The Weekly Excel Template for Personal Budgeting helps track income and expenses efficiently on a weekly basis, ensuring better financial control. It includes customizable categories and automatic calculations to simplify budget management. Using this template regularly promotes disciplined spending and savings habits.

Weekly Expense Tracker for Personal Budgeting

A Weekly Expense Tracker is a document designed to monitor and record all personal expenses on a weekly basis. It typically contains categories such as food, transportation, entertainment, and utilities to help users understand their spending patterns. This tool is essential for effective personal budgeting and financial planning.

To optimize your tracking, ensure you consistently update the tracker with accurate expense entries and categorize each expenditure clearly. Setting weekly spending limits for each category can help maintain control over finances and avoid overspending. Regularly reviewing the tracker allows for identifying unnecessary expenses and adjusting your budget accordingly.

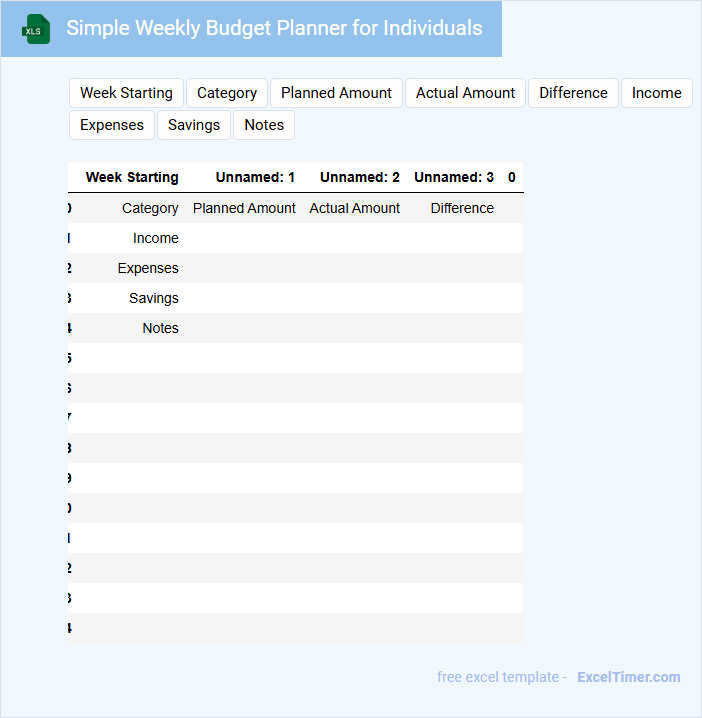

Simple Weekly Budget Planner for Individuals

What information is typically included in a Simple Weekly Budget Planner for Individuals? A Simple Weekly Budget Planner usually contains sections for tracking income sources, listing weekly expenses, and monitoring savings goals. It helps individuals manage their finances by providing a clear overview of their spending habits and ensuring they stay within their budget limits.

What is an important aspect to consider when using a weekly budget planner? Consistently updating the planner with actual expenses and income ensures accuracy and helps identify spending patterns. Additionally, prioritizing essential expenses and setting realistic savings targets can improve financial discipline and achieve monetary goals effectively.

Weekly Income and Expense Sheet for Personal Use

A Weekly Income and Expense Sheet for Personal Use is a financial tracking document designed to record and monitor weekly earnings and expenditures. It typically contains sections for categorizing income sources and detailed expense entries for better budgeting. This document helps individuals maintain control over their cash flow and identify spending patterns.

Weekly Savings Tracker for Personal Budgeting

A Weekly Savings Tracker is a document designed to monitor and manage personal finances by recording savings on a weekly basis. It typically contains columns for the date, amount saved, and notes about spending habits or goals. To optimize its effectiveness, ensure it includes clear categories and regular review prompts to encourage consistent budgeting and financial awareness.

