The Annually Donation Log Excel Template for Charities efficiently tracks and organizes yearly donations, ensuring accurate financial records. It allows charities to monitor donor contributions, generate reports, and maintain transparency for audits and tax purposes. This template streamlines data management, saving time and enhancing accountability for nonprofit organizations.

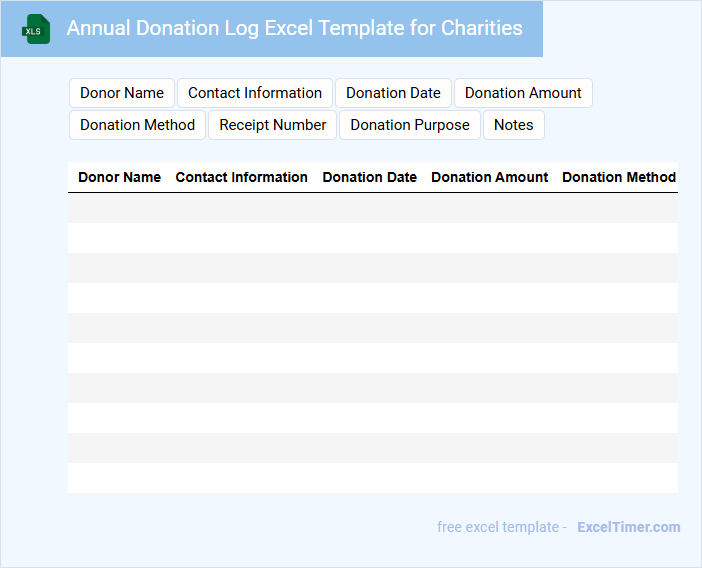

Annual Donation Log Excel Template for Charities

An Annual Donation Log Excel Template for charities is a structured document designed to record and track all donations received throughout the year. It typically contains donor information, donation dates, amounts, and payment methods to maintain accurate financial records.

This template is essential for transparent donation management and helps organizations generate reports for audits and donor acknowledgments. Ensuring data accuracy and regular updates are important practices when using this log.

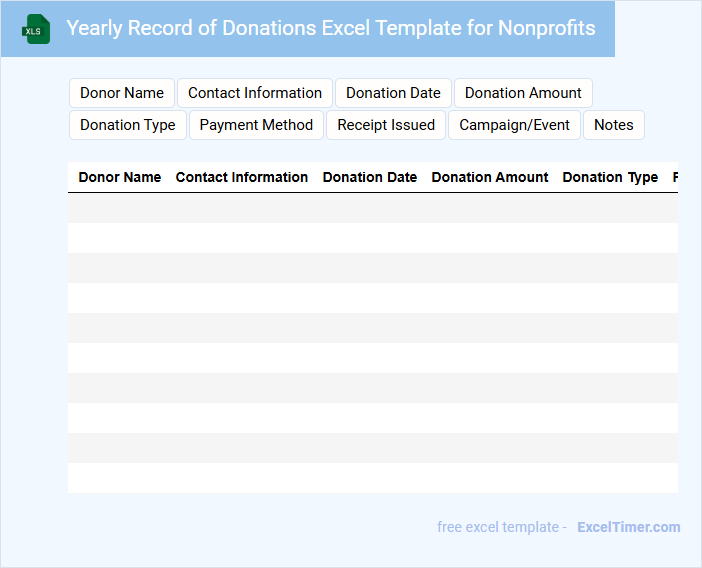

Yearly Record of Donations Excel Template for Nonprofits

What information is typically included in a Yearly Record of Donations Excel Template for Nonprofits? This document usually contains detailed records of all donations received throughout the year, including donor names, donation amounts, dates, and payment methods. It helps nonprofits efficiently track contributions, generate reports for tax purposes, and maintain transparent financial records.

What are important considerations when using this template? Ensuring accurate and consistent data entry is crucial to avoid discrepancies and facilitate easy analysis. Additionally, including categories for donation types and enabling summary tables can enhance usability and provide quick overview insights for stakeholders.

Donation Tracking Spreadsheet with Annual Summary for Charity

Donation Tracking Spreadsheets with Annual Summaries for Charity typically contain detailed records of individual donations, donor information, and summarized financial data for the year.

- Donor Information: Essential details like names, contact information, and donation frequency for effective communication and acknowledgment.

- Donation Records: Dates and amounts of donations to track contributions and monitor fundraising progress.

