The Monthly Budget Excel Template for Small Businesses helps track income, expenses, and cash flow efficiently, ensuring financial stability. It features customizable categories and automatic calculations to simplify budgeting and improve decision-making. Using this template promotes better financial planning and supports business growth by preventing overspending.

Monthly Income and Expense Tracker for Small Businesses

A Monthly Income and Expense Tracker is a crucial document for small businesses to monitor their financial health. It typically contains detailed records of all incoming revenue and outgoing expenses for the month. Keeping this tracker accurate and up-to-date helps business owners make informed financial decisions and plan budgets effectively.

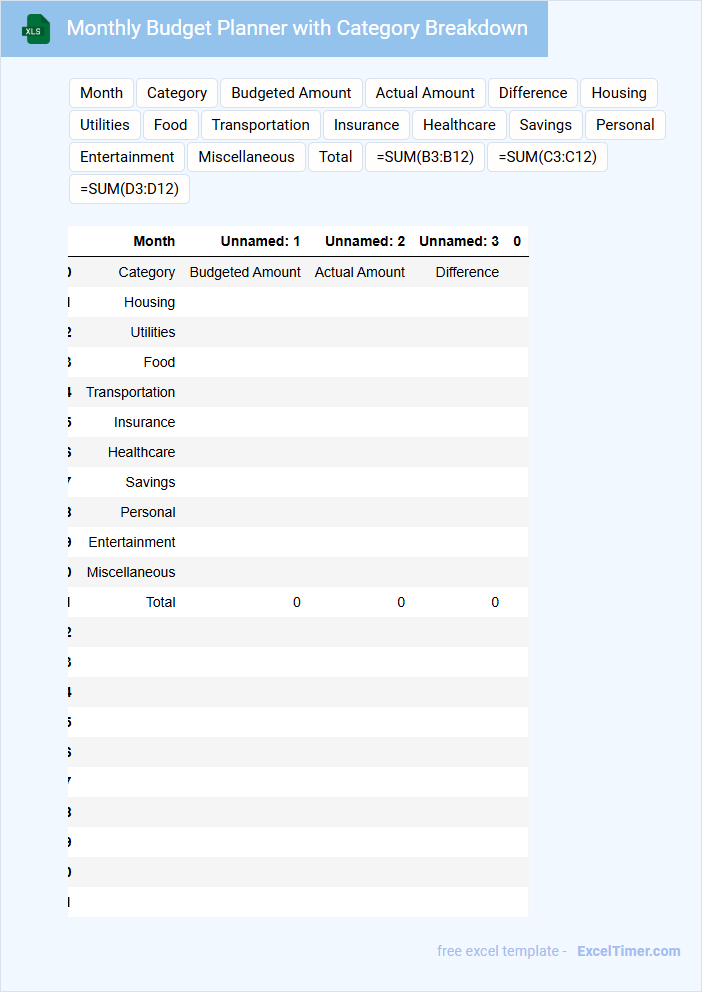

Monthly Budget Planner with Category Breakdown

A Monthly Budget Planner typically contains an overview of income sources, fixed and variable expenses, and savings goals. It helps individuals or households manage their finances by tracking spending patterns and ensuring bills are paid on time.

This document usually includes a Category Breakdown to organize expenses into groups such as housing, transportation, food, and entertainment. Such classification enables clearer insight into spending habits and better decision-making for future budgeting.

Important elements to include are estimated versus actual expenses, a summary of total savings, and notes for unexpected costs or adjustments throughout the month.

