The Semi-annually Tax Estimator Excel Template for Independent Contractors simplifies tracking and calculating tax liabilities every six months, ensuring accurate financial planning. It helps independent contractors stay compliant with tax regulations by estimating quarterly payments based on income and deductions. Utilizing this template reduces the risk of underpayment penalties and improves cash flow management throughout the year.

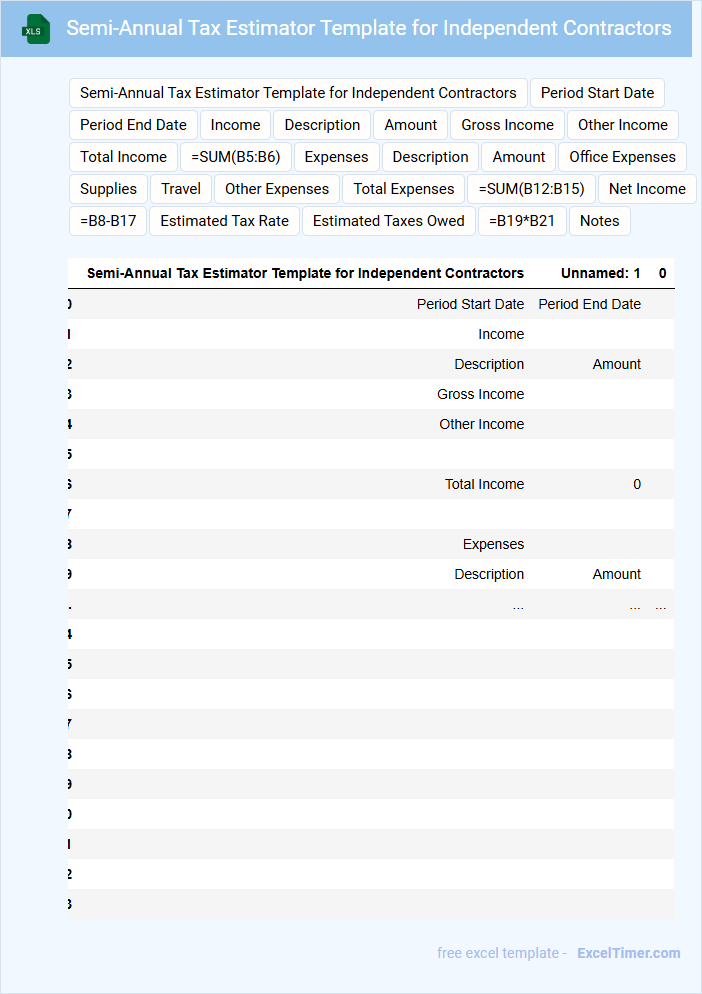

Semi-Annual Tax Estimator Template for Independent Contractors

The Semi-Annual Tax Estimator Template is designed to help independent contractors accurately estimate their tax liabilities every six months. This document typically contains sections for reporting income, calculating deductible expenses, and estimating quarterly tax payments. Keeping detailed and organized records within this template ensures proper tax planning and avoids potential penalties.

