The Annually Expense Claim Excel Template for Remote Employees simplifies the process of tracking and submitting yearly expenses, ensuring accuracy and easy documentation. This template helps remote employees organize receipts, categorize expenses, and calculate totals efficiently. Its user-friendly format supports timely reimbursement and financial transparency within remote work environments.

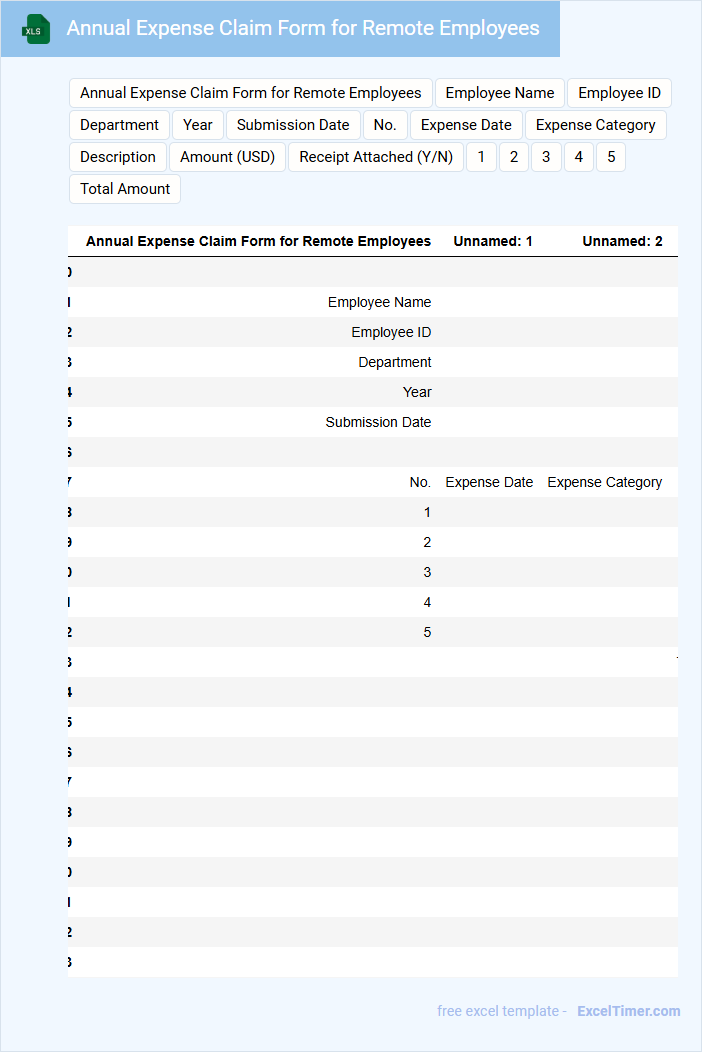

Annual Expense Claim Form for Remote Employees

An Annual Expense Claim Form for Remote Employees typically contains detailed records of yearly expenses incurred by employees working remotely to ensure accurate reimbursement and financial tracking.

- Employee Information: Essential personal and employment details to verify the claimant's identity and employment status.

- Expense Details: Clear itemization of expenses with dates, amounts, and descriptions to provide transparency and justification.

- Approval and Documentation: Sections for necessary approvals and attached receipts to validate and authorize the claimed expenses.

