The Daily Revenue and Expense Excel Template for Restaurant Owners provides a streamlined way to track daily sales and expenditures, ensuring accurate financial management. It allows restaurant owners to monitor cash flow, identify spending patterns, and make informed decisions to maximize profitability. Easy to customize, this template supports better budgeting and financial planning tailored to the food service industry.

Daily Revenue and Expense Tracker for Restaurant Businesses

What information does a Daily Revenue and Expense Tracker for Restaurant Businesses typically contain? This document usually includes daily sales figures, expense details such as inventory purchases, staff wages, and utility costs, helping restaurant owners monitor financial performance. It is essential for tracking cash flow and identifying areas for cost control to ensure business profitability.

What is an important aspect to consider when using this tracker? Accuracy in recording each revenue and expense item daily is crucial to maintain reliable data. Additionally, categorizing expenses clearly helps in analyzing spending patterns and making informed operational decisions.

Restaurant Daily Income and Expense Log

A Restaurant Daily Income and Expense Log is a crucial document that records the daily financial transactions of a restaurant. It typically includes details about sales revenue, operational expenses, and cash flow. Maintaining this log helps managers monitor profitability and make informed financial decisions.

Daily Cash Flow Statement for Restaurant Owners

What information is typically contained in a Daily Cash Flow Statement for Restaurant Owners? It usually includes a detailed record of daily cash inflows and outflows, such as sales revenue, payments to suppliers, and operating expenses. This document helps restaurant owners monitor real-time liquidity and manage their financial health effectively.

Why is accurate and timely updating important for a Daily Cash Flow Statement? Consistent updates ensure that owners can promptly identify cash shortages or surpluses, enabling better decision-making for purchasing, staffing, and other operational needs. Maintaining this accuracy supports sustainable business growth and prevents cash-related crises.

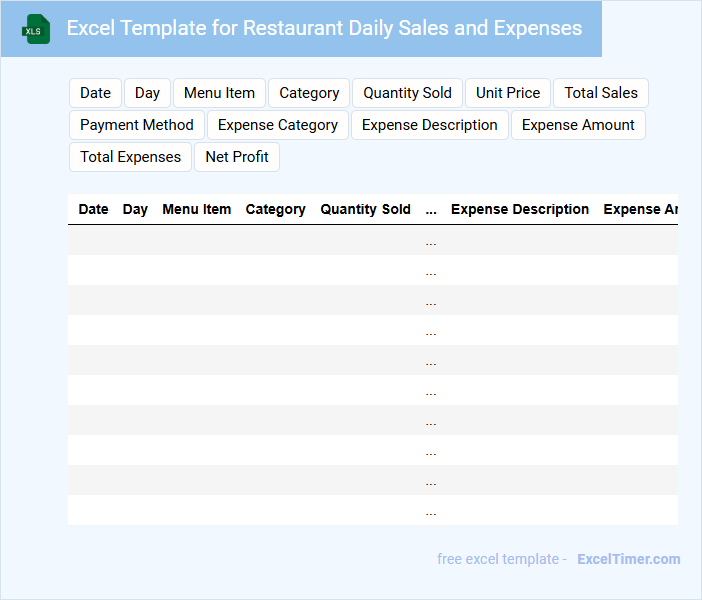

Excel Template for Restaurant Daily Sales and Expenses

This document is an Excel Template designed to track daily sales and expenses for restaurants. It typically includes sections for recording food sales, beverage sales, operational costs, and miscellaneous expenses.

Its purpose is to streamline financial monitoring and help restaurant owners analyze profitability on a daily basis. For best results, ensure data consistency and update the template at the close of each business day.

Daily Financial Record for Restaurants

A Daily Financial Record for restaurants typically contains detailed information about daily sales, expenses, and cash flow. It helps in tracking revenue, monitoring costs, and ensuring accurate bookkeeping. Maintaining this record is crucial for effective financial management and decision-making in the restaurant business.

Important elements to include are total daily sales, itemized expenses (such as inventory, payroll, and utilities), and cash receipts. Additionally, reconciling the cash register with recorded sales is essential for accuracy. Consistently updating and reviewing these records can significantly aid in identifying trends and controlling operational costs.

