The Weekly Expense Report Excel Template for Consultants streamlines tracking of project-related costs, ensuring accurate financial management. It allows consultants to input income, categorize expenses, and generate a clear summary of weekly spending. Using this template enhances budget control and simplifies expense documentation for client billing purposes.

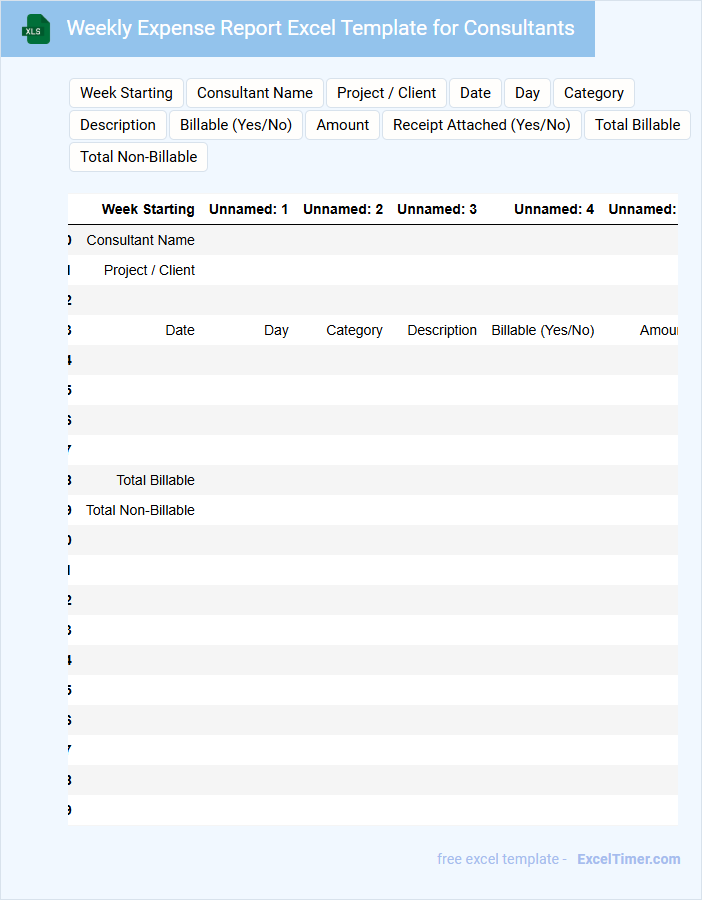

Weekly Expense Report Excel Template for Consultants

What information is typically included in a Weekly Expense Report Excel Template for Consultants? This document generally contains detailed records of expenses incurred during the week, categorized by type such as travel, meals, lodging, and other business-related costs. It helps consultants track spending, maintain accurate financial records, and streamline reimbursement processes.

What important elements should be included to optimize its use? Key features include clear date entries, itemized expense descriptions, receipt attachment options, and automated calculation of totals. Including a summary section and customizable categories ensures the template can be tailored to various consulting projects and client requirements.

Expense Tracker with Weekly Summary for Consultants

An Expense Tracker with Weekly Summary for Consultants is a document designed to record and monitor all business-related expenditures efficiently. It typically contains detailed entries of daily expenses, categorized by type and project, to maintain accurate financial records. Additionally, it includes a summarized weekly overview to help consultants analyze spending patterns and manage budgets effectively.

Weekly Consulting Expense Report for Reimbursement

A Weekly Consulting Expense Report is a financial document used to detail expenses incurred during consulting activities. It typically contains the date, description, amount, and receipts for each expense item. Ensuring accuracy and including all relevant supporting documents is crucial for timely reimbursement.

