The Monthly Payroll Excel Template for Freelancers streamlines income tracking by allowing easy recording of hours worked, rates, and payments. It helps freelancers manage finances efficiently by generating clear monthly summaries and calculating net income automatically. Keeping organized payroll records with this template ensures accurate tax reporting and financial planning.

Monthly Payroll Tracker for Freelancers

A Monthly Payroll Tracker for Freelancers is a document used to record and monitor income, expenses, and payments over a given month. It helps freelancers stay organized and manage their finances effectively.

- Include detailed payment dates and amounts received from each client.

- Track tax deductions and any business-related expenses for accurate reporting.

- Summarize total monthly earnings to assess cash flow and plan budgeting.

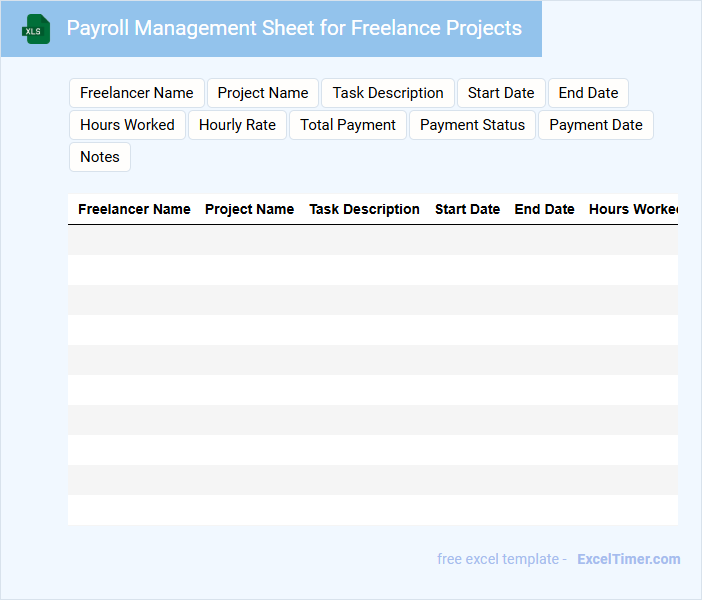

Payroll Management Sheet for Freelance Projects

A Payroll Management Sheet for freelance projects is a crucial document that helps track payments, hours worked, and project details efficiently. It typically contains freelancer names, payment amounts, project descriptions, deadlines, and payment statuses. Proper organization of this sheet ensures accurate and timely compensation for freelance contributors.

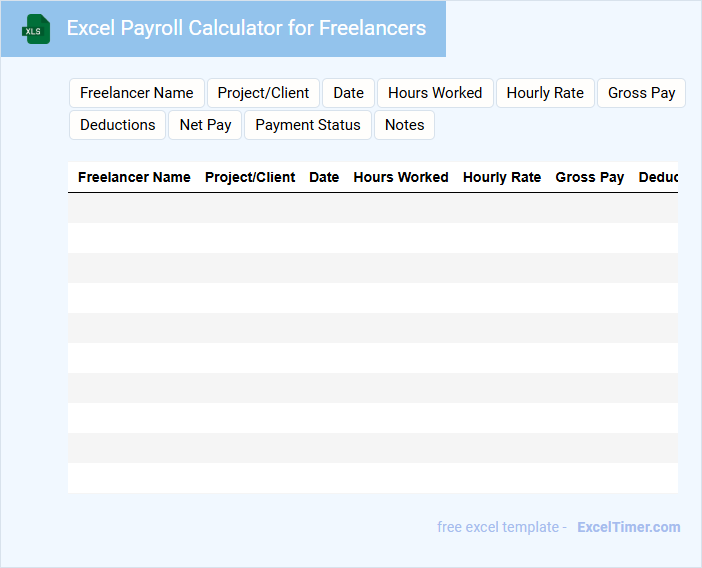

Excel Payroll Calculator for Freelancers

An Excel Payroll Calculator for freelancers is a spreadsheet designed to simplify wage calculations by automating tax deductions and net pay. It usually contains sections for inputting hours worked, rates, tax percentages, and other deductions. This type of document helps freelancers track earnings accurately while ensuring compliance with tax obligations.

