The Monthly Loan Repayment Excel Template for Students helps track and manage student loan payments efficiently. It includes features such as payment schedules, interest calculations, and outstanding balance updates. Using this template ensures timely repayments and better financial planning during studies.

Monthly Loan Repayment Tracker for Students

What information is typically included in a Monthly Loan Repayment Tracker for Students? This document usually contains details such as the monthly repayment amount, due dates, remaining loan balance, and payment status. It helps students organize their finances and ensure timely payments to avoid penalties and maintain a good credit score.

What is an important suggestion for effectively using a Monthly Loan Repayment Tracker for Students? Regularly updating the tracker with each payment and checking for changes in interest rates or repayment plans is crucial. This practice promotes better financial management and helps students stay on top of their loan obligations.

Student Loan Payment Schedule with Monthly Breakdown

A Student Loan Payment Schedule typically contains a detailed breakdown of monthly payments, including principal and interest amounts. It outlines the total loan amount, interest rate, and payment due dates to help borrowers manage their finances effectively. An important aspect is maintaining consistent payments to avoid penalties and improve credit scores.

Excel Template for Monthly Loan Repayment Tracking

An Excel Template for Monthly Loan Repayment Tracking typically contains organized tables to record loan details, payment dates, and amounts. It often includes formulas to calculate remaining balances and interest accrued automatically.

This template is important for maintaining consistent financial monitoring and ensuring timely loan payments to avoid penalties. Users benefit from clear visualization through charts and reminders for due dates.

For optimal use, it is suggested to regularly update payment information and customize the template to reflect varying loan terms and interest rates.

Monthly Loan Repayment Calculator for Students

This document typically contains essential financial information and tools to help students calculate their monthly loan repayments effectively.

- Loan Amount: The total principal amount borrowed by the student, which forms the base for repayment calculations.

- Interest Rate: The percentage charged on the loan amount, influencing the monthly repayment size.

- Repayment Term: The duration over which the loan must be repaid, impacting the length and amount of monthly payments.

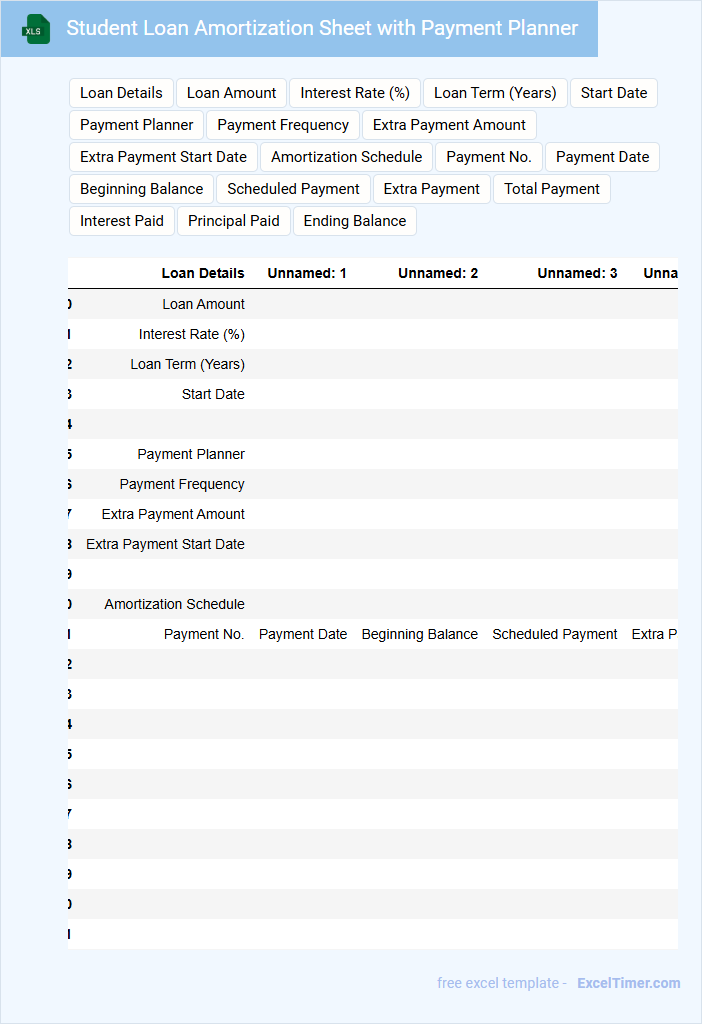

Student Loan Amortization Sheet with Payment Planner

A Student Loan Amortization Sheet typically contains detailed information about loan repayment schedules, including principal and interest breakdowns over time. It helps borrowers track their payments and understand how each installment affects their outstanding balance. Incorporating a Payment Planner allows users to strategize and optimize their repayment process for faster loan clearance.

