The Annually Appraisal Report Excel Template for Property Managers streamlines the evaluation process by organizing property performance data clearly and efficiently. This template enables property managers to track key metrics such as occupancy rates, maintenance costs, and tenant satisfaction, providing a comprehensive overview for decision-making. Its customizable format allows for easy updates and comparisons across multiple properties, ensuring accurate and consistent appraisals each year.

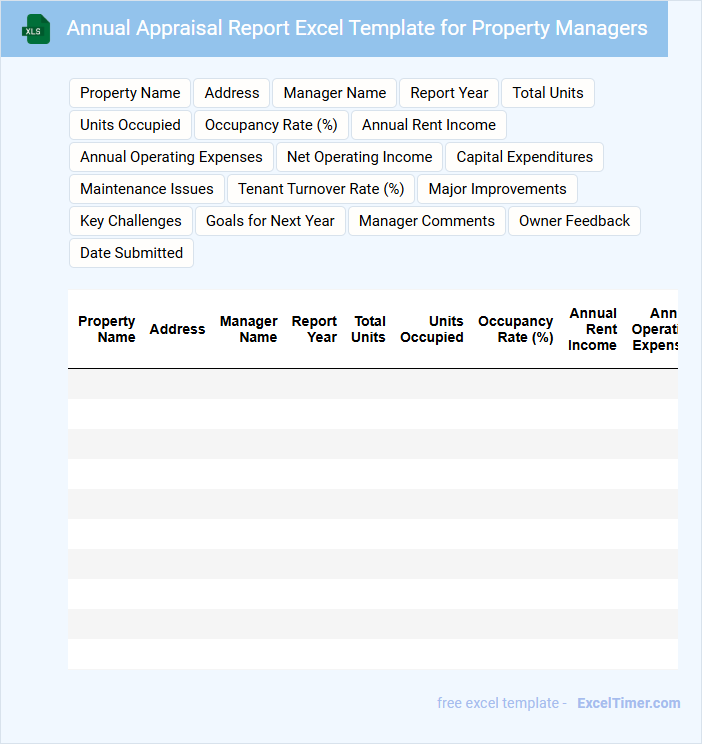

Annual Appraisal Report Excel Template for Property Managers

An Annual Appraisal Report Excel template for Property Managers typically contains detailed financial data, property performance metrics, and maintenance records. It helps streamline the evaluation process by organizing revenue, expenses, and tenant information in a clear format. Using this template ensures consistent, accurate, and comprehensive reporting for informed decision-making.

Key suggestions include ensuring customizable fields for property-specific metrics, integrating sections for qualitative feedback, and enabling easy comparison with previous years. Including visual charts and automated calculations can further enhance clarity and efficiency. Regular updates to reflect new appraisal standards and regulations are also important.

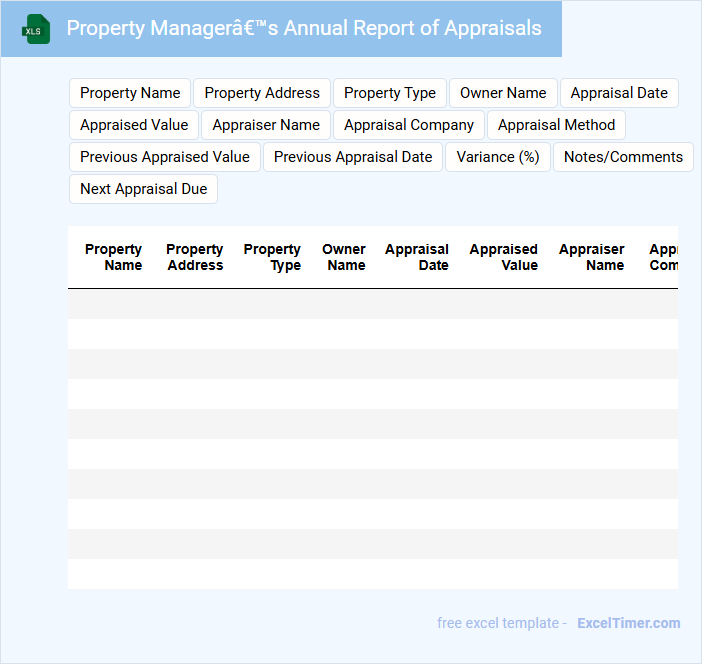

Property Manager’s Annual Report of Appraisals

The Property Manager's Annual Report of Appraisals typically contains a summary of property evaluations conducted over the year to assess market value and rental performance. It is essential for tracking property investment performance and planning future management strategies.

