The Daily Expense Log Excel Template for Small Businesses streamlines tracking of daily costs, helping owners manage cash flow efficiently. This template offers customizable categories and automatic calculations to simplify expense monitoring and budgeting. Accurate daily expense tracking ensures better financial decisions and improved business profitability.

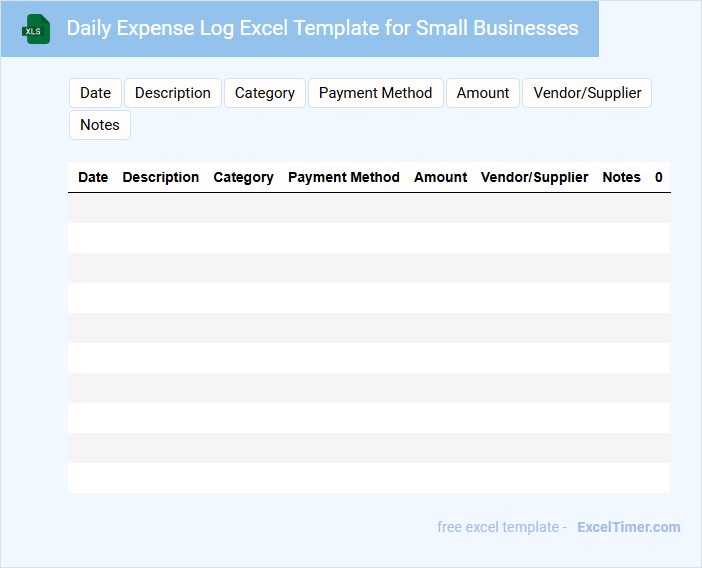

Daily Expense Log Excel Template for Small Businesses

What information does a Daily Expense Log Excel Template for Small Businesses typically contain? It usually includes fields for date, expense category, description, payment method, and amount spent. This template helps small businesses systematically track and categorize their daily expenses for better financial management and budgeting.

Simple Daily Expense Tracker for Small Businesses

A Simple Daily Expense Tracker for small businesses is a document designed to record daily financial transactions and monitor cash flow efficiently. It usually contains columns for date, description of the expense, category, payment method, and amount spent. Keeping this record helps business owners maintain budget control and identify spending patterns over time.

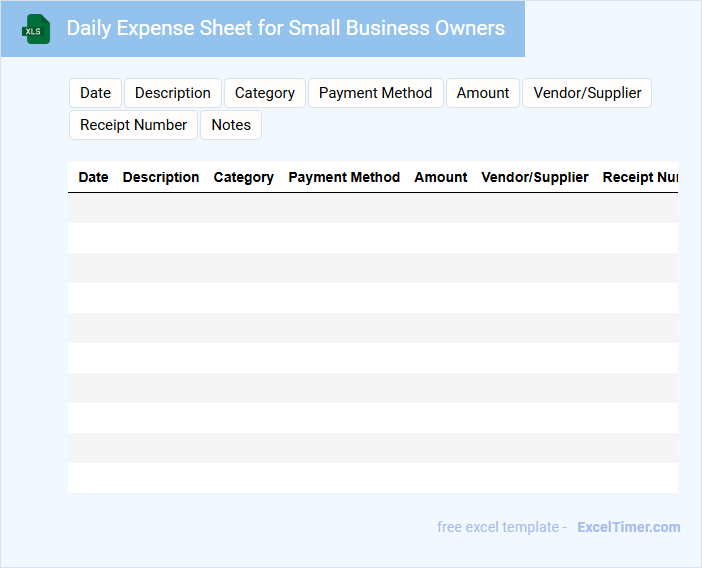

Daily Expense Sheet for Small Business Owners

A Daily Expense Sheet is a vital document for small business owners to track everyday expenditures systematically. It records all costs, helping maintain accurate financial records throughout the day.

This document usually contains date, description of expense, amount spent, and payment method. Consistently updating this sheet ensures better budgeting and financial control.

