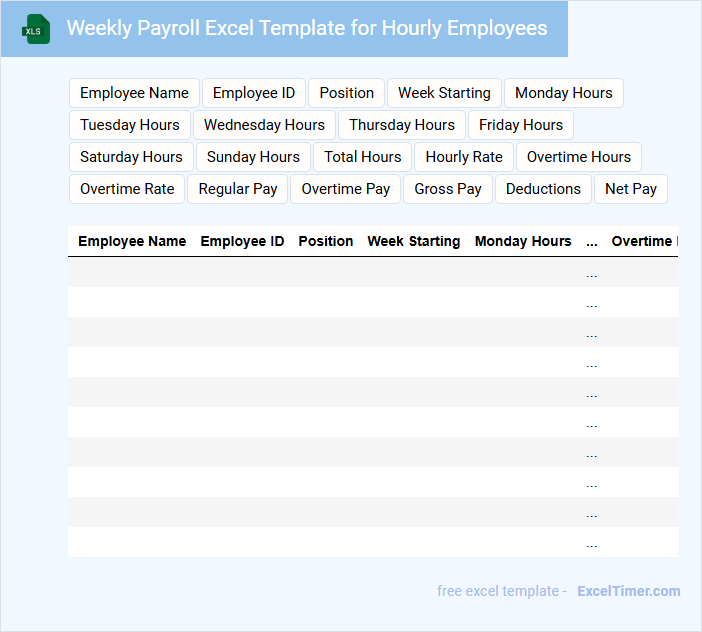

The Weekly Payroll Excel Template for Hourly Employees streamlines salary calculations by automatically computing wages based on hours worked and hourly rates. It includes essential features such as overtime tracking, tax deductions, and net pay summaries to ensure accurate and efficient payroll management. This template is customizable to fit various business needs, reducing errors and saving time during payroll processing.

Weekly Payroll Excel Template for Hourly Employees

What information does a Weekly Payroll Excel Template for Hourly Employees typically contain? This type of document usually includes employee details, hours worked, hourly rates, and total wages calculated for each week. It helps in accurately tracking pay and ensuring timely payment while maintaining organized payroll records.

Why is it important to regularly update and verify the data in this template? Regular updates ensure that any changes in hours worked or pay rates are reflected correctly, reducing errors and discrepancies. Verifying the data helps maintain compliance with labor laws and supports transparent communication with employees.

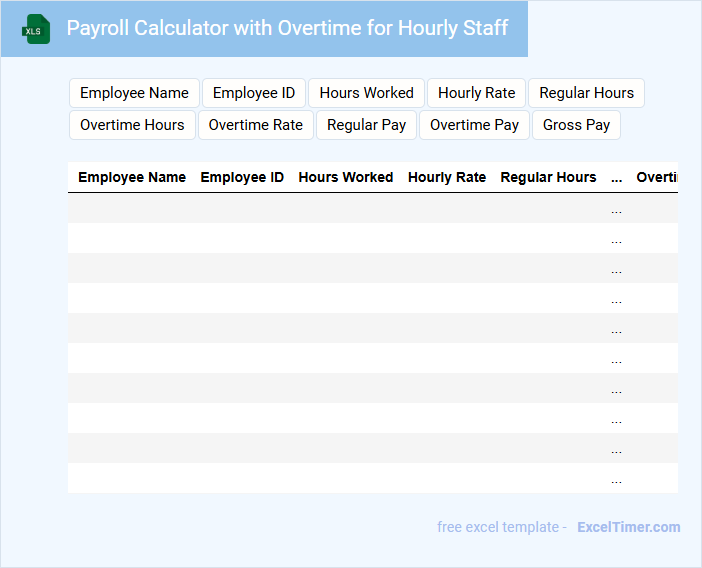

Payroll Calculator with Overtime for Hourly Staff

This document typically contains a Payroll Calculator designed to compute employee wages based on their hourly rates and hours worked. It ensures accurate payment by including regular hours alongside Overtime calculations. A clear layout of input fields for hours, rates, and overtime rules is essential.

Such calculators help streamline payroll processing, reduce errors, and ensure compliance with labor laws. Including detailed instructions and customizable overtime settings improves usability and adaptability. Always validate input data to maintain accuracy and integrity.

Timesheet Tracker for Weekly Payroll of Hourly Employees

A timesheet tracker for weekly payroll of hourly employees typically contains detailed records of hours worked each day, including start and end times. It ensures accurate calculation of wages by capturing overtime and break periods, aiding in compliance with labor regulations. Maintaining this document is crucial for both employee accountability and streamlined payroll processing.

