![]()

The Semi-annually Excel Template for Personal Expense Tracking offers a structured way to monitor and manage expenses every six months, ensuring better financial planning and budgeting. This template allows users to categorize spending, track income, and analyze trends over two quarters, providing clear insights into financial habits. Easy-to-use formulas and customizable sections make it a valuable tool for maintaining long-term financial health.

Semi-Annually Excel Template for Personal Expense Tracking

A Semi-Annually Excel Template for Personal Expense Tracking is designed to help individuals monitor their spending habits over six-month periods. It typically includes categories such as income, fixed expenses, variable expenses, and savings goals.

This document provides a clear summary of financial inflows and outflows, enabling better budgeting decisions. Important considerations include accurate data entry and regular updates to reflect true financial status.

Personal Expense Tracker with Semi-Annual Overview

What information does a Personal Expense Tracker with Semi-Annual Overview typically contain? This document usually includes detailed records of daily expenses categorized by type, as well as summaries of spending patterns over six-month periods. It helps individuals monitor their financial habits and identify areas for potential savings or budget adjustments.

What is an important aspect to consider when maintaining this type of document? Ensuring consistent and accurate data entry is crucial so that the semi-annual overview provides meaningful insights. Additionally, regularly reviewing trends and adjusting financial goals accordingly will maximize the effectiveness of the tracker.

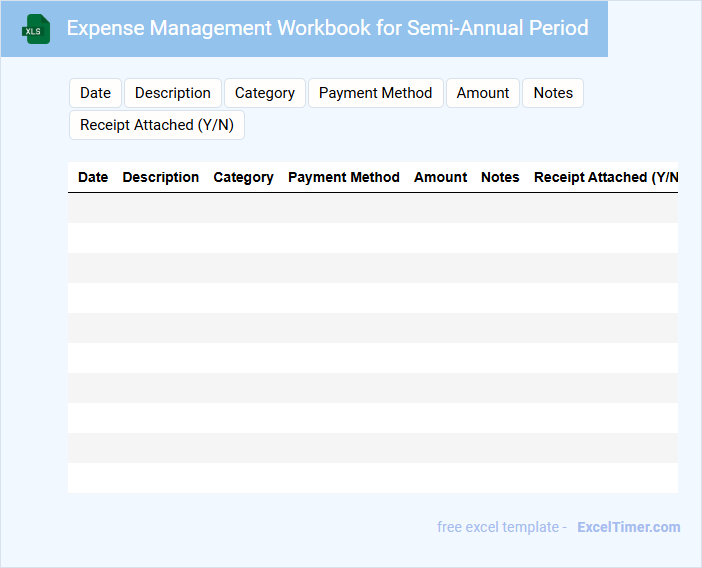

Expense Management Workbook for Semi-Annual Period

What information is typically contained in an Expense Management Workbook for a Semi-Annual Period? This document usually includes detailed records of all expenses incurred over a six-month timeframe, categorized by type, date, and department or project. It helps organizations track spending patterns, budget adherence, and identify potential cost-saving opportunities.

Why is it important to regularly update and review this workbook? Consistent updates ensure accuracy in financial reporting and enable timely decision-making to control expenditures. Additionally, reviewing the workbook semi-annually supports strategic planning and financial forecasting for the upcoming periods.

