The Annually Payroll Adjustment Excel Template for Startups streamlines the process of updating employee salaries and benefits, ensuring accuracy and compliance with financial regulations. It allows startups to efficiently manage payroll changes, track salary increments, and forecast budget impacts with ease. This template is essential for maintaining organized records and supporting strategic financial planning during growth phases.

Annual Payroll Adjustment Tracker for Startups

An Annual Payroll Adjustment Tracker is a document that records all changes in employee compensation throughout the year, including raises, bonuses, and deductions. It helps startups maintain accurate and up-to-date payroll records for budgeting and financial planning.

Key elements usually included are employee names, adjustment dates, reasons for changes, and updated salary amounts. For startups, it is crucial to ensure compliance with labor laws and to keep the tracker transparent and easily accessible for audits.

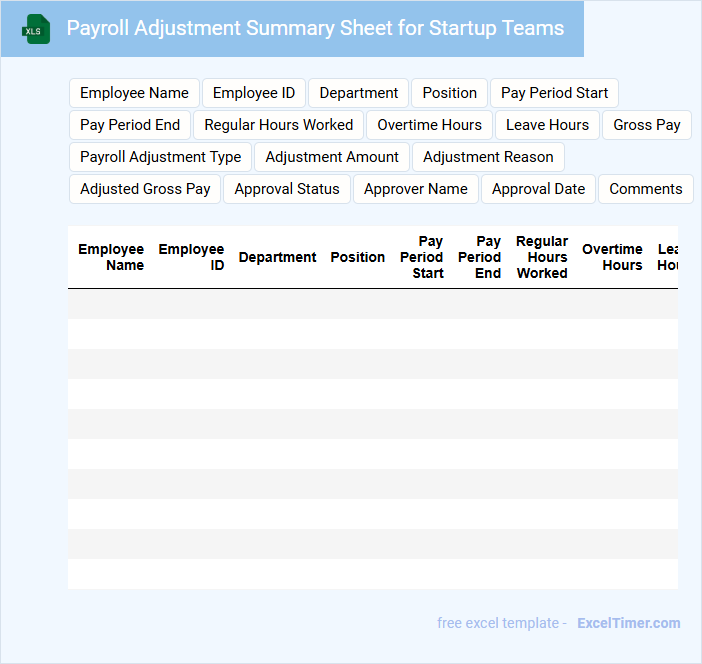

Payroll Adjustment Summary Sheet for Startup Teams

What information does a Payroll Adjustment Summary Sheet for Startup Teams typically contain? This document usually includes detailed records of salary changes, bonuses, deductions, and corrections for team members within a specific pay period. It serves as a transparent summary to ensure accurate payroll processing and helps track adjustments for financial and auditing purposes.

What important elements should be included to optimize its use? Include clear employee identification, precise adjustment reasons, approval signatures, and dates to maintain accountability. Additionally, ensure the summary aligns with company policies and compliance regulations to support payroll accuracy and avoid legal issues.

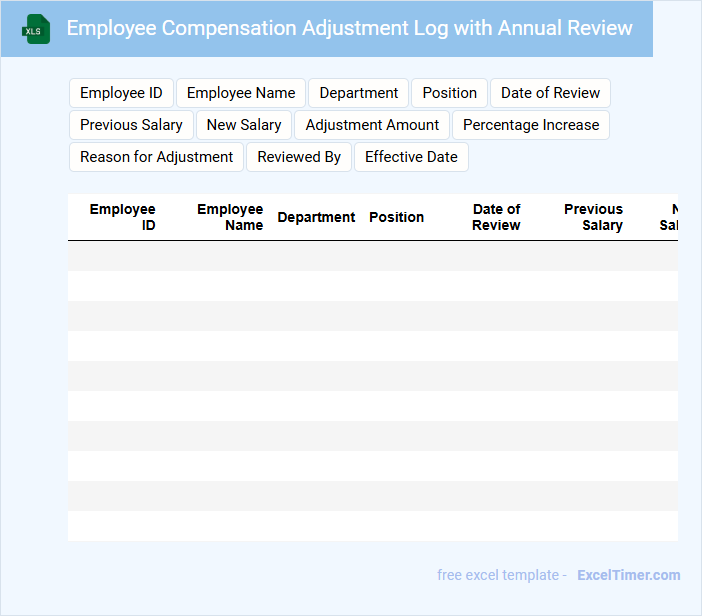

Employee Compensation Adjustment Log with Annual Review

The Employee Compensation Adjustment Log is a document that records all changes made to an employee's salary, including bonuses, raises, and other financial benefits. It helps organizations maintain transparency and track compensation history over time.

