![]()

The Daily Expense Tracker Excel Template for Freelancers provides an easy way to monitor daily income and expenses, helping freelancers maintain financial discipline. It includes customizable categories, automatic calculations, and visual charts for clear financial insights. Using this template ensures accurate budgeting and better cash flow management essential for freelance success.

Daily Expense Tracker Excel Template for Freelancers

A Daily Expense Tracker Excel Template for Freelancers is a structured document designed to record and manage daily business expenses effectively. It helps freelancers monitor their spending habits and maintain accurate financial records.

- Include categories such as travel, supplies, and meals for detailed expense tracking.

- Incorporate automatic calculations for total and category-wise expenses to save time.

- Ensure the template is customizable to adapt to different freelancing industries and income sources.

Simple Daily Expense Log for Freelancers

A Simple Daily Expense Log for freelancers is a essential document that helps track daily expenditures related to their work. It usually contains entries like date, description of expenses, amount spent, and payment method. Keeping this log updated ensures better budget management and accurate tax reporting.

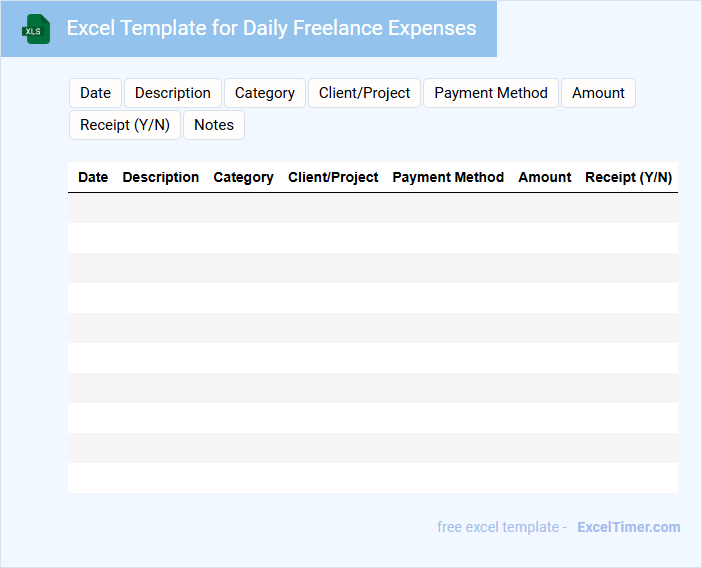

Excel Template for Daily Freelance Expenses

An Excel Template for Daily Freelance Expenses typically contains categorized fields to record and track daily costs incurred during freelance work. It includes sections for date, description, amount, and payment method to ensure accurate financial monitoring.

Such a document helps maintain organized expense reports, making tax filing and budgeting more efficient. It is important to update entries daily to avoid missing any transactions and to ensure precise financial analysis.

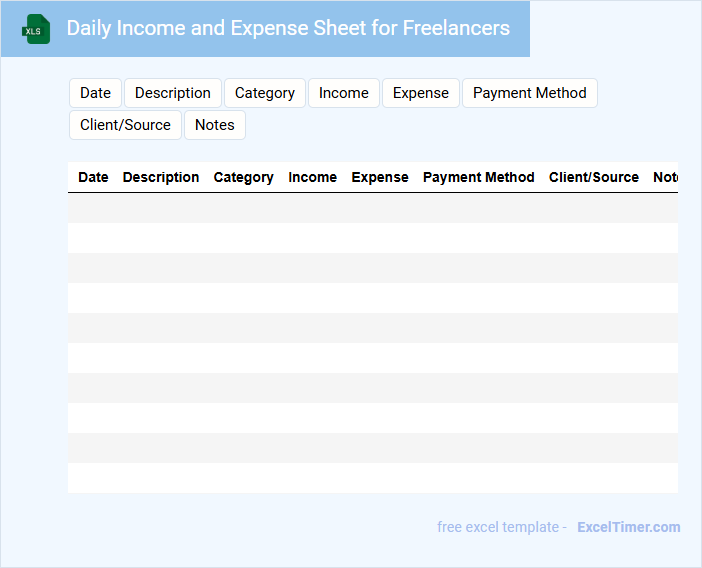

Daily Income and Expense Sheet for Freelancers

The Daily Income and Expense Sheet for freelancers is a crucial document used to track daily financial transactions. It typically contains sections for recording income sources, expenses, dates, and payment methods. Maintaining this sheet helps freelancers monitor cash flow and manage their finances efficiently.