- Include a clear comparison of current appraisals with previous years to highlight trends.

- Provide detailed notes on market conditions impacting property values.

- Recommend actionable steps for property improvements based on appraisal outcomes.

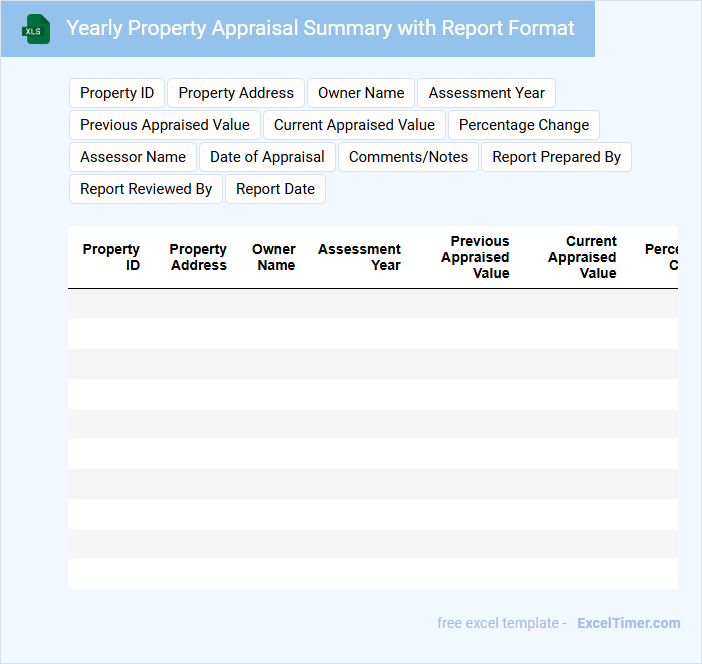

Yearly Property Appraisal Summary with Report Format

The Yearly Property Appraisal Summary document typically contains an overview of a property's value assessment conducted over the year, including significant changes and market comparisons. It consolidates data from inspections, market trends, and previous appraisals to offer a comprehensive valuation insight.

For an effective report format, it is important to include clear sections such as property details, appraisal methodology, valuation results, and recommendations. Ensuring accuracy and transparency in data presentation strengthens trust and supports informed decision-making.

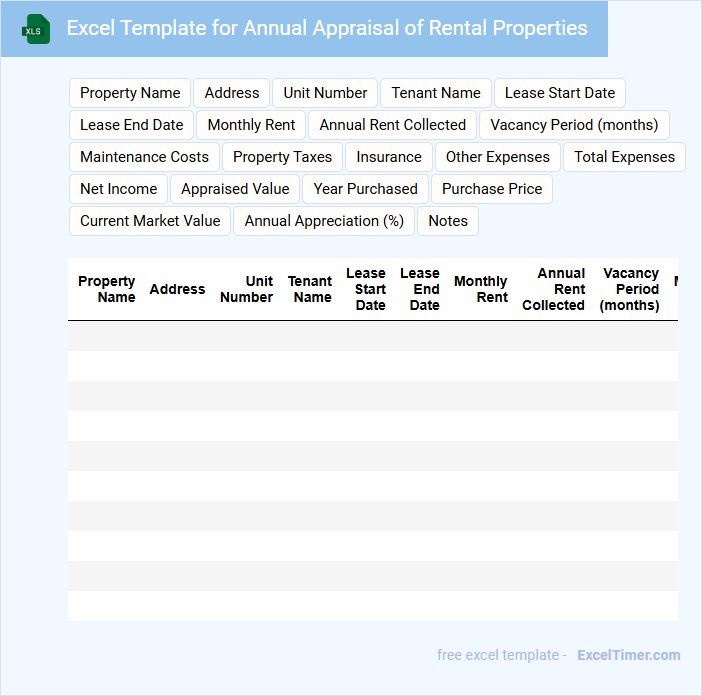

Excel Template for Annual Appraisal of Rental Properties

An Excel Template for Annual Appraisal of Rental Properties typically contains detailed financial data, property details, and performance metrics. It helps landlords and property managers track income, expenses, and overall property value changes over the year. Essential components include rent roll, expense tracking, and market value comparisons for accurate appraisal.

