The Monthly Budget Excel Template for Families helps organize household expenses and income efficiently, providing clear visibility on spending habits and financial goals. It includes customizable categories for bills, groceries, savings, and entertainment, making budgeting simple and adaptable to different family sizes. Regular use of this template promotes financial discipline and improves money management skills for long-term stability.

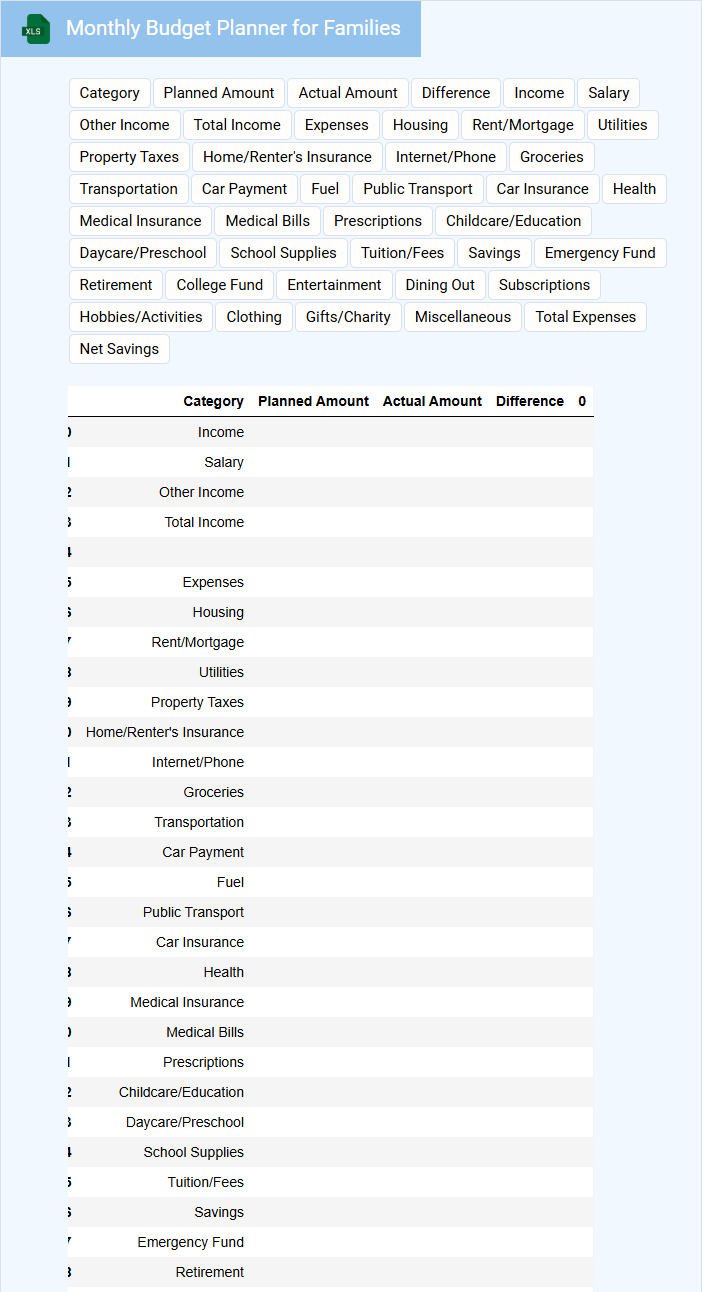

Monthly Budget Planner for Families

What does a Monthly Budget Planner for Families typically contain? It usually includes sections for tracking income, fixed and variable expenses, and savings goals to help manage household finances effectively. This document helps families monitor their spending, plan for upcoming expenses, and work towards financial stability by providing a clear overview of their monthly financial situation.

What important elements should be considered when using a Monthly Budget Planner for Families? It is crucial to categorize expenses accurately, regularly update the planner with actual spending, and set realistic savings targets. Additionally, including an emergency fund section and reviewing the budget monthly ensures ongoing financial health and preparedness for unexpected costs.