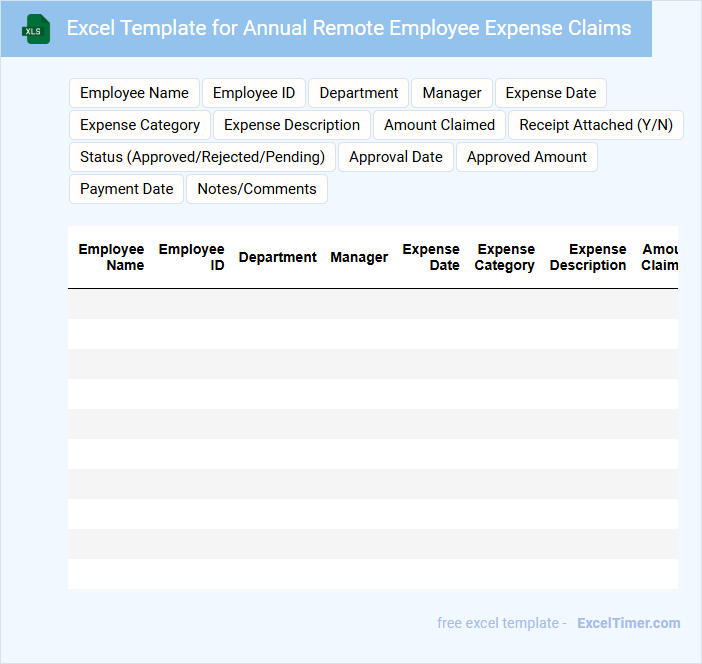

Excel Template for Annual Remote Employee Expense Claims

What information does an Excel Template for Annual Remote Employee Expense Claims typically contain? This document usually includes sections for employee details, expense categories, dates, descriptions, amounts, and approval statuses. It is designed to streamline the submission and tracking of expense reimbursements for remote employees over the course of a year.

What important aspects should be considered when creating this template? It is essential to ensure accuracy in data entry, include clear instructions for employees, and integrate formulas for automatic calculations to minimize errors and improve efficiency.

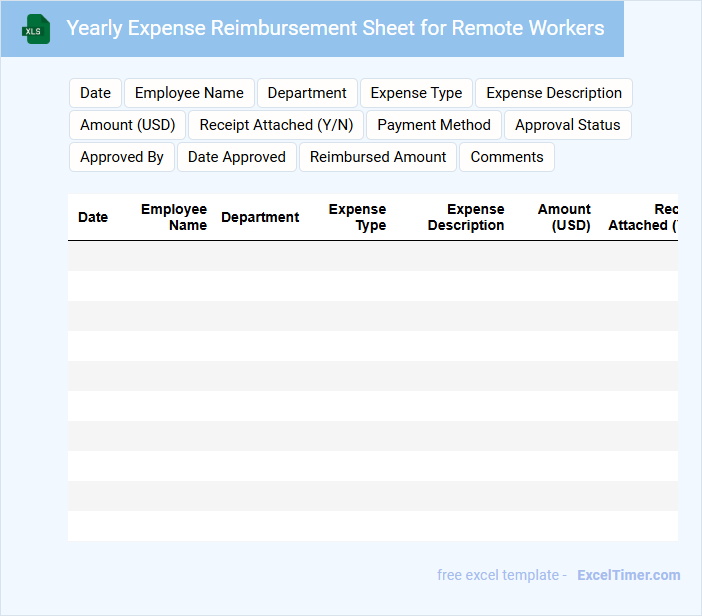

Yearly Expense Reimbursement Sheet for Remote Workers

A Yearly Expense Reimbursement Sheet for Remote Workers typically contains detailed records of expenses submitted for reimbursement throughout the year to ensure proper tracking and approval.

- Accurate expense categorization: clearly classify expenses by type such as travel, equipment, and home office costs.

- Receipt documentation: attach or reference original receipts for verification and auditing purposes.

- Approval status tracking: include fields to indicate approval stages and final reimbursement amounts.