The Annual Review section highlights performance evaluations tied to salary adjustments, ensuring that increases are justified and aligned with employee contributions. It serves as a formal record for HR and management decisions.

For effective use, it is important to consistently update the log with accurate dates, adjustment reasons, and approval signatures to maintain compliance and support future audits.

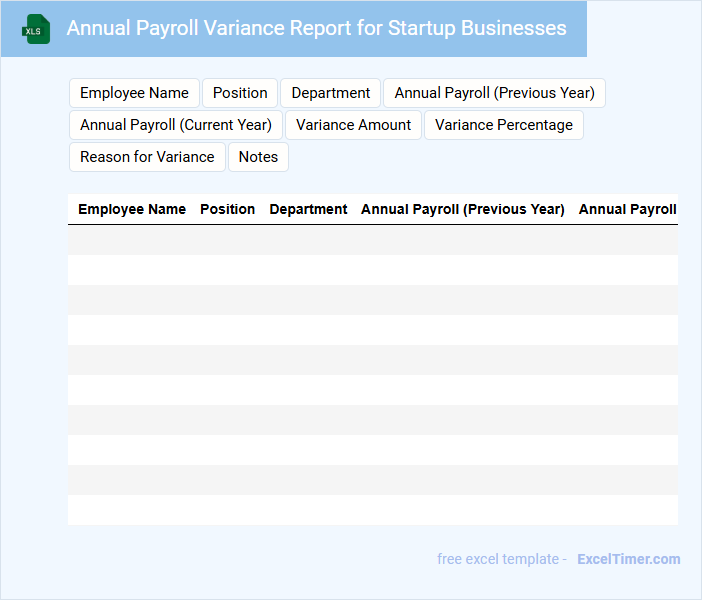

Annual Payroll Variance Report for Startup Businesses

The Annual Payroll Variance Report for startup businesses typically contains detailed comparisons between the expected payroll expenses and the actual payroll costs incurred throughout the year. This report highlights discrepancies and helps in understanding where payroll budgeting adjustments are necessary.

It is essential to include clear breakdowns of employee salaries, taxes, benefits, and bonuses to ensure transparency and accuracy. Emphasizing cash flow management can aid startups in maintaining financial stability while scaling their teams.

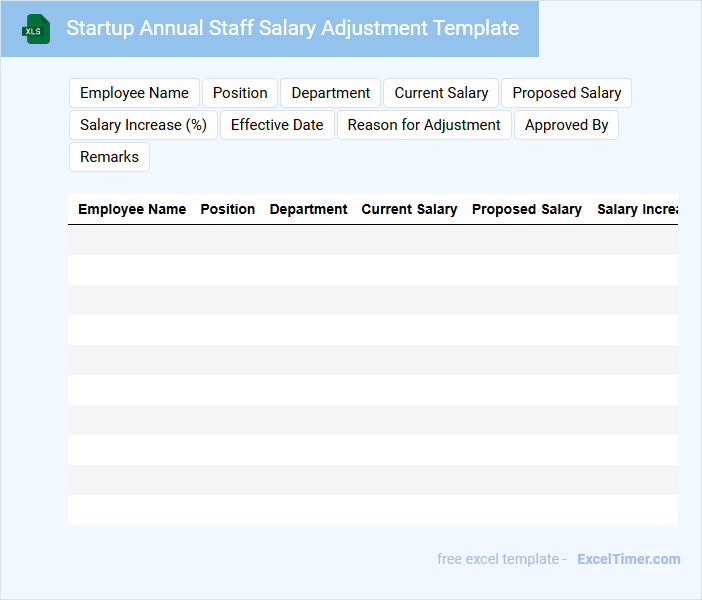

Startup Annual Staff Salary Adjustment Template

A Startup Annual Staff Salary Adjustment Template is typically used to document and standardize employee salary changes during yearly reviews. It includes current salaries, proposed adjustments, and justification for raises or bonuses.

Such a document ensures transparency and consistency in compensation management within a growing company. To optimize effectiveness, it should clearly outline criteria for adjustments and align with company budget constraints.

