The Annually Income Statement Excel Template for Nonprofits provides a streamlined way to track and analyze yearly revenues and expenses, ensuring financial transparency and accountability. It helps organizations monitor funding sources, program costs, and operational expenses to maintain fiscal responsibility. This template is essential for generating accurate financial reports needed for audits, grant applications, and board reviews.

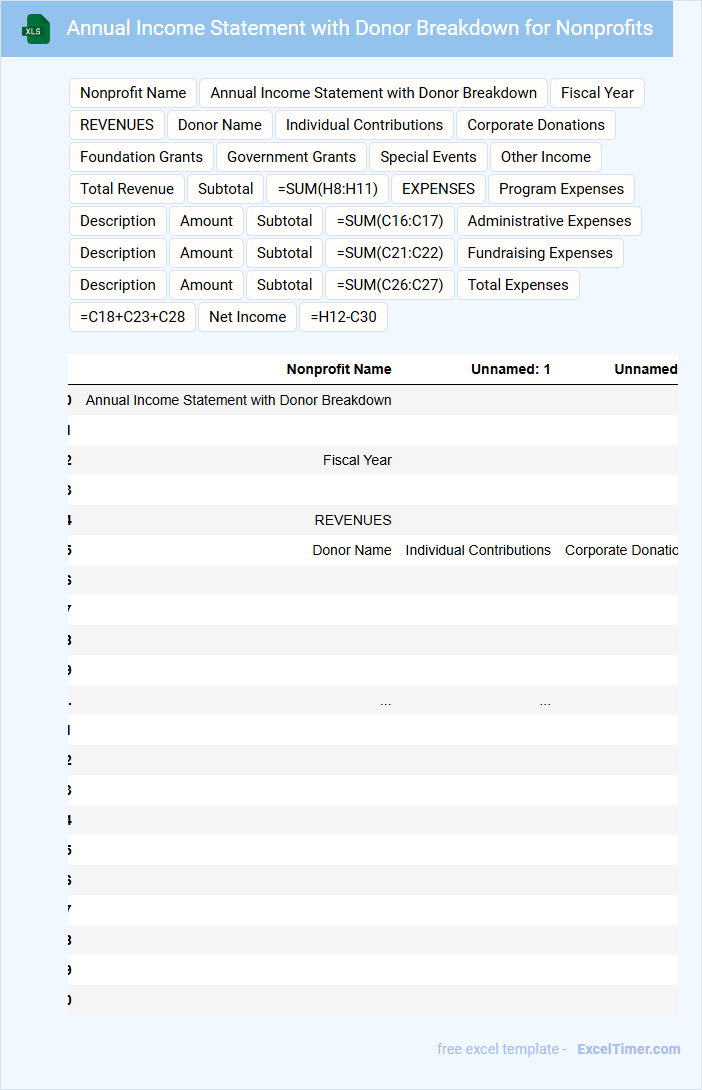

Annual Income Statement with Donor Breakdown for Nonprofits

An Annual Income Statement with Donor Breakdown for Nonprofits is a financial document that details the organization's yearly revenues and expenses, highlighting contributions from various donor segments. This report offers transparency and helps stakeholders understand funding sources and financial health. It is essential for demonstrating accountability and planning future fundraising strategies.

