The Annually Budget Excel Template for Small Business provides a streamlined way to track income, expenses, and profits throughout the year. It includes customizable categories tailored to small business needs, helping owners manage cash flow and plan financial goals efficiently. Accurate budgeting with this template supports informed decision-making and sustainable growth.

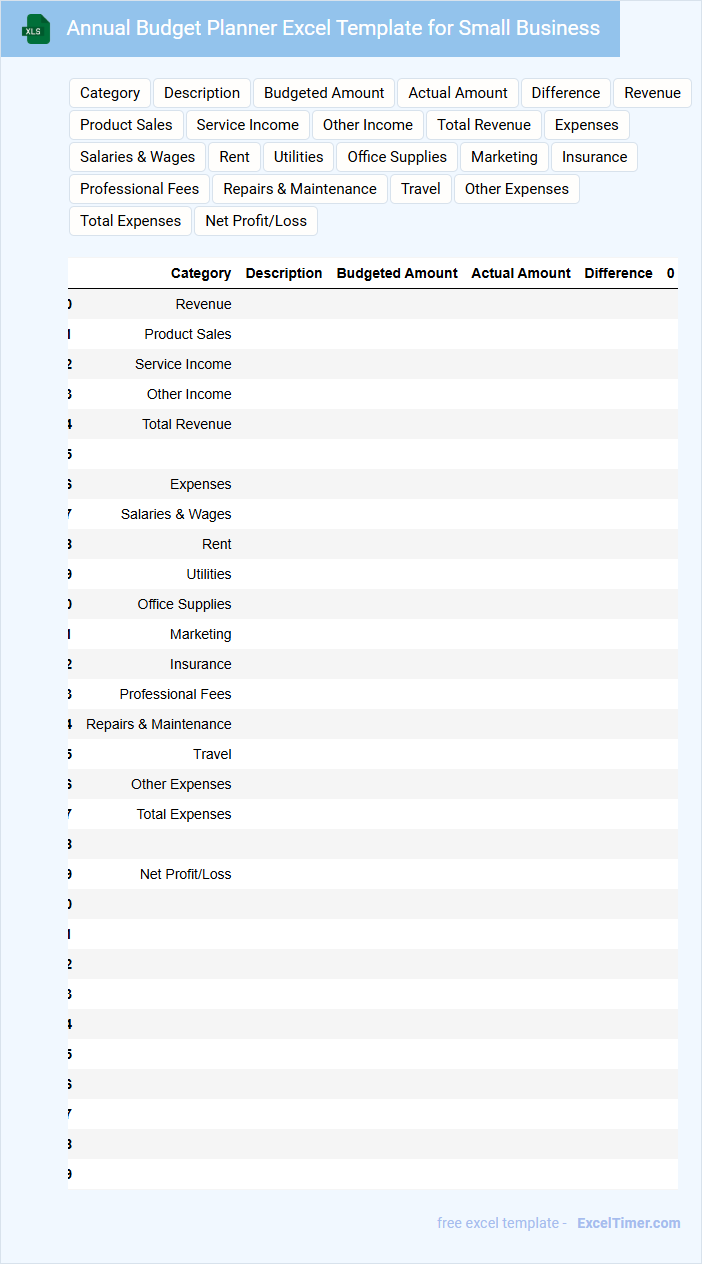

Annual Budget Planner Excel Template for Small Business

The Annual Budget Planner Excel Template is a structured document designed to help small businesses organize their finances effectively. It typically contains income projections, expense tracking, and cash flow analysis to provide a clear financial overview. This tool aids in setting realistic financial goals and monitoring performance throughout the year.

Key components include categorized expense lists, revenue forecasts, and visual charts for quick interpretation of data. Utilizing this template ensures businesses stay aligned with their financial plans and make informed decisions. Regularly updating the planner is essential for maintaining accuracy and adapting to changing business conditions.

Yearly Financial Tracker for Small Business Owners

What information is typically included in a Yearly Financial Tracker for Small Business Owners? This document usually contains detailed records of income, expenses, profits, and losses throughout the year to provide a clear financial overview. It helps business owners monitor cash flow, track budget adherence, and plan for future growth effectively.

Why is it important to maintain a Yearly Financial Tracker? Accurate financial tracking ensures compliance with tax regulations, facilitates informed decision-making, and highlights areas where cost savings or investment opportunities exist. Consistent updates and categorization of transactions are essential for maintaining the tracker's reliability and usefulness.

Simple Annual Budget Template for Small Companies

What information is typically included in a Simple Annual Budget Template for Small Companies?