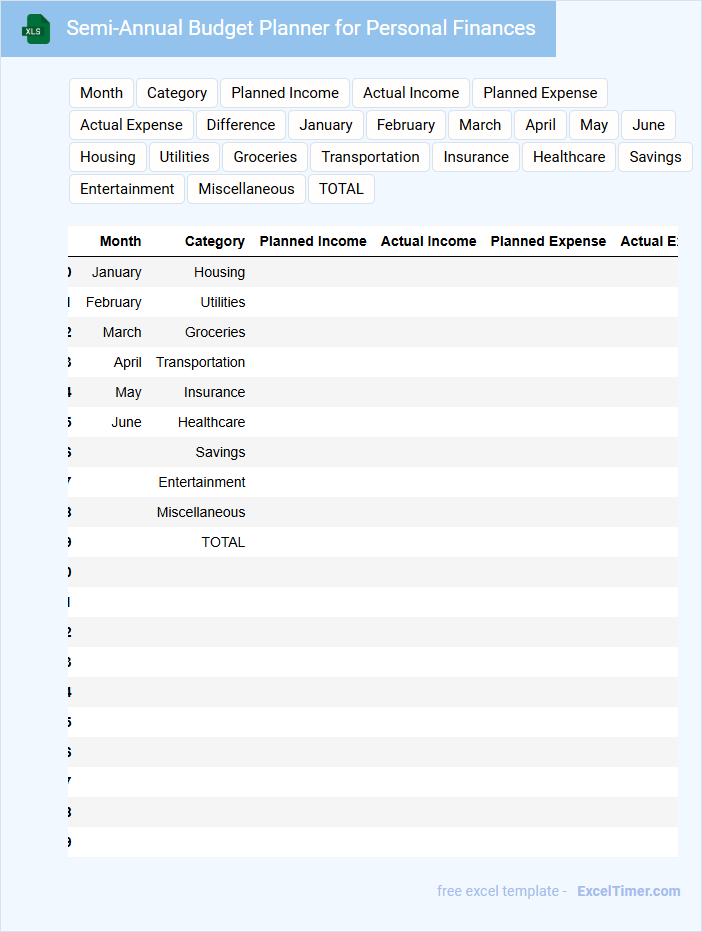

Semi-Annual Budget Planner for Personal Finances

A Semi-Annual Budget Planner is a financial document that helps individuals track and organize their income and expenses over a six-month period. It usually contains sections for fixed and variable expenses, savings goals, and debt repayments. An important aspect of this planner is setting clear financial goals to maintain control of spending and improve savings. Consistently reviewing and adjusting the budget ensures it remains aligned with personal priorities and changing circumstances.

Excel Template for Tracking Personal Expenses Every Six Months

An Excel Template for tracking personal expenses every six months typically contains categorized sections for income, fixed expenses, variable expenses, and savings. It helps users monitor and analyze their spending patterns to manage finances effectively.

Important features include automated calculations, clear charts for visual summary, and easy input fields. Consistent updating and categorization are crucial for accurate financial insights.

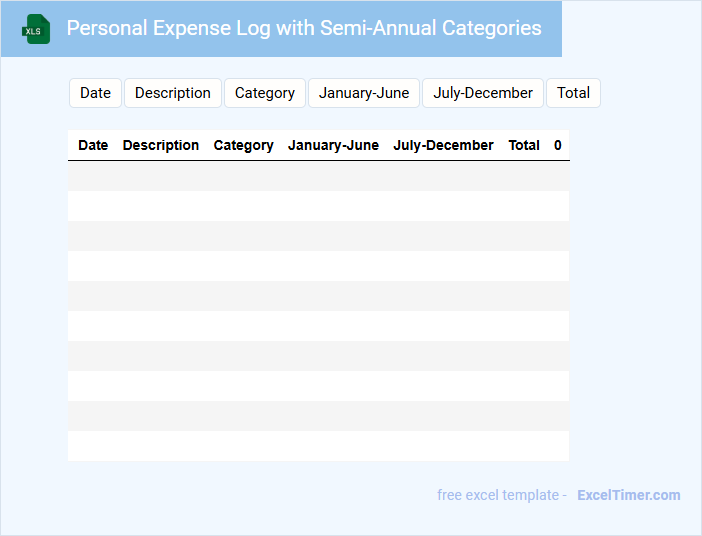

Personal Expense Log with Semi-Annual Categories

A Personal Expense Log is a document used to track individual spending habits and manage finances effectively. It usually contains categorized expenses, dates, amounts, and payment methods for better financial overview. Maintaining this log regularly helps identify spending patterns and control unnecessary expenditures.