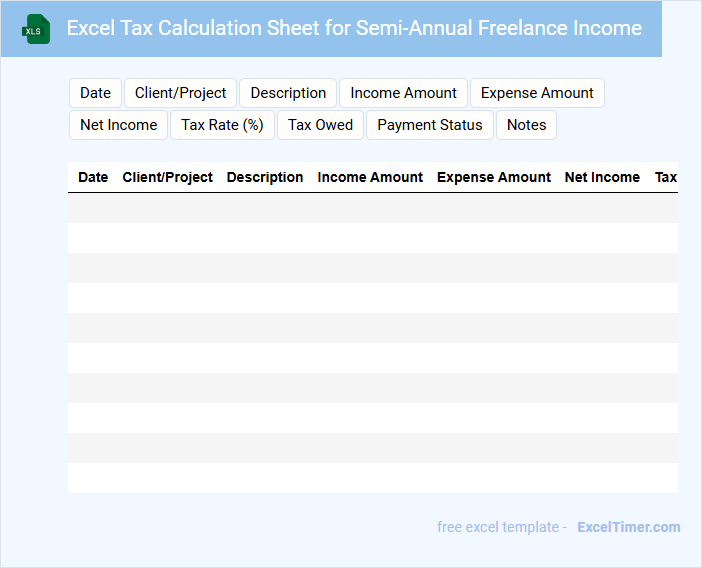

Excel Tax Calculation Sheet for Semi-Annual Freelance Income

An Excel Tax Calculation Sheet for Semi-Annual Freelance Income typically contains detailed income tracking, expense categorization, and tax liability estimation.

- Income Tracking: Records all freelance earnings within the specified semi-annual period for accurate reporting.

- Expense Categorization: Separates deductible expenses to minimize taxable income effectively.

- Tax Liability Estimation: Calculates estimated taxes owed based on income and applicable tax rates.

Semi-Annual Income Tax Estimator with Deduction Tracker

The Semi-Annual Income Tax Estimator is a document designed to help individuals or businesses estimate their tax liabilities for a six-month period. It typically contains income summaries, tax rates, and projected deductions to provide an accurate tax forecast.

Incorporating a Deduction Tracker within this estimator allows users to monitor eligible expenses that reduce taxable income effectively. This combination helps ensure better financial planning and timely tax payments.

Federal and State Tax Estimator for Independent Contractors (Semi-Annually)

This document typically contains a detailed breakdown of estimated federal and state taxes that an independent contractor must pay on a semi-annual basis. It includes income projections, applicable tax rates, and deductions specific to contractor earnings.

Important elements include instructions on calculating quarterly payments, deadlines, and potential penalties for underpayment. Keeping accurate records and regularly updating income estimates are essential for compliance and avoiding surprises at tax time.

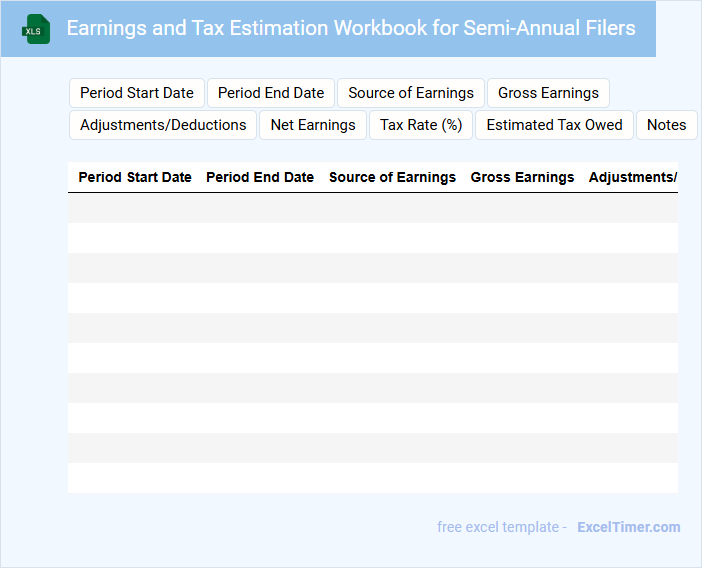

Earnings and Tax Estimation Workbook for Semi-Annual Filers

This document typically contains detailed financial data and projections to help semi-annual filers accurately estimate their earnings and tax obligations.

- Comprehensive Income Details: Ensure all earnings sources for the period are thoroughly recorded to avoid miscalculations.

- Tax Liability Calculations: Review tax rates and deductions applicable to semi-annual filers for precise estimation.

- Filing Deadlines and Compliance: Keep track of important dates to ensure timely submissions and avoid penalties.

