![]()

The Annually Tax Deduction Tracker Excel Template for Landlords simplifies managing and organizing tax deductions throughout the year. It helps landlords accurately record expenses such as maintenance, mortgage interest, and property taxes, ensuring maximum tax savings. Utilizing this template improves financial tracking and streamlines tax filing processes for rental property owners.

Annual Tax Deduction Tracker Excel Template for Landlords

An Annual Tax Deduction Tracker Excel Template for Landlords typically contains detailed records of rental income and deductible expenses to streamline tax filing.

- Income Summary: Tracks all rental payments received throughout the year.

- Expense Categories: Organizes deductible costs such as repairs, maintenance, and property management fees.

- Tax Calculation: Provides automated calculations to estimate total tax deductions and liabilities.

Yearly Expense Tracker with Tax Deductions for Rental Properties

What information is typically included in a Yearly Expense Tracker with Tax Deductions for Rental Properties? This document usually contains detailed records of all income and expenses related to rental properties, including rental income, maintenance costs, mortgage interest, and property taxes. It also highlights potential tax deductions such as depreciation, insurance, and repairs to ensure accurate financial tracking and maximize tax benefits.

What important aspects should be considered when maintaining this document? Consistency in recording all transactions, keeping receipts and invoices for verification, and regularly categorizing expenses to identify deductible items are crucial. Additionally, staying updated on relevant tax laws and consulting a tax professional can help optimize deductions and compliance.

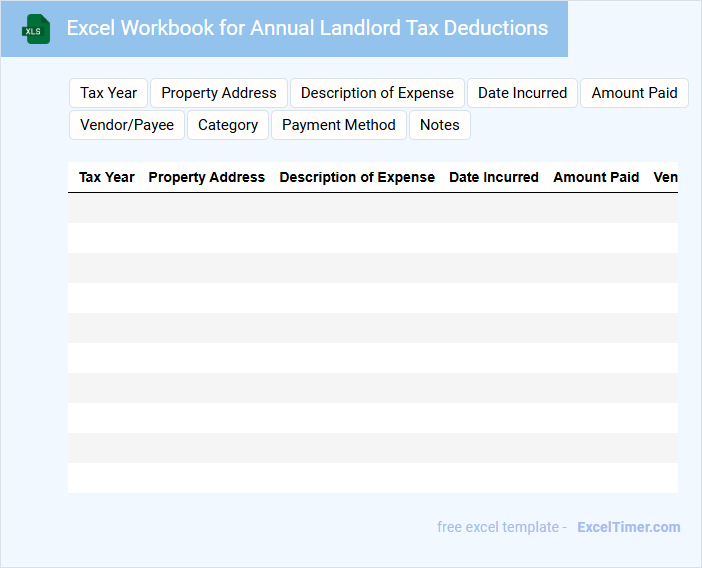

Excel Workbook for Annual Landlord Tax Deductions

An Excel Workbook for Annual Landlord Tax Deductions typically contains detailed financial records and calculations pertinent to rental property expenses and income for tax reporting purposes.

- Income Tracking: Records all rental income received throughout the fiscal year.

- Expense Categorization: Organizes deductible expenses such as repairs, maintenance, and mortgage interest.

- Summary Reports: Provides easy-to-read summaries for accurate tax filing and financial analysis.

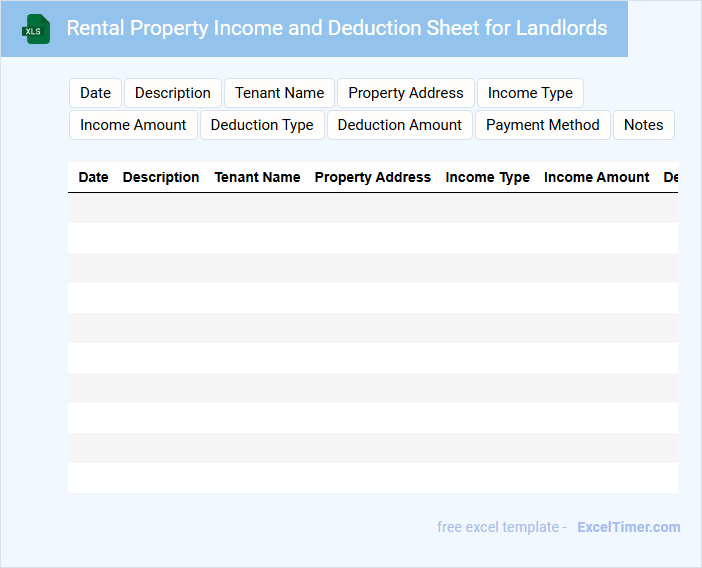

Rental Property Income and Deduction Sheet for Landlords

A Rental Property Income and Deduction Sheet is a crucial document for landlords to track their rental earnings and expenses comprehensively. It typically contains details of rental income, maintenance costs, mortgage interest, property taxes, and other deductible expenses. This helps landlords efficiently manage their finances and prepare accurate tax returns.

