Weekly Cash Flow Excel Template for Home-based Businesses helps track income and expenses efficiently, ensuring accurate financial management. This template simplifies budgeting by organizing cash inflows and outflows on a weekly basis, providing clear visibility into business liquidity. Maintaining consistent cash flow records is crucial for making informed decisions and sustaining business growth.

Weekly Cash Flow Tracker for Home-Based Businesses

A Weekly Cash Flow Tracker for home-based businesses is a valuable document that records all cash inflows and outflows on a weekly basis to monitor financial health. It typically contains sections for income sources, expenses, and net cash flow, enabling business owners to stay organized and make informed financial decisions. Important aspects to include are accurate categorization of transactions, regular updates, and a summary of weekly balances to identify trends and manage liquidity effectively.

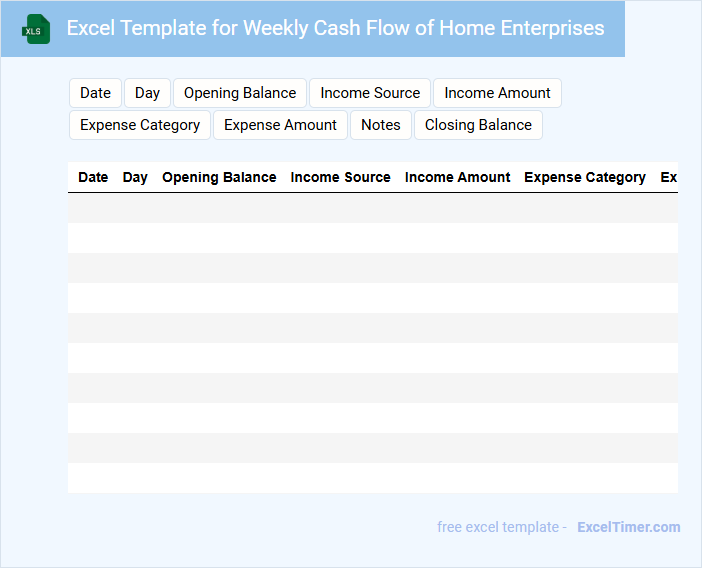

Excel Template for Weekly Cash Flow of Home Enterprises

What information is typically included in an Excel template for the weekly cash flow of home enterprises? This type of document usually contains sections for tracking income, expenses, and net cash flow on a weekly basis to help monitor financial health. It also includes categories for different revenue streams and cost types, allowing users to analyze their cash movement systematically.

What is an important consideration when using this template? Ensuring accurate and timely data entry is crucial for meaningful insights, so users should regularly update figures and reconcile them with actual bank statements. Additionally, including a section for forecasting can help predict future cash flow trends and support better financial planning.

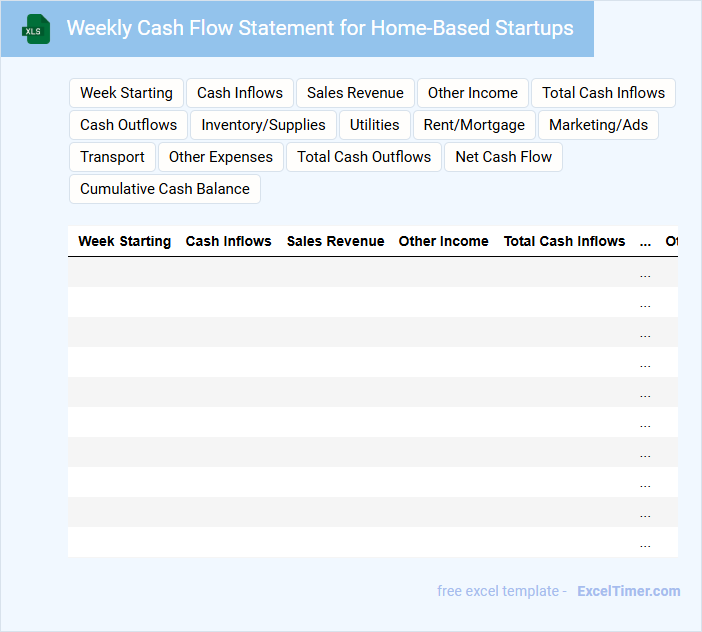

Weekly Cash Flow Statement for Home-Based Startups

A Weekly Cash Flow Statement for home-based startups is a crucial financial document that tracks the inflow and outflow of cash within a seven-day period. It provides insight into the startup's liquidity, helping to ensure that the business can meet its short-term obligations. Key components usually include revenues, expenses, and net cash flow, which facilitate informed decision-making and budgeting.

