The Annually Tax Preparation Excel Template for Sole Traders is designed to simplify tax filing by organizing income, expenses, and deductions efficiently. This template ensures accurate calculations and compliance with tax regulations, helping sole traders avoid errors and penalties. Customizable and user-friendly, it streamlines the annual tax preparation process, saving time and reducing stress.

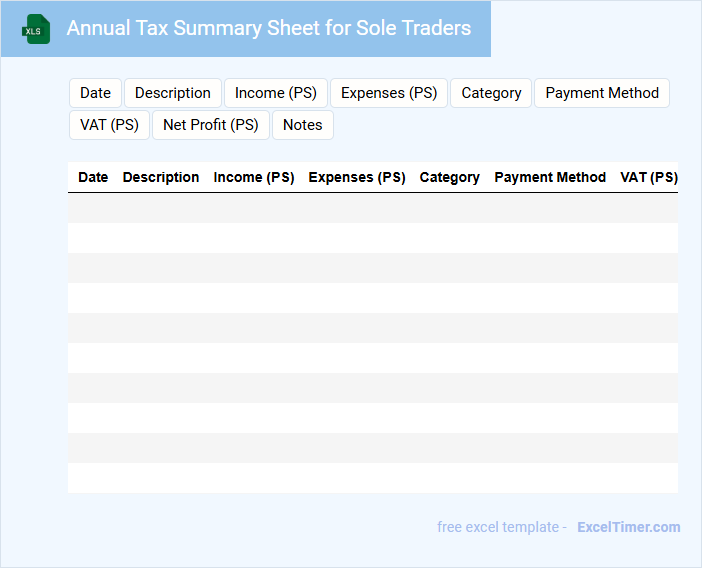

Annual Tax Summary Sheet for Sole Traders

An Annual Tax Summary Sheet for Sole Traders typically contains a detailed overview of income and expenses for the fiscal year. It helps in accurately calculating taxable profits and ensures compliance with tax regulations.

- Include all sources of income and categorize business expenses clearly.

- Keep accurate records of VAT if registered for tax purposes.

- Retain supporting documents such as receipts and invoices for audit purposes.

Expense Tracking Spreadsheet for Sole Trader Tax Preparation

An Expense Tracking Spreadsheet for sole traders is a crucial document that organizes all business-related expenses chronologically. It typically contains categories such as date, description, amount, and payment method to ensure accurate recording.

This spreadsheet facilitates efficient tax preparation by providing clear, traceable financial data for deductions and reporting. Its accurate maintenance helps sole traders comply with tax regulations and optimize their tax returns.

It is important to regularly update the spreadsheet and categorize expenses consistently to avoid errors and ensure comprehensive tax documentation.

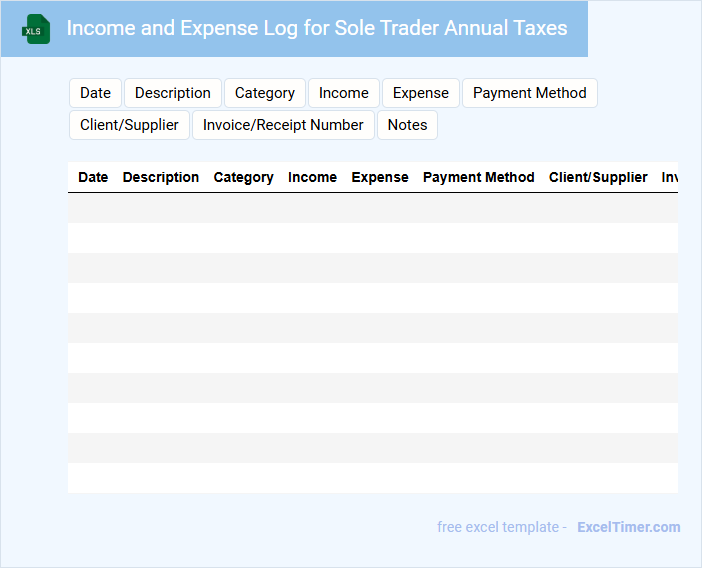

Income and Expense Log for Sole Trader Annual Taxes

The Income and Expense Log is a crucial document for sole traders, capturing all financial transactions throughout the fiscal year. It typically includes detailed records of earnings, business expenses, and any related financial activity. Maintaining this log helps ensure accurate annual tax reporting and aids in financial analysis.

