The Annually Financial Report Excel Template for Nonprofits streamlines the process of tracking income, expenses, and donations with customizable spreadsheets tailored to nonprofit needs. This template ensures accurate financial reporting, helping organizations maintain transparency and comply with regulatory requirements. Efficiently managing budgets and generating clear visuals supports effective decision-making and donor communication.

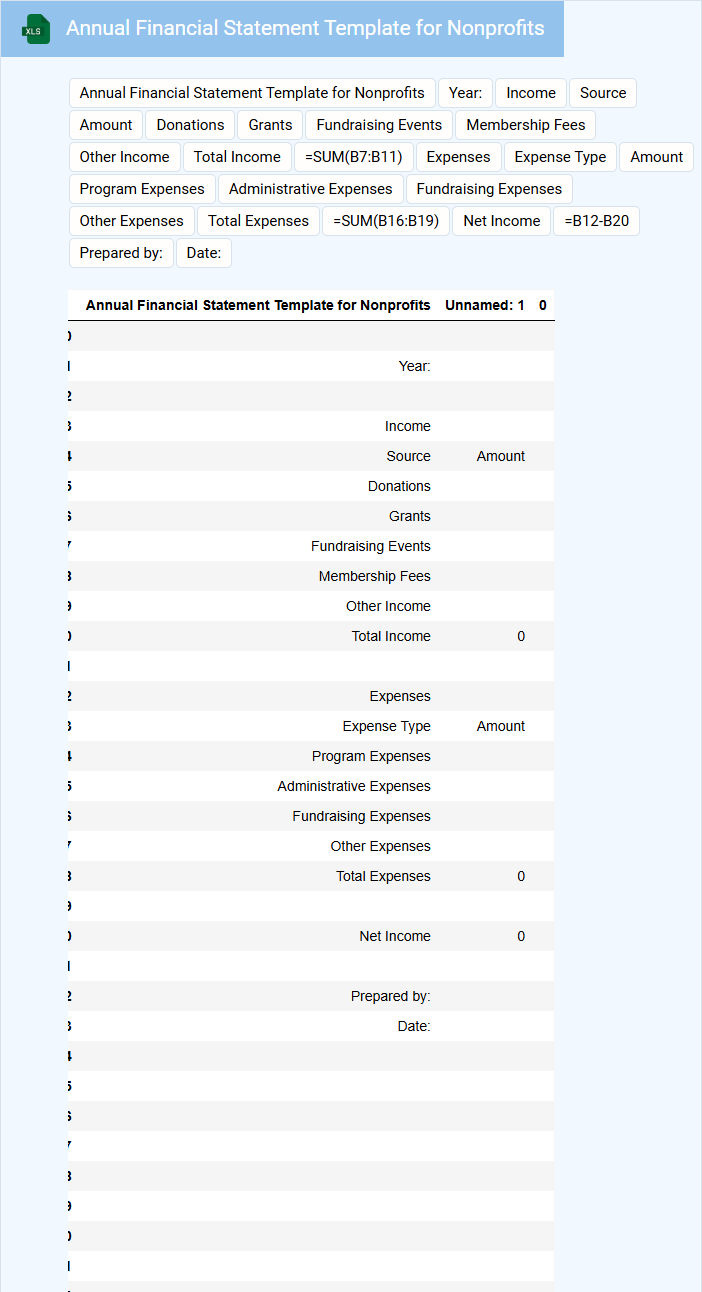

Annual Financial Statement Template for Nonprofits

What information is typically included in an Annual Financial Statement Template for Nonprofits? This document usually contains detailed records of income, expenses, assets, and liabilities for the organization throughout the fiscal year. It serves to provide transparency and accountability to donors, stakeholders, and regulatory bodies.

What is an important consideration when preparing this template? Accuracy and clarity are crucial, ensuring that all financial data is reliable and presented in an easily understandable format to support informed decision-making and compliance with nonprofit regulations.

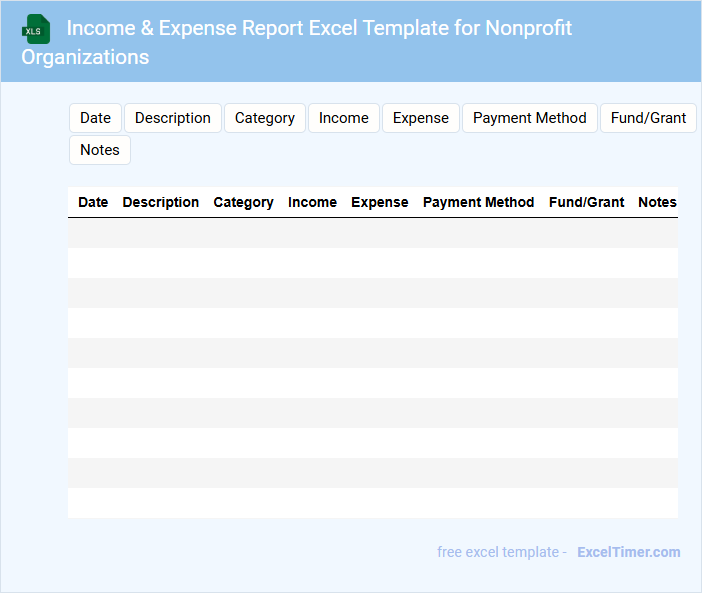

Income & Expense Report Excel Template for Nonprofit Organizations

What does an Income & Expense Report Excel Template for Nonprofit Organizations typically contain? This type of document usually includes detailed records of all income sources and expenses categorized by type, date, and purpose to track the financial health of the nonprofit. It is essential for maintaining transparency, budgeting accurately, and ensuring compliance with regulatory requirements.