Key elements to include are detailed entries of all daily earnings, categorized expenses, and notes for unusual transactions. It's important to update the sheet regularly to avoid missing any financial data. Additionally, adding a summary section at the end of each day can help review overall financial performance quickly.

Daily Cash Flow Tracker for Freelance Work

What information is typically contained in a Daily Cash Flow Tracker for Freelance Work? This type of document usually includes daily records of income, expenses, and balances to monitor financial health accurately. It helps freelancers track payments received, outgoings, and ensure cash flow remains positive.

What is an important consideration when using a Daily Cash Flow Tracker for Freelance Work? Consistently updating the tracker with accurate data is crucial to avoid discrepancies and gain a clear understanding of financial status. Additionally, categorizing transactions can help identify spending patterns and optimize budgeting.

Personal Expense Tracker with Daily Logs for Freelancers

What information does a Personal Expense Tracker with Daily Logs for Freelancers usually contain? This type of document typically includes detailed records of daily income and expenses, categorized by type such as work-related costs, personal purchases, and savings. It helps freelancers monitor their cash flow meticulously, ensuring accurate budgeting and financial planning for variable income streams.

What is an important feature to include in such a tracker? Incorporating daily logs with timestamps and brief descriptions enhances accountability and clarity. Additionally, providing monthly summaries and visual charts can help freelancers quickly assess their spending habits and make informed financial decisions.

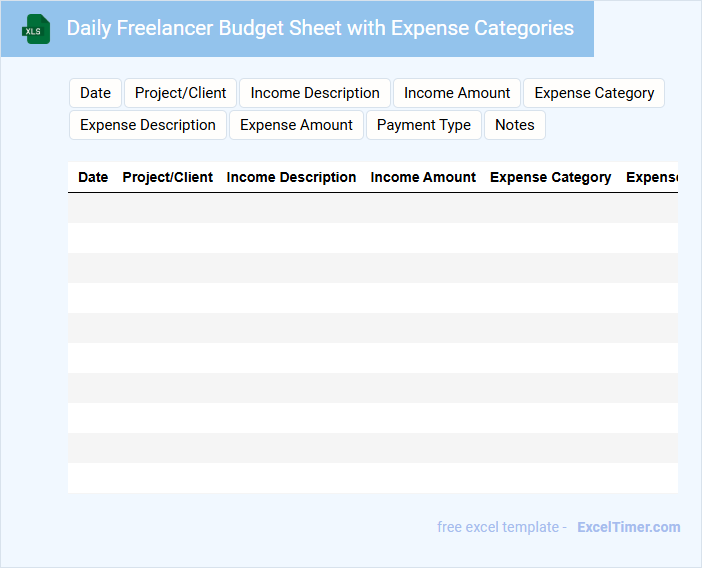

Daily Freelancer Budget Sheet with Expense Categories

What does a Daily Freelancer Budget Sheet with Expense Categories typically contain? It usually includes a detailed record of daily income and expenses divided into various categories such as office supplies, software subscriptions, meals, and transportation. This helps freelancers track their spending accurately and manage their cash flow efficiently.

Why is it important to categorize expenses in such a budget sheet? Categorizing expenses allows freelancers to identify spending patterns, optimize deductions for taxes, and make informed financial decisions. Ensuring consistent updates and reviewing the sheet regularly can significantly improve financial discipline and profitability.