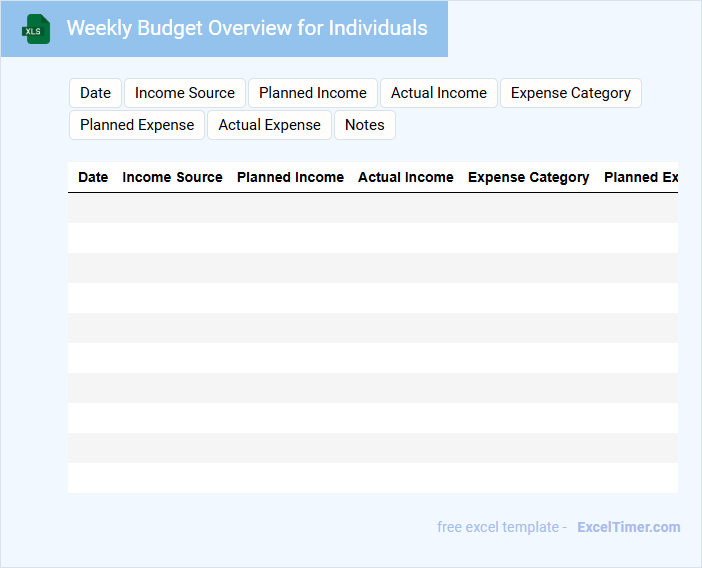

Weekly Budget Overview for Individuals

A Weekly Budget Overview for Individuals typically outlines income, expenses, and savings plans over a seven-day period to help manage personal finances effectively. It provides a clear snapshot of financial inflows and outflows to maintain fiscal discipline.

- Track all sources of income and categorize expenses for accurate budgeting.

- Set realistic spending limits to avoid overspending during the week.

- Review the budget regularly to adjust for unexpected costs and savings goals.

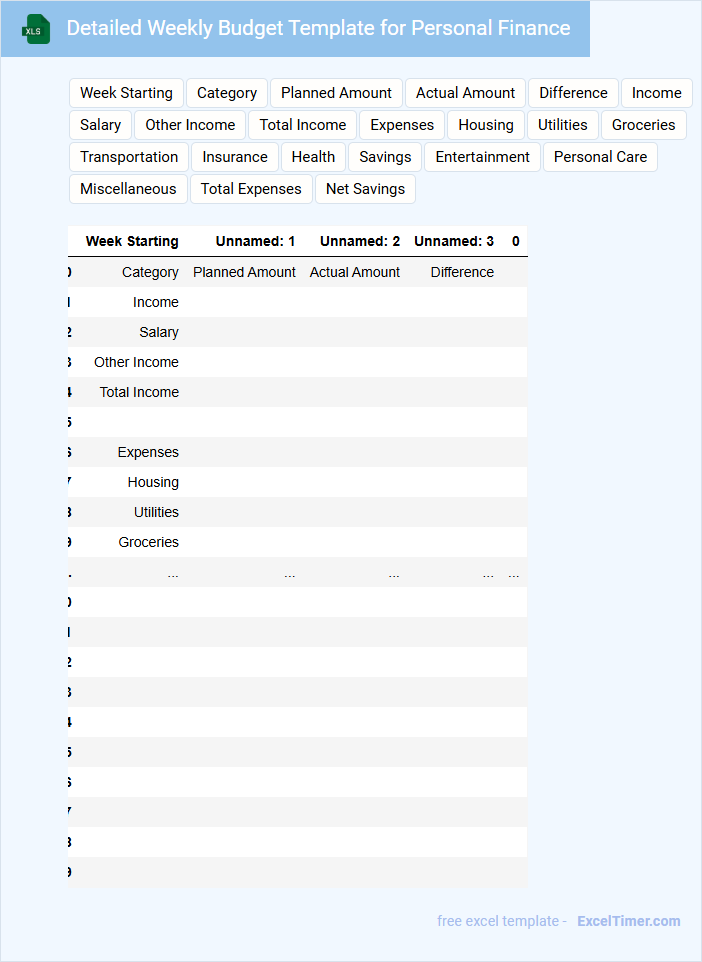

Detailed Weekly Budget Template for Personal Finance

A Detailed Weekly Budget Template typically includes income sources, fixed and variable expenses, and savings goals. It helps track spending patterns over each week to maintain financial discipline.

For Personal Finance, it's important to categorize expenses clearly and update the budget regularly. This ensures better control over finances and aids in achieving financial objectives.

