The Monthly Rent Receipt Excel Template for Landlords simplifies rent tracking by providing a clear and organized format to record tenant payments. This template ensures accurate documentation, helping landlords maintain financial records and manage rent collection efficiently. It also includes customizable fields for tenant details, payment dates, and amounts, enhancing professional communication and transparency.

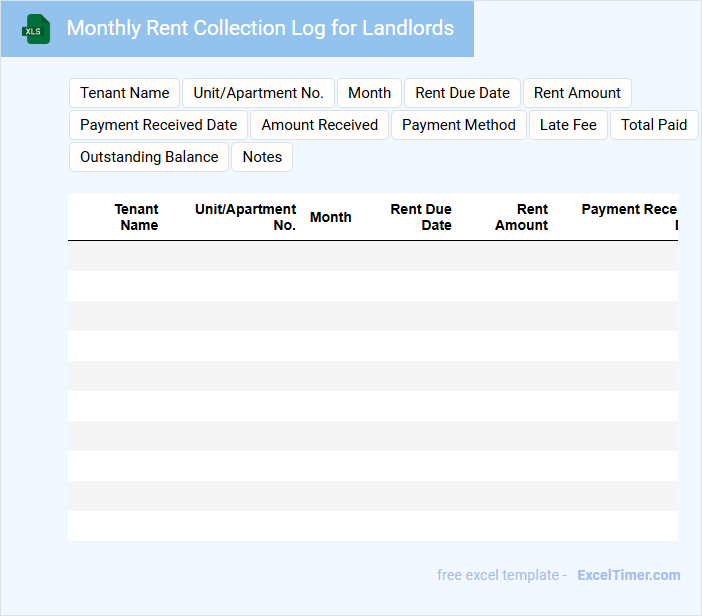

Monthly Rent Collection Log for Landlords

A Monthly Rent Collection Log is a document where landlords record payments received from tenants each month. It typically contains tenant names, payment dates, amounts paid, and any outstanding balances. This log helps landlords maintain accurate financial records and track rent collection efficiency.

Important elements to include are the tenant's contact information, payment method, and notes on any late or partial payments. Consistently updating this log ensures transparency and aids in resolving disputes. Using a clear, organized format can improve ease of use and accuracy.

Rent Payment Tracker with Tenant Details

A Rent Payment Tracker with Tenant Details is a document used to monitor and record rental payments from tenants efficiently. It helps landlords keep organized financial records and manage tenant information seamlessly.

- Include tenant names, contact information, and lease terms for clarity.

- Record payment dates, amounts, and payment methods for accuracy.

- Update the tracker regularly to avoid discrepancies and late payments.