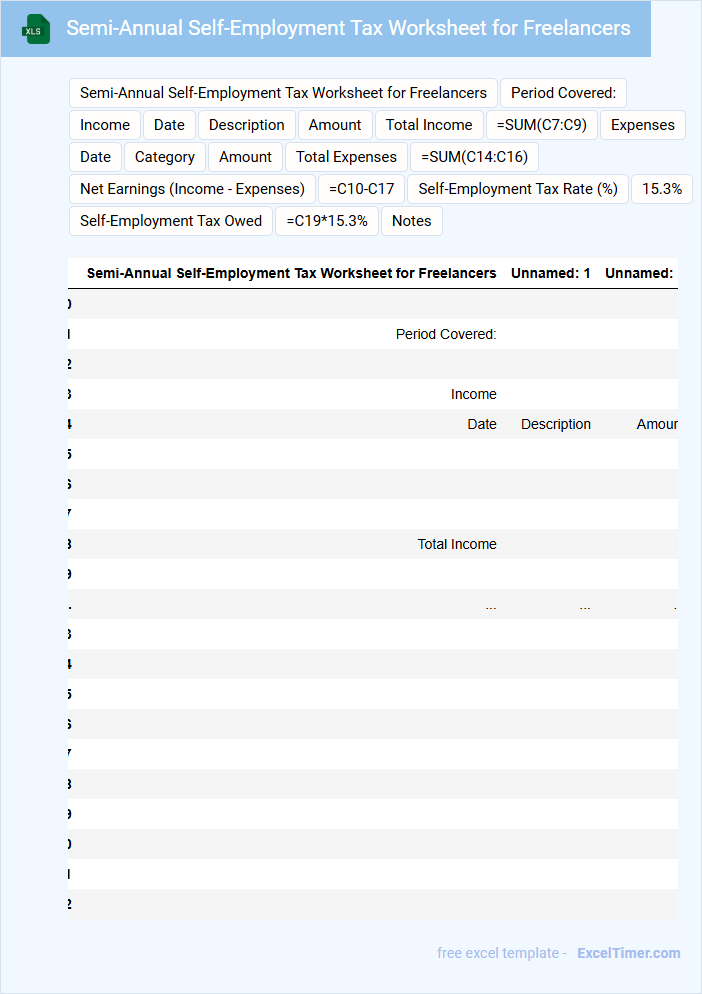

Semi-Annual Self-Employment Tax Worksheet for Freelancers

The Semi-Annual Self-Employment Tax Worksheet for freelancers typically contains detailed income records and calculated estimated tax payments due every six months. It helps freelancers track earnings and calculate obligations to avoid penalties.

This document is essential for managing tax compliance and ensuring timely payments of Social Security and Medicare taxes. Accurate record-keeping and regular updates to the worksheet are crucial for financial planning.

Excel Template for Semi-Annual Tax Planning of Contractors

An Excel Template for Semi-Annual Tax Planning of contractors typically contains detailed sections for tracking income, expenses, and tax deductions relevant to self-employed individuals. It helps organize financial data systematically, ensuring accuracy in quarterly estimates and compliance with tax regulations. This document is essential for contractors to efficiently manage their finances and avoid last-minute tax filing issues.