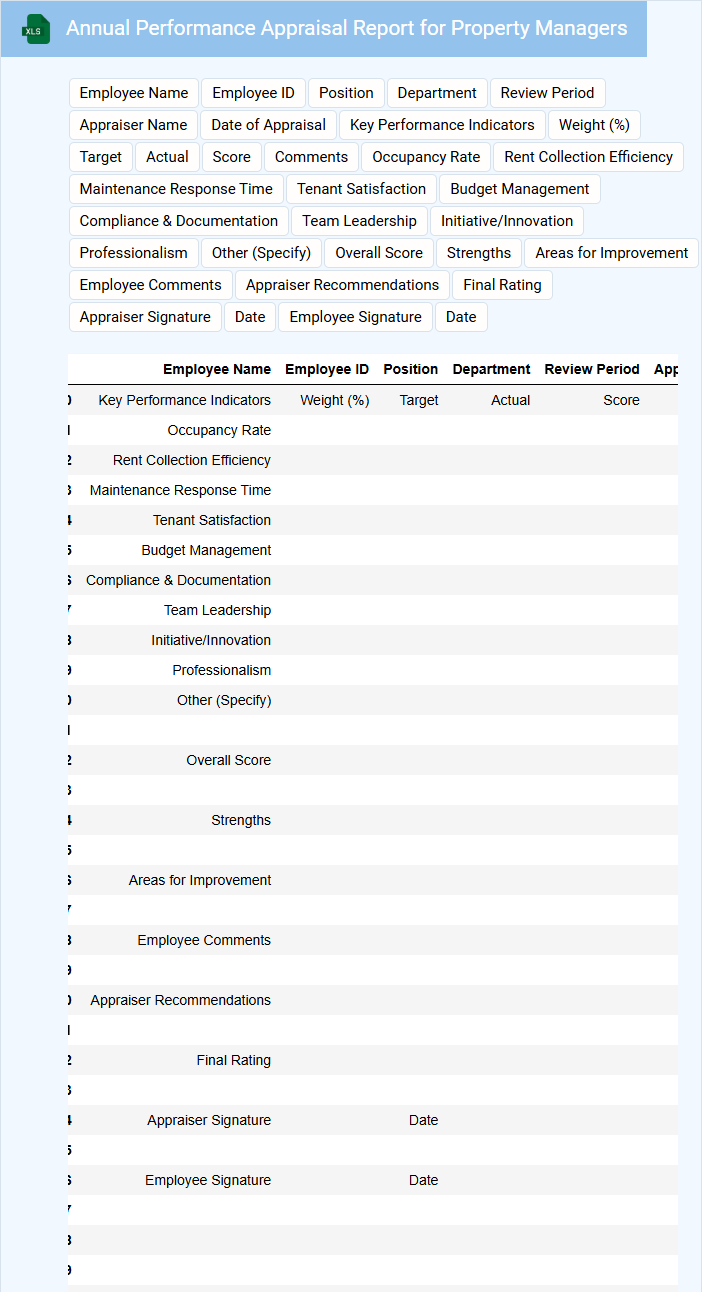

Annual Performance Appraisal Report for Property Managers

Annual Performance Appraisal Reports for Property Managers typically contain evaluations of job performance, achievement of goals, and areas for improvement.

- Job Performance: Detailed assessment of the property manager's efficiency, tenant relations, and maintenance oversight.

- Goal Achievement: Review of completed objectives related to occupancy rates, budget management, and property condition.

- Improvement Areas: Identification of skills to develop and strategies for enhancing management effectiveness.