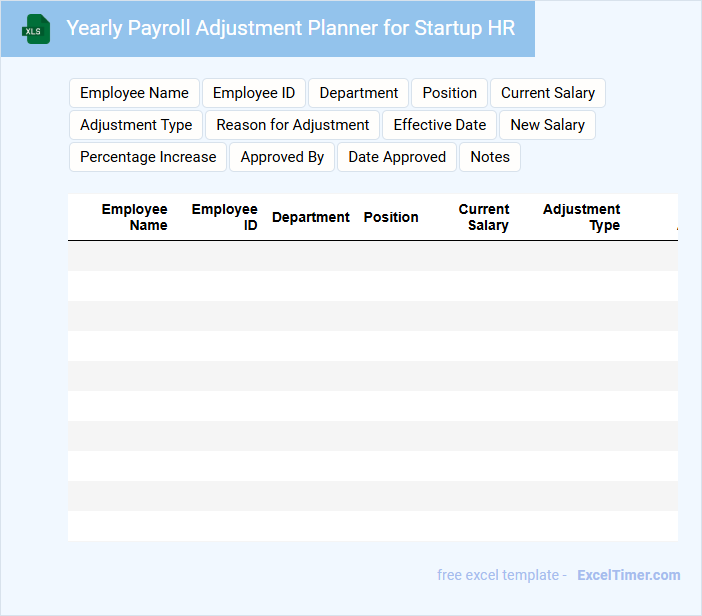

Yearly Payroll Adjustment Planner for Startup HR

The Yearly Payroll Adjustment Planner is an essential document that outlines planned changes in employee compensation, including raises, bonuses, and tax adjustments. It helps startups systematically manage payroll updates while ensuring budget alignment.

For Startup HR teams, this planner provides a clear roadmap to implement salary adjustments transparently and timely. Including sections on employee categories, adjustment rationale, and approval workflows is highly recommended for accuracy and compliance.

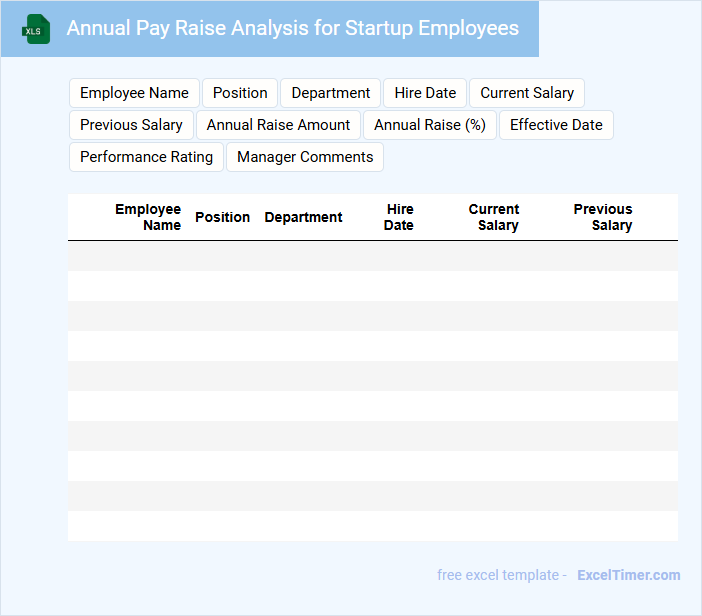

Annual Pay Raise Analysis for Startup Employees

An Annual Pay Raise Analysis document for startup employees typically includes a detailed review of salary adjustments based on performance, market trends, and company financial health. It highlights individual contributions and benchmarks against industry standards to ensure competitive compensation.

Important aspects to consider are transparency in criteria and clear communication of raise justification to maintain employee motivation. This document helps startups retain talent and plan budget allocations effectively.