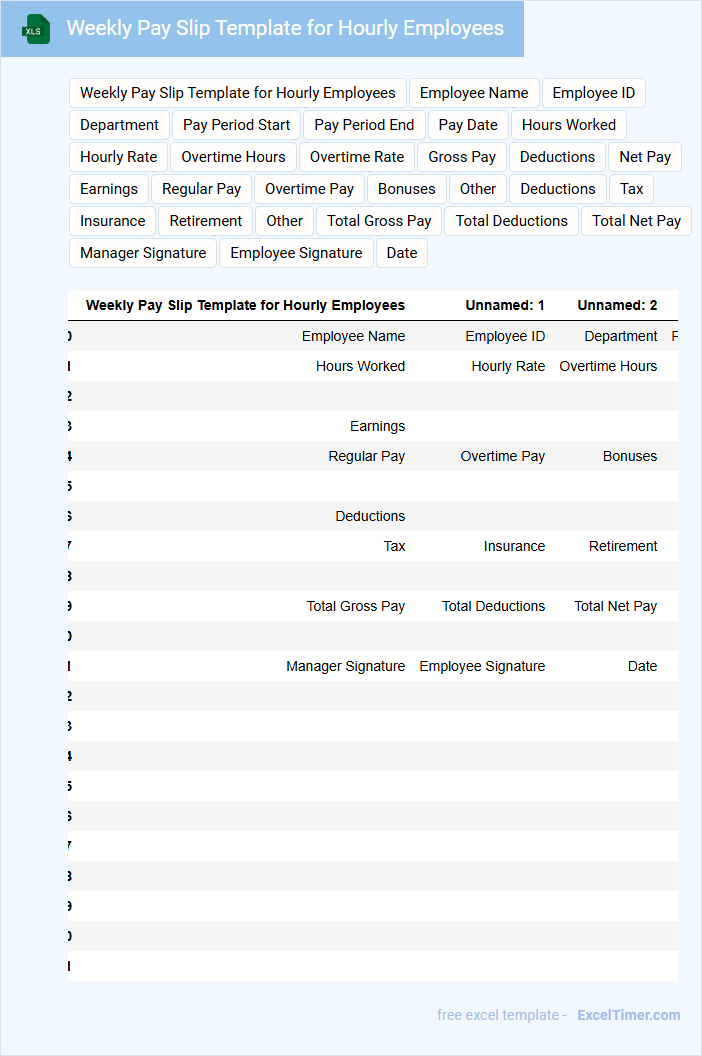

Weekly Pay Slip Template for Hourly Employees

What information is typically included in a Weekly Pay Slip Template for Hourly Employees? A weekly pay slip usually contains detailed records of hours worked, hourly pay rate, total earnings, deductions, and net pay for the week. It serves as an essential document for both employers and employees to ensure accurate payment and transparent payroll tracking.

What important elements should be included in a Weekly Pay Slip Template for Hourly Employees? Important components include employee details, pay period dates, total hours worked (regular and overtime), gross pay, itemized deductions such as taxes or benefits, and net pay. Including clear terms and a space for employer contact information enhances clarity and accountability.

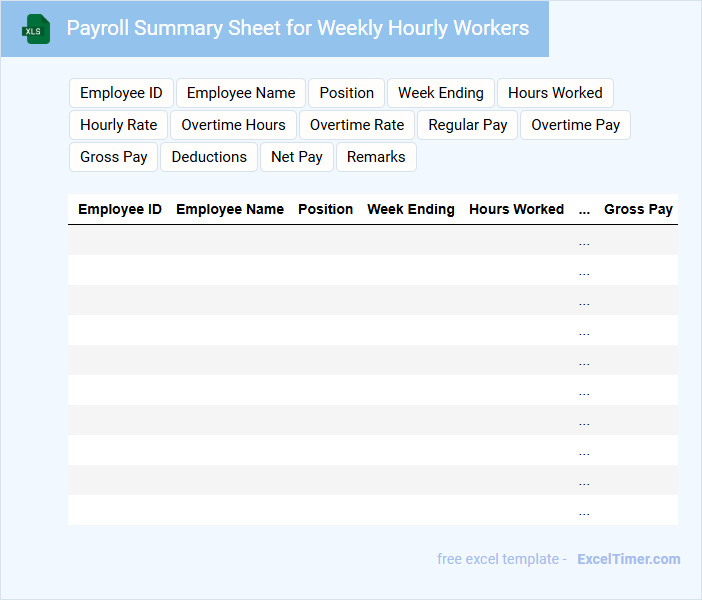

Payroll Summary Sheet for Weekly Hourly Workers

A Payroll Summary Sheet for Weekly Hourly Workers typically contains detailed records of hours worked, pay rates, and total earnings to ensure accurate payroll processing.