Yearly Tax Deduction Tracker with Category Breakdown

A Yearly Tax Deduction Tracker is a document designed to systematically record and monitor all deductible expenses throughout the fiscal year. It typically contains categorized entries such as medical expenses, charitable donations, and business costs for accurate tax filing. Keeping an organized category breakdown helps ensure that no deductible item is overlooked, optimizing your tax returns.

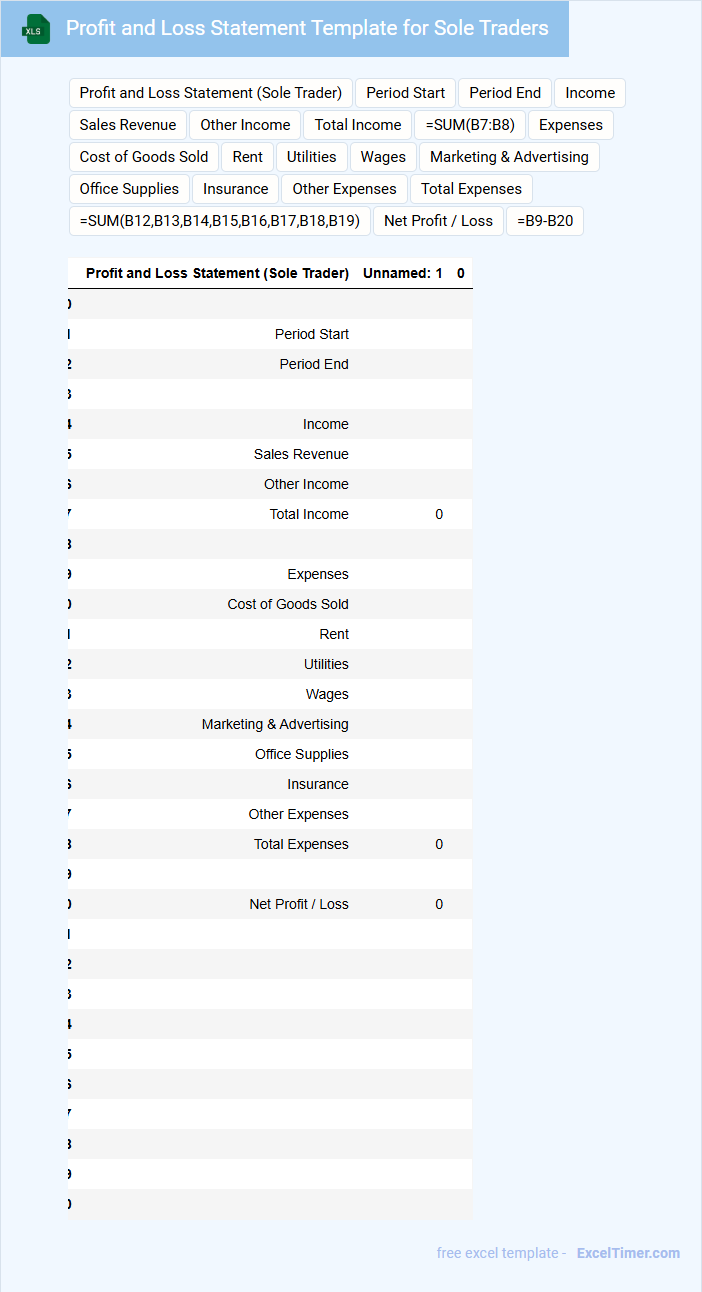

Profit and Loss Statement Template for Sole Traders

The Profit and Loss Statement Template for sole traders typically contains detailed records of income, expenses, and net profit over a specific period. It allows sole traders to track business performance and make informed financial decisions.

