![]()

The Annually Expense Tracker Excel Template for Freelancers helps manage and monitor yearly expenses efficiently, allowing freelancers to keep accurate financial records. This template simplifies budgeting by categorizing costs and providing clear visibility into spending patterns. Using it ensures better financial planning and easier tax preparation throughout the year.

Annual Expense Tracker Excel Template for Freelancers

What information is typically included in an Annual Expense Tracker Excel Template for Freelancers? This type of document usually contains detailed records of all business-related expenses throughout the year, categorized by type such as office supplies, travel, and software subscriptions. It helps freelancers monitor their spending, prepare accurate tax filings, and make informed financial decisions.

What is an important suggestion for using an Annual Expense Tracker Excel Template effectively? Regularly updating the tracker with every expense ensures accuracy and prevents missing deductions during tax season. Additionally, including notes or receipts for each entry can provide valuable context and support during financial reviews or audits.

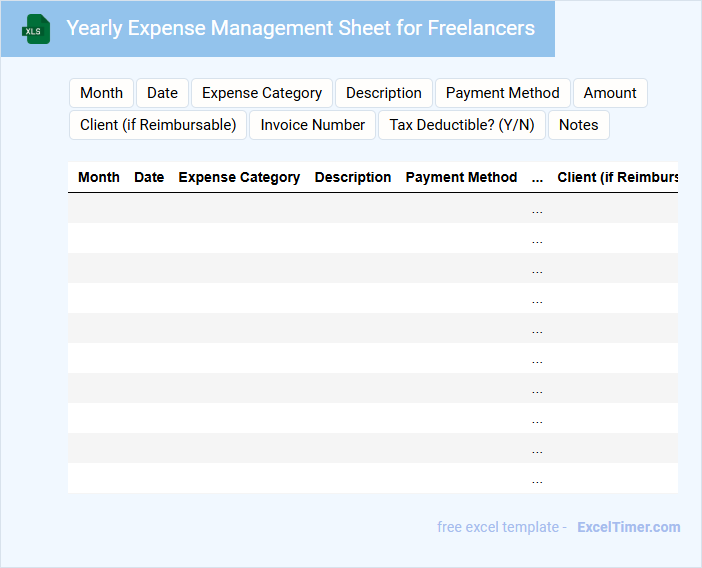

Yearly Expense Management Sheet for Freelancers

A Yearly Expense Management Sheet for Freelancers is a document used to track and organize all income and expenditures throughout the year to maintain financial clarity and budget effectively. It helps freelancers monitor their cash flow, prepare for taxes, and plan for future expenses.

- Include categories for different types of expenses such as office supplies, software subscriptions, and travel costs.

- Regularly update the sheet to ensure accuracy and avoid missing any deductible expenses.

- Incorporate a summary section to review total income, total expenses, and net profit annually.

Freelancer Annual Cost Tracking Spreadsheet

What information is typically included in a Freelancer Annual Cost Tracking Spreadsheet? This type of document usually contains detailed records of all expenses and income related to freelance projects throughout the year. It helps freelancers monitor their financial health, prepare for taxes, and optimize budgeting by tracking categories like software subscriptions, office supplies, travel, and client payments.

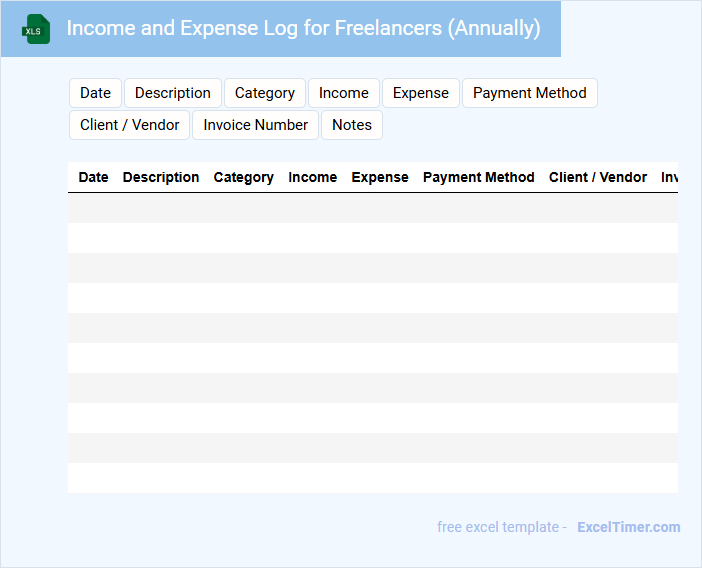

Income and Expense Log for Freelancers (Annually)