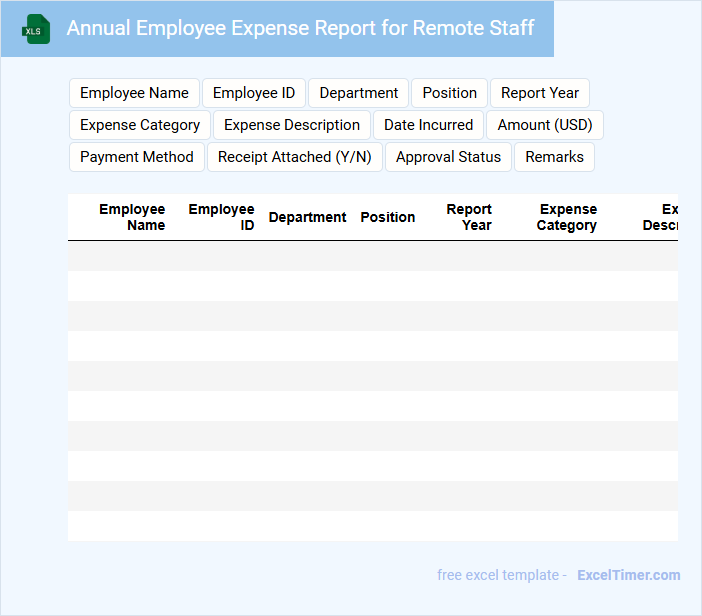

Annual Employee Expense Report for Remote Staff

An Annual Employee Expense Report for Remote Staff typically contains detailed records of reimbursements, expense categories, and policy compliance throughout the fiscal year.

- Expense Categories: Clearly categorized expenses such as travel, equipment, and internet costs ensure accurate tracking.

- Policy Compliance: Documentation must reflect adherence to company expense policies for transparency and auditing.

- Reimbursement Summary: A comprehensive summary of approved and pending reimbursements aids in financial planning.

Remote Employee Expense Claim Tracker for the Year

What information does a Remote Employee Expense Claim Tracker for the Year typically contain? It usually includes detailed records of expenses claimed by remote employees, such as dates, amounts, purposes, and attached receipts. This document helps organizations monitor reimbursement requests and maintain accurate financial records.

Why is it important to use this type of tracker effectively? An optimized tracker ensures transparency, reduces errors, and simplifies auditing processes. Key features should include clear categorization of expenses, timely updates, and secure data storage to protect sensitive employee information.

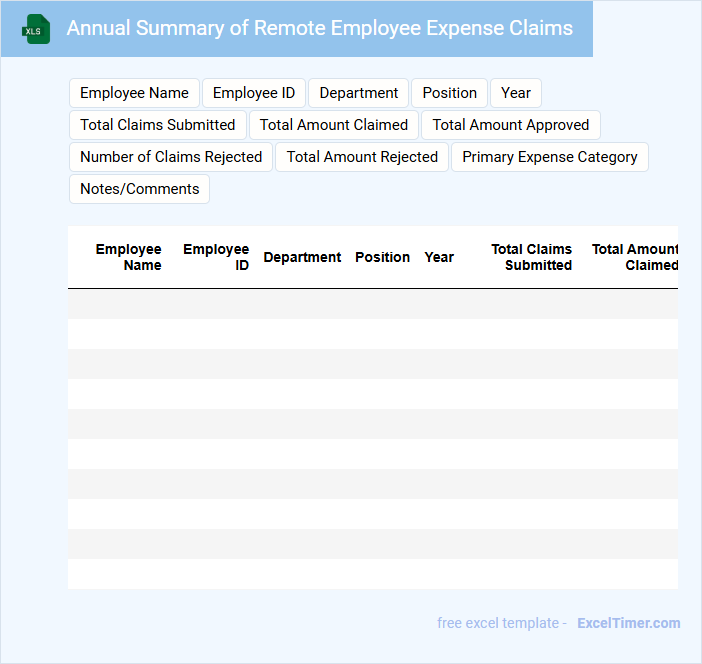

Annual Summary of Remote Employee Expense Claims

An Annual Summary of Remote Employee Expense Claims typically contains a comprehensive overview of all reimbursable expenses submitted by remote employees throughout the year. It includes detailed records such as travel costs, office supplies, and communication expenses essential for remote work. This document helps organizations track spending, ensure policy compliance, and streamline financial auditing processes. Important considerations include verifying the accuracy of expense claims, ensuring all submissions comply with company policies, and maintaining clear documentation for each expense to support accountability and reimbursement approvals.