What important features should be included in this template? The template should have clear categories for donations, grants, fundraising activities, and operational expenses, along with summary sections for total income and total expenses. Additionally, incorporating automated calculations and visual charts can help nonprofit leaders easily analyze financial trends and make informed decisions.

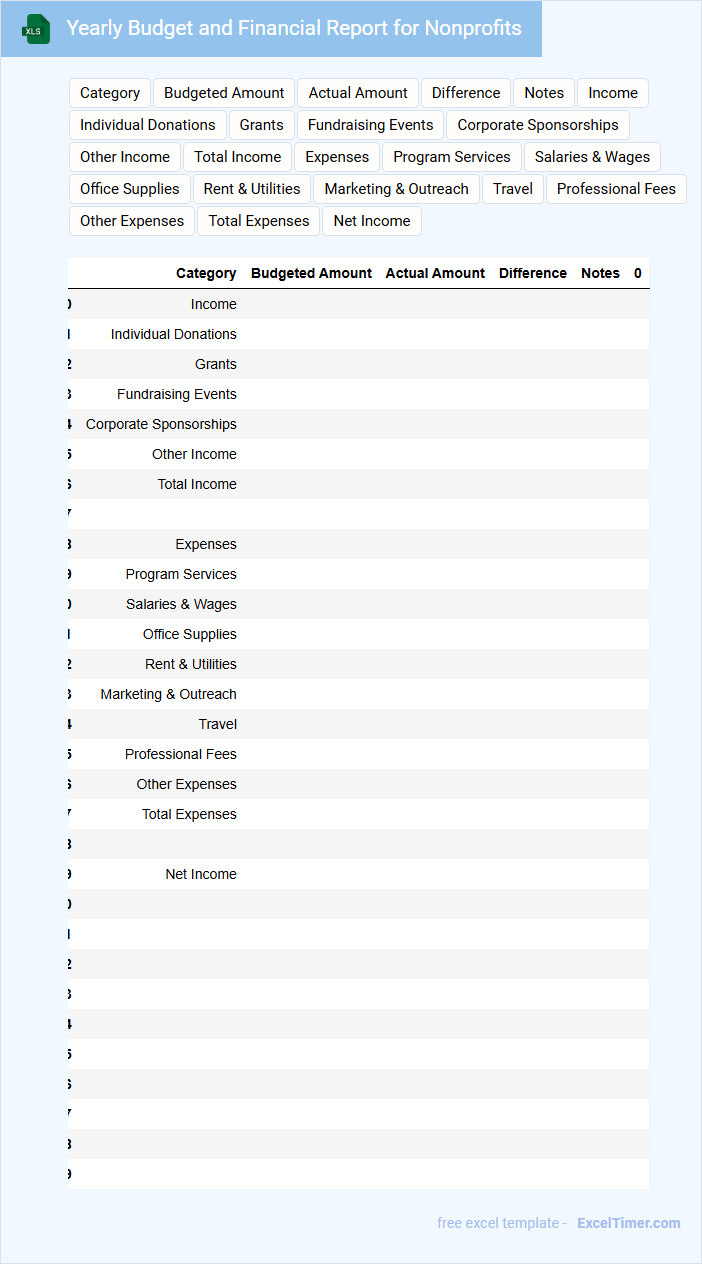

Yearly Budget and Financial Report for Nonprofits

This document typically contains a comprehensive overview of a nonprofit's annual financial activities and future budget plans.

- Income and Expenses: Detailed records of all sources of revenue and categories of expenditures.

- Financial Statements: Including balance sheets, income statements, and cash flow statements.

- Budget Projections: Planned allocations for the upcoming year with clear justification.