Important elements to include are accurate revenue entries, categorized expenses, and a clear calculation of net profit or loss. Regularly updating this template ensures effective financial management and tax compliance for sole traders.

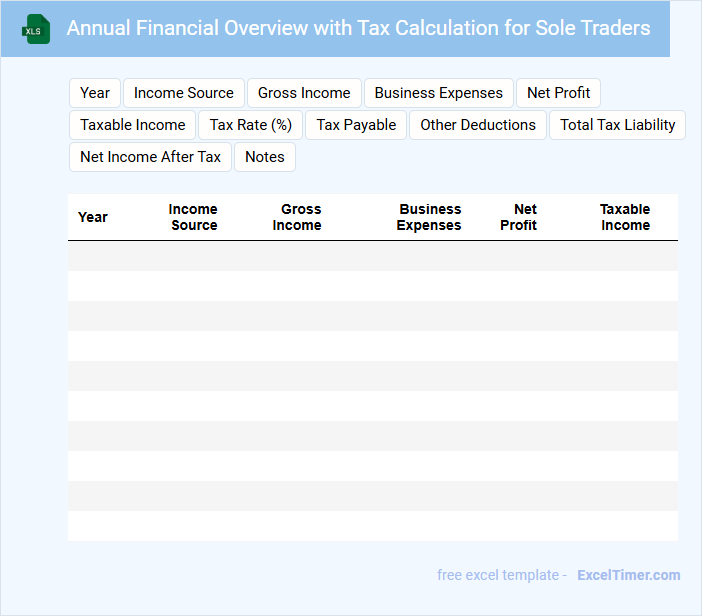

Annual Financial Overview with Tax Calculation for Sole Traders

An Annual Financial Overview typically contains a summary of income, expenses, and net profit for the fiscal year. It provides sole traders with a clear snapshot of their business performance over time.

The Tax Calculation section breaks down taxable income, allowable deductions, and the estimated tax liability. Ensuring accuracy and including all relevant receipts is crucial for compliance and maximizing deductions.

