![]()

The Annually Personal Finance Tracker Excel Template for Individuals helps users efficiently manage their income, expenses, and savings throughout the year. It features easy-to-use spreadsheets that categorize financial transactions, providing clear visual summaries and insights. Maintaining this template supports better budget control and long-term financial planning.

Annual Personal Finance Tracker with Budget Planning

Annual Personal Finance Tracker with Budget Planning documents your yearly income, expenses, savings, and financial goals to help you manage money effectively.

- Income Sources: Record all sources of income to get a clear picture of your earnings.

- Expense Categories: Categorize expenses to monitor spending habits and identify areas to cut costs.

- Budget Goals: Set realistic budget targets and track progress toward your financial objectives.

Yearly Expense Tracker for Individuals

A Yearly Expense Tracker for individuals is a comprehensive document used to monitor and record personal financial expenditures over a year. It typically includes categories such as housing, food, transportation, and entertainment, allowing users to analyze their spending habits. This tool helps in budgeting, identifying cost-saving opportunities, and achieving financial goals effectively.

Important elements to include are detailed monthly expense entries, clear categorization, and summaries or charts for easy visualization. Additionally, setting monthly spending limits and noting unexpected expenses can enhance the tracker's usefulness. Regularly updating the document ensures accurate financial awareness and better money management throughout the year.

Annual Income and Expense Tracker for Personal Use

An Annual Income and Expense Tracker for Personal Use is a document designed to record and monitor an individual's financial inflows and outflows over a year. It helps in budgeting and identifying spending patterns to improve financial management.

- Include all sources of income and categorize all expenses clearly.

- Track monthly totals to observe trends and adjust budgets accordingly.

- Review and update the document regularly to maintain accuracy and relevance.

12-Month Personal Finance Tracker with Charts

What information is typically included in a 12-Month Personal Finance Tracker with Charts? This document usually contains detailed monthly records of income, expenses, savings, and investments, visually represented through charts for easy analysis. It helps users monitor financial trends, identify spending patterns, and plan budgets effectively over a year.

What important features should be considered when using this tracker? Ensuring accurate categorization of transactions and regular updates is crucial, along with visual clarity in charts such as line graphs or pie charts to highlight key financial insights. Additionally, integrating goal-setting components can enhance personal financial management and motivation.

Yearly Savings Goals Tracker for Individuals

A Yearly Savings Goals Tracker for individuals typically contains a detailed breakdown of monthly savings targets and actual amounts saved. It also includes progress charts and motivational notes to encourage consistent saving habits.

This document helps users monitor their financial discipline and adjust their spending to meet their financial objectives. Including a summary of total savings and key milestones achieved is important for evaluating overall performance.

Annual Personal Budget Tracker with Category Breakdown

An Annual Personal Budget Tracker is a comprehensive document used to monitor and manage yearly income and expenses. It typically contains detailed category breakdowns, such as housing, food, transportation, and entertainment, allowing for thorough financial analysis. Including clear summaries and visual aids like charts is essential for easy tracking and better financial decision-making.

