![]()

The Daily Expense Tracker Excel Template for Small Businesses simplifies financial management by allowing owners to record and monitor daily expenditures efficiently. It helps in maintaining accurate expense logs, identifying spending patterns, and improving budget control. Using this template enhances cash flow visibility and supports informed decision-making for business growth.

Daily Expense Tracker with Category Breakdown

What information does a Daily Expense Tracker with Category Breakdown usually contain?

This document typically records daily expenditures organized by categories such as food, transportation, and entertainment. It also includes the amount spent, date, and sometimes notes for better financial management and insight into spending habits.

To optimize its usefulness, ensure consistent daily entries and regularly review category totals to identify areas for budget adjustment and savings opportunities.

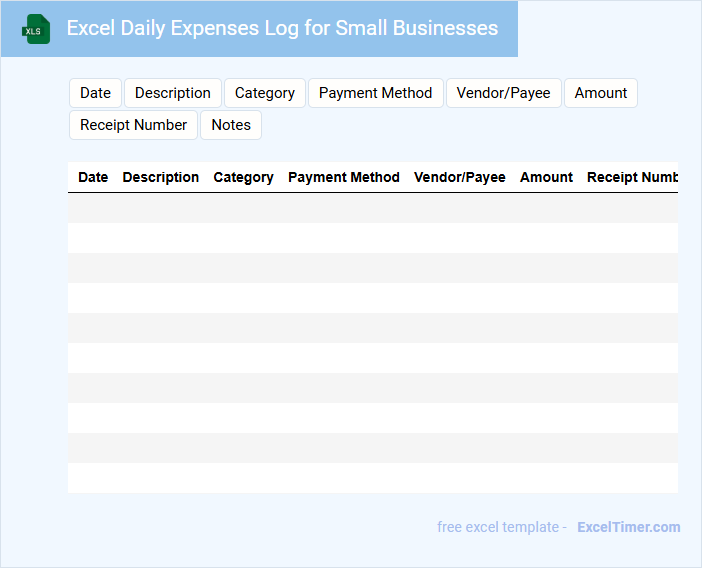

Excel Daily Expenses Log for Small Businesses

An Excel Daily Expenses Log for Small Businesses is a vital tool for tracking daily financial transactions. It typically contains columns for date, description, category, payment method, and amount spent. Accurate record-keeping helps in budget management, expense analysis, and tax preparation.

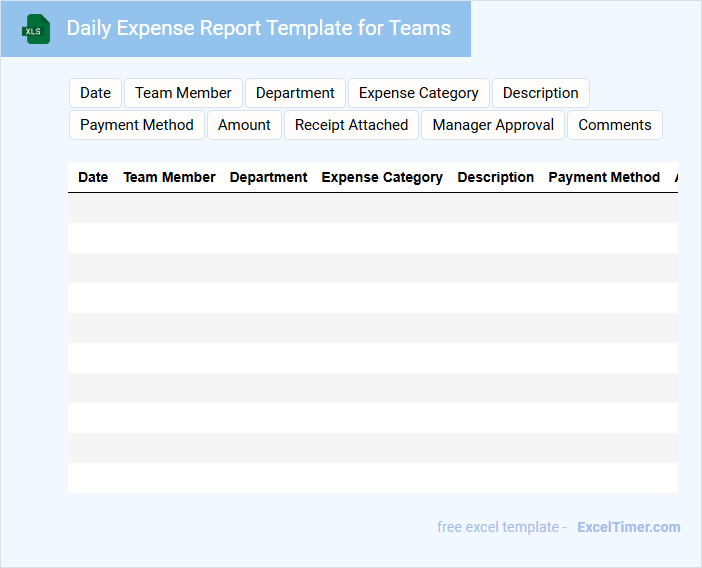

Daily Expense Report Template for Teams

A Daily Expense Report Template for Teams typically contains detailed records of expenses incurred by team members throughout the day. It includes categories such as transportation, meals, and office supplies to ensure accurate tracking and reimbursement. This document helps maintain financial transparency and accountability within a team.

For optimal use, ensure the template incorporates clear fields for date, description, amount, and the team member's name. Including a section for receipts or proof of purchase is crucial for verification purposes. Regularly updating and reviewing the report promotes efficient budget management and prevents overspending.