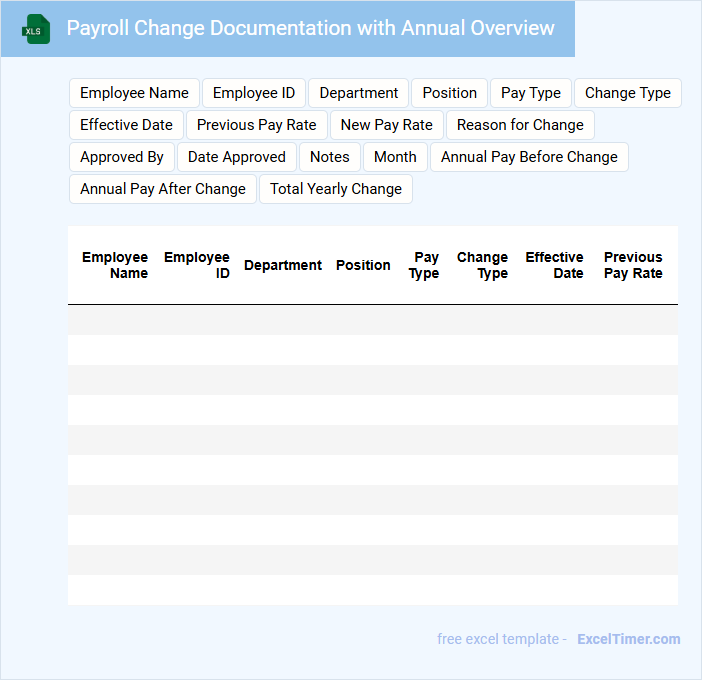

Payroll Change Documentation with Annual Overview

What information is typically included in a Payroll Change Documentation with Annual Overview? This type of document usually contains detailed records of all payroll modifications made throughout the year, including salary adjustments, bonuses, deductions, and changes in employee status. It provides a comprehensive summary to ensure accurate tracking and compliance with financial and legal standards.

What are important considerations when preparing Payroll Change Documentation with Annual Overview? It is essential to maintain clear, accurate, and up-to-date records that reflect every payroll change promptly. Additionally, ensuring confidentiality and securing the document helps protect sensitive employee information and supports smooth audits or financial reviews.

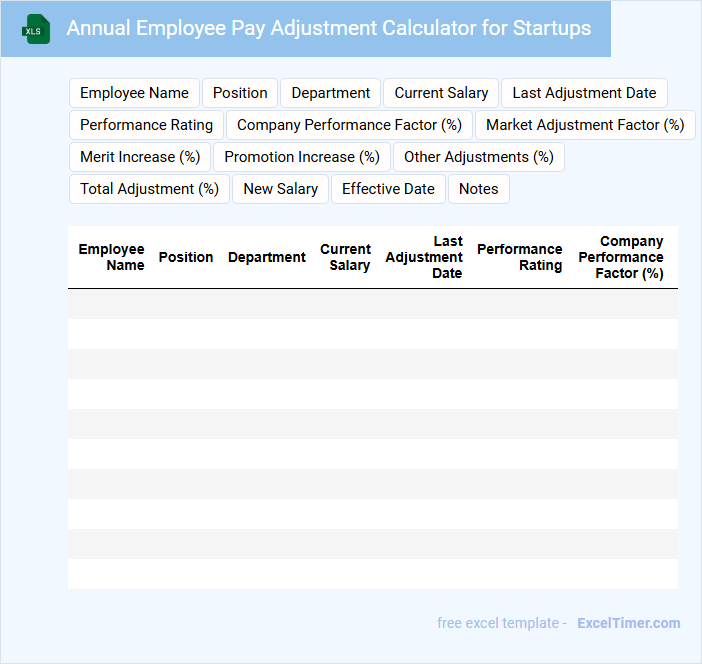

Annual Employee Pay Adjustment Calculator for Startups

An Annual Employee Pay Adjustment Calculator for startups is a crucial tool designed to manage salary increments efficiently. It typically contains employee salary data, performance metrics, and budget constraints to ensure fair and strategic pay adjustments. Important factors to consider include market salary trends, individual performance ratings, and overall company financial health to maintain competitive compensation.