- Annual Summary: Aggregated data showcasing total donations, trends, and financial health to support transparency and reporting.

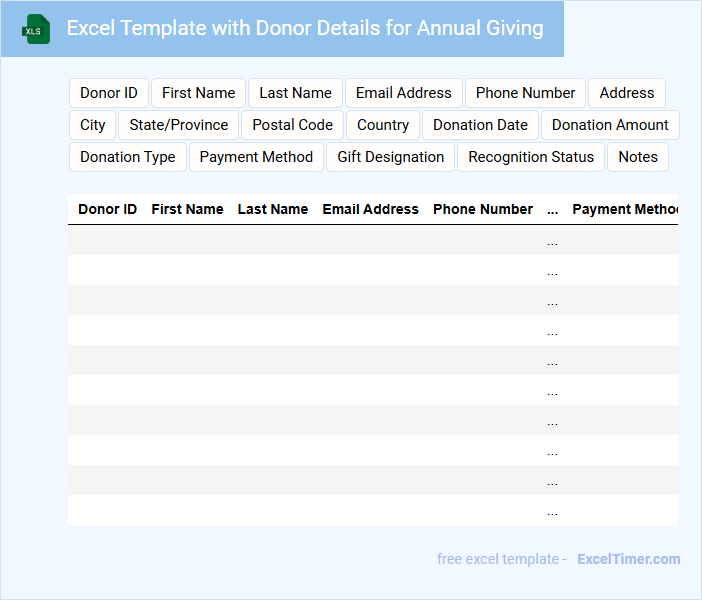

Excel Template with Donor Details for Annual Giving

An Excel Template with Donor Details for Annual Giving typically contains organized columns for donor names, contact information, and contribution amounts. It often includes fields for tracking donation dates and specific campaigns, ensuring clear and efficient record-keeping. Utilizing this template helps nonprofits streamline their fundraising efforts and maintain accurate donor databases for better relationship management.

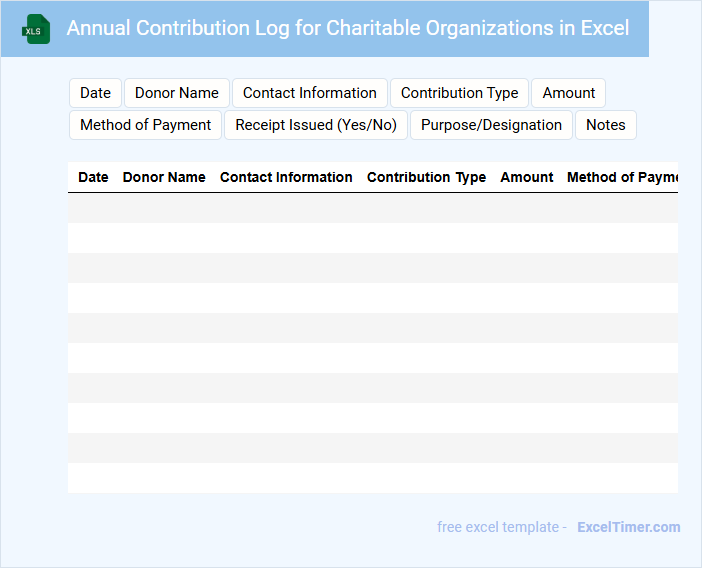

Annual Contribution Log for Charitable Organizations in Excel

An Annual Contribution Log for Charitable Organizations in Excel typically contains detailed records of all donations received throughout the year. It includes donor information, donation amounts, dates, and donation types, allowing for efficient tracking and reporting. Maintaining this log is crucial for transparency, tax purposes, and enhancing donor relationships.

To optimize the log, ensure consistent data entry, use clear categorization for contributions, and include formulas for automatic totals. Regularly back up the file to prevent data loss and keep it secure to protect sensitive donor information. Implementing filters and drop-down menus can further improve usability and accuracy.

