![]()

The Semi-annually Excel Template for Recurring Expense Tracking simplifies managing expenses by organizing costs every six months, ensuring timely budget reviews. Its user-friendly layout allows accurate monitoring of recurring payments, helping prevent missed bills and optimize cash flow. Customizable features enable users to tailor categories and due dates according to personal or business needs.

Semi-Annual Expense Tracker with Category Breakdown

A Semi-Annual Expense Tracker systematically records and monitors expenses over a six-month period, providing clear insights into spending habits. This document usually contains categorized expenditures such as housing, utilities, groceries, transportation, and entertainment for easy analysis. An important suggestion is to regularly update the tracker and review category breakdowns to identify areas for potential savings and budgeting improvements.

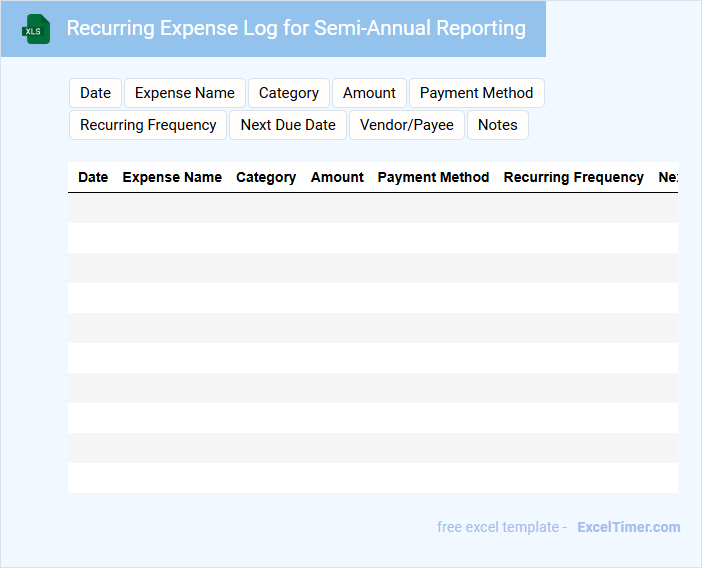

Recurring Expense Log for Semi-Annual Reporting

The Recurring Expense Log is a vital document that systematically records all periodic expenses incurred over a specified period, typically used for semi-annual reporting. It includes detailed entries such as dates, descriptions, amounts, and categories of recurring expenses to ensure accurate financial tracking. Maintaining this log helps organizations analyze spending patterns and prepare precise budgets.

For optimal use, it is important to regularly update the log to reflect all incurred expenses without omission. Clearly categorizing each entry can improve the clarity and usefulness of the report. Additionally, reconciling the log with bank statements ensures accuracy and supports effective financial management.

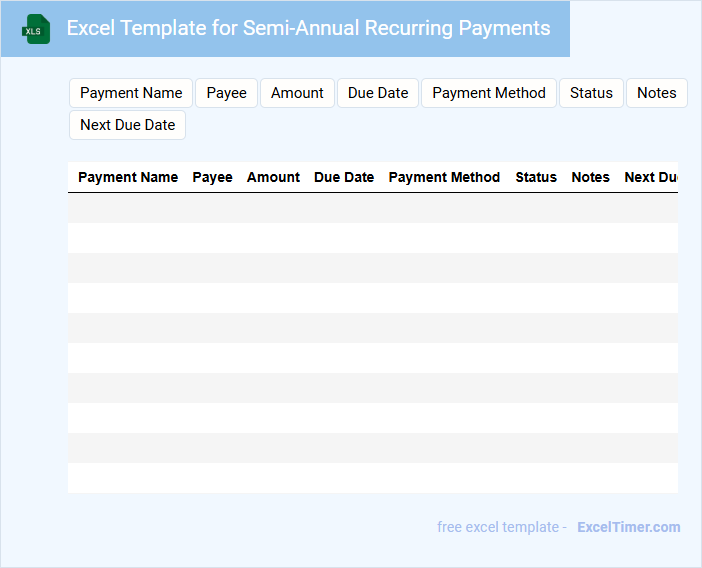

Excel Template for Semi-Annual Recurring Payments

An Excel Template for Semi-Annual Recurring Payments typically contains detailed schedules of payment dates, amounts, and payee information. It helps users maintain accuracy in financial tracking and forecasting for payments occurring twice a year.