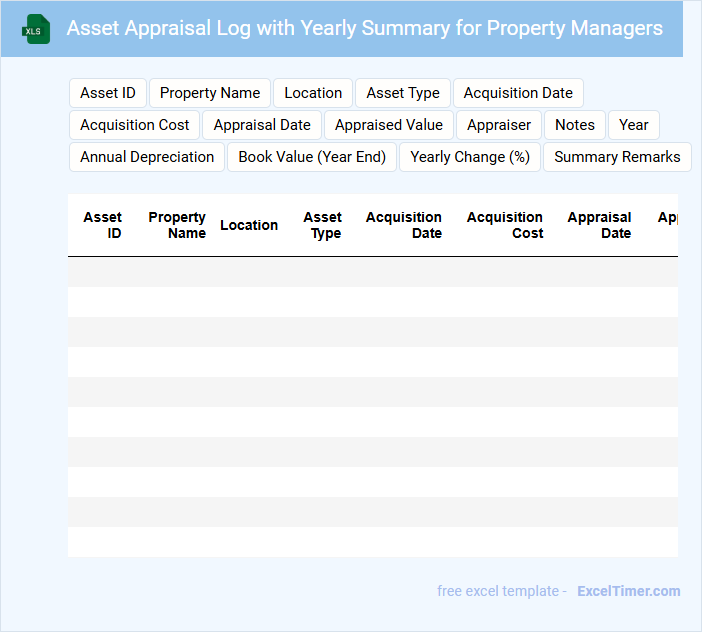

Asset Appraisal Log with Yearly Summary for Property Managers

An Asset Appraisal Log with Yearly Summary is a document used by property managers to track and evaluate the value and condition of assets over time. It helps in making informed decisions regarding maintenance, investments, and disposals.

- Include detailed descriptions and current valuations of each asset for accuracy.

- Summarize yearly changes to highlight trends and necessary actions.

- Maintain consistent appraisal intervals to ensure data reliability and comparability.

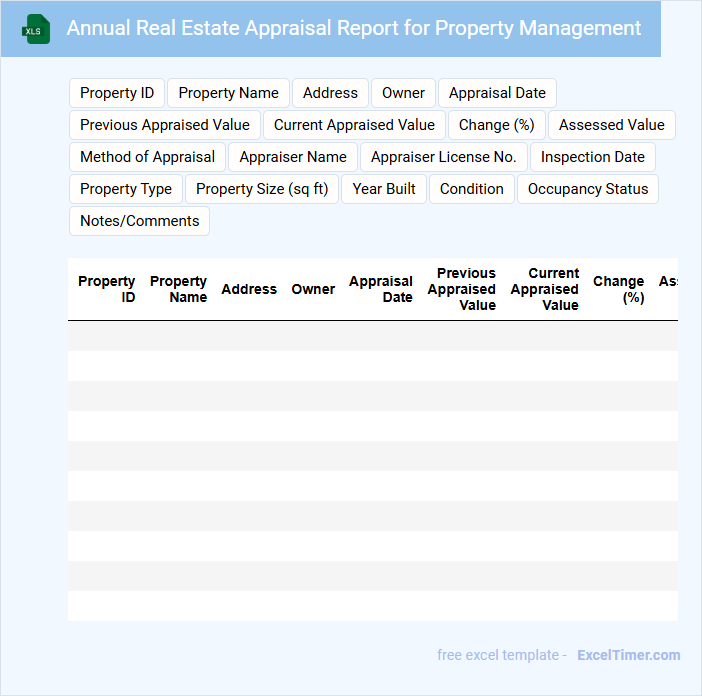

Annual Real Estate Appraisal Report for Property Management

An Annual Real Estate Appraisal Report typically contains a detailed evaluation of a property's current market value based on recent sales, market trends, and property conditions. It includes data on location, physical characteristics, and economic factors influencing the property's worth.

This report is essential for property management because it informs decision-making related to leasing, maintenance, and investment strategies. Ensuring accuracy and up-to-date information is crucial to maximize asset performance and financial planning.

Property Appraisal Tracking Sheet with Annual Updates

A Property Appraisal Tracking Sheet is a document used to record and monitor the value assessments of real estate properties over time. It typically contains details such as the property description, appraisal dates, appraised values, and adjustments or notes from each annual update. This sheet helps property owners or managers keep an organized history of property valuations for financial planning or reporting purposes.