What information does an Income and Expense Log for Freelancers (Annually) typically contain? This document usually records all sources of income and detailed expenses related to freelance work over the course of a year. It helps freelancers track their financial performance and prepare accurate tax filings by organizing earnings and deductible costs clearly.

Detailed Annual Expense Report for Freelancers

A Detailed Annual Expense Report for Freelancers outlines all business-related expenditures incurred throughout the year, providing a clear financial overview. It helps in budgeting, tax preparation, and identifying potential cost-saving opportunities.

- Include categories such as office supplies, software subscriptions, and travel expenses for accurate tracking.

- Maintain detailed receipts and invoices to support all reported expenses for tax auditing purposes.

- Regularly update the report monthly to avoid discrepancies and simplify end-of-year reporting.

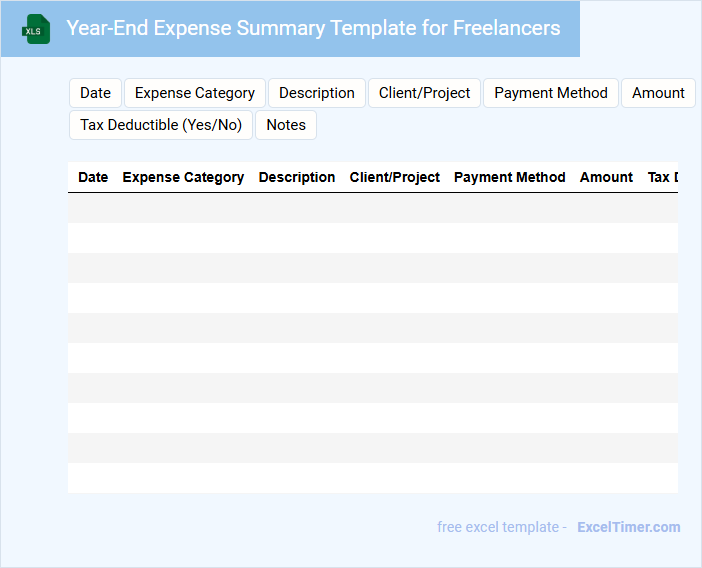

Year-End Expense Summary Template for Freelancers

A Year-End Expense Summary Template for Freelancers is a financial document designed to track and organize all expenses incurred throughout the year. It typically contains categories such as office supplies, software subscriptions, travel costs, and client-related expenses. Using this template helps freelancers accurately report deductions for tax purposes and monitor spending habits.