The Semi-Annual Categories format groups expenses into six-month periods, which assists in long-term budgeting and financial planning. Important elements include clear category labels, consistent date entries, and summary totals for each period. Regular reviews ensure more accurate tracking and help adjust budgets accordingly.

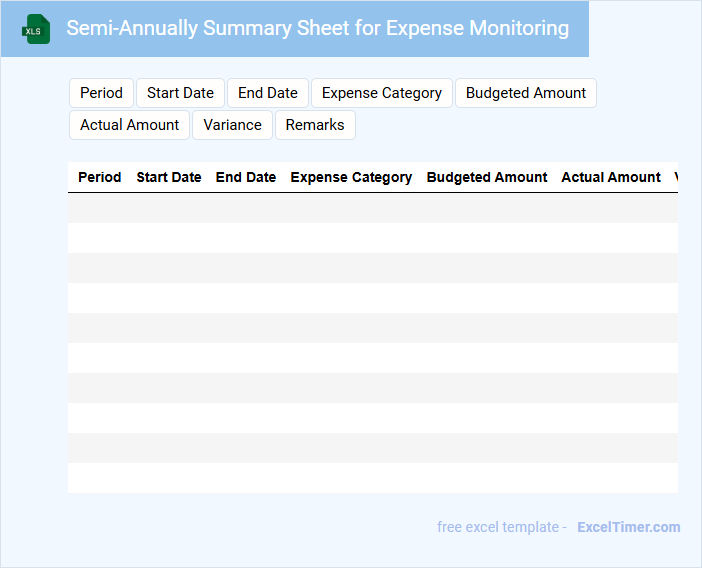

Semi-Annually Summary Sheet for Expense Monitoring

A Semi-Annually Summary Sheet for Expense Monitoring typically contains a concise record of all expenses incurred over six months to facilitate financial tracking and budgeting.

- Detailed Expense Categories: Break down expenses into categories for clear analysis.

- Comparative Analysis: Include comparisons with previous periods to highlight trends.

- Summary Totals: Provide aggregate amounts for quick financial overview.

Tracker of Personal Spending with Semi-Annual Reports

This type of document primarily contains financial data related to personal expenses tracked over a given period. It includes categorized spending details that help in understanding where money is allocated.

Additionally, it features semi-annual reports summarizing spending trends and highlighting significant changes over six months. This allows for better budgeting and financial planning. To maximize effectiveness, consistently update entries and review reports for irregularities or opportunities to save.