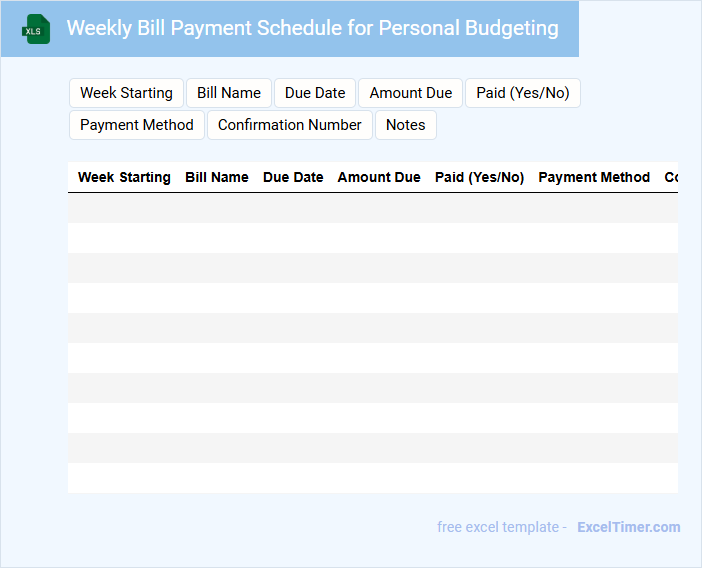

Weekly Bill Payment Schedule for Personal Budgeting

A Weekly Bill Payment Schedule for Personal Budgeting is a document that helps track and organize all recurring bill payments within a week to manage personal finances effectively. It ensures timely payments and prevents missed deadlines.

- List all recurring bills with due dates to avoid late fees.

- Include payment amounts and method (e.g., online, check) for clarity.

- Update the schedule weekly to reflect any changes in bills or income.

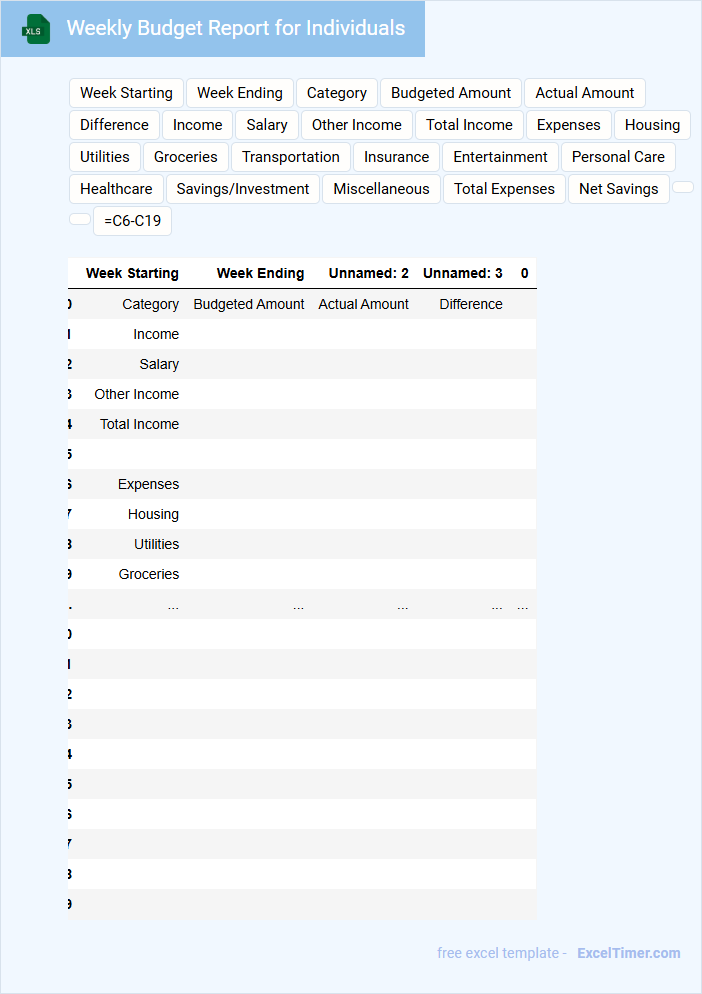

Weekly Budget Report for Individuals

A Weekly Budget Report for individuals typically includes a detailed summary of income, expenses, and savings over a seven-day period. It helps track spending habits and identify areas where adjustments are needed to maintain financial health. Key components often consist of categorized expenditures, total income, and a comparison against the planned budget.

Important elements to include are accurate tracking of all income sources, clear categorization of expenses, and notes on any unexpected costs. Visual aids like charts or graphs can enhance understanding and highlight trends. Regular review of this report promotes better financial decision-making and goal achievement.