When preparing this statement, it is important to accurately record all income sources and categorize expenses to identify cost-saving opportunities. Including a detailed breakdown of fixed and variable costs will provide clarity and assist in forecasting future cash needs. Regularly updating the statement helps maintain financial stability and avoid cash shortages.

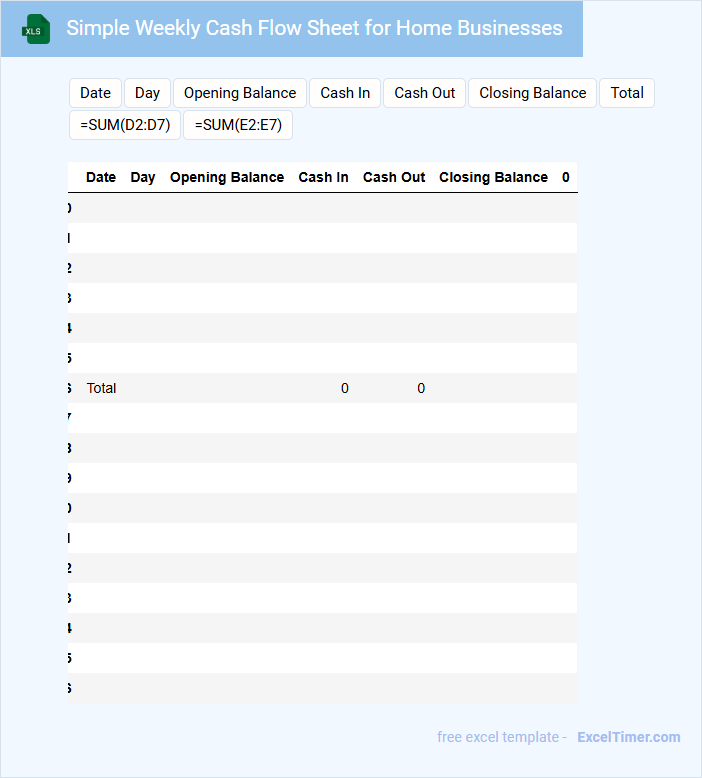

Simple Weekly Cash Flow Sheet for Home Businesses

A Simple Weekly Cash Flow Sheet for Home Businesses typically contains essential financial tracking elements to manage income and expenses effectively.

- Income tracking: records all sources of revenue received during the week.

- Expense monitoring: lists all costs and payments made to keep the business running.

- Cash balance calculation: shows the remaining cash on hand after accounting for income and expenses.

