The Annually Tax Deduction Excel Template for Freelancers streamlines the process of tracking and calculating yearly tax deductions, ensuring accurate financial management. This template helps freelancers organize expenses, income, and deductible items in one place, reducing the risk of errors during tax filing. Its user-friendly interface and customizable features make it essential for optimizing tax savings and maintaining compliance.

Annual Tax Deduction Tracker for Freelancers

An Annual Tax Deduction Tracker for freelancers is a document that helps organize and record all deductible expenses throughout the fiscal year. It ensures freelancers can maximize their deductions and stay compliant with tax regulations.

Key components include expense categories, dates, amounts, and receipts to support claims. Maintaining accurate and detailed records is essential for simplifying tax filing and minimizing audit risks.

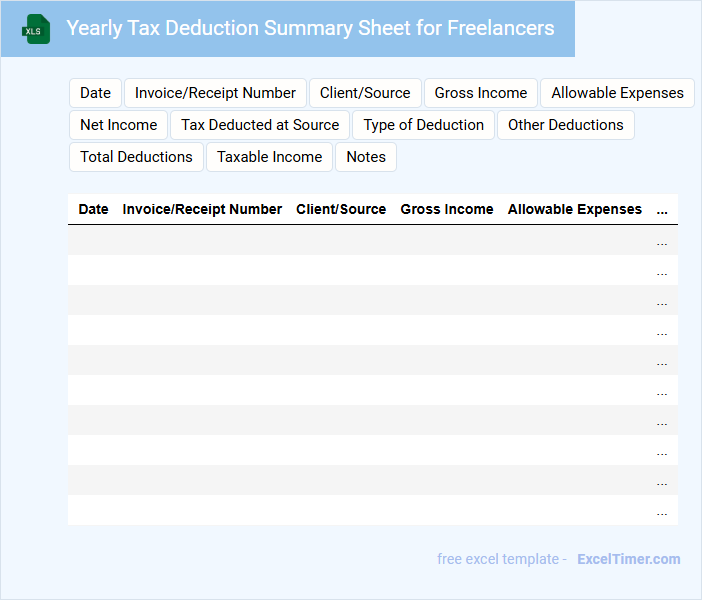

Yearly Tax Deduction Summary Sheet for Freelancers

A Yearly Tax Deduction Summary Sheet for Freelancers is a document that outlines all deductible expenses and tax-related payments made throughout the fiscal year. It helps freelancers organize and calculate their taxable income for accurate tax filing.

- Include all business-related expenses with corresponding receipts and dates.

- Clearly categorize deductions such as office supplies, travel, and professional fees.

- Keep a running total to simplify year-end tax reporting and avoid missed deductions.

Excel Template for Annually Tracking Freelancer Tax Deductions

What information is typically included in an Excel template for annually tracking freelancer tax deductions? This type of document usually contains detailed records of income, expenses, and categorized tax-deductible items relevant to freelancers. It helps users systematically organize financial data throughout the year, facilitating accurate tax reporting and maximizing deductible claims.

Important features to include are clear categories for expenses, date and amount fields, and summaries for totals and tax calculations. Additionally, incorporating space for notes and receipt references can enhance accuracy and ease during tax season.

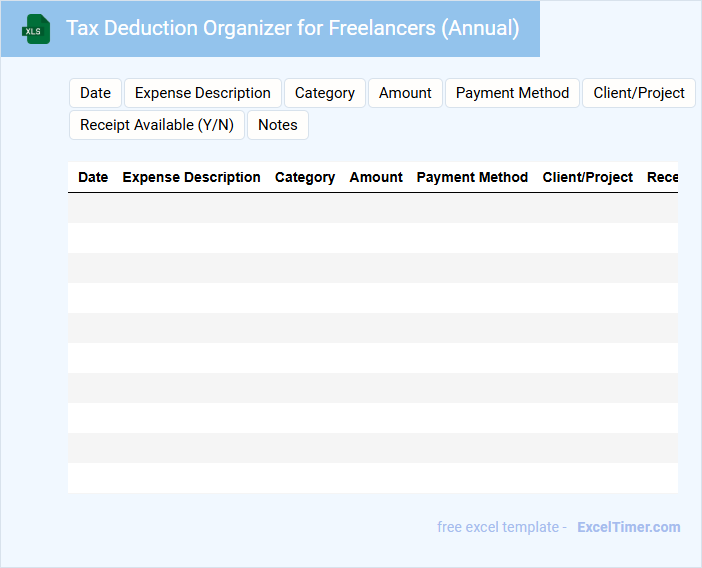

Tax Deduction Organizer for Freelancers (Annual)