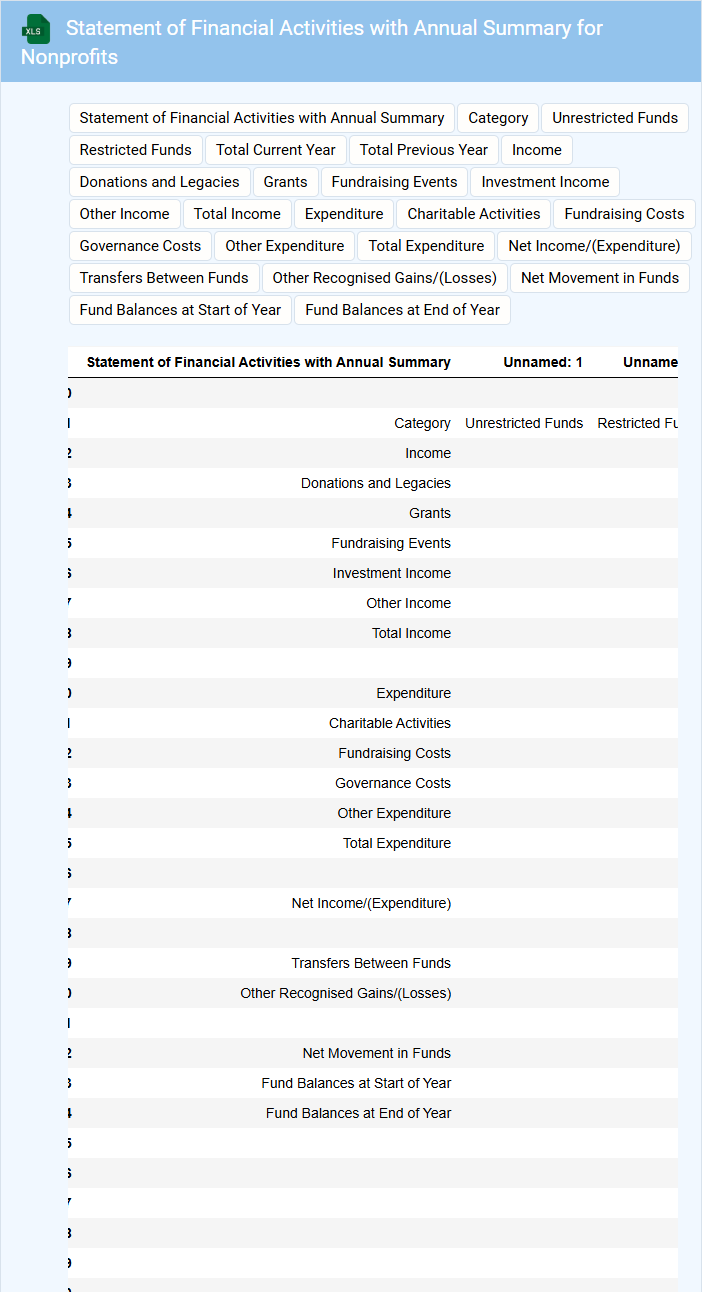

Statement of Financial Activities with Annual Summary for Nonprofits

A Statement of Financial Activities for nonprofits details all income and expenses, showing how funds are utilized over the year. It provides a clear overview of the organization's financial health and accountability.

Including an Annual Summary helps stakeholders quickly grasp the overall financial performance and changes in net assets. It is crucial to ensure accuracy and transparency for regulatory compliance and donor trust.

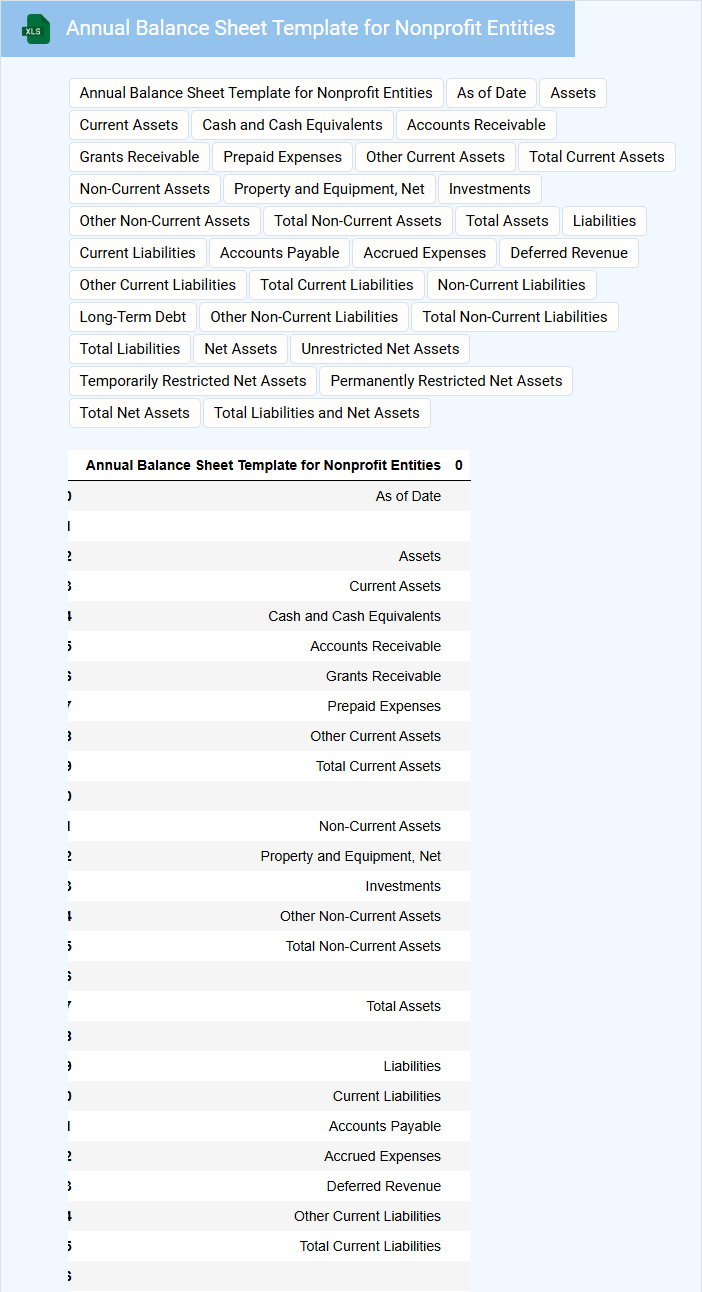

Annual Balance Sheet Template for Nonprofit Entities

The Annual Balance Sheet Template for nonprofit entities is a financial document that summarizes the organization's assets, liabilities, and net assets at a specific point in time. It provides a clear snapshot of the nonprofit's financial health and stability.