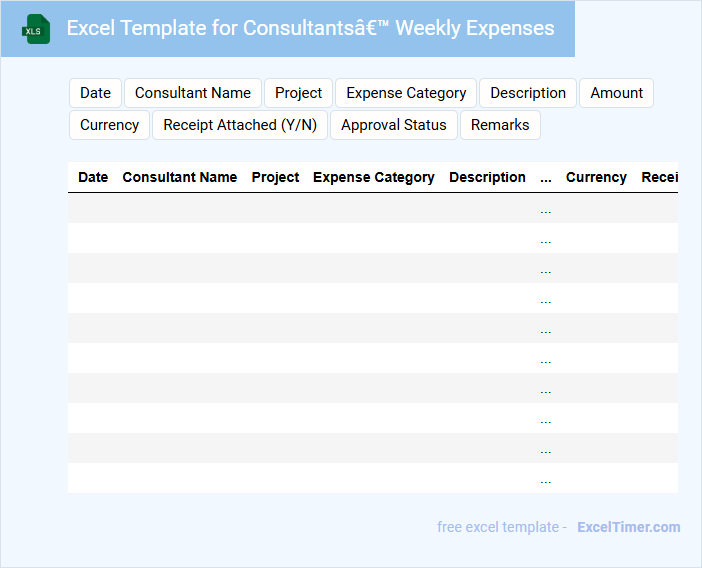

Excel Template for Consultants’ Weekly Expenses

What information is typically included in an Excel Template for Consultants' Weekly Expenses? This type of document generally contains detailed entries of daily expenses such as transportation, meals, accommodation, and client-related costs. It helps consultants track their spending accurately and ensures reimbursement requests are well-documented and organized.

What important elements should be included in this template to enhance its usability? Key features should include categorized expense fields, date stamps, total calculations, and sections for notes or justification. Incorporating dropdown menus and built-in formulas will streamline data entry and reduce errors, making expense management efficient.

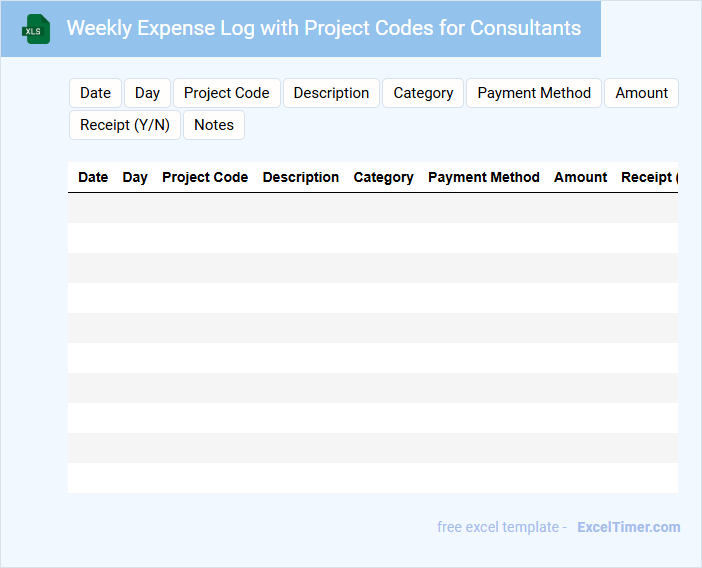

Weekly Expense Log with Project Codes for Consultants

What information is typically included in a Weekly Expense Log with Project Codes for Consultants? This document usually contains detailed records of expenses incurred by consultants over a week, categorized by specific project codes to track costs accurately. It helps in maintaining transparency, managing budgets, and ensuring correct billing for each project.

Why is it important to use project codes in expense logs? Project codes allow precise allocation of expenses to different projects, which simplifies financial reporting and auditing. They also facilitate better project cost management and improve overall accountability.

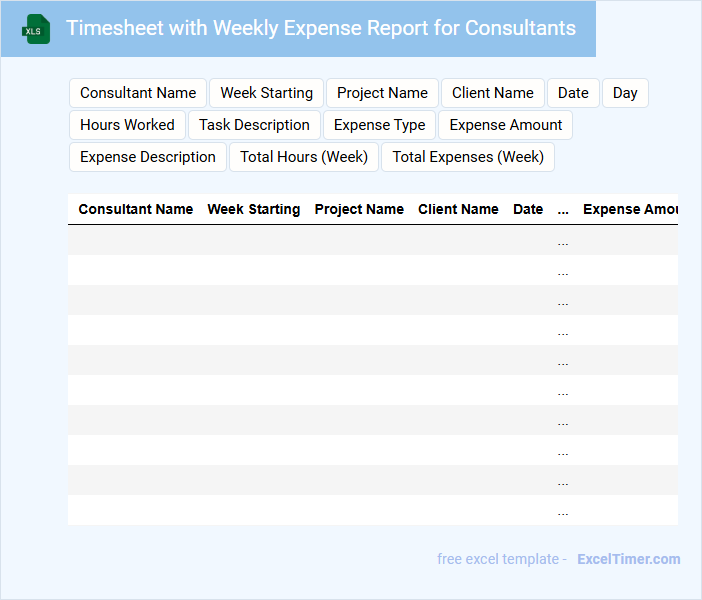

Timesheet with Weekly Expense Report for Consultants

Timesheet with Weekly Expense Report for Consultants typically contains detailed records of hours worked and expenses incurred during a week for accurate billing and reimbursement.

