The Annually Financial Statement Excel Template for Startups provides a streamlined way to track income, expenses, and cash flow throughout the year. It helps startups maintain organized financial records, facilitating accurate budgeting and forecasting. Using this template ensures startups can present clear, professional financial reports to investors and stakeholders.

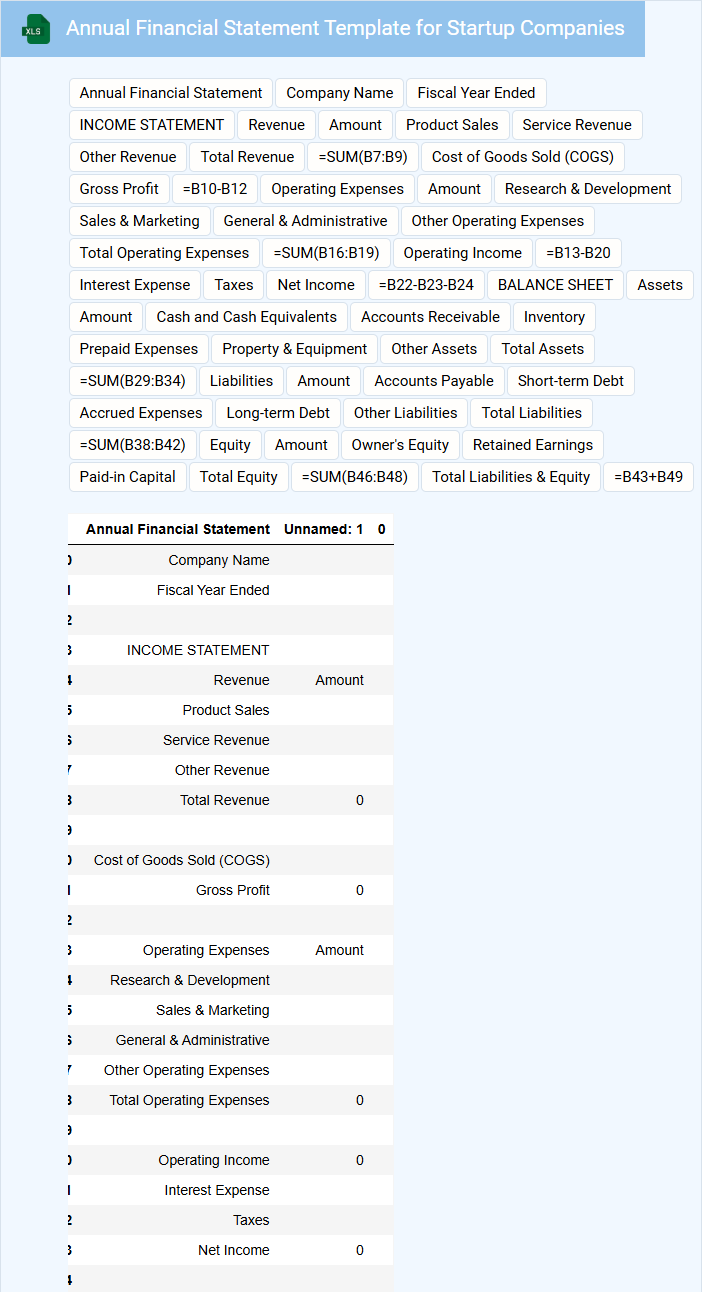

Annual Financial Statement Template for Startup Companies

The Annual Financial Statement Template for startup companies typically contains detailed records of income, expenses, assets, liabilities, and equity. It provides a clear overview of the company's financial health over a fiscal year in a structured format.

Important elements to include are accurate cash flow statements, balance sheets, and profit and loss accounts to ensure transparency and compliance. Using standardized headings and clear categorization enhances readability and supports effective financial analysis.