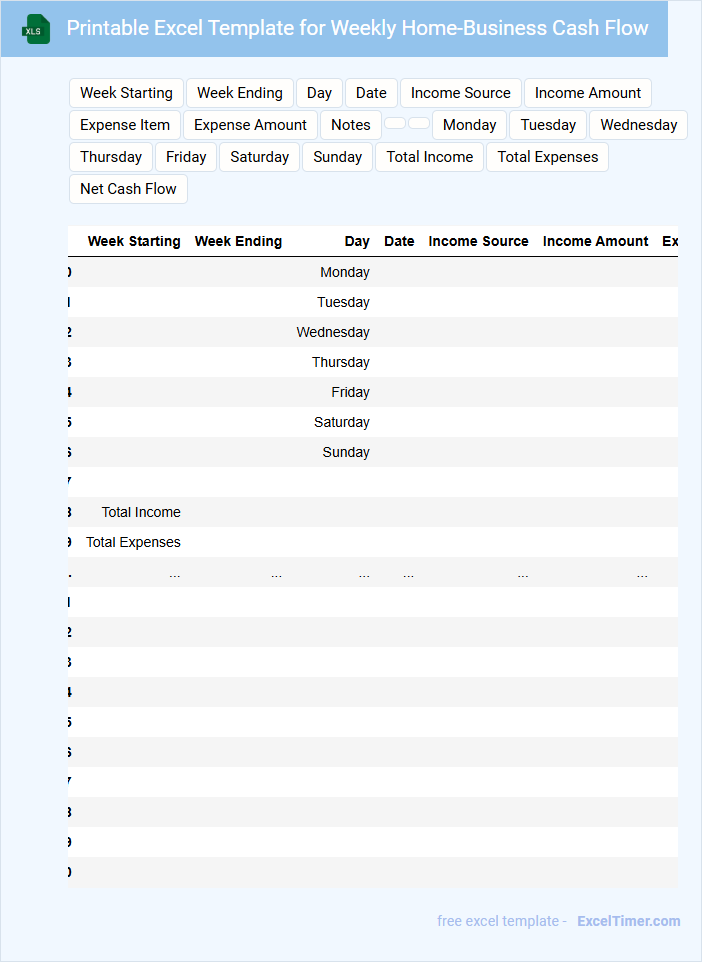

Printable Excel Template for Weekly Home-Business Cash Flow

A Printable Excel Template for Weekly Home-Business Cash Flow typically contains sections for tracking income, expenses, and overall cash balance for each week. It helps users monitor financial performance and maintain accurate records for budgeting and tax purposes. Including formulas for automatic calculations enhances efficiency and reduces errors.

Cash Flow Management Spreadsheet for Weekly Home Operations

What information is typically included in a Cash Flow Management Spreadsheet for Weekly Home Operations? This document usually contains detailed records of all income and expenses incurred each week to help track household finances efficiently. It provides a clear overview of cash inflows and outflows, enabling better budget planning and financial decision-making for home management.

What are important elements to include in such a spreadsheet? Essential components include categorized expense tracking (e.g., utilities, groceries, and maintenance), income sources, and running totals to monitor weekly cash flow trends. Additionally, incorporating sections for savings goals and unexpected expenses helps ensure thorough financial preparedness for the household.

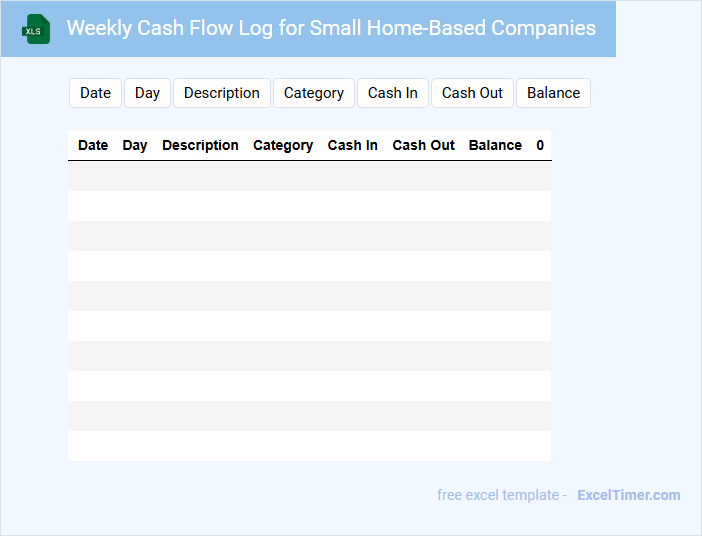

Weekly Cash Flow Log for Small Home-Based Companies

A Weekly Cash Flow Log for small home-based companies typically contains detailed records of all cash inflows and outflows within the week. It helps track the liquidity by documenting sales, expenses, and any other financial transactions. This document is crucial for maintaining accurate financial oversight and planning effective budgeting strategies.