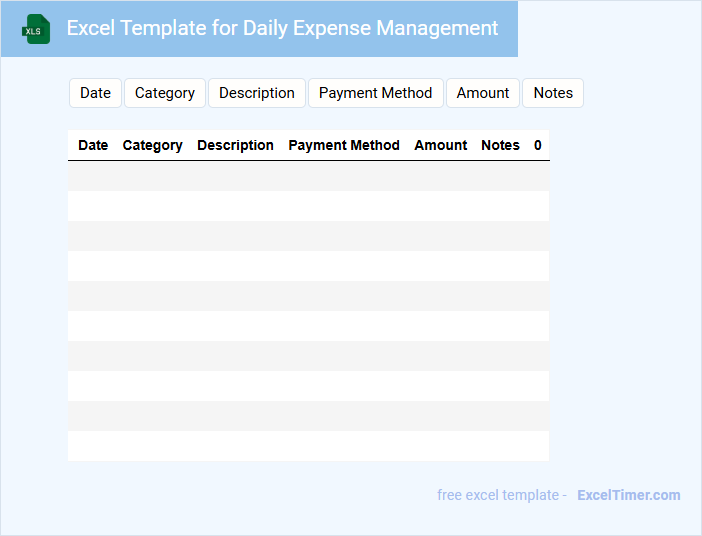

Excel Template for Daily Expense Management

An Excel Template for Daily Expense Management typically contains sections for categorizing expenses, recording daily transactions, and summarizing monthly spending. It helps users track their income and expenditures systematically to maintain financial discipline.

Important features to include are predefined categories, automatic calculations, and visual charts for better expense analysis. Regularly updating the template ensures accurate financial insights and effective budget control.

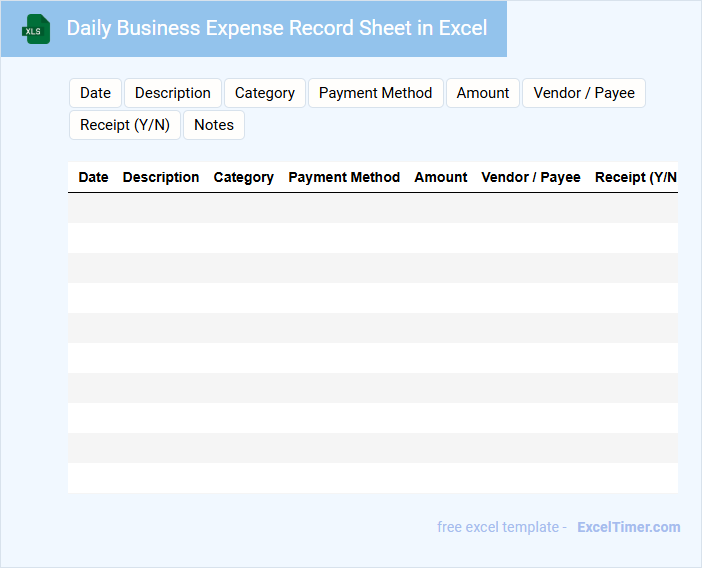

Daily Business Expense Record Sheet in Excel

What information is typically included in a Daily Business Expense Record Sheet in Excel? This type of document usually contains detailed entries of daily expenditures such as dates, expense categories, amounts, payment methods, and brief descriptions. It helps businesses track and manage their spending efficiently for accurate financial analysis and budgeting.

What is an important suggestion for maintaining a Daily Business Expense Record Sheet? Consistently entering expenses with clear categorizations and supporting documentation, such as receipts, is crucial to ensure accuracy and facilitate easy reconciliation with bank statements or accounting software.