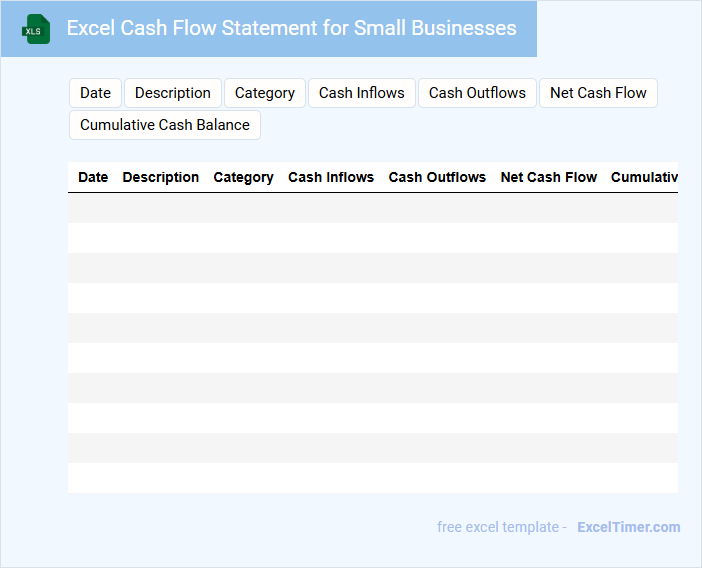

Excel Cash Flow Statement for Small Businesses

An Excel Cash Flow Statement for small businesses typically contains detailed records of cash inflows and outflows over a specific period. It helps businesses track how money moves in and out, ensuring they maintain adequate liquidity. This document usually includes sections for operating, investing, and financing activities to provide a clear financial overview.

When creating an Excel Cash Flow Statement, it is important to ensure accuracy in recording all cash transactions to avoid misrepresentation. Including projections based on historical data can help in planning for future cash needs. Additionally, regularly updating the statement will enable small businesses to make informed financial decisions and maintain stability.

Budget vs. Actuals Monthly Report for Small Businesses

A Budget vs. Actuals Monthly Report compares the planned financial budget against the actual income and expenses for small businesses, providing critical insights into financial performance. This document helps identify variances and informs better budgeting decisions to improve financial management.

- Include clear categorization of revenue and expense items for detailed tracking.

- Highlight significant deviations from the budget to focus on areas needing attention.

- Incorporate visual aids such as graphs or charts for quick trend analysis.