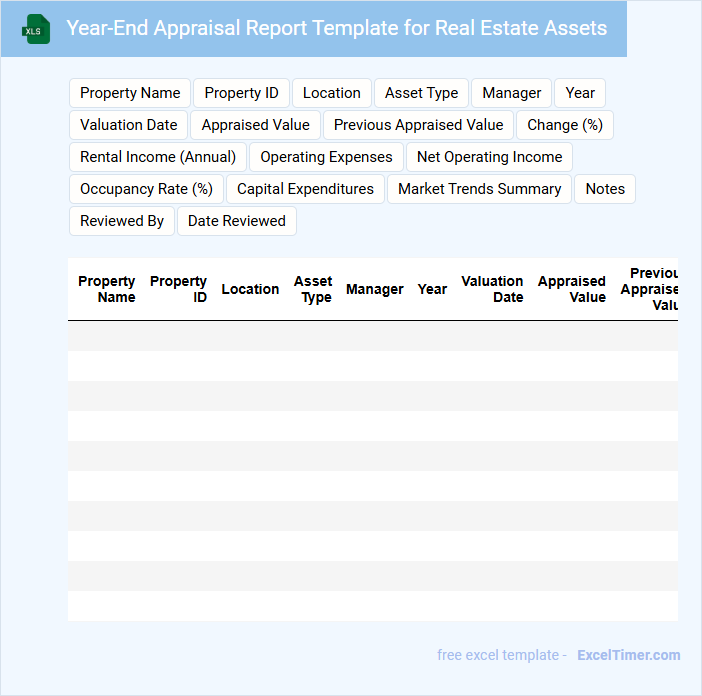

Year-End Appraisal Report Template for Real Estate Assets

A Year-End Appraisal Report Template for Real Estate Assets provides a structured summary of property evaluations conducted throughout the year. It serves as a crucial document for assessing asset value and investment performance.

- Include detailed property descriptions and market comparisons for accurate valuation.

- Incorporate trends and changes in local real estate markets influencing asset values.

- Highlight recommended actions or adjustments based on appraisal outcomes.

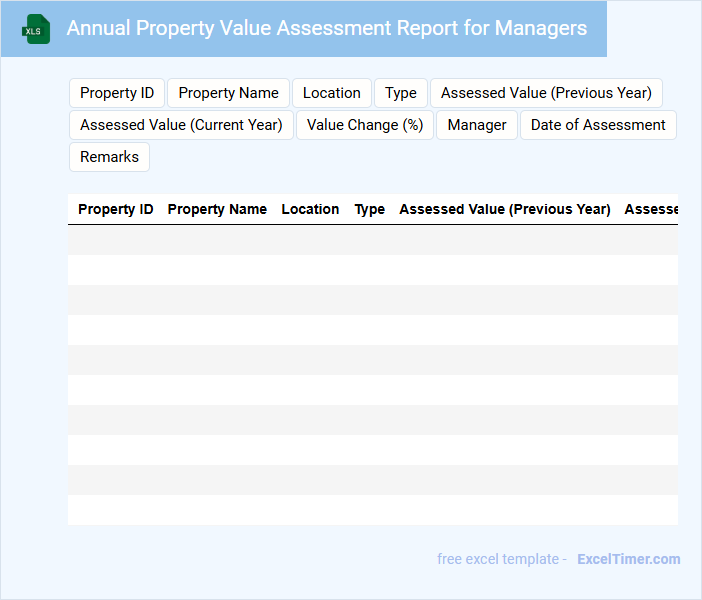

Annual Property Value Assessment Report for Managers

The Annual Property Value Assessment Report typically contains detailed evaluations of property values within a specific portfolio or region. It highlights changes in market trends, property conditions, and comparative analysis over the past year. Managers use this document to make informed decisions on asset management and investment strategies.

Important aspects to consider include accurate and updated valuation data, clear identification of market influencing factors, and transparent methodology explanations. Ensuring the report includes actionable insights and future projections can significantly aid in strategic planning. Additionally, compliance with relevant regulations and standards enhances the report's credibility and usefulness for decision-making.