The Tax Deduction Organizer for Freelancers is a crucial document designed to help self-employed individuals systematically track their expenses and income throughout the fiscal year. It typically contains categorized records of deductible expenses such as office supplies, travel, and client entertainment. Using this organizer can simplify tax filing and ensure maximum lawful deductions are claimed.

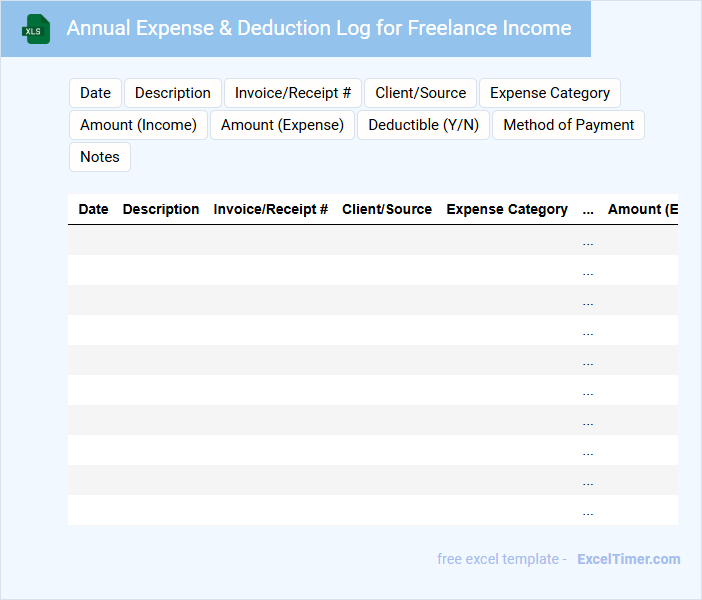

Annual Expense & Deduction Log for Freelance Income

What information is typically included in an Annual Expense & Deduction Log for Freelance Income? This document usually contains detailed records of business-related expenses and deductions claimed throughout the year, helping freelancers accurately track their deductible costs. It provides a clear summary of transactions, including dates, amounts, and categories, essential for tax reporting and financial planning.

Why is maintaining a thorough Annual Expense & Deduction Log important for freelancers? Keeping an organized log ensures that all eligible expenses are accounted for, maximizing tax deductions and minimizing taxable income. It is crucial to regularly update entries, keep receipts, and categorize expenses correctly to simplify tax filing and maintain compliance with tax regulations.

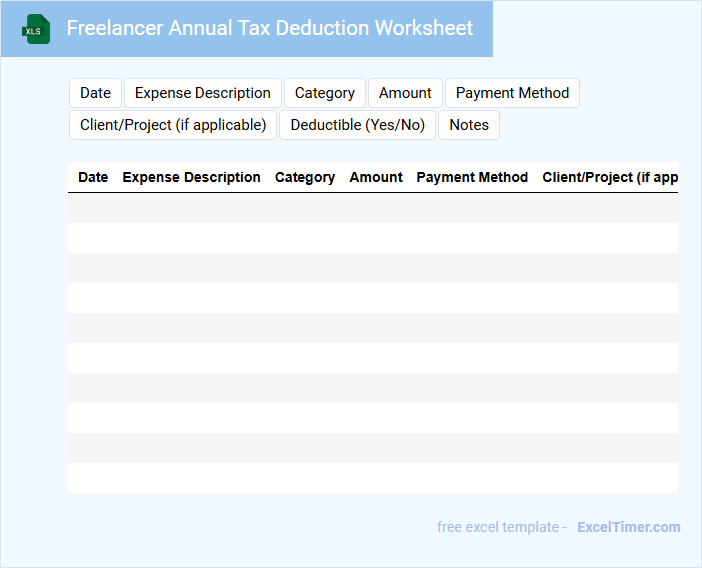

Freelancer Annual Tax Deduction Worksheet

What information is typically included in a Freelancer Annual Tax Deduction Worksheet? This document generally contains a detailed record of all income and business-related expenses incurred by the freelancer throughout the year. It helps to organize deductible expenses, such as office supplies, travel costs, and professional services, to accurately calculate the annual tax liability.