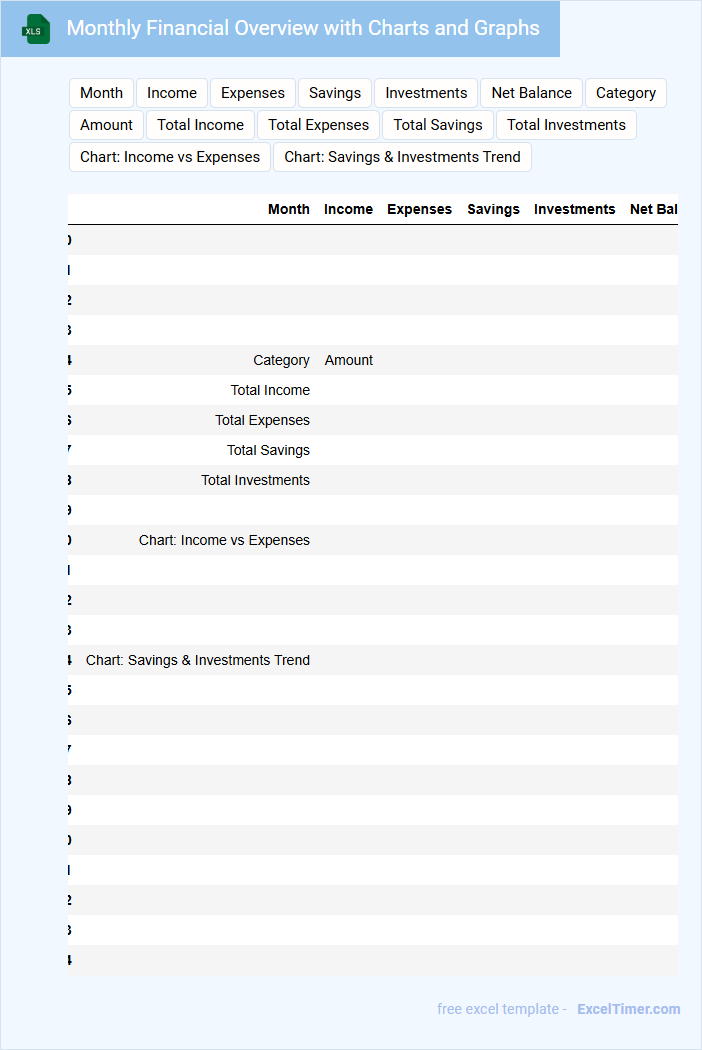

Monthly Financial Overview with Charts and Graphs

The Monthly Financial Overview document typically contains a detailed summary of financial activities within a specific month, including income, expenses, and net profit. It also features various charts and graphs to visually represent trends and comparisons.

This report helps stakeholders quickly understand financial performance and make informed decisions. It is important to ensure data accuracy and include clear labels on all visual elements for maximum clarity.

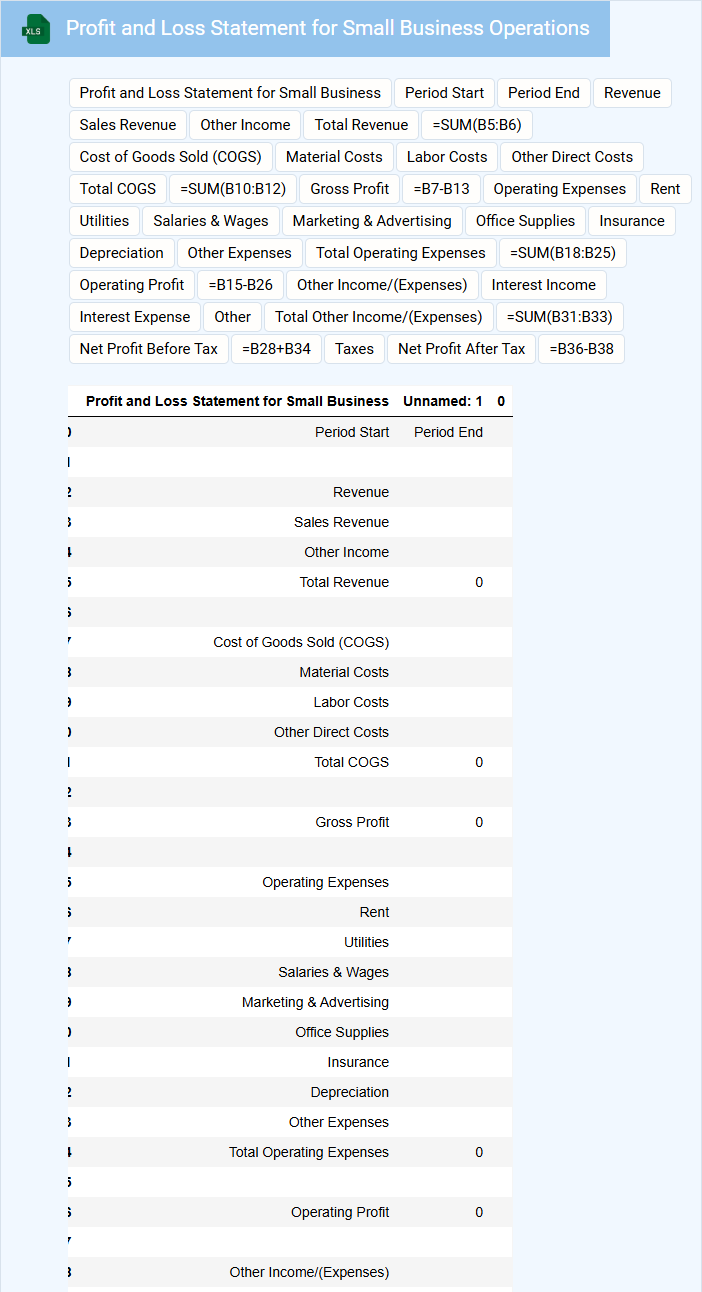

Profit and Loss Statement for Small Business Operations

A Profit and Loss Statement is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period. It provides insight into a small business's ability to generate profit by subtracting total expenses from total revenues.