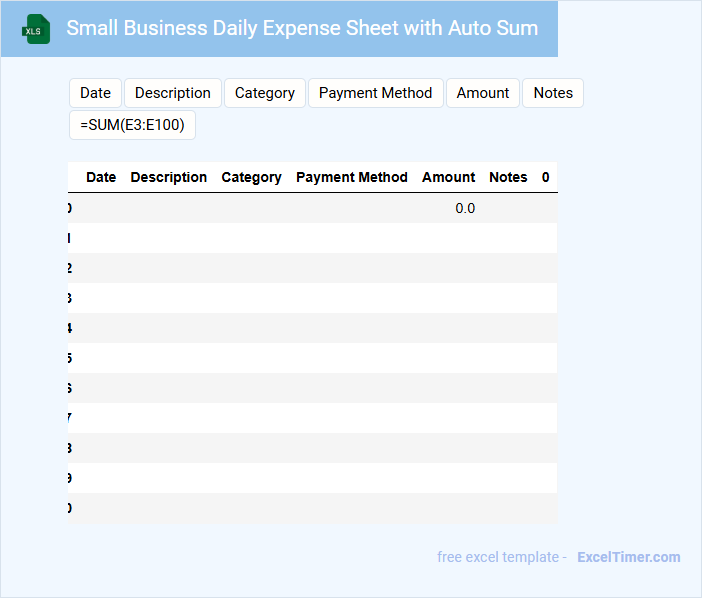

Small Business Daily Expense Sheet with Auto Sum

A Small Business Daily Expense Sheet with Auto Sum typically contains daily transaction records with automatic calculations for streamlined financial tracking.

- Accurate Date Entry to ensure each expense is recorded on the correct day for precise tracking.

- Categorized Expenses allowing easy identification and analysis of spending patterns.

- Auto Sum Functionality to automatically total expenses, reducing manual errors and saving time.

Simple Daily Expense Tracker for Startups

A Simple Daily Expense Tracker is a document that records all daily expenditures, helping startups maintain clear financial oversight. It typically includes categories such as office supplies, travel costs, and miscellaneous expenses to ensure comprehensive tracking.

Using a daily tracker promotes budget discipline and enables timely identification of overspending areas. Startups should prioritize accuracy and consistency when entering data to optimize financial decision-making and cash flow management.

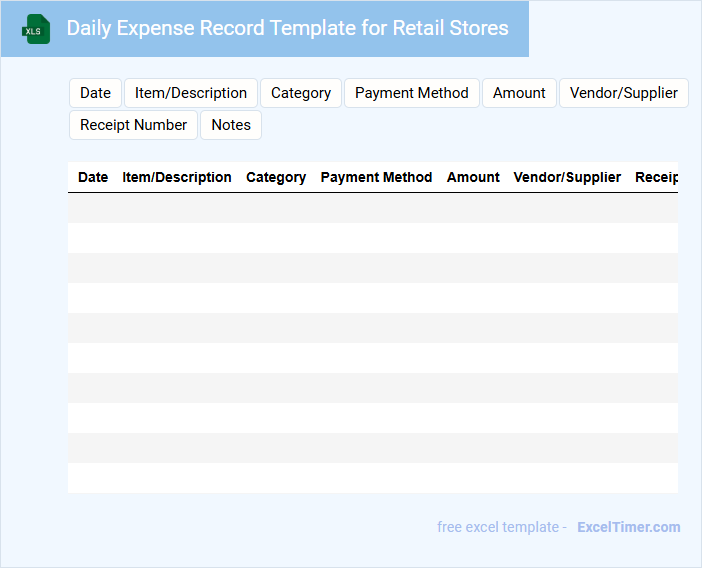

Daily Expense Record Template for Retail Stores

What information does a Daily Expense Record Template for Retail Stores typically contain?

This document usually includes detailed entries of daily expenditures such as purchases of inventory, utility bills, employee wages, and miscellaneous retail expenses. It helps store managers track spending patterns and maintain accurate financial records to optimize budgeting and cash flow management.

Important elements to include are date, expense category, amount, payment method, and a brief description or vendor name to ensure clarity and ease of auditing. Regularly updating and reviewing this template aids in identifying cost-saving opportunities and preventing overspending.