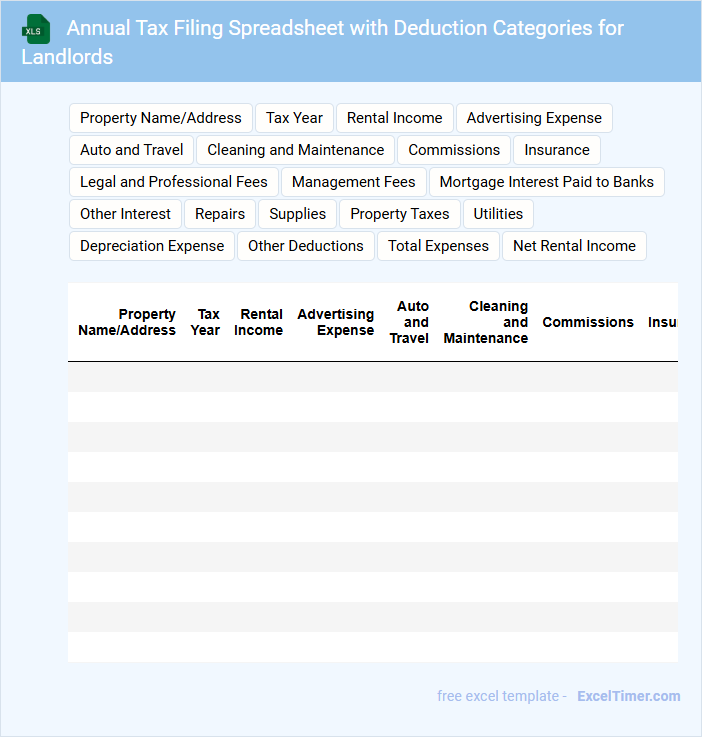

Annual Tax Filing Spreadsheet with Deduction Categories for Landlords

What information is typically included in an Annual Tax Filing Spreadsheet with Deduction Categories for Landlords? This document usually contains detailed records of rental income, expenses, and categorized deductions specific to property management. It helps landlords systematically organize financial data to maximize tax benefits and ensure compliance with tax regulations.

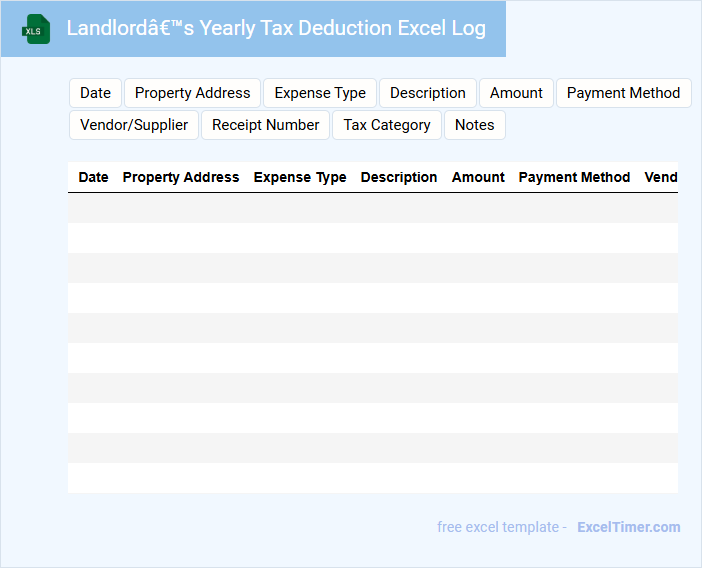

Landlord’s Yearly Tax Deduction Excel Log

A Landlord's Yearly Tax Deduction Excel Log typically contains detailed records of rental income and expenses throughout the fiscal year. It helps landlords systematically track deductible costs such as repairs, maintenance, and mortgage interest payments. Maintaining accurate entries ensures easier tax filing and maximizes potential tax deductions.