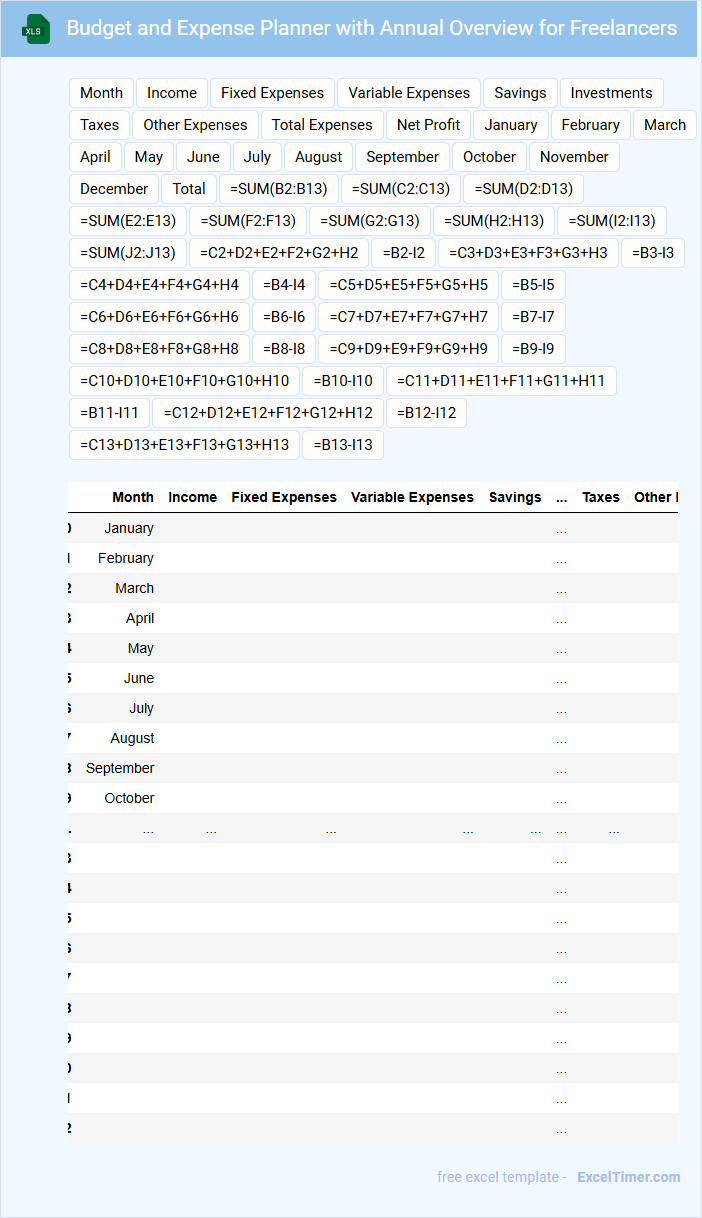

Budget and Expense Planner with Annual Overview for Freelancers

A Budget and Expense Planner with Annual Overview for Freelancers is a comprehensive financial document designed to track income, manage expenses, and provide a yearly summary to ensure financial stability.

- Income Tracking: Accurately record all sources of freelance income to monitor cash flow and identify revenue patterns.

- Expense Categorization: Organize expenses into clear categories to control spending and optimize tax deductions.

- Annual Overview: Summarize yearly financial data to evaluate profitability and plan future budgets effectively.

Tax-Ready Yearly Expense Tracker for Freelancers

A Tax-Ready Yearly Expense Tracker for freelancers is a document designed to systematically record and categorize all business-related expenses throughout the fiscal year. It helps in organizing financial data crucial for accurate tax filing and minimizing liabilities.

This type of document usually contains detailed entries of income, deductible expenses, receipts, invoices, and payment dates. Keeping such a tracker updated regularly ensures comprehensive records that support tax deductions and financial planning.

It is important to include categories aligned with tax codes and to review entries monthly to avoid last-minute discrepancies during tax season.

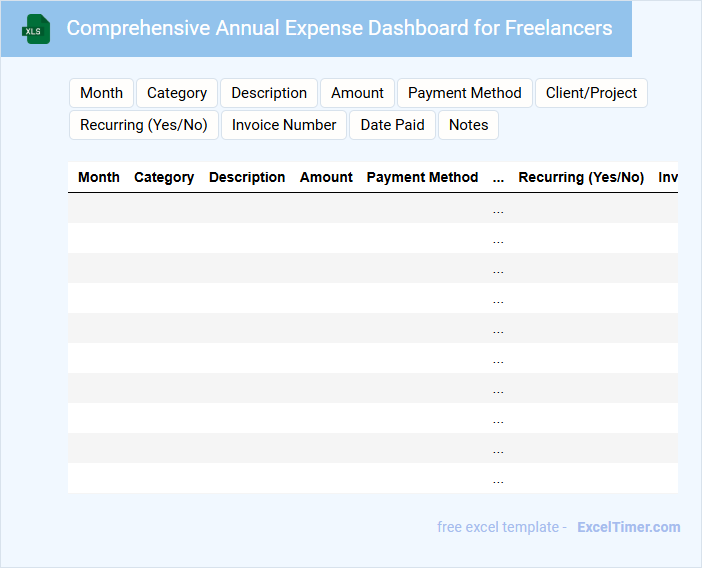

Comprehensive Annual Expense Dashboard for Freelancers

A Comprehensive Annual Expense Dashboard for Freelancers is a detailed document that tracks all yearly expenditures related to a freelancer's business operations. It usually contains categorized expense entries, monthly summaries, and visual charts for an easy overview of spending patterns. An important suggestion is to regularly update and review the dashboard to ensure accurate financial planning and tax preparedness.