- Time Tracking: Document all hours worked on various projects or tasks to ensure precise client invoicing.

- Expense Details: Record all reimbursable expenses such as travel, meals, and materials with receipts attached.

- Approval Signatures: Obtain client and manager approvals to verify the accuracy and authorization of reported time and expenses.

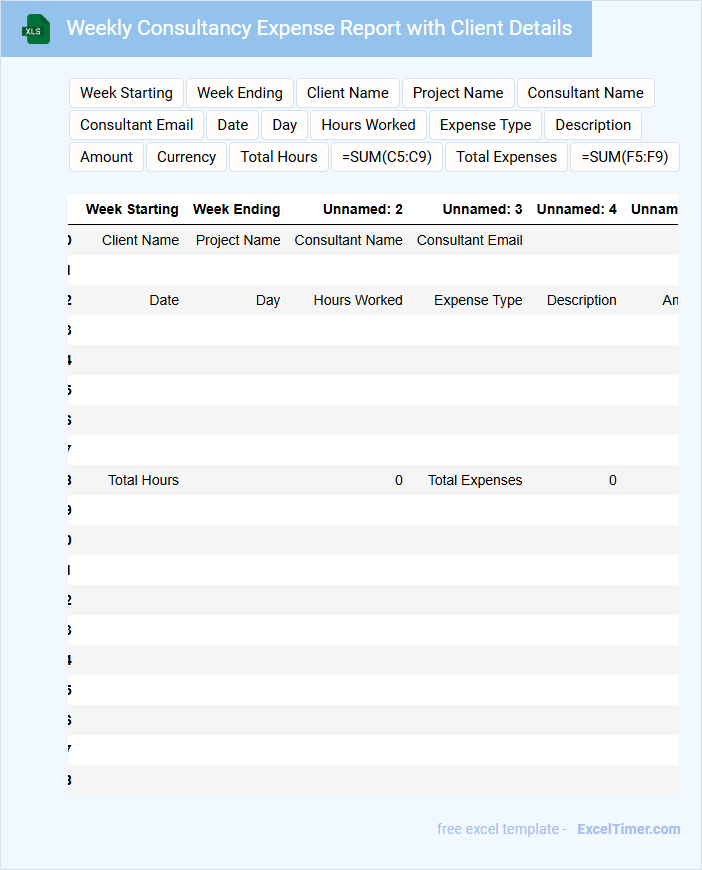

Weekly Consultancy Expense Report with Client Details

What information is typically included in a Weekly Consultancy Expense Report with Client Details? This document generally contains a detailed record of all expenses incurred during consultancy activities within a week, including dates, amounts, and descriptions. It also lists client-specific details to ensure accurate billing and transparent communication for both the consultant and the client.

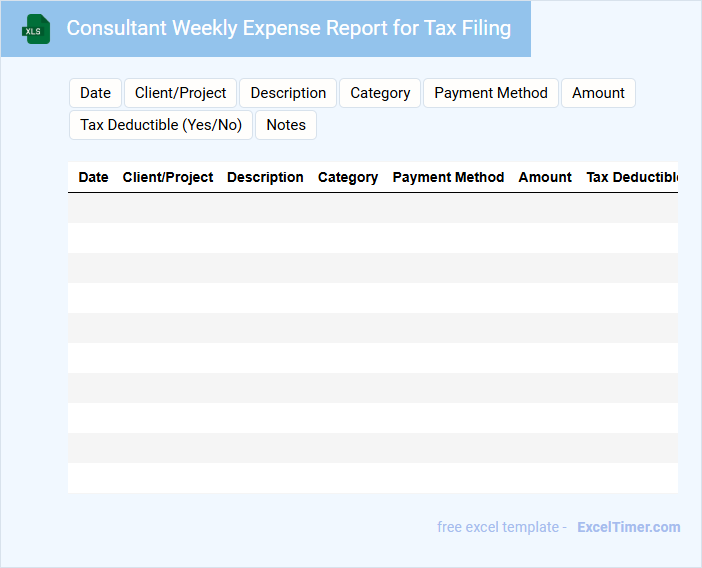

Consultant Weekly Expense Report for Tax Filing

A Consultant Weekly Expense Report typically contains detailed records of all expenses incurred by a consultant during a specific week. This document includes receipts, dates, descriptions, and amounts to track costs accurately for tax filing purposes. Ensuring precise documentation helps streamline the tax reporting process and supports compliance with tax authorities.