Rental Income Statement with Deduction Tracking for Landlords

The Rental Income Statement is a crucial document for landlords, detailing monthly earnings from rental properties alongside tracking all relevant deductions. It helps in maintaining transparent financial records, ensuring accurate reporting for tax purposes.

This statement typically includes rent received, expenses such as repairs, maintenance, property management fees, and any other deductible costs. For effective management, landlords should consistently update and categorize each entry to maximize tax benefits and avoid discrepancies.

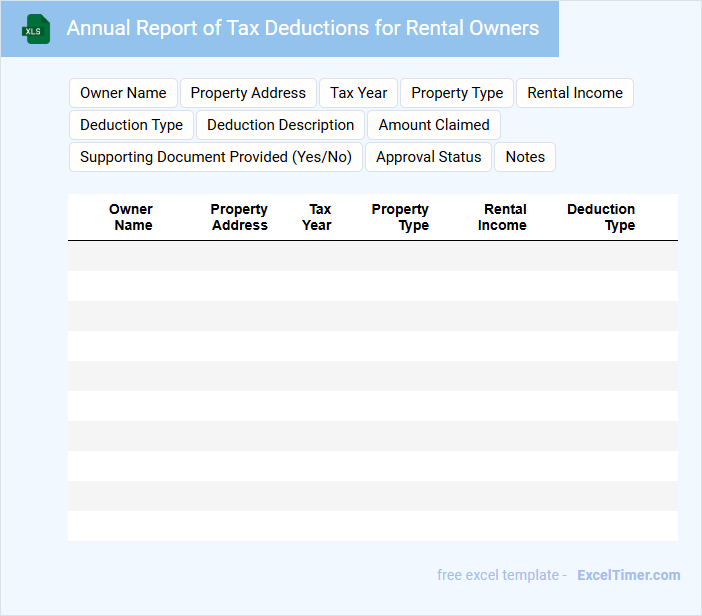

Annual Report of Tax Deductions for Rental Owners

What information is typically included in an Annual Report of Tax Deductions for Rental Owners? This document usually contains a detailed summary of all tax-deductible expenses related to rental properties, such as maintenance costs, mortgage interest, and property management fees. It helps rental owners track and organize relevant financial data to maximize their tax benefits.

Year-End Expense & Deduction Tracking Sheet for Landlords

What information is typically included in a Year-End Expense & Deduction Tracking Sheet for Landlords? This document usually contains detailed records of all rental property-related expenses such as repairs, maintenance, property management fees, and mortgage interest. It helps landlords organize financial data for accurate tax reporting and maximizes deductible expenses.

What are the important considerations when using this tracking sheet? It is crucial to maintain thorough and accurate records throughout the year, categorizing each expense properly to ensure tax compliance and ease of preparation. Additionally, landlords should regularly update the sheet and keep supporting documents like receipts and invoices for verification.

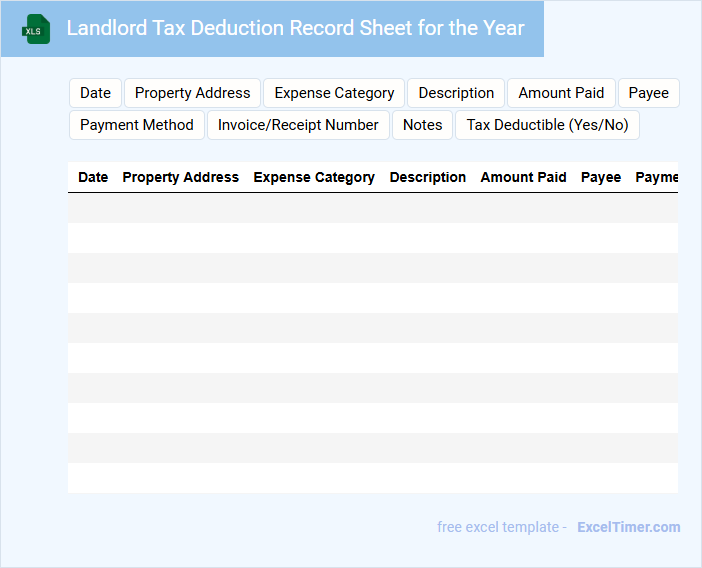

Landlord Tax Deduction Record Sheet for the Year

The Landlord Tax Deduction Record Sheet for the year is a crucial document that helps landlords track their deductible expenses related to rental properties. It typically contains detailed entries of all income received and expenses incurred, such as maintenance costs, mortgage interest, and property taxes. Keeping accurate records in this sheet ensures compliance and maximizes tax benefits.