This type of document usually contains detailed line items such as cash, investments, receivables, payables, and fund balances. Ensuring accurate categorization and completeness of financial data is essential for transparency and compliance.

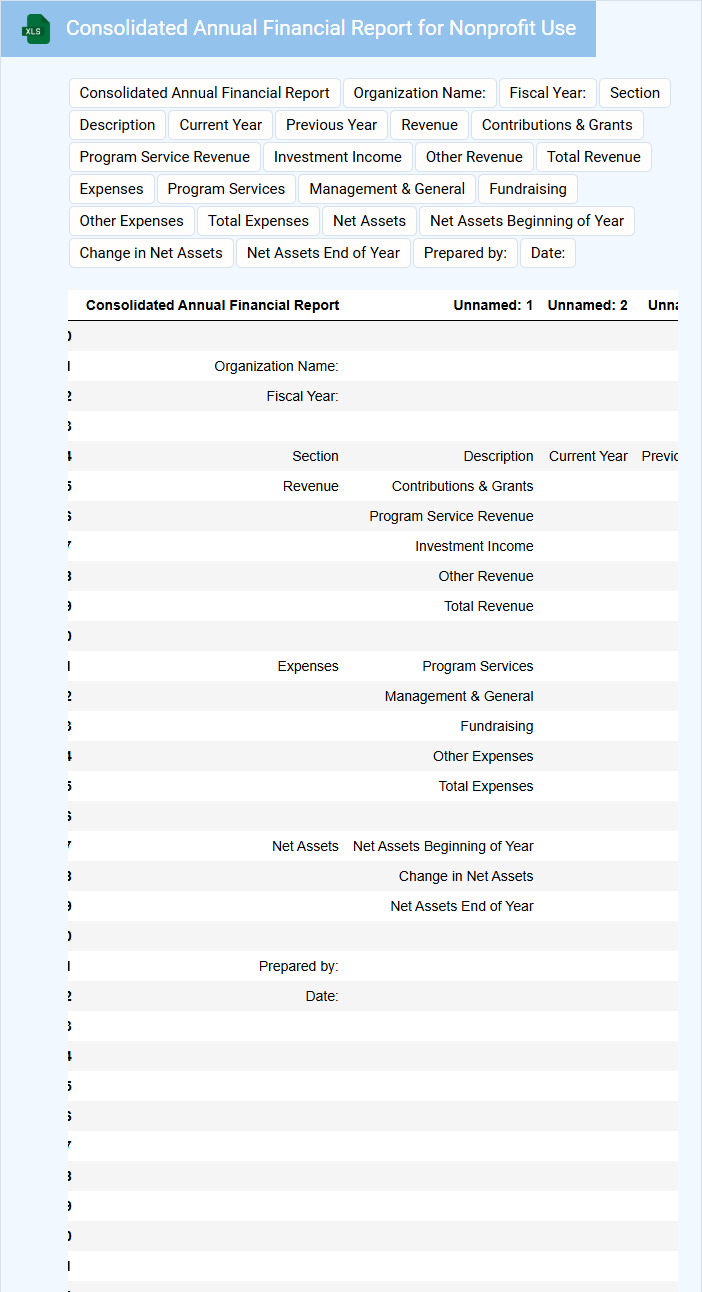

Consolidated Annual Financial Report for Nonprofit Use

The Consolidated Annual Financial Report for nonprofit organizations typically contains aggregated financial data from multiple branches or entities within the nonprofit. It provides a comprehensive overview of the organization's financial health, including income, expenses, assets, and liabilities. This report is essential for transparency and accountability to stakeholders and regulatory bodies.

Important elements to include are a detailed breakdown of revenue sources, expenditure categories, and notes explaining any significant financial fluctuations. Ensuring compliance with accounting standards and highlighting programmatic impact linked to financial outcomes enhances stakeholder trust. Additionally, auditors' reports and management discussion add credibility and context to the financial statements.