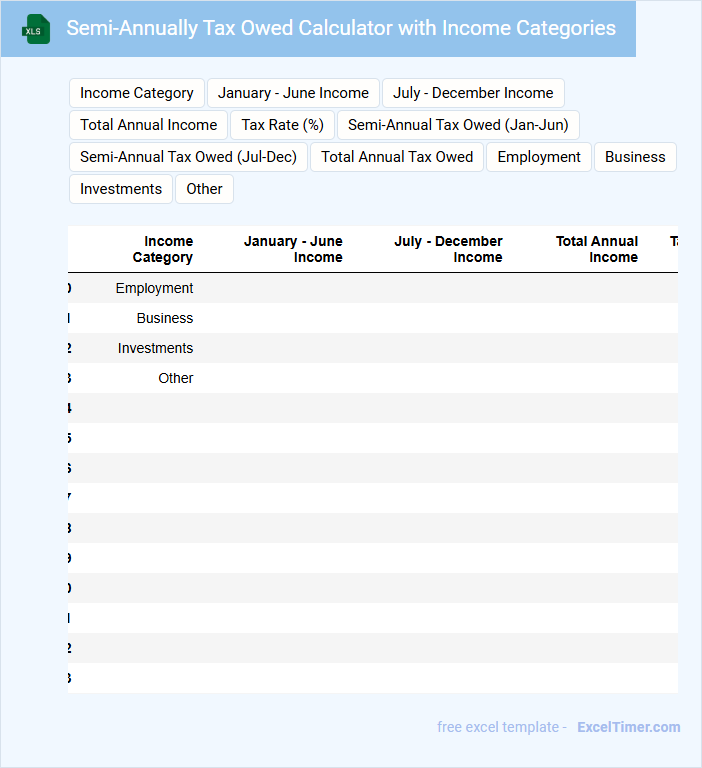

Semi-Annually Tax Owed Calculator with Income Categories

This document typically contains fields for income input, categorized income types, and calculated tax amounts due on a semi-annual basis. It helps users estimate their tax liabilities by organizing income sources and applying relevant tax rates.

- Include clear income categories such as wages, investments, and self-employment income for precise calculations.

- Provide real-time calculation of tax owed to enhance user understanding and timely payment planning.

- Incorporate reminders about deadlines and penalties associated with semi-annual tax payments.

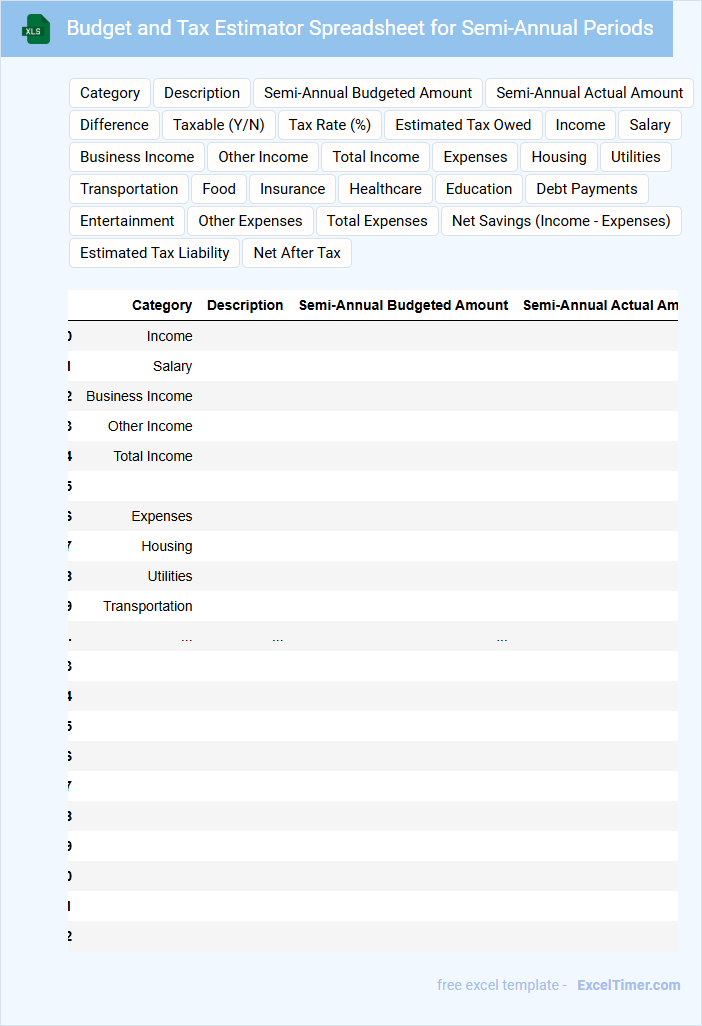

Budget and Tax Estimator Spreadsheet for Semi-Annual Periods

A Budget and Tax Estimator Spreadsheet for Semi-Annual Periods typically contains detailed financial projections, including income, expenses, and estimated tax obligations split into two six-month intervals. It helps individuals or businesses plan their finances efficiently by providing a clear overview of periodic cash flow and tax liabilities. Important elements to include are accurate income sources, deductible expenses, and updated tax rates to ensure reliable estimates.