Important factors to include are clear dates, descriptions of transactions, and categorized expenses to simplify tax filing. Regular updates and backups reduce the risk of errors and loss of information. Landlords should also retain supporting documents like receipts and invoices alongside the record sheet.

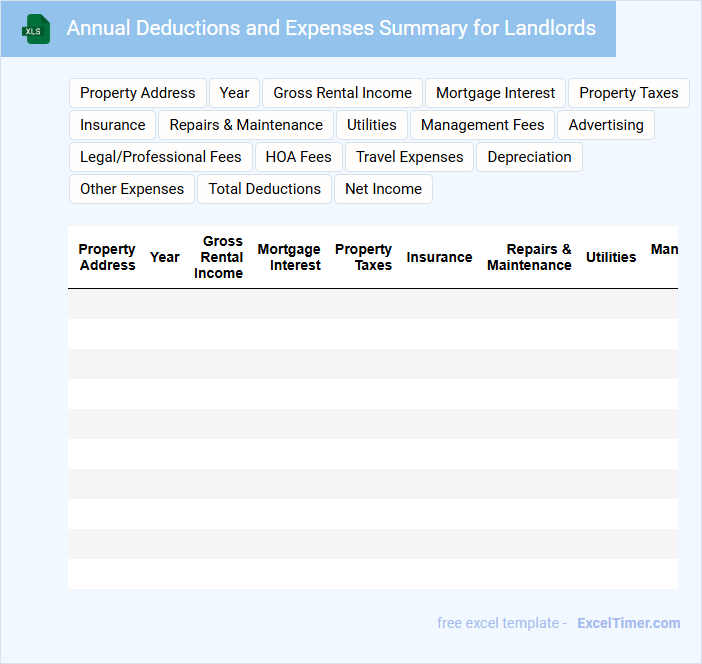

Annual Deductions and Expenses Summary for Landlords

What information is typically included in an Annual Deductions and Expenses Summary for Landlords? This document usually outlines all deductible expenses related to property management and maintenance over the year. It provides a detailed record of costs that landlords can claim to reduce taxable income.

Why is it important to maintain accurate records in this summary? Keeping precise and organized expense records ensures landlords maximize allowable deductions and comply with tax regulations. Important items to track include mortgage interest, repairs, property taxes, insurance, and professional fees.

Excel Template for Yearly Rental Income & Tax Deduction Reporting

This Excel template for yearly rental income and tax deduction reporting typically contains detailed spreadsheets to track rental revenues, expenses, and allowable tax deductions throughout the fiscal year. It usually includes sections for tenant information, monthly rent payments, maintenance costs, and mortgage interest. To maximize its utility, ensure the template features clear categories for deductible expenses and automated summary calculations for tax filing purposes.

Yearly Property Tax Deduction Tracker with Rental Details

What information does a Yearly Property Tax Deduction Tracker with Rental Details typically contain? This document usually includes a summary of annual property tax payments alongside detailed records of rental incomes and related expenses. It helps property owners accurately track deductions for tax filing and optimize their financial planning.

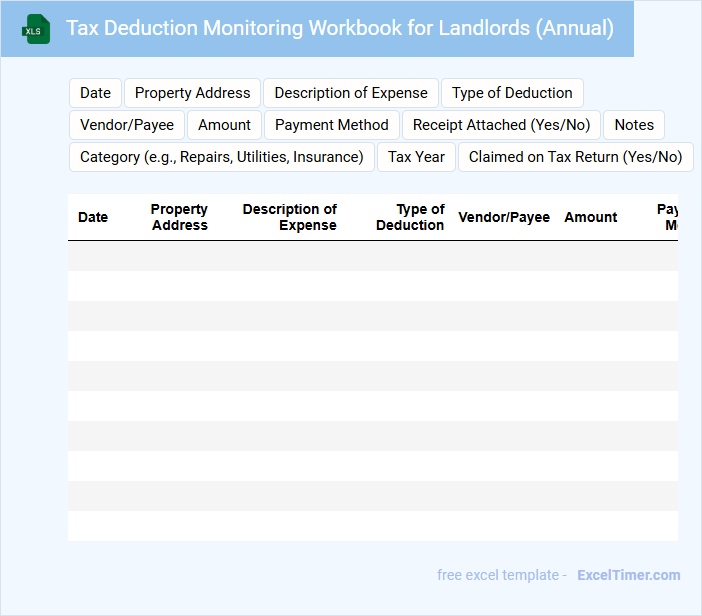

Tax Deduction Monitoring Workbook for Landlords (Annual)

The Tax Deduction Monitoring Workbook for landlords is a structured document that helps track and organize all deductible expenses related to rental properties over the fiscal year. Typically, it includes sections for recording income, maintenance costs, mortgage interest, and other relevant expenditures, ensuring accurate financial reporting. Maintaining this workbook annually is crucial for maximizing tax benefits and simplifying tax return preparation.