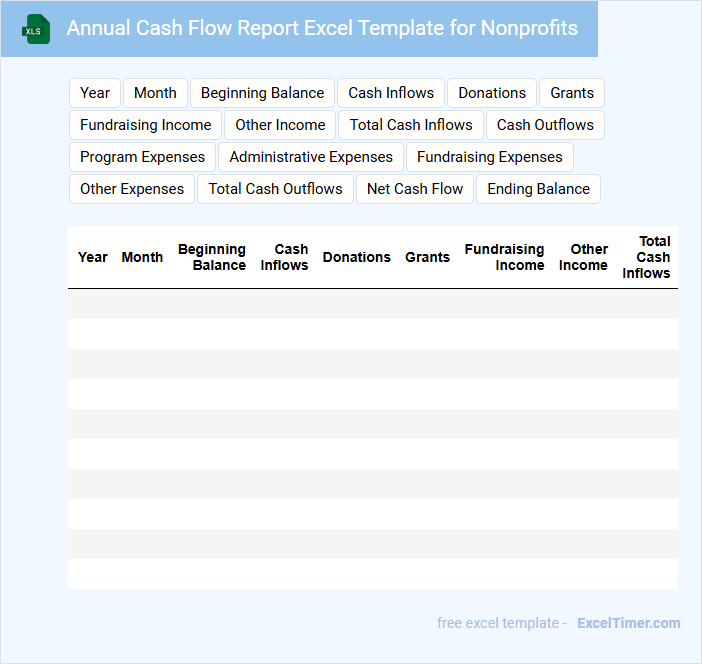

Annual Cash Flow Report Excel Template for Nonprofits

An Annual Cash Flow Report Excel Template for Nonprofits typically contains detailed financial data reflecting the organization's sources and uses of cash throughout the year.

- Accurate Cash Tracking: Ensure all inflows and outflows are meticulously recorded for transparency.

- Budget vs. Actual Comparison: Highlight variances to monitor financial health and plan accordingly.

- Clear Categorization: Organize income and expenses by program, funding source, or operational area for better analysis.

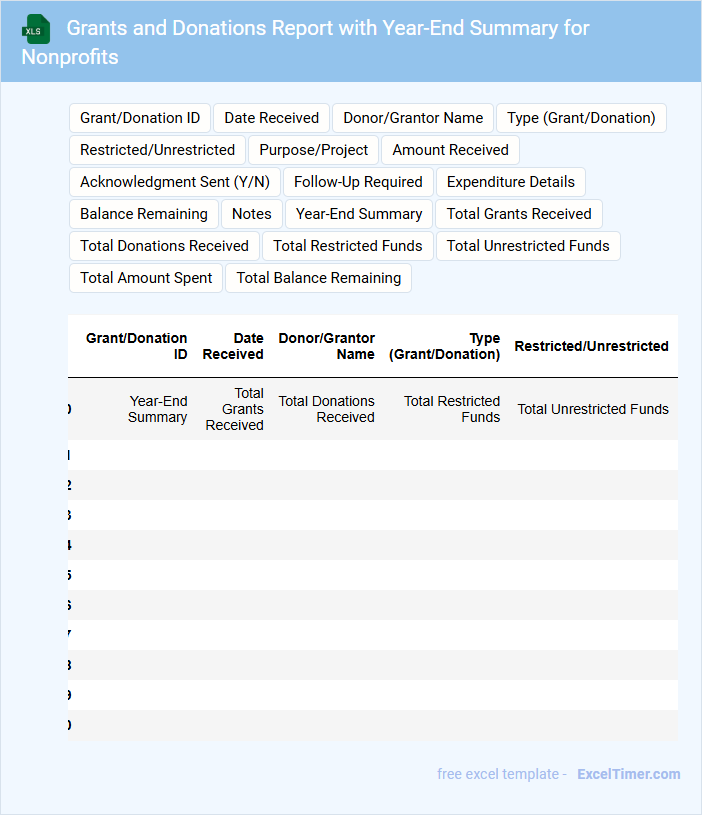

Grants and Donations Report with Year-End Summary for Nonprofits

Grants and Donations Reports with Year-End Summaries for Nonprofits provide a comprehensive overview of funding received throughout the year, detailing both grants and individual donations. These documents highlight the sources, amounts, and impact of financial contributions, ensuring transparency and accountability to stakeholders. It is crucial to include a clear summary of fund allocation and future funding goals to maintain donor trust and support.

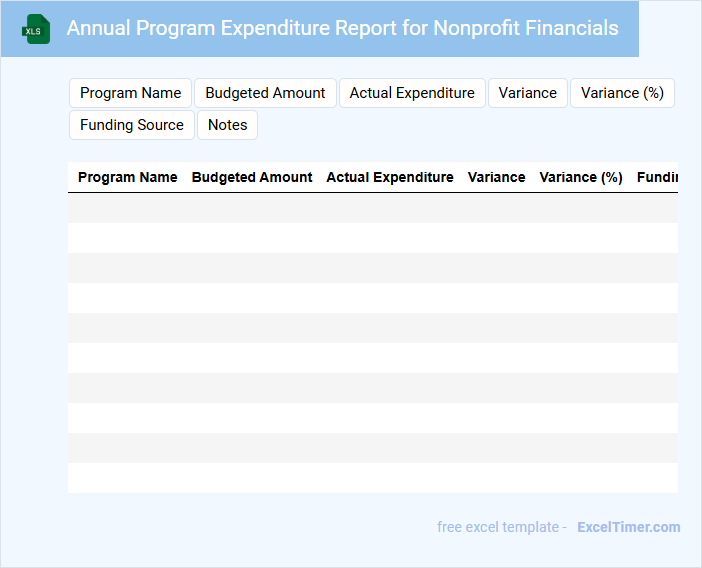

Annual Program Expenditure Report for Nonprofit Financials

The Annual Program Expenditure Report for nonprofit financials typically contains detailed information on the allocation and utilization of funds within various programs throughout the fiscal year. It provides transparency regarding how resources are managed and ensures accountability to stakeholders and donors. Key components often include program-wise expenses, budget comparisons, and narrative explanations of variances.