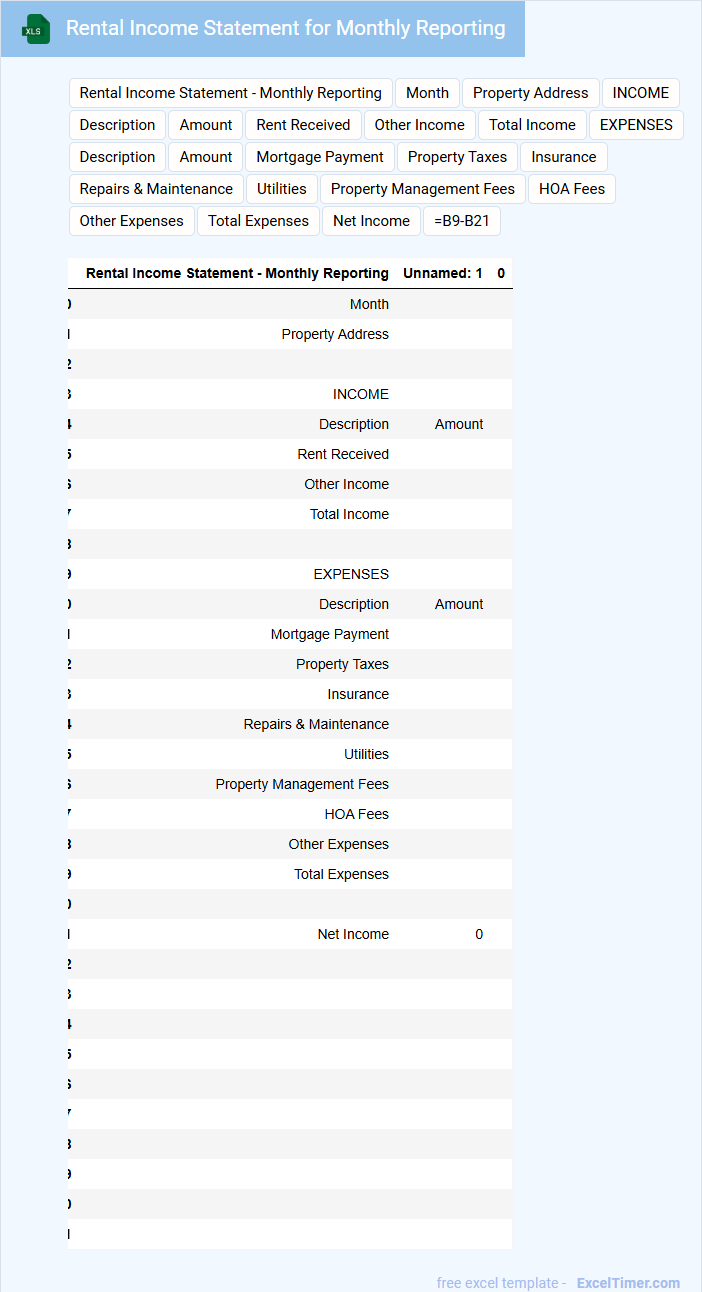

Rental Income Statement for Monthly Reporting

A Rental Income Statement for Monthly Reporting summarizes the revenue generated from rental properties over a month. It provides an overview of income and related expenses to assess profitability.

- Include accurate rental income received from tenants during the reporting period.

- List all operating expenses such as repairs, maintenance, and management fees.

- Highlight any outstanding payments or discrepancies for clear financial tracking.

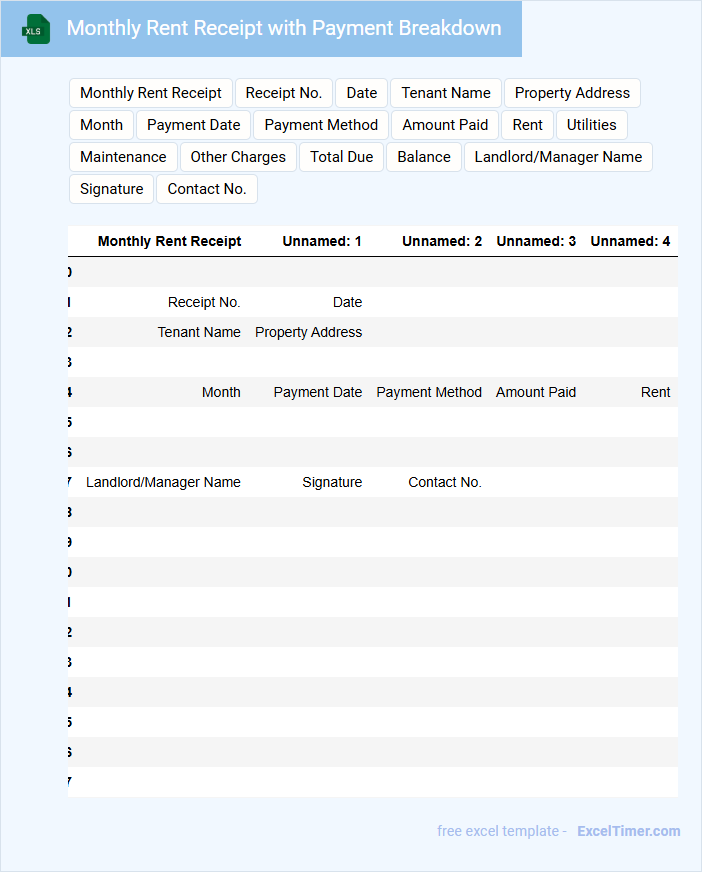

Monthly Rent Receipt with Payment Breakdown

A Monthly Rent Receipt typically contains details such as the landlord and tenant's names, the rental property address, the payment amount, and the date the rent was received. It often includes a breakdown of the payment, specifying portions allocated to rent, utilities, and any other charges. This document serves as proof of payment and helps maintain clear financial records for both parties.