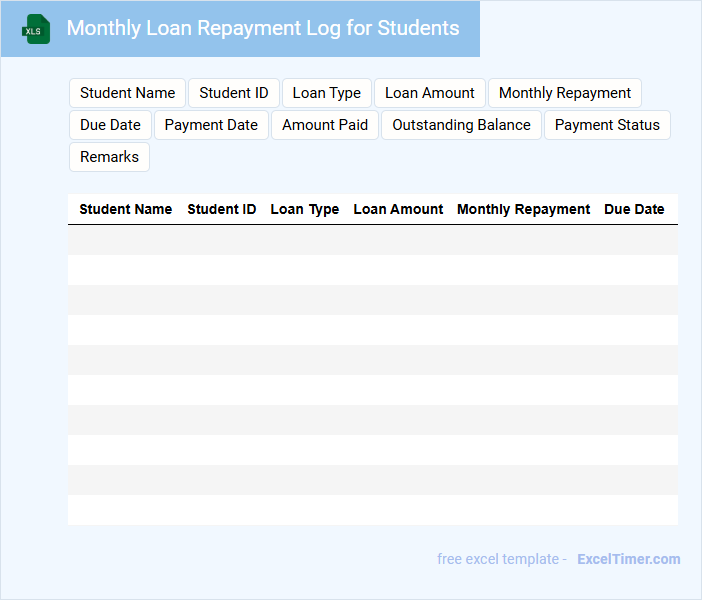

Monthly Loan Repayment Log for Students

A Monthly Loan Repayment Log for Students typically contains detailed records of each loan repayment made within a month, including dates, amounts, and payment methods. It helps students keep track of their financial obligations systematically to avoid missed payments.

Maintaining an accurate log promotes financial responsibility and assists in budgeting for future payments. It is important to regularly update the log to ensure all transactions are recorded and discrepancies are promptly addressed.

Student Debt Tracker with Monthly Repayment Plan

What information is typically included in a Student Debt Tracker with Monthly Repayment Plan? This type of document usually contains details such as the total student loan amount, interest rates, repayment deadlines, and a breakdown of monthly payments. It helps students organize their debts and create a manageable repayment schedule to stay on track and avoid missed payments.

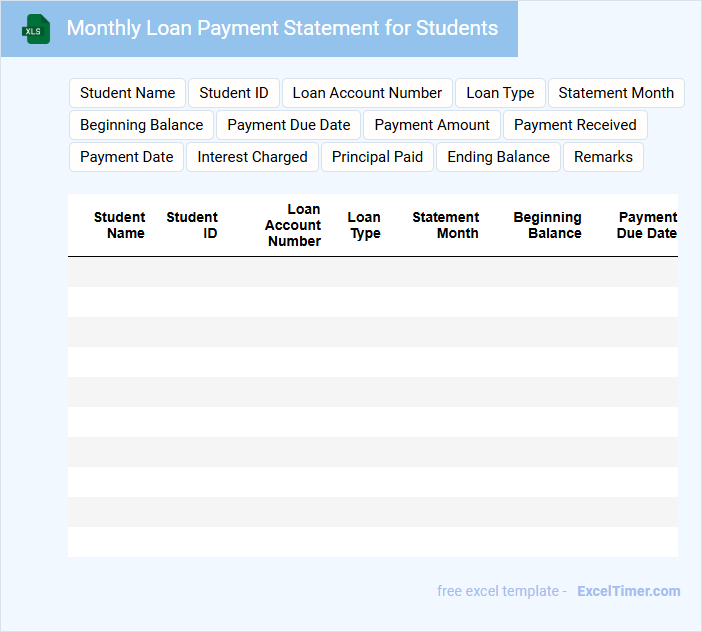

Monthly Loan Payment Statement for Students

A Monthly Loan Payment Statement for students typically contains detailed information about the loan amount, payment due, and interest accrued. It serves as a record to help students track their repayment progress and ensure timely payments. Important elements include the loan balance, payment deadline, and contact information for customer support.