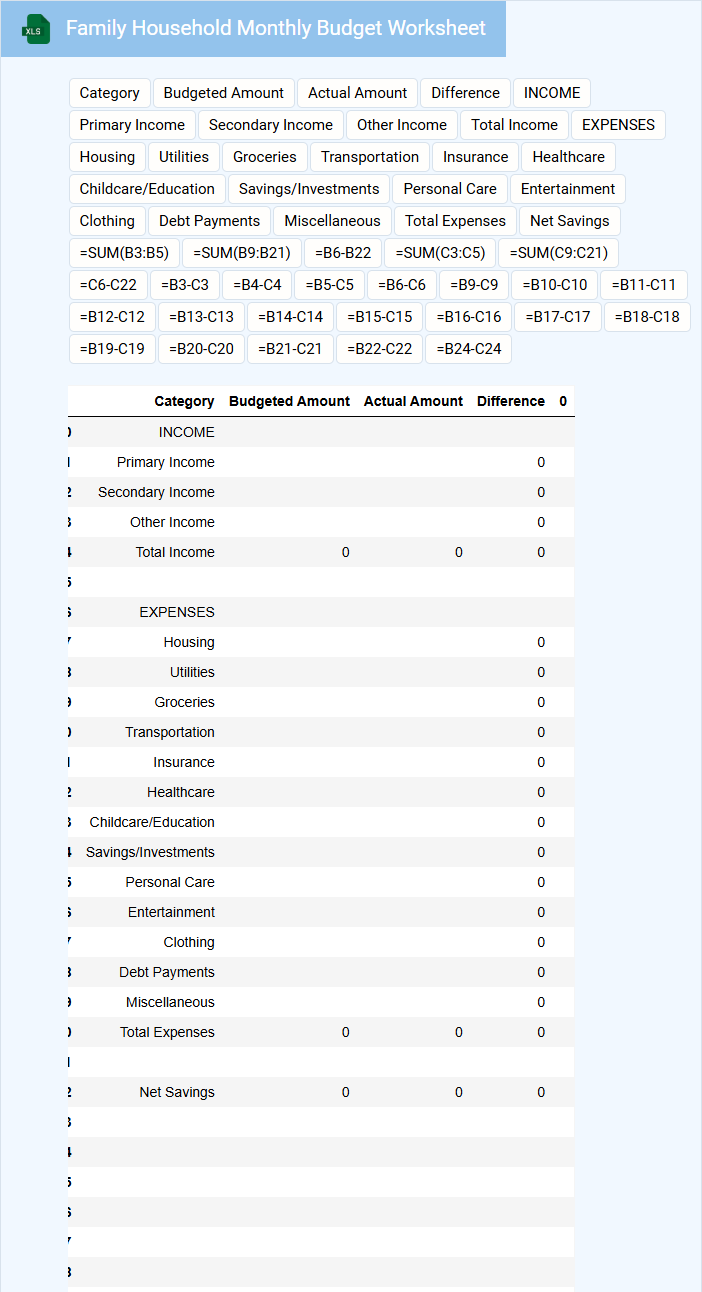

Family Household Monthly Budget Worksheet

A Family Household Monthly Budget Worksheet typically contains sections for income, fixed expenses, variable expenses, and savings goals to help track a family's financial status. It often includes categories for essentials like housing, utilities, groceries, transportation, and discretionary spending. This document is essential for managing finances, ensuring expenses do not exceed income, and planning for future savings or emergencies.