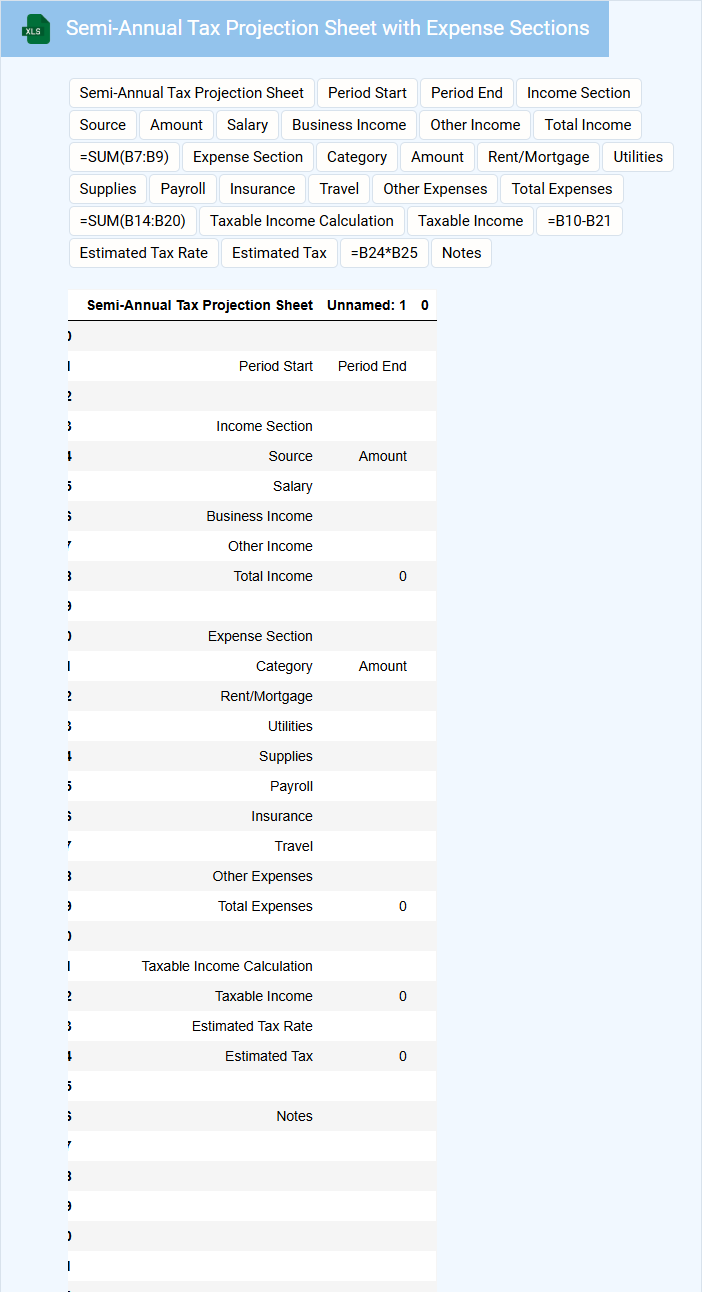

Semi-Annual Tax Projection Sheet with Expense Sections

A Semi-Annual Tax Projection Sheet typically contains estimated income, tax liabilities, and deductions expected over a six-month period. It helps individuals or businesses plan for upcoming tax payments and avoid surprises at year-end.