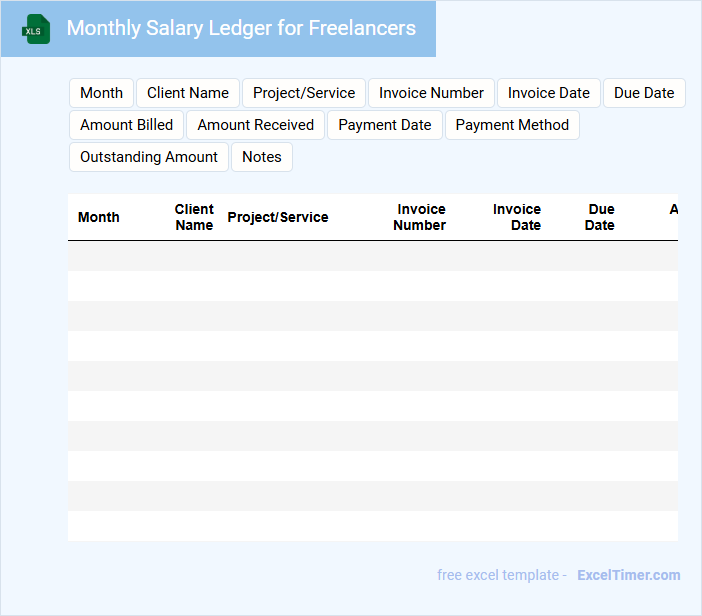

Monthly Salary Ledger for Freelancers

The Monthly Salary Ledger for Freelancers typically contains detailed records of individual payments made to freelancers, including dates, amounts, and project descriptions. It serves as an essential document for tracking income and verifying financial transactions over the month.

Maintaining accuracy in the ledger entries is crucial for both record-keeping and tax purposes. Regular updates help ensure transparent and organized financial management.