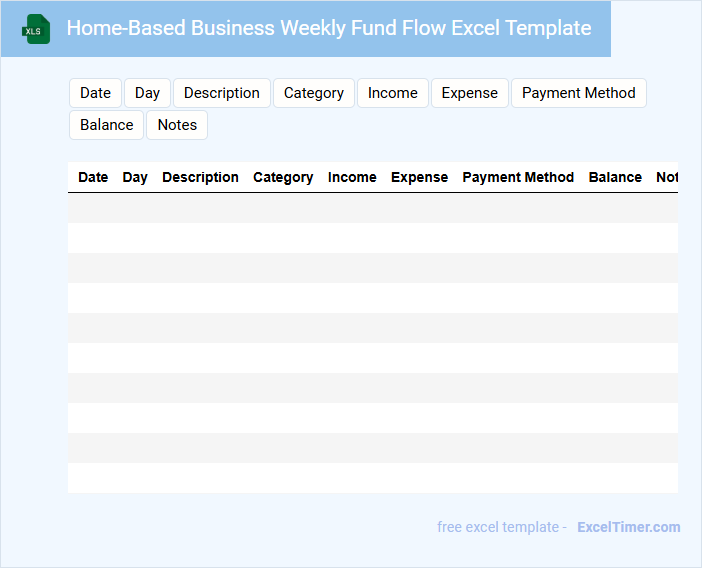

Home-Based Business Weekly Fund Flow Excel Template

What does a Home-Based Business Weekly Fund Flow Excel Template usually contain and why is it important? This document typically includes detailed records of weekly cash inflows and outflows, tracking the movement of funds to ensure financial stability. It is essential for monitoring profitability, managing expenses, and making informed decisions to sustain and grow a home-based business effectively.

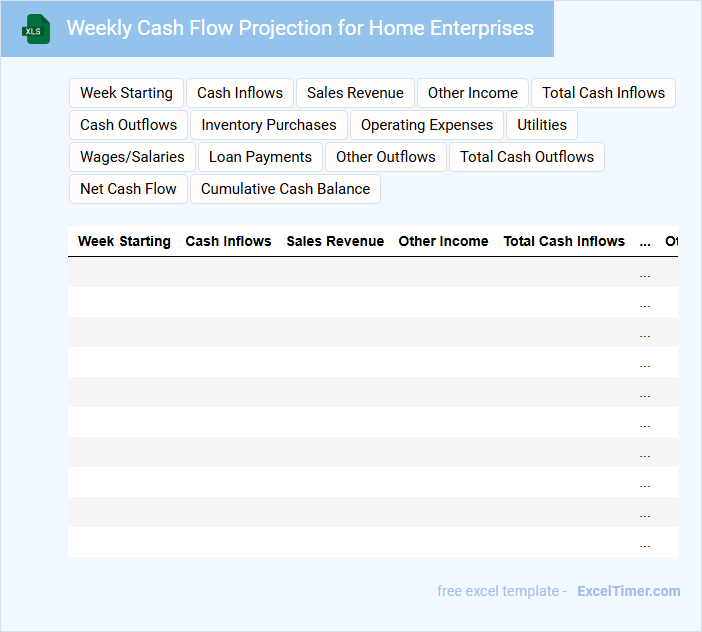

Weekly Cash Flow Projection for Home Enterprises

Weekly Cash Flow Projection for Home Enterprises is a crucial financial document that estimates the cash inflows and outflows for a home-based business over a week. It typically contains sales forecasts, anticipated expenses, and net cash positions to help manage liquidity effectively. Accurate and timely updates ensure the business maintains sufficient cash to cover obligations and plan for growth.

Excel Budget Tracker with Weekly Cash Flow for Home Business

This document typically contains detailed financial records and projections tailored for managing a home business's budget and weekly cash flow.

- Income Tracking: Regularly document all sources of revenue to maintain accurate cash flow summaries.

- Expense Categorization: Organize expenses into meaningful categories to identify saving opportunities.

- Weekly Analysis: Review cash flow weekly to anticipate shortfalls and ensure financial stability.