Such documents usually include columns for invoice numbers, payment statuses, and notes for any discrepancies or adjustments. For optimal use, ensure to regularly update the template and include automatic reminders for upcoming payments.

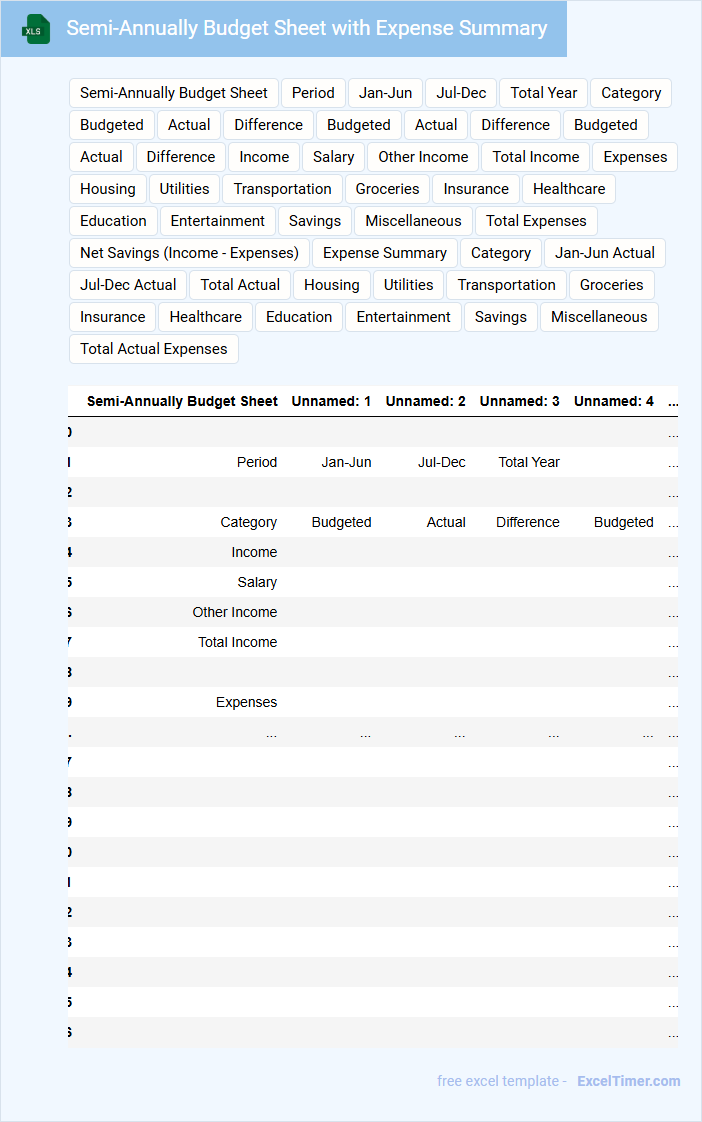

Semi-Annually Budget Sheet with Expense Summary

A Semi-Annually Budget Sheet typically contains detailed financial plans and expense summaries for a six-month period. It includes projected incomes, planned expenditures, and actual spending to track financial performance. Key elements ensure effective budget management and financial accountability over the half-year term.

Expense Tracking Workbook for Semi-Annual Recurrences

An Expense Tracking Workbook for Semi-Annual Recurrences is designed to help users systematically monitor and manage expenses that occur every six months. This type of document typically contains categorized expense entries, scheduled due dates, and a summary of payment statuses. It is essential to include clear sections for recurring expense details, reminders for upcoming payments, and space for notes or adjustments.