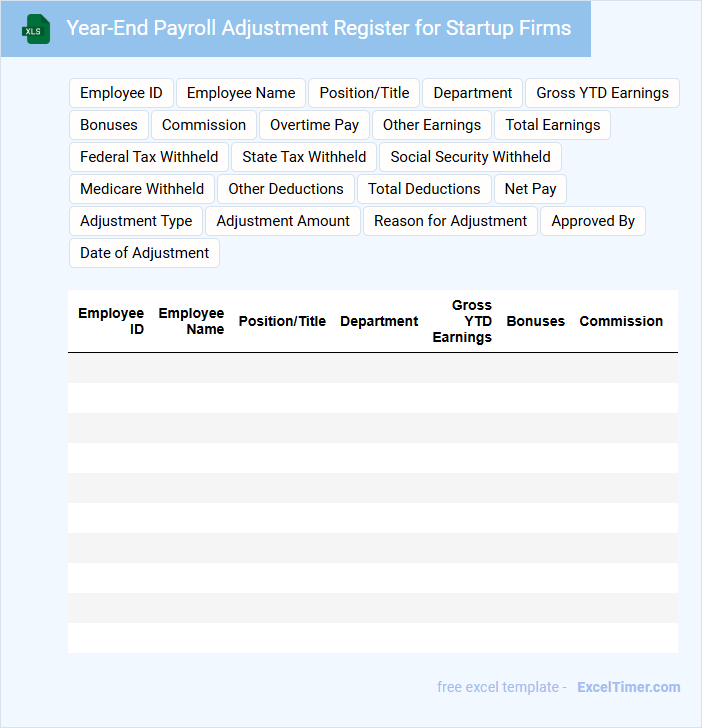

Year-End Payroll Adjustment Register for Startup Firms

The Year-End Payroll Adjustment Register for startup firms typically contains detailed records of all payroll corrections and adjustments made throughout the fiscal year. This document ensures accuracy in employee compensation, tax filings, and compliance with labor laws. Maintaining a clear and comprehensive register is crucial for transparent financial reporting and audit readiness.

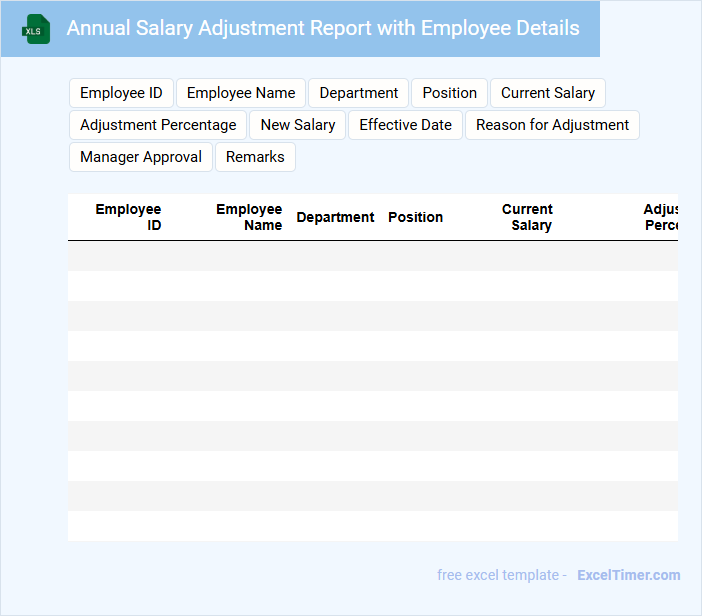

Annual Salary Adjustment Report with Employee Details

The Annual Salary Adjustment Report typically contains detailed information about employees' salary changes within a fiscal year. It includes personal employee data such as names, positions, and departments, along with the percentage and amount of salary adjustments. This report helps organizations track compensation trends and ensure fairness across all levels.

Payroll Adjustment Timeline for Startup Companies

The Payroll Adjustment Timeline document outlines the schedule and key milestones for implementing payroll changes in startup companies. It typically includes deadlines, responsible parties, and processes to ensure accurate and timely payroll updates.

For startup companies, maintaining a clear and detailed timeline is crucial to avoid payment errors and compliance issues. This document helps coordinate HR, finance, and management teams effectively. Prioritizing communication and regular reviews is essential for successful payroll adjustments.