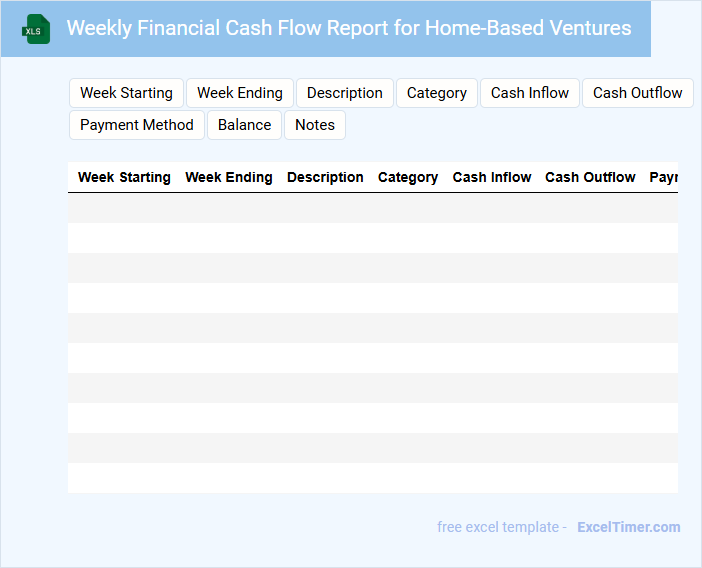

Weekly Financial Cash Flow Report for Home-Based Ventures

The Weekly Financial Cash Flow Report is a document that tracks the inflow and outflow of cash within a home-based business over a one-week period. It provides a detailed summary of revenue, expenses, and net cash position, helping to ensure financial stability.

Such reports are essential for monitoring liquidity, forecasting short-term financial needs, and making informed budgeting decisions. It is important to maintain accuracy and update the report consistently to reflect real-time financial health.

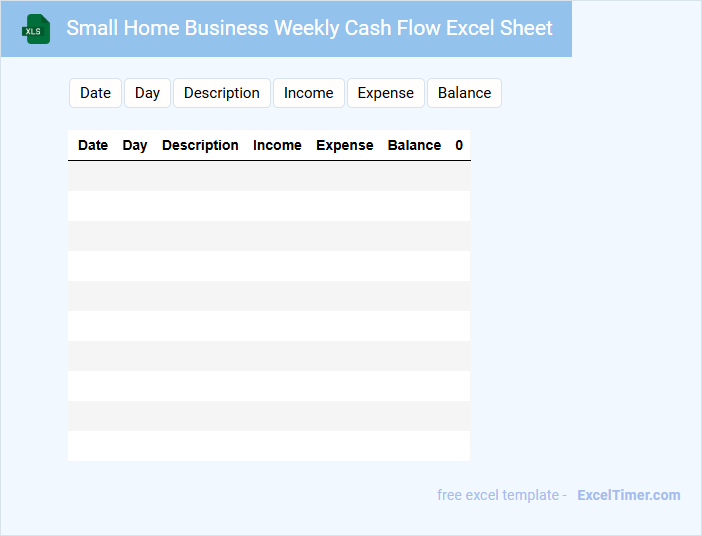

Small Home Business Weekly Cash Flow Excel Sheet

What information is typically included in a Small Home Business Weekly Cash Flow Excel Sheet? This document usually contains detailed records of weekly cash inflows and outflows, including sales revenue, expenses, and net cash flow. It helps business owners monitor financial health and manage cash effectively on a short-term basis.

What are important features to include in this cash flow sheet? It is essential to incorporate accurate categories for income and expenses, clear date labels, and automatic calculations for totals and balances. Additionally, including visual charts for cash trends can enhance quick understanding and decision-making.