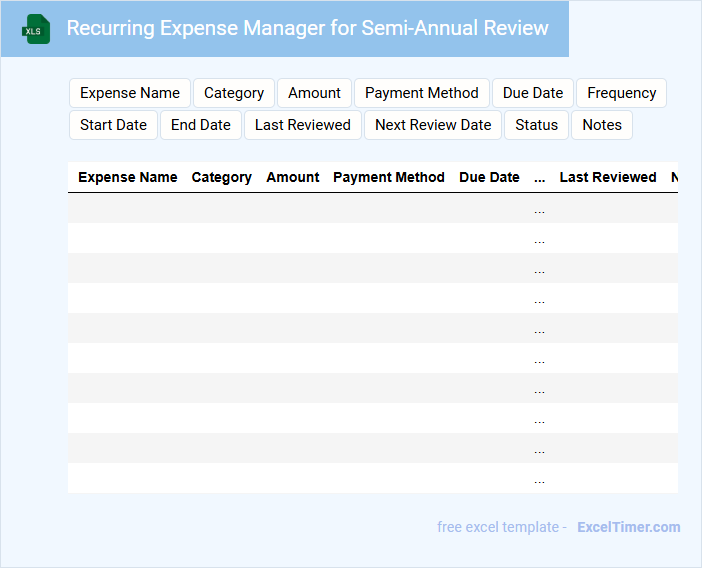

Recurring Expense Manager for Semi-Annual Review

A Recurring Expense Manager document typically contains detailed records of expenses that occur at regular intervals, such as monthly or semi-annual payments. It tracks amounts, due dates, and categories to help with budgeting and financial planning. For a Semi-Annual Review, it is crucial to verify the accuracy of all entries and assess trends to optimize future spending.

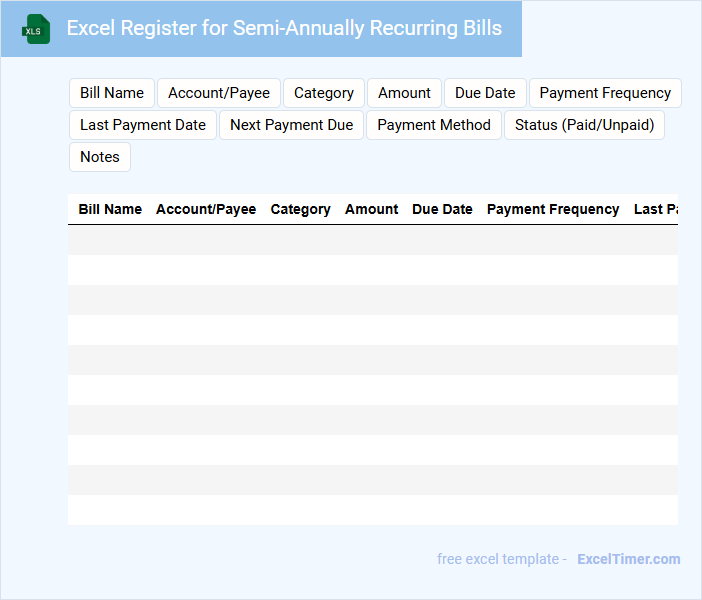

Excel Register for Semi-Annually Recurring Bills

An Excel Register for Semi-Annually Recurring Bills typically contains detailed records of bills that recur every six months, including due dates, payment amounts, and vendor information. This document helps to ensure timely payments and accurate tracking of financial obligations.

It is important to include clear categorization, payment status, and reminders within the register to avoid missed or late payments. Regular updates and reconciliation with bank statements will enhance accuracy and financial control.