Daily Business Expense Tracker with Charts

A Daily Business Expense Tracker is a document designed to record and monitor all expenses incurred by a business on a daily basis. It typically contains detailed entries including date, category, amount, and notes for each expense. Incorporating charts in this document helps visualize spending patterns and identify areas where cost-saving measures can be implemented.

One important suggestion is to consistently update the tracker daily to maintain accuracy and reliability of financial data. Utilizing categorized expenses ensures a better understanding of where funds are allocated. Additionally, integrating automated charts for trends over time enhances decision-making and budget adjustments.

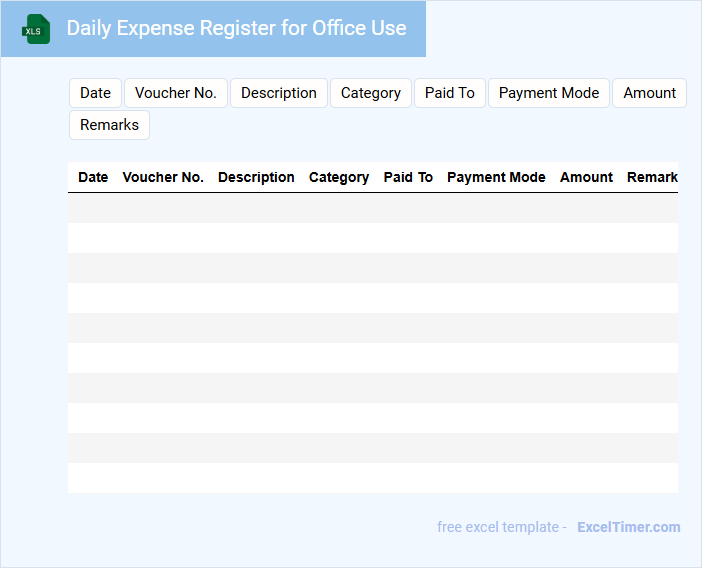

Daily Expense Register for Office Use

What information is typically included in a Daily Expense Register for Office Use? This document usually records all daily expenditures made by the office to track and manage budget allocation efficiently. It includes details such as the date, description of the expense, amount spent, and the person responsible for the transaction to ensure transparency and accountability.

What is an important suggestion for maintaining this register effectively? Consistently updating the register at the end of each day helps prevent errors and omissions, ensuring accurate financial records. Additionally, regularly reviewing the expenses supports better budget control and identifies potential areas for cost savings.

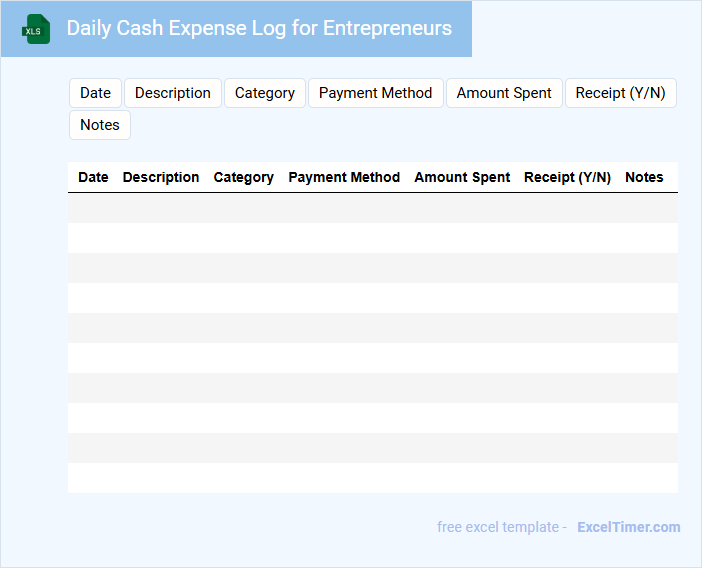

Daily Cash Expense Log for Entrepreneurs

A Daily Cash Expense Log for entrepreneurs is a critical document used to track all cash outflows on a daily basis. It typically contains details such as the date, description of the expense, amount spent, and the purpose of the transaction. Maintaining this log helps in managing finances effectively and ensuring accurate record-keeping for budgeting and tax purposes.