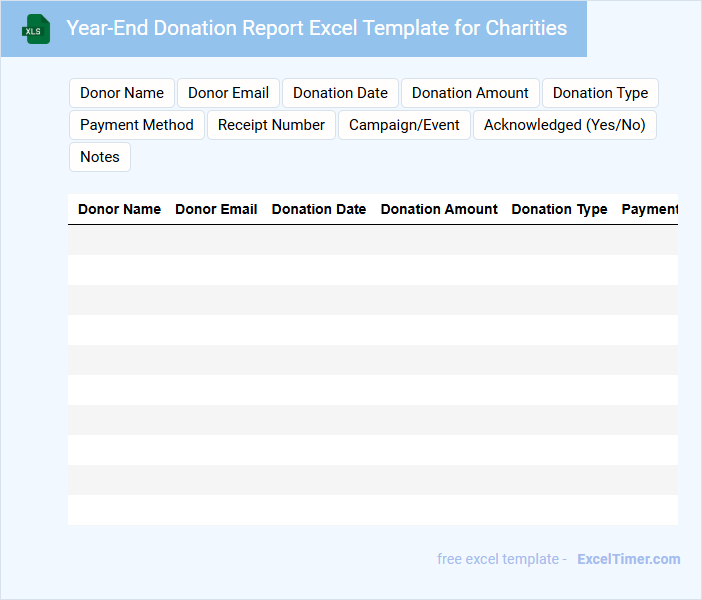

Year-End Donation Report Excel Template for Charities

The Year-End Donation Report Excel Template typically contains detailed records of donations received throughout the year, including donor information, donation amounts, and dates. It provides a clear summary and categorization of funds to help charities manage their financial data efficiently.

It is crucial for transparency and accountability in nonprofit organizations to ensure accurate reporting. Remember to include a section for matching gifts and recurring donations to capture all contributions comprehensively.

Annual Gift Tracker for Nonprofits with Excel

Annual Gift Tracker for Nonprofits with Excel is a document that helps organizations monitor and manage their fundraising donations efficiently.

- Donor Information: Keep detailed records of each donor's contact and giving history to personalize engagement.

- Donation Tracking: Record amounts, dates, and campaign sources to analyze fundraising performance.

- Reporting and Analysis: Use Excel's tools to generate summaries and visualizations for strategic planning.

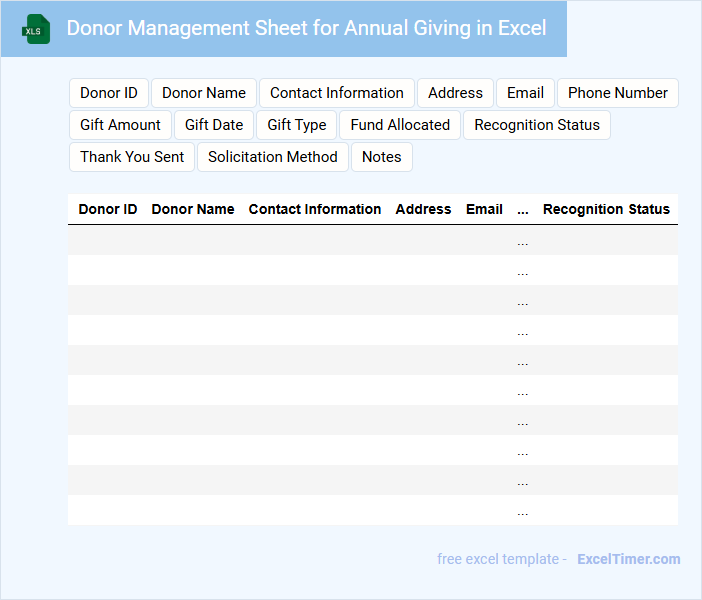

Donor Management Sheet for Annual Giving in Excel

Donor Management Sheet for Annual Giving in Excel is a structured document used to organize and track donor information, contributions, and engagement history efficiently. It typically contains columns for donor names, contact details, donation amounts, payment dates, and communication notes. To maximize its effectiveness, ensure data accuracy and regularly update the sheet to maintain strong donor relationships and optimize fundraising efforts.