Why is maintaining an accurate tax deduction worksheet important for freelancers? Keeping precise records ensures compliance with tax laws and maximizes potential deductions, thereby reducing taxable income. It is crucial to regularly update the worksheet and retain supporting receipts to simplify tax filing and avoid disputes with tax authorities.

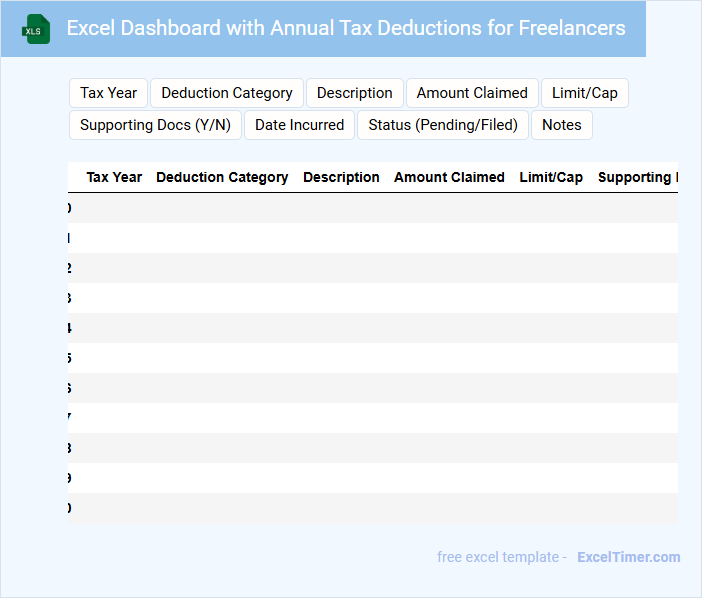

Excel Dashboard with Annual Tax Deductions for Freelancers

An Excel Dashboard with Annual Tax Deductions for Freelancers typically contains a detailed summary of income, expenses, and deductible items to help track and optimize tax payments efficiently.

- Income Tracking: This section consolidates all sources of freelance earnings for accurate tax calculation.

- Expense Categorization: Expenses are grouped by type to identify deductible costs clearly and ensure compliance.

- Tax Summary: Provides an overview of total deductions, taxable income, and estimated tax liability for the year.

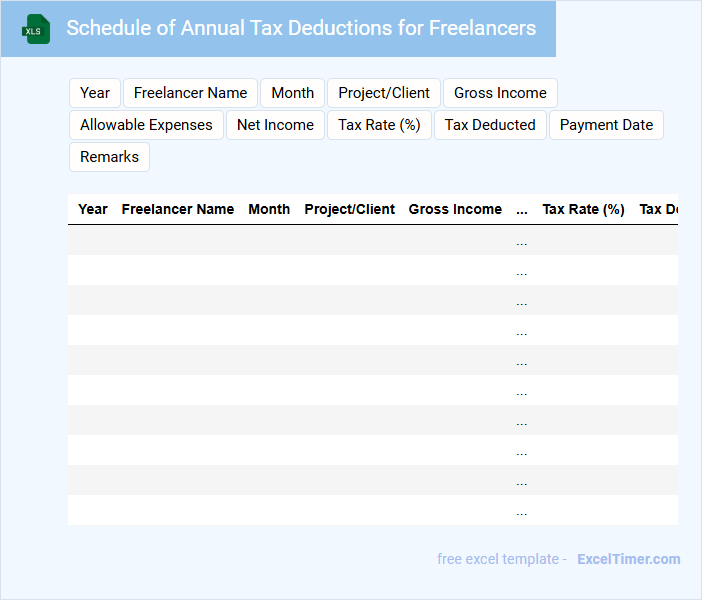

Schedule of Annual Tax Deductions for Freelancers

A Schedule of Annual Tax Deductions for Freelancers is a document detailing the various deductible expenses freelancers can claim throughout the tax year. It helps in organizing and planning finances to maximize tax savings.