The document usually includes detailed expense sections categorized by type to track deductible costs and optimize tax savings. Maintaining accurate and updated expense records is crucial for precise projections and effective financial management.

Estimated Tax Payments Tracker for Independent Contractors (Semi-Annual)

The Estimated Tax Payments Tracker is a document used by independent contractors to record and monitor their tax payments made throughout the year. It helps ensure accuracy in tracking payments against expected tax liabilities.

This tracker is typically updated on a semi-annual basis to reflect payments due at mid-year and year-end. Keeping detailed records of payment dates and amounts is essential for avoiding penalties and managing cash flow efficiently.

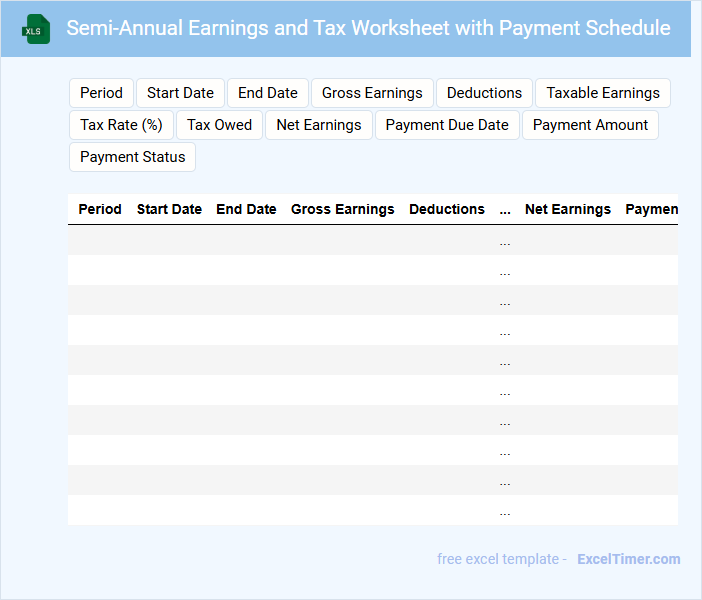

Semi-Annual Earnings and Tax Worksheet with Payment Schedule

A Semi-Annual Earnings and Tax Worksheet with Payment Schedule typically contains detailed income records, tax calculations, and a timeline for tax payments to help individuals or businesses manage their fiscal responsibilities efficiently.

- Accurate Income Reporting: Ensure all earnings are precisely documented to avoid discrepancies during tax assessments.

- Tax Calculation Clarity: Clearly list applicable tax rates and deductions to reflect the correct tax liabilities.

- Payment Schedule Awareness: Highlight important tax payment deadlines to prevent penalties and interest charges.