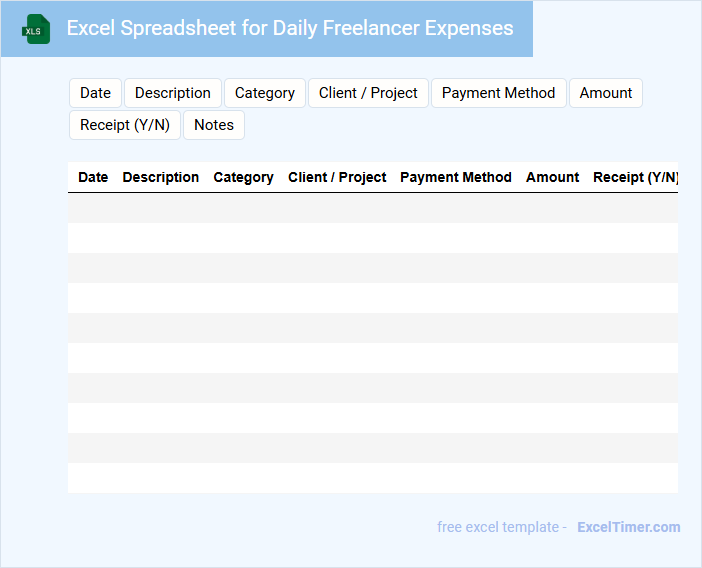

Excel Spreadsheet for Daily Freelancer Expenses

An Excel Spreadsheet for Daily Freelancer Expenses is a document that meticulously records the day-to-day financial transactions related to freelancing work. It typically includes entries for income, expenditures, and receipts, helping freelancers track funds efficiently.

This type of document is essential for budgeting and tax preparation, providing a clear view of cash flow and expense patterns. It is important to include categories, dates, and descriptions for each expense to maintain accurate records.

Daily Financial Tracker for Freelance Professionals

A Daily Financial Tracker for freelance professionals typically contains detailed records of all income and expenses logged each day. It helps in monitoring cash flow, ensuring accurate budgeting, and preparing for taxes efficiently. Keeping this document updated is essential for maintaining financial health and making informed business decisions.

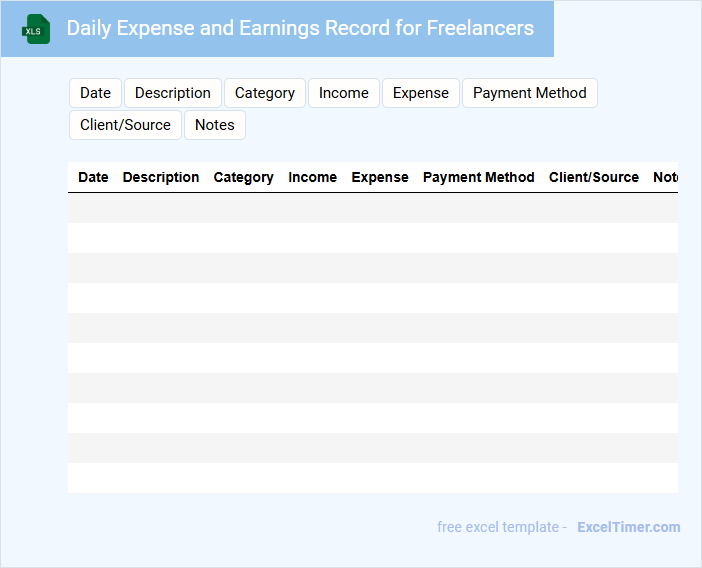

Daily Expense and Earnings Record for Freelancers

A Daily Expense and Earnings Record for freelancers typically contains detailed entries of income and expenditures on a day-to-day basis. It helps track financial inflows and outflows clearly, ensuring accurate budgeting and tax preparation. Maintaining consistency and including all relevant transactions is crucial for effective financial management.

Daily Tracker of Freelance Business Expenses

The Daily Tracker for Freelance Business Expenses is a vital document that records all monetary outflows related to freelance work on a daily basis. It helps maintain clear financial records and improves budget management for independent contractors.

This type of document usually contains expense categories, amounts, dates, and payment methods to ensure accurate tracking. Including receipts and notes for each entry strengthens the accountability and auditing process.