This type of document usually contains projected revenues, estimated expenses, and net income for the year. It helps small businesses plan their finances effectively by outlining expected cash flow and supporting informed decision-making.

What is an important consideration when creating this budget template?

It is crucial to ensure accuracy in forecasting both income and costs to avoid financial shortfalls. Including contingency funds and regularly updating the budget can enhance its reliability and usefulness throughout the year.

Annual Business Expense Tracker with Income Analysis

What is an Annual Business Expense Tracker with Income Analysis usually used for? This type of document is designed to monitor and record all business expenses alongside income streams throughout the fiscal year. It helps businesses evaluate financial health by identifying spending patterns and income sources, enabling better budgeting and strategic planning.

What is an important feature to include in this document? It is crucial to include categorized expense entries and a clear breakdown of income sources, ensuring comprehensive insight into profitability. Additionally, incorporating visual elements like charts or graphs can enhance the analysis and decision-making process.

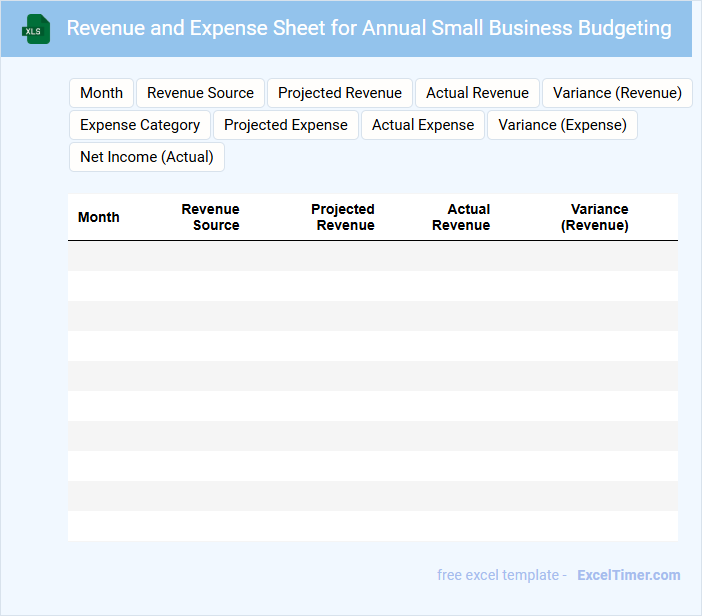

Revenue and Expense Sheet for Annual Small Business Budgeting

The Revenue and Expense Sheet is a crucial document that outlines all income and costs associated with a small business over a fiscal year. It provides a clear summary of financial performance to assist in budgeting and forecasting.

This type of document typically contains categorized revenue sources, fixed and variable expenses, and net profit or loss. Accurate tracking and updating of each category are essential for effective financial planning.