When preparing this report, it is crucial to accurately categorize expenses and maintain clear documentation to support all figures presented. Including impact metrics alongside financial data can strengthen the report's usefulness for strategic planning and fundraising efforts. Additionally, adhering to compliance requirements and audit standards enhances credibility.

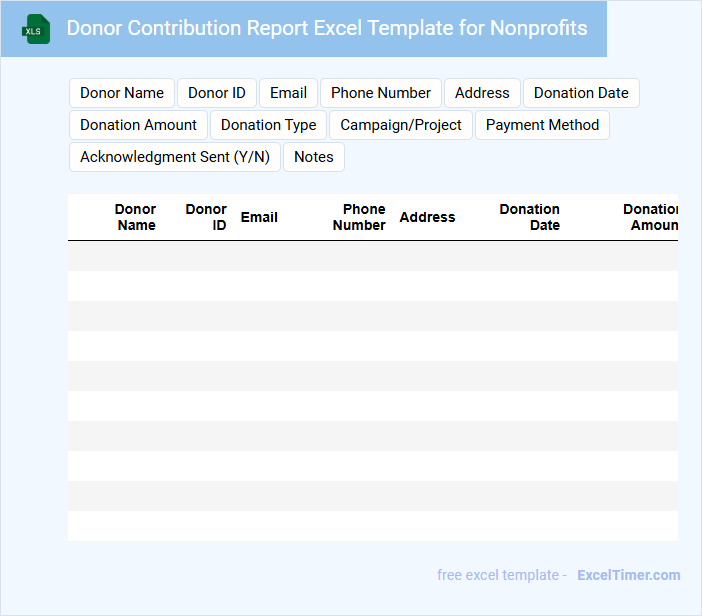

Donor Contribution Report Excel Template for Nonprofits

This Donor Contribution Report Excel Template is designed to systematically track and organize donation data for nonprofits. It typically contains donor information, contribution amounts, dates, and campaign details to provide clear financial insights. Using this template helps in maintaining transparent records and aids in effective fundraising analysis. For nonprofits, an important aspect is ensuring accurate data entry and regular updates to reflect the latest contributions. Consistent use of this template enhances donor relationship management and supports compliance with financial reporting standards. Incorporating visual charts can also improve data interpretation for stakeholders.

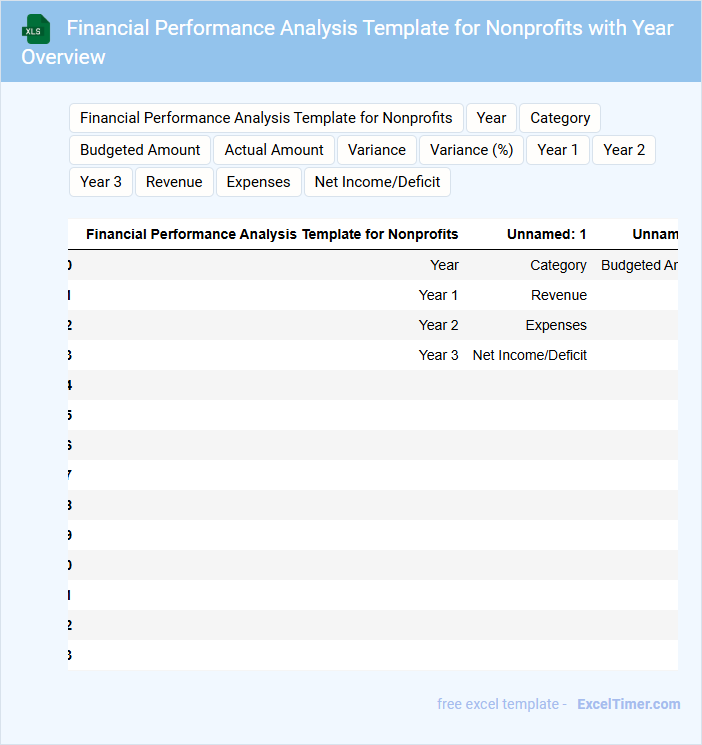

Financial Performance Analysis Template for Nonprofits with Year Overview

A Financial Performance Analysis Template for nonprofits typically contains detailed data on income, expenses, and funding sources spread over a fiscal year. It provides a structured overview that helps organizations track their financial health and sustainability. Key components often include revenue streams, expenditure breakdowns, and year-over-year comparisons to evaluate efficiency.

Important considerations for this template include ensuring accurate data entry, incorporating visual aids like charts for clarity, and highlighting critical financial ratios. It is essential to include a section summarizing major financial trends and any deviations from budget expectations. Additionally, clear labeling of timeframes and notes for significant financial events enhance the document's utility for stakeholders.