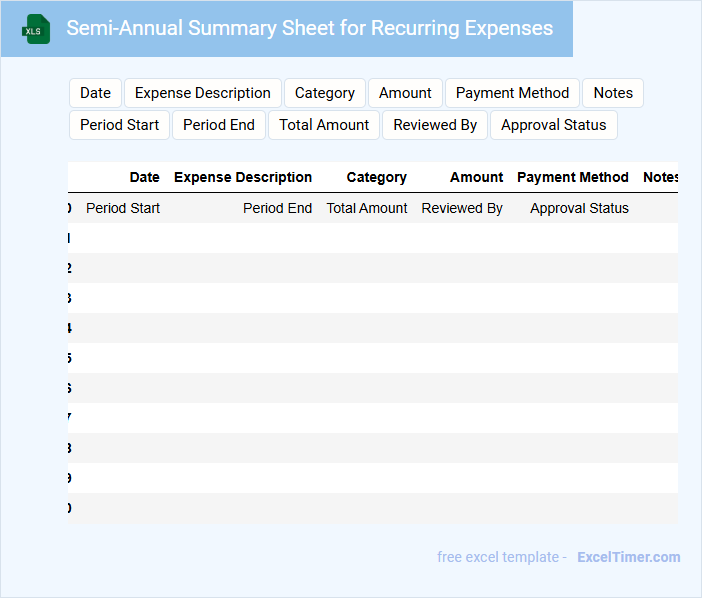

Semi-Annual Summary Sheet for Recurring Expenses

What information is typically included in a Semi-Annual Summary Sheet for Recurring Expenses? This document usually contains a detailed overview of all regular expenses incurred over a six-month period, such as rent, utilities, subscriptions, and loan payments. It helps track spending patterns and supports budget planning by consolidating expense data for easy review.

Why is accuracy important when preparing a Semi-Annual Summary Sheet for Recurring Expenses? Accurate recording ensures reliable financial analysis and helps identify cost-saving opportunities or discrepancies. Including clear labels, consistent formatting, and timely updates improves the document's usefulness for decision-making and auditing purposes.

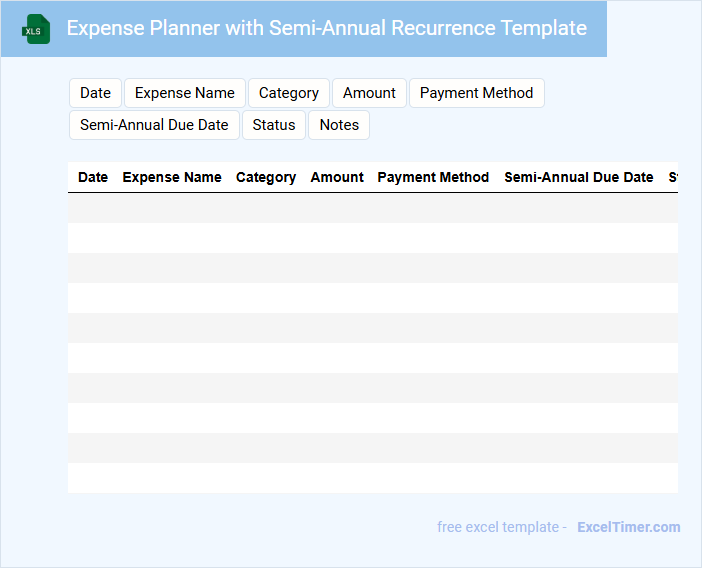

Expense Planner with Semi-Annual Recurrence Template

An Expense Planner with Semi-Annual Recurrence Template is typically used to track and manage expenses that occur every six months. It helps individuals or businesses organize and anticipate upcoming financial obligations efficiently.

This document usually contains categorized expense items, due dates, and payment status columns to ensure clarity and easy monitoring. For optimal use, it is important to regularly update the planner and review semi-annual expenses to maintain accurate budgeting.

Tracking Log for Semi-Annually Recurring Costs

What information is typically included in a Tracking Log for Semi-Annually Recurring Costs? This document usually contains detailed records of expenses that occur every six months, such as maintenance fees, subscription renewals, or insurance premiums. It helps in budgeting and ensures timely payments by providing an organized schedule and cost analysis.

Why is it important to accurately track semi-annual recurring costs? Accurate tracking prevents missed payments and unexpected budget shortfalls, supporting financial planning and accountability. Including clear due dates, cost descriptions, and payment status in the log enhances its effectiveness and aids in forecasting future expenses.