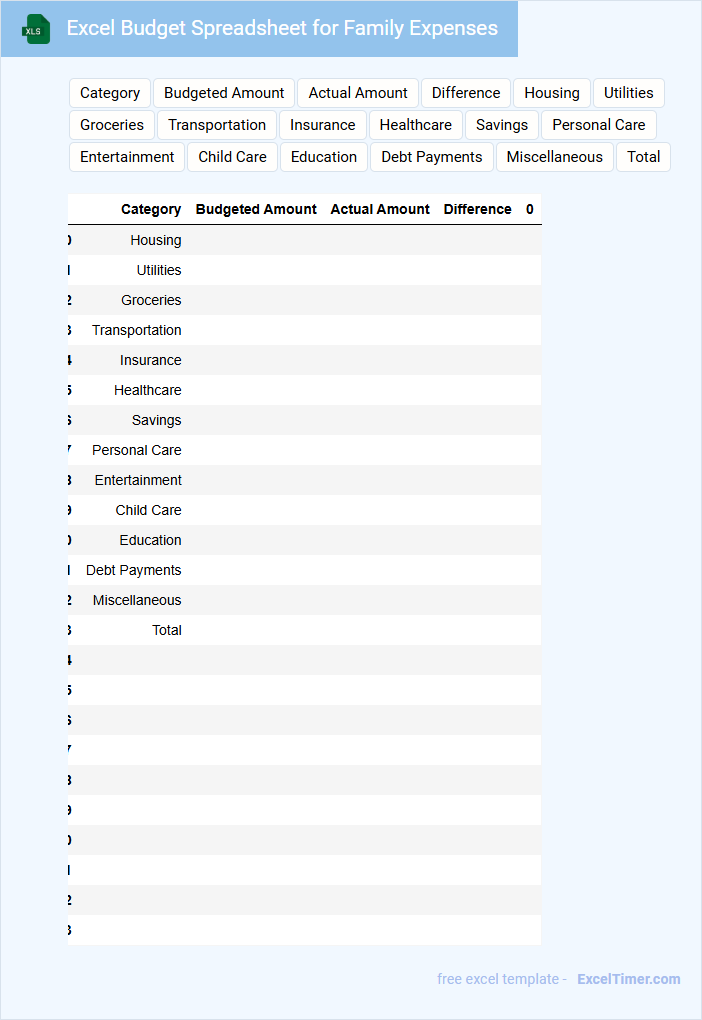

Excel Budget Spreadsheet for Family Expenses

An Excel Budget Spreadsheet for Family Expenses typically contains detailed records of income, expenditures, and savings goals to help manage household finances efficiently. It provides a clear overview of spending patterns and helps in planning future budgets.

- Include categories for all major expense types such as housing, utilities, groceries, and transportation.

- Ensure the spreadsheet has columns for actual spending, budgeted amounts, and variance to track performance.

- Incorporate charts or graphs for visual representation of the budget data to easily identify trends and areas for adjustment.

Family Monthly Income and Expense Tracker

This document typically contains a detailed record of a family's monthly earnings and expenditures to help manage finances effectively.

- Income sources: List all monthly income streams clearly to track total earnings.

- Expense categories: Organize expenses into categories like utilities, groceries, and entertainment for better budgeting.

- Savings goals: Include planned savings to ensure financial growth and emergency preparedness.

Simple Family Budget Template for Excel

What information is typically included in a Simple Family Budget Template for Excel? This type of document usually contains categories for income, expenses, savings, and financial goals, enabling users to track their monthly finances comprehensively. It is designed to help families organize their budget clearly and manage their money effectively.

What is an important aspect to consider when using a Simple Family Budget Template for Excel? Ensuring all income sources and recurring expenses are accurately entered is crucial for realistic budgeting. Additionally, regularly updating and reviewing the template promotes better financial planning and helps avoid overspending.

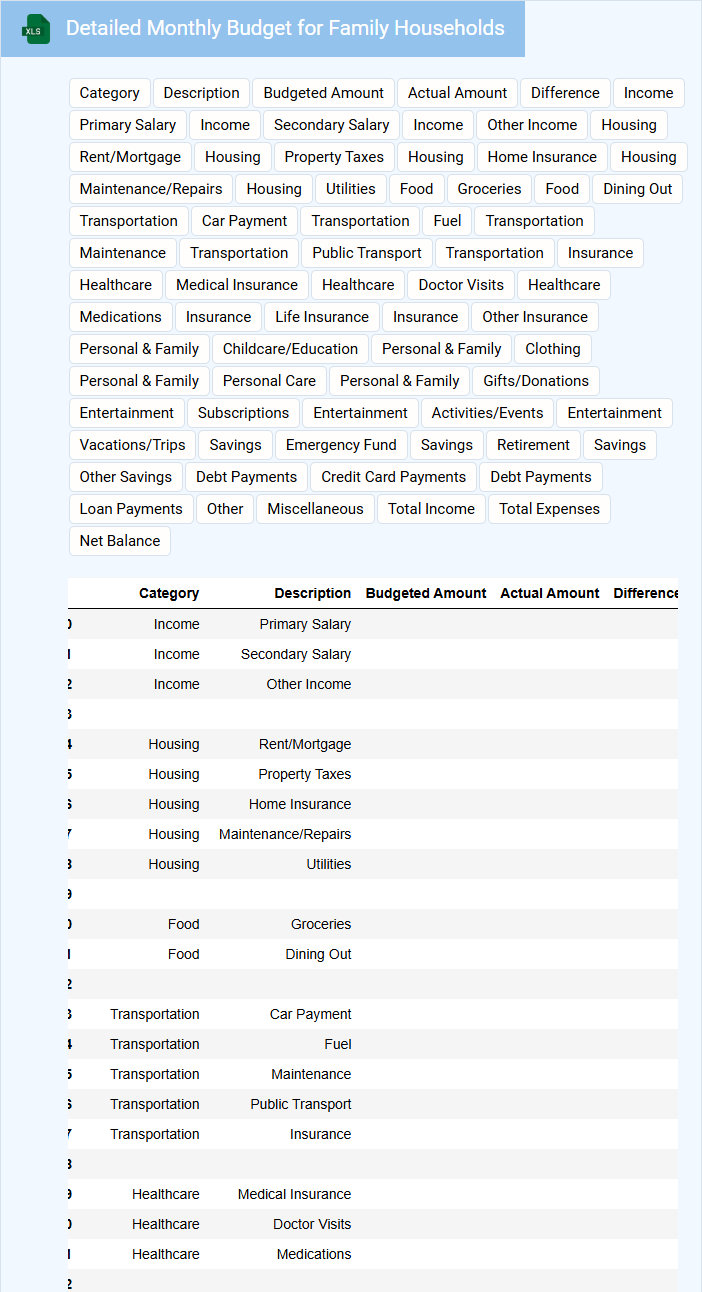

Detailed Monthly Budget for Family Households

A Detailed Monthly Budget for family households typically contains an itemized list of income sources and all monthly expenses, including housing, utilities, groceries, transportation, and savings. This document helps families track their spending patterns and manage their finances effectively. Ensuring accuracy in expense entries is key to maintaining a realistic budget.