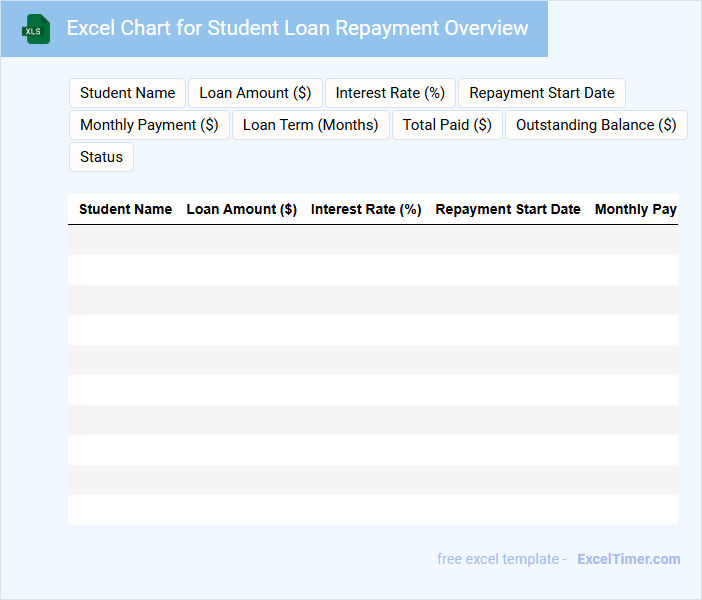

Excel Chart for Student Loan Repayment Overview

What information is typically included in an Excel chart for a Student Loan Repayment Overview? This type of document usually contains data on loan amounts, interest rates, repayment terms, and monthly payment schedules. It visually represents the repayment progress and helps users track outstanding balances and forecast remaining payments effectively.

What important elements should be highlighted in such a chart? Key aspects to emphasize include the total loan amount, interest accrued over time, payment milestones, and timelines for repayment completion. Including clear labels, color coding for payment status, and projections for future payments can greatly enhance comprehension and planning.

Monthly Loan Repayment Journal with Progress Tracking

A Monthly Loan Repayment Journal is a document that records each loan payment made, including principal and interest details. It typically contains information such as payment dates, amounts, remaining balances, and sometimes notes on repayment progress. For effective tracking, it is important to regularly update the journal and review it to ensure on-time payments and understand repayment progress.

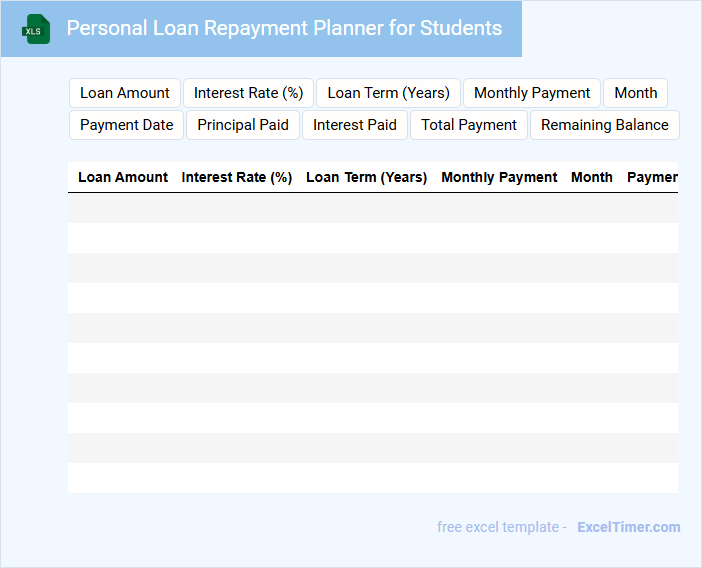

Personal Loan Repayment Planner for Students

What information does a Personal Loan Repayment Planner for Students usually contain? This document typically includes details about the loan amount, interest rates, repayment schedules, and monthly payment estimates. It is designed to help students manage their loan repayment effectively by providing a clear timeline and financial planning tools to avoid defaulting.

What is an important consideration when using a Personal Loan Repayment Planner for Students? It is essential to account for potential changes in income and expenses after graduation. Additionally, incorporating a contingency plan for unexpected financial difficulties can help ensure consistent repayment and protect credit scores.