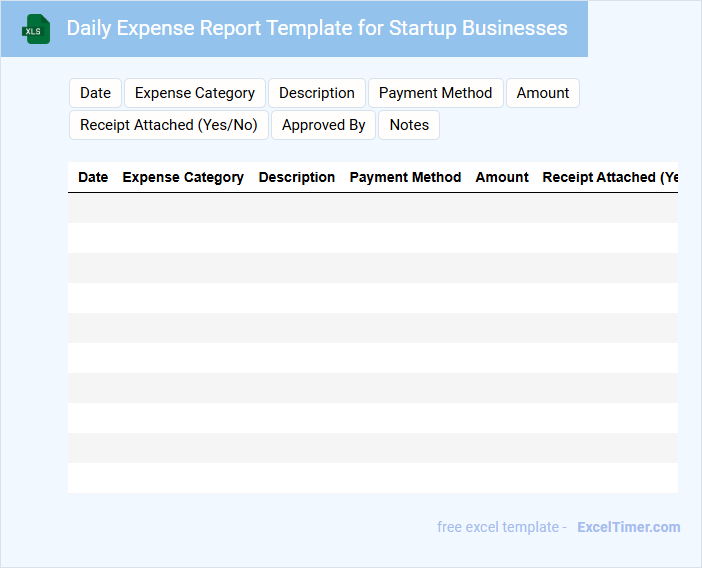

Daily Expense Report Template for Startup Businesses

What information does a Daily Expense Report Template for Startup Businesses typically contain? It includes detailed records of daily financial transactions such as purchases, payments, and other business-related expenses. This documentation helps startups track their spending efficiently and manage cash flow effectively.

Why is it important to use a Daily Expense Report Template for startups? By maintaining accurate daily expense reports, startup businesses can identify cost-saving opportunities and ensure accountability. These reports also assist in budgeting and financial planning, which are crucial for sustaining and growing a new business.

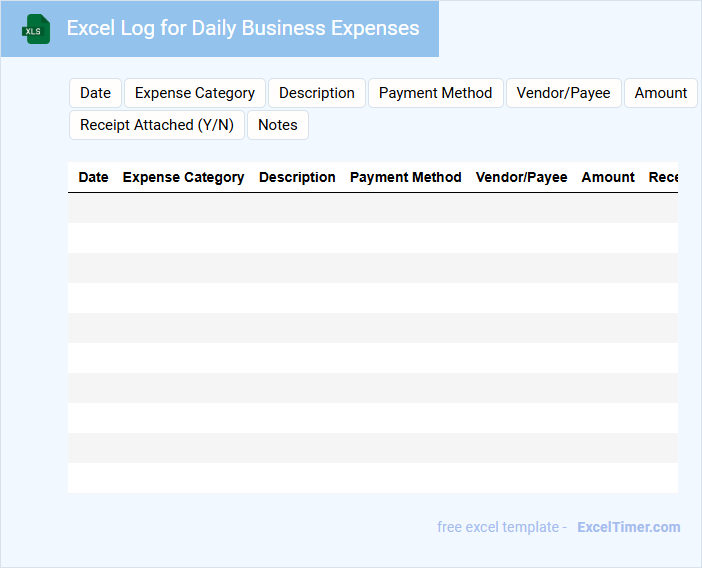

Excel Log for Daily Business Expenses

Excel Log for Daily Business Expenses is a vital tool used to systematically record all financial outflows related to business activities. It helps maintain accurate expense tracking, ensuring transparency and ease of budgeting. This document typically includes columns for date, description, category, amount, and payment method to organize expenses effectively.

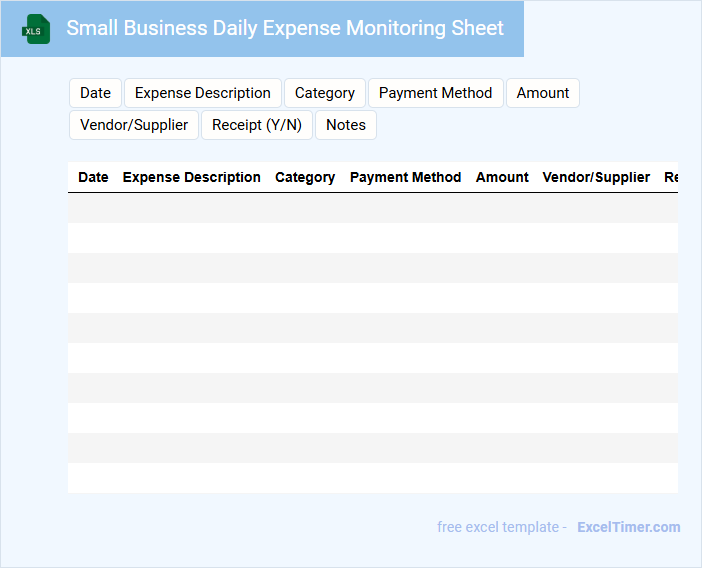

Small Business Daily Expense Monitoring Sheet

A Small Business Daily Expense Monitoring Sheet typically contains detailed records of daily expenditures, including categories like utilities, supplies, and salaries. It helps track cash flow and manage budgeting effectively.