- Include all eligible business expenses such as equipment, software, and office supplies.

- Keep accurate records of travel and meal expenses related to work.

- Regularly update the schedule to reflect any changes in tax laws or personal business activities.

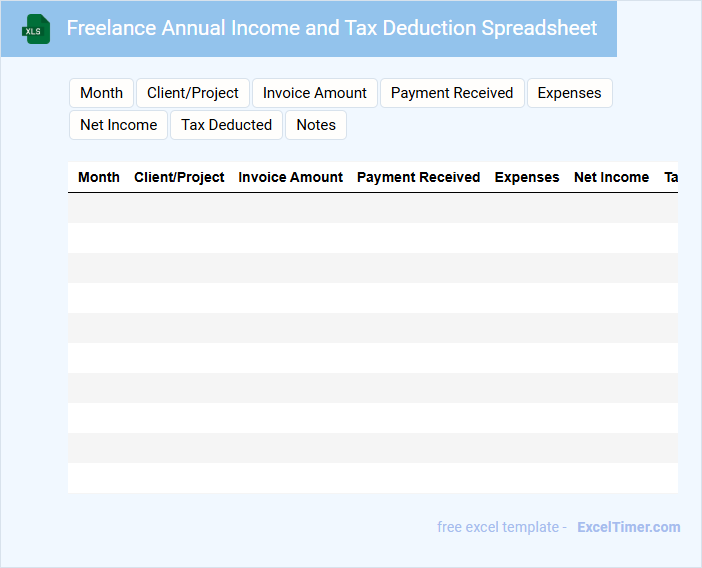

Freelance Annual Income and Tax Deduction Spreadsheet

A Freelance Annual Income and Tax Deduction Spreadsheet typically contains detailed records of income earned and expenses incurred throughout the year to calculate taxable income accurately. It helps freelancers track their financial performance and ensure compliance with tax regulations.

- Include all sources of freelance income with dates and amounts for precise record-keeping.

- List deductible expenses categorized by type to maximize tax deductions.

- Regularly update the spreadsheet to maintain accuracy and simplify tax filing.

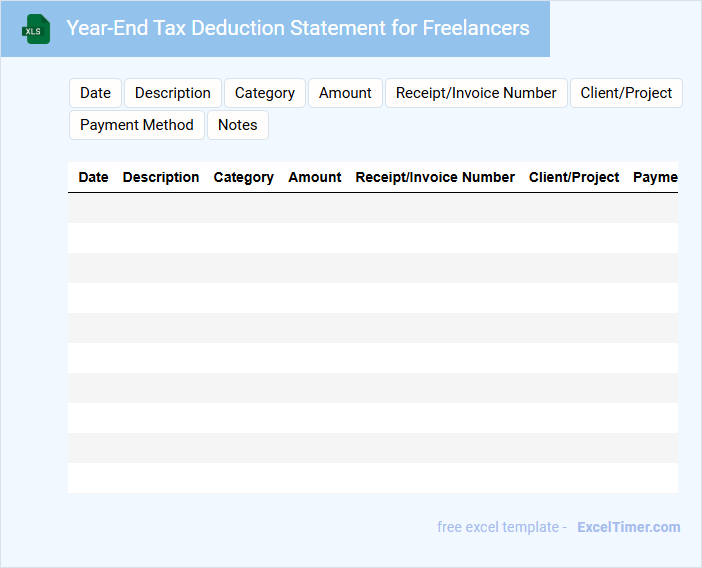

Year-End Tax Deduction Statement for Freelancers

The Year-End Tax Deduction Statement for freelancers typically contains a detailed summary of all income earned and taxes withheld throughout the fiscal year. It consolidates information essential for accurately filing annual tax returns, including deductible expenses and withheld amounts. Freelancers should ensure all financial records are meticulously documented to maximize deductions and comply with tax regulations.