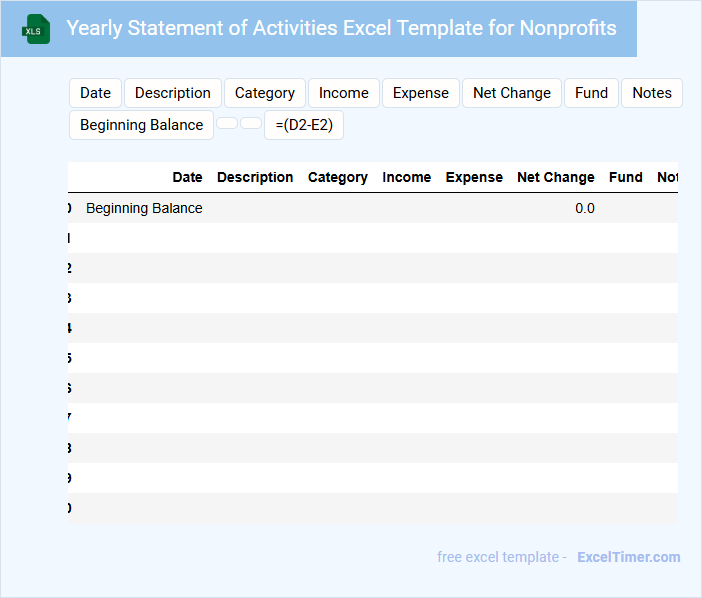

Yearly Statement of Activities Excel Template for Nonprofits

The Yearly Statement of Activities Excel Template is commonly used by nonprofits to summarize their financial performance over a fiscal year. It details income, expenses, and changes in net assets to provide a clear overview of financial health. This document helps stakeholders understand how funds were utilized to support the organization's mission.

When using this template, it is important to ensure accurate categorization of revenue and expenses to maintain transparency and compliance with regulations. It should also include notes on significant financial events or grants received during the year. Proper documentation supports effective financial management and reporting to donors and regulatory bodies.

Income and Expense Report for Nonprofit Organizations

An Income and Expense Report for Nonprofit Organizations provides a detailed overview of the financial activities within a specific period. It highlights all sources of income alongside all expenditures, helping to track the organization's financial health.

This report is crucial for maintaining transparency and accountability to donors and stakeholders. When preparing the report, it is important to ensure accuracy in categorizing revenue and expenses, as well as including notes on any unusual financial activities.

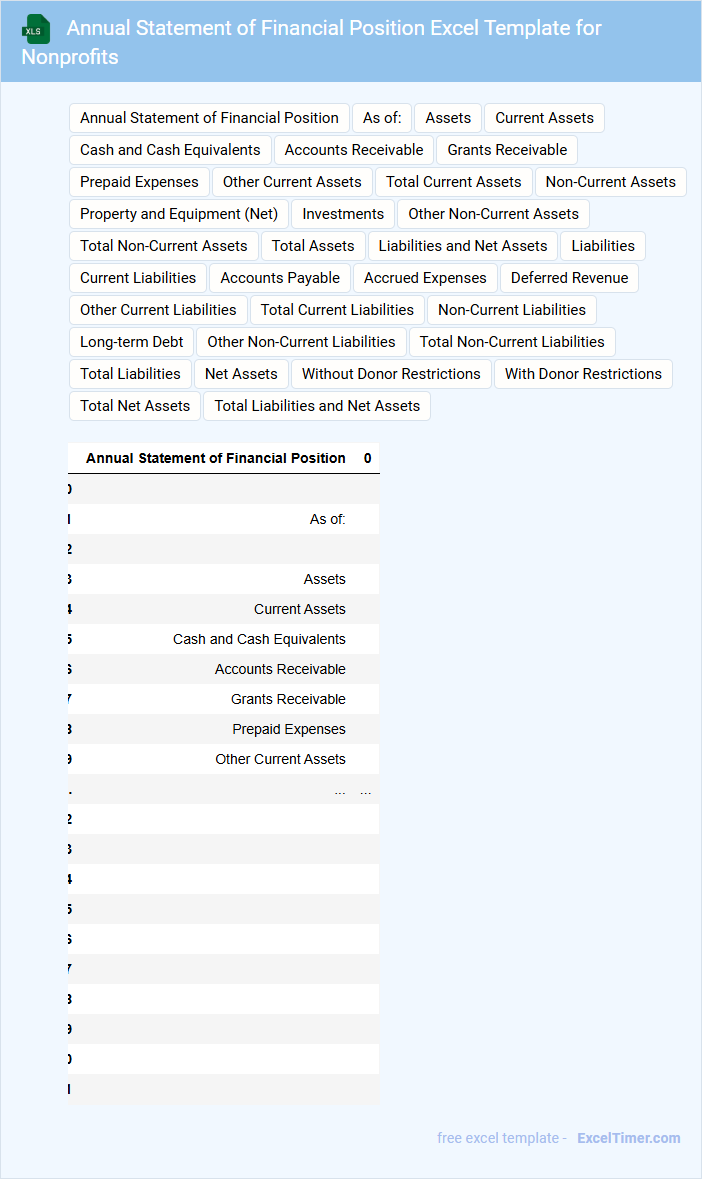

Annual Statement of Financial Position Excel Template for Nonprofits

What does an Annual Statement of Financial Position Excel Template for Nonprofits usually contain?

