The Weekly Payroll Excel Template for Small Business streamlines employee wage calculations and tracks hours worked, ensuring accurate and timely payments. It includes automated formulas for deductions, taxes, and net pay, reducing manual errors and saving valuable time. Customizable features let business owners easily adapt the template to their specific payroll needs and compliance requirements.

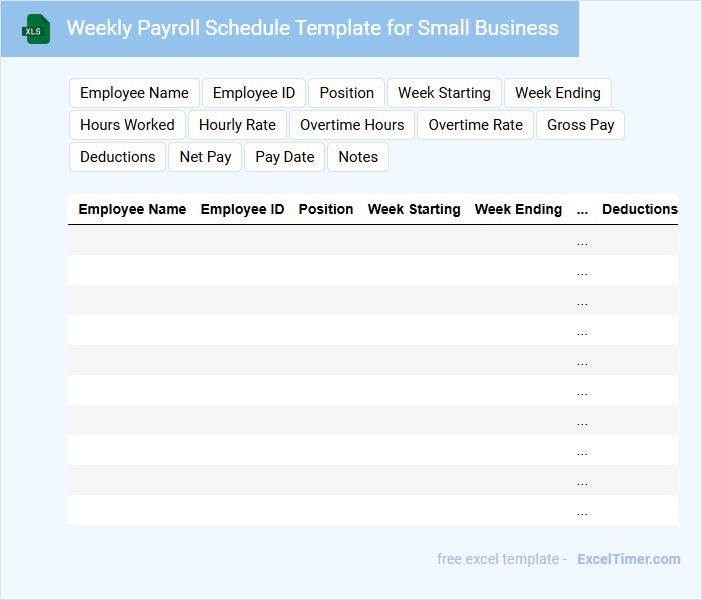

Weekly Payroll Schedule Template for Small Business

A Weekly Payroll Schedule Template for small businesses is a structured document used to organize employee payment dates and payroll processing tasks efficiently. It typically includes pay periods, payment dates, employee hours, and tax deductions. Ensuring accuracy and regular updates in this template helps prevent payroll errors and maintains compliance with labor laws.

Employee Timesheet with Payroll for Small Business

What information is typically included in an Employee Timesheet with Payroll for Small Business? This document usually contains details such as employee hours worked, breaks taken, overtime, and hourly rates. It also integrates payroll data like wages calculated, deductions, and net pay to ensure accurate compensation and record-keeping for small businesses.

Why is it important to maintain accurate timesheets and payroll records? Proper documentation helps in legal compliance, prevents payroll errors, and facilitates efficient payroll processing. For small businesses, this accuracy ensures employee trust and smooth financial management.

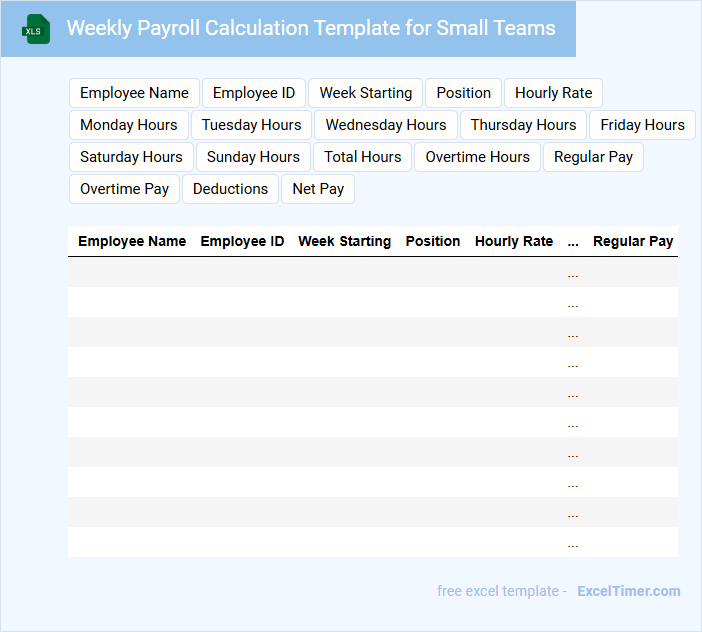

Weekly Payroll Calculation Template for Small Teams

A Weekly Payroll Calculation Template typically contains employee names, hours worked, and pay rates to ensure accurate compensation. It tracks overtime, deductions, and tax withholdings automatically for quick payroll processing. Small teams benefit from this streamlined approach, reducing errors and saving administrative time.