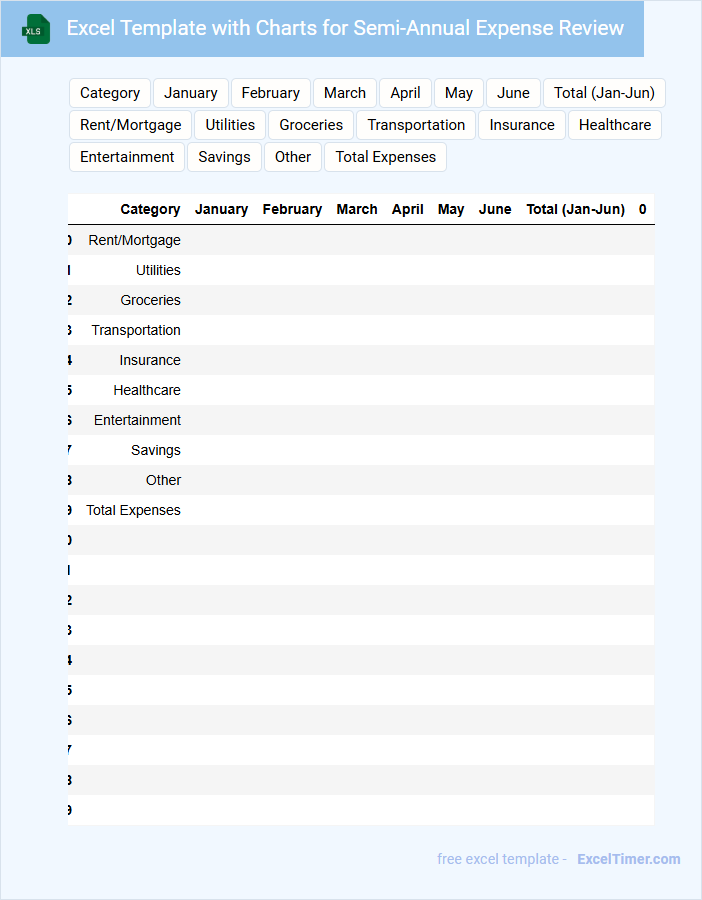

Excel Template with Charts for Semi-Annual Expense Review

An Excel Template with charts for Semi-Annual Expense Review typically contains organized financial data input fields alongside visual representations like bar graphs and pie charts. This document allows users to track expenses efficiently over a six-month period and identify key spending trends. Including detailed labels and clear data segmentation enhances usability and accuracy in financial analysis.

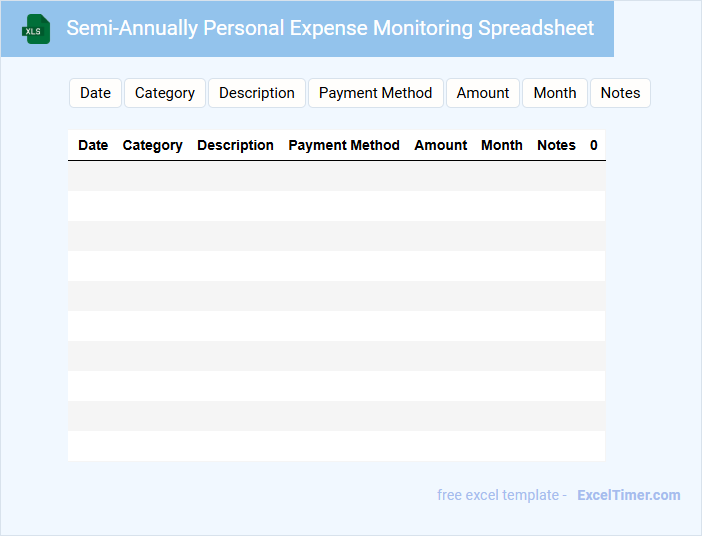

Semi-Annually Personal Expense Monitoring Spreadsheet

A Semi-Annually Personal Expense Monitoring Spreadsheet typically contains detailed records of income, expenses, and savings tracked over two consecutive quarters. It helps individuals analyze spending habits, identify patterns, and plan budgets effectively for the next half-year period. Important aspects include categorizing expenses accurately, updating data regularly, and reviewing summaries for financial decision-making.