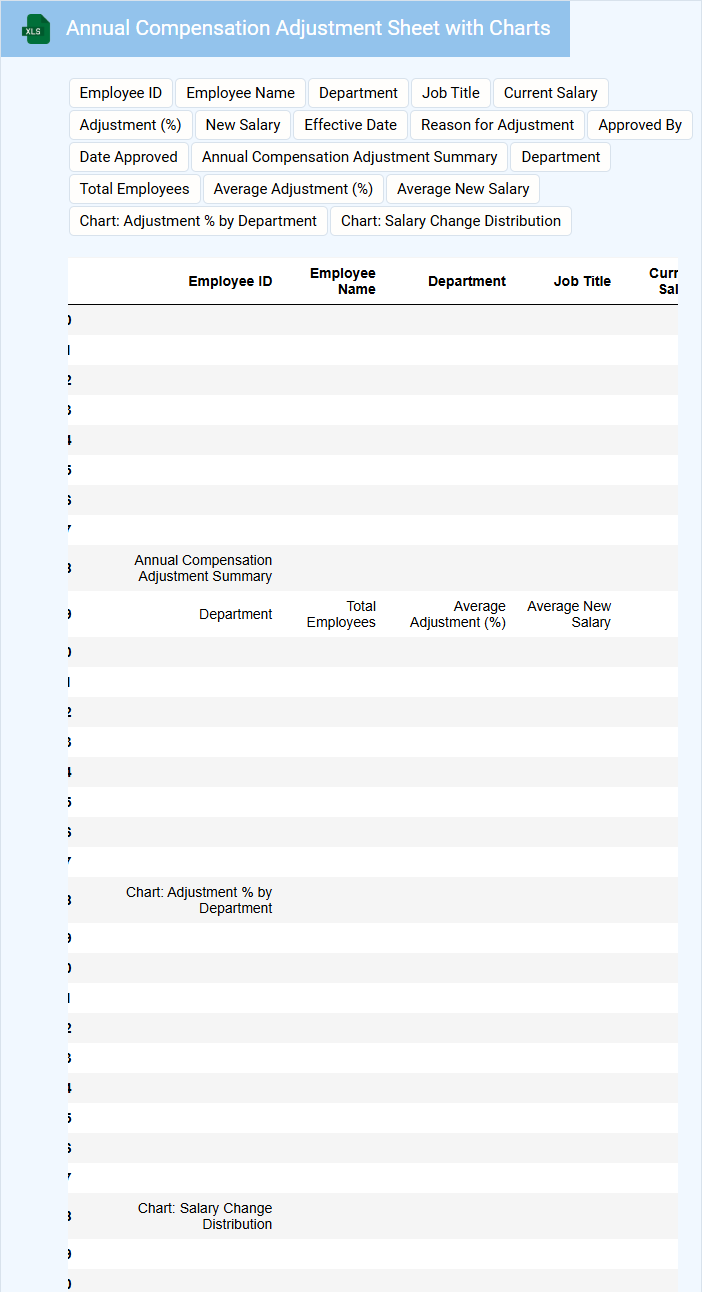

Annual Compensation Adjustment Sheet with Charts

The Annual Compensation Adjustment Sheet typically contains detailed information about salary changes, bonuses, and benefits adjustments for employees within an organization over the past year. It includes charts that visually represent compensation trends, comparison of departmental budgets, and individual performance impacts. Ensuring accuracy and transparency in these documents is crucial for fair employee evaluation and strategic financial planning.

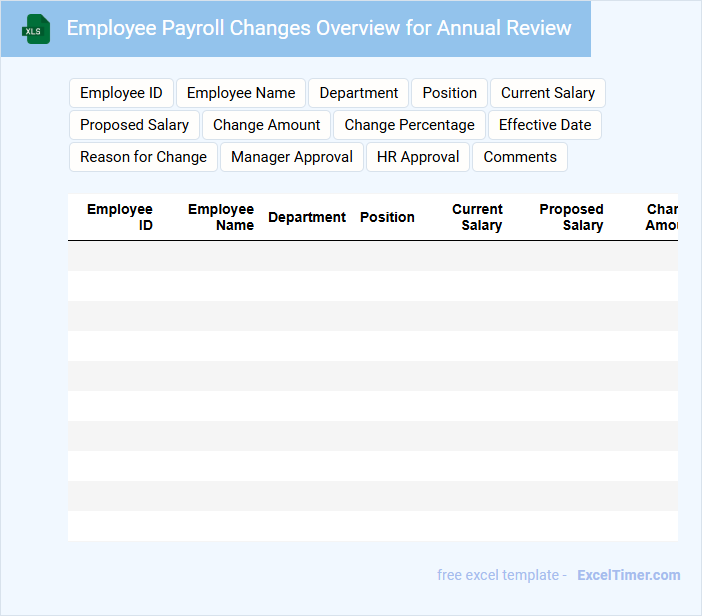

Employee Payroll Changes Overview for Annual Review

Employee Payroll Changes Overview for Annual Review typically contains a summary of all payroll adjustments made throughout the year to ensure accuracy and compliance.

- Employee Information: Detailed records of employee names, positions, and payroll identification numbers.

- Payroll Adjustments: Documentation of salary changes, bonuses, deductions, and benefits updates.