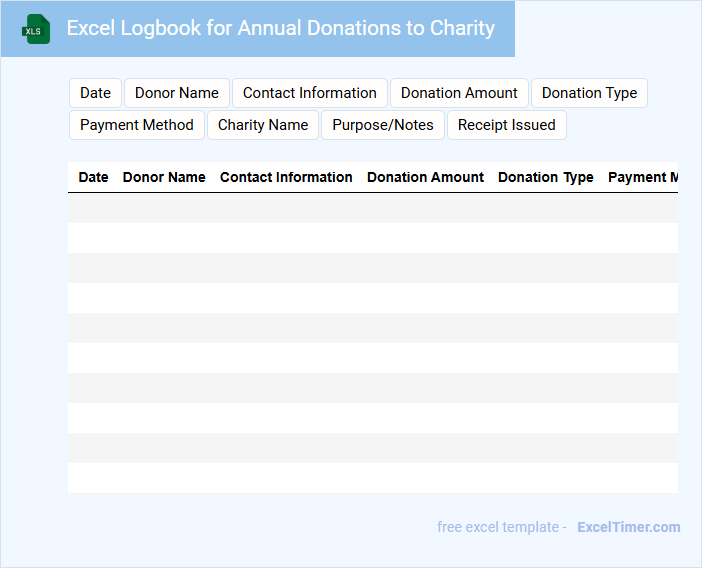

Excel Logbook for Annual Donations to Charity

An Excel Logbook for Annual Donations to Charity typically contains detailed records of donor names, donation amounts, and dates of contributions. It helps organizations track the consistency and total value of charitable donations over the year. Maintaining accurate data in this logbook ensures transparency and aids in financial reporting and donor recognition.

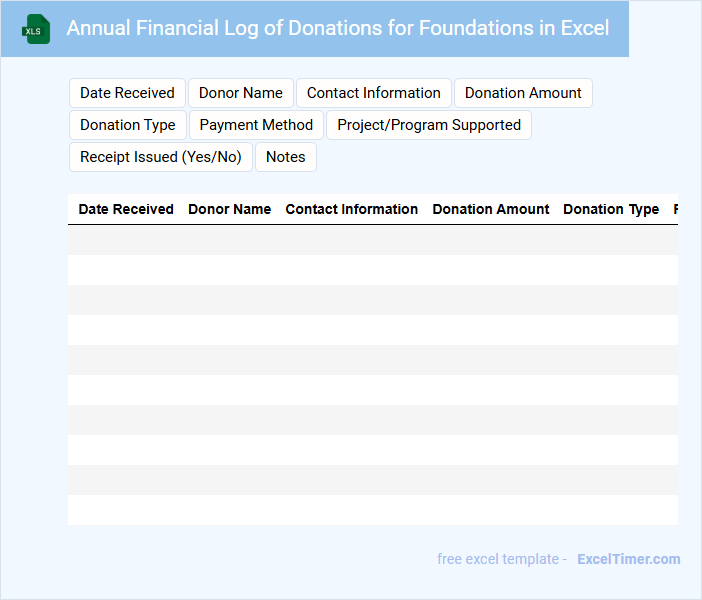

Annual Financial Log of Donations for Foundations in Excel

The Annual Financial Log of Donations for foundations in Excel typically contains detailed records of all monetary contributions received throughout the year. This document includes donor information, donation amounts, dates, and any restrictions associated with the funds. Maintaining accuracy in these entries is critical for transparency and financial accountability.

It is important to ensure the Excel log is regularly updated and cross-checked against bank statements to prevent discrepancies. Organizing data with clear headings and using formulas for automatic summation enhances efficiency and reduces errors. Additionally, protecting sensitive donor information through password protection or encryption is essential to uphold privacy and trust.

Excel Tracker with Donation History for Charitable Causes

An Excel Tracker with Donation History is a structured document designed to monitor and record contributions made towards charitable causes. It typically includes donor details, donation amounts, dates, and purposes for transparency and accountability. Maintaining accurate donation history is essential for building trust with donors and ensuring effective fund management.

To optimize this tracker, it is important to include clear categories for donation types, automated summary calculations, and secure data protection measures. Regular updates and data validation help maintain accuracy and usability over time. Integrating visual charts can also provide quick insights into donation trends and impact.