For clarity, always include the payment method, a unique receipt number, and a signature from the landlord or authorized agent. Ensure the receipt is issued promptly after payment to avoid disputes. Additionally, keeping digital or physical copies of all receipts is important for future reference and legal purposes.

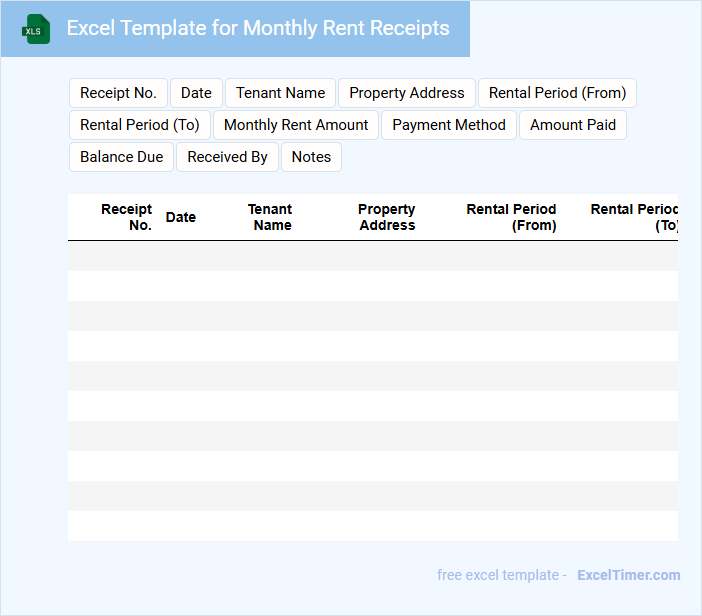

Excel Template for Monthly Rent Receipts

An Excel Template for Monthly Rent Receipts typically contains fields for tenant details, payment amounts, and payment dates, providing clear documentation of rental transactions. It facilitates tracking of rent payments and issuance of official receipts for tenants. This template ensures accuracy and ease in managing rental income records.

It is important to include a clear identification of the tenant, landlord, and property address to avoid any confusion. Adding automatic calculations for totals and balances enhances efficiency. Ensuring a professional and easy-to-read layout helps maintain proper documentation for tax or legal purposes.