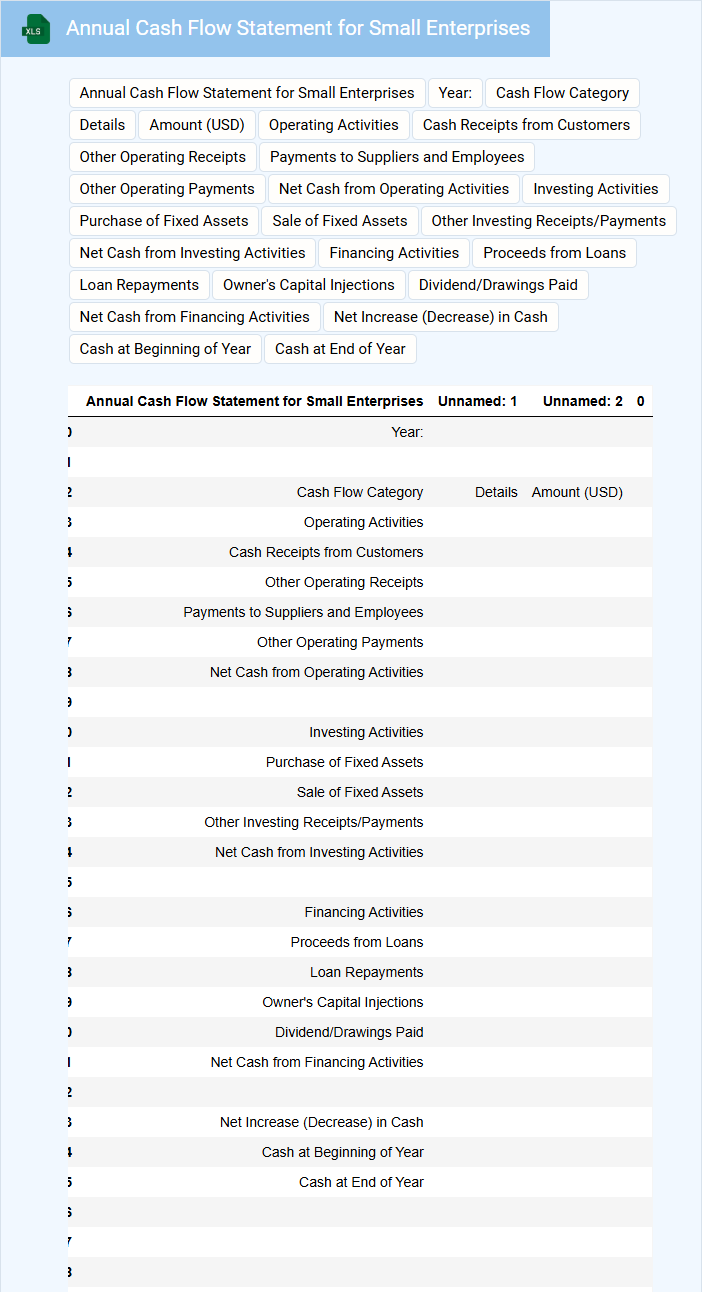

Annual Cash Flow Statement for Small Enterprises

An Annual Cash Flow Statement for Small Enterprises provides a comprehensive summary of the cash inflows and outflows over a fiscal year. It helps business owners understand their liquidity and manage financial stability effectively.

- Track operating cash flows to monitor daily business activities and profitability.

- Include detailed financing activities to show loans, repayments, and equity changes.

- Analyze investing cash flows, such as asset purchases or sales, to plan future investments.

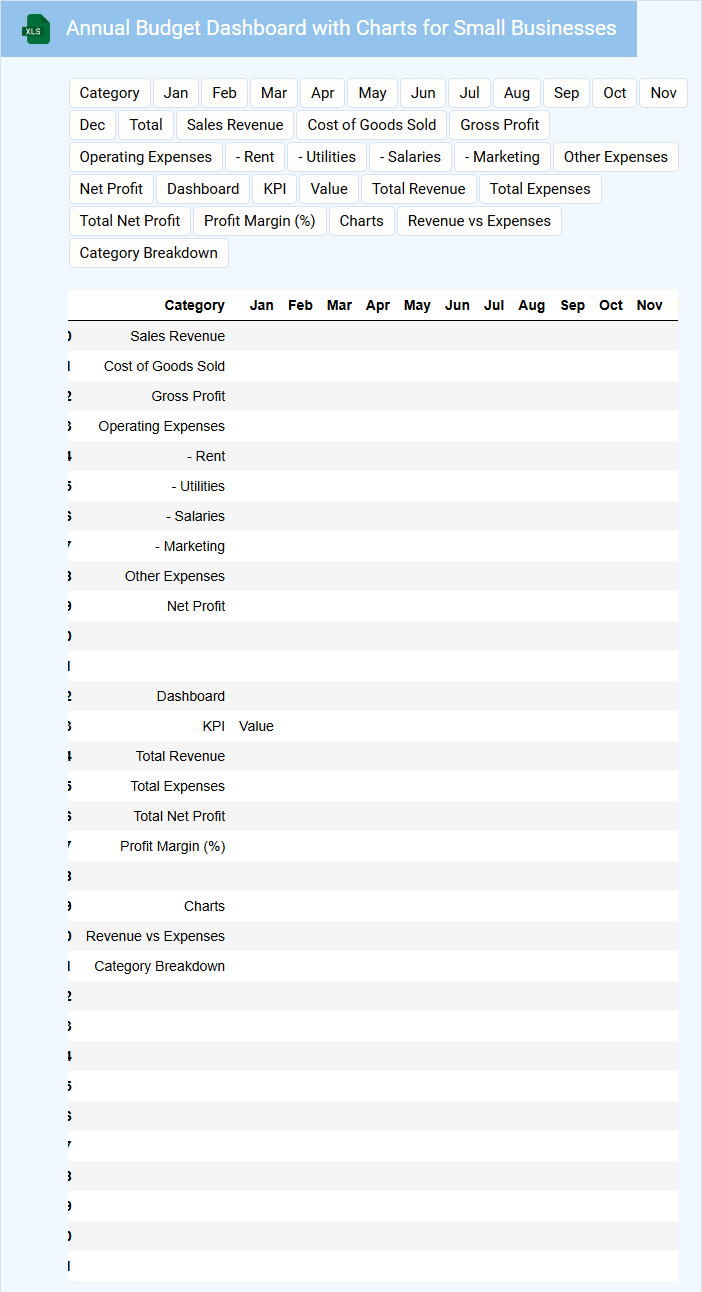

Annual Budget Dashboard with Charts for Small Businesses

An Annual Budget Dashboard for small businesses typically contains detailed financial data, including income, expenses, and profit margins. It uses visual charts like bar graphs and pie charts to present the budget status clearly and concisely.