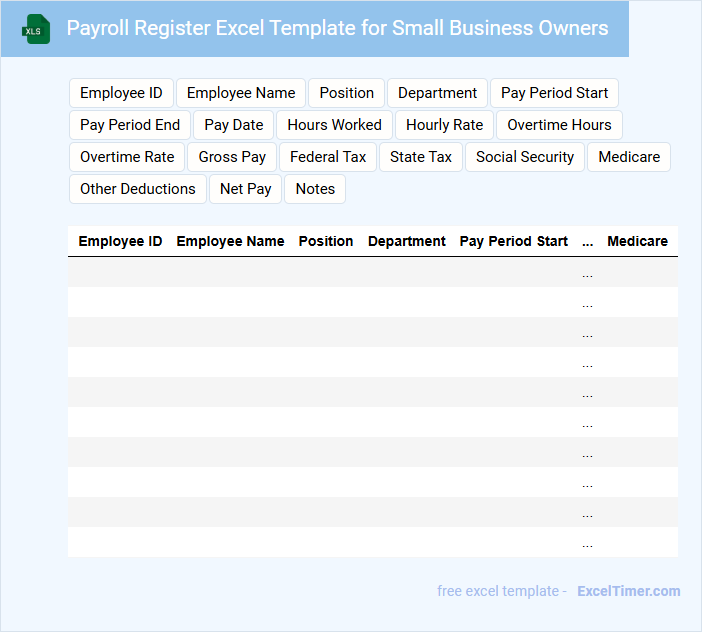

Payroll Register Excel Template for Small Business Owners

Payroll Register Excel Template for Small Business Owners is a document used to track employee wages, deductions, and net pay systematically. It helps in maintaining accurate payroll records for compliance and financial management.

- Include employee details such as name, ID, and pay period to ensure clear identification.

- Record gross pay, taxes, and other deductions for transparent salary calculation.

- Summarize net pay and payment date to facilitate timely and accurate compensation.

Simple Weekly Payroll Log for Small Companies

A Simple Weekly Payroll Log is a document used by small companies to track employee work hours and calculate weekly wages accurately. It typically contains employee names, hours worked, pay rates, and total earnings. Maintaining this log ensures timely and error-free payroll processing.

Important details to include are overtime hours, deductions, and payment dates to maintain clear financial records. This document helps small businesses stay organized and compliant with labor regulations. Regular updates and backups of the log are essential for accuracy and accountability.

Weekly Wage Tracker with Overtime for Small Business

What information does a Weekly Wage Tracker with Overtime for Small Business typically contain?

This document usually includes employee names, hours worked, regular and overtime hours, and calculated wages for each week. It helps small business owners monitor payroll accurately and ensure compliance with labor laws.

What is an important feature to include in this tracker?

Incorporating automatic overtime calculations and clearly defined pay rates is crucial to avoid errors and simplify payroll processing. Additionally, providing space for notes or adjustments helps maintain detailed records for future reference.

Payroll Deductions Worksheet for Small Businesses

What information does a Payroll Deductions Worksheet for small businesses usually contain? This document typically lists various payroll deductions such as taxes, insurance premiums, retirement contributions, and wage garnishments. It helps small business owners ensure accuracy in calculating employee net pay while complying with legal requirements.

What is an important consideration when using a Payroll Deductions Worksheet? It is crucial to regularly update the worksheet to reflect changes in tax laws and employee benefit selections, ensuring precise payroll processing and avoiding potential legal issues.

Weekly Pay Slip Generator for Small Business Employees

A Weekly Pay Slip Generator is a tool designed to create detailed pay slips for employees on a weekly basis. It typically contains information such as employee details, hours worked, pay rate, deductions, and net pay.

This document helps small business owners streamline payroll management and ensure transparency in employee compensation. Important elements include accurate tax calculations, clear breakdowns of earnings, and compliance with labor regulations.

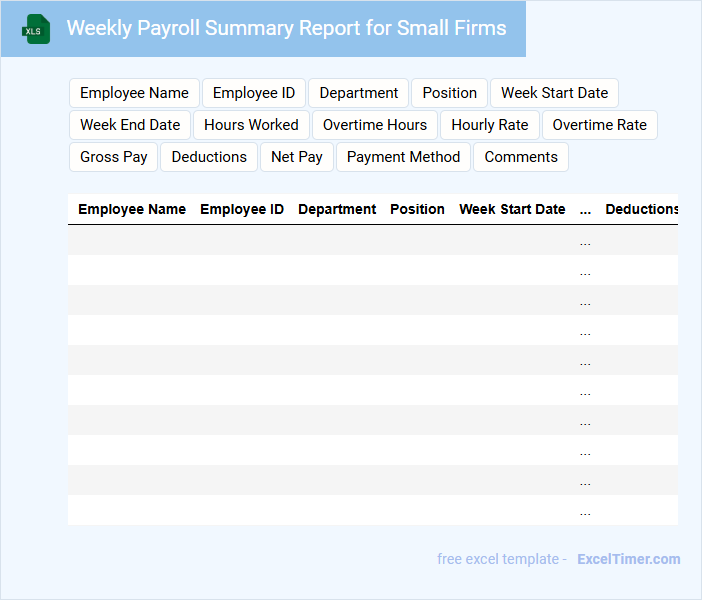

Weekly Payroll Summary Report for Small Firms

A Weekly Payroll Summary Report for small firms typically contains detailed records of employee wages, hours worked, and deductions made during the week. This document helps in tracking payroll expenses, ensuring compliance with tax regulations, and maintaining accurate financial records. For small firms, it is crucial to include overtime calculations, tax withholdings, and any bonuses or commissions to provide a comprehensive overview.