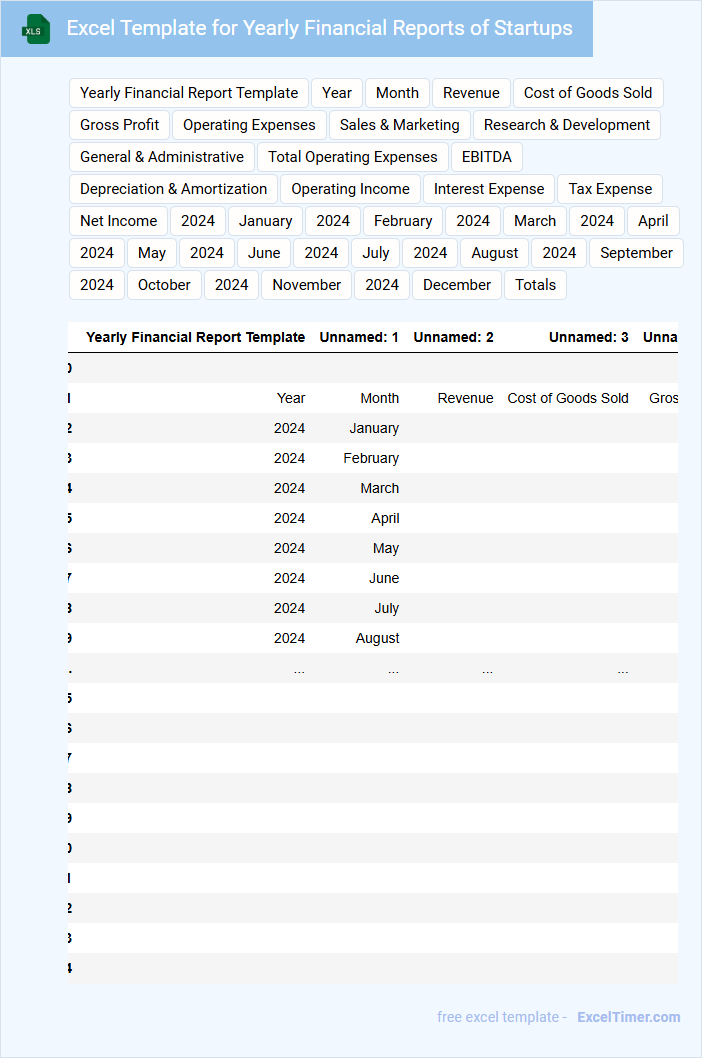

Excel Template for Yearly Financial Reports of Startups

This document is an Excel template designed to help startups organize and analyze their yearly financial data efficiently. It typically includes pre-formatted tables and charts to track income, expenses, and key financial metrics.

- Include clear categories for revenue streams and expense types to ensure accurate financial tracking.

- Incorporate formulas for automatic calculations of profit, loss, and growth percentages.

- Use visual aids like charts to provide quick insights into financial performance trends.

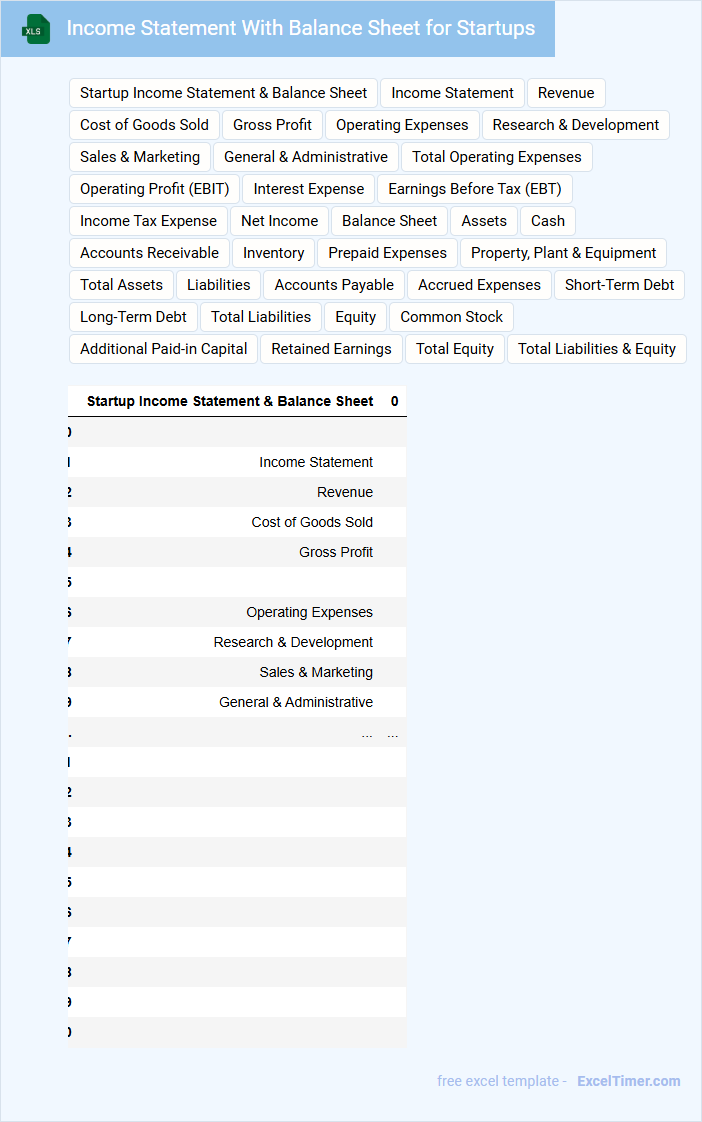

Income Statement With Balance Sheet for Startups

An Income Statement for startups typically contains details about revenue, expenses, and profit over a specific period, showcasing the company's financial performance. It helps entrepreneurs understand business viability and operational efficiency.

The Balance Sheet provides a snapshot of assets, liabilities, and equity at a given point in time, reflecting the startup's financial position and stability. It is crucial for assessing liquidity and investment potential.

For startups, combining these documents ensures a comprehensive view of financial health, aiding in better decision-making and attracting investors.