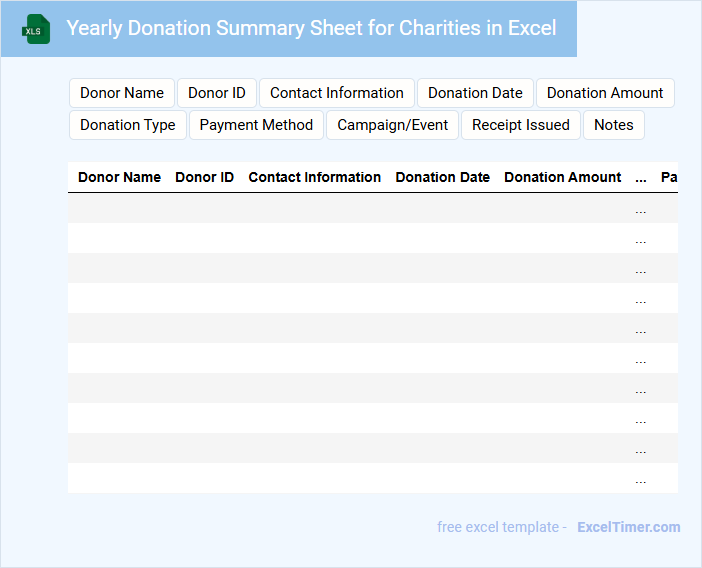

Yearly Donation Summary Sheet for Charities in Excel

What information is typically included in a Yearly Donation Summary Sheet for Charities in Excel? This document usually contains detailed records of all donations received throughout the year, including donor names, donation amounts, dates, and payment methods. It helps charities efficiently track funding sources and prepare for financial reporting or tax purposes.

Why is accuracy important in a Yearly Donation Summary Sheet, and what should be prioritized? Accuracy ensures transparent financial management and donor trust, so maintaining up-to-date and error-free entries is crucial. Additionally, prioritizing easy-to-read formatting and clear categorization aids quick analysis and strategic planning for future fundraising.

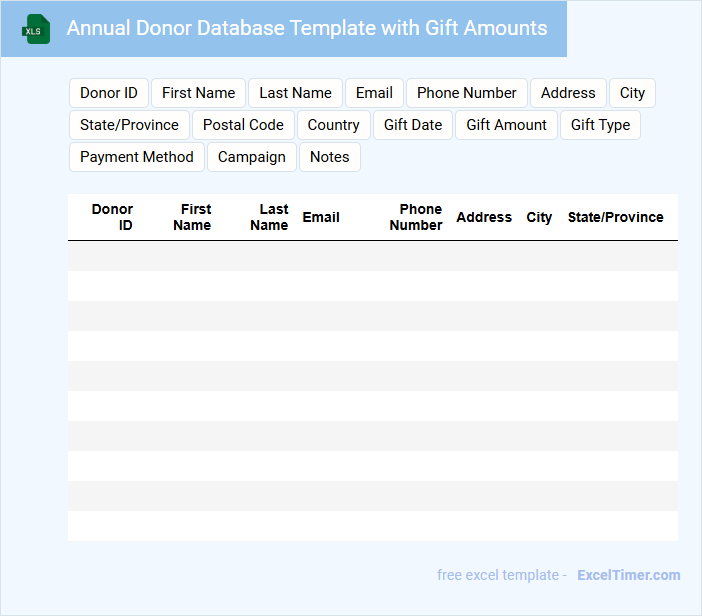

Annual Donor Database Template with Gift Amounts

An Annual Donor Database Template with Gift Amounts typically contains detailed records of donors, their contributions, and giving history throughout the year. This document helps organizations track donation trends and manage relationships effectively.

Key elements include donor names, contact information, gift dates, and gift amounts to provide an accurate financial overview. Maintaining data accuracy and regularly updating the template is essential for successful fundraising planning.

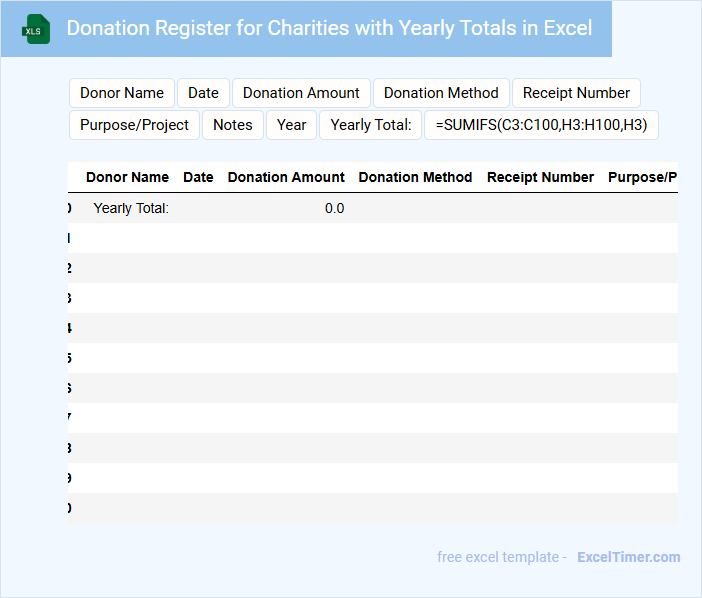

Donation Register for Charities with Yearly Totals in Excel

A Donation Register for charities in Excel is a structured document that records individual donations, donor details, and contribution dates. It typically includes columns for donor names, donation amounts, and payment methods to maintain clear and organized financial tracking. Yearly totals are crucial for summarizing donations, monitoring fundraising progress, and generating transparent reports for stakeholders and regulators.