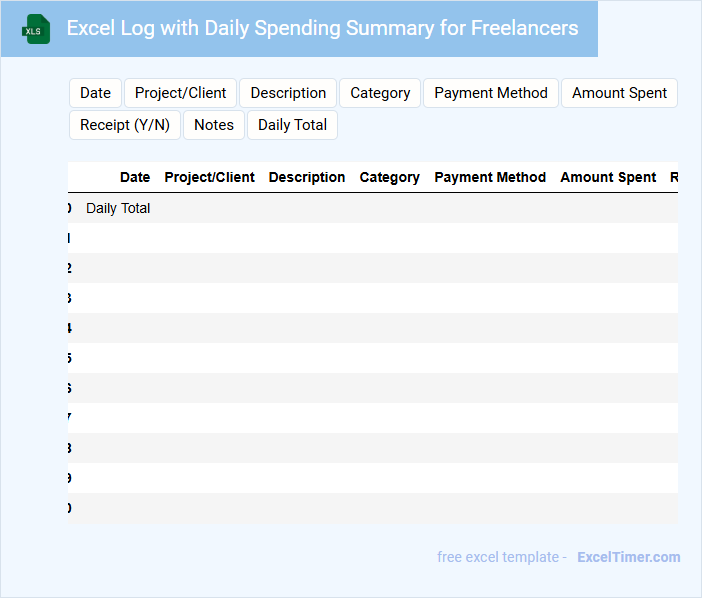

Excel Log with Daily Spending Summary for Freelancers

An Excel Log with Daily Spending Summary for freelancers is a structured document used to track daily expenses and financial transactions. It typically contains categorized spending entries, dates, payment methods, and running totals. This log helps freelancers manage budgets, analyze spending patterns, and prepare for taxes efficiently.

Important elements to include are consistent date formats, clear expense categories, and a summary section showcasing daily totals. Using formulas for automatic calculations and maintaining updated records enhances accuracy. Keeping backups and regular reviews ensures financial clarity and accountability.

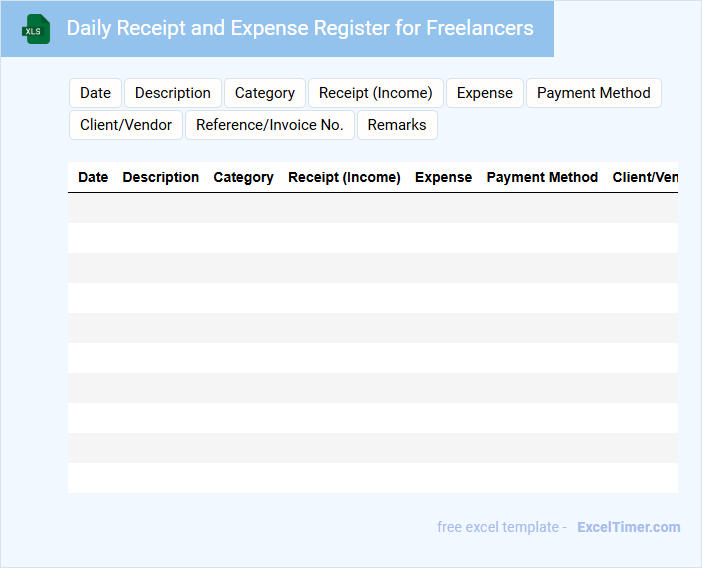

Daily Receipt and Expense Register for Freelancers

The Daily Receipt and Expense Register for freelancers is a vital document that tracks all financial transactions on a day-to-day basis. It includes detailed records of income received and expenses paid, helping freelancers maintain accurate financial monitoring.

Maintaining this register ensures transparency and simplifies tax filing and budgeting processes. It is important to record each entry promptly and categorize expenses clearly to maximize financial clarity and control.