- Employee Hours: Tracks daily and total hours worked by each employee.

- Pay Rates: Lists hourly wages and any overtime rates applied.

- Total Earnings: Summarizes gross pay, deductions, and net pay for the pay period.

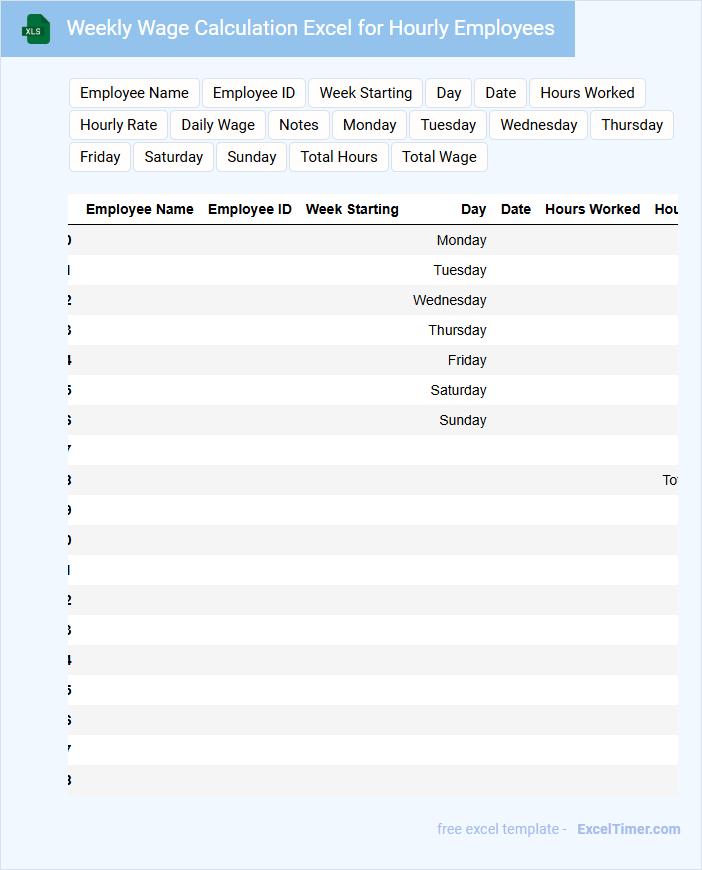

Weekly Wage Calculation Excel for Hourly Employees

A Weekly Wage Calculation Excel for hourly employees typically contains details such as hours worked, hourly rates, and total earnings. It helps in accurately tracking employee pay based on time logged during the week. Important elements to include are overtime calculations, deductions, and clear formatting for easy review.

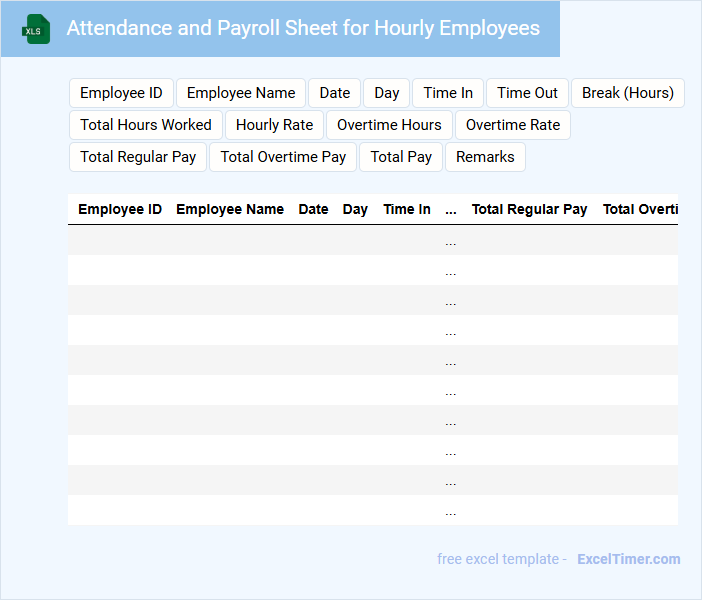

Attendance and Payroll Sheet for Hourly Employees

An Attendance and Payroll Sheet for hourly employees is a crucial document that tracks working hours and calculates wages accordingly. It typically includes employee names, dates, clock-in/clock-out times, total hours worked, and payment details. Ensuring accuracy and timely updates in this sheet helps maintain transparent payroll processing and compliance with labor regulations.