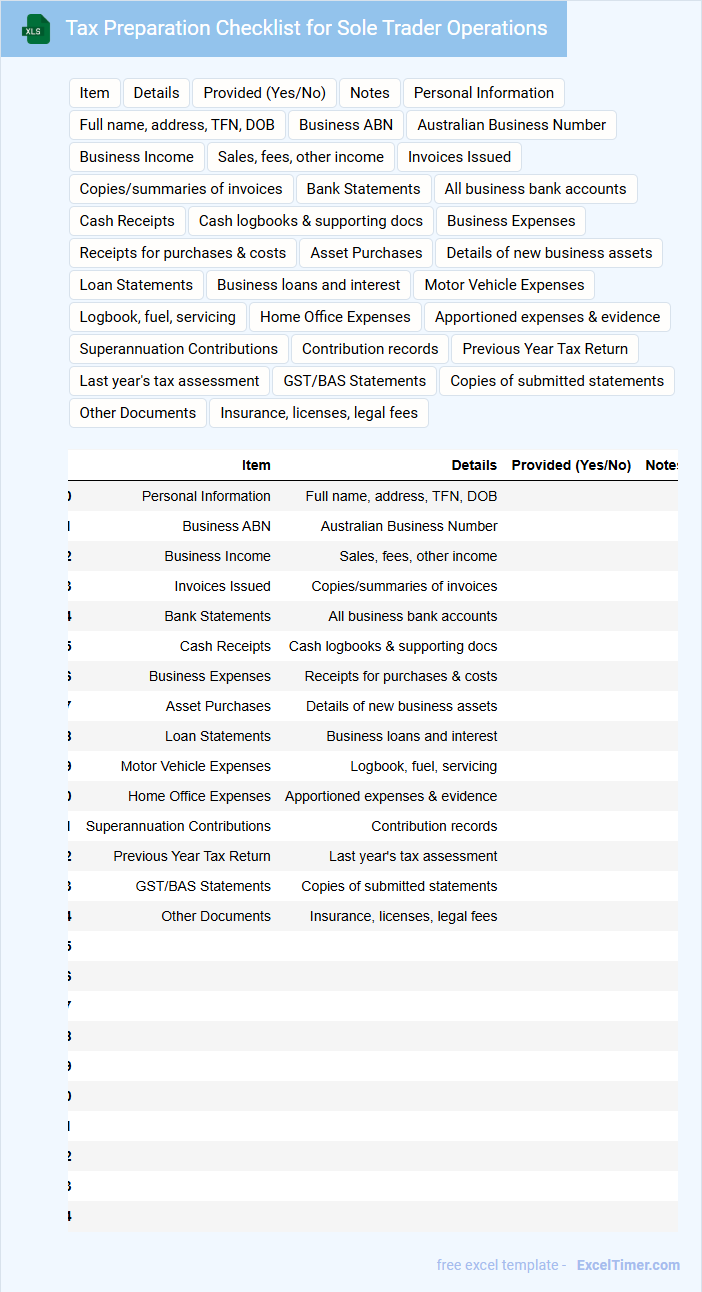

Tax Preparation Checklist for Sole Trader Operations

This type of document typically contains an organized list of items and information necessary for preparing taxes for sole trader operations to ensure accuracy and compliance.

- Income Records: Keep detailed sales and revenue documentation to report all earnings accurately.

- Expense Receipts: Collect all business-related expense proofs to claim valid deductions.

- Tax Forms and Deadlines: Be aware of required tax filings and important submission dates to avoid penalties.

Annual Invoice and Payment Tracker for Sole Traders

What does an Annual Invoice and Payment Tracker for Sole Traders typically contain and why is it important? This document usually includes all issued invoices, payment statuses, client details, and dates, providing a clear overview of income and cash flow throughout the year. It is essential for accurate financial management, tax preparation, and ensuring timely follow-up on unpaid invoices.

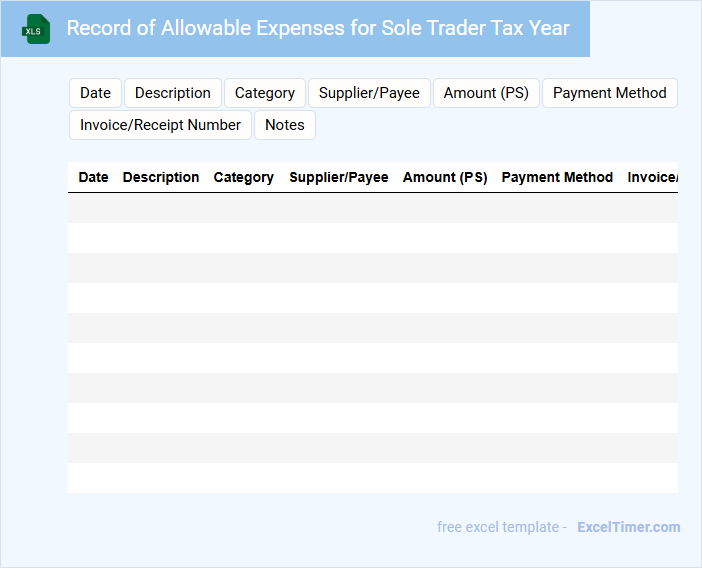

Record of Allowable Expenses for Sole Trader Tax Year

This document typically contains detailed records of all expenses that a sole trader can legally claim as deductions for a specific tax year. It is essential for accurate tax reporting and financial management.

- Include all receipts and invoices related to business expenses.

- Separate personal and business expenditures clearly.