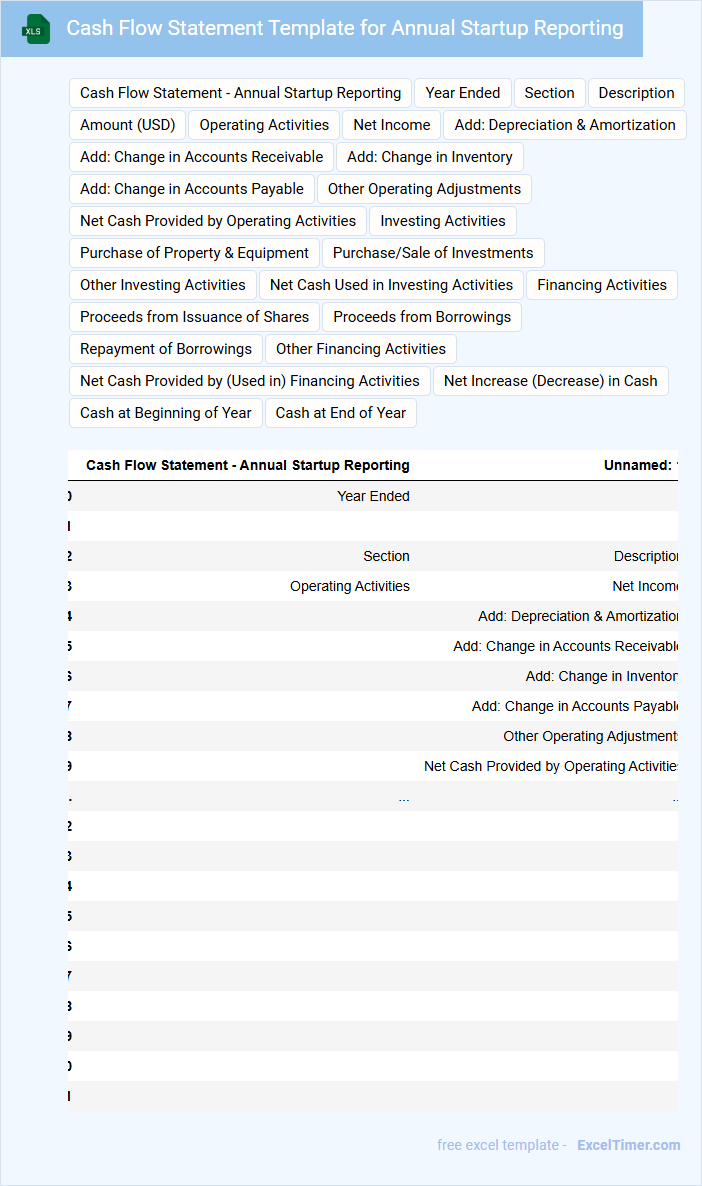

Cash Flow Statement Template for Annual Startup Reporting

What information is typically included in a Cash Flow Statement Template for Annual Startup Reporting? This document usually contains detailed records of cash inflows and outflows categorized by operating, investing, and financing activities, providing a clear picture of the startup's liquidity over the fiscal year. It helps stakeholders understand how the business generates and uses cash, which is crucial for assessing financial health and future sustainability.

What important elements should be considered when preparing this statement for a startup? It is vital to ensure accuracy in tracking cash receipts and payments, include projections for future cash flows, and clearly segregate cash flows related to core operations versus financing or investment activities. These elements help provide actionable insights, support strategic decision-making, and present a reliable financial overview to investors and management.

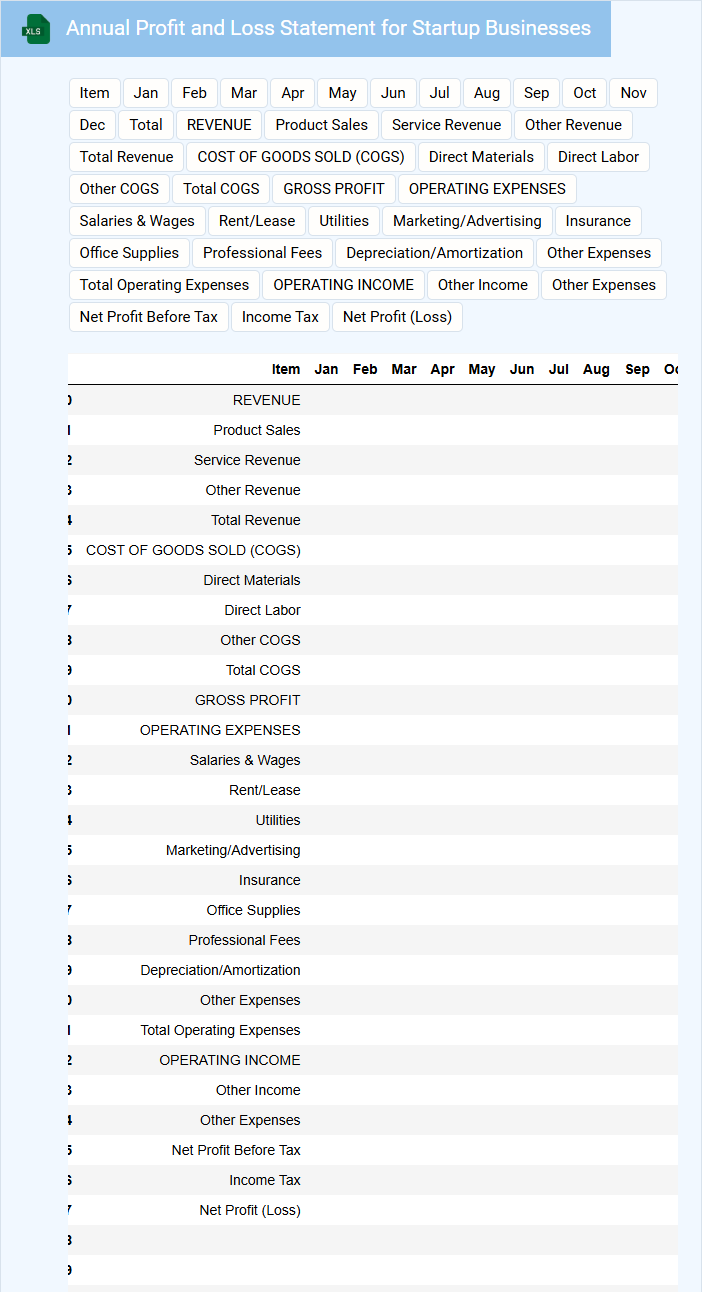

Annual Profit and Loss Statement for Startup Businesses

The Annual Profit and Loss Statement for startup businesses provides a comprehensive summary of revenues, costs, and expenses over a fiscal year. It highlights the company's ability to generate profit while managing operational costs. This document is critical for investors and stakeholders to evaluate financial performance and growth potential.