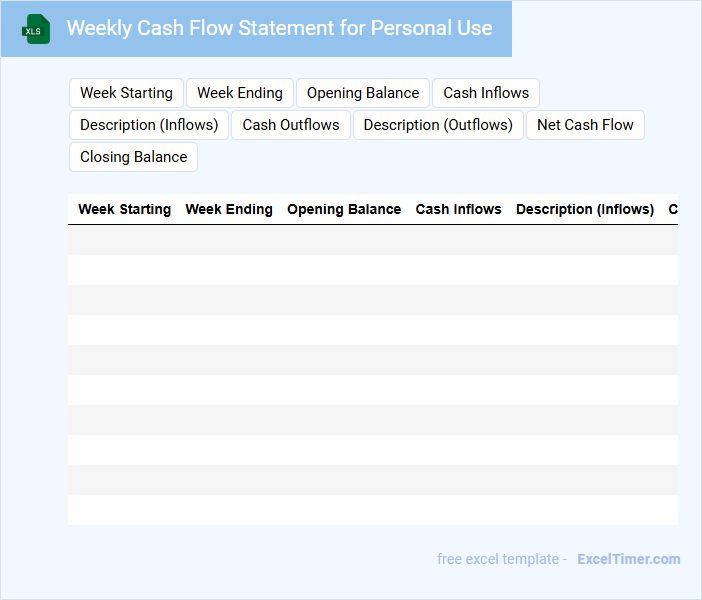

Weekly Cash Flow Statement for Personal Use

A Weekly Cash Flow Statement for personal use is a financial document that tracks income and expenses on a weekly basis. It helps individuals monitor their cash inflows and outflows to maintain a balanced budget. This statement is essential for identifying spending patterns and ensuring sufficient funds for upcoming needs.

Important elements to include are all sources of income, fixed and variable expenses, and any savings or debt payments. Regular updates and categorization of expenses improve accuracy and financial awareness. Maintaining this document consistently aids in better financial planning and avoiding cash shortages.

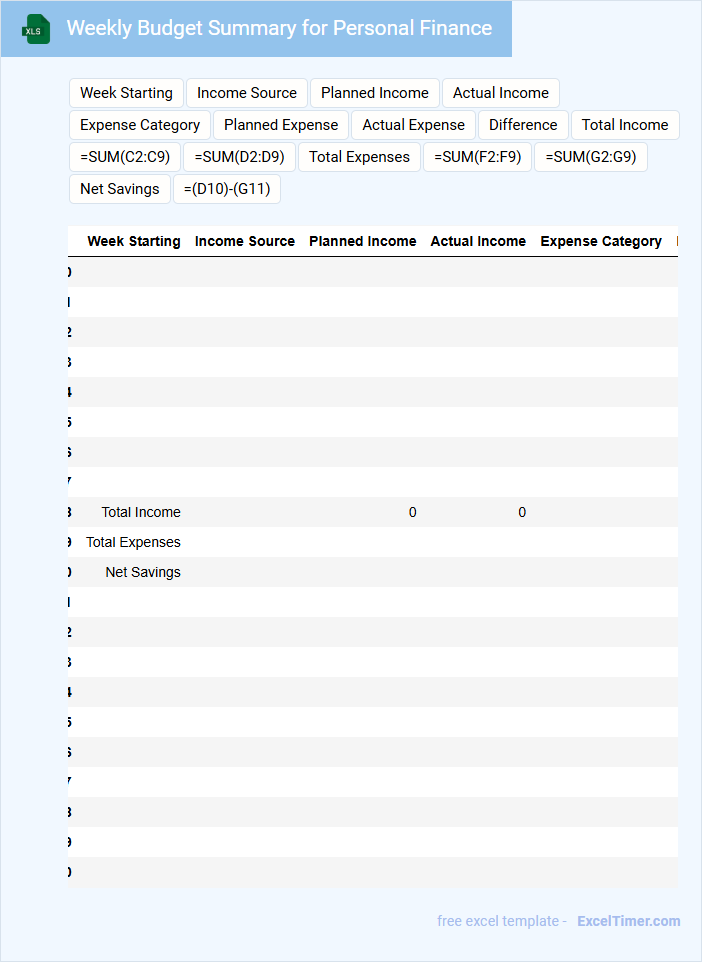

Weekly Budget Summary for Personal Finance

A Weekly Budget Summary is a concise overview of your income and expenses within a one-week period, helping to track spending habits effectively. It typically contains categories such as income, fixed expenses, variable expenses, and savings goals. Maintaining this document regularly supports better financial planning and helps avoid unnecessary debt.

Weekly Financial Goals Tracker for Personal Budgeting

What does a Weekly Financial Goals Tracker for Personal Budgeting typically contain? It usually includes sections for income, expenses, savings targets, and progress updates. This document helps individuals monitor their financial habits weekly to achieve budgeting goals effectively.