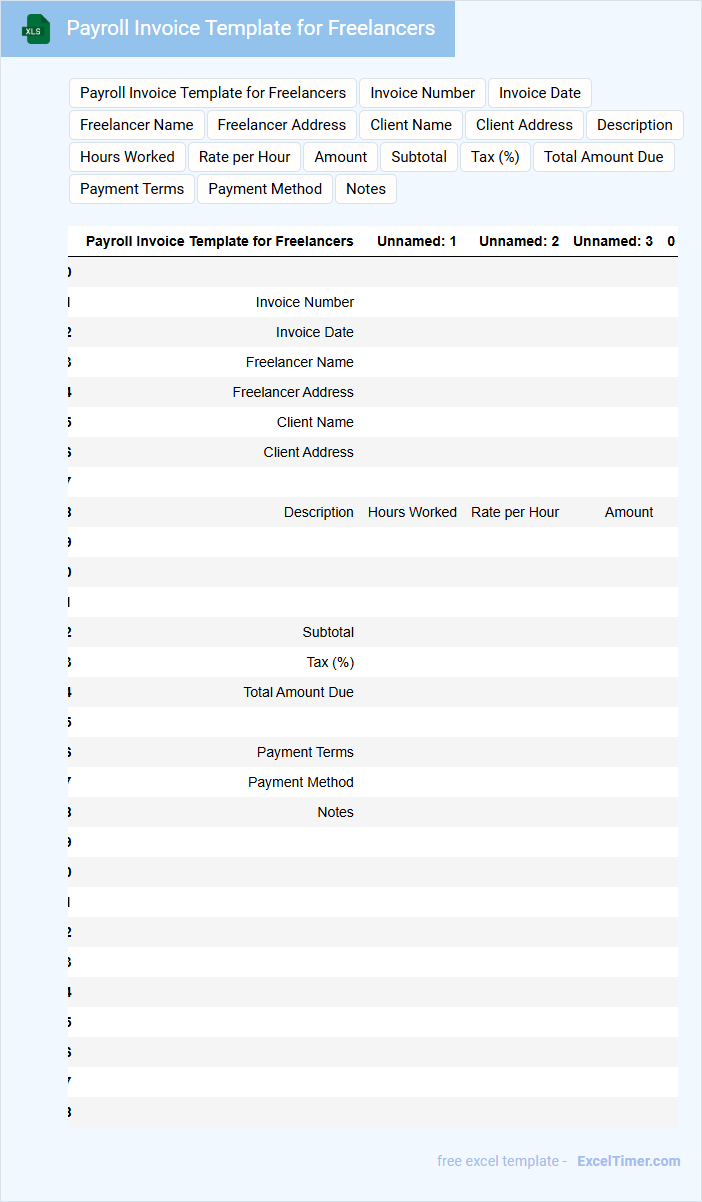

Payroll Invoice Template for Freelancers

A Payroll Invoice Template for Freelancers typically contains essential details such as the freelancer's name, contact information, and payment terms. It includes a breakdown of services provided, hours worked, and the total amount due. Ensuring accuracy and clarity in this document is important to facilitate timely payments and clear communication with clients.

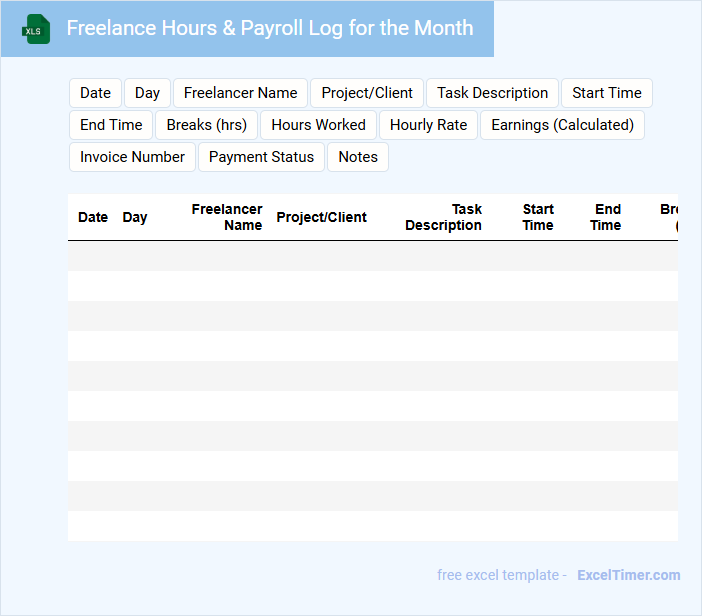

Freelance Hours & Payroll Log for the Month

Freelance Hours & Payroll Log for the Month typically contains a detailed record of hours worked, payments due, and client information to ensure accurate payroll processing.

- Hours Tracked: Record daily or weekly freelance work hours precisely for accurate compensation.

- Payment Details: Include rates, invoices, and payment dates to maintain financial clarity.

- Client Information: List client names and project descriptions to organize work and billing efficiently.

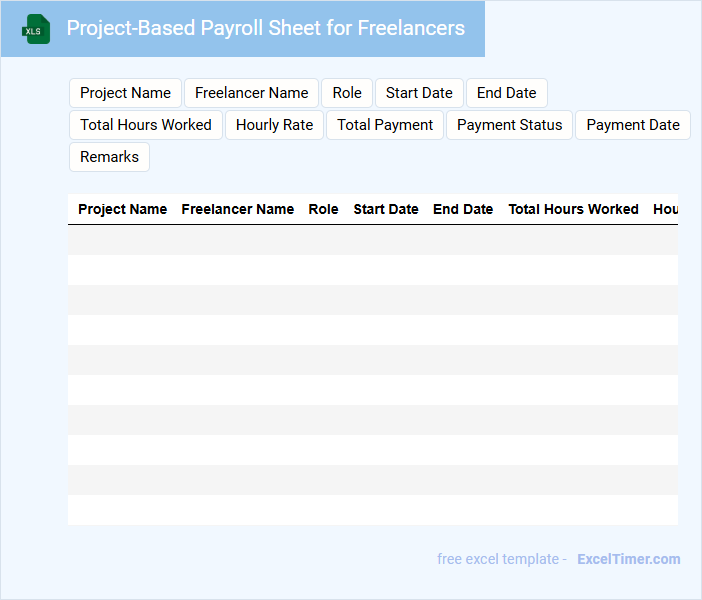

Project-Based Payroll Sheet for Freelancers

What information does a Project-Based Payroll Sheet for Freelancers typically contain? A Project-Based Payroll Sheet for Freelancers usually includes details such as the freelancer's name, project description, hours worked, hourly or fixed rate, and total payment. This document helps in tracking payments and ensuring accurate compensation for completed project work.