This document helps track financial performance throughout the year and aids in making informed business decisions. It is important to include real-time data updates and customizable views for different departments.

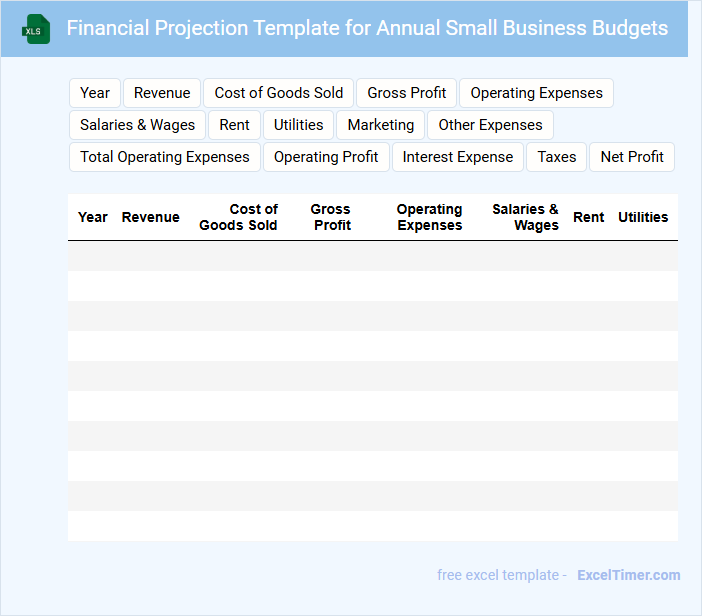

Financial Projection Template for Annual Small Business Budgets

A Financial Projection Template for annual small business budgets typically includes revenue forecasts, expense estimates, and cash flow statements. These documents help businesses anticipate financial performance and plan accordingly to ensure sustainability.

Key components often involve detailed budget allocations for marketing, operations, and staffing costs. Accurate assumptions and realistic figures are crucial for creating effective projections.

It is important to regularly update the template to reflect actual financial results and adjust future projections accordingly.