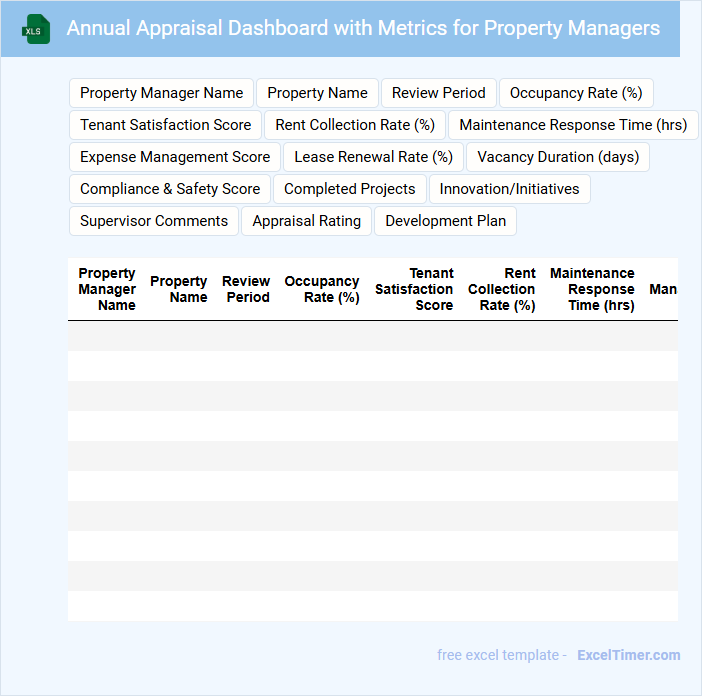

Annual Appraisal Dashboard with Metrics for Property Managers

The Annual Appraisal Dashboard for Property Managers typically contains comprehensive performance metrics and key indicators that reflect property management efficiency. It includes data such as occupancy rates, tenant satisfaction scores, maintenance request resolution times, and financial performance. This document helps identify areas of strength and opportunities for improvement to optimize property management strategies.

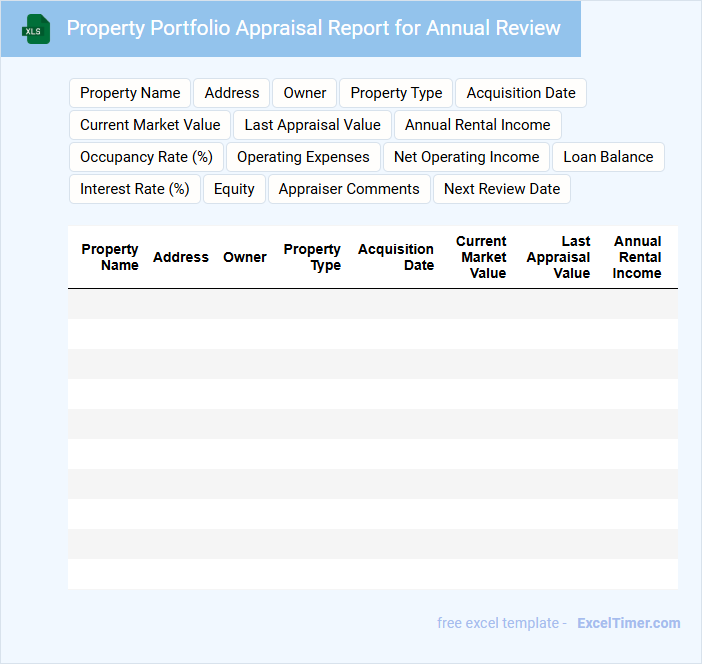

Property Portfolio Appraisal Report for Annual Review

A Property Portfolio Appraisal Report for Annual Review evaluates the current value, performance, and potential risks of a property portfolio. It is essential for informed decision-making by stakeholders and investors.

- Include detailed market analysis to support valuation accuracy.

- Highlight any changes in property conditions or tenant status.

- Provide recommendations for future investment or divestment strategies.