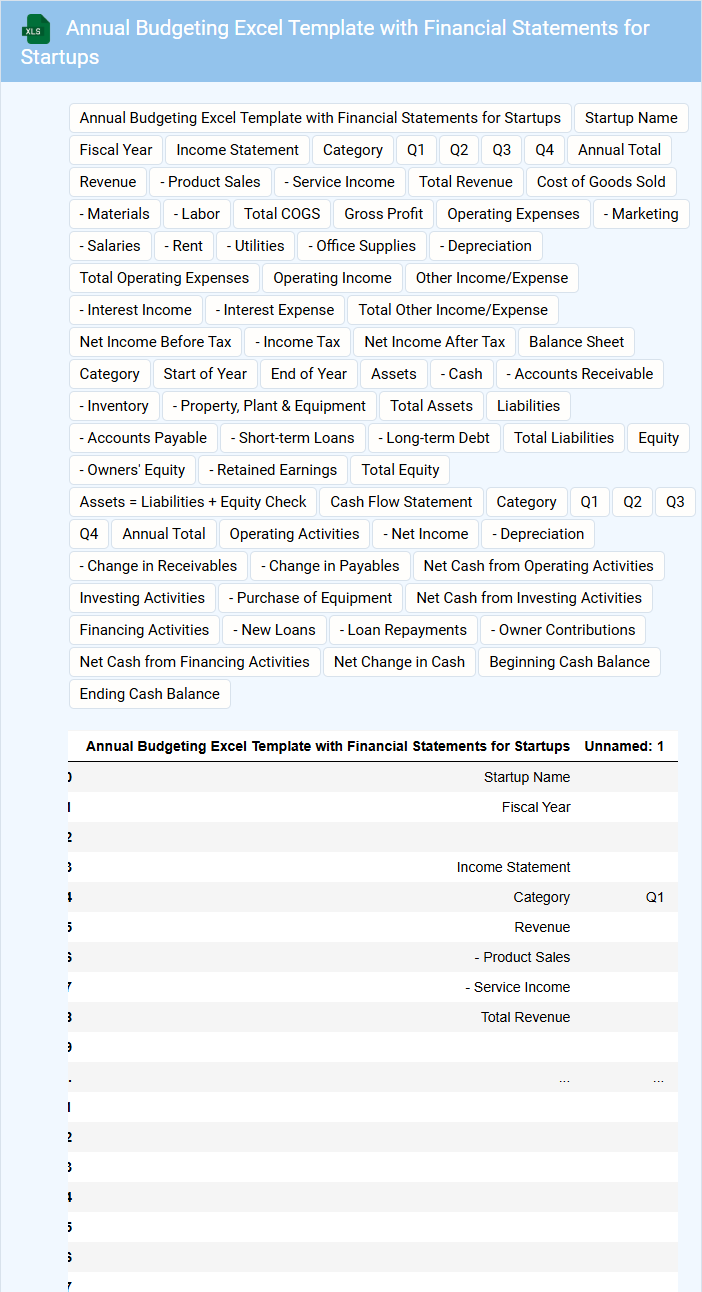

Annual Budgeting Excel Template with Financial Statements for Startups

The Annual Budgeting Excel Template for startups typically contains detailed projections of income, expenses, and cash flows. It includes integrated financial statements such as the balance sheet, income statement, and cash flow statement to provide a comprehensive financial overview. This document is essential for planning, monitoring, and securing funding by illustrating the startup's financial strategy and anticipated performance.

Key components to include are realistic revenue forecasts, detailed expense categories, and consistent updates reflecting actual results versus projections. Ensuring accuracy in assumptions and incorporating scenarios for risk management will improve decision-making and investor confidence. Clear labeling and organized formatting enhance usability, making it easier to analyze and present financial data.

Editable Annual Financial Overview Template for Startups

An Annual Financial Overview Template for startups typically contains detailed summaries of income, expenses, and cash flow throughout the fiscal year. It serves as a vital tool for tracking financial performance and making informed business decisions. Including clear charts and editable sections ensures dynamic updates as the startup grows.

Important elements to include are accurate revenue projections, expense categorization, and key financial ratios for quick assessment. Startups should ensure the template is customizable to reflect changing financial priorities and investor requirements. Additionally, incorporating notes on assumptions and potential risks enhances transparency and planning accuracy.