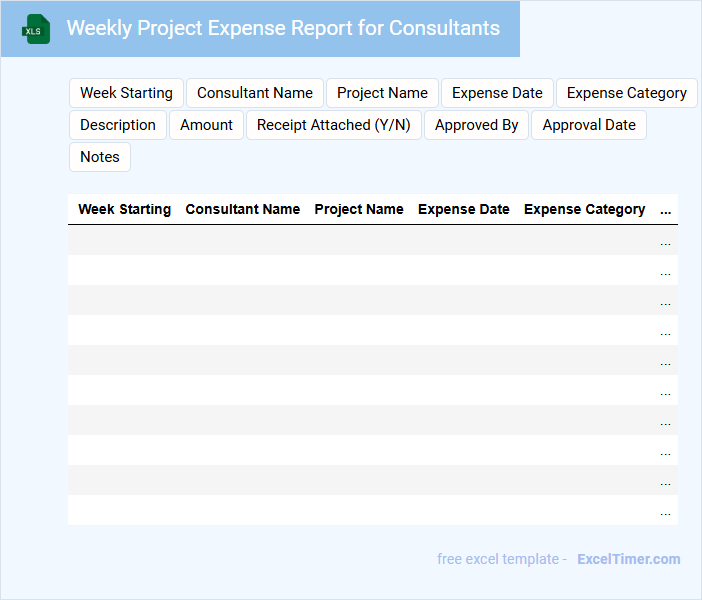

Weekly Project Expense Report for Consultants

A Weekly Project Expense Report for consultants typically contains detailed records of all expenses incurred during the week related to a specific project. It includes categories such as travel, materials, labor, and miscellaneous costs to ensure accurate financial tracking. Maintaining clarity and accuracy in this document is essential for budget management and project accountability.

Important suggestions for this report include ensuring itemized receipts are attached for verification, categorizing expenses properly for easier analysis, and submitting the report promptly to avoid delays in reimbursements. Additionally, consultants should double-check calculations and provide brief descriptions for each expense to enhance transparency. Clear documentation supports effective project budgeting and financial planning.

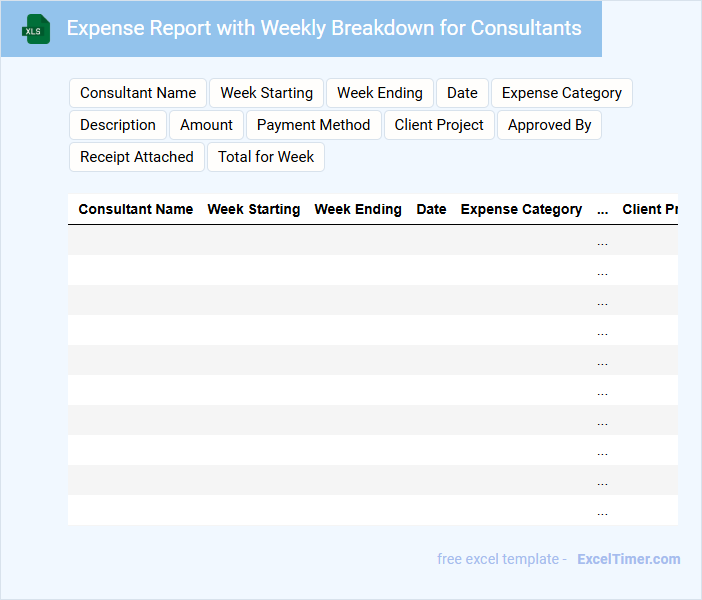

Expense Report with Weekly Breakdown for Consultants

An Expense Report with Weekly Breakdown for Consultants typically contains detailed records of all expenditures incurred by consultants over a specific week. It includes categories such as travel, meals, accommodation, and miscellaneous costs, ensuring clear financial tracking.

This document is essential for maintaining transparency and facilitating accurate reimbursement processes. It is important to highlight the consultant's name, dates, and approval signatures for validation.