- Maintain chronological order for ease of reference during audits.

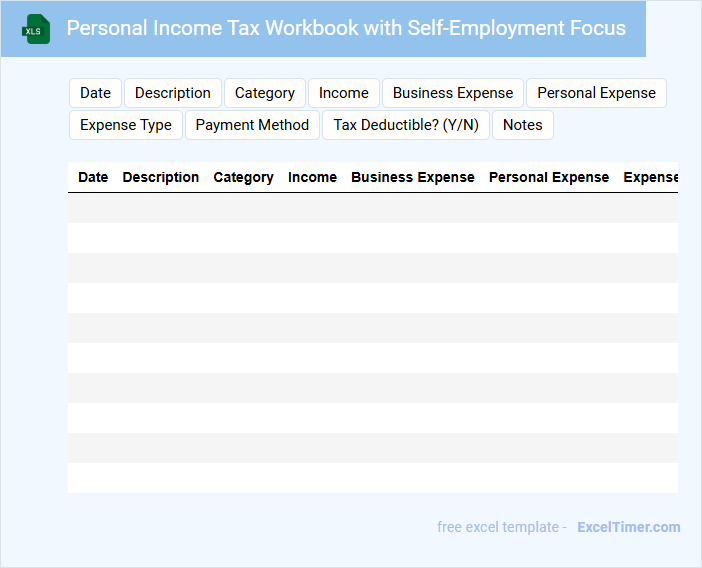

Personal Income Tax Workbook with Self-Employment Focus

What information is typically included in a Personal Income Tax Workbook with a Self-Employment Focus? This document usually contains detailed records of income, expenses, and deductions relevant to self-employed individuals. It helps track financial activity for accurate tax reporting and ensures compliance with tax regulations.

What is an important consideration when using this workbook? Ensuring all business-related expenses are thoroughly documented is crucial for maximizing deductions and minimizing tax liability. It is also essential to regularly update the workbook to maintain accurate and organized records throughout the fiscal year.

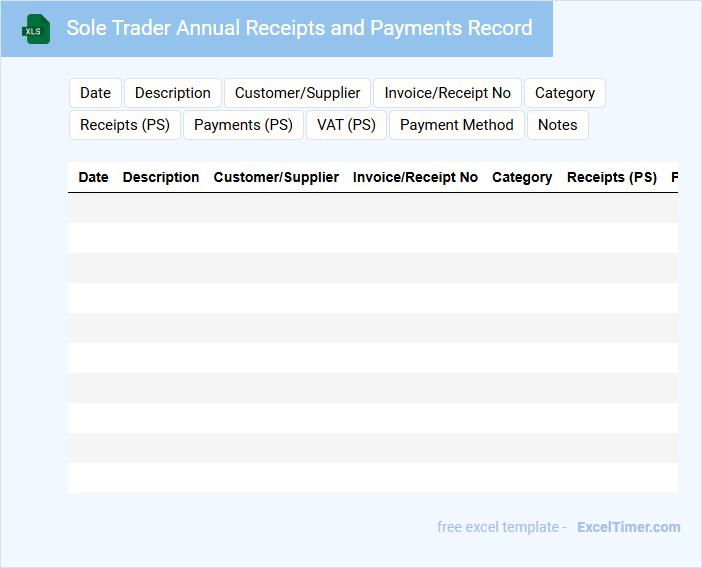

Sole Trader Annual Receipts and Payments Record

The Sole Trader Annual Receipts and Payments Record is a financial document that tracks all income and expenses throughout the fiscal year. It provides a clear overview of business transactions, helping sole traders monitor their financial performance. Accurate record-keeping is essential for tax reporting and compliance purposes.

Typically, this document contains detailed entries of all sales receipts, business expenses, and other financial transactions relevant to the sole trader's operations. It often includes dates, amounts, descriptions, and categories to ensure transparency and ease of review. Maintaining this record regularly reduces the risk of errors and missed deductions.