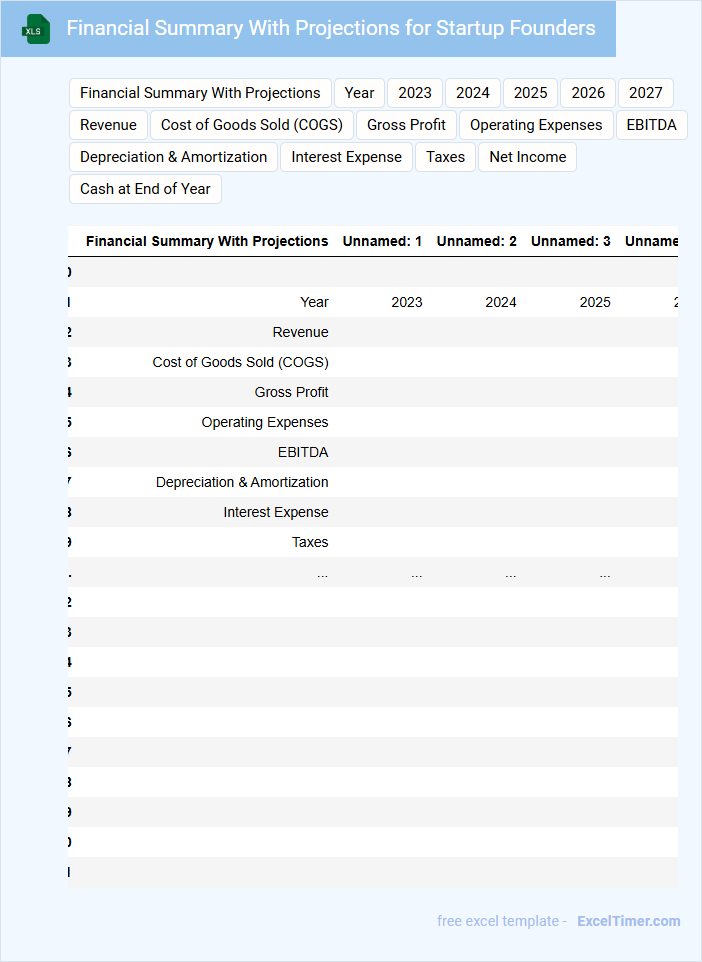

Financial Summary With Projections for Startup Founders

A Financial Summary with Projections for Startup Founders typically contains an overview of current financial status alongside future revenue and expense forecasts to aid in strategic planning.

- Revenue Forecast: Detailed predictions of income streams expected over specific periods.

- Expense Breakdown: Comprehensive listing of operational costs and capital expenditures.

- Cash Flow Projections: Estimates of liquidity to ensure solvency throughout growth phases.

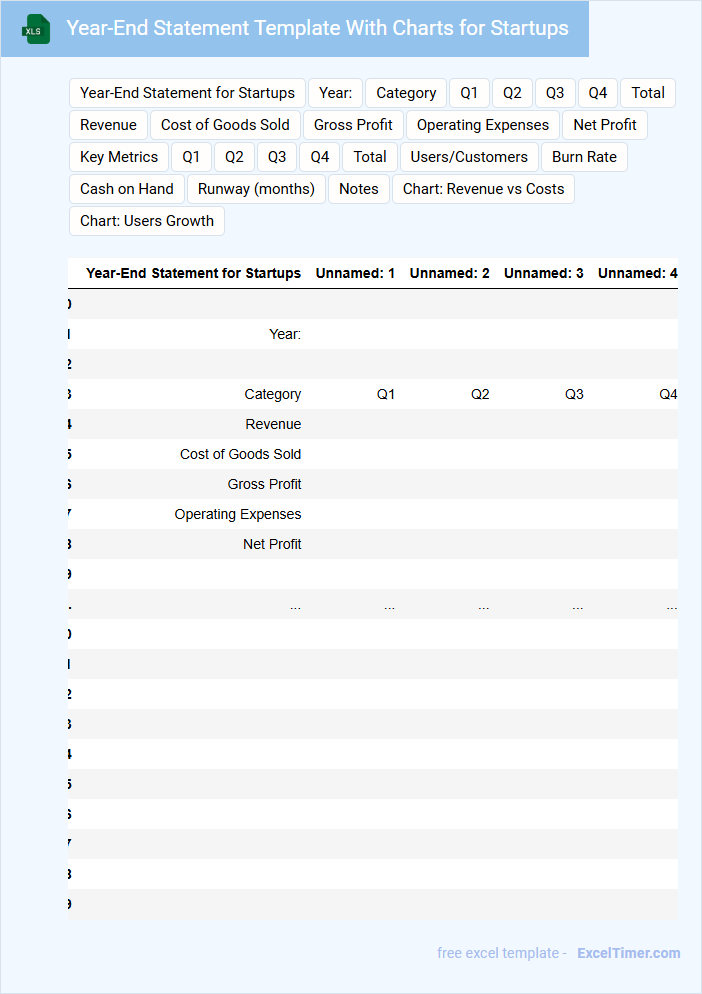

Year-End Statement Template With Charts for Startups

What information does a Year-End Statement Template with Charts for Startups typically contain? This document usually includes a comprehensive overview of the company's financial performance, key metrics, and achievements throughout the year. It combines numerical data with visual charts to effectively communicate growth, expenses, revenue, and projections.

Why is it important to include specific elements in this template? Important features include clear financial summaries, trend analysis through charts, and concise commentary to provide context and aid stakeholders in understanding the startup's progress and future outlook.