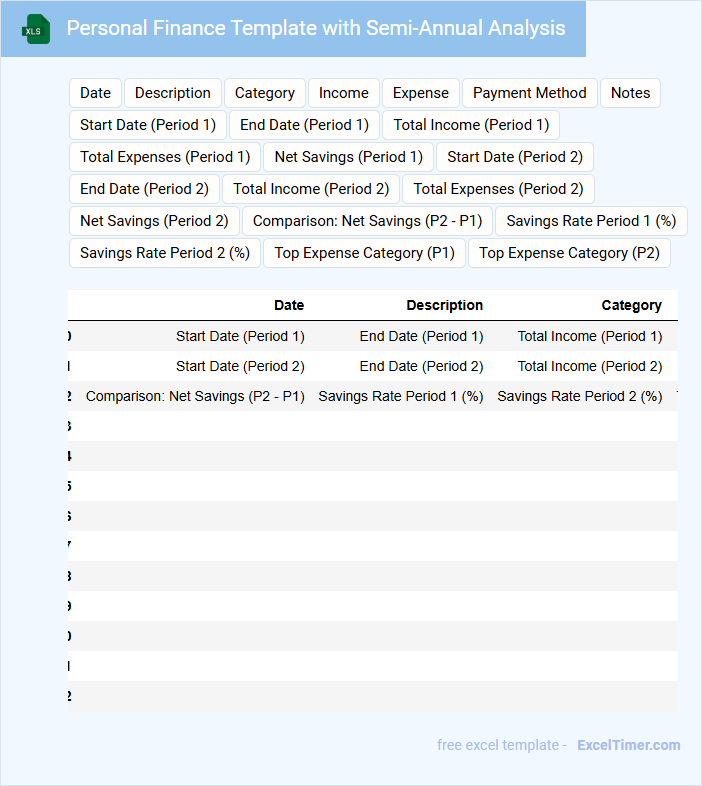

Personal Finance Template with Semi-Annual Analysis

A Personal Finance Template with Semi-Annual Analysis typically contains detailed records of income, expenses, savings, and investments reviewed twice a year to monitor financial health. It helps individuals track their financial goals and adjust budgets based on changing circumstances. Regular updates ensure accurate and relevant financial planning. Important elements to include are categorized expense tracking, income sources, asset allocation, and liability management, all summarized in semi-annual reports. This structure encourages disciplined saving habits and informed decision-making. Consistent review cycles prevent financial surprises and support goal achievement.

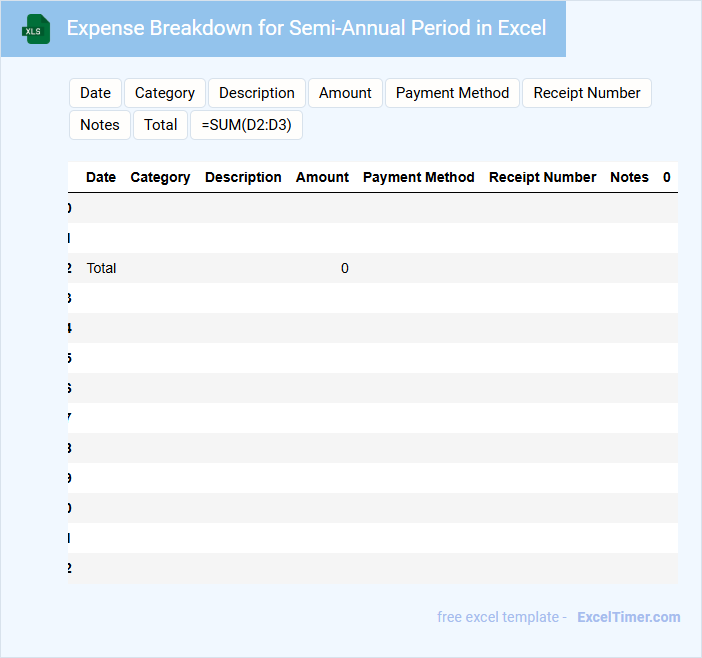

Expense Breakdown for Semi-Annual Period in Excel

The Expense Breakdown document for a semi-annual period in Excel typically contains detailed records of all expenses incurred during the six months. It includes categorized cost entries, dates, amounts, and any relevant notes for clarity. This document helps in monitoring spending patterns and preparing accurate financial reports.

Important elements to include are clear category labels, formulas to sum totals automatically, and visual aids like charts for quick interpretation. Ensuring data accuracy and consistency in formatting enhances usability and audit readiness. Additionally, incorporating comparison columns with previous periods aids in trend analysis and budget planning.