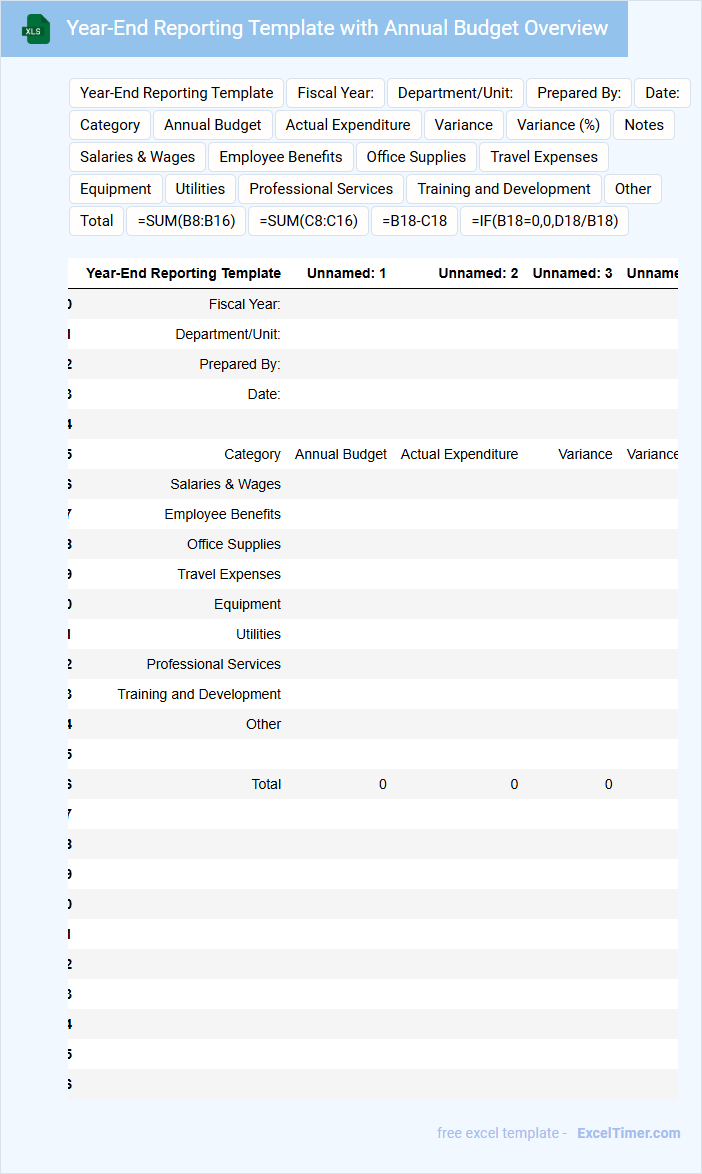

Year-End Reporting Template with Annual Budget Overview

What information is typically included in a Year-End Reporting Template with Annual Budget Overview?

This document usually contains a comprehensive summary of the organization's financial performance throughout the year, including actual expenses compared to the budget. It highlights key achievements, budget variances, and areas for improvement to inform stakeholders and support future financial planning.

What important elements should be included in a Year-End Reporting Template with Annual Budget Overview?

Important elements include detailed income and expenditure reports, a clear comparison between budgeted and actual figures, and analysis of discrepancies. Additionally, including graphical representations of data and actionable recommendations enhances clarity and decision-making for the upcoming year.

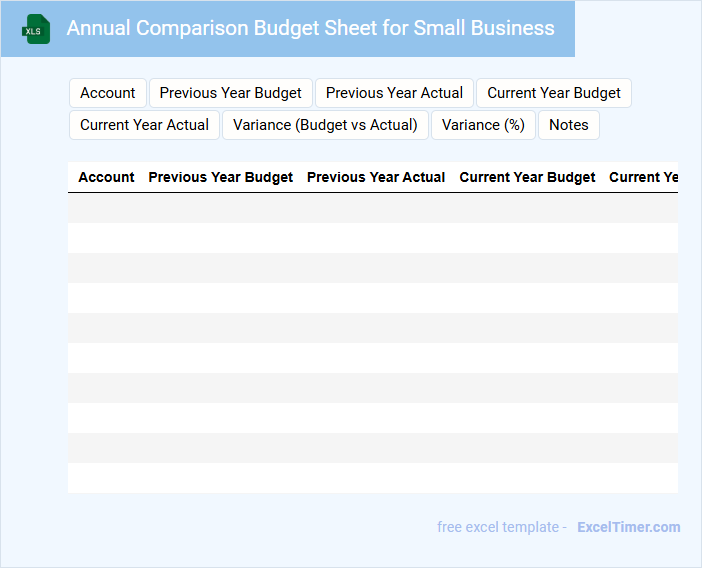

Annual Comparison Budget Sheet for Small Business

The Annual Comparison Budget Sheet for small businesses is a crucial financial document that tracks income and expenses over the fiscal year. It helps in analyzing spending patterns and revenue growth to make informed financial decisions.

This document typically contains monthly or quarterly budget data compared against actual figures, highlighting variances and trends. Important elements to include are accurate revenue projections, detailed expense categories, and clear variance explanations for better budget management.