Consultant Weekly Mileage and Expense Report

What information is typically included in a Consultant Weekly Mileage and Expense Report? This document usually contains detailed records of a consultant's travel mileage, expenses incurred during the work week, and any reimbursements requested. It helps organizations track travel costs, ensure accurate billing, and maintain financial accountability.

What is an important suggestion for preparing this report? It is crucial to keep precise and timely records of all mileage and expenses, including receipts and travel logs, to avoid discrepancies and streamline the approval process. Clear categorization and adherence to company policies enhance accuracy and facilitate efficient reimbursement.

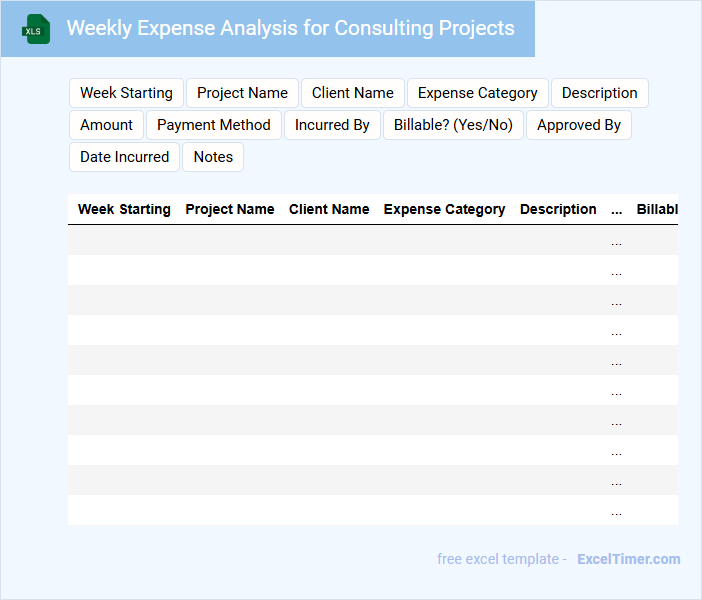

Weekly Expense Analysis for Consulting Projects

What information does a Weekly Expense Analysis for Consulting Projects typically contain? This document usually includes detailed records of all project-related expenses incurred within a week, categorized by type such as travel, materials, and labor. It also summarizes total costs against the project budget to help track spending and identify any discrepancies early.

Why is it important to maintain accuracy and timeliness in this analysis? Accurate and timely expense tracking ensures better financial control, aids in forecasting future costs, and supports transparent reporting to clients and stakeholders. Regular review helps consulting teams make informed decisions and maintain project profitability.

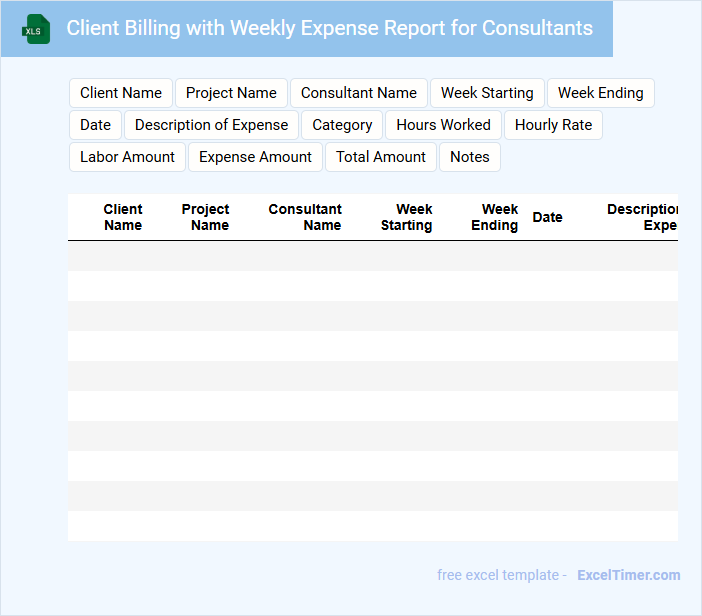

Client Billing with Weekly Expense Report for Consultants

The Client Billing document typically contains detailed records of services rendered, hours worked, and corresponding charges. It ensures transparent financial transactions between consultants and clients.

The Weekly Expense Report for consultants includes itemized expenses incurred during the week, such as travel, materials, and other reimbursable costs. It helps maintain accurate cost tracking and budget adherence.