Maintaining accuracy and consistency in data entry is a key step in ensuring reliable financial insights. Regularly reviewing and updating the sheet supports informed decision-making and cost control.

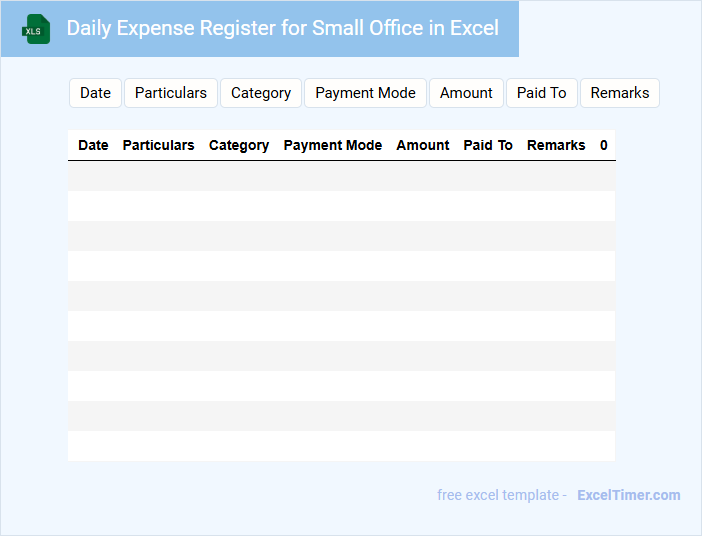

Daily Expense Register for Small Office in Excel

A Daily Expense Register for a small office in Excel is a document used to record all daily financial transactions systematically. It typically contains columns for date, description of expense, amount, and payment method. This register helps in maintaining accurate financial records and tracking office expenditures efficiently.

It is important to ensure that each entry is detailed and updated regularly to avoid discrepancies. Including categories for expenses can simplify analysis and budgeting. Using Excel formulas for totals and summaries enhances accuracy and saves time in financial reviews.

Daily Expense Tracking Spreadsheet for Entrepreneurs

A Daily Expense Tracking Spreadsheet for entrepreneurs typically contains detailed records of all business-related expenditures, organized by date, category, and amount. This document helps maintain a clear overview of cash flow and assists in budgeting and financial planning.

Important elements include columns for expense descriptions, payment methods, and receipt references to ensure accuracy and accountability. Regularly updating the spreadsheet promotes better expense management and informed decision-making.

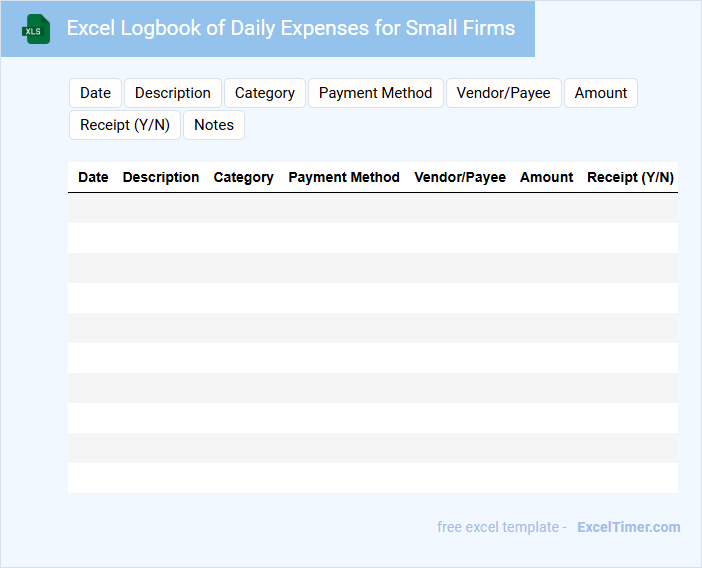

Excel Logbook of Daily Expenses for Small Firms

An Excel Logbook of Daily Expenses for Small Firms is typically a detailed record of all financial transactions occurring daily to track spending efficiently. It helps in maintaining transparency and managing budgets effectively.

