses such as inventory purchases, stall rental fees, staff wages, and utility costs to maintain accurate daily cash flow. Recording transportation expenses and packaging materials also ensures complete financial tracking. Accurate documentation of these costs helps in managing profitability and forecasting future cash needs.

How can Excel formulas be used to automatically calculate daily profit and overall cash balance?

Excel formulas like SUM and IF can automatically calculate your daily profit by subtracting total expenses from total sales. Use cumulative SUM formulas to update the overall cash balance each day, ensuring accurate tracking of cash inflow and outflow. These formulas streamline financial management for market stall owners, enhancing real-time decision-making.

What methods ensure the accuracy and security of cash flow records stored in an Excel file?

Implement password protection and regularly back up your Excel file to ensure the security of daily cash flow records. Use built-in Excel features like data validation and cell locking to maintain accuracy and prevent unauthorized changes. Employ audit trails or version control to track modifications and verify the integrity of your cash flow data.