Employee Pay Record for Weekly Payroll of Hourly Staff

The Employee Pay Record for weekly payroll typically contains detailed information about hours worked, hourly rates, and total earnings for hourly staff. It records attendance, overtime, and any deductions to ensure accurate compensation. Maintaining this document helps both employers and employees track payments and comply with labor laws.

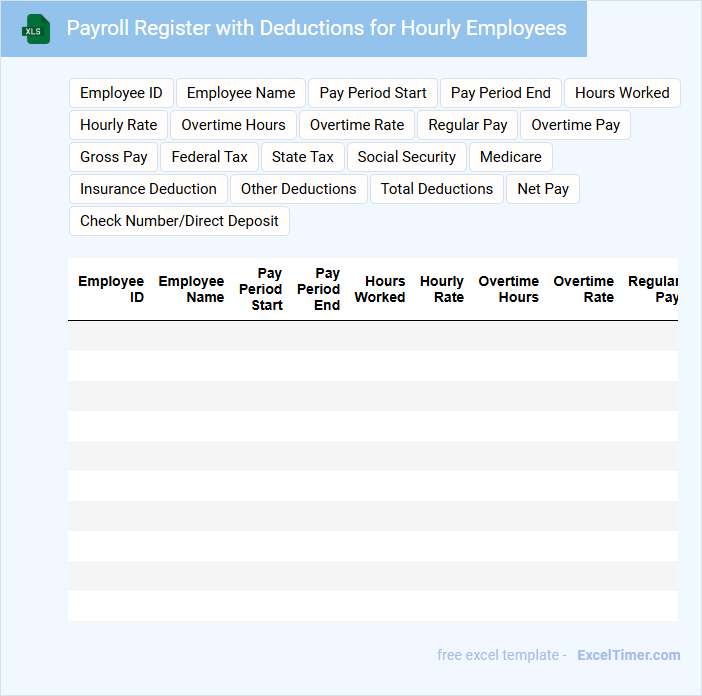

Payroll Register with Deductions for Hourly Employees

A Payroll Register with Deductions for Hourly Employees is a detailed record of wages paid, hours worked, and various deductions applied to hourly staff. It typically includes employee identification, hours worked, gross pay, tax withholdings, and other deductions like benefits or garnishments. This document ensures accuracy in payroll processing and compliance with labor laws.

Weekly Payroll Log for Hourly Employees

A Weekly Payroll Log for hourly employees typically contains detailed records of hours worked, pay rates, and total earnings for each employee. It helps ensure accurate and timely compensation by tracking attendance and calculating wages based on recorded hours. Maintaining this document is crucial for compliance with labor laws and for resolving any payroll discrepancies.

Hourly Employee Payment Tracker for Weekly Wages

What information is typically contained in an Hourly Employee Payment Tracker for Weekly Wages? This document usually includes employee names, hours worked each day, hourly rates, and total weekly wages calculated. It helps ensure accurate and timely payments while keeping detailed records for payroll management.

What is an important aspect to consider when maintaining this tracker? Consistent and precise time tracking is crucial, along with regularly updating wage rates and verifying hours before processing payments to avoid errors and discrepancies.

Payroll Management Sheet for Hourly Employees Weekly

A Payroll Management Sheet for hourly employees weekly typically includes employee names, hours worked, hourly rates, and total wages. It ensures accurate tracking of each employee's pay based on their recorded hours.

Important elements to include are overtime calculations and deductions for taxes or benefits to maintain precise payroll processing. Regularly updating the sheet helps prevent errors and ensures timely payments.

Weekly Payroll and Timesheet Template for Hourly Staff

This document typically includes detailed records of hours worked and wages earned by hourly staff on a weekly basis. It helps ensure accurate payroll processing and compliance with labor regulations.

- Include employee names, dates, and total hours worked each day.

- Record hourly rates and calculate gross pay for the week.

- Incorporate approval signatures to verify accuracy and authorization.