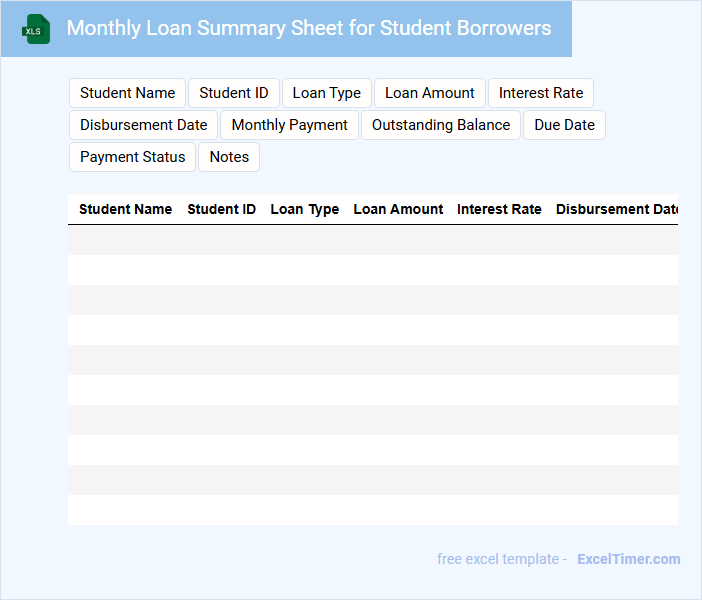

Monthly Loan Summary Sheet for Student Borrowers

The Monthly Loan Summary Sheet for student borrowers typically contains detailed information about loan balances, payment histories, and interest rates. It helps both students and loan officers monitor financial obligations and repayment progress effectively.

Important elements to include are the due dates for payments, outstanding amounts, and any changes in loan terms. Keeping this document updated ensures transparency and aids in financial planning for borrowers.

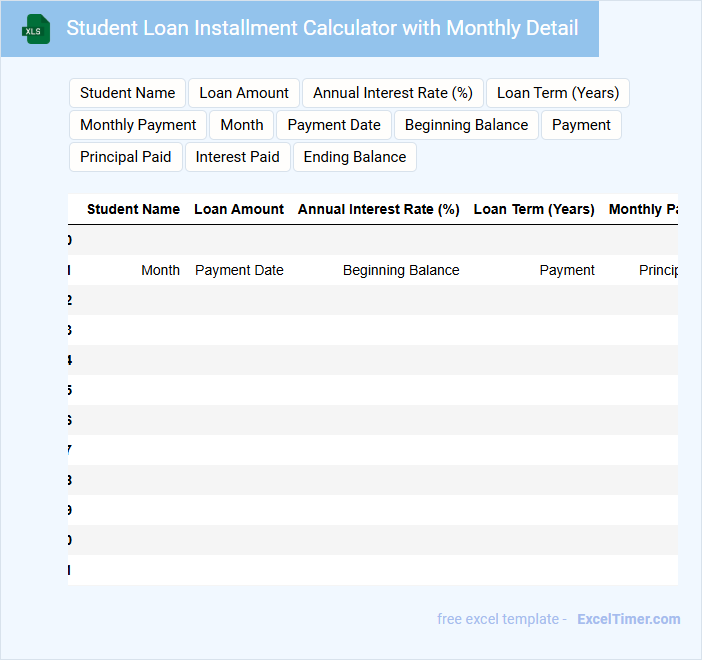

Student Loan Installment Calculator with Monthly Detail

A Student Loan Installment Calculator document typically includes detailed input fields such as loan amount, interest rate, and repayment period to help users estimate monthly payments. It provides a clear breakdown of each month's principal and interest portions, giving borrowers insight into their payment schedule. This tool is essential for planning finances and understanding the total cost of a student loan over time.