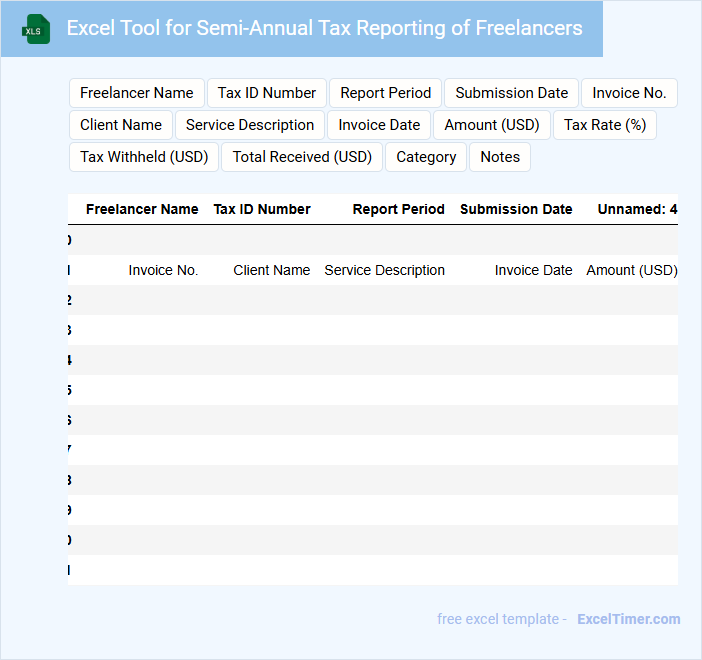

Excel Tool for Semi-Annual Tax Reporting of Freelancers

What does an Excel tool for semi-annual tax reporting of freelancers typically contain? This type of document usually includes organized sheets for tracking income, expenses, and tax calculations tailored for freelancers' specific needs. It helps users systematically record financial data and generate reports necessary for accurate tax submissions twice a year.

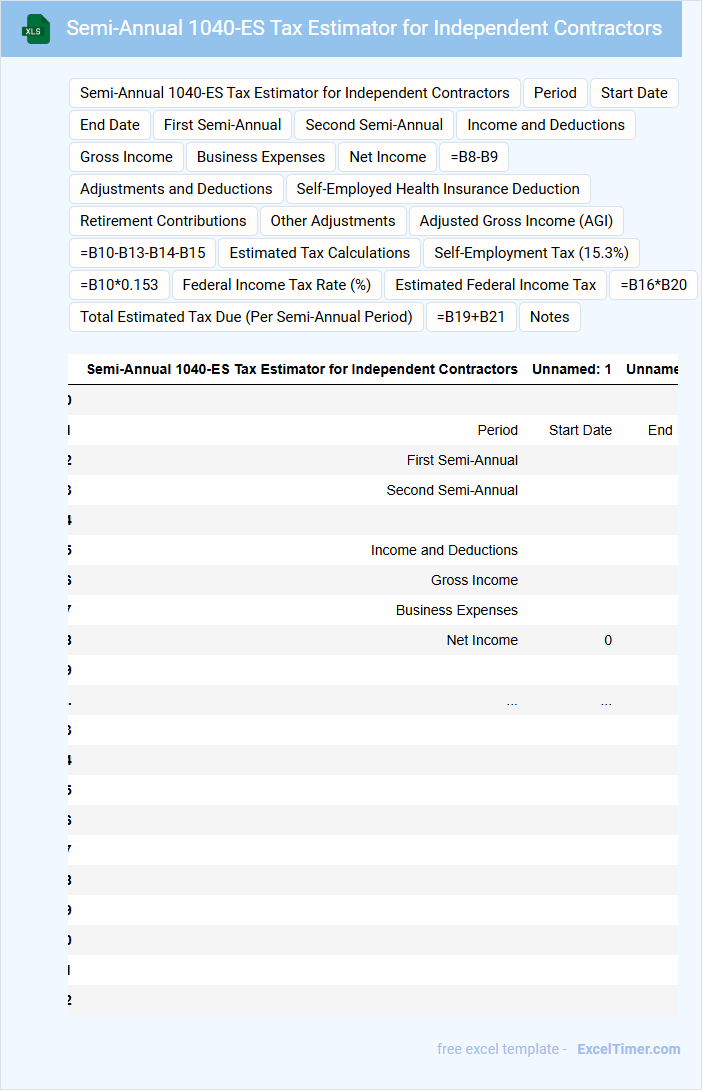

Semi-Annual 1040-ES Tax Estimator for Independent Contractors

The Semi-Annual 1040-ES Tax Estimator is a crucial document for independent contractors to approximate their federal income tax payments. It typically contains estimated income, deductions, and tax payment schedules for the relevant period. This tool helps in avoiding underpayment penalties by ensuring timely and accurate tax planning.