- Include date, description, amount, and category for each expense to ensure clear tracking.

- Summarize weekly or monthly totals to monitor spending trends over time.

- Use formulas to automatically calculate balances and generate reports for better financial analysis.

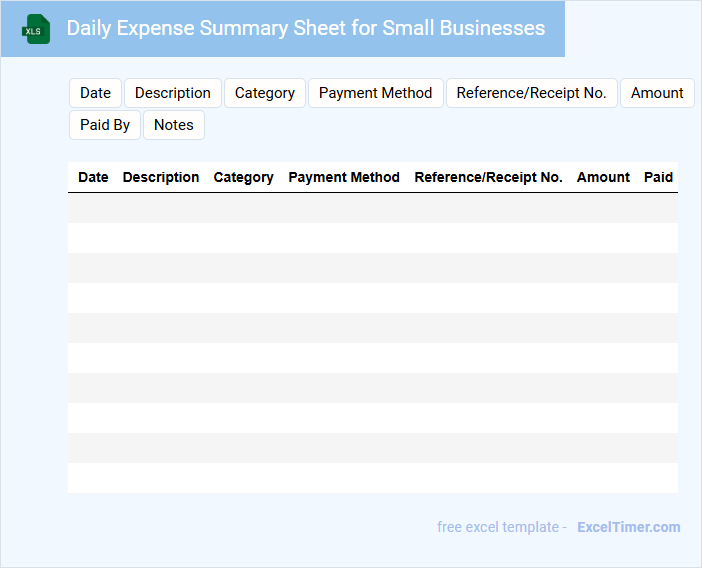

Daily Expense Summary Sheet for Small Businesses

A Daily Expense Summary Sheet is a document used by small businesses to record and track daily expenditures systematically. It helps in maintaining an accurate log of all financial outflows for better budget management.

This sheet typically contains details such as the date, description of the expense, amount spent, and category of the expense. Regularly updating and reviewing this document ensures improved financial control and aids in identifying cost-saving opportunities.

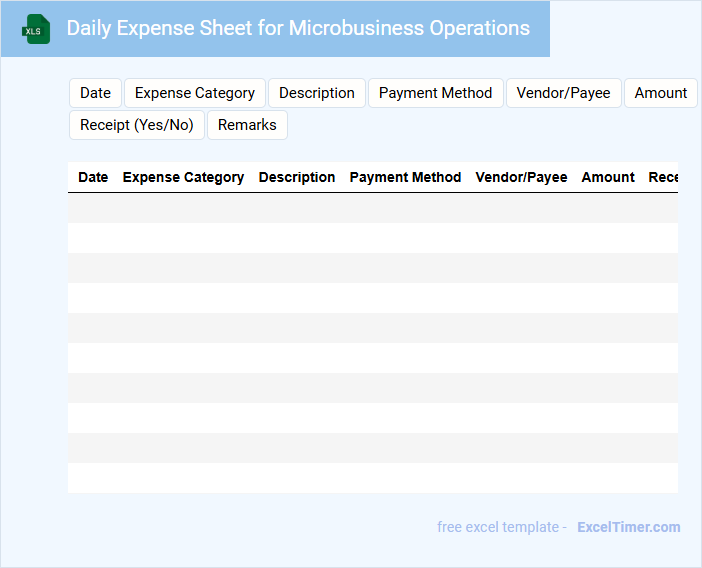

Daily Expense Sheet for Microbusiness Operations

What information is typically contained in a Daily Expense Sheet for Microbusiness Operations? This document usually records all daily expenditures incurred during business activities, including details such as date, description, amount spent, and payment method. It helps track financial outflows accurately and supports budgeting and financial analysis for microbusinesses.

What are important considerations when maintaining a Daily Expense Sheet for Microbusiness Operations? Ensuring completeness and accuracy of entries is crucial, as is regularly updating the sheet to prevent data loss and facilitate timely financial decision-making. Including categorization of expenses and periodic review can improve understanding of spending patterns and enhance cost control.