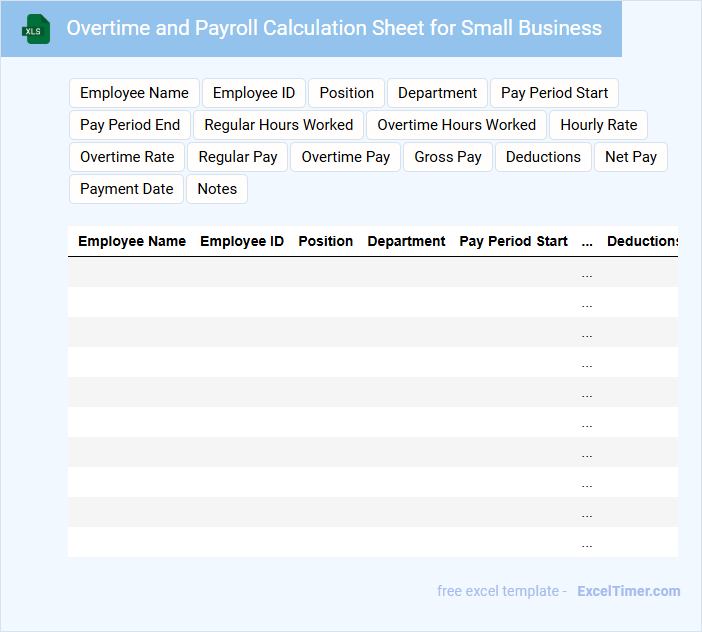

Overtime and Payroll Calculation Sheet for Small Business

The Overtime and Payroll Calculation Sheet is a crucial document used by small businesses to accurately track employee hours and compute wages. It typically contains details such as regular hours, overtime hours, pay rates, and total earnings. This sheet ensures transparent payroll management and helps avoid discrepancies in employee compensation.

Weekly Payroll Tracker with Hourly Rates for Small Business

What information is typically included in a Weekly Payroll Tracker with Hourly Rates for Small Business? This document usually contains employee names, hours worked each day, hourly pay rates, and total weekly earnings. It helps businesses ensure accurate wage calculations and maintain organized payment records.

Payroll Management Spreadsheet for Weekly Employees

Payroll Management Spreadsheets for Weekly Employees typically contain detailed records of employee work hours, wages, deductions, and net pay to ensure accurate and timely compensation.

- Employee Details: Essential information such as employee names, IDs, and contact information to maintain proper identification.

- Work Hours Tracking: Precise logging of hours worked each day or week to calculate total payable time accurately.

- Deductions and Taxes: Clear documentation of tax withholdings and any other deductions impacting the final payroll amount.

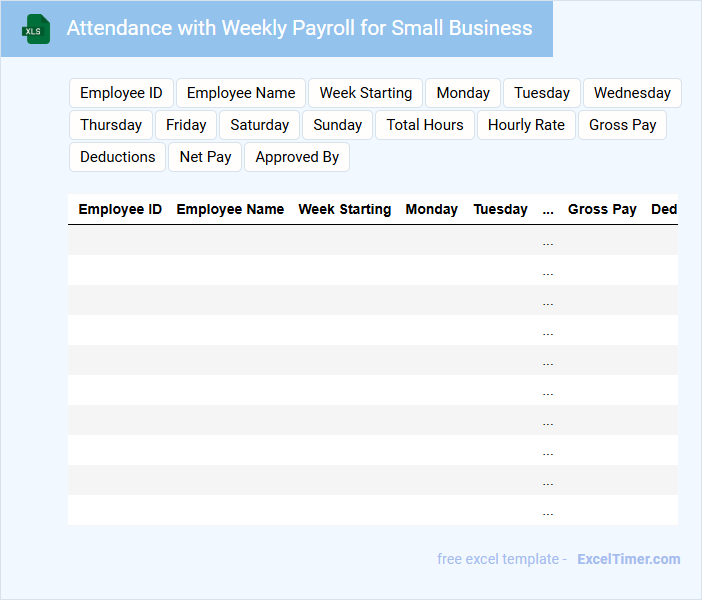

Attendance with Weekly Payroll for Small Business

What does an Attendance with Weekly Payroll document typically contain? This document usually includes employee attendance records such as hours worked each day, along with payroll details like wages calculated weekly. It helps small businesses accurately track labor costs and ensure timely payment, improving both operational efficiency and employee satisfaction.