Important suggestions include organizing receipts promptly, categorizing payments correctly, and backing up records digitally. Ensuring accuracy and completeness of the record supports efficient tax filing and financial decision-making. Sole traders should also retain supporting documents for at least five years in case of audits.

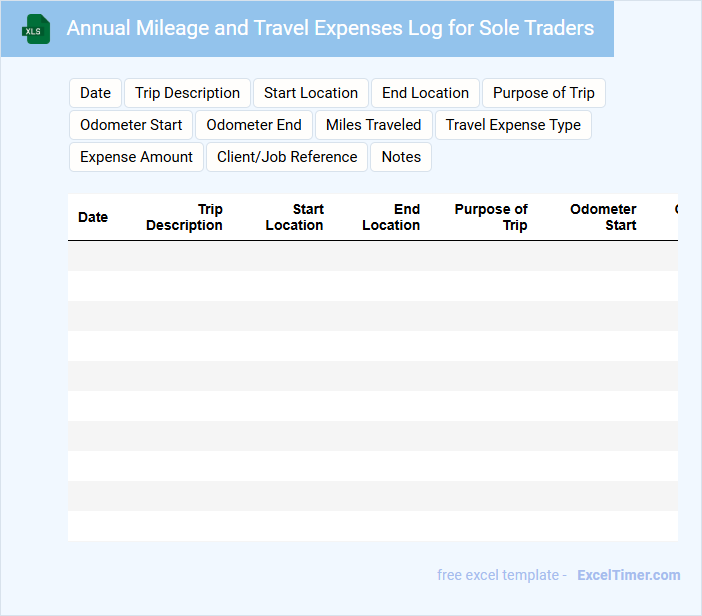

Annual Mileage and Travel Expenses Log for Sole Traders

An Annual Mileage and Travel Expenses Log for sole traders is a document that records detailed information about business-related travel throughout the year. It typically contains dates, destinations, miles traveled, and associated costs to help track deductible expenses. Maintaining an accurate log is essential for tax compliance and maximizing allowable deductions.

Important elements to include are the purpose of each trip, vehicle details, odometer readings, and receipts for fuel and other travel expenses. Consistent and thorough entries improve financial record-keeping and simplify tax reporting. Regularly updating the log prevents omissions and supports the legitimacy of claimed expenses.

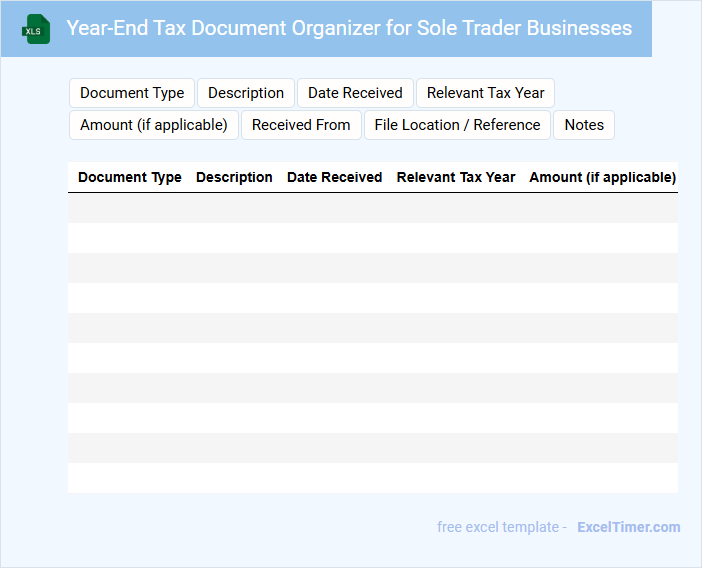

Year-End Tax Document Organizer for Sole Trader Businesses

The Year-End Tax Document Organizer is essential for sole trader businesses to efficiently compile all financial records required for tax filing. It typically contains receipts, invoices, expense records, and summaries of income throughout the fiscal year. Keeping these documents well-organized ensures accuracy in tax returns and helps maximize potential deductions.