This document typically includes detailed assets, liabilities, and net assets to present a nonprofit's financial health at year-end. It organizes financial data systematically for transparency and better decision-making. Key elements usually are cash balances, accounts receivable, liabilities, and fund balances specific to nonprofit accounting.

What important considerations should be made when using this template?

Ensure accurate categorization of restricted and unrestricted funds to comply with nonprofit accounting standards. Regular updates and reconciliations are essential for maintaining reliable financial statements. Additionally, customizing the template to reflect the organization's unique funding sources and expenses enhances clarity and usefulness.

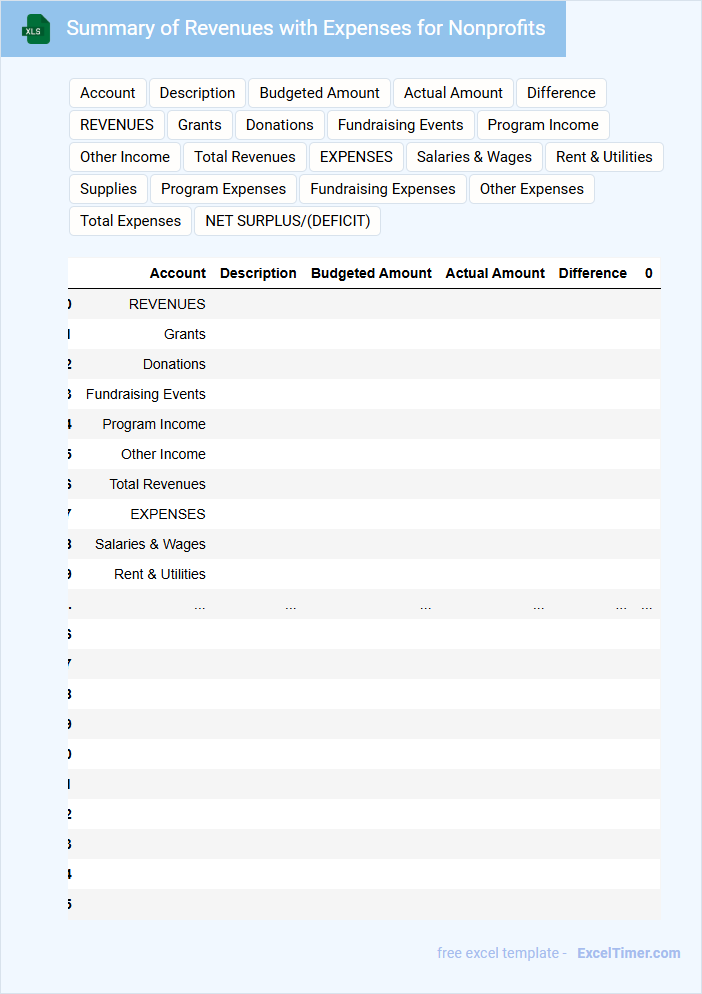

Summary of Revenues with Expenses for Nonprofits

The Summary of Revenues with Expenses for nonprofits is a crucial financial document that outlines the total income and expenditures within a specific period. It typically includes sources of revenue such as donations, grants, and fundraising events, alongside detailed expense categories like program costs, administrative expenses, and fundraising costs. This document helps stakeholders evaluate the organization's financial health and ensure accountability.