What important aspects should be considered when creating this document? It is essential to clearly outline payment terms, project deadlines, and invoice dates to avoid confusion. Additionally, including tax deductions and payment methods can streamline financial processes and maintain transparency between freelancers and clients.

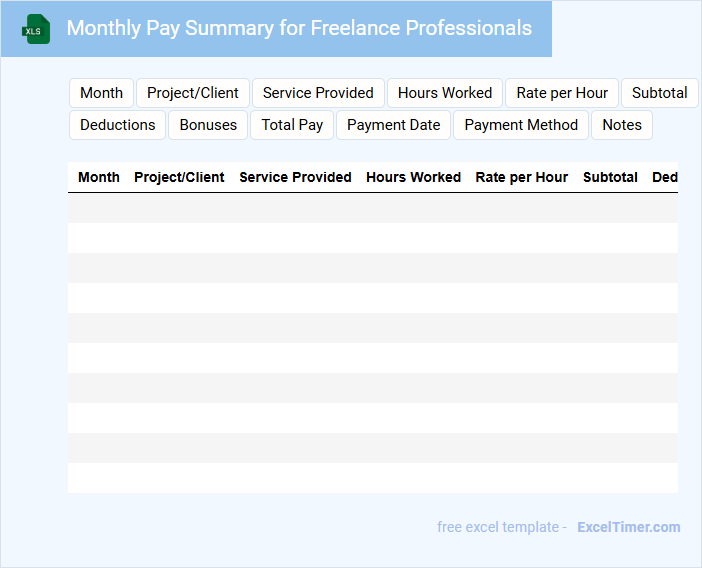

Monthly Pay Summary for Freelance Professionals

A Monthly Pay Summary for Freelance Professionals typically contains detailed information about the total earnings, including payments received for completed projects and any pending invoices. It also highlights deductions such as taxes or service fees. This summary offers a clear financial overview for freelancers each month.

Including accurate payment dates and client details ensures transparency and aids in tracking income sources. It is essential to also list the project descriptions to verify the work associated with each payment. Maintaining organized records helps freelancers manage taxes and financial planning efficiently.

Timesheet and Payroll Tracker for Freelancers

What information does a Timesheet and Payroll Tracker for Freelancers usually contain? It typically includes details about hours worked, project names, and payment rates to accurately record work and calculate earnings. This document helps freelancers maintain organized records of their time and income for efficient invoicing and financial management.

What is an important feature to include in a Timesheet and Payroll Tracker for Freelancers? It is crucial to have clear date entries and automatic calculation of total hours and payments to avoid errors. Including sections for client names and payment status can also help freelancers track outstanding payments and manage cash flow effectively.