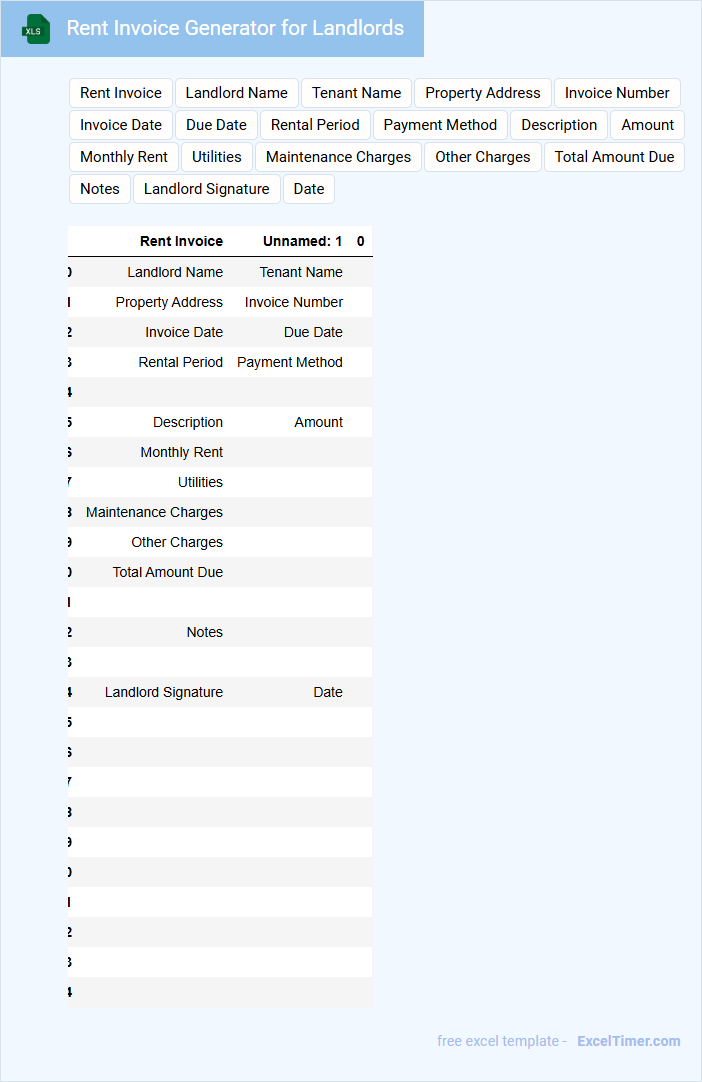

Rent Invoice Generator for Landlords

A Rent Invoice Generator for landlords typically contains essential details such as tenant information, rental period, amount due, and payment terms. It serves as a formal request for payment and helps maintain organized financial records. Key features should include automated calculations, customizable templates, and clear payment instructions to ensure prompt and accurate transactions.

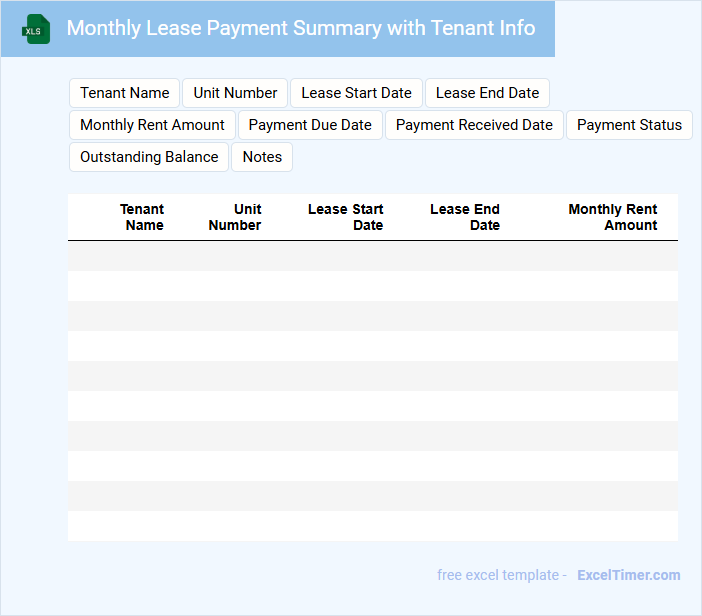

Monthly Lease Payment Summary with Tenant Info

A Monthly Lease Payment Summary with Tenant Info typically contains detailed financial transactions and tenant data for lease management.

- Tenant Details: Includes the name, contact information, and lease agreement specifics for each tenant.

- Payment Breakdown: Lists the monthly lease payment amount, due dates, and payment status for transparency.

- Outstanding Balances: Highlights any unpaid amounts or late fees to ensure accurate financial tracking.

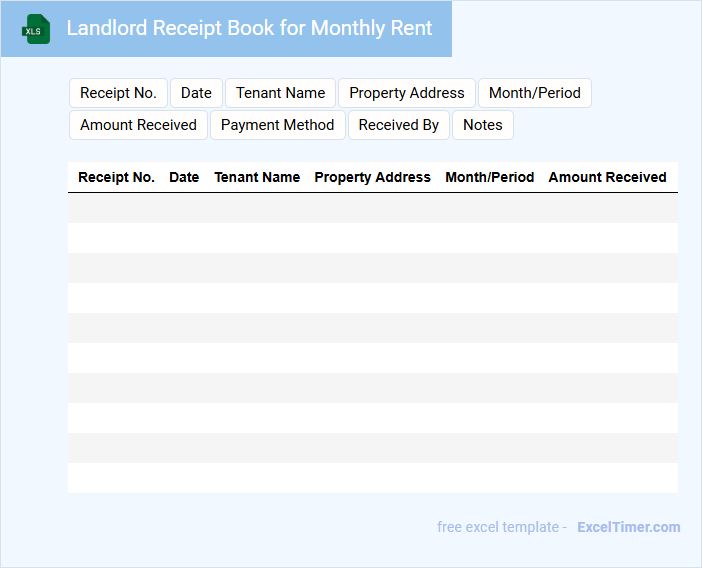

Landlord Receipt Book for Monthly Rent

What information is typically included in a Landlord Receipt Book for Monthly Rent? This document usually contains details such as the tenant's name, rental property address, payment amount, and date of payment. It serves as an official acknowledgment of rent received, helping both landlord and tenant maintain clear and organized financial records.