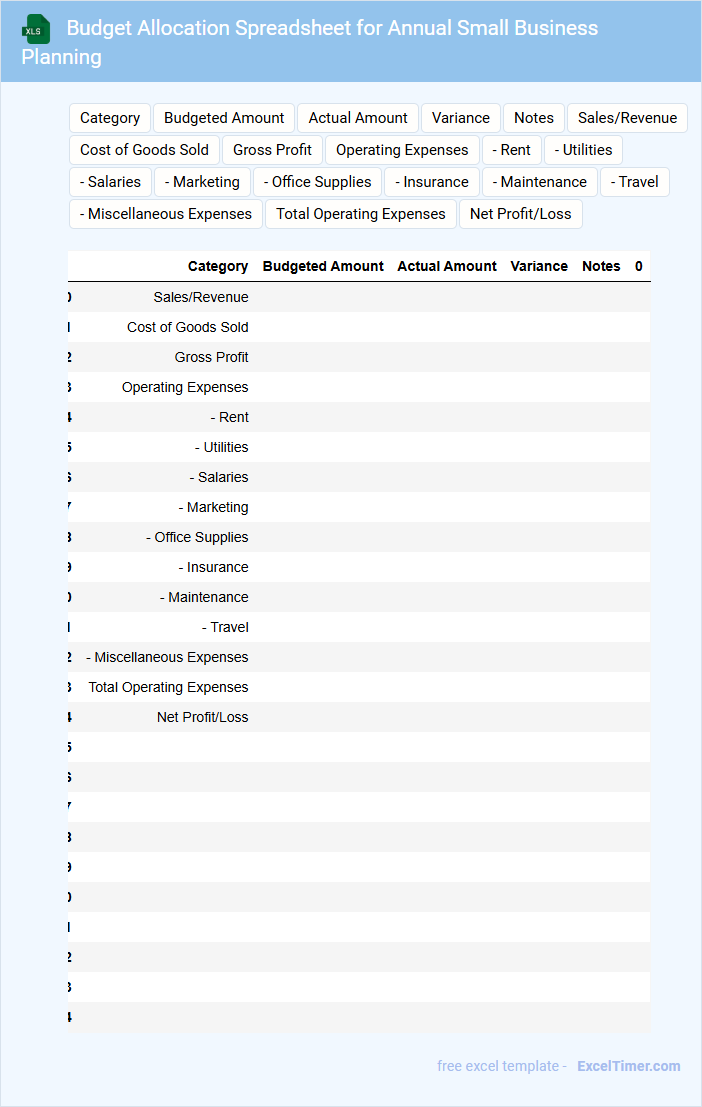

Budget Allocation Spreadsheet for Annual Small Business Planning

A Budget Allocation Spreadsheet for Annual Small Business Planning typically contains detailed financial data organized to help allocate resources efficiently throughout the year. It serves as a financial roadmap to ensure all departments and projects receive appropriate funding aligned with business goals.

- Include clear categories for expenses and income to enhance readability and tracking.

- Incorporate formulas for automatic calculations to minimize errors and save time.

- Regularly update the spreadsheet to reflect changes in business priorities and market conditions.

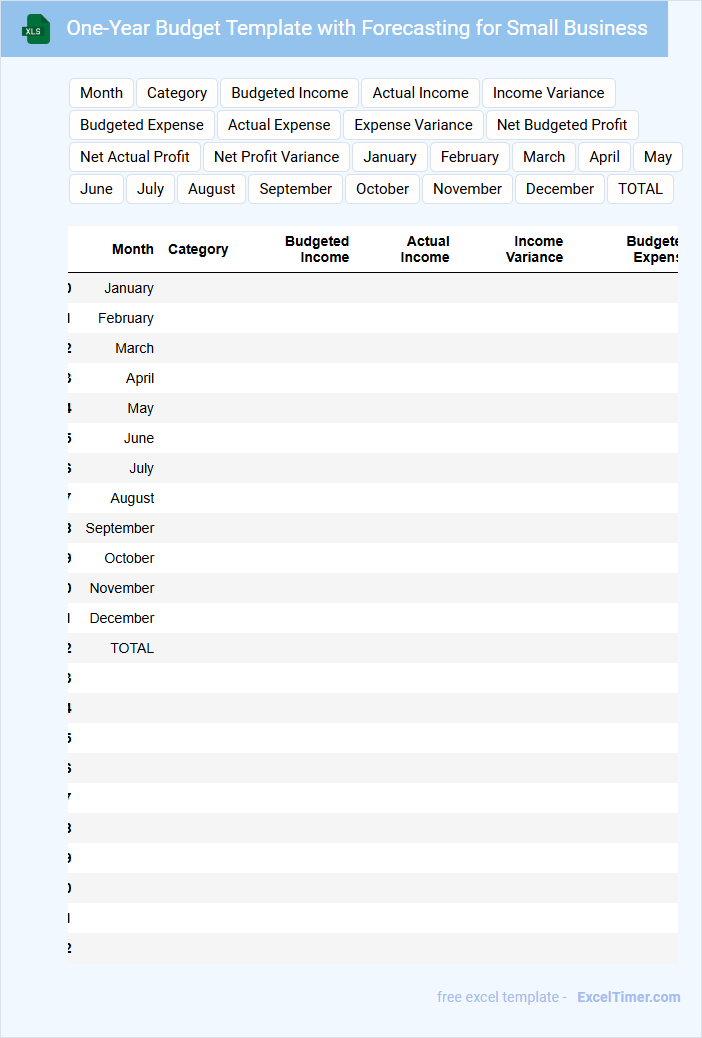

One-Year Budget Template with Forecasting for Small Business

This One-Year Budget Template is designed to help small businesses plan and allocate their financial resources effectively for the upcoming year. It typically contains sections for monthly income, expenses, profits, and detailed forecasting to ensure accurate financial tracking.

Forecasting elements in this template allow businesses to predict future revenues and costs, aiding in strategic decision-making and cash flow management. Including contingency plans and regularly updating the forecast are important to adapt to market changes and unexpected expenses.