What is an important aspect to consider when using this type of tracker? Consistent and accurate recording of all financial transactions is crucial to gain realistic insights. Regularly reviewing and adjusting goals based on tracked data ensures better financial discipline and success.

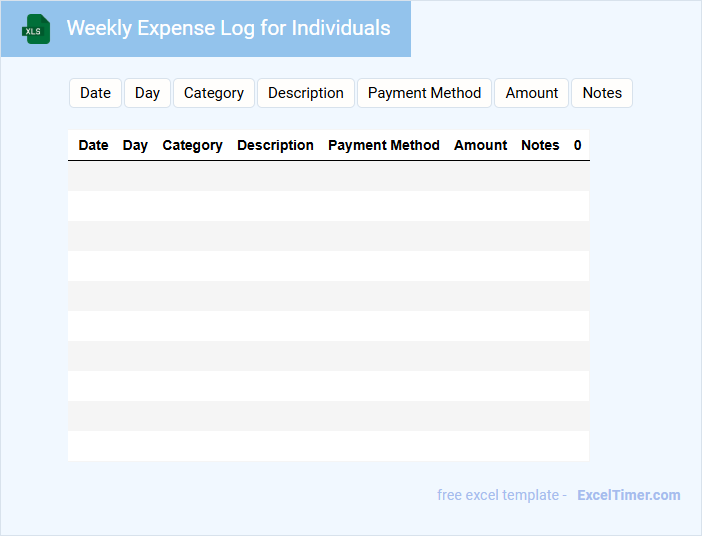

Weekly Expense Log for Individuals

A Weekly Expense Log is a document used by individuals to track their daily spending habits. It helps in maintaining a clear record of all expenses incurred within a week.

This type of document typically contains categories such as food, transportation, utilities, and entertainment costs. Regularly updating and reviewing the log can aid in better financial management.

It is important to include accurate dates, detailed descriptions, and payment methods to ensure comprehensive tracking and analysis.

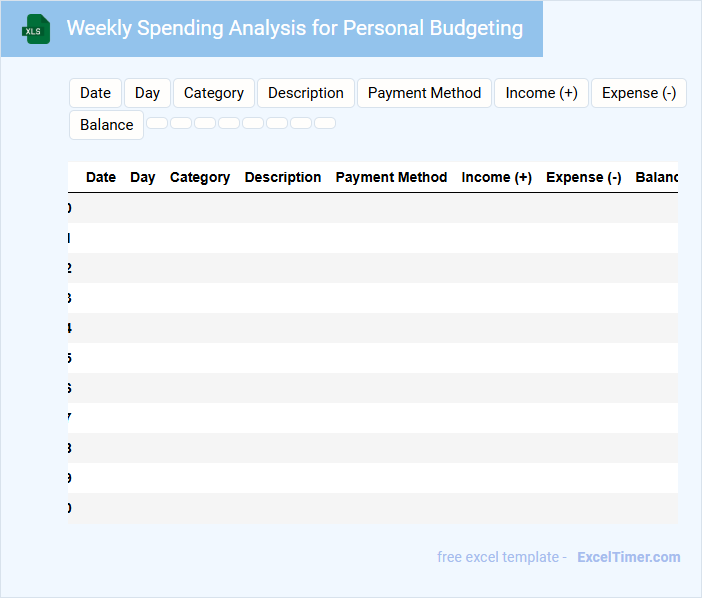

Weekly Spending Analysis for Personal Budgeting

What information is typically included in a Weekly Spending Analysis for Personal Budgeting? This document usually contains detailed records of all expenses incurred during the week, categorized by type such as groceries, entertainment, and bills. It helps individuals track their spending patterns and identify areas where they can save money.

Why is it important to regularly review a Weekly Spending Analysis? Consistent review enables better financial control and helps in setting realistic budget limits. It also highlights unexpected expenditures, allowing timely adjustments to avoid overspending.