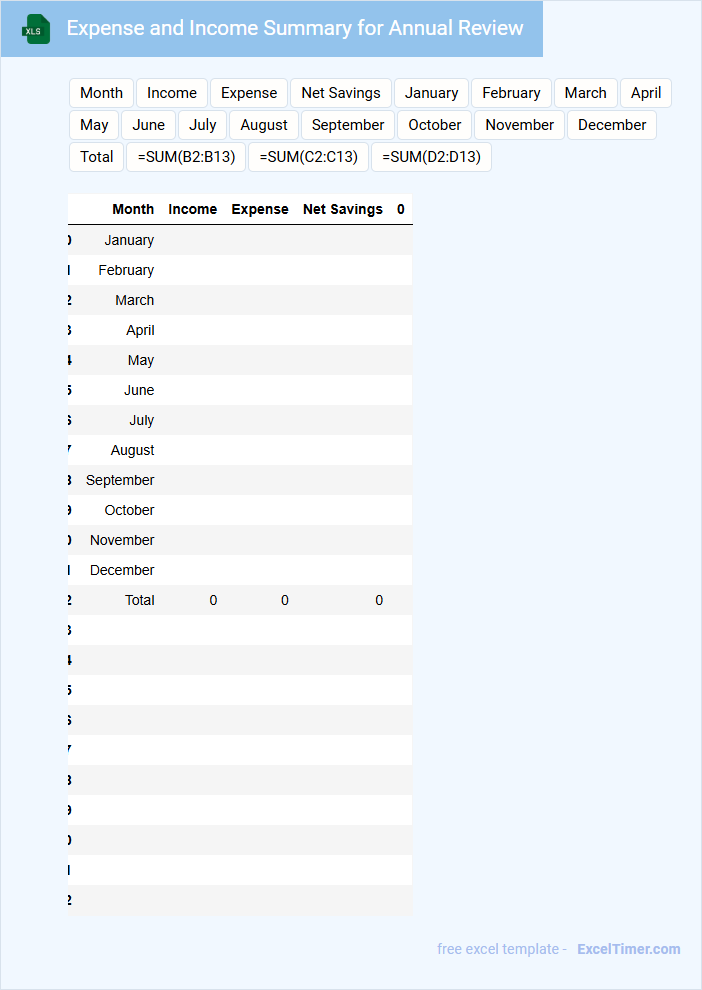

Expense and Income Summary for Annual Review

An Expense and Income Summary document typically contains a detailed record of all financial transactions over a specified period, often used for annual reviews. It includes categorized lists of income sources and expenses, providing a clear overview of financial health. This summary helps to identify spending patterns, measure profitability, and guide future budgeting decisions.

For an effective annual review, ensure the summary is accurate, comprehensive, and includes comparative data from previous years. Highlight significant variances and trends to facilitate informed decision-making. Including notes or explanations for anomalies can enhance clarity and usefulness.

Personal Cash Flow Tracker with Yearly Analysis

What does a Personal Cash Flow Tracker with Yearly Analysis typically contain? It usually includes records of all income and expenses categorized by type over a specific period. This document helps individuals understand their spending habits and savings trends by providing a comprehensive overview of their financial inflows and outflows throughout the year.

What is an important consideration when using this type of document? It is crucial to maintain accurate and consistent entries to ensure reliable data for analysis. Additionally, regularly reviewing the yearly summary can help identify areas for budget improvement and financial goal setting.

Annual Debt Reduction Tracker for Individuals

An Annual Debt Reduction Tracker for individuals typically contains detailed records of debts such as credit cards, loans, and mortgages, along with payment schedules and amounts. It helps users monitor their debt repayment progress over the year and identify trends or obstacles. Keeping consistent updates and setting realistic payment goals are important for effective debt management.

Yearly Bill Payment Tracker for Individuals

A Yearly Bill Payment Tracker is a document used by individuals to systematically record and monitor their bill payments throughout the year. It helps ensure all due payments are made on time, preventing late fees and financial stress.

This type of tracker typically contains payment dates, amounts, bill types, and due dates for utilities, subscriptions, and other recurring expenses. Including reminders and notes sections can enhance its effectiveness for personal financial management.

Annual Net Worth Tracker with Asset Allocation

An Annual Net Worth Tracker with Asset Allocation typically contains a detailed summary of an individual's or organization's financial standing and the distribution of assets across various investment categories throughout the year.

- Comprehensive asset listing: Record all assets including cash, investments, real estate, and other valuables to ensure accurate net worth calculation.

- Liabilities tracking: Include all debts and obligations to provide a clear picture of financial health.

- Asset allocation analysis: Monitor the percentage distribution of assets by category to optimize investment balance and risk management.

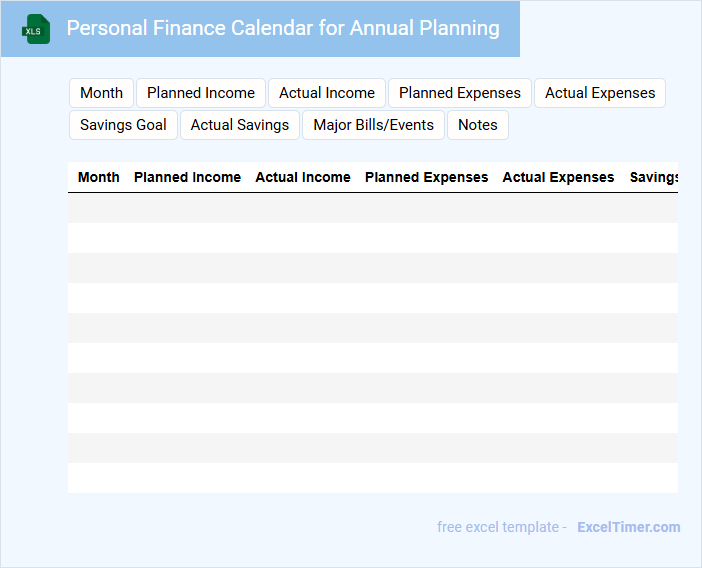

Personal Finance Calendar for Annual Planning

What information does a Personal Finance Calendar for Annual Planning typically include? This type of document usually contains key financial dates such as tax deadlines, bill due dates, investment reviews, and budget planning sessions throughout the year. It helps individuals stay organized and proactive in managing their finances effectively.