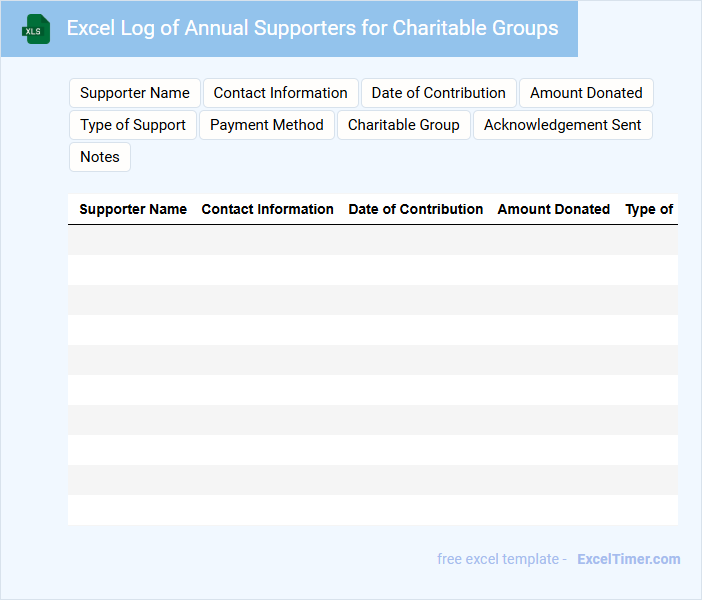

Excel Log of Annual Supporters for Charitable Groups

What information is typically included in an Excel Log of Annual Supporters for Charitable Groups? This document usually contains detailed records of donors, including names, contact details, donation amounts, and dates of contributions. Tracking this data helps charitable groups manage donor relationships and plan fundraising strategies effectively.

Why is maintaining accuracy in this log important? Ensuring the data is regularly updated and verified prevents errors and fosters trust with supporters. Additionally, including notes on donor preferences and communication history can enhance personalized engagement and support retention.

What key donor information should be included in an annually donation log for charities?

Your annually donation log for charities should include key donor information such as full name, contact details, donation amount, date of contribution, and payment method. Tracking donation frequency and designation or purpose of each gift helps optimize fundraising efforts. Detailed records enable accurate acknowledgment, tax reporting, and long-term relationship management with your donors.

How should donation amounts and dates be accurately recorded and categorized?

Donation amounts should be recorded as numerical values in a dedicated "Donation Amount" column formatted as currency. Dates must be entered in a consistent date format, such as MM/DD/YYYY, within a "Donation Date" column to ensure chronological accuracy. Categorize donations by charity name in a separate "Charity" column and use additional columns for donation type or campaign to enable detailed tracking and reporting.

What methods can be used to track recurring versus one-time donations annually?

You can track recurring versus one-time donations annually in your Excel donation log by using columns to categorize donation types and applying filters or pivot tables for clear segmentation. Utilizing date stamps alongside unique donor IDs helps distinguish repeated contributions over the year. Conditional formatting can highlight recurring entries for quick identification and better data management.

How can the document ensure donation transparency and compliance for audits?

Your Annually Donation Log for Charities records detailed transaction data, including donor names, amounts, dates, and purposes, ensuring clear financial tracking. This document supports transparency by providing verifiable evidence of all donations, facilitating compliance with legal and regulatory audit requirements. Maintaining accurate and up-to-date logs enables auditors to efficiently verify charitable contributions and organizational accountability.

What features can facilitate efficient summary and reporting of annual donation totals?

Excel features like PivotTables enable efficient summarization of annual donation totals by automatically aggregating data from your donation log. Conditional formatting highlights key trends and large contributions to enhance visual analysis. Using data validation and built-in formulas streamlines accurate reporting and reduces errors in your charity donation records.