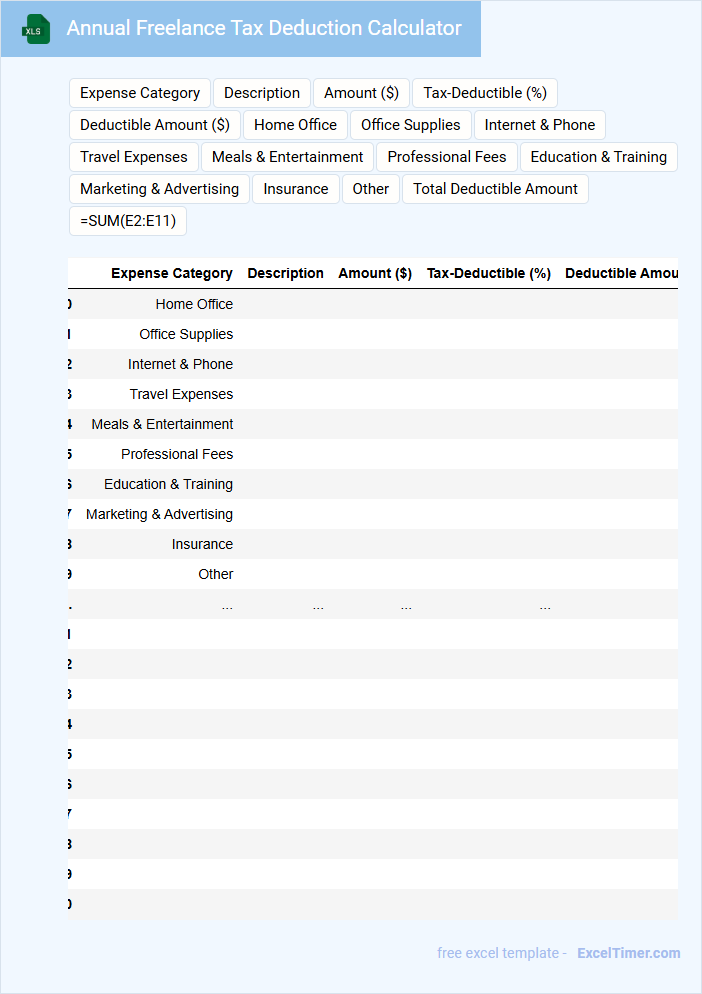

Annual Freelance Tax Deduction Calculator

An Annual Freelance Tax Deduction Calculator document typically contains a detailed list of expenses and income relevant to freelance work. It helps freelancers estimate their tax deductions accurately by categorizing expenses like office supplies, travel, and equipment. The document ensures that freelancers maximize their eligible deductions while remaining compliant with tax regulations.

Important suggestions for this document include maintaining accurate records of all expenses throughout the year, regularly updating the calculator with current tax rules, and consulting a tax professional to verify deductions.

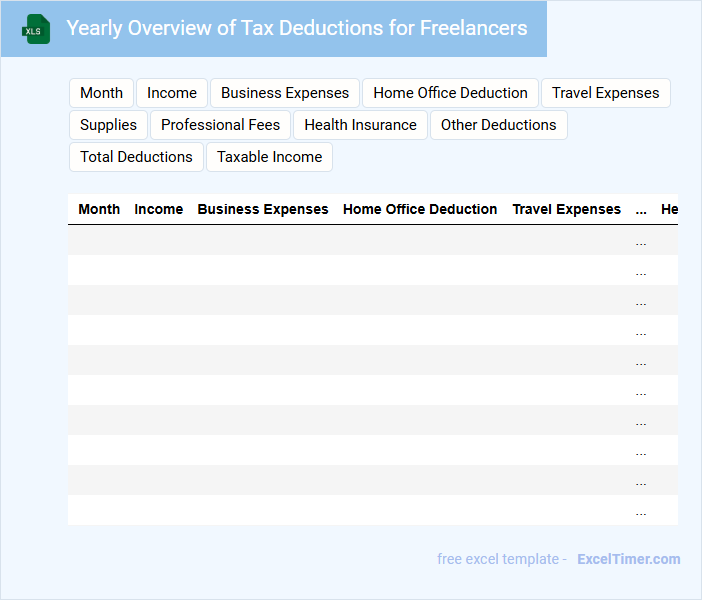

Yearly Overview of Tax Deductions for Freelancers

A Yearly Overview of Tax Deductions for Freelancers typically contains detailed records of all deductible expenses incurred throughout the fiscal year. It helps freelancers organize their financial data to optimize tax savings and ensure compliance with tax regulations. Important details usually include categories of expenses, total amounts spent, and relevant documentation for verification.