Important aspects include categorizing expenses clearly and prioritizing essential costs over discretionary spending. Regularly reviewing and adjusting the budget allows families to meet financial goals and avoid overspending. Incorporating an emergency fund is a critical recommendation for financial security.

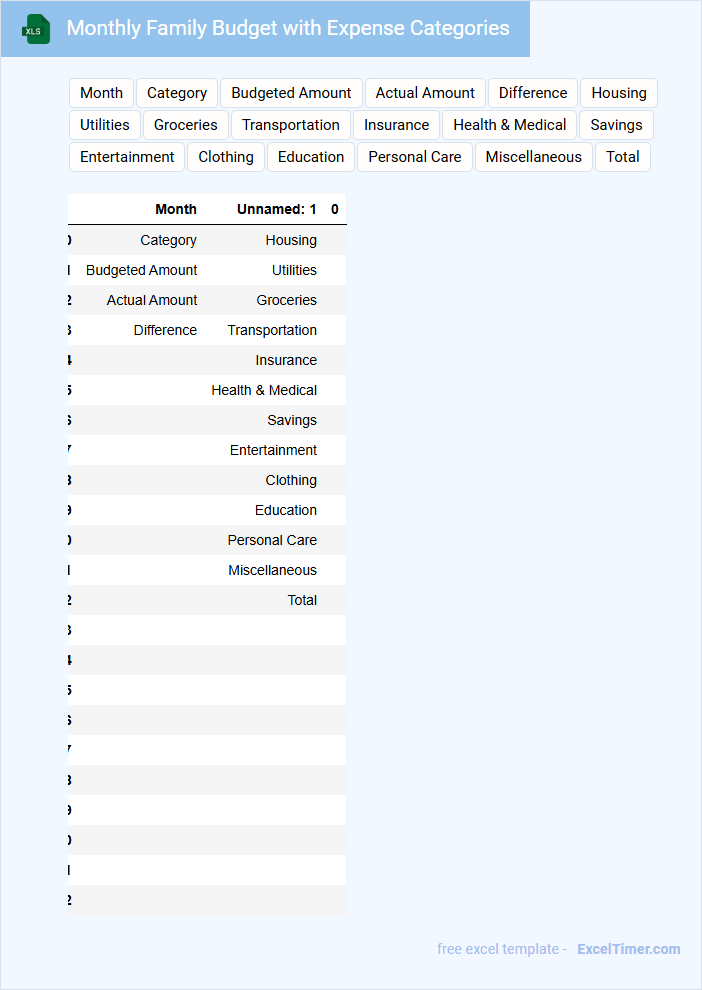

Monthly Family Budget with Expense Categories

A Monthly Family Budget document typically outlines income versus expenses to help manage household finances effectively. It categorizes spending to track where money is allocated each month.

- Include clear expense categories such as housing, food, transportation, and utilities for organized tracking.

- Regularly update income and expenses to maintain an accurate and realistic budget.

- Set spending limits and savings goals to encourage financial discipline and future planning.