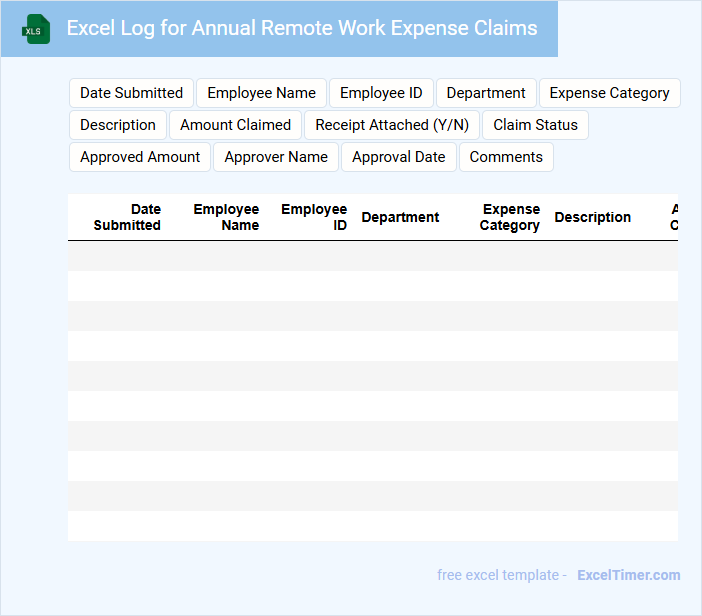

Excel Log for Annual Remote Work Expense Claims

This type of document is typically used to systematically record and track annual remote work expenses for reimbursement purposes.

- Expense Categories: Clearly list all types of remote work expenses such as internet, office supplies, and utilities.

- Date and Amount: Accurately record the date of each expense and the corresponding amount spent.

- Supporting Documentation: Attach or reference receipts and invoices for verification and audit purposes.

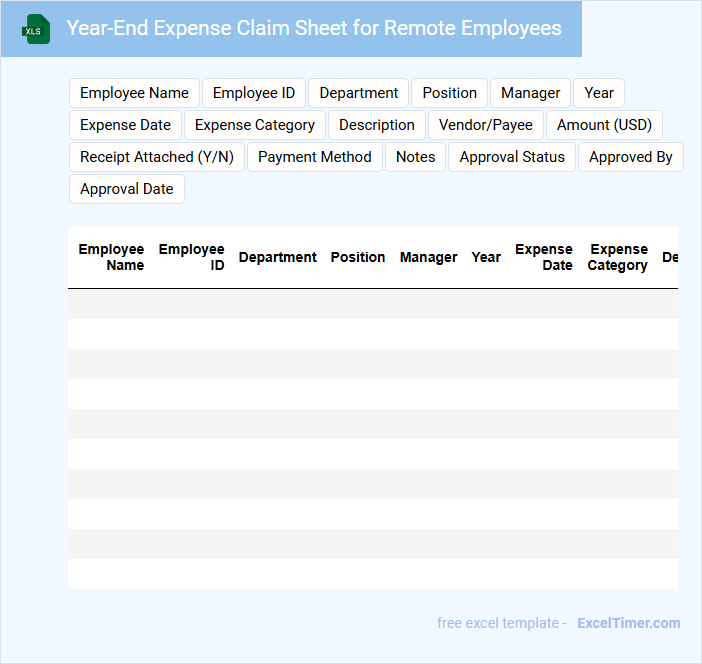

Year-End Expense Claim Sheet for Remote Employees

A Year-End Expense Claim Sheet for remote employees typically contains detailed records of reimbursable business expenses incurred throughout the year. It includes categories such as travel, supplies, and home office costs. Ensuring accuracy and timely submission helps maintain clear financial tracking and compliance with company policies.

Annual Expense Tracker with Categories for Remote Employees

An Annual Expense Tracker for remote employees typically contains detailed records of all expenses incurred throughout the year, categorized by type such as equipment, software, and internet costs. It helps organizations monitor spending patterns and manages budgets effectively. Including clear category labels and regular updates ensures accuracy and ease of use.