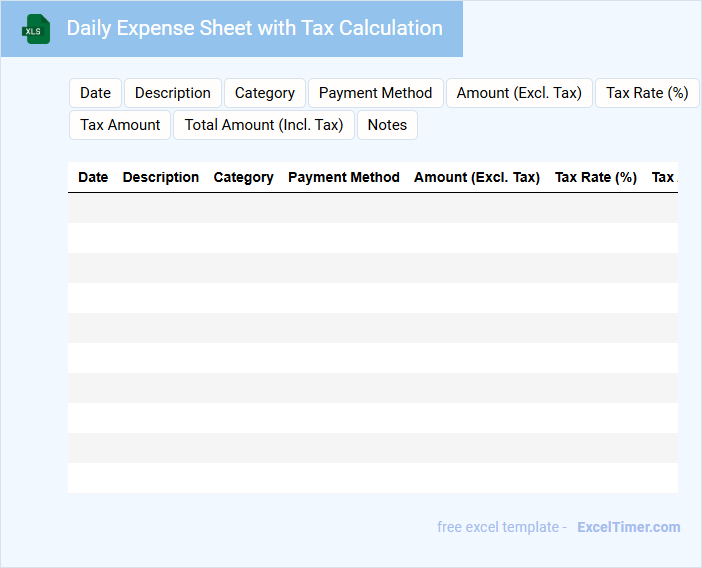

Daily Expense Sheet with Tax Calculation

A Daily Expense Sheet typically contains a detailed record of daily expenditures along with their corresponding receipts and payment methods. It includes columns for item description, amount, and tax calculations to provide a clear financial summary. For accurate accounting, it is essential to include precise tax rates and categorize expenses properly.

Daily Travel Expense Tracker for Employees

A Daily Travel Expense Tracker for Employees is a document used to record and monitor daily travel-related costs incurred by employees during business trips.

- Accurate Recording: Ensure all expenses are logged daily with receipts attached for verification.

- Clear Categorization: Separate expenses into categories such as transportation, meals, and lodging for better analysis.

- Timely Submission: Require employees to submit the tracker promptly to facilitate speedy reimbursement and accounting.

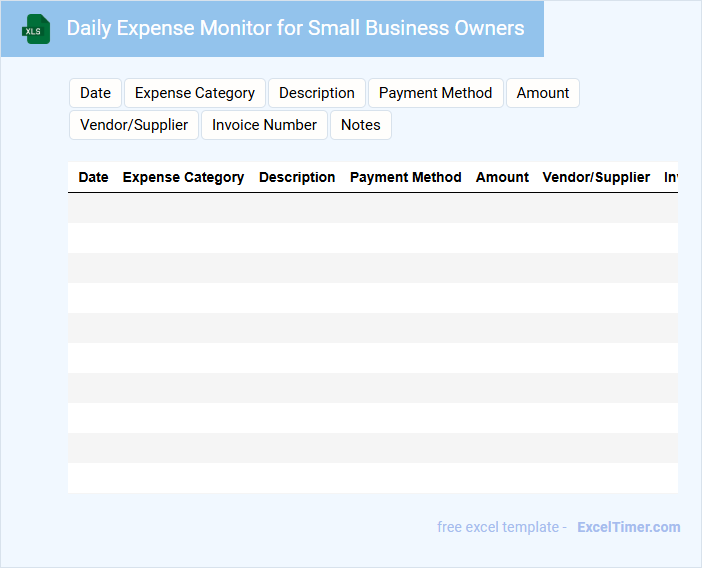

Daily Expense Monitor for Small Business Owners

A Daily Expense Monitor for small business owners is a document designed to track and record everyday expenditures systematically. It helps in maintaining transparent and accurate financial records, crucial for budget management and cost control.

This type of document usually contains entries of daily purchases, payment dates, categories of expenses, and payment methods. Important features include categorization of expenses, date logging, and regular review to ensure financial discipline.

Daily Expense Tracker with Receipts Attachment

A Daily Expense Tracker with Receipts Attachment is a document used to record daily spending along with corresponding receipts for accurate financial management. It helps individuals monitor their expenses and keep proof of transactions for budgeting and auditing purposes.

- Include the date, amount, and category for each expense entry to maintain organized records.

- Attach digital or scanned copies of receipts to verify and support the recorded expenses.