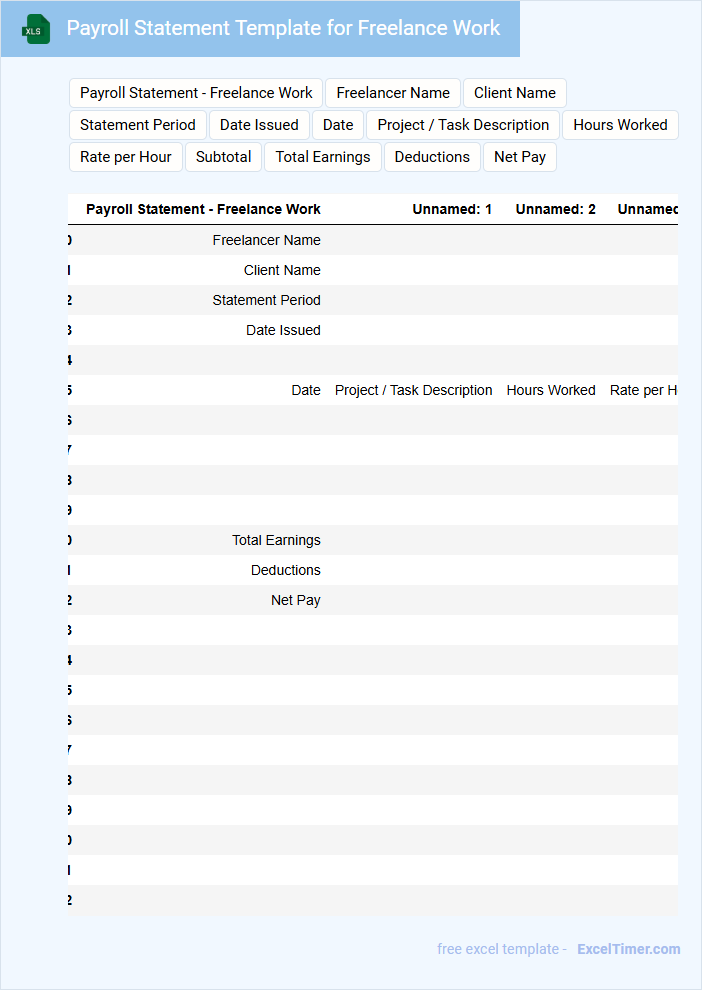

Payroll Statement Template for Freelance Work

A Payroll Statement Template for freelance work is a document that itemizes earnings, deductions, and net payments for freelance services rendered. It typically includes details such as hours worked, pay rate, taxes withheld, and total compensation.

This template helps freelancers maintain accurate financial records and ensures clear communication with clients regarding payments. Including fields for project descriptions and payment dates is important for transparency and proper bookkeeping.

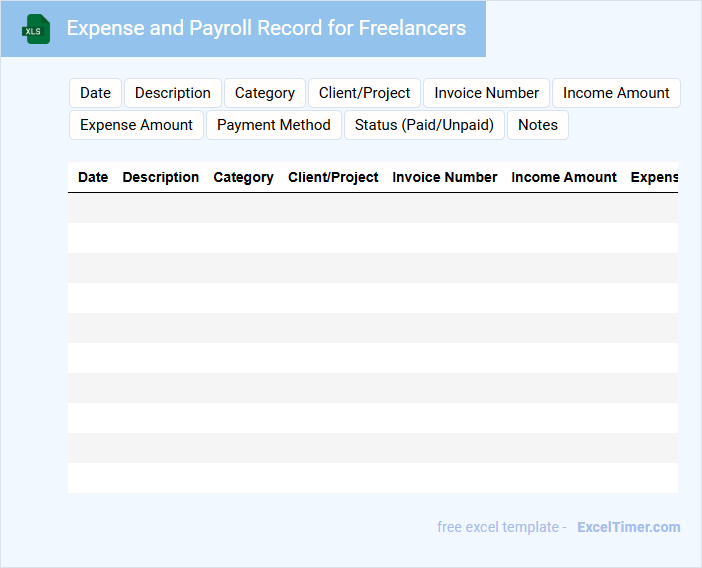

Expense and Payroll Record for Freelancers

An Expense and Payroll Record for freelancers typically contains detailed tracking of income and expenditures related to freelance projects. It includes documentation of payments received, invoices issued, and any business-related costs incurred. Maintaining accurate records helps freelancers manage their finances efficiently and prepare for tax obligations.

Important things to include are precise dates, payment amounts, and descriptions of services rendered or expenses. Using organized categories for different types of expenses and income can simplify bookkeeping. Regularly updating the record ensures clear financial oversight and smoother tax filing.