Important considerations include systematically categorizing all business expenses, maintaining clear records of income sources, and regularly updating the organizer to avoid last-minute stress. Using digital tools or spreadsheets can enhance accessibility and reduce errors. Ensuring compliance with the latest tax regulations is crucial for avoiding penalties.

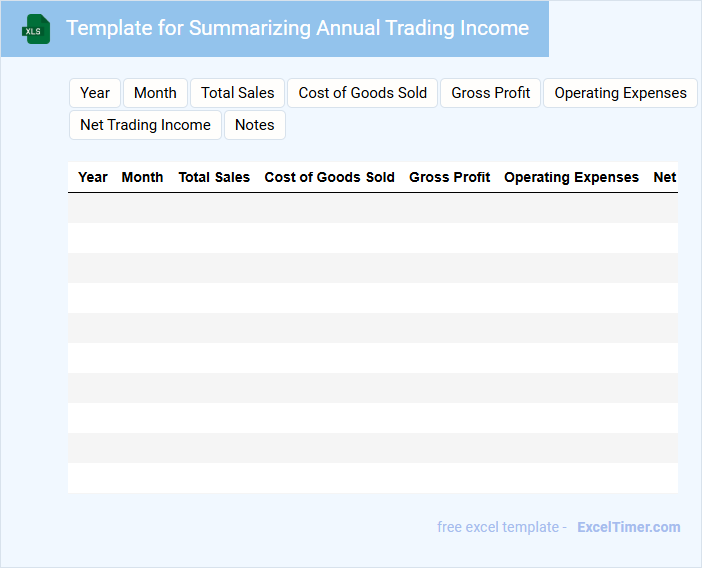

Template for Summarizing Annual Trading Income

What information is typically included in a Template for Summarizing Annual Trading Income? This type of document generally contains detailed records of all trades conducted throughout the year, including dates, asset types, quantities, purchase prices, and sale prices. It helps traders and accountants organize financial data systematically for accurate tax reporting and performance evaluation.

What are the important elements to consider when creating this template? It is crucial to ensure clear categorization of trades by asset type, inclusion of total income and losses, and fields for cost basis and realized gains. Additionally, providing sections for notes or explanations can aid in clarifying any unusual transactions or adjustments.