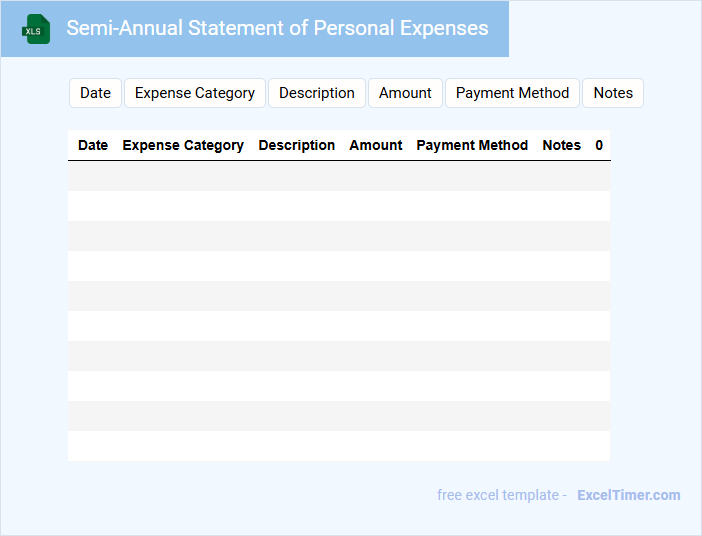

Semi-Annual Statement of Personal Expenses

The Semi-Annual Statement of Personal Expenses is a financial document that summarizes an individual's expenditures over six months. It typically includes categories such as housing, transportation, food, and entertainment expenses. This statement helps in tracking spending habits and creating budgets for future financial planning.

Important elements to include are detailed transaction records, categorized expenses, and unplanned or irregular costs. Consistent and accurate documentation ensures clarity and aids in identifying areas for cost reduction. Additionally, reviewing this statement regularly promotes financial discipline and informed decision-making.

Personal Spending Tracker with Semi-Annual Tabs

A Personal Spending Tracker with Semi-Annual Tabs is a document designed to monitor and organize individual expenses over six-month periods. It typically contains categorized expense entries, income records, and summary sections for each half-year. This format helps users analyze spending patterns and make informed financial decisions.

Important elements to include are clear date ranges for each tab, consistent categories for tracking expenses, and visual summaries such as charts or totals. Ensuring easy navigation between semi-annual tabs enhances usability and long-term financial planning. Regularly updating the tracker helps maintain accuracy and provides valuable insights into spending habits.

Analytics Dashboard for Semi-Annual Personal Expenses in Excel

An Analytics Dashboard for Semi-Annual Personal Expenses in Excel typically contains summarized financial data, visual charts, and key performance indicators to track spending habits. It helps users monitor income sources, categorize expenses, and identify trends over six months. This document is essential for budgeting, financial planning, and making informed money management decisions.

How do you structure a semi-annual personal expense tracking table in Excel for clear month-by-month analysis?

Create an Excel table with columns for each month, grouped into two semi-annual sections labeled H1 (January-June) and H2 (July-December). Include rows for expense categories such as Housing, Food, Transportation, and Entertainment, with a total expense row summing monthly values. Use formulas to calculate semi-annual and annual totals, enabling clear month-by-month and period-specific expense analysis.

What Excel formulas best calculate total and average expenses for each semi-annual period?

Use the SUMIFS formula to calculate total expenses for each semi-annual period by specifying date ranges for the first (January to June) and second (July to December) halves of the year. Apply AVERAGEIFS to determine the average expenses within these semi-annual periods, using the same date range criteria. Ensure the expense dates and amounts are accurately referenced in your formulas for precise personal expense tracking.

How can conditional formatting be used to highlight spending spikes in each semi-annual segment?

Use conditional formatting in Excel to highlight spending spikes by setting rules that compare each expense to the average spending in your semi-annual segments. Apply color scales or data bars to visually emphasize amounts significantly higher than the segment's mean. This approach helps you quickly identify and analyze unusual expenses within each six-month period.

Which Excel chart type most effectively visualizes trends in semi-annual personal expenditures?

A line chart is the most effective Excel chart type for visualizing trends in semi-annual personal expenditures. It clearly displays changes over time, highlighting increases or decreases between the two periods each year. Using a line chart helps track spending patterns and identify significant fluctuations in personal expenses.

What methods help automate the rollover of expense categories and totals from one semi-annual period to the next?

Using Excel formulas like SUMIF and INDIRECT automates the rollover of expense categories and totals between semi-annual periods. PivotTables dynamically summarize and update expense data, streamlining your tracking process. VBA macros can also be programmed for automatic data transfer and report generation.