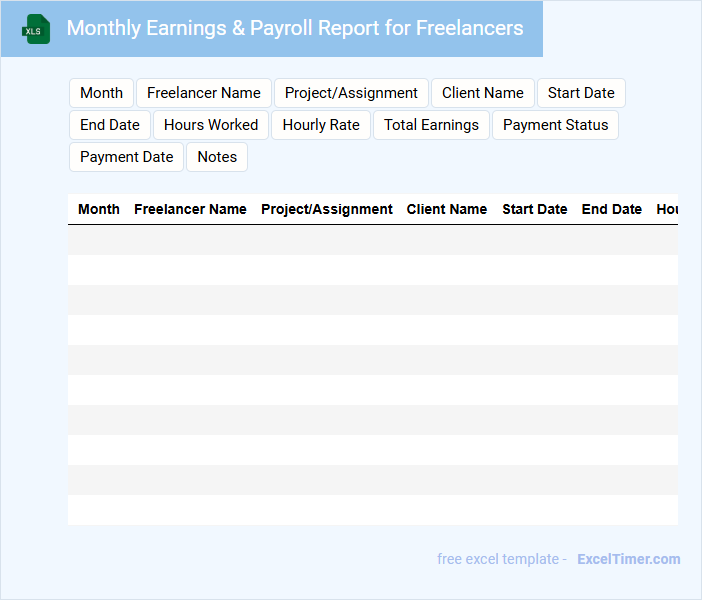

Monthly Earnings & Payroll Report for Freelancers

The Monthly Earnings & Payroll Report for freelancers typically contains detailed records of income, invoices, and payments received throughout the month. It also summarizes tax deductions, expenses, and net pay to ensure accurate financial tracking.

This document is crucial for maintaining financial transparency and simplifying tax filing processes. It is important to include clear payment dates, client details, and a breakdown of earnings per project for precise accounting.

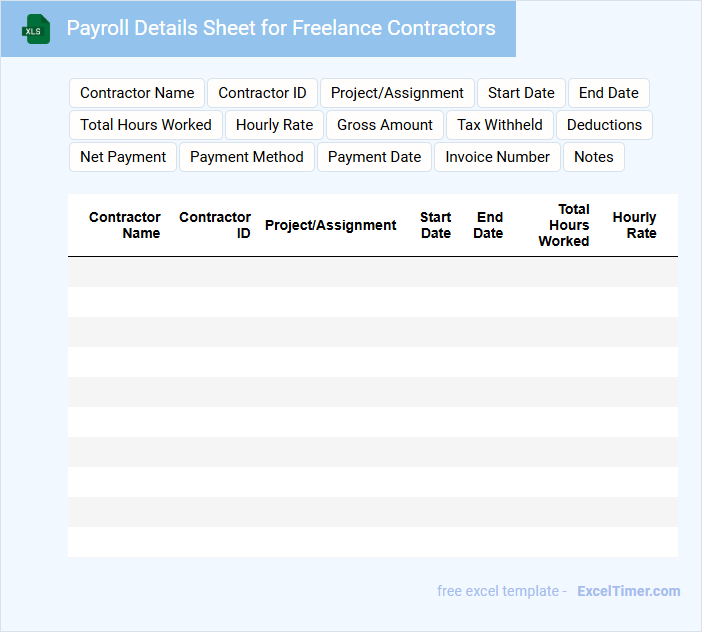

Payroll Details Sheet for Freelance Contractors

What is typically included in a Payroll Details Sheet for Freelance Contractors?

A Payroll Details Sheet for freelance contractors usually contains information such as contractor names, payment rates, hours worked, and total payment amounts. It records essential payroll details to ensure accurate and timely payments while maintaining compliance with tax and labor laws. This document also helps in tracking and auditing contractor payments for financial transparency and record-keeping purposes.

What are important considerations when preparing a Payroll Details Sheet for Freelance Contractors?

It is crucial to include accurate contractor identification and payment terms to avoid payment discrepancies and legal issues. Additionally, ensuring clear documentation of payment dates, deductions, and tax withholdings supports regulatory compliance and facilitates smooth financial operations. Always verify the data for accuracy and update the sheet regularly to reflect any contractual changes.

Salary and Payment Tracker for Freelancers

What information does a Salary and Payment Tracker for Freelancers typically contain? This document usually includes details such as client names, payment amounts, invoicing dates, due dates, and payment statuses to keep track of financial transactions efficiently. It helps freelancers monitor their income streams, ensure timely payments, and manage their cash flow effectively.