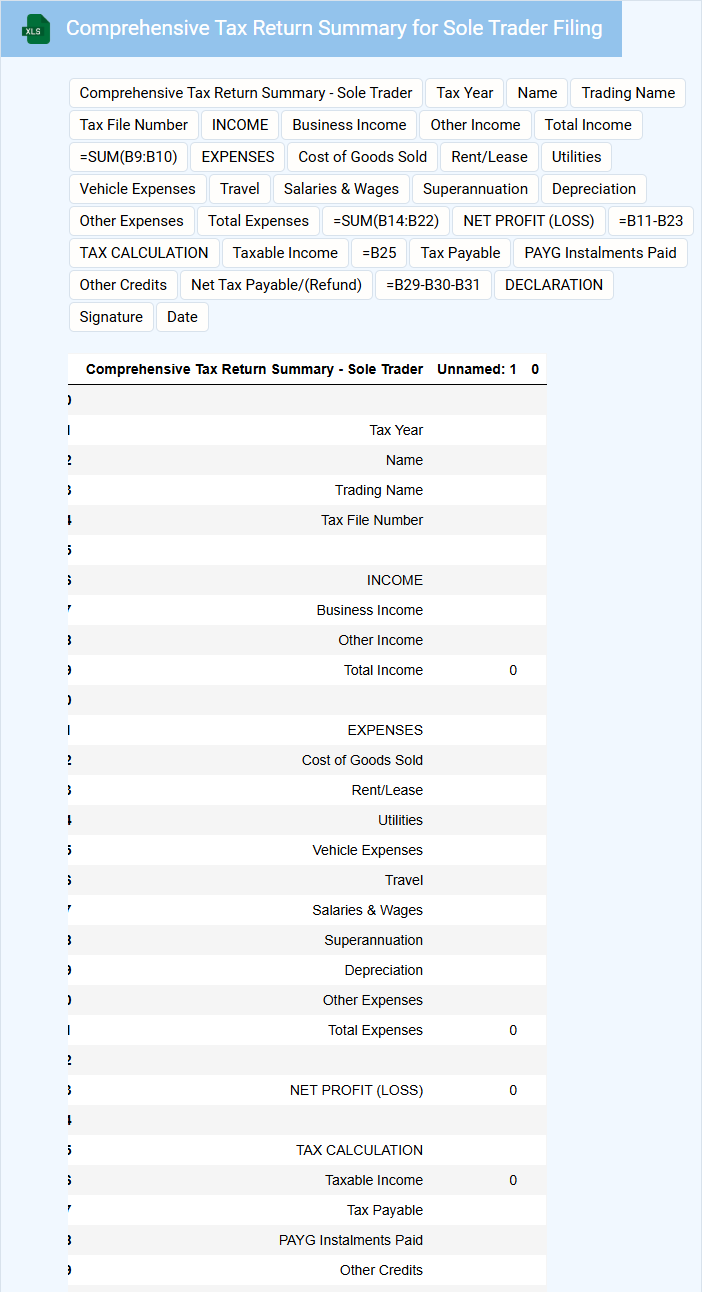

Comprehensive Tax Return Summary for Sole Trader Filing

A Comprehensive Tax Return Summary for a sole trader typically contains detailed financial information including income, expenses, and tax deductions relevant to the business. It provides a clear overview of the taxable earnings and tax liabilities for the fiscal year. Ensuring accuracy in reporting income and allowable expenses is crucial for compliance and optimizing tax obligations.

What essential financial records should sole traders maintain annually for accurate tax preparation in Excel?

Sole traders should maintain detailed Excel records including annual income statements, expense receipts, and bank transactions for accurate tax preparation. Key financial data such as sales revenue, operational costs, asset depreciation, and tax payments must be systematically logged. Organizing these records annually ensures compliance with tax regulations and simplifies data retrieval during tax filing.

How can income and expense categories be organized in an Excel document for efficient tax calculation?

Organize income and expense categories in your Excel document by creating separate, clearly labeled sheets or tables for each type, such as Sales Revenue, Operational Costs, and Miscellaneous Expenses. Use consistent column headers like Date, Description, Amount, and Category to ensure data is easily sortable and filterable for accurate tax calculations. Implement formulas to automatically sum categorized totals, enhancing efficiency during annual tax preparation.

What key tax-deductible expenses should be tracked by sole traders throughout the year in Excel?

Sole traders should track key tax-deductible expenses like office supplies, business travel, vehicle costs, and professional fees in Excel to maximize tax efficiency. Recording utility bills, marketing expenses, and home office costs ensures accurate deductible claims. Consistent documentation of these expenses supports compliance and simplifies annual tax preparation.

How can Excel formulas be used to automatically calculate annual taxable income for sole traders?

Excel formulas can automatically calculate your annual taxable income by summing all income entries and subtracting allowable business expenses using functions like SUM and SUMIF. Custom formulas can categorize income and expenses by type, ensuring accurate tax calculations tailored to sole traders. This automation reduces errors and saves time during annual tax preparation.

What important tax deadlines and payment reminders should be documented in an Excel sheet for sole traders?

Record key annual tax deadlines such as the Self-Assessment tax return filing by January 31st and the payment of any outstanding tax by this date. Include quarterly payment on account deadlines on January 31st and July 31st to manage cash flow and avoid penalties. Your Excel sheet should also track the VAT return deadlines if applicable to ensure timely submissions and payments.