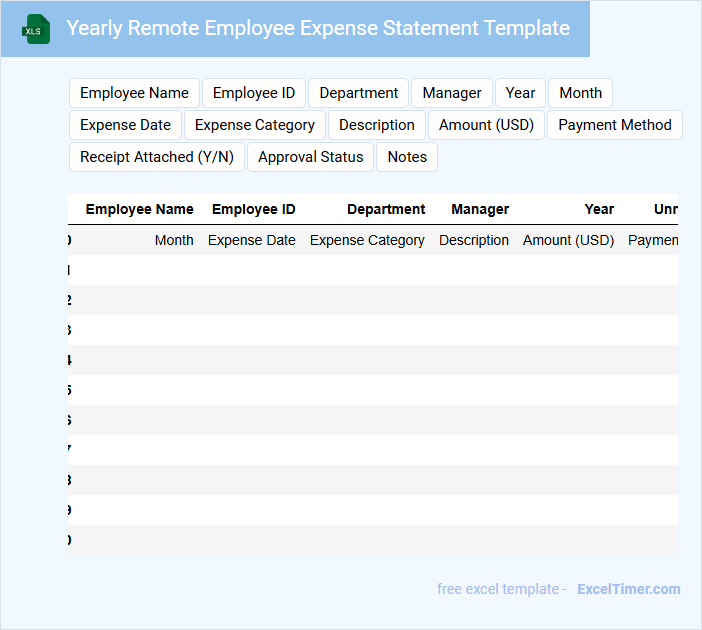

Yearly Remote Employee Expense Statement Template

The Yearly Remote Employee Expense Statement document typically contains a detailed summary of all expenses incurred by a remote employee throughout the year. This includes categories such as travel, office supplies, software subscriptions, and internet costs. It helps both the employee and employer keep track of reimbursable expenses and maintain clear financial records.

For effective use, it's important to include accurate dates, receipts, and clear descriptions of each expense to ensure transparency and proper reimbursement. A well-organized template also allows for easy review during audits or tax filing. Keeping this document updated regularly reduces errors and streamlines the expense reporting process.

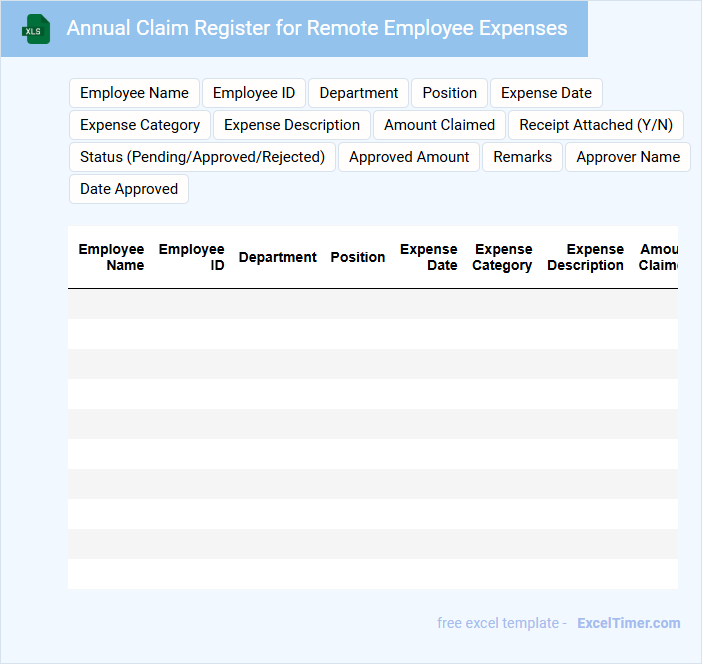

Annual Claim Register for Remote Employee Expenses

The Annual Claim Register for Remote Employee Expenses is a detailed record of all expense claims made by remote employees throughout the fiscal year. It typically includes dates, expense categories, amounts, and approval statuses to ensure transparency and accurate reimbursement.

Maintaining a comprehensive expense register helps organizations monitor spending patterns and comply with financial policies. It is important to regularly verify claims for accuracy and retain supporting documentation to facilitate audits and budgeting.