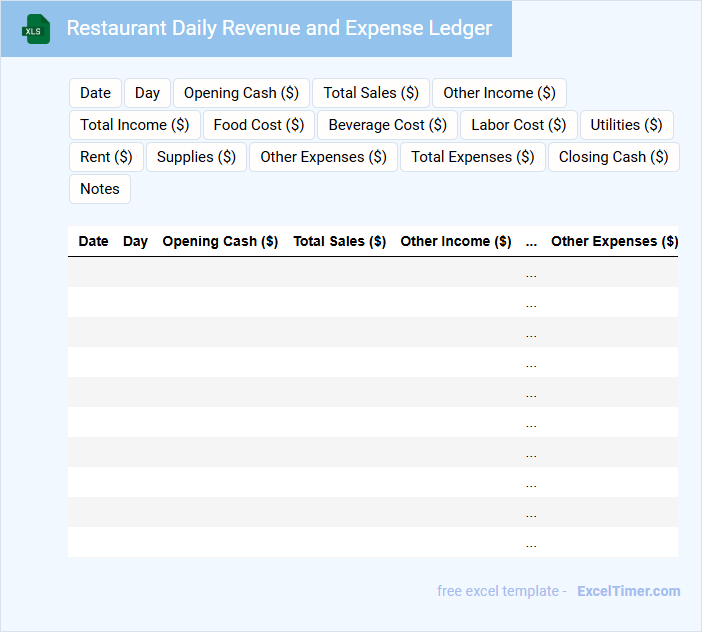

Restaurant Daily Revenue and Expense Ledger

A Restaurant Daily Revenue and Expense Ledger is a crucial document that records all daily financial transactions, including sales income and operational expenses. It helps restaurant managers track profitability and manage budgets effectively. Maintaining accurate entries in this ledger ensures better financial control and decision-making.

Daily Income and Outgoings Sheet for Restaurant Accounting

A Daily Income and Outgoings Sheet for Restaurant Accounting typically records all financial transactions related to daily sales and expenses to monitor cash flow accurately.

- Income Tracking: Detail all sources of daily revenue including food sales, beverage sales, and any additional services.

- Expense Logging: Record all daily expenditures such as inventory purchases, staff wages, and utility costs.

- Cash Flow Reconciliation: Ensure daily income matches outgoing payments to maintain accurate accounting and detect discrepancies early.

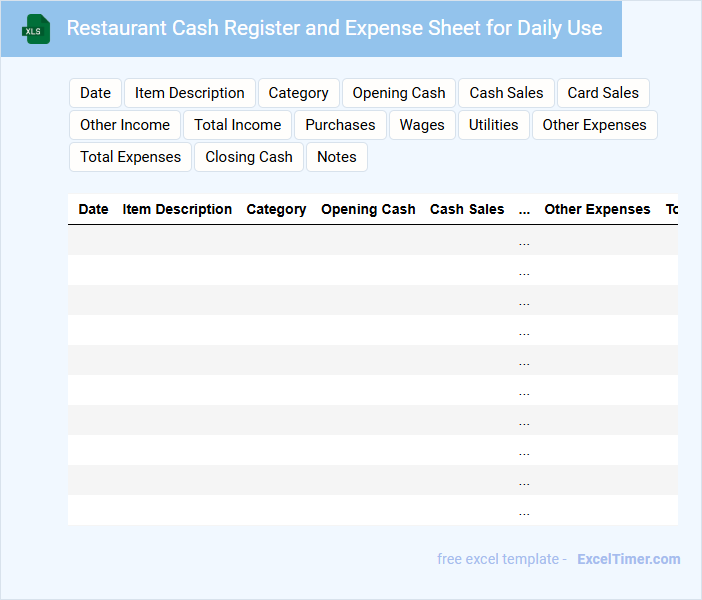

Restaurant Cash Register and Expense Sheet for Daily Use

What information is typically included in a Restaurant Cash Register and Expense Sheet for Daily Use? This document usually contains detailed records of daily sales, cash transactions, and all expenses incurred throughout the day, ensuring accurate financial tracking. It helps restaurant owners monitor their cash flow, control costs, and maintain organized financial data for better decision-making.

What is an important consideration when using this type of sheet? It is crucial to consistently update the sheet at the end of each business day to avoid discrepancies and maintain precise records. Ensuring clear categorization of expenses and sales facilitates easier analysis and financial reporting.