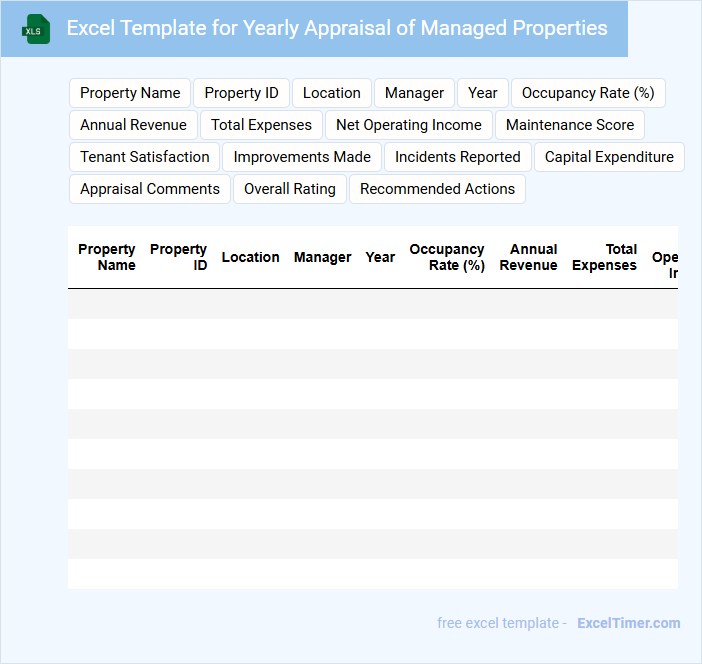

Excel Template for Yearly Appraisal of Managed Properties

An Excel Template for Yearly Appraisal of Managed Properties typically contains structured data fields such as property details, financial performance metrics, and maintenance records. It is designed to help property managers assess the value, condition, and profitability of their real estate portfolio systematically. Key components often include income statements, expense tracking, and improvement logs to provide a comprehensive overview.

When using this template, it is important to ensure accuracy in data entry and consistency in the measurement periods for meaningful year-over-year comparisons. Incorporating automated formulas for calculating key performance indicators (KPIs) like net operating income and occupancy rates enhances efficiency. Additionally, securing the document with password protection can prevent unauthorized changes and maintain data integrity.

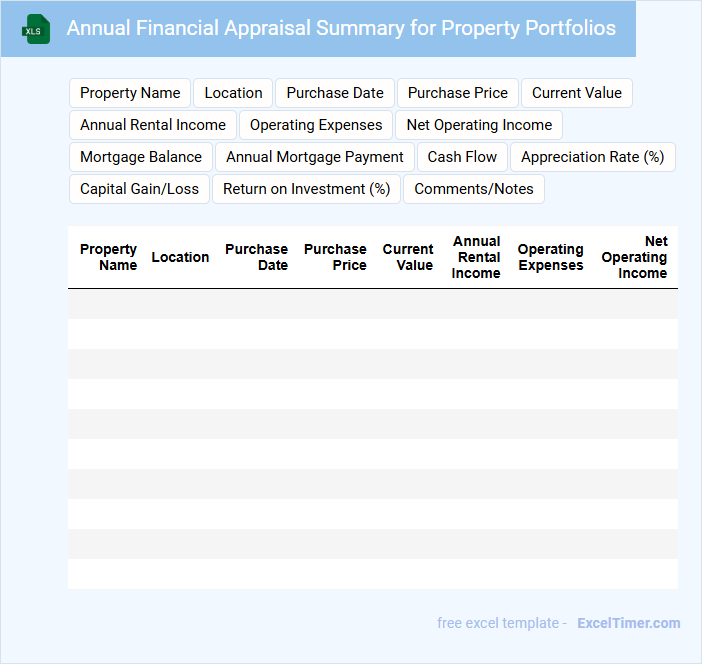

Annual Financial Appraisal Summary for Property Portfolios

The Annual Financial Appraisal Summary for Property Portfolios typically contains a detailed analysis of the financial performance and valuation of real estate assets over the fiscal year. It includes income statements, expense reports, and market value assessments to provide a comprehensive overview. Key insights often focus on investment returns, risk factors, and portfolio growth potential.

It is important to highlight accurate data collection and consistent valuation methodologies to ensure reliability and comparability. Including a breakdown of property types, geographic distribution, and tenant performance adds valuable context for stakeholders. Additionally, summarizing upcoming market trends and potential financial risks can guide strategic decision-making.