Why is it important to use a Personal Finance Calendar for Annual Planning? Incorporating a finance calendar ensures timely payments, prevents missed opportunities for savings or investments, and encourages consistent financial goal setting. Regularly updating this calendar can significantly enhance long-term financial health and stability.

Annual Investment Tracker with Portfolio Overview

An Annual Investment Tracker typically contains detailed records of all investment transactions made throughout the year, including dates, amounts, and asset types. It provides a comprehensive portfolio overview to help investors monitor performance and assess risk levels. Essential elements include clear categorization of assets, accurate valuation updates, and summaries of returns to facilitate informed decision-making.

Yearly Financial Goals Tracker for Individuals

A Yearly Financial Goals Tracker for individuals is a document designed to monitor and evaluate personal financial objectives over the course of a year. It typically contains sections for budgeting, savings targets, debt repayment plans, and investment tracking to ensure comprehensive financial management.

Such trackers also include progress charts, monthly summaries, and reminders to stay motivated and accountable. Regularly updating this document helps individuals stay focused and adjust strategies as needed to achieve their financial ambitions.

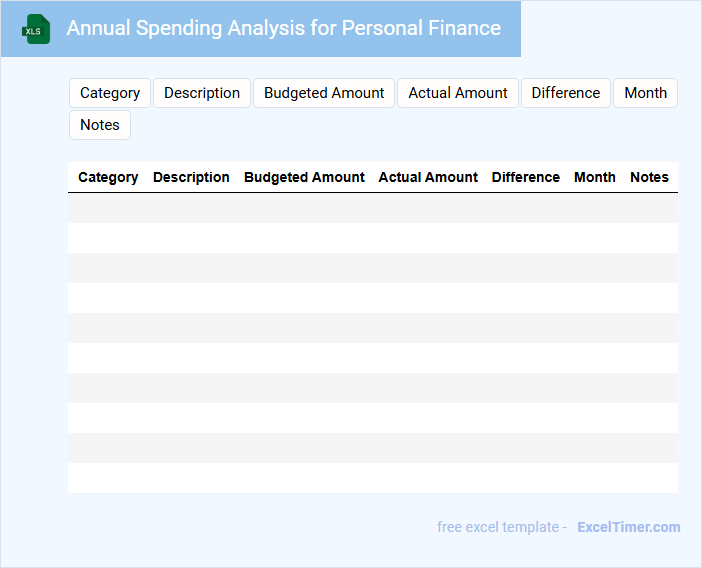

Annual Spending Analysis for Personal Finance

What information does an Annual Spending Analysis for Personal Finance typically contain? This document usually includes a detailed breakdown of all expenses and income over the year, categorized by type such as housing, food, entertainment, and savings. It helps individuals understand their spending habits, identify areas for budget adjustment, and set financial goals effectively.

What is an important aspect to consider when preparing this analysis? Ensuring accuracy in recording and categorizing all transactions is crucial, as it provides a clear financial picture. Additionally, reviewing trends month-to-month can highlight unnecessary expenditures and opportunities for improved saving strategies.

What essential annual income and expense categories should be included in a Personal Finance Tracker spreadsheet?

A Personal Finance Tracker spreadsheet should include essential annual income categories such as salary, bonuses, investments, and rental income. Key expense categories should cover housing (mortgage or rent), utilities, groceries, transportation, insurance, healthcare, education, entertainment, and savings contributions. Tracking these categories enables comprehensive financial analysis and effective budget management.

How can Excel formulas automate the calculation of yearly savings and spending trends?

Excel formulas automate yearly savings and spending trends by summing monthly income and expenses with functions like SUM and SUMIF. YEAR and DATE functions categorize transactions by year, enabling accurate annual totals and comparisons. PivotTables combined with formula-driven calculations visualize spending patterns and savings growth efficiently.

Which visual tools (charts, graphs, conditional formatting) most effectively highlight annual financial progress in the tracker?

Bar charts effectively display annual income and expense trends in your Personal Finance Tracker, making financial progress easy to analyze. Line graphs highlight savings growth over time, revealing patterns and forecasting future balances. Conditional formatting instantly alerts you to budget deviations, emphasizing key areas needing attention.

What data security features in Excel help protect sensitive personal finance information throughout the year?

Excel offers password protection and file encryption to secure sensitive personal finance data annually. Data validation and cell locking features prevent unauthorized modifications in personal finance trackers. AutoSave and OneDrive integration ensure continuous backup and recovery of important financial records.

How can an Excel document track, compare, and summarize annual financial goals versus actual outcomes for individuals?

An Excel document can track your annual financial goals by organizing income, expenses, and savings in categorized sheets with timestamps. It compares planned targets against actual outcomes using formulas and conditional formatting to highlight discrepancies and progress. Summary dashboards consolidate key metrics, enabling quick analysis of financial performance throughout the year.