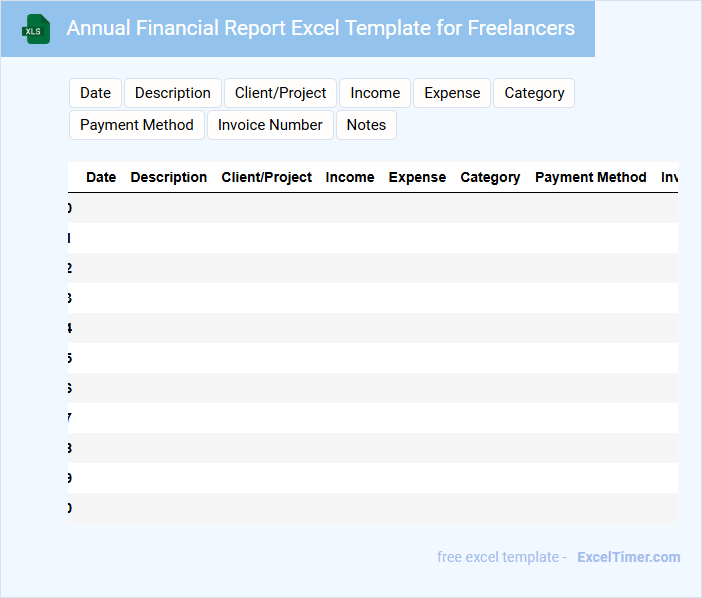

Annual Financial Report Excel Template for Freelancers

What information does an Annual Financial Report Excel Template for Freelancers typically contain? This document usually includes sections for income tracking, expense records, and profit calculations to provide a comprehensive view of a freelancer's financial status over the year. It is designed to help freelancers manage their finances efficiently and prepare accurate tax submissions.

What should freelancers focus on when using this template? It's important to ensure all income sources and expenses are itemized clearly, and to regularly update the template to avoid missing any financial data. Additionally, including tax deductions and savings goals can enhance financial planning and reporting accuracy.

Freelancer’s Yearly Payment and Expense Tracker

A Freelancer's Yearly Payment and Expense Tracker is a document used to record and monitor all income and expenditures over the course of a year. It helps freelancers manage their finances efficiently and prepare for tax season with accurate data.

This tracker typically contains sections for client payments, project details, expense categories, and payment dates. Maintaining organized and up-to-date records in this document ensures better financial planning and reduces the risk of missed deductions.

Tracker for Yearly Business Expenses of Freelancers

What information is typically included in a tracker for yearly business expenses of freelancers? This document usually contains detailed records of all business-related expenditures such as office supplies, software subscriptions, travel costs, and client-related expenses. Keeping an organized and up-to-date tracker helps freelancers monitor their spending, prepare for tax filings, and manage budgets effectively.

What is an important consideration when creating a yearly expense tracker for freelancers? It is essential to categorize expenses accurately and consistently to simplify financial analysis and tax deductions. Including features like date, expense type, payment method, and receipts ensures thorough documentation and improves financial clarity.

Annual Personal and Business Expense Sheet for Freelancers

The Annual Personal and Business Expense Sheet for freelancers typically contains detailed records of all income and expenditures related to both personal and professional activities. It helps in organizing financial data to track spending, prepare taxes, and assess overall financial health.

Maintaining accurate and categorized expense entries is crucial for maximizing tax deductions and budgeting effectively. Always include receipts and invoices to support your claims during tax filing and financial review processes.

All-in-One Annual Expense Tracker for Freelancers

The All-in-One Annual Expense Tracker for Freelancers is a comprehensive document that helps individuals monitor and organize their yearly expenses efficiently. It typically contains detailed sections for categorizing costs, tracking payments, and calculating total expenditures to maintain clear financial records. Keeping this tracker updated regularly prevents overlooked expenses and simplifies tax filing.