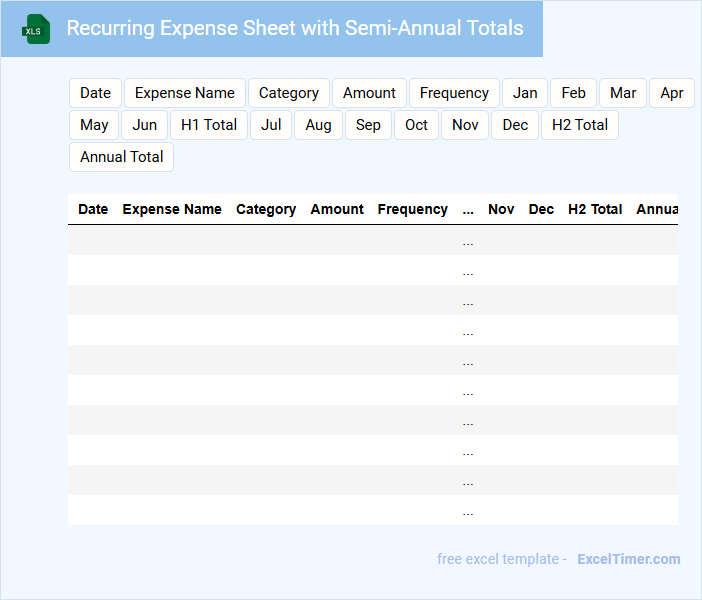

Recurring Expense Sheet with Semi-Annual Totals

A Recurring Expense Sheet with Semi-Annual Totals is a document that tracks periodic expenses occurring regularly throughout the year, summarizing costs every six months. It helps individuals or businesses monitor financial commitments and plan budgets effectively.

- List each recurring expense clearly with its frequency and amount.

- Include semi-annual subtotal calculations to identify spending patterns.

- Update the sheet regularly to maintain accurate financial records for analysis.

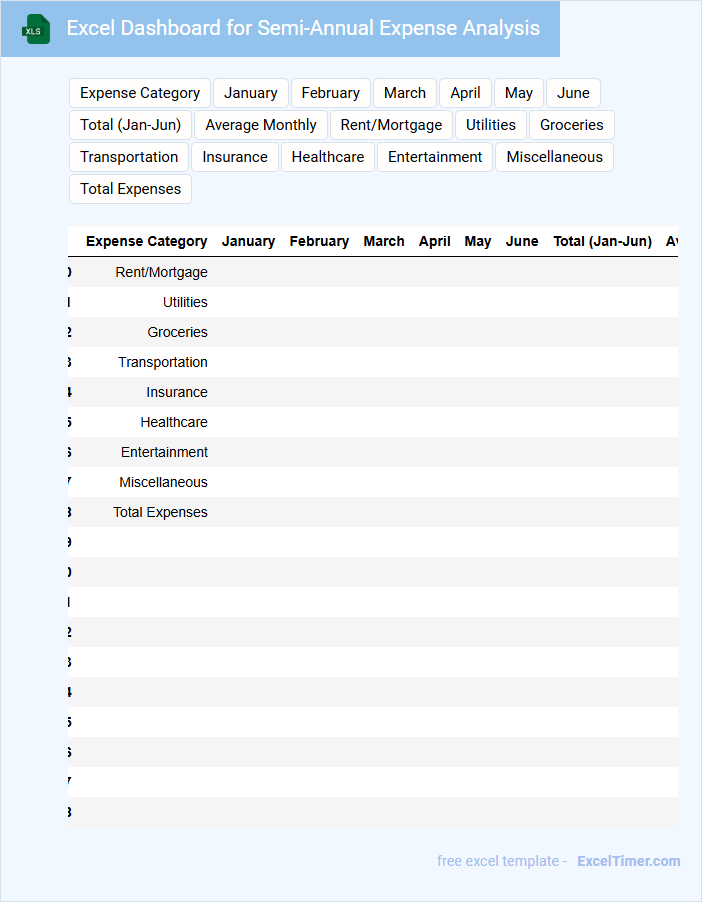

Excel Dashboard for Semi-Annual Expense Analysis

An Excel Dashboard for Semi-Annual Expense Analysis typically summarizes financial data to track and visualize expenses over a six-month period.