Typically, this statement contains sections for sales income, cost of goods sold, gross profit, operating expenses, and net profit or loss. For small business operations, accurate record-keeping and timely updates are crucial to ensure reliable financial analysis.

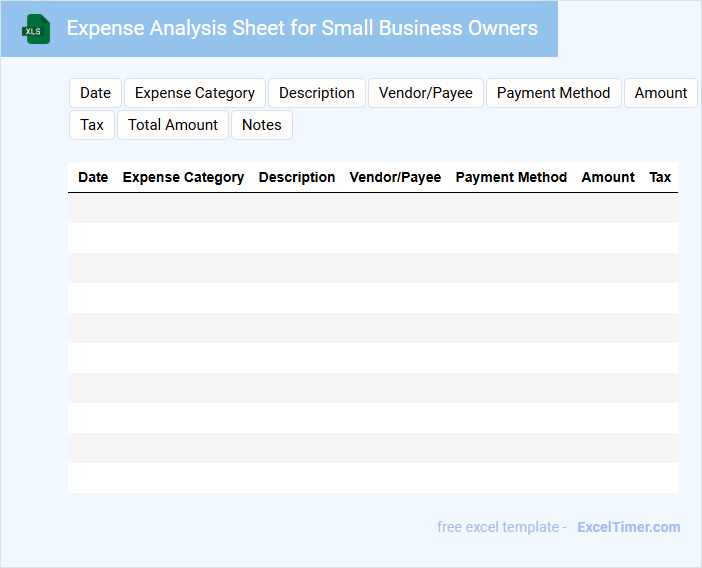

Expense Analysis Sheet for Small Business Owners

What information does an Expense Analysis Sheet for Small Business Owners usually contain? It typically includes detailed records of all business-related expenses such as rent, utilities, salaries, and supplies. This document helps owners track spending patterns, identify cost-saving opportunities, and maintain financial control.

Why is it important to regularly update and review this sheet? Consistent updates ensure accuracy and timely insights into cash flow, enabling better budgeting and financial planning. Regular analysis helps prevent overspending and supports informed decision-making for sustainable business growth.

Monthly Sales and Revenue Tracker for Small Businesses

The Monthly Sales and Revenue Tracker is a crucial document for small businesses to monitor their financial performance consistently. It typically contains detailed records of sales figures, revenue streams, and related expenses for each month. This helps in identifying trends and making informed business decisions.

Essential components include total sales, revenue growth, and comparison with previous months, ensuring accuracy and up-to-date entries. Additionally, incorporating visual aids like graphs can enhance understanding and quick assessment of the business's financial health. Regular review of this document supports strategic planning and financial stability.