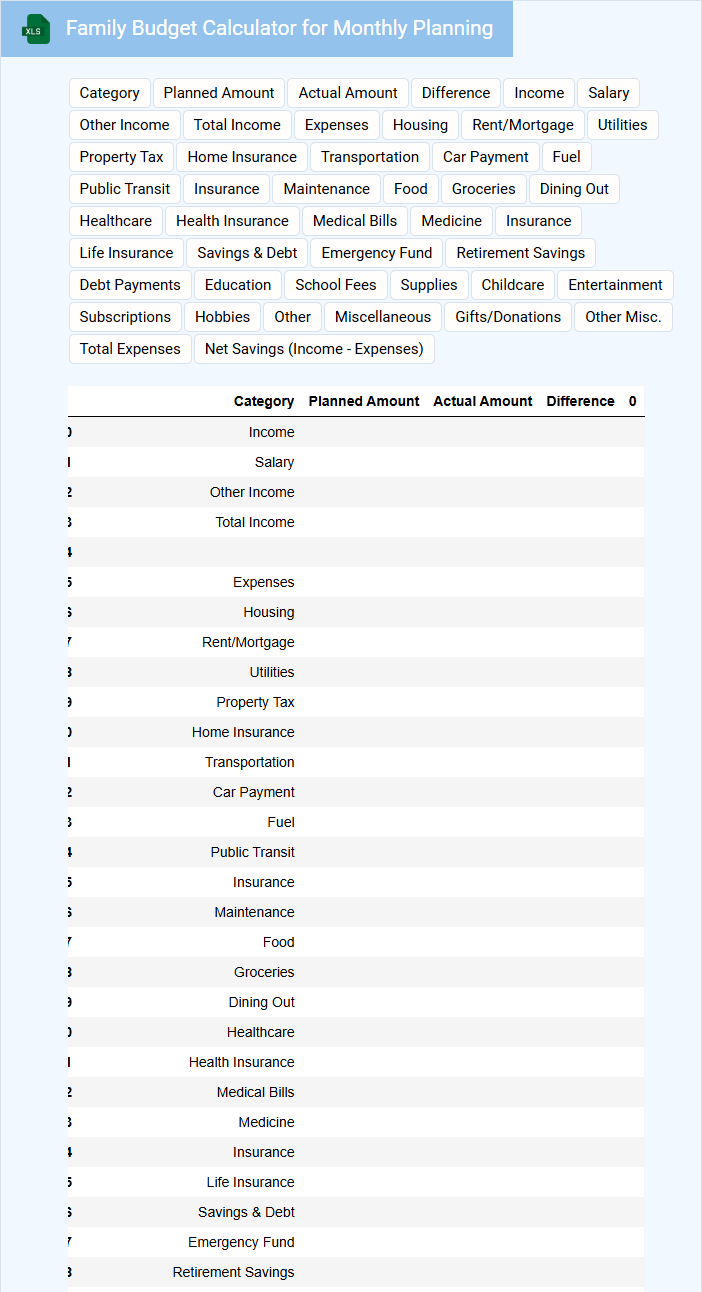

Family Budget Calculator for Monthly Planning

What does a Family Budget Calculator for Monthly Planning typically include? This type of document usually contains sections for income, fixed expenses, variable expenses, and savings goals. It helps families track their earnings versus spending to manage finances effectively and plan for future needs.

What is an important consideration when using this calculator? Accurate data entry on all income sources and expenses is crucial to obtain reliable results. Regularly updating the budget ensures it reflects current financial situations and helps maintain control over family finances.

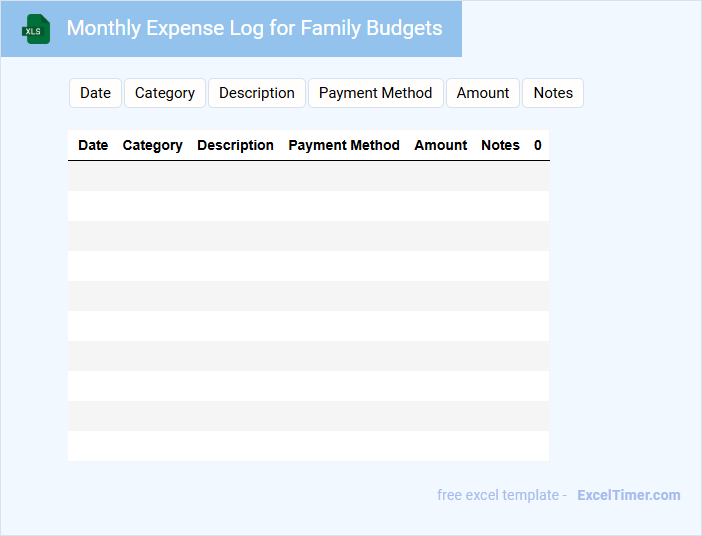

Monthly Expense Log for Family Budgets

A Monthly Expense Log for Family Budgets is a financial tool used to track and manage household spending. It typically contains detailed records of income, expenses, and savings goals. Keeping this document updated helps in identifying spending patterns and improving budget planning.