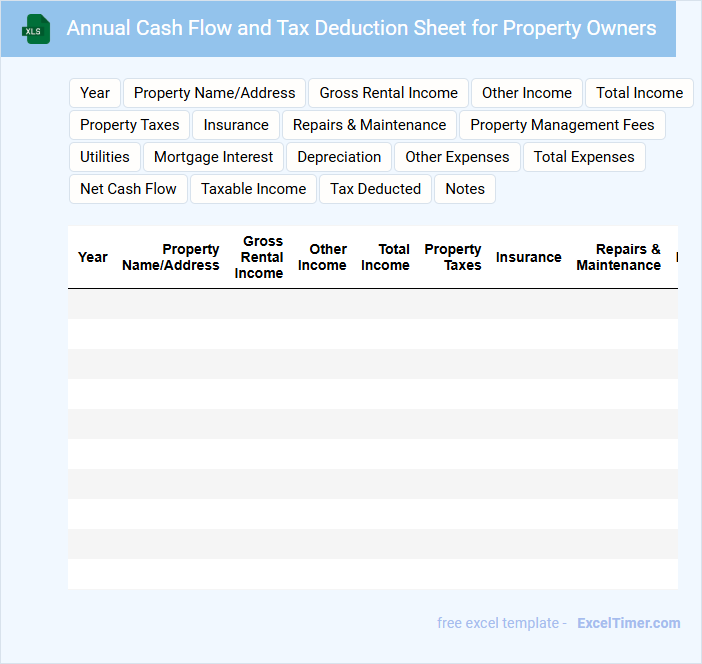

Annual Cash Flow and Tax Deduction Sheet for Property Owners

An Annual Cash Flow and Tax Deduction Sheet for property owners typically contains detailed records of all income generated from the property, including rent and other sources. It also lists expenses such as maintenance, mortgage interest, and property taxes that can be deducted for tax purposes. This document is essential for accurately assessing the financial performance and tax obligations related to property ownership.

What essential expense categories should be included in an Annually Tax Deduction Tracker for landlords in Excel?

An Annually Tax Deduction Tracker for landlords in Excel should include essential expense categories such as mortgage interest, property taxes, insurance premiums, maintenance and repairs, property management fees, utilities, and depreciation. Tracking these categories enables accurate tax deduction claims and maximizes landlord savings. Detailed expense documentation within each category improves financial reporting and audit readiness.

How can you automate total annual deductions using Excel formulas for each property?

Use the SUMIF formula to automate total annual deductions by property in your Excel tracker. Apply =SUMIF(PropertyRange, PropertyName, DeductionRange) where PropertyRange contains property names and DeductionRange lists corresponding deductions. This dynamically calculates total deductions per property, improving accuracy and efficiency in annual tax tracking.

Which columns are critical for tracking payment dates, vendor names, and receipt numbers for tax documentation?

Critical columns for your Annually Tax Deduction Tracker include Payment Dates, Vendor Names, and Receipt Numbers. Accurately recording these ensures proper tax documentation and eases deduction claims. Maintaining organized data in these specific columns supports compliance and audit readiness.

What method can be used in Excel to separate deductible versus non-deductible landlord expenses?

Use Excel's IF function to separate deductible versus non-deductible landlord expenses by setting criteria based on expense categories. For example, create a column with the formula =IF(ISNUMBER(MATCH(A2, deductible_list, 0)), "Deductible", "Non-Deductible") using a predefined list of deductible expenses. This method helps you efficiently track and categorize your annual tax deductions.

How should depreciation be accounted for and recorded in a landlord's annual tax deduction tracker spreadsheet?

Depreciation should be recorded as a non-cash expense that reduces the taxable rental income in the landlord's annual tax deduction tracker spreadsheet. Each rental property's depreciable assets must be listed with their purchase cost, useful life, and accumulated depreciation calculated using the IRS-approved method, typically the Modified Accelerated Cost Recovery System (MACRS). Accurate tracking of annual depreciation ensures compliance and maximizes tax deductions by reflecting the gradual loss of asset value over time.