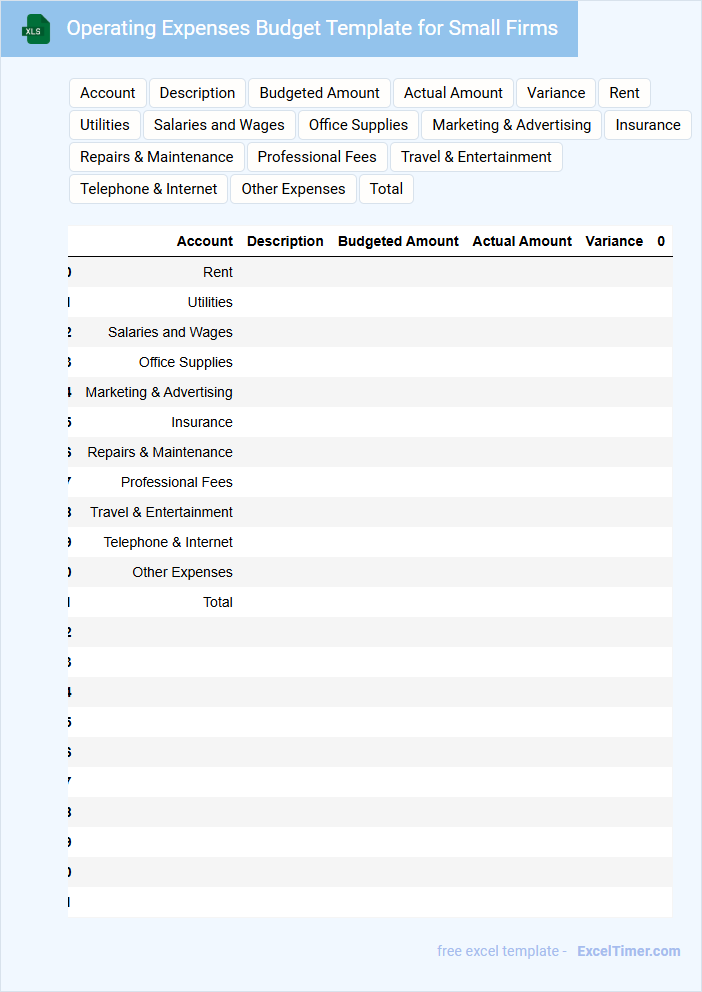

Operating Expenses Budget Template for Small Firms

An Operating Expenses Budget Template for Small Firms typically outlines all expected operational costs for a business over a specific period. It helps in managing cash flow and controlling expenses efficiently.

- Include detailed categories such as rent, utilities, salaries, and office supplies to ensure comprehensive coverage.

- Regularly update the template to reflect actual expenses and adjust projections accordingly.

- Use the budget to identify cost-saving opportunities and allocate resources effectively.

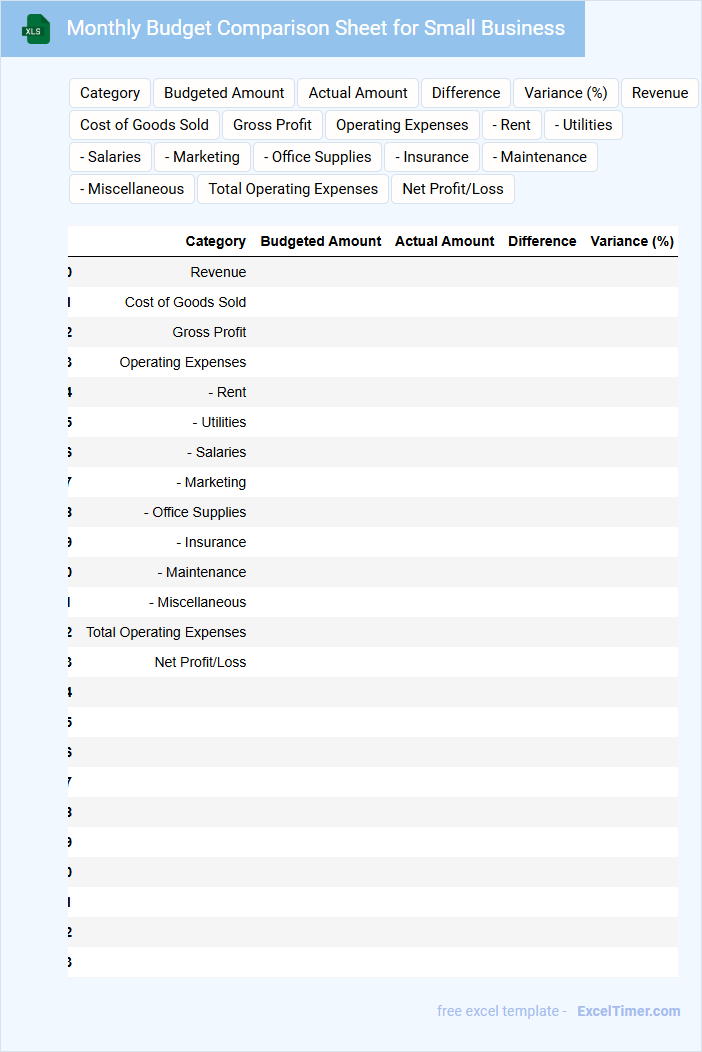

Monthly Budget Comparison Sheet for Small Business

What information is typically contained in a Monthly Budget Comparison Sheet for a Small Business? This document usually includes detailed records of expected versus actual income and expenses over a specific month. It helps small businesses track financial performance and identify variances to manage cash flow effectively.