What important aspects should be considered when using a Landlord Receipt Book for Monthly Rent? It is crucial to ensure each receipt is clearly dated and signed by the landlord or agent to avoid disputes. Also, including the mode of payment and any outstanding balance helps maintain transparency and accuracy in rent transactions.

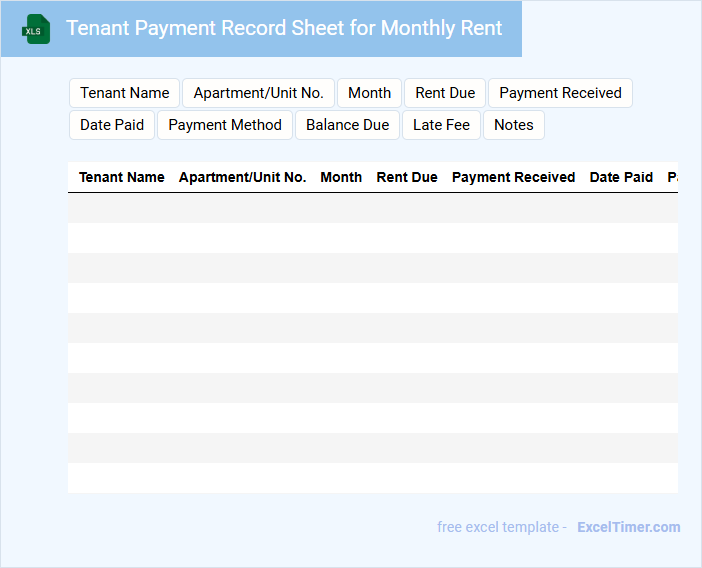

Tenant Payment Record Sheet for Monthly Rent

A Tenant Payment Record Sheet is a document used to track monthly rent payments made by tenants. It typically includes details such as tenant names, payment dates, amounts paid, and any outstanding balances. Maintaining this record ensures transparency and helps landlords manage payments efficiently.

Monthly Rental Revenue Tracker with Due Dates

A Monthly Rental Revenue Tracker is a document designed to record and monitor rental income on a monthly basis, helping landlords or property managers keep track of payments received. It typically includes details such as tenant names, rental amounts, payment status, and due dates to ensure timely collection.

This tracker is essential for maintaining financial accuracy and identifying overdue payments promptly. To enhance its effectiveness, always ensure the inclusion of clear due dates and a status column for payment reminders.

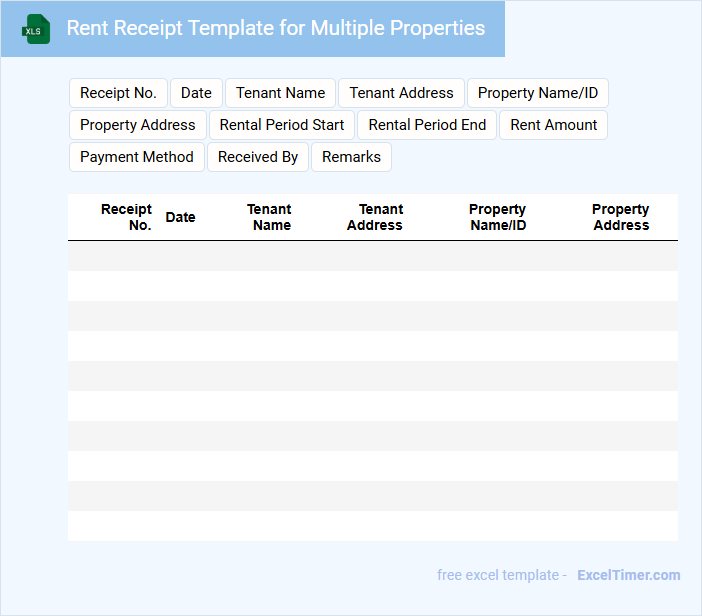

Rent Receipt Template for Multiple Properties

A Rent Receipt Template for Multiple Properties typically contains detailed information on rental payments across various properties managed by a landlord or agent.

- Accurate Tenant Details: Ensure each tenant's name and rental property are clearly specified to avoid confusion.

- Payment Information: Include the amount paid, payment date, and mode of payment for transparent financial records.

- Receipt Numbering: Use unique receipt numbers for each transaction to maintain organized and verifiable documentation.