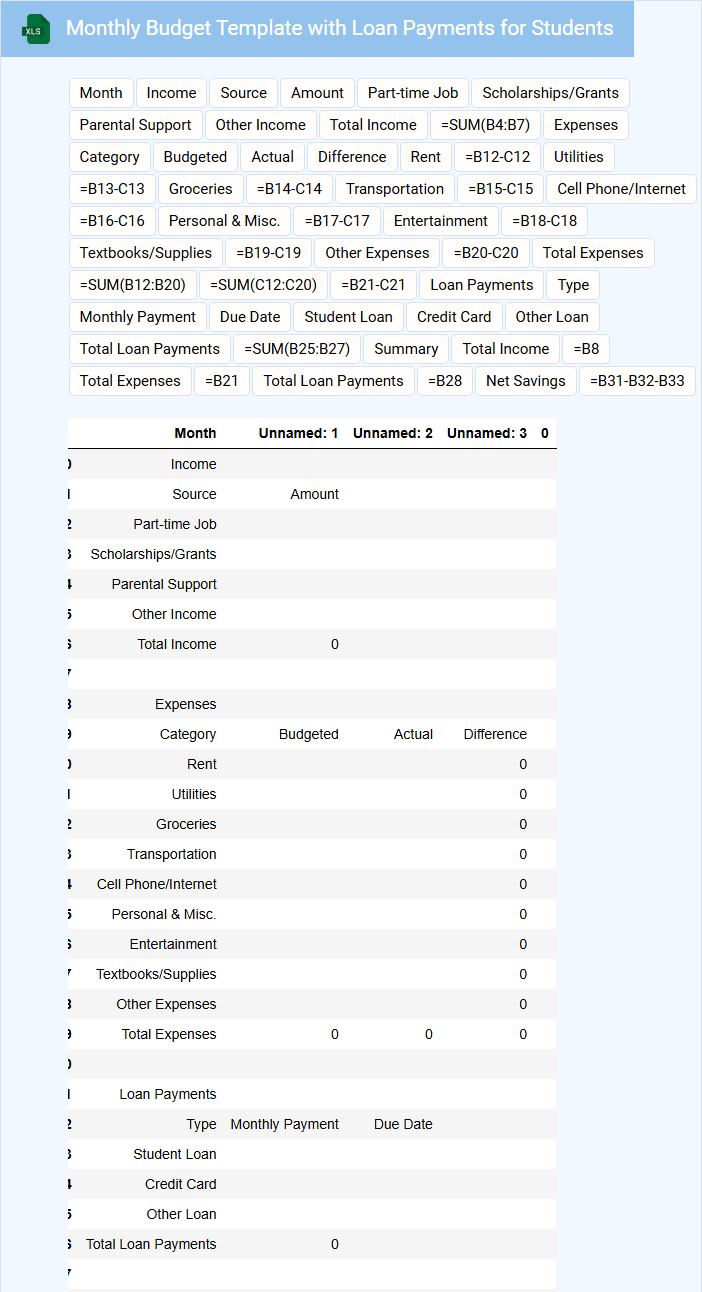

Monthly Budget Template with Loan Payments for Students

What information is typically included in a Monthly Budget Template with Loan Payments for Students? This type of document usually contains sections for tracking income sources, monthly expenses, and detailed loan payment schedules. It helps students manage their finances effectively by balancing their spending with loan repayments and other essential costs.

What important aspects should students consider when using this template? Students should prioritize accurate recording of all income and living expenses, clearly outline loan terms and payment amounts, and regularly update the template to reflect changes in their financial situation. This ensures they stay on top of their budget and avoid missed payments or financial stress.

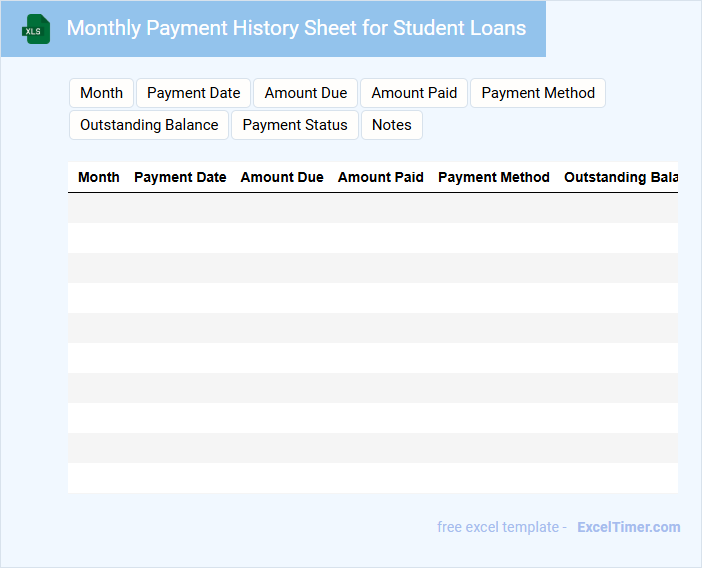

Monthly Payment History Sheet for Student Loans

The Monthly Payment History Sheet for student loans typically contains a detailed record of all payments made each month, including the payment date, amount, and outstanding balance. This document helps borrowers track their repayment progress and ensures all transactions are accurately recorded. It is essential for verifying payment history when disputing discrepancies or applying for loan forgiveness programs.