- Data Accuracy: Ensure all expense entries are verified for correct values and consistent formats to avoid misleading conclusions.

- Clear Visualization: Use charts and graphs to highlight key spending trends and anomalies for quick insights.

- Interactivity: Include filters or slicers to allow users to dynamically explore different categories or timeframes of expenses.

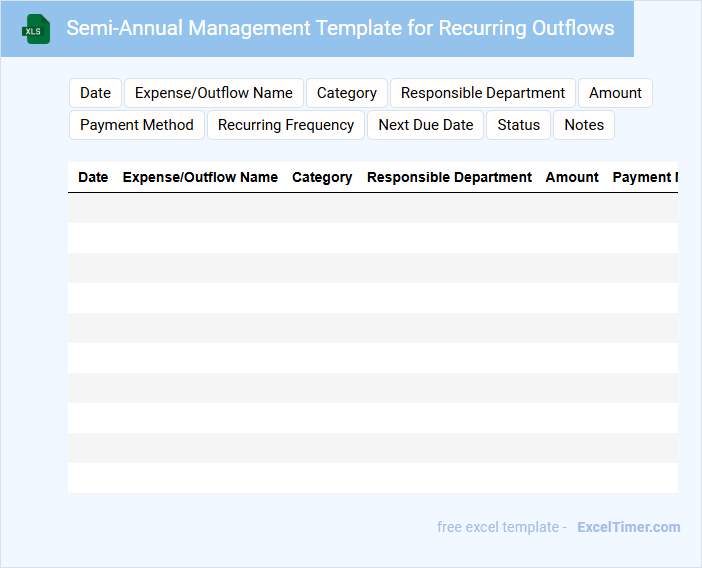

Semi-Annual Management Template for Recurring Outflows

The Semi-Annual Management Template for Recurring Outflows typically contains detailed financial tracking and forecasting information. It includes summaries of expenses, budget comparisons, and recurring payment schedules to facilitate effective cash flow management. This document is essential for identifying trends and ensuring timely payments in organizational financial planning.

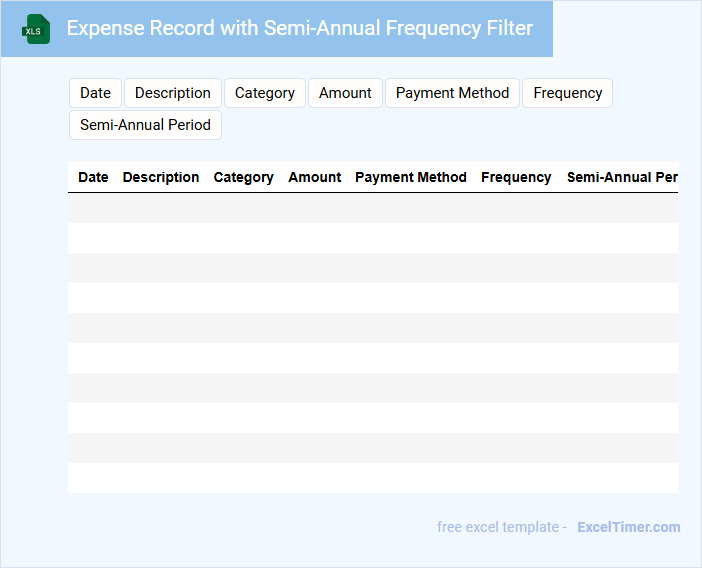

Expense Record with Semi-Annual Frequency Filter

What information is typically included in an Expense Record with a Semi-Annual Frequency Filter? This type of document usually contains detailed entries of expenses incurred over a six-month period, categorized by type, date, and amount. It helps in analyzing spending patterns and managing budgets more effectively by focusing on semi-annual financial data.