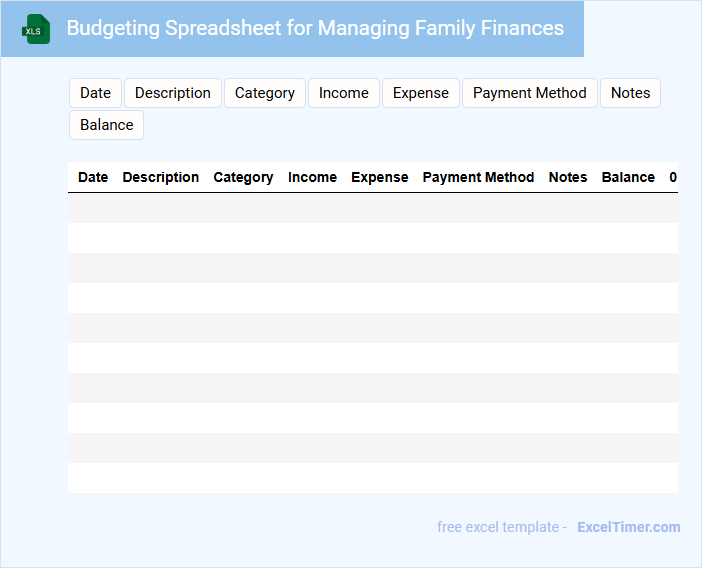

Budgeting Spreadsheet for Managing Family Finances

A budgeting spreadsheet for managing family finances typically contains detailed income sources, monthly expenses, savings goals, and debt tracking. It provides a clear overview of financial health and helps in making informed spending decisions.

Important aspects include regular updates of actual expenses versus planned budgets and setting realistic financial targets. Consistent monitoring ensures better control over cash flow and long-term financial stability.

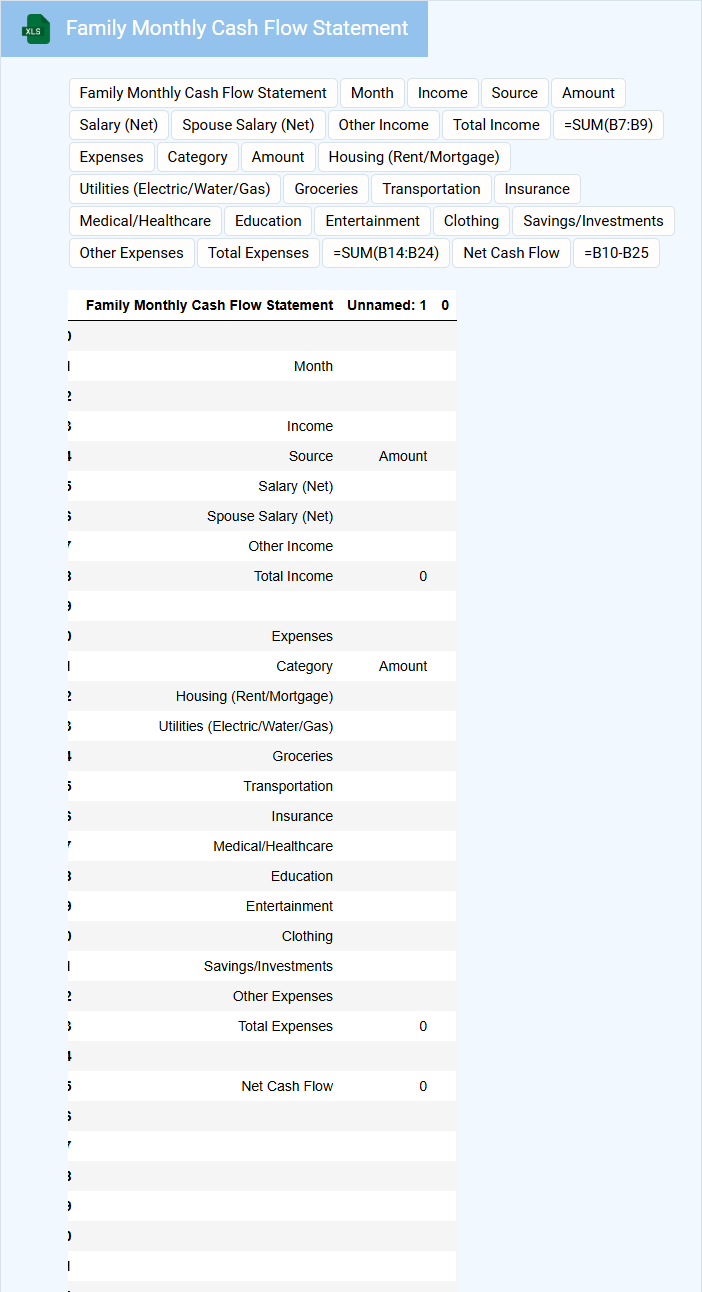

Family Monthly Cash Flow Statement

A Family Monthly Cash Flow Statement usually contains detailed records of all income sources and expenses over a month. It helps track spending habits and identify areas for potential savings. Maintaining accurate data in this document is crucial for effective budget management and financial planning.

Excel Template with Charts for Family Budgets

Excel templates with charts for family budgets usually contain preformatted spreadsheets that help users track income, expenses, and savings visually and systematically.

- Income and Expense Categories: clearly defined sections to input various sources of income and types of expenses.

- Dynamic Charts: interactive graphs that update automatically to reflect changes in financial data.