- Regularly review and reconcile entries to ensure accuracy and control over spending habits.

Daily Petty Cash Tracker for Small Teams

A Daily Petty Cash Tracker for Small Teams is a document used to record and monitor daily small cash expenditures to ensure accurate financial management.

- Expense Details: It should include a clear description of each petty cash transaction for accountability.

- Amount Tracking: The tracker must record the exact amount spent and remaining balance to avoid discrepancies.

- Approval Signatures: Including a space for authorization or verification by a team member enhances transparency.

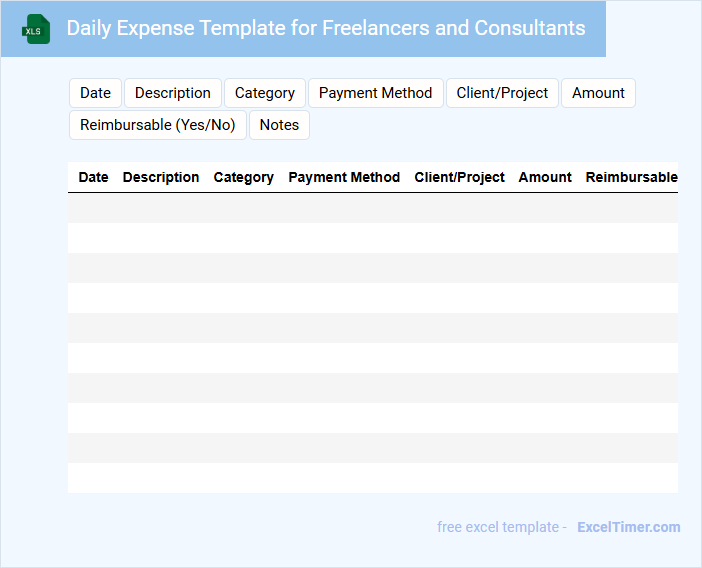

Daily Expense Template for Freelancers and Consultants

A Daily Expense Template for Freelancers and Consultants typically contains detailed records of daily expenditures to help manage finances effectively.

- Accurate tracking: Enables precise logging of all expenses to maintain clear financial records.

- Category organization: Helps categorize expenses for better analysis and budgeting.

- Invoice integration: Facilitates linking expenses to client invoices for efficient billing.

How can you categorize daily expenses in your Excel tracker for better financial analysis?

Categorize daily expenses in your Excel tracker by creating distinct columns for expense types such as utilities, supplies, salaries, and marketing. Use dropdown lists or data validation to maintain consistent categorization, enabling accurate filtering and pivot table analysis. This structured approach enhances your financial insights and helps identify spending patterns effectively.

What formulas should you use to automatically calculate daily, weekly, and monthly totals?

Use the SUM formula to calculate daily totals by adding expenses for each day. Apply the SUMIF formula to aggregate weekly expenses based on date ranges matching each week. For monthly totals, use the SUMPRODUCT formula combined with MONTH and YEAR functions to sum expenses within the specified month and year automatically.

How can data validation be applied to minimize input errors in expense entries?

Data validation in an Excel Daily Expense Tracker for Small Businesses ensures accurate expense entries by restricting input types, such as allowing only dates for expense dates or predefined categories for expense types. Setting drop-down lists with fixed expense categories and limiting amount fields to positive numbers reduces errors and maintains consistent data. Implementing these validation rules improves data reliability and streamlines financial tracking for small business owners.

Which essential columns and data types should you include in a daily expense tracking sheet?

Include essential columns such as Date (date format), Expense Category (text), Description (text), Payment Method (text), Amount (currency), Vendor Name (text), and Receipt Number (text or numeric). Ensure Amount is formatted for currency to track expenses accurately. Categorizing expenses allows for detailed analysis of spending patterns and budgeting.

How can you use Excel charts or PivotTables to visualize spending patterns over time?

Excel charts like line, bar, or pie charts effectively visualize daily, weekly, and monthly spending patterns by categorizing expenses and highlighting trends. PivotTables summarize large expense datasets, enabling dynamic filtering and grouping by date, category, or vendor to identify key spending areas. Combining PivotTables with PivotCharts provides interactive visual analysis for better decision-making in small business expense management.