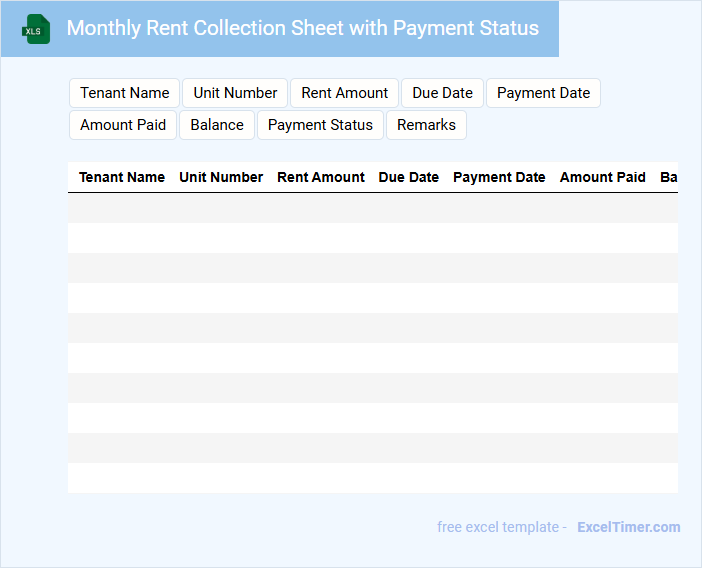

Monthly Rent Collection Sheet with Payment Status

The Monthly Rent Collection Sheet is a document used to track tenant payments and rental income over a specific month. It typically contains tenant names, rent amounts, due dates, and payment status indicators.

Maintaining an accurate Payment Status section is essential for identifying late or missed payments promptly. It helps landlords and property managers manage cash flow and communicate effectively with tenants.

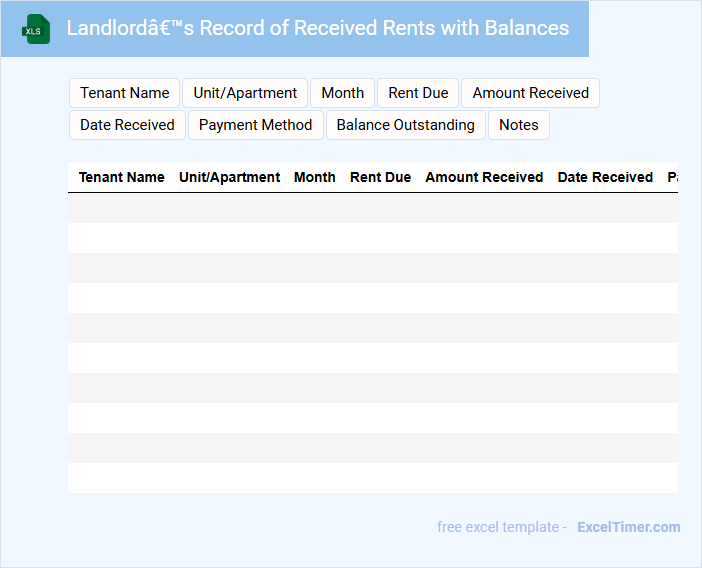

Landlord’s Record of Received Rents with Balances

A Landlord's Record of Received Rents is an essential document used to track rent payments from tenants over a specific period. It typically contains details such as tenant names, payment dates, amounts received, and any outstanding balances. Maintaining accurate records helps landlords manage finances effectively and resolve disputes quickly.