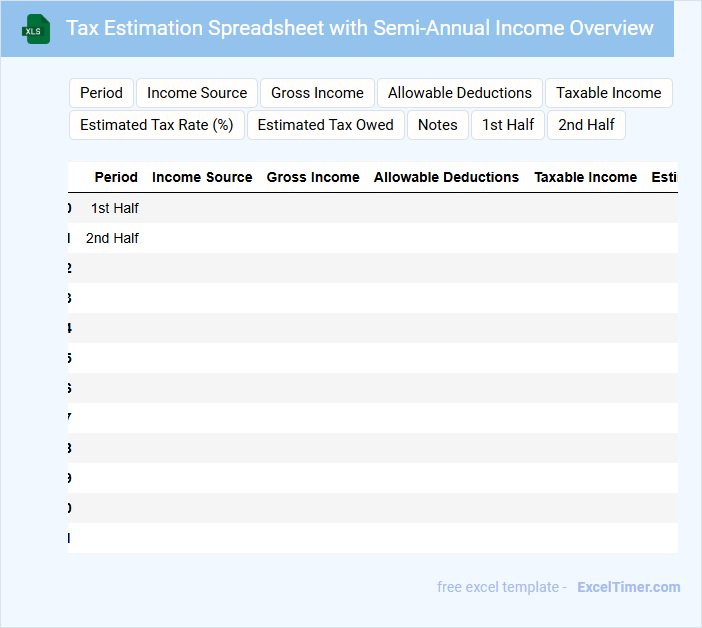

Tax Estimation Spreadsheet with Semi-Annual Income Overview

A Tax Estimation Spreadsheet with Semi-Annual Income Overview typically contains detailed income data divided into two six-month periods to help individuals or businesses estimate their tax liabilities more accurately. It allows users to track and analyze income trends over each half of the year for better financial planning.

- Include clear sections for income sources, deductions, and tax rates for each semi-annual period.

- Ensure automatic calculations for estimated taxes based on current tax laws are included.

- Provide visual summaries such as charts or graphs to highlight income and tax estimation changes across the year.

What are the key input fields required in an Excel semi-annual tax estimator for independent contractors?

Key input fields for a semi-annual tax estimator for independent contractors include gross income for the six-month period, allowable business expenses, and estimated withholding or prepayments. Tax rates based on current federal and state guidelines, along with self-employment tax percentages, are essential for accurate calculations. Input fields for deductions such as retirement contributions and health insurance premiums enhance the precision of the tax estimate.

How does the estimator calculate federal, state, and self-employment tax liabilities for a six-month period?

The Semi-annually Tax Estimator calculates federal, state, and self-employment tax liabilities by estimating income earned over a six-month period and applying current tax rates and brackets specific to independent contractors. It factors in allowable deductions and credits to determine taxable income and prorates tax obligations accordingly. The estimator uses IRS guidelines and relevant state tax codes to provide accurate semi-annual tax liability projections.

What formulas are used to project total taxable income and allowable expense deductions?

The Semi-annually Tax Estimator for Independent Contractors uses SUM and IF formulas to project total taxable income and allowable expense deductions accurately. Your taxable income is calculated by summing all revenue entries, while allowable expense deductions are determined using conditional IF statements to include only valid expenses. These formulas ensure precise estimations for semi-annual tax planning.

How is estimated quarterly or semi-annual tax payment tracking structured within the document?

The Semi-annually Tax Estimator for Independent Contractors organizes estimated tax payments by clearly segmented periods, typically splitting the fiscal year into two or four payment intervals. Each section includes input fields for income projections, tax rates, and payment dates to calculate and track owed amounts. Detailed summaries display cumulative tax liabilities and payment balances to help contractors manage deadlines and avoid penalties.

What summary outputs and visualizations (e.g., charts or tables) are included to help users understand their tax obligations?

The Semi-annually Tax Estimator for Independent Contractors includes summary outputs such as estimated tax liability, total income, deductible expenses, and quarterly payment breakdowns. Visualizations feature bar charts comparing tax owed versus payments made and pie charts illustrating expense categories. Tables provide detailed itemized income and expense records alongside tax rate application summaries for clear financial tracking.