What is an important aspect to focus on for this document? Maintaining precise and up-to-date attendance data is essential to avoid payroll errors and disputes. Additionally, integrating attendance with payroll systems can streamline processing and enhance overall accuracy in small business payroll management.

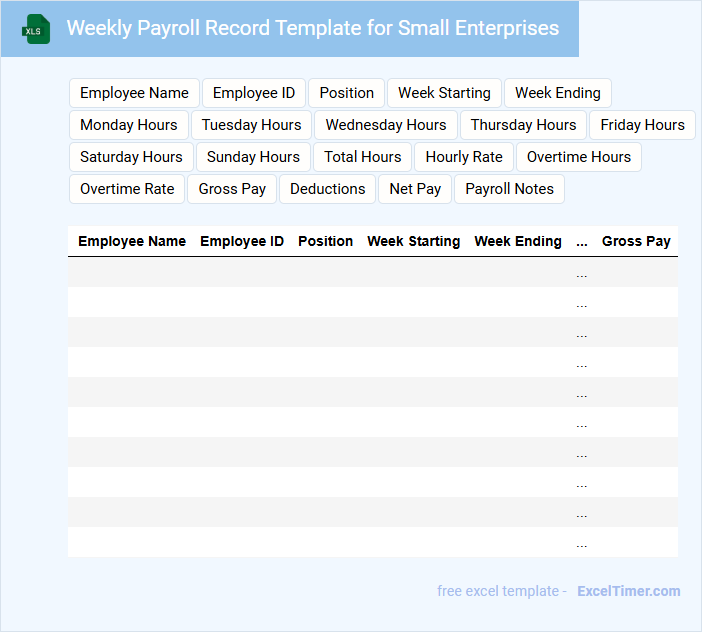

Weekly Payroll Record Template for Small Enterprises

The Weekly Payroll Record Template is an essential document that tracks employee wages, hours worked, and deductions for small enterprises. It ensures accuracy and compliance with labor laws while simplifying payroll processing. Including details such as employee names, pay rates, and total earnings helps maintain organized financial records.

Payroll Timesheet with Break Tracker for Small Business

A Payroll Timesheet with Break Tracker for Small Business is a document that records employee work hours and break times accurately to ensure precise payroll processing. It helps small businesses maintain compliance with labor laws and streamline payroll management.

- Include employee details, date, clock-in/out times, and break durations.

- Track regular and overtime hours separately for accurate wage calculation.

- Ensure easy-to-use format with clear instructions for consistent data entry.

What are the essential columns needed in an Excel weekly payroll template for small businesses?

Essential columns in an Excel weekly payroll template for small businesses include Employee Name, Employee ID, Hours Worked, Hourly Rate, Gross Pay, Taxes Withheld, Deductions, and Net Pay. Including Pay Period Start and End Dates ensures accurate tracking of weekly payroll. Adding Department or Job Title helps categorize employee roles for reporting purposes.

How can Excel formulas automate gross and net pay calculations in a payroll sheet?

Excel formulas automate gross and net pay calculations by using functions like SUM to total hours worked and multiplication for hourly rates, streamlining accurate gross pay computations. Excel also applies deductions through formulas that subtract taxes, benefits, and other withholdings, providing precise net pay results. Your payroll sheet becomes efficient and error-free, saving time and ensuring consistency.

What Excel features help track employee hours and overtime each week?

Excel features such as Time Tracking Templates and PivotTables help monitor employee hours and overtime each week efficiently. The built-in formulas like SUMIFS and IF enable automatic calculations of regular and overtime hours based on predefined criteria. Conditional Formatting highlights overtime instances, ensuring accurate weekly payroll management for small businesses.

How can you use data validation to minimize input errors in payroll records?

Use data validation in your weekly payroll Excel document to restrict entries, such as setting date ranges for pay periods and limiting hours worked to realistic values. Implement dropdown lists for employee names and pay rates to ensure consistency and reduce manual input errors. This approach helps maintain accurate payroll records and minimizes costly mistakes.

What steps ensure payroll tax deductions are accurately calculated and recorded in Excel?

To ensure payroll tax deductions are accurately calculated and recorded in Excel, set up formulas that automatically apply current federal, state, and local tax rates to employee wages. Use structured tables to organize employee details, hours worked, gross pay, and deduction categories for clarity and easy updating. Review tax rate updates regularly and validate calculations against official payroll tax guidelines to keep your records compliant and precise.