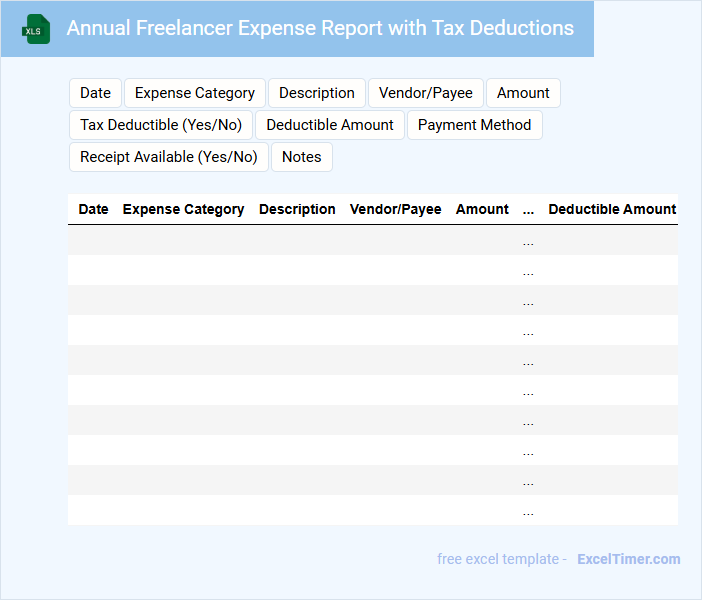

Annual Freelancer Expense Report with Tax Deductions

What does an Annual Freelancer Expense Report with Tax Deductions usually contain?

This document typically includes a detailed summary of all business-related expenses incurred by the freelancer throughout the year. It categorizes costs such as office supplies, travel, software subscriptions, and equipment purchases to help maximize tax deductions. Accurately documenting these expenses ensures compliance with tax regulations and optimizes the freelancer's financial reporting.

Important suggestions:

Keep thorough and organized receipts for all deductible expenses to simplify the reporting process. Regularly update the report throughout the year to avoid missing potential deductions and ensure accuracy during tax filing.

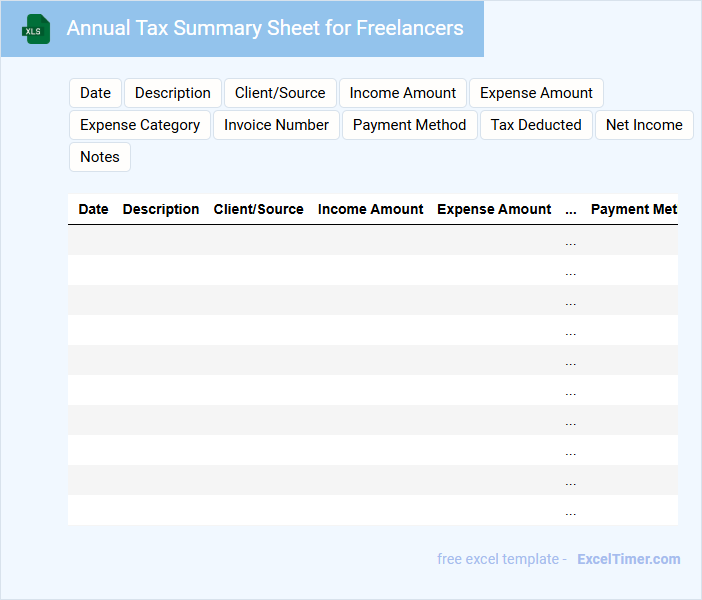

Annual Tax Summary Sheet for Freelancers

The Annual Tax Summary Sheet for freelancers typically contains a comprehensive overview of income, expenses, and tax payments made throughout the fiscal year. It serves as a critical document for tracking financial activities and ensuring accurate tax reporting.