What is an important aspect to consider when using a Semi-Annual Frequency Filter in expense records? It is crucial to ensure all relevant expenses within the six-month timeframe are accurately recorded and categorized to provide a clear overview. Consistent updating and verification of entries help maintain reliable financial tracking and support better decision-making.

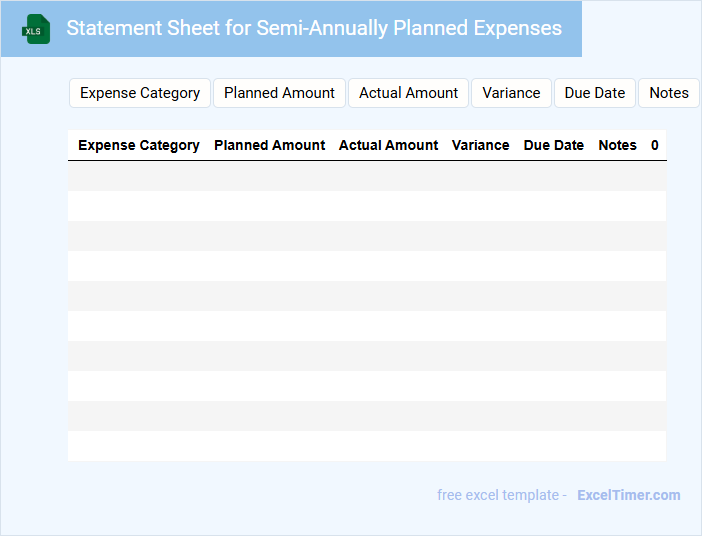

Statement Sheet for Semi-Annually Planned Expenses

A Statement Sheet for Semi-Annually Planned Expenses typically contains a detailed summary of anticipated costs over a six-month period. It outlines various expense categories, projected amounts, and payment schedules to ensure accurate financial planning. This document helps organizations manage cash flow and budget effectively for upcoming obligations.

How do you set up a semi-annual frequency for recurring expense entries in Excel?

To set up a semi-annual frequency for recurring expense entries in Excel, input the initial expense date, then use the formula =EDATE(start_date, 6) to calculate the next occurrence every six months. Create a series by dragging the formula down to cover all desired periods. Your Excel sheet will efficiently track expenses occurring twice a year with accurate date intervals.

What Excel formula can automate reminders for semi-annual expense due dates?

Use the Excel formula =IF(TODAY()>=EDATE(LastPaymentDate,6),"Expense Due","") to automate reminders for semi-annual recurring expenses. This formula compares the current date with a date six months after your last payment, triggering a notification when the expense is due. You can customize LastPaymentDate to your specific expense tracking sheet for effective semi-annual reminder automation.

Which columns are essential for effective semi-annual expense tracking in your spreadsheet?

Essential columns for semi-annual recurring expense tracking include Expense Name, Expense Category, Amount, Due Date, Payment Status, and Notes. These fields enable clear identification, categorization, and timely monitoring of expenses occurring every six months. Including a Last Payment Date column helps ensure accurate scheduling and budgeting for upcoming payments.

How can conditional formatting highlight overdue semi-annual recurring expenses?

Conditional formatting in Excel can highlight overdue semi-annual recurring expenses by using a formula that compares the next due date to today's date. You can set a rule to format cells in red when the expense due date is earlier than the current date, signaling an overdue payment. This visual cue helps you quickly identify and manage semi-annually recurring expenses that require immediate attention.

What method ensures accurate year-to-year comparisons of semi-annual expenses in Excel?

Use consistent date formatting and categorize expenses by fiscal periods to ensure accurate year-to-year comparisons of semi-annual expenses in Excel. Implement pivot tables to summarize and analyze recurring expense data efficiently. Apply cell formulas like SUMIFS to dynamically calculate expenses within specified semi-annual date ranges.