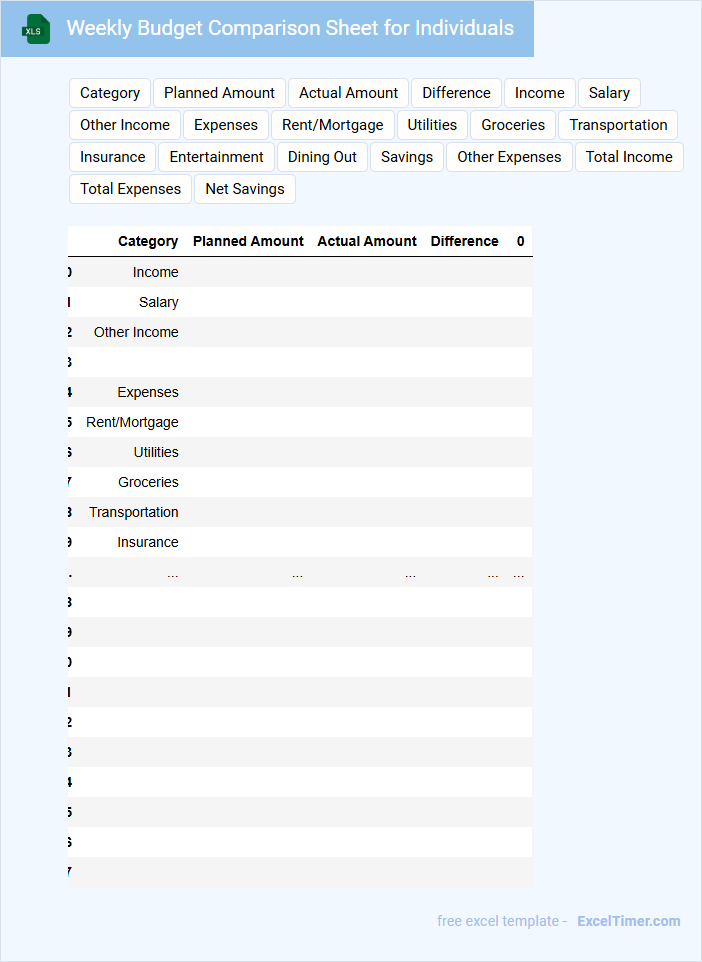

Weekly Budget Comparison Sheet for Individuals

A Weekly Budget Comparison Sheet is a document used by individuals to track and compare their income and expenses over a weekly period. It typically contains categories for various types of spending, such as groceries, transportation, and entertainment, alongside the expected budget and actual amounts spent. This helps users identify spending patterns and make more informed financial decisions.

Important elements to include are clearly defined categories, columns for budgeted versus actual expenditures, and a summary showing the difference or variance. Highlighting any overspending or savings each week helps individuals adjust their habits promptly. Regularly updating the sheet ensures ongoing financial awareness and better money management.

Weekly Personal Budget Calendar for Expense Tracking

A Weekly Personal Budget Calendar is a document designed to help individuals track their expenses on a weekly basis, providing clear visibility into spending habits. It usually contains categories of expenses, dates, amounts spent, and balance tracking. An important suggestion is to consistently update the calendar to ensure accurate monitoring and better financial management.

What are the essential categories to include in a weekly personal budget on Excel?

Essential categories for a weekly personal budget on Excel include Income, Housing (rent or mortgage), Utilities, Groceries, Transportation, Entertainment, Savings, and Miscellaneous expenses. Your Excel sheet should track these categories for accurate spending analysis and financial planning. Including these distinct sections ensures comprehensive budgeting and better money management.

How can you track and compare actual versus planned expenses each week?

Use Excel formulas like SUMIFS to aggregate actual and planned expenses by category each week. Create separate columns for planned and actual amounts, then calculate the variance to identify overspending or savings. Incorporate charts or conditional formatting to visually compare weekly budget performance.

Which Excel formulas help automate weekly income and expense calculations?

Excel formulas such as SUMIF and SUM enable you to automate weekly income and expense calculations by categorizing and totaling amounts based on dates or categories. The TODAY function helps track current week expenses by dynamically updating dates, while the IF formula assists in conditional budgeting scenarios. Employing these formulas in your personal budgeting Excel sheet streamlines financial management and enhances accuracy.

What methods can you use in Excel to visualize weekly spending trends?

Excel offers methods like line charts and bar graphs to visualize weekly spending trends effectively. Conditional formatting highlights spending patterns and anomalies across weekly data ranges. PivotTables summarize and analyze weekly expenses, enabling interactive trend visualization and category breakdowns.

How do you set up recurring weekly expenses in an Excel budgeting sheet?

To set up recurring weekly expenses in an Excel budgeting sheet, create a column for the expense name, amount, and a date column representing each week's start date. Use Excel formulas like =IF(WEEKDAY(TODAY())=X, Amount, 0) to automate expense entry based on the week day or use a table with weekly dates and reference the expense amount for each week. Incorporate SUM or SUMIF functions to total weekly expenses for accurate personal budget tracking.