Freelancers benefit greatly from this tool by gaining a clear overview of their spending habits and cash flow throughout the year. Important elements to include are sections for client payments, business-related purchases, and tax deductions. Consistent use ensures better budgeting and financial planning for future projects.

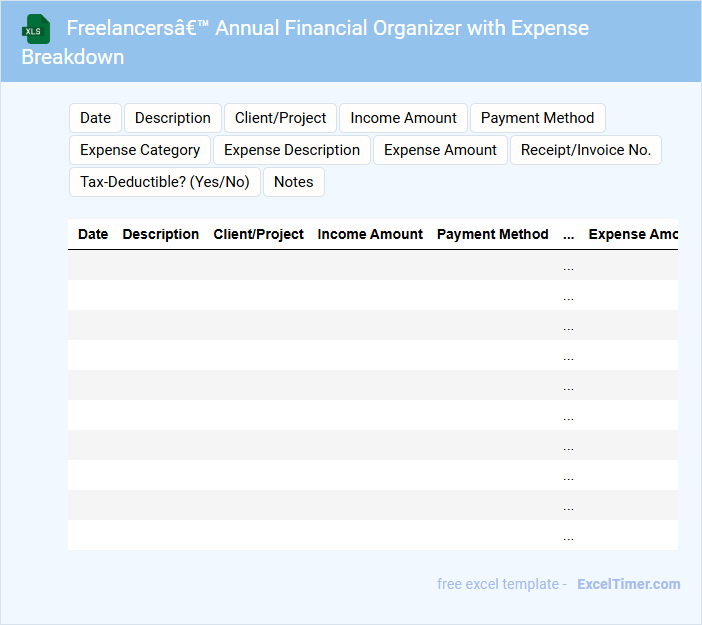

Freelancers’ Annual Financial Organizer with Expense Breakdown

The Freelancers' Annual Financial Organizer is a comprehensive document designed to track and summarize yearly income and expenses for self-employed individuals. It typically contains detailed breakdowns of earnings, categorized expenses, invoices, and tax deductions.

This organizer is essential for accurate tax filing and financial planning. Including a well-structured Expense Breakdown helps freelancers monitor spending habits and maximize deductible costs effectively.

What are the essential income and expense categories to include in an annually expense tracker for freelancers?

An annual expense tracker for freelancers should include essential income categories like client payments, project bonuses, and passive income. Expense categories must cover office supplies, software subscriptions, marketing costs, taxes, and professional development. Your tracker enables precise budgeting and financial planning by capturing these key financial elements.

How can formulas be used to automatically calculate monthly and annual totals in an expense tracker?

Formulas like SUM and SUMIF in Excel can automatically calculate your monthly and annual totals by aggregating expense data based on specified date ranges. Using cell references and dynamic ranges, these formulas update totals instantly as new expenses are entered. This ensures accurate tracking of your freelance spending patterns without manual calculations.

What methods can be employed to visually highlight overspending or budget deviations in an Excel tracker?

Use conditional formatting with color scales or icon sets in your Excel expense tracker to visually highlight overspending or budget deviations. Data bars can also provide intuitive visual cues for expenses nearing or exceeding set limits. Incorporate sparklines or customized charts next to your expense categories for quick trend analysis and instant recognition of budget variances.

How can freelancers effectively differentiate between business and personal expenses within a single document?

Freelancers can effectively differentiate between business and personal expenses by creating separate expense categories or columns within the annual expense tracker Excel document. Using distinct labels such as "Business" and "Personal" for each entry ensures clear classification and simplifies tax reporting. Leveraging filters and conditional formatting further enhances visibility and accuracy in tracking expenses.

What best practices ensure accurate and consistent data entry throughout the year in an annually expense tracker?

Use consistent categories and standardized date formats to maintain data uniformity in your annually expense tracker. Regularly update expenses with detailed descriptions to enhance accuracy and tracking efficiency. Implement data validation rules and periodic reviews to prevent errors and ensure reliable financial records.