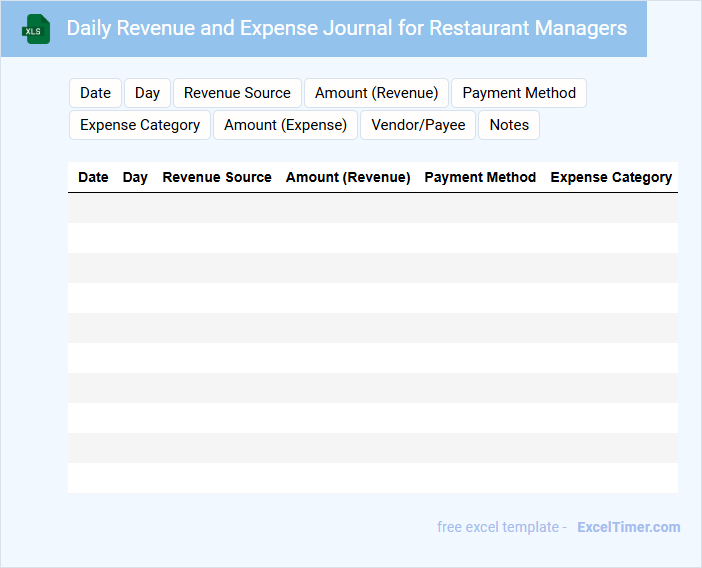

Daily Revenue and Expense Journal for Restaurant Managers

The Daily Revenue and Expense Journal is a crucial document for restaurant managers, recording all financial transactions made throughout the day. It details sales income, costs, and miscellaneous expenses to track daily profitability effectively.

This journal typically includes sections for categorizing revenue from food, beverages, and other services, alongside expense entries such as supplies, wages, and utilities. Careful daily entries help identify spending patterns and ensure budget adherence.

Managers should prioritize accuracy and completeness to maintain reliable financial records and support informed decision-making.

Simple Daily Sales and Expense Spreadsheet for Restaurants

A Simple Daily Sales and Expense Spreadsheet for restaurants typically contains detailed records of daily revenue and operational costs. It helps track sales performance and monitor expenses to ensure profitability. Maintaining accurate entries is crucial for effective financial management.

This document often includes sections for food and beverage sales, labor costs, and miscellaneous expenses. It provides a straightforward view of daily cash flow and budget adherence. Regular updates and reconciliation with receipts are important for accuracy.

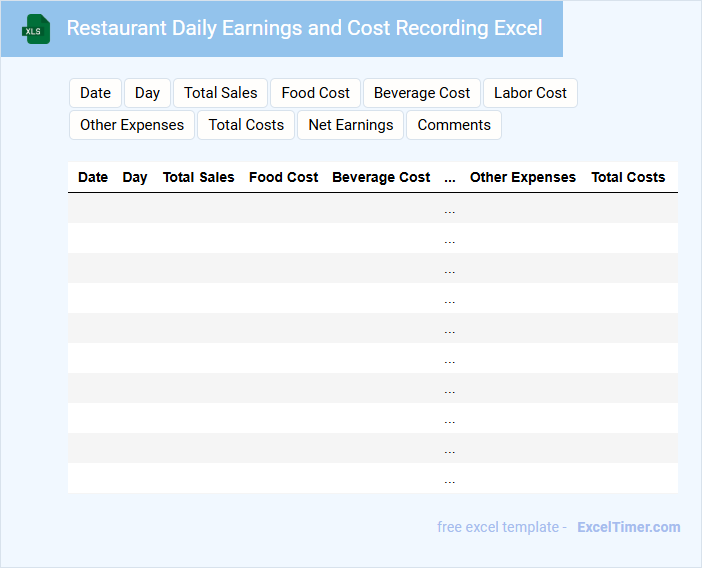

Restaurant Daily Earnings and Cost Recording Excel

A Restaurant Daily Earnings and Cost Recording Excel document typically contains detailed records of daily revenue, food and beverage costs, and other operational expenses. It allows restaurant managers to monitor profitability and identify cost-saving opportunities effectively. Essential components include sales data, inventory usage, and labor costs for accurate financial tracking.

To ensure efficiency, it is important to maintain consistent data entry and update the sheet daily. Including clear categories and automated formulas can help in quick analysis and error reduction. Regularly reviewing trends from the document supports better budgeting and decision-making.

Daily Restaurant Operations Expense and Income Tracker

What information is typically included in a Daily Restaurant Operations Expense and Income Tracker? This document usually contains detailed records of daily sales, expenses, and cash flow to monitor the financial health of the restaurant. It helps in tracking revenues, costs of goods sold, labor expenses, and other operational costs to ensure profitability and budget compliance.

What is an important aspect to focus on when using this tracker? Accuracy and consistency in recording each transaction are crucial to generate reliable financial insights. Regularly reviewing and updating the tracker supports informed decision-making and helps identify trends or issues promptly.