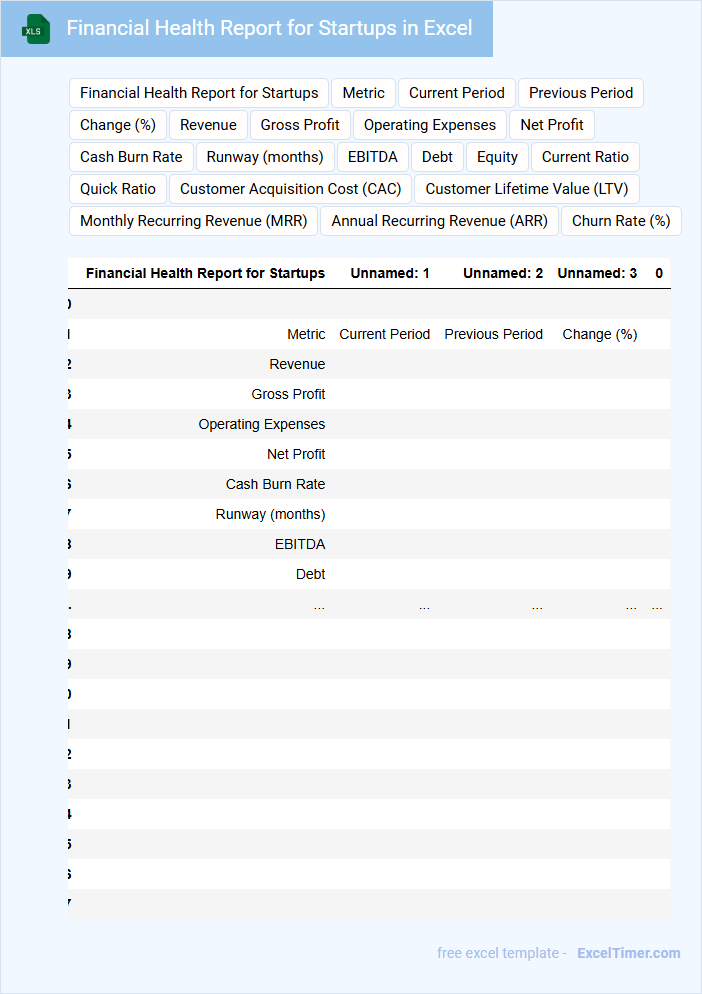

Financial Health Report for Startups in Excel

A Financial Health Report for Startups in Excel typically contains comprehensive data analyzing a startup's financial stability and growth potential.

- Revenue Trends: Track monthly or quarterly revenue to identify growth patterns and seasonality.

- Expense Analysis: Monitor fixed and variable costs to manage cash flow effectively.

- Burn Rate and Runway: Calculate how long the startup can operate before needing additional funding.

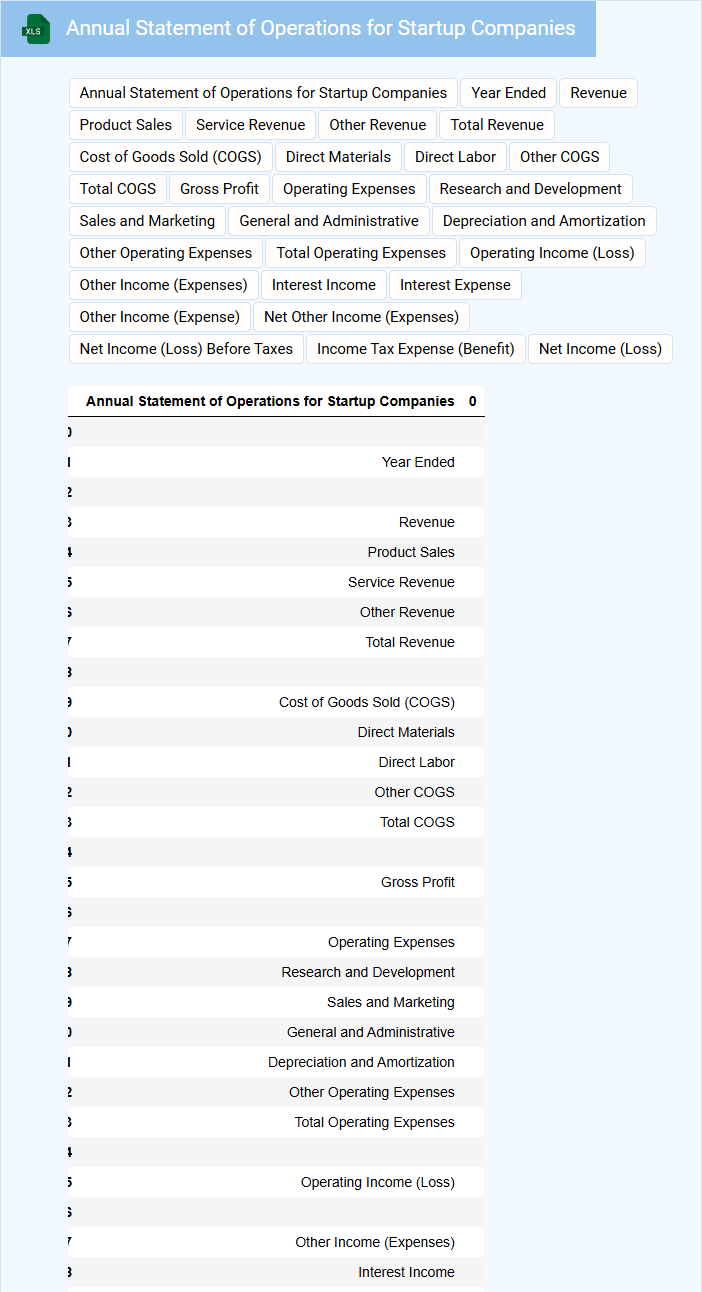

Annual Statement of Operations for Startup Companies

An Annual Statement of Operations for startup companies typically contains detailed financial data outlining the company's revenue, expenses, and net income over the fiscal year. This document provides insights into the startup's financial health and operational efficiency.

It usually includes key sections such as sales income, cost of goods sold, operating expenses, and profit margins. Ensuring accuracy and clarity in these sections is crucial for stakeholders assessing company performance.