- Summary and Forecasting: concise overviews and projections to assist in managing budget goals effectively.

Family Expenses Tracker for Monthly Budgeting

Family Expenses Tracker for Monthly Budgeting is a document used to monitor and manage household spending over a month.

- Detailed Categorization: It organizes expenses into categories such as groceries, utilities, and entertainment for clarity.

- Regular Updates: Consistently recording expenses ensures accurate tracking and helps avoid overspending.

- Comparison with Budget: Comparing actual expenses against the budget helps identify saving opportunities and financial adjustments.

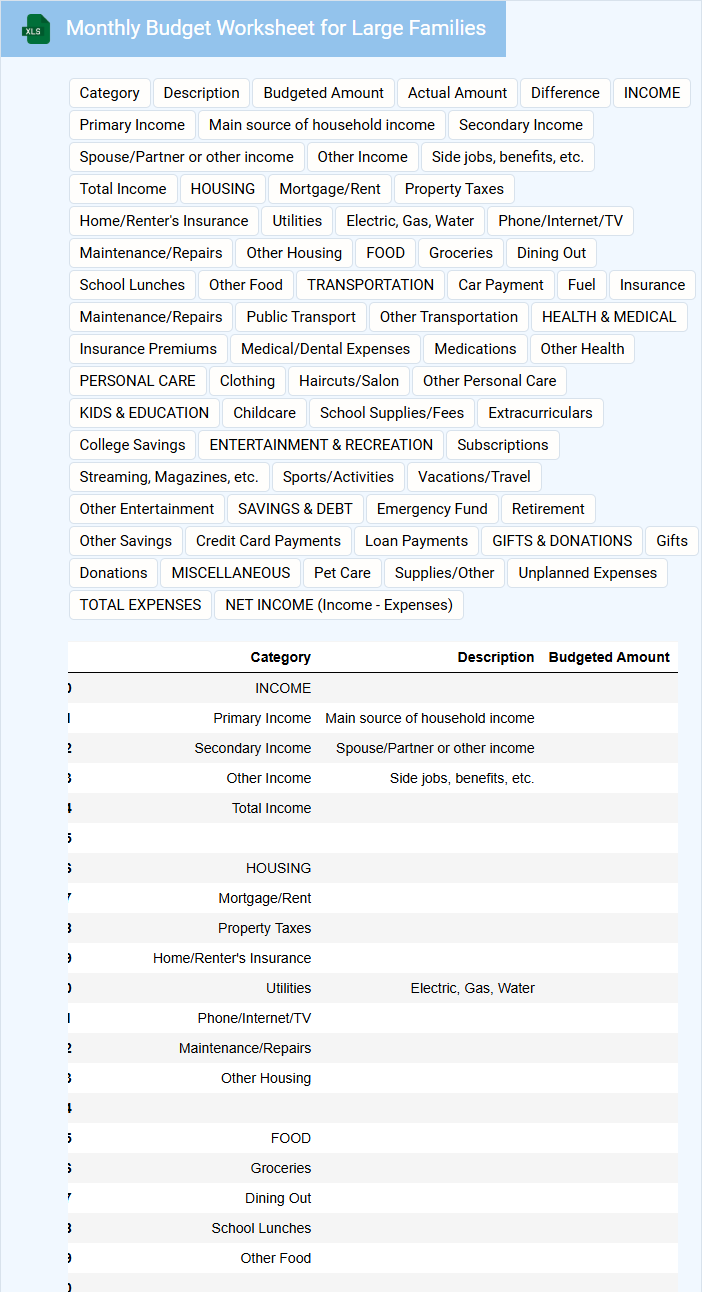

Monthly Budget Worksheet for Large Families

What information is typically included in a Monthly Budget Worksheet for Large Families? A Monthly Budget Worksheet for Large Families usually contains detailed sections for income sources, categorized expenses such as housing, utilities, groceries, transportation, childcare, and savings goals. It helps organize finances systematically to ensure that the needs of a large household are met efficiently while avoiding overspending.

What important factors should be considered when creating this worksheet? It is essential to account for variable expenses like food and school supplies, which can fluctuate significantly in large families, and to prioritize emergency funds and insurance coverage for added security. Additionally, regularly updating the worksheet ensures realistic budgeting and helps identify areas for potential savings or adjustments.