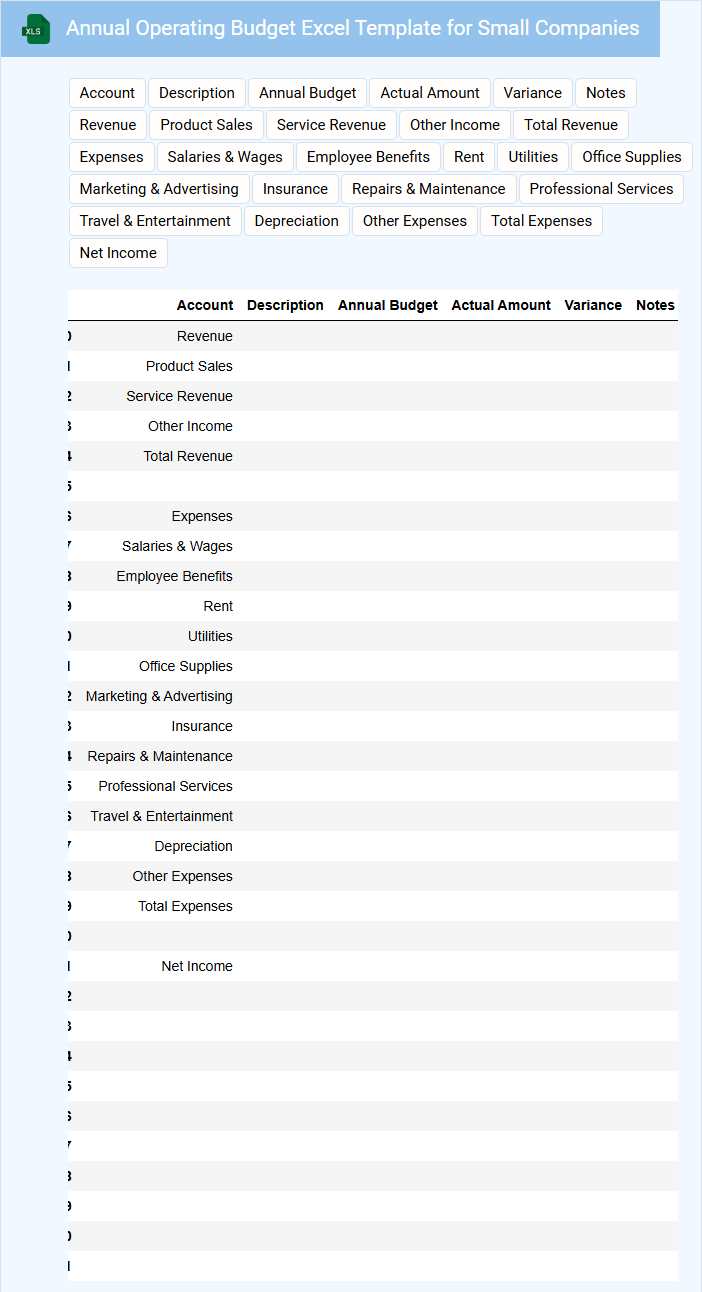

Annual Operating Budget Excel Template for Small Companies

An Annual Operating Budget Excel Template for small companies typically contains detailed financial projections, including revenue, expenses, and cash flow forecasts. It serves as a crucial tool for planning and managing company finances over the fiscal year. This document helps in setting financial goals, monitoring performance, and making informed business decisions.

Annual Budget Analysis Sheet for Small Businesses

What does an Annual Budget Analysis Sheet for Small Businesses typically contain? This document includes detailed records of income, expenses, and profit margins over the fiscal year to help business owners track financial performance. It also provides insights into spending patterns and identifies areas for cost reduction and investment opportunities.

Why is it important to regularly review this sheet? Regular reviews ensure that small businesses remain financially healthy by adapting strategies based on budget variances and market changes. Key suggestions include consistently updating data, comparing forecasts to actuals, and using the analysis to inform future financial planning and resource allocation.