What is an important consideration when using a Salary and Payment Tracker for Freelancers? Maintaining accuracy and regularly updating the tracker with received payments and pending invoices is crucial. Additionally, including notes about payment methods and terms can help prevent misunderstandings and streamline financial management.

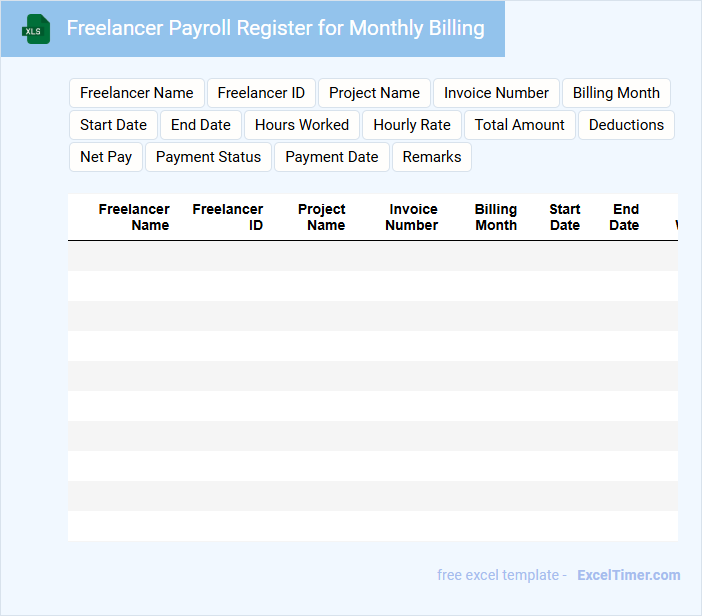

Freelancer Payroll Register for Monthly Billing

The Freelancer Payroll Register is a crucial document that helps track payments made to freelancers on a monthly basis. It typically contains details such as names, payment dates, hours worked, and amounts billed.

Maintaining an accurate monthly billing record ensures transparency and smooth financial management. It is important to regularly update this register to avoid discrepancies and streamline payroll processing.

What key columns should be included in a monthly payroll Excel document for freelancers?

A monthly payroll Excel document for freelancers should include key columns such as Freelancer Name, Project Description, Hours Worked, Hourly Rate, Total Payment, Payment Date, and Payment Status. Including Tax Deductions and Payment Method columns enhances accuracy and compliance. Tracking Invoice Number and Notes ensures clear documentation and communication.

How can you automate monthly payment calculations for variable freelancer hours in Excel?

Automate monthly payment calculations for variable freelancer hours in Excel by using timesheet data combined with hourly rates in a structured table. Apply the SUMPRODUCT function to multiply hours worked by respective rates, providing accurate total payments per freelancer. Integrate data validation and dynamic ranges to ensure scalability and reduce manual errors in payroll processing.

What formulas are essential for tracking due payments and payment status in a freelancer payroll sheet?

Essential formulas for tracking due payments and payment status in a freelancer payroll sheet include SUMIF to calculate total payments due, IF statements to determine payment status based on due dates and amounts, and VLOOKUP or INDEX-MATCH to fetch freelancer details. You can use TODAY() combined with IF to flag overdue payments automatically. These formulas help ensure accurate monitoring of your monthly payroll for freelancers.

How do you structure a payroll spreadsheet to accommodate multiple project-based rates for freelancers?

Structure your payroll spreadsheet by creating separate columns for freelancer names, project-based rates, hours worked per project, and total earnings per project. Use formulas to calculate total pay by multiplying hours by rates and summing across projects for each freelancer. Include payment dates and tax deductions to ensure accurate monthly payroll tracking for freelancers.

Which Excel features help ensure data accuracy and prevent duplication in freelancer payroll records?

Excel's Data Validation feature helps ensure data accuracy by restricting input values in your Monthly Payroll for Freelancers. The Conditional Formatting tool highlights duplicate entries, preventing duplication in freelancer payroll records. Using unique functions like COUNTIF can further identify and manage repeated freelancer data.