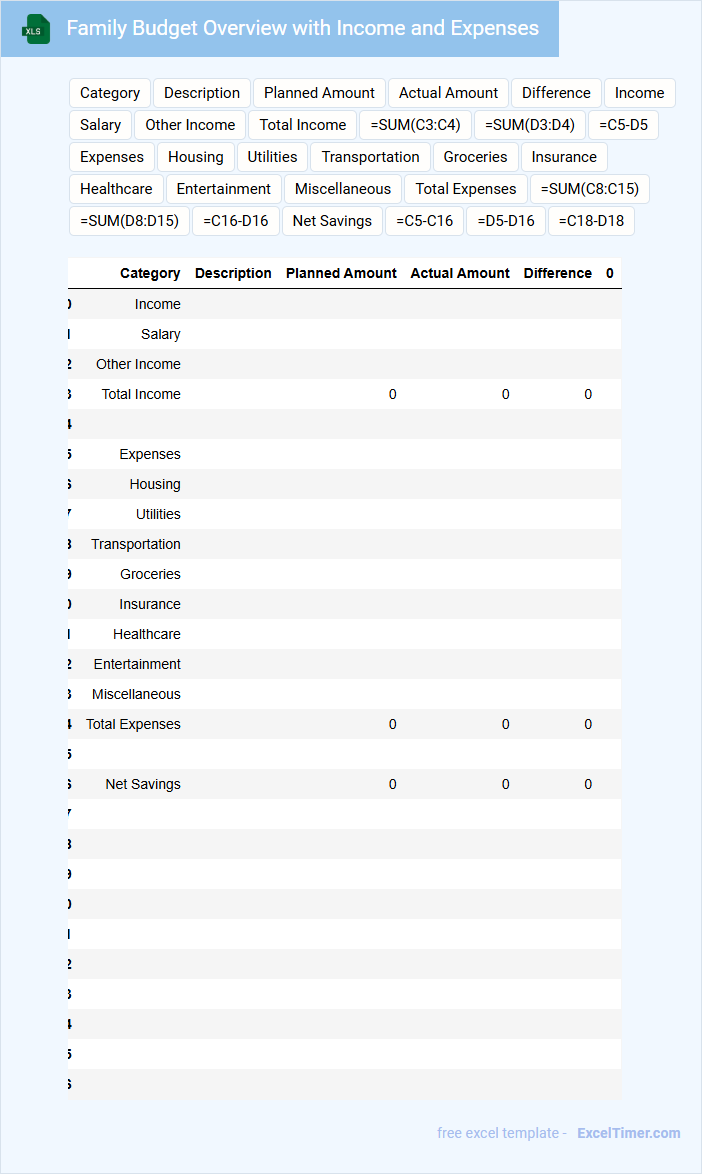

Family Budget Overview with Income and Expenses

A Family Budget Overview typically contains detailed records of all income sources and categorized expenses, helping to manage household finances effectively. It provides a clear snapshot of cash inflow versus outflow over a set period.

This document highlights essential financial data such as monthly earnings, bills, savings, and discretionary spending, ensuring transparency and control. Regularly updating the overview is important for accurate financial planning.

For best results, prioritize tracking variable expenses and setting realistic saving goals to maintain a balanced budget.

What are the essential categories to include in a family's monthly budget spreadsheet?

Essential categories in a family's monthly budget spreadsheet include Income, Housing (Rent or Mortgage), Utilities, Groceries, Transportation, Insurance, Healthcare, Debt Payments, Savings, and Entertainment. Tracking these core areas helps you manage expenses and plan financial goals effectively. Including a category for Miscellaneous ensures unexpected costs are accounted for.

How can you use Excel formulas to automatically calculate total income and expenses?

Use the SUM formula in Excel to automatically calculate total income by summing all income entries (e.g., =SUM(B2:B10)) and total expenses by summing all expense entries (e.g., =SUM(C2:C10)). Employ cell references consistent with your data layout to ensure accurate dynamic calculations. This method streamlines monthly budgeting for families by providing real-time financial summaries.

Which Excel features help track and visualize spending trends month-over-month for a family?

Excel features like PivotTables enable detailed analysis of monthly expenses, while Charts automatically visualize spending trends for your family over time. Conditional Formatting highlights budget variances to keep your financial goals on track. Data Validation ensures accurate input, making your Monthly Budget both reliable and insightful.

How can conditional formatting in Excel highlight budget overruns in specific categories?

Conditional formatting in Excel can highlight budget overruns by automatically changing the cell color when expenses exceed set budget limits in specific categories. Your monthly budget sheet uses rules to compare actual spending against your allocated amounts, making overruns visually distinct. This feature helps you quickly identify and manage categories where overspending occurs.

What methods can families use in Excel to set and monitor financial goals within their monthly budget?

Families can use Excel's built-in templates or create custom spreadsheets with categorized income and expenses to set clear financial goals. Utilizing formulas like SUM and IF enables automatic tracking and variance analysis against budgeted amounts. Visual tools such as charts and conditional formatting help monitor progress and highlight overspending for effective budget management.