Yearly Expense Reimbursement Tracker for Remote Work

This document typically records and organizes expenses incurred by employees working remotely to ensure accurate reimbursement. It helps maintain transparency and accountability for financial transactions related to remote work.

- Include detailed categories for expenses such as internet, office supplies, and software subscriptions.

- Ensure clear dates and descriptions for each expense entry to facilitate verification.

- Incorporate a summary section to calculate total reimbursements for each employee annually.

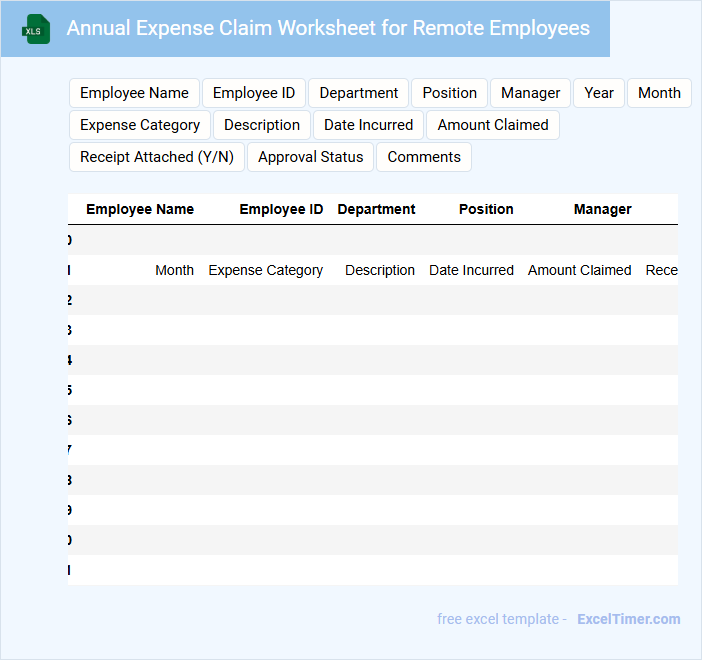

Annual Expense Claim Worksheet for Remote Employees

The Annual Expense Claim Worksheet is a formal document used by remote employees to report and itemize their yearly business-related expenses. It typically includes categories such as travel, office supplies, internet costs, and other work-from-home necessities.

Ensuring accurate documentation and attaching all relevant receipts is crucial for proper reimbursement. Employees should also review company policies to understand eligible expenses and claim limits.

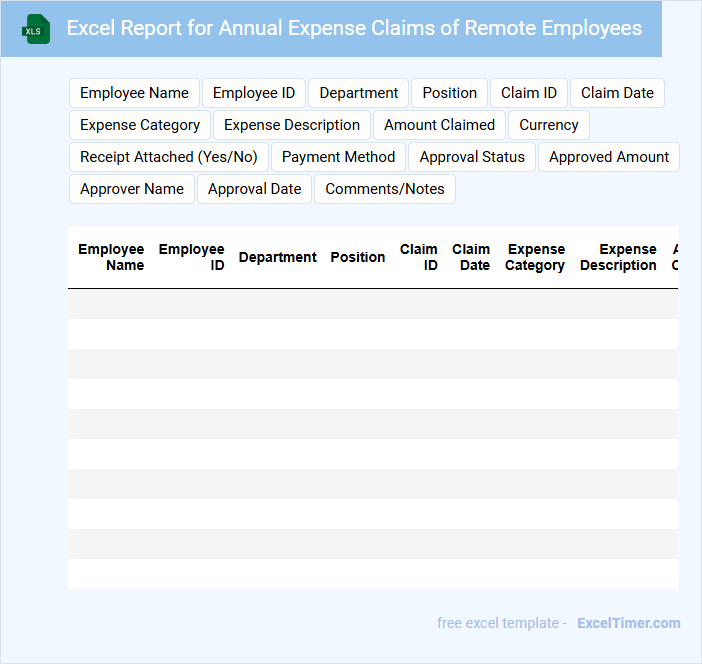

Excel Report for Annual Expense Claims of Remote Employees

An Excel Report for Annual Expense Claims of Remote Employees typically contains detailed records of all expenses submitted throughout the year. It includes categorized costs such as travel, office supplies, and telecommunications, along with dates and approval statuses. This report is essential for accurate financial tracking and reimbursement processing in organizations managing remote workforces.