Important factors to consider are clear documentation, timely submission, and accuracy to avoid disputes and ensure smooth financial operations.

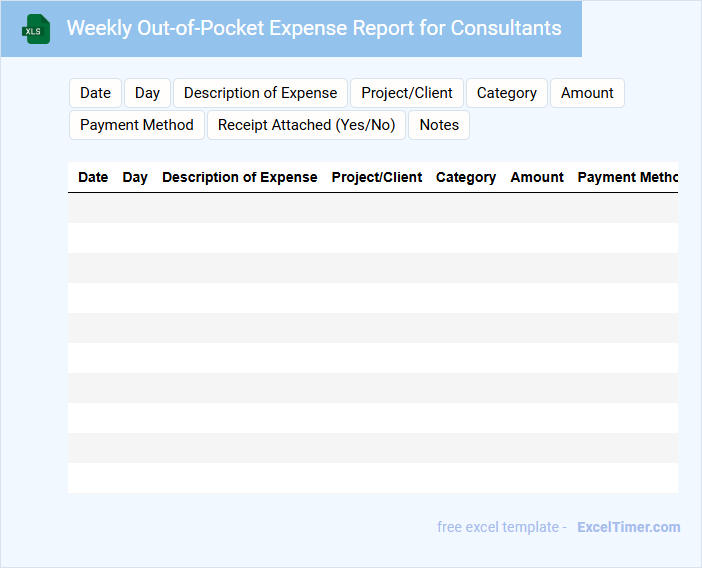

Weekly Out-of-Pocket Expense Report for Consultants

What information is typically included in a Weekly Out-of-Pocket Expense Report for Consultants? This report usually contains details of all personal expenses incurred by consultants during the week that are eligible for reimbursement. It helps track costs such as travel, meals, and supplies, ensuring accurate financial management and accountability.

Why is it important to include thorough documentation in this report? Detailed receipts and clear descriptions of each expense are essential to validate claims and prevent disputes. Proper categorization and timely submission also streamline the reimbursement process and maintain transparency.

Excel Template for Weekly Expense Tracking of Consulting Services

An Excel Template for Weekly Expense Tracking is typically designed to help consultants monitor and manage their weekly expenditures effectively. It usually contains categories for various consulting-related costs such as travel, meals, and client entertainment. Including features like automatic calculations and summary charts enhances its usability and accuracy.

When creating or using this template, it is important to ensure clear categorization of expenses, weekly date tracking, and the ability to generate quick reports for budgeting purposes. Additionally, incorporating customizable fields for project names or clients can provide better insight into cost allocation. Regular updates and backups of the file are essential for maintaining accurate records.

What key data fields should be included in a weekly expense report for consultants?

A weekly expense report for consultants should include key data fields such as Date, Consultant Name, Project or Client, Expense Category, Description, Amount, Payment Method, and Approval Status. Including a Summary Total of expenses and any reimbursable amounts helps track financial accountability. Clear categorization of expenses like travel, meals, lodging, and supplies ensures accurate budget management.

How can formulas be used to automatically calculate totals and reimbursement amounts?

Formulas in an Excel Weekly Expense Report for Consultants can automatically sum individual expense categories using functions like SUM to calculate total costs. Reimbursement amounts are computed by applying predefined rates or percentages to eligible expenses through multiplication formulas. This automation reduces errors and ensures accurate, real-time financial tracking.

What methods ensure accurate categorization of expenses by type or project?

Using predefined expense categories and project codes in dropdown menus ensures consistent data entry in a Weekly Expense Report for Consultants. Implementing validation rules and conditional formatting helps identify errors or misclassifications promptly. Regular audits and cross-referencing receipts with reported entries further maintain accuracy in expense categorization.

How can consultants use validation or dropdowns to minimize data entry errors?

Consultants can use data validation and dropdown menus in Excel to ensure accurate expense categorization and consistent input, reducing the chance of errors in your Weekly Expense Report. Dropdown lists limit entries to predefined options, streamlining data entry and improving report reliability. Applying validation rules helps maintain data integrity by preventing invalid inputs or incorrect formats.

What security measures should be applied for sensitive financial information in the report?

Your Weekly Expense Report for Consultants must implement encryption to protect sensitive financial information. Access controls and password protection ensure only authorized users can view or edit the document. Regular backups and secure storage minimize the risk of data loss or unauthorized access.