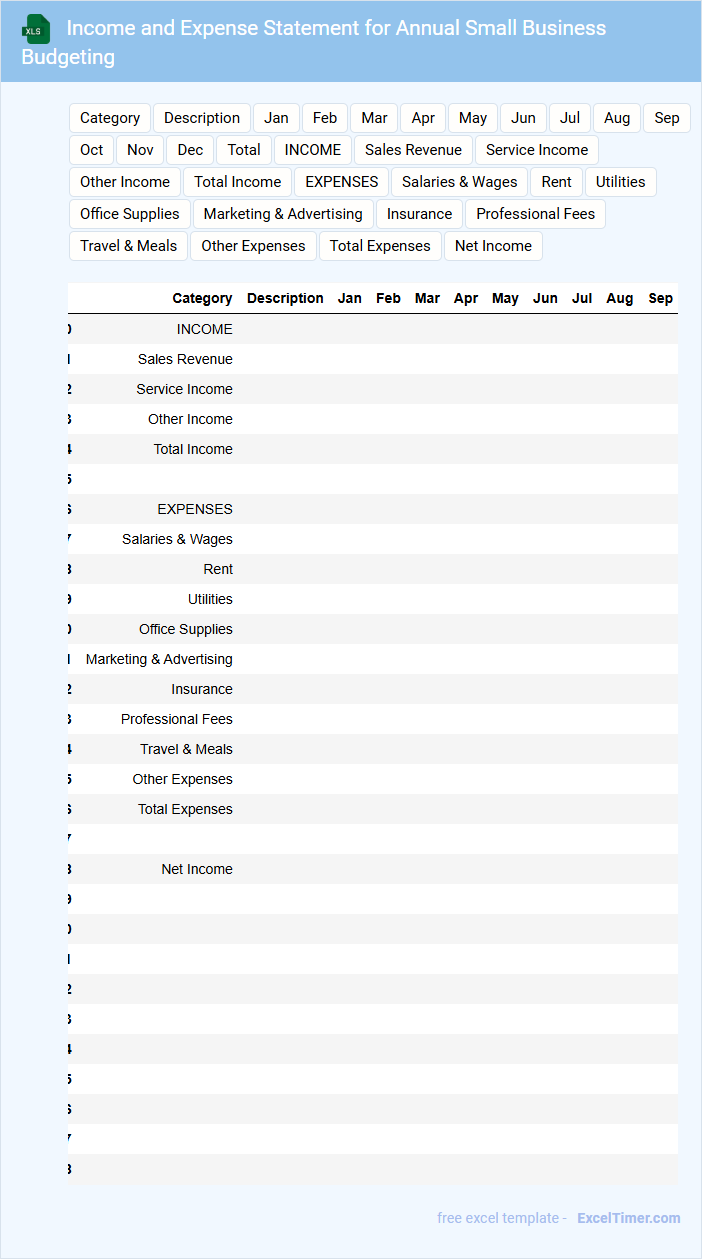

Income and Expense Statement for Annual Small Business Budgeting

An Income and Expense Statement is a financial document that summarizes revenues and expenditures over a specific period, typically a fiscal year. It provides small business owners with a clear view of profitability and helps identify areas for cost control. This statement is essential for effective annual budgeting and financial planning.

What are the essential components to include in an annual budget for a small business?

An annual budget for a small business must include detailed revenue projections, fixed and variable expenses, and cash flow forecasts to ensure financial stability. Essential components are sales estimates, cost of goods sold (COGS), operating expenses such as rent and utilities, payroll, marketing costs, and contingency funds. Accurate budgeting helps manage resources effectively, plan for growth, and identify potential financial challenges.

How does historical financial data inform annual budgeting decisions?

Historical financial data provides a clear record of past revenues, expenses, and cash flow patterns essential for accurate annual budget planning. By analyzing trends and anomalies, you can allocate resources effectively, anticipate seasonal fluctuations, and set realistic financial goals. This data-driven approach minimizes risks and maximizes profitability for small businesses.

Which Excel formulas and functions are most effective for projecting annual revenue and expenses?

Key Excel formulas for projecting annual revenue and expenses in a small business budget include SUM for total calculations, IF for conditional expenses, and VLOOKUP or XLOOKUP for referencing price lists or cost categories. The PMT function assists in calculating loan payments, while forecasting can be enhanced with TREND or FORECAST.LINEAR for predicting future sales. Utilizing these functions optimizes accuracy and efficiency in annual budget projections.

What strategies can be used in Excel to monitor and compare budget vs. actual performance throughout the year?

Use Excel's pivot tables and conditional formatting to track and highlight variances between budgeted and actual figures throughout the year. Implement dynamic charts and monthly data entry sheets to visualize trends and adjust forecasts. Your regularly updated dashboard ensures precise monitoring of financial performance for informed decision-making.

How can a small business budget in Excel support cash flow planning and management?

An annual budget template in Excel helps small businesses track income and expenses, providing clear visibility into cash flow patterns. Your business can use customizable categories and formulas to forecast monthly revenue and expenditures, ensuring timely payment management and avoiding shortfalls. This structured approach enables proactive financial decisions and sustained cash flow stability throughout the year.