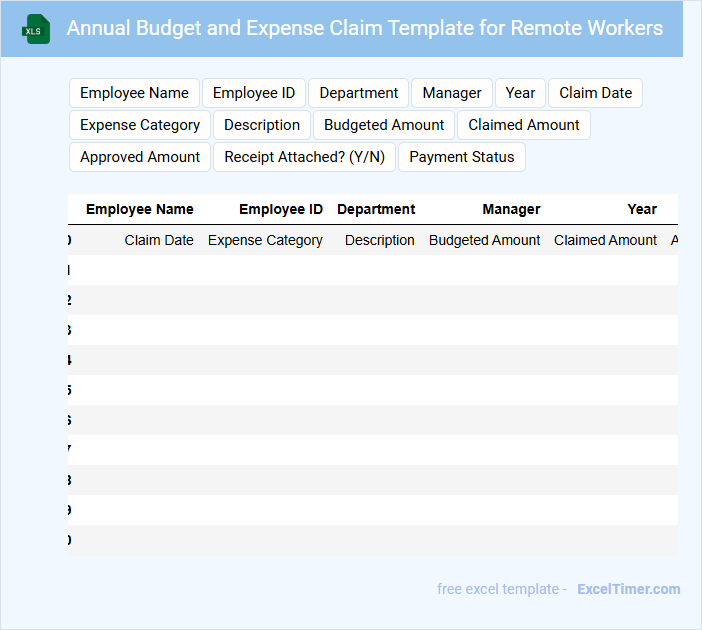

Annual Budget and Expense Claim Template for Remote Workers

Annual Budget and Expense Claim Template for Remote Workers typically contains planned financial allocations and detailed records of expenses incurred during remote work.

- Budget Overview: outlines estimated costs and allocated funds for various remote work necessities.

- Expense Tracking: records and categorizes all submitted claims to ensure accurate reimbursement.

- Compliance Guidelines: specifies policies and required documentation for valid expense claims.

What are the mandatory fields required for submitting an annual expense claim in the Excel document for remote employees?

Mandatory fields for submitting an annual expense claim in the Excel document for remote employees include Employee Name, Employee ID, Expense Date, Expense Category, Description of Expense, Amount Claimed, and Receipt Attachment. Accurate entry in these fields ensures proper tracking and approval of expenses. Compliance with these data points facilitates efficient reimbursement and auditing processes.

How should remote employees categorize and label different types of expenses within the ?

Remote employees should categorize expenses as Travel, Equipment, Software, Internet, and Miscellaneous in the Excel template. Each expense entry must include the date, description, amount, and relevant project or client. Consistent labeling with predefined categories ensures accurate tracking and efficient reimbursement processing.

What supporting documentation must be attached alongside the annual expense claim in Excel for verification?

Your annual expense claim in Excel must include detailed receipts, proof of payment, and any relevant approval forms to ensure accurate verification. Supporting documents should clearly match the listed expenses and comply with company policies for remote employee reimbursements. Proper attachment of these files helps streamline the approval process and maintain transparent financial records.

What is the approval workflow process for submitted annual expense claims in the Excel document for remote employees?

The approval workflow for submitted annual expense claims in the Excel document for remote employees involves initial verification by the employee's immediate supervisor, followed by review and authorization from the finance department. Each claim is cross-checked against documented receipts and company policy criteria to ensure compliance. Approved claims are then recorded and processed for reimbursement in the payroll system.

How should remote employees track their reimbursement status using the Excel document after submitting their annual expense claim?

Remote employees should update the Excel document by entering the submission date and claim ID in the designated tracking section. They need to monitor status columns labeled "Pending," "Approved," or "Rejected" to check reimbursement progress. Regularly refreshing the file ensures real-time updates from the finance department are visible for accurate status tracking.