What formula can be used in Excel to calculate the monthly loan repayment amount based on principal, interest rate, and loan term?

Use the PMT function in Excel to calculate monthly loan repayments. The formula is =PMT(interest_rate/12, loan_term*12, -principal), where interest_rate is the annual rate, loan_term is in years, and principal is the loan amount. This formula returns the monthly payment needed to repay the loan completely over the specified term.

Which Excel functions help students compare fixed-rate vs. variable-rate loan repayment plans?

Excel functions like PMT calculate fixed monthly loan payments based on interest rates, loan amount, and term. The IF function enables comparison between fixed-rate and variable-rate scenarios by adjusting payment calculations dynamically. Excel's Goal Seek feature helps determine required interest rates or payment amounts to meet financial goals under different loan conditions.

How can Excel be used to create an amortization schedule for student loans?

Excel can be used to create an amortization schedule for student loans by inputting your loan amount, interest rate, and repayment term into a structured table. Formulas such as PMT, IPMT, and PPMT automate the calculation of monthly payments, interest, and principal portions over time. This approach helps you track your monthly loan repayment progress and plan your finances effectively.

What key columns should be included in an Excel table to track monthly payments, interest paid, and remaining balance on student loans?

Your Excel table should include key columns such as Month, Payment Amount, Interest Paid, Principal Paid, and Remaining Balance to effectively track monthly loan repayments. Including Loan Account Number and Due Date can enhance organization and timely payment monitoring. Accurate data input in these columns ensures clear visibility of your student loan progress.

How can conditional formatting in Excel be used to highlight late or missed monthly loan repayments?

Conditional formatting in Excel can highlight late or missed monthly loan repayments by applying rules based on repayment dates and payment status. Set a rule to format cells red if the repayment date is past today's date and the payment is not marked as complete. Use formulas like =AND($B2 To calculate your monthly loan repayment in an Excel document, include key components such as the principal loan amount, annual interest rate, and loan term in months. Use the PMT function to compute the fixed monthly payment based on these inputs. Ensure accurate data entry for interest rate division by 12 and consistent loan term units for precise results. The PMT function in Excel calculates monthly loan payments by using the loan amount (principal), interest rate, and loan term as inputs. Enter the interest rate divided by 12 as the rate, the total number of monthly payments as nper, and the loan amount as the present value (pv) to get accurate monthly repayment figures. This function allows comparison of repayments across different loan amounts and interest rates in a student loan repayment schedule. Excel cell references like B2 for interest rate and C2 for loan term, combined with formulas such as =PMT(B2/12, C2*12, -D2) help track monthly loan repayments. Using absolute references (e.g., $B$2) allows consistent tracking when copying formulas across rows for multiple months. Incorporating data tables or dynamic ranges captures changes in interest rates or loan terms over time, providing a detailed repayment schedule. Adjusting the loan term in your Excel sheet directly affects the monthly repayment amount by spreading the total loan balance over a longer or shorter period. Extending the loan term decreases the monthly payment but increases the total interest paid over time. Shortening the loan term increases monthly repayments while reducing overall interest costs. Conditional formatting in Excel highlights months when your monthly loan repayments surpass a set budget threshold, helping you quickly identify overspending periods. This visual alert allows you to manage cash flow effectively and prioritize repayment strategies. Using color scales or data bars makes tracking your repayment trends easier and more intuitive.What are the key components required to calculate monthly loan repayment in an Excel document?

How can you use the PMT function in Excel to determine monthly loan payments for different loan amounts and interest rates?

Which Excel cell references and formulas help track changes in interest rates or loan terms over time for student loans?

What is the impact of adjusting the loan term (in months or years) in your Excel sheet on the monthly repayment amount for a student loan?

How can conditional formatting in Excel help identify months when monthly loan repayments exceed a specific budget threshold for students?