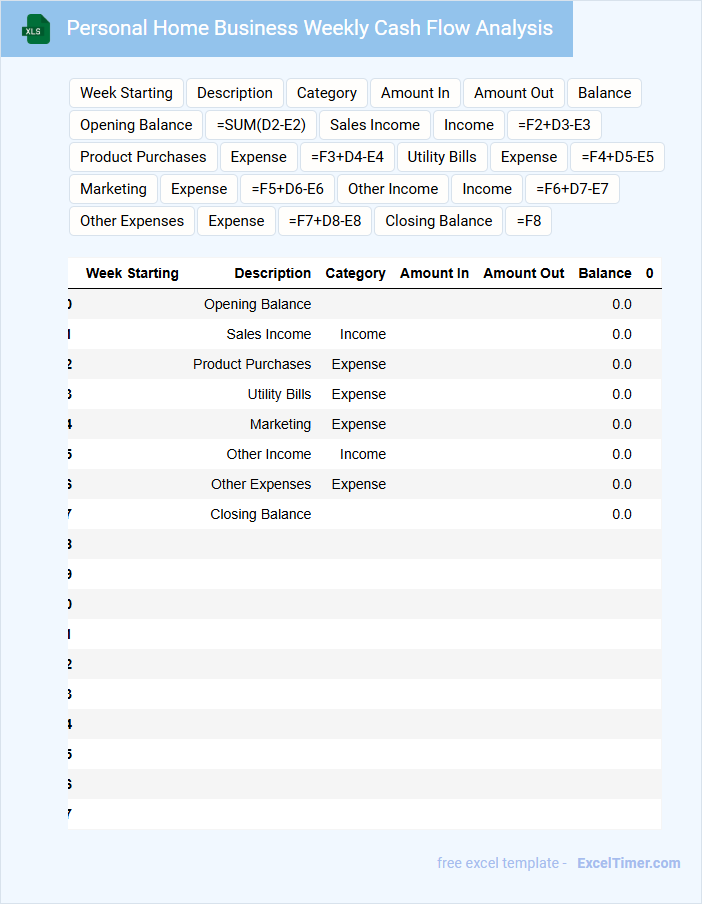

Personal Home Business Weekly Cash Flow Analysis

The Personal Home Business Weekly Cash Flow Analysis document typically contains detailed records of all cash inflows and outflows within a week. It helps track how money is moving through the business to ensure liquidity and operational stability.

Important considerations include monitoring expenses closely to avoid overspending and identifying patterns in revenue for better forecasting. This analysis supports making informed financial decisions for sustainable growth.

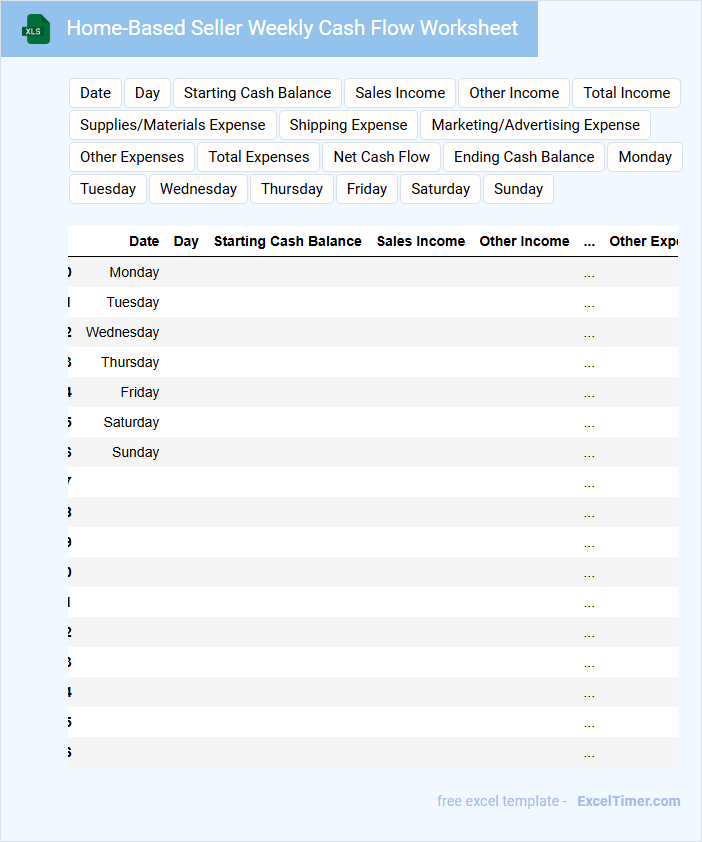

Home-Based Seller Weekly Cash Flow Worksheet

A Home-Based Seller Weekly Cash Flow Worksheet is a financial document used by small business owners to track income and expenses on a weekly basis. It helps sellers maintain a clear overview of cash flow to manage budgets effectively.