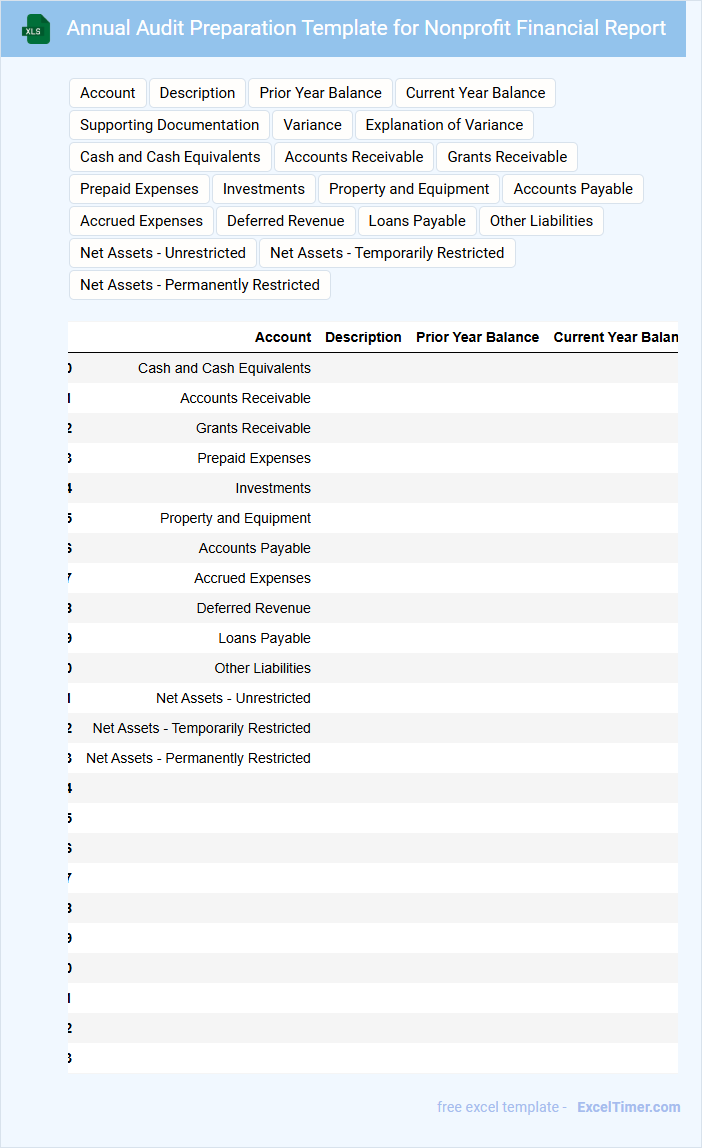

Annual Audit Preparation Template for Nonprofit Financial Report

The Annual Audit Preparation Template serves as a comprehensive guide to organizing and reviewing financial documents for nonprofits. It typically contains sections like income statements, balance sheets, and cash flow summaries.

Its primary purpose is to ensure accuracy and compliance during the audit process by preparing key financial data in advance. A crucial suggestion is to maintain detailed records and reconcile accounts regularly.

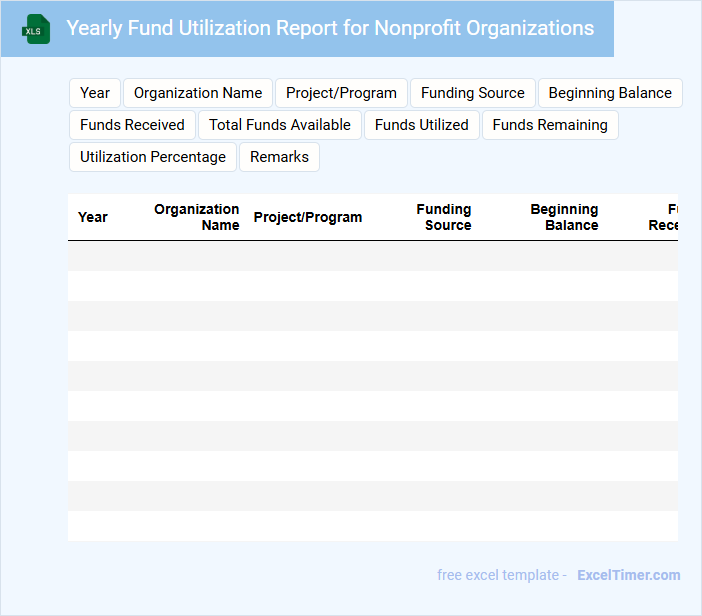

Yearly Fund Utilization Report for Nonprofit Organizations

The Yearly Fund Utilization Report for nonprofit organizations is a document that details how the funds received throughout the year were allocated and spent. It typically includes summaries of revenue sources, expenditures, and financial balances.

This report is crucial for maintaining transparency and accountability with donors and stakeholders. To ensure clarity, it is important to provide detailed breakdowns of expenses and clearly link them to the nonprofit's mission and program outcomes.

Income and Grants Tracking Excel Template for Annual Nonprofit Reports

This document is an Income and Grants Tracking Excel Template designed to help nonprofits efficiently monitor and report their financial inflows for annual reports.

- Comprehensive Income Records: Maintain detailed revenue streams to ensure accurate financial tracking and reporting.

- Grant Management: Track grant sources, amounts, and usage to comply with funding requirements and enhance transparency.

- Data Accuracy and Consistency: Use built-in formulas and validations to minimize errors and support reliable annual reporting.