Important elements include detailed records of earnings, deductible expenses, and tax deductions or credits claimed. Maintaining organized receipts and invoices throughout the year can greatly simplify the preparation of this summary.

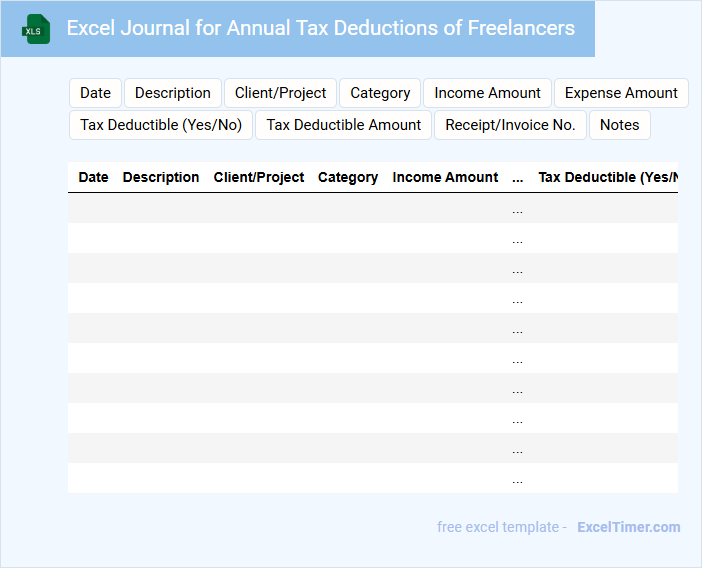

Excel Journal for Annual Tax Deductions of Freelancers

What information is typically included in an Excel Journal for Annual Tax Deductions of Freelancers? This document usually contains detailed records of income, expenses, and deductible items relevant to a freelancer's tax filings. It helps track financial transactions to ensure accurate reporting and maximizes potential tax benefits.

What important elements should be included in this journal? It is crucial to consistently categorize expenses, include dates and descriptions for each entry, and maintain receipts or proof of transactions. This organization simplifies tax preparation, supports audit processes, and ensures compliance with tax regulations.

What documents should freelancers include in an Excel sheet to accurately track annual tax deductions?

Your Excel sheet for tracking annual tax deductions should include detailed records like income statements, receipts for business expenses, and proof of tax payments. Categorize expenses by type, date, and amount to ensure precise calculation and compliance with tax regulations. Regularly updating these documents helps maximize deductions and simplifies your annual tax filing process.

Which deductible expenses can be categorized and recorded for freelancers in an annual Excel report?

Freelancers can categorize and record deductible expenses such as home office costs, equipment purchases, software subscriptions, and business travel in an annual Excel report. Your tax deductions may also include professional services fees, marketing expenses, and educational courses related to your freelance work. Organizing these expenses clearly enhances accuracy and maximizes annual tax benefits.

How does tracking income and expenses monthly in Excel impact the accuracy of annual tax deductions?

Tracking income and expenses monthly in Excel enhances the accuracy of annual tax deductions by providing detailed, organized financial records that reduce errors and omissions. It allows freelancers to categorize deductible expenses properly, ensuring compliance with tax regulations and maximizing allowable deductions. Consistent monthly tracking in Excel facilitates real-time financial analysis, improving tax planning and minimizing the risk of underreporting income or overestimating deductions.

What Excel formulas or functions are most effective for summing deductible categories annually?

To calculate your annual tax deduction for freelancers in Excel, use the SUMIFS function to sum deductible expenses based on category and date criteria. The formula =SUMIFS(range_of_amounts, range_of_categories, category_criteria, range_of_dates, ">=01/01/yyyy", range_of_dates, "<=12/31/yyyy") efficiently aggregates your expenses per year. PivotTables also offer a dynamic way to summarize deductible categories annually without complex formulas.

How can freelancers use Excel to separate personal and business expenses for annual tax reporting?

Freelancers can use Excel to create distinct worksheets or columns for personal and business expenses, ensuring clear categorization throughout the year. They can input transaction details, apply formulas to sum business expenses, and generate reports summarizing deductible amounts for accurate annual tax reporting. This method enhances accuracy and simplifies tax deduction tracking for freelancing professionals.