What important elements should be included in this sheet? Key components include categorized income and expense entries, columns for budgeted and actual amounts, and a variance column to highlight differences. Adding notes or comments can provide context for discrepancies and assist in future financial planning.

Cost Management Tracker with Monthly Summaries

A Cost Management Tracker typically contains detailed records of expenses, budget allocations, and spending patterns over a specific period. It helps organizations maintain financial control and identify areas where cost savings are possible.

Monthly summaries provide a concise overview of expenditures and budget variances, enabling quick assessment of financial health. Regular updates ensure timely adjustments and better decision-making.

For effective use, ensure accurate data entry and include clear categories for expenses to enhance analysis and reporting.

Monthly Budget Forecast Template for Small Business Growth

A Monthly Budget Forecast Template is a crucial tool that small businesses use to project their income and expenses for the upcoming month. It typically contains sections for expected revenue, fixed and variable costs, and cash flow analysis. This document helps in planning financial strategies and ensuring sustainable growth.

Important elements to include are accurate sales forecasts, detailed expense categories, and contingency funds for unexpected costs. Regularly updating the template with actual financial data improves its reliability and decision-making value. Consistent use of this document promotes better resource allocation and business scalability.

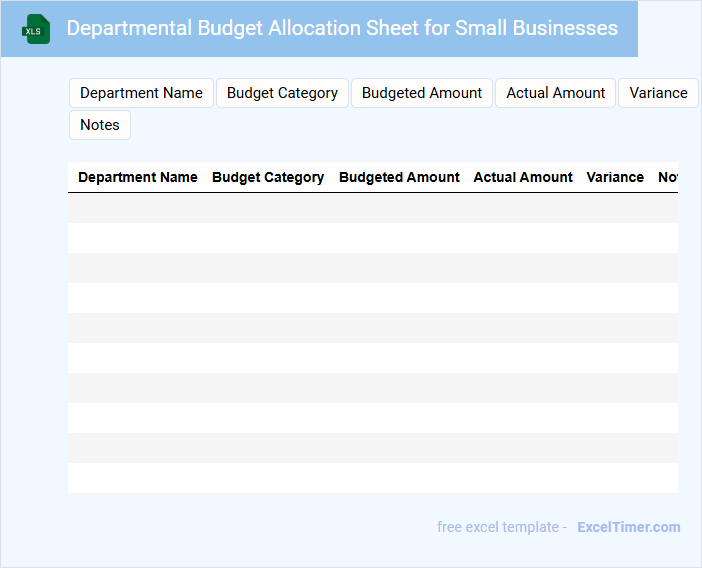

Departmental Budget Allocation Sheet for Small Businesses

A Departmental Budget Allocation Sheet for Small Businesses typically outlines the planned distribution of financial resources across various departments to ensure efficient resource management.

- Clear Categorization: The sheet must distinctly categorize expenses by department for transparent tracking.

- Accurate Projections: Include realistic revenue and cost estimates to avoid budget shortfalls.

- Regular Updates: Periodically review and revise allocations based on actual spending and business needs.