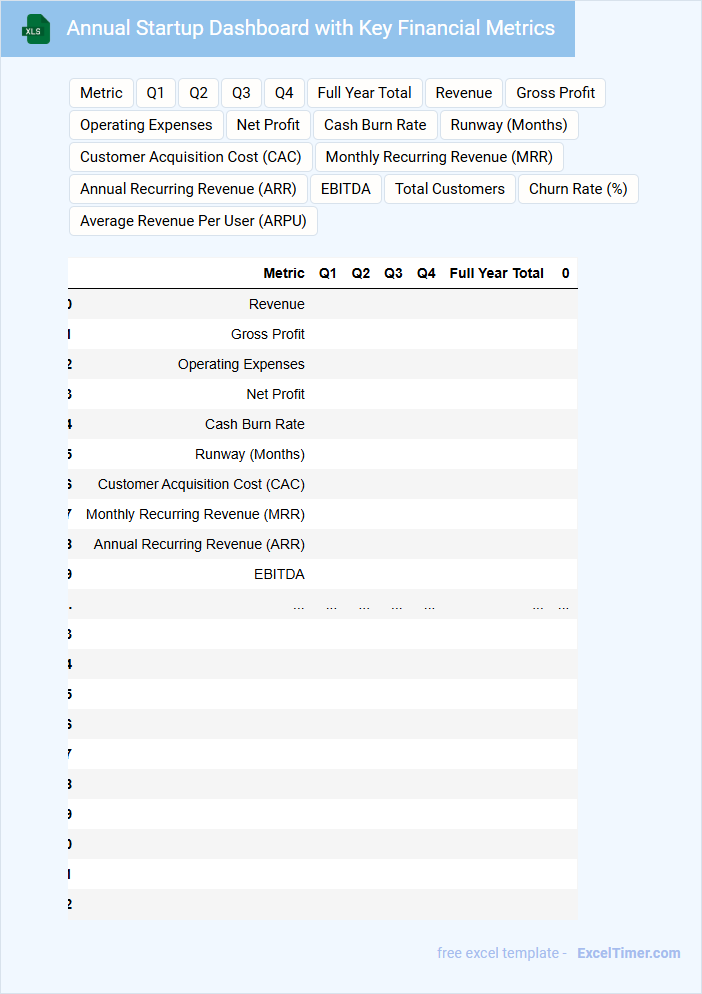

Annual Startup Dashboard with Key Financial Metrics

An Annual Startup Dashboard typically contains a comprehensive overview of a startup's financial health, including revenue, expenses, and profitability metrics. It tracks key performance indicators (KPIs) throughout the year to provide insights into growth trends and operational efficiency. This document helps stakeholders make informed decisions by consolidating essential financial data in one place.

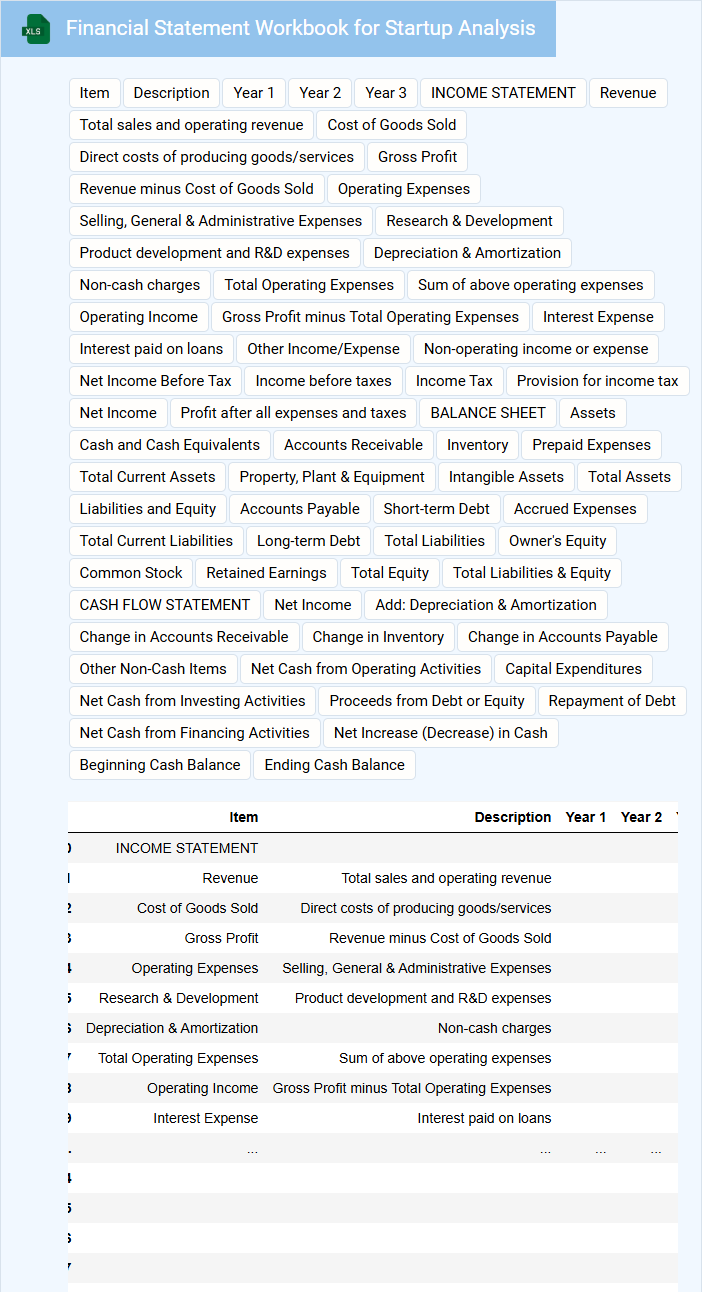

Financial Statement Workbook for Startup Analysis

Financial Statement Workbook for Startup Analysis is a comprehensive document that consolidates key financial reports such as income statements, balance sheets, and cash flow statements. It typically contains detailed projections, assumptions, and financial metrics tailored to evaluate a startup's viability and growth potential. This workbook serves as a critical tool for investors and founders to understand and monitor the startup's financial health and performance over time.