Excel Tracker with Daily Expenses for Small Business

An Excel Tracker with Daily Expenses for Small Business is a crucial document used to monitor and record daily financial transactions. It typically contains categories such as income, various expenses, dates, and balance calculations. This tool helps in maintaining accurate financial records and supports effective budget management for small enterprises.

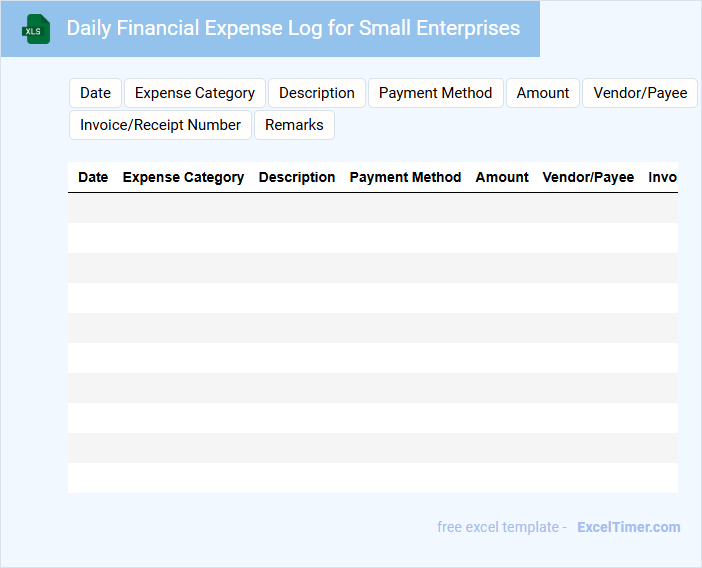

Daily Financial Expense Log for Small Enterprises

Daily Financial Expense Log for Small Enterprises

What information is typically recorded in a Daily Financial Expense Log for Small Enterprises? This document usually contains detailed entries of daily business expenses such as purchases, payments, and petty cash usage. It helps business owners track spending patterns and manage their cash flow efficiently.

Why is it important to maintain accuracy in this log? Accurate record-keeping ensures proper financial management, aids in budgeting, and supports tax filing processes. Regularly updating this log also helps identify cost-saving opportunities and prevents financial discrepancies.

What key information should be included in a daily expense log for small businesses in Excel?

A daily expense log for small businesses in Excel should include the date, expense category, description, payment method, and amount spent to track financial outflows accurately. Your log must also feature columns for vendor or payee details and a running total to monitor daily expenses efficiently. Incorporating these key data points ensures precise budgeting and financial management for small business operations.

How can categories and subcategories be structured for tracking expenses effectively?

Categories for a Daily Expense Log in small businesses should include fixed costs, variable costs, and administrative expenses. Subcategories can be broken down into rent, utilities, payroll, office supplies, advertising, travel, and maintenance. Organizing expenses this way enables precise tracking and simplifies financial analysis for budgeting and tax purposes.

What formulas or functions can automate total and subtotal calculations in the log?

Using SUM and SUBTOTAL functions can automate total and subtotal calculations in your Daily Expense Log for small businesses. SUM adds up all expense amounts, while SUBTOTAL calculates totals within filtered data, ensuring accurate expense tracking. Applying these formulas reduces manual errors and saves valuable time in managing your finances.

How can you use filters or pivot tables to analyze expense trends over time?

Use filters in the Daily Expense Log to isolate specific dates, categories, or vendors, enabling targeted analysis of spending patterns. Pivot tables summarize expenses by time periods, categories, or accounts, revealing trends and anomalies. This approach helps small businesses identify cost-saving opportunities and monitor financial performance efficiently.

What best practices ensure data accuracy and consistency in daily expense tracking sheets?

Use standardized categories and consistent data formats in your daily expense log to enhance accuracy and ease of analysis. Regularly update and reconcile entries with receipts or invoices to maintain reliability. Implement data validation rules in Excel to prevent errors and ensure consistent input throughout the tracking sheet.