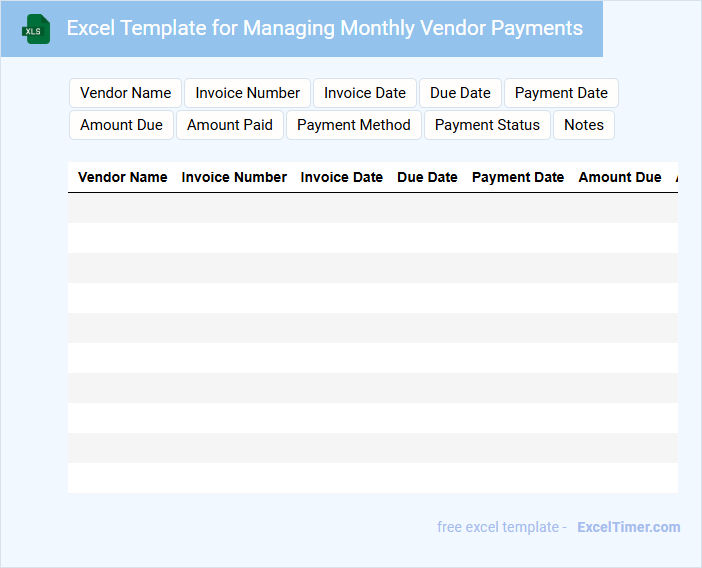

Excel Template for Managing Monthly Vendor Payments

What information is typically included in an Excel template for managing monthly vendor payments? This type of document usually contains detailed records of each vendor, payment due dates, amounts owed, and payment statuses to ensure accurate tracking. It helps streamline the payment process, avoid missed payments, and maintain clear financial records for budgeting and auditing purposes.

What important features should be incorporated in an Excel template for managing monthly vendor payments? Key elements include automated calculation fields, conditional formatting to highlight overdue payments, drop-down menus for consistent data entry, and summary dashboards to provide quick insights into outstanding balances and payment timelines. Incorporating these features enhances usability, reduces errors, and supports effective financial management.

Monthly Savings and Reinvestment Tracker for Small Businesses

A Monthly Savings and Reinvestment Tracker for Small Businesses is a document used to monitor the amounts saved and reinvested by the business each month to ensure financial growth and stability. It helps business owners keep track of funds allocated for future investments and operational improvements.

- Record monthly income, expenses, and the exact savings amount to maintain accuracy.

- Track reinvestment activities to understand how saved funds contribute to business growth.

- Include notes on financial goals and adjust savings targets based on performance.

What are the essential income and expense categories included in a small business monthly budget Excel document?

A small business monthly budget Excel document essential income categories include sales revenue, service income, and other operational earnings. Key expense categories cover payroll, rent, utilities, marketing, supplies, and loan repayments. Tracking these categories helps ensure accurate financial management and cash flow analysis.

How can formulas be used to automatically calculate totals, variances, and balances in the monthly budget?

Formulas in Excel can automatically calculate totals by summing income and expenses using the SUM function. Variances are determined by subtracting actual expenses from budgeted amounts with simple subtraction formulas. Balances are updated dynamically by subtracting total expenses from total income, providing real-time financial insights for small business budgets.

What built-in Excel features help small businesses track budget performance and identify overspending each month?

Excel's built-in features like PivotTables and conditional formatting enable small businesses to track monthly budget performance efficiently. The conditional formatting highlights overspending by automatically flagging budget categories exceeding set limits. PivotTables summarize financial data, providing clear insights into spending patterns to support informed decision-making.

How can you use Excel charts or conditional formatting to visualize key budget trends and problem areas?

Use Excel charts like line graphs and bar charts to visualize monthly income, expenses, and profit trends, highlighting fluctuations over time for small businesses. Apply conditional formatting with color scales or data bars to instantly identify overspending categories and budget variances. These visualization tools enhance budget management by making key financial trends and problem areas clear at a glance.

What steps should be taken to ensure the accuracy and consistency of data entry in a monthly budget Excel document?

To ensure accuracy and consistency in your monthly budget Excel document, implement data validation rules and use standardized templates for uniform data entry. Regularly cross-check entries against source documents and utilize Excel functions like SUM and IFERROR to flag discrepancies. Maintaining clear labels and consistent formatting helps streamline review and reduce errors.