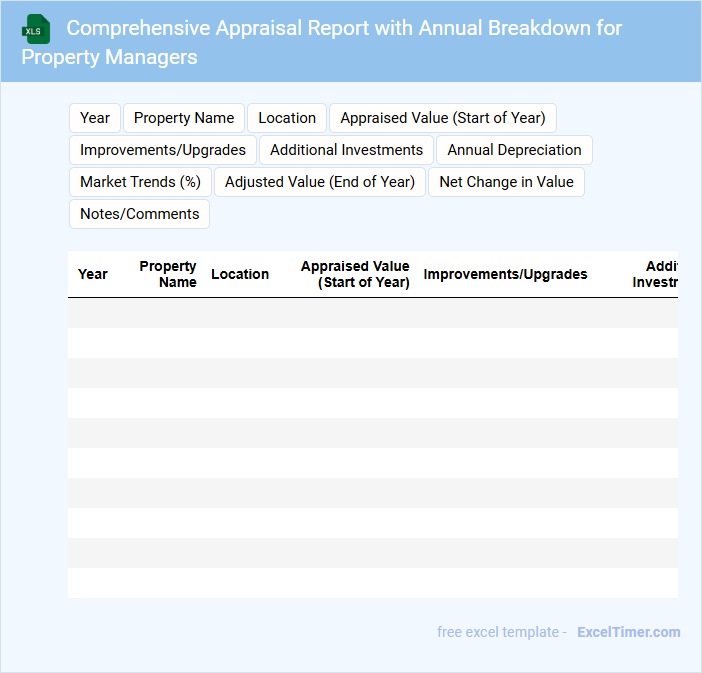

Comprehensive Appraisal Report with Annual Breakdown for Property Managers

What information does a Comprehensive Appraisal Report with Annual Breakdown for Property Managers typically include? This report usually contains detailed yearly assessments of property values, including market trends, maintenance costs, and rental income analysis. It helps property managers make informed decisions regarding investments, budgeting, and asset management.

Why is it important to include an annual breakdown in such appraisal reports? An annual breakdown provides clear insights into the property's financial performance over time, highlighting fluctuations and growth trends. This detailed timeline supports strategic planning and accurate forecasting for property managers.

What key performance indicators (KPIs) are most critical to include in an annual appraisal report for property managers?

Key performance indicators (KPIs) critical for an annual appraisal report for property managers include occupancy rate, tenant retention rate, maintenance response time, and rental income growth. Measuring operating expense ratio and lease renewal rate also provides insight into financial efficiency and tenant satisfaction. Tracking these KPIs helps evaluate property managers' effectiveness in maximizing property value and ensuring smooth operations.

How should tenant satisfaction and retention rates be measured and reported annually?

Tenant satisfaction should be measured through comprehensive surveys focusing on communication, responsiveness, and maintenance quality. Retention rates must be calculated by comparing the number of tenants renewing leases against total occupancy throughout the year. Your annual appraisal report should include these metrics with trend analysis and actionable insights for property management improvements.

What financial metrics best reflect a property manager's effectiveness in maximizing revenue and controlling expenses?

Key financial metrics reflecting a property manager's effectiveness include Net Operating Income (NOI), occupancy rate, and expense ratio. NOI measures profitability by subtracting operating expenses from gross rental income. Occupancy rate indicates revenue generation efficiency, while expense ratio assesses cost control relative to income.

How are property maintenance and capital improvement activities documented and evaluated in the annual appraisal report?

Property maintenance and capital improvement activities are documented in the annual appraisal report through detailed records of completed tasks, costs incurred, and timelines. Evaluation includes assessing the impact on property value, tenant satisfaction, and compliance with budget projections. Performance metrics and visual documentation such as before-and-after photos support objective analysis in the report.

What compliance and regulatory standards must be verified in the annual appraisal process for property managers?

The annual appraisal process for property managers must verify compliance with Fair Housing Act regulations, local building and safety codes, and Environmental Protection Agency (EPA) guidelines. Documentation should confirm adherence to tenant rights, rental licensing requirements, and anti-discrimination laws. Ensuring conformity with financial reporting standards and state-specific property management statutes safeguards legal and operational integrity.