- Include all sources of revenue, such as sales and refunds.

- Record every expense, including inventory, shipping, and marketing costs.

- Regularly update the worksheet to monitor cash flow trends accurately.

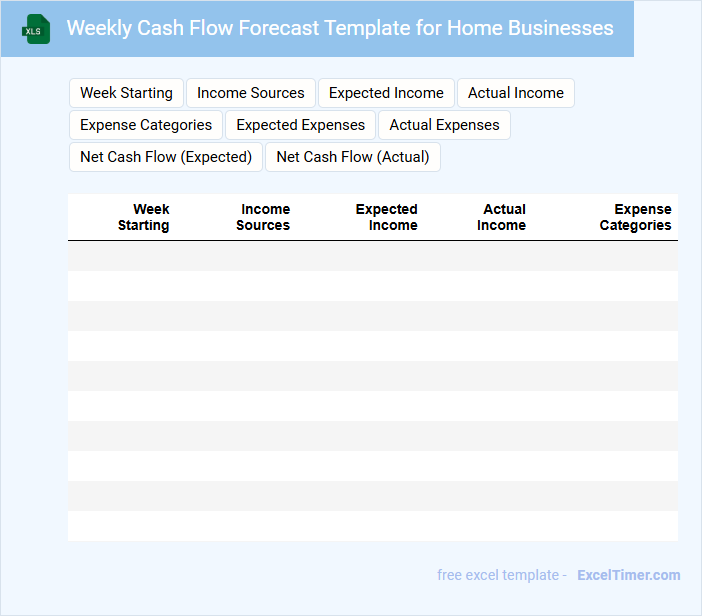

Weekly Cash Flow Forecast Template for Home Businesses

A Weekly Cash Flow Forecast Template for home businesses is a vital financial tool that helps track and predict cash inflows and outflows over a week. It typically contains sections for expected income, planned expenses, and net cash position to ensure business liquidity. Using this template regularly helps home business owners manage their finances effectively and avoid unexpected shortfalls.

What are the key components to include in a weekly cash flow sheet for a home-based business?

A weekly cash flow sheet for a home-based business should include key components such as starting cash balance, total cash inflows from sales and other income, and total cash outflows including expenses like supplies, utilities, and marketing. Tracking net cash flow by subtracting outflows from inflows helps monitor financial health and liquidity. Including estimated and actual amounts allows for accurate forecasting and effective cash management.

How should you categorize and track regular and one-time expenses in your cash flow document?

Categorize regular expenses as recurring costs such as rent, utilities, and subscriptions, while one-time expenses should be logged separately under special or non-recurring costs. Track each expense with date, amount, and description to maintain clear cash flow visibility. Use separate columns or tabs in your Excel document to differentiate these expense types for accurate financial analysis.

What formula should you use in Excel to calculate net cash flow for each week?

Use the formula `=SUM(WeeklyCashInflows) - SUM(WeeklyCashOutflows)` to calculate net cash flow for each week in an Excel document for home-based businesses. Replace `WeeklyCashInflows` and `WeeklyCashOutflows` with the cell ranges containing your specific cash inflow and outflow data. This formula accurately captures the difference between total cash received and total cash spent weekly.

How can conditional formatting help identify negative cash flow trends in your spreadsheet?

Conditional formatting in Excel highlights negative cash flow values by applying distinct colors or icons, enabling quick identification of financial downturns. Setting rules to flag cells with cash outflows exceeding inflows helps monitor weekly trends visually. This technique supports proactive management by signaling potential liquidity issues in home-based business cash flow sheets.

What is the best way to use Excel charts to visually represent changes in weekly cash inflows and outflows?

Use line charts in Excel to clearly display trends in weekly cash inflows and outflows for home-based businesses. Employ separate lines with distinct colors for inflows and outflows to enhance comparison and identify patterns. Incorporate data labels and a time-based axis to improve clarity and facilitate timely cash flow analysis.