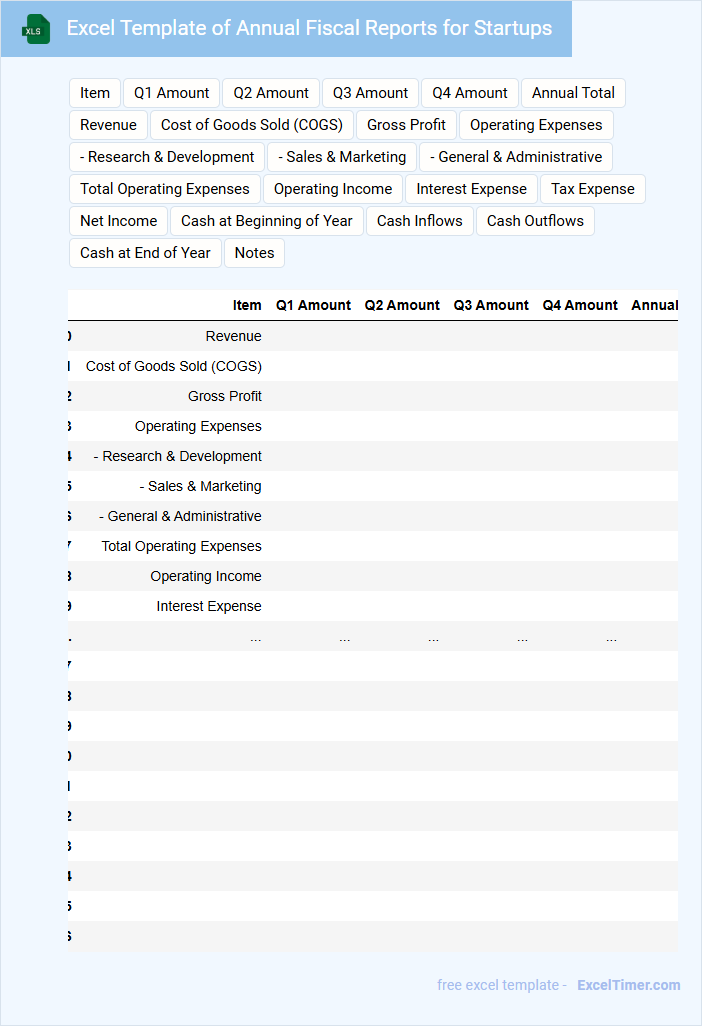

Excel Template of Annual Fiscal Reports for Startups

An Excel Template for Annual Fiscal Reports typically contains structured financial data including income statements, balance sheets, and cash flow summaries. It allows startups to organize their yearly financial performance in a clear, accessible format. This document is essential for accurate record-keeping and financial analysis.

Such templates often include customizable fields to reflect unique startup expenses and revenues, making it easier to track growth and make informed business decisions. Regularly updating the template ensures accurate forecasting and compliance with financial regulations. Always back up your data and review formulas to prevent errors.

Statement of Financial Position with Income Tracker for Startups

What information does a Statement of Financial Position with Income Tracker for startups usually contain? This document typically includes a detailed summary of a startup's assets, liabilities, and equity at a specific point in time, providing a snapshot of financial health. It also integrates an income tracker that monitors revenue streams and expenses, helping startups to manage cash flow effectively and make informed business decisions.

Why is it important for startups to maintain an accurate Statement of Financial Position with Income Tracker? Maintaining accuracy ensures transparency for investors and stakeholders, enabling better trust and potential funding opportunities. Additionally, regularly updating this document aids in identifying financial trends early and supports strategic planning for sustainable growth.

What are the key components included in an annual financial statement for startups in Excel?

An annual financial statement for startups in Excel typically includes key components such as the balance sheet, income statement, and cash flow statement. Your document should also feature equity statements and notes to the financials to provide a comprehensive view of the startup's financial health. Accurate categorization of assets, liabilities, revenues, and expenses enhances the clarity and usefulness of the report.

How do startups use Excel to track revenue, expenses, and profitability annually?

Startups use Excel to create detailed financial statements by organizing revenue, expenses, and profitability data into structured worksheets for each fiscal year. Your Excel workbook enables automated calculations and visual charts, helping monitor cash flow trends and identify cost-saving opportunities. This annual tracking supports informed decision-making and simplified reporting to stakeholders.

What formulas should be applied in Excel to calculate net income, EBITDA, and cash flow for the year?

To calculate net income in your annual financial statement for startups, use the formula: =SUM(Revenue)-SUM(Expenses)-SUM(Taxes). For EBITDA, apply =Net_Income+Interest+Taxes+Depreciation+Amortization, referencing relevant cells. Determine cash flow by using =Net_Income+Non-Cash_Expenses-Changes_in_Working_Capital, ensuring accurate data input in your Excel document.

How does Excel facilitate visual presentation of financial data through charts and pivot tables for annual reports?

Excel enhances the visual presentation of annual financial statements for startups by enabling the creation of dynamic charts that clearly illustrate key financial metrics such as revenue growth and expense trends. Pivot tables allow efficient summarization and analysis of complex financial data, making it easier to identify patterns and insights. These tools simplify the interpretation of financial performance, supporting data-driven decision-making in annual reports.

What are the essential steps for ensuring data accuracy and integrity in annual financial statements prepared in Excel?

Ensure your data accuracy and integrity by validating all entries using Excel's built-in error-checking and data validation tools. Regularly reconcile financial figures against source documents and apply consistent formulas and functions across your annual financial statement. Implement version control and secure your Excel file to prevent unauthorized changes or data corruption.