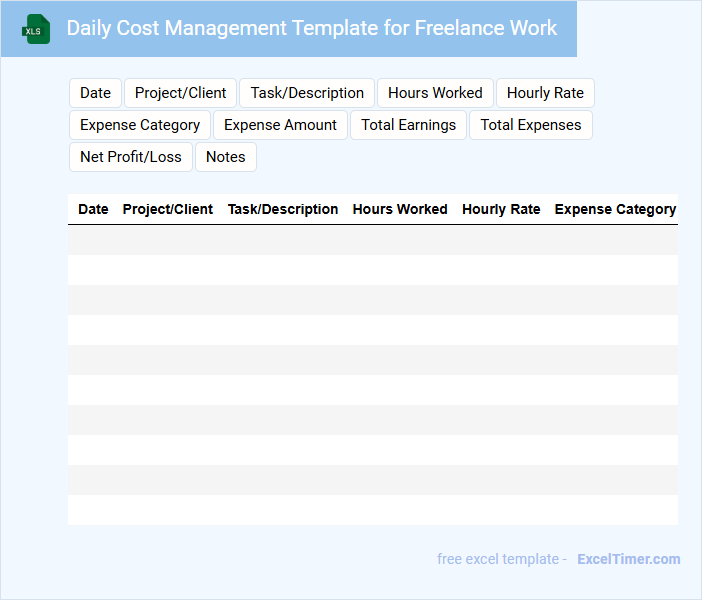

Daily Cost Management Template for Freelance Work

What information does a Daily Cost Management Template for Freelance Work typically contain? This type of document usually includes sections for tracking daily expenses, income, project-related costs, and time spent on various tasks. It helps freelancers maintain a clear overview of their financial activities and ensures accurate budgeting and billing.

What is an important suggestion when using a Daily Cost Management Template for Freelance Work? Consistently updating the template with actual expenses and income throughout the day is crucial to avoid missing any costs and maintain accurate financial records. Additionally, categorizing expenses by project or client can improve clarity and simplify tax preparation.

Daily Expense Planner with Invoice Tracker for Freelancers

A Daily Expense Planner with Invoice Tracker for Freelancers is a crucial tool designed to manage and record daily financial transactions effectively. This document typically contains sections for tracking income, expenses, and outstanding invoices, helping freelancers maintain clear and organized financial records. Emphasizing financial management ensures timely payments and accurate budgeting, leading to better cash flow control.

How can you categorize daily expenses effectively in an Excel tracker for clear financial insights?

Categorize daily expenses in an Excel tracker by creating labeled columns for categories such as Office Supplies, Travel, Meals, and Software Subscriptions, each with designated data validation lists for consistent entry. Use pivot tables to summarize and analyze expenses by category, enabling clear visualization of spending patterns. Conditional formatting can highlight overspending trends, providing freelancers with actionable financial insights.

What formulas are essential for automatically calculating daily, weekly, and monthly totals in an expense spreadsheet?

Essential formulas for a Daily Expense Tracker include SUM for calculating daily totals by summing expenses within a date range, SUMIFS for weekly totals by summing amounts with criteria based on week numbers, and SUMPRODUCT combined with MONTH for monthly totals by multiplying expense amounts with a logical test for matching months. Using these formulas ensures automated, accurate aggregation of expenses over different time periods in Excel. Incorporating dynamic date ranges and referencing date columns enhances the reliability of daily, weekly, and monthly calculations for freelancers.

Which columns are crucial for tracking the payment status and associated client details in a freelancer's expense log?

Crucial columns in a Daily Expense Tracker for freelancers include "Client Name," "Payment Status," "Invoice Number," and "Payment Due Date." These columns ensure you can efficiently monitor which clients have pending payments and track specific invoices. Accurate logging in these fields streamlines your financial management and cash flow monitoring.

How can you visually monitor spending patterns using charts or conditional formatting in Excel?

You can visually monitor spending patterns in your Daily Expense Tracker for Freelancers by using Excel's built-in charts like pie charts or bar graphs to display expense categories over time. Conditional formatting highlights specific spending thresholds or anomalies, making it easier to spot trends and control your budget. Incorporating these visual tools transforms raw data into actionable insights for smarter financial management.

What is the best method to separate business expenses from personal expenses within a single worksheet?

The best method to separate business expenses from personal expenses within a single Excel worksheet is by creating distinct categories or columns labeled specifically for each type. You can use data validation dropdowns or filters to easily classify and analyze your expenses. This approach ensures clear tracking within your Daily Expense Tracker for Freelancers without mixing personal and business costs.