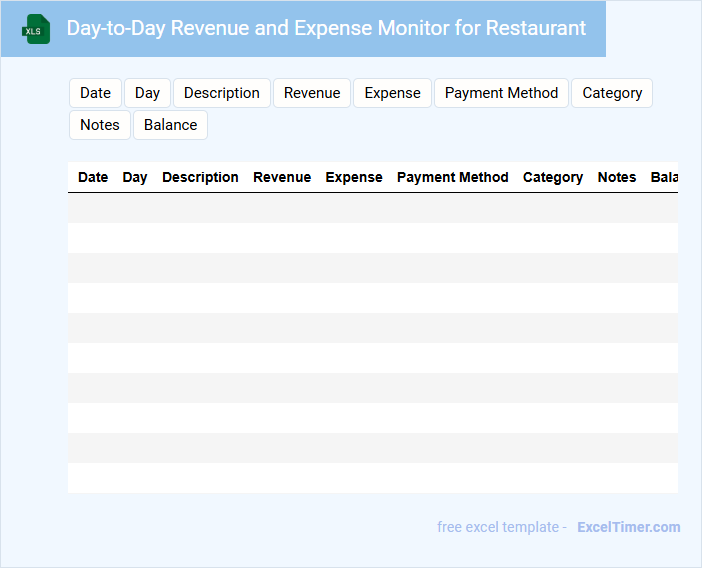

Day-to-Day Revenue and Expense Monitor for Restaurant

A Day-to-Day Revenue and Expense Monitor for a restaurant typically contains detailed daily records of all income and expenditures, including sales, purchases, and operational costs. It helps restaurateurs track financial performance and maintain budgets effectively. This document is crucial for identifying trends, controlling expenses, and maximizing profitability.

Excel Log for Daily Restaurant Revenue and Expense Management

Excel Log for Daily Restaurant Revenue and Expense Management

What information does an Excel log for daily restaurant revenue and expense management typically contain?

This type of document usually includes daily records of sales revenue, food and beverage costs, labor expenses, and other operational expenditures. It helps restaurant managers track financial performance, identify trends, and make informed budgeting decisions effectively.

What is an important suggestion for maintaining an effective Excel log in this context?

Consistently updating the log with accurate and detailed entries ensures reliable data analysis. Including separate categories and using formulas for automatic calculations can enhance clarity and reduce errors in financial tracking.

Restaurant Daily Financial Tracking Sheet with Income and Expense Columns

A Restaurant Daily Financial Tracking Sheet is a crucial document used to monitor daily income and expenses. It typically contains columns for various revenue sources, operational costs, and summary totals. This sheet helps restaurant managers maintain accurate financial records and make informed decisions.

Important aspects to include are clear categorization of income and expense entries, date stamping each transaction, and a running balance to track daily profitability. Additionally, incorporating sections for notes or irregular expenditures can provide valuable insights for future budgeting. Consistent and precise data entry ensures effective financial management and aids in identifying cost-saving opportunities.

What are the key columns needed to track daily revenue and expenses in an Excel sheet for restaurant management?

Key columns to track daily revenue and expenses in a restaurant Excel sheet include Date, Sales Revenue, Cost of Goods Sold (COGS), Labor Costs, Operating Expenses, and Net Profit. Include additional columns for Payment Method, Daily Covers (number of customers), and Notes for anomalies or special events. Accurate daily entries in these columns enable effective financial analysis and management decisions.

How can Excel formulas automate the calculation of daily profit from revenue and expense entries?

Excel formulas automate daily profit calculation by subtracting total expenses from total revenue using a simple formula like =SUM(B2:B10)-SUM(C2:C10), where B2:B10 represents revenue entries and C2:C10 represents expense entries. Implementing this formula across rows enables real-time profit tracking for each day. Integrating functions like SUM or SUMIF streamlines financial analysis for restaurant owners managing daily revenue and expenses.

Which Excel chart types best visualize daily sales and expense trends for a restaurant?

Line charts and clustered column charts best visualize daily sales and expense trends for restaurant owners. Line charts clearly show revenue and expense fluctuations over time, while clustered column charts enable side-by-side comparison of daily figures. Using these charts in your Excel document helps identify patterns and make informed business decisions.

What methods can be used in Excel to categorize and filter different expense types (e.g., food, labor, utilities)?

Use Excel's Data Validation feature to create dropdown lists for consistent expense categorization such as food, labor, and utilities. Apply Excel's Filter or Advanced Filter tools to display specific expense types quickly. PivotTables can summarize and analyze categorized expenses across different dates and parameters.

How can restaurant owners use conditional formatting in Excel to flag days with unusually high or low expenses?

You can use conditional formatting in Excel to highlight days with unusually high or low expenses by setting rules that compare daily expenses against defined thresholds or averages. Applying color scales or data bars visually flags these outliers, making it easy to identify days that require further review. This approach helps restaurant owners quickly monitor daily revenue and expenses for better financial control.