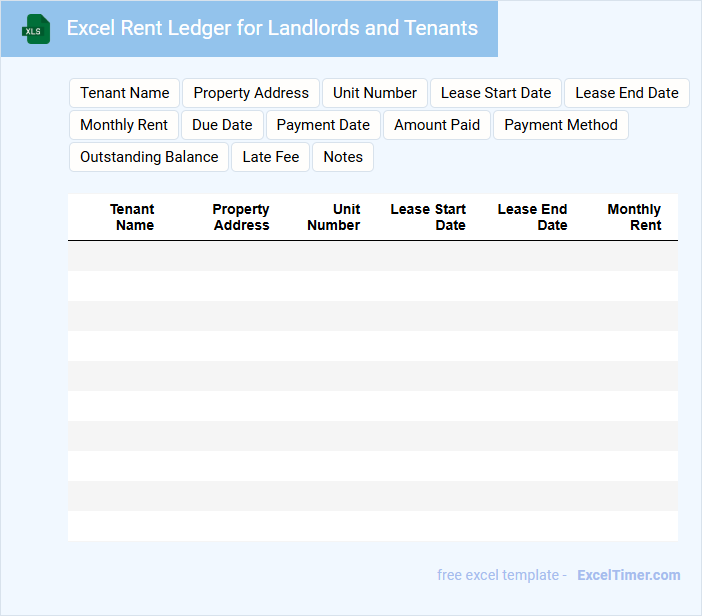

Excel Rent Ledger for Landlords and Tenants

An Excel Rent Ledger is a vital document used by landlords and tenants to accurately track rental payments and outstanding balances. It typically contains details such as payment dates, amounts paid, due dates, and any late fees incurred. Maintaining this ledger helps ensure transparency and protects both parties by providing a clear record of all financial transactions related to the rental property.

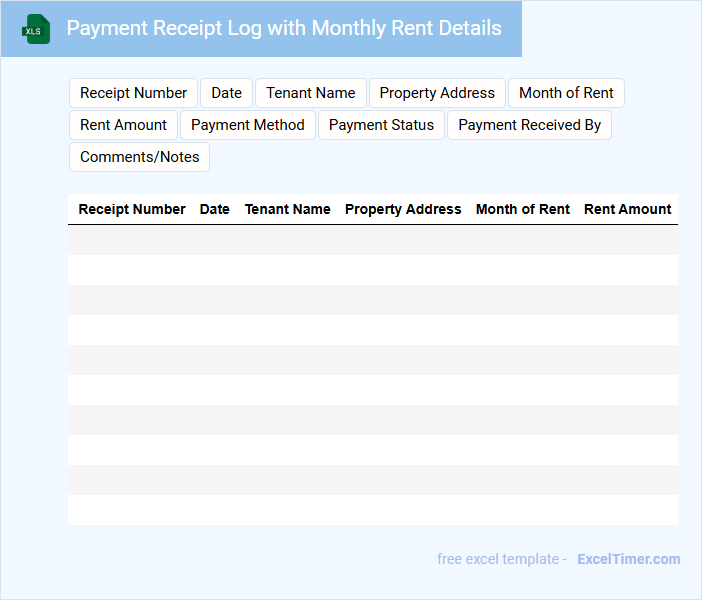

Payment Receipt Log with Monthly Rent Details

A Payment Receipt Log is a document that systematically records all transactions related to monthly rent payments. It typically includes details such as the tenant's name, payment date, amount paid, and the payment method.

The log helps landlords and property managers maintain accurate financial records and track payment histories efficiently. It is important to ensure that each entry is clear, consistent, and verified for accuracy.

What key details must be included in a monthly rent receipt for legal compliance?

A monthly rent receipt for legal compliance must include the tenant's name, payment date, rent amount, payment method, and property address. It should also feature the landlord's name and signature to verify authenticity. Providing this information ensures Your records are accurate and legally valid.

How should payment methods be documented on the rent receipt?

Payment methods on the Monthly Rent Receipt should be clearly documented by specifying the type of payment, such as cash, check, bank transfer, or digital payment platform. Include details like transaction reference numbers or check numbers to ensure accurate record-keeping. This helps you maintain transparent and verifiable proof of each rent payment received.

What is the importance of including payment period dates on the rent receipt?

Including payment period dates on the rent receipt clearly defines the exact rental timeframe covered, preventing disputes between landlords and tenants. You ensure transparent documentation for monthly rent transactions, supporting accurate financial records and legal accountability. This detail enhances trust and facilitates smooth rental management.

How can landlords use Excel formulas to automate rent receipt generation?

Landlords can use Excel formulas like CONCATENATE or TEXTJOIN to automatically generate rent receipts by combining tenant information, payment dates, and rent amounts. Utilizing IF formulas helps track payment status, while date functions like TODAY() dynamically update receipt dates. Embedding SUM and VLOOKUP formulas streamlines rent calculation and tenant data retrieval for efficient monthly rent receipt management.

Which columns are essential in an for monthly rent receipts?

Essential columns in an Excel template for monthly rent receipts include Tenant Name, Property Address, Rent Amount, Payment Date, Payment Method, Receipt Number, and Notes for additional details. Including columns for Late Fees and Payment Status can enhance tracking and management accuracy. These fields ensure clear documentation and easy reference for both landlords and tenants.