- Compliance and Approvals: Verification of approvals, tax withholdings, and regulatory adherence for each payroll change.

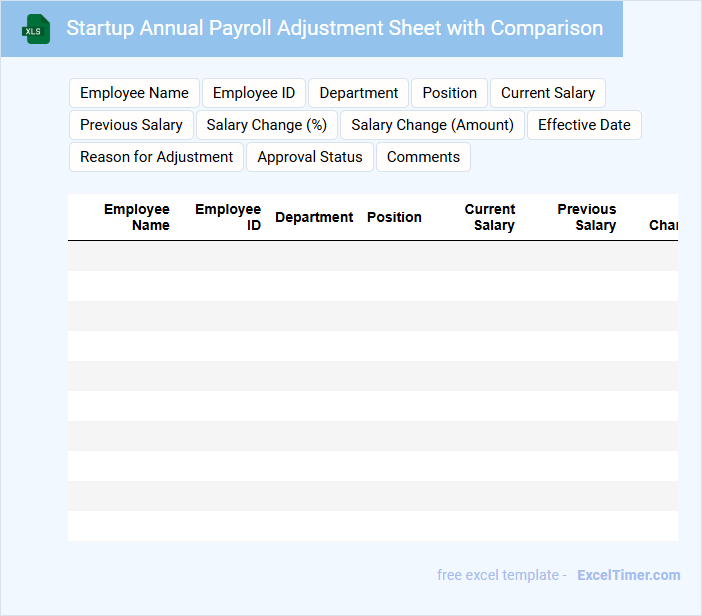

Startup Annual Payroll Adjustment Sheet with Comparison

The Startup Annual Payroll Adjustment Sheet typically contains detailed records of employee salaries, bonuses, and any adjustments made throughout the fiscal year. It helps in tracking payroll changes and ensures accurate compensation management.

This document usually includes a comparison between current and previous salary figures to highlight increments or deductions. Maintaining clarity in these comparisons is essential for transparency and effective financial planning.

Ensure to include clear headers, consistent data formatting, and a summary of key changes to facilitate easy review by stakeholders.

What are the key data fields required to accurately perform an annual payroll adjustment in an Excel document for startups?

Accurate annual payroll adjustment for startups in Excel requires key data fields such as employee ID, salary or hourly wage, hours worked, tax withholdings, bonuses, and deductions. Including year-to-date earnings and benefits contributions ensures comprehensive payroll compliance. Your Excel document should also track changes in tax rates or employee status to maintain precision.

How should salary changes, bonuses, and deductions be structured and tracked within the Excel worksheet for end-of-year payroll reconciliation?

Structure the Excel worksheet with separate columns for base salary changes, bonuses, and deductions, each linked to individual employee IDs. Use formulas to calculate net pay and annual totals, ensuring real-time updates for accurate end-of-year payroll reconciliation. Incorporate data validation and timestamped entries to maintain data integrity and track all adjustments systematically.

What Excel formulas or functions are best for dynamically updating payroll totals and tax withholdings during the annual adjustment process?

Use the SUM function to dynamically update payroll totals by totaling individual employee salaries efficiently. Employ the IF function combined with VLOOKUP or XLOOKUP to apply correct tax withholding rates based on salary brackets or employee categories. You can also utilize the ROUND function to ensure tax calculations are accurate and comply with regulatory standards during the annual payroll adjustment for startups.

Which columns should be included to ensure compliance with government reporting requirements for annual payroll in startups?

Your Excel document for Annual Payroll Adjustment in Startups should include columns for Employee Name, Employee ID, Gross Salary, Tax Withheld, Social Security Contributions, Medicare Contributions, and Year-to-Date Earnings. Including columns for State and Federal Tax Filing Status, Payroll Period, and Employer Contributions ensures compliance with government reporting requirements. Accurate data in these fields supports proper tax reporting and audit readiness.

How can Excel be set up to flag discrepancies or potential errors in annual payroll adjustments for timely review and correction?

Excel can be set up to flag discrepancies in annual payroll adjustments by using conditional formatting to highlight values that deviate from predefined thresholds or expected ranges. Data validation rules ensure that entered payroll figures comply with set criteria, while formulas like IF and VLOOKUP identify inconsistencies or missing entries for timely review. Incorporating pivot tables and error-checking functions further streamlines the detection and correction of payroll adjustment errors in startup financial documents.