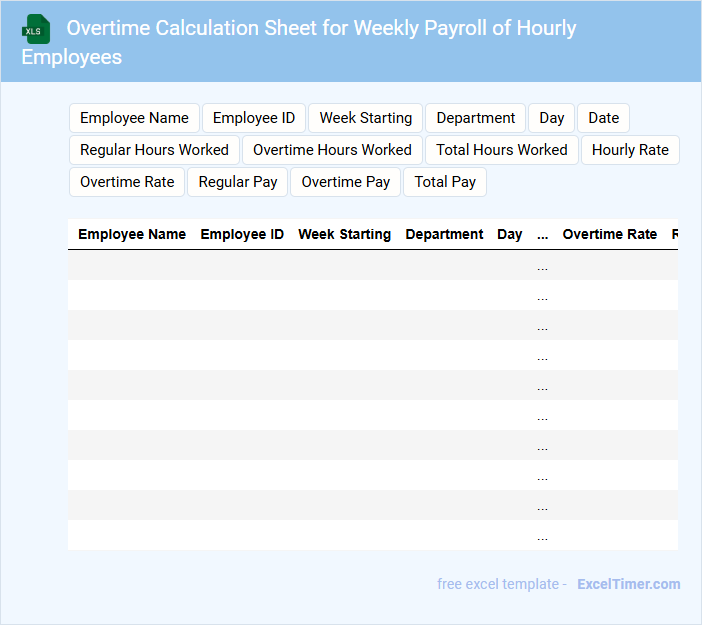

Overtime Calculation Sheet for Weekly Payroll of Hourly Employees

Overtime Calculation Sheets for Weekly Payroll of Hourly Employees are essential documents used to accurately track and compute extra hours worked beyond regular schedules. They ensure correct compensation and compliance with labor laws.

- Include total hours worked each day along with standard and overtime hours separately.

- Clearly state the overtime pay rate and rules applied based on company policy or legal requirements.

- Provide a summary of total overtime pay for the week along with employee identification details.

Weekly Payroll Overview for Teams of Hourly Employees

This document typically contains a summary of the hours worked, wages earned, and deductions for hourly employees within a team during a specific week.

- Accurate Time Tracking: Ensure all hours worked are precisely recorded to avoid payroll errors.

- Clear Wage Details: Include pay rates, overtime, and any bonuses or adjustments.

- Deductions Overview: Transparently list taxes, benefits, and other withholdings.

What formulas calculate regular and overtime pay for hourly employees in a weekly payroll worksheet?

Regular pay is calculated using the formula =MIN(HoursWorked, 40) * HourlyRate, which caps regular hours at 40. Overtime pay uses =MAX(HoursWorked - 40, 0) * HourlyRate * 1.5 to compute hours worked beyond 40 at a time-and-a-half rate. Your weekly payroll worksheet applies these formulas to accurately separate and calculate regular and overtime earnings.

How can you automate tax deductions (e.g., federal, state, social security) for each employee in Excel?

Automate tax deductions in Excel by setting up formula-based calculations using each employee's taxable hours, hourly rate, and predefined tax rates for federal, state, and social security. Use named ranges or tables to store current tax rates and apply Excel functions like SUMPRODUCT for scalable and accurate deductions. Implement data validation and conditional formatting to ensure accuracy and flag anomalies in payroll calculations.

Which Excel functions ensure accurate summation of total hours worked and total pay per week?

The SUM function in Excel accurately totals hours worked and pay per week for hourly employees by adding individual daily entries. Using SUMPRODUCT multiplies hourly rates by hours worked, calculating total pay efficiently across multiple records. Implementing these functions ensures precise weekly payroll calculations and minimizes errors.

How would you use conditional formatting to highlight employees who worked overtime in a pay period?

Use Excel's conditional formatting to highlight employees who worked overtime by selecting the hours worked column and applying a rule that formats cells greater than 40 hours per week. Set the formatting style, such as a red fill or bold text, to visually identify overtime hours. This method quickly flags employees exceeding the standard 40-hour workweek in the weekly payroll sheet.

What essential data fields should be included in a weekly payroll spreadsheet for hourly employees?

A weekly payroll spreadsheet for hourly employees should include essential data fields like Employee Name, Employee ID, Hours Worked, Hourly Rate, Overtime Hours, Overtime Rate, Gross Pay, Taxes Withheld, and Net Pay. Your document must also capture Pay Period Start and End Dates to ensure accurate payroll processing. Including these key fields helps you track employee earnings and manage payroll efficiently.