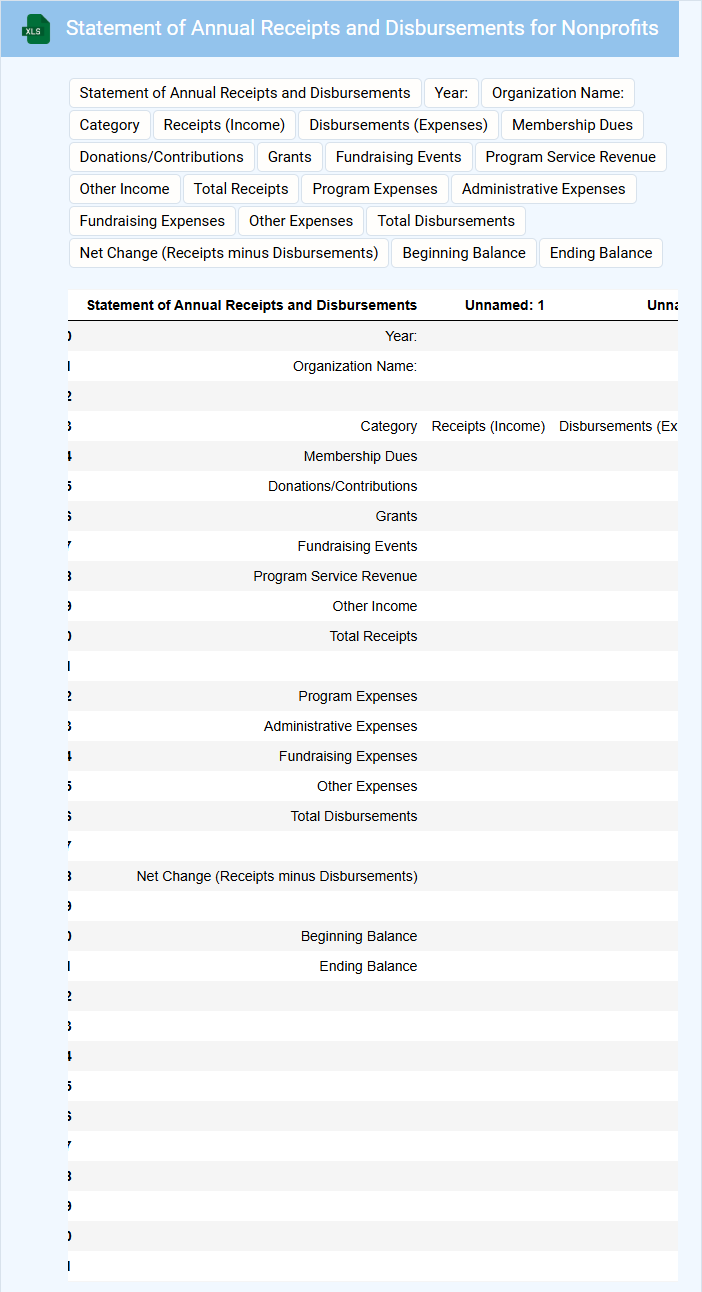

Statement of Annual Receipts and Disbursements for Nonprofits

What information is typically included in a Statement of Annual Receipts and Disbursements for Nonprofits? This document usually contains detailed records of all income received and expenses paid by the nonprofit organization during the fiscal year. It helps demonstrate financial transparency and accountability to stakeholders and ensures compliance with regulatory requirements.

What important elements should be highlighted in this statement? It is crucial to categorize receipts and disbursements clearly, including donations, grants, program expenses, and administrative costs. Accurate and timely recording of transactions is vital to maintain trust and support from donors and regulatory bodies.

What key financial statements are essential in an annual financial report for nonprofits?

Your annual financial report for nonprofits must include the Statement of Financial Position, Statement of Activities, and Statement of Cash Flows. These key financial statements provide a comprehensive overview of assets, revenues, expenses, and cash movements. Accurate presentation of this data ensures transparency and compliance with accounting standards for nonprofit organizations.

How does the Statement of Activities in nonprofit financials differ from a for-profit income statement?

The Statement of Activities in nonprofit financials emphasizes changes in net assets by tracking revenues, expenses, and contributions without focusing on profit or loss. It categorizes income as unrestricted, temporarily restricted, or permanently restricted based on donor-imposed stipulations. Unlike for-profit income statements, it reflects the organization's mission-driven financial performance rather than shareholder profitability.

What information should be disclosed regarding donor restrictions and fund classification?

Your annual financial report for nonprofits should disclose detailed information about donor restrictions, specifying the nature and duration of any limitations on the use of contributed funds. Clearly classify funds into categories such as unrestricted, temporarily restricted, and permanently restricted to provide transparency on financial stewardship. This disclosure ensures compliance with accounting standards and builds donor trust.

How are in-kind donations and grant revenues typically reported in a nonprofit's annual financial report?

In nonprofit annual financial reports, in-kind donations are recorded as both revenue and an equivalent expense, reflecting the fair market value of goods or services donated. Grant revenues are reported as unrestricted or restricted income based on donor-imposed conditions, often classified in the statement of activities. Accurate presentation complies with accounting standards like FASB ASC 958 to ensure transparency and donor trust.

What are best practices for ensuring transparency and accountability in nonprofit financial disclosures?

Ensure your nonprofit's financial disclosures include detailed breakdowns of income sources, expenses, and funding allocations to enhance transparency. Use standardized accounting methods and regularly update reports to maintain accuracy and accountability. Implement third-party audits and provide accessible summaries to build trust with stakeholders.