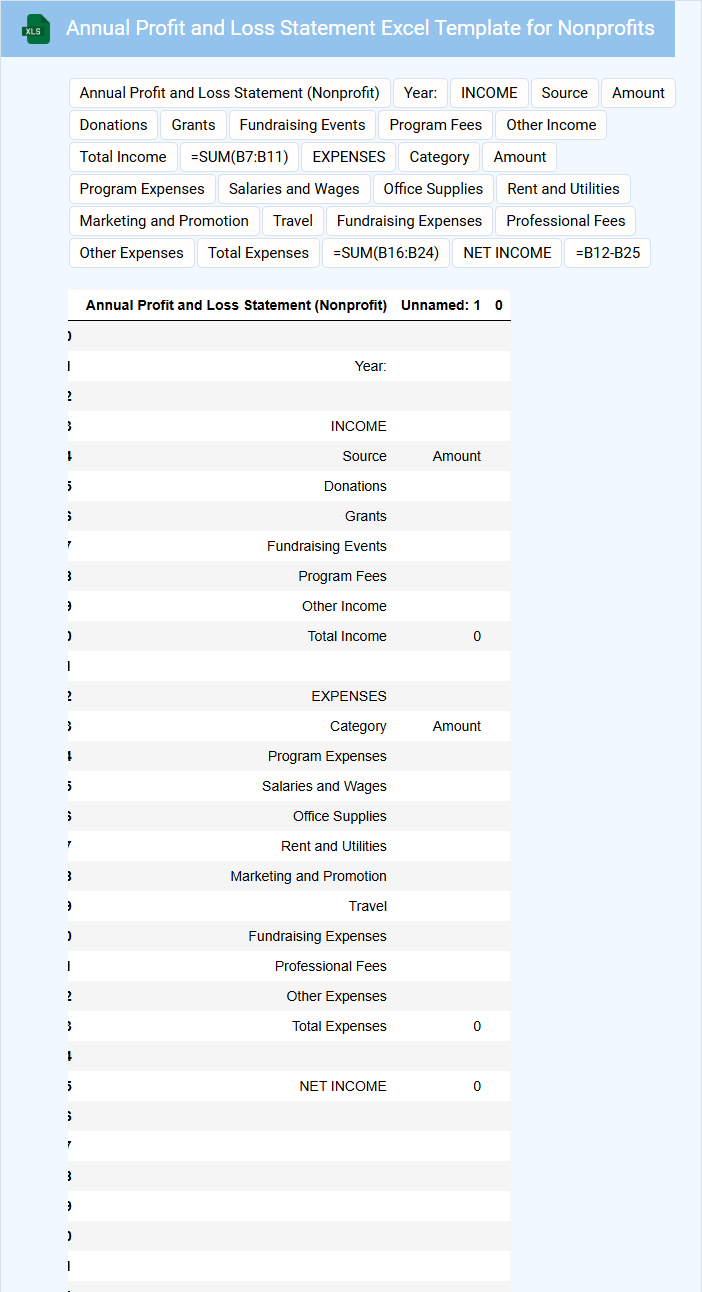

Annual Profit and Loss Statement Excel Template for Nonprofits

An Annual Profit and Loss Statement Excel Template for Nonprofits typically contains detailed records of income, expenses, and net profit or loss over the fiscal year. It helps organizations track financial performance, ensuring transparency and accountability. Key sections usually include donation revenues, operational costs, and program expenses.

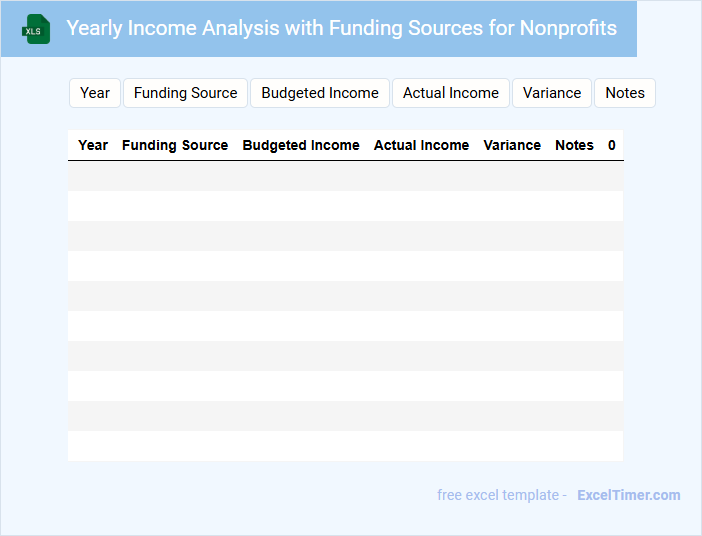

Yearly Income Analysis with Funding Sources for Nonprofits

A Yearly Income Analysis with Funding Sources for Nonprofits provides a detailed overview of the financial health and revenue streams of an organization over the course of a year. It typically contains income data categorized by various funding sources such as grants, donations, sponsorships, and fundraising events. This type of document assists in identifying trends, allocating resources efficiently, and planning future fundraising strategies.

Important elements to include are a clear breakdown of income sources, comparative year-over-year financial data, and notes on any significant changes or anomalies. Emphasizing transparency and accuracy will build trust with stakeholders. Additionally, highlighting major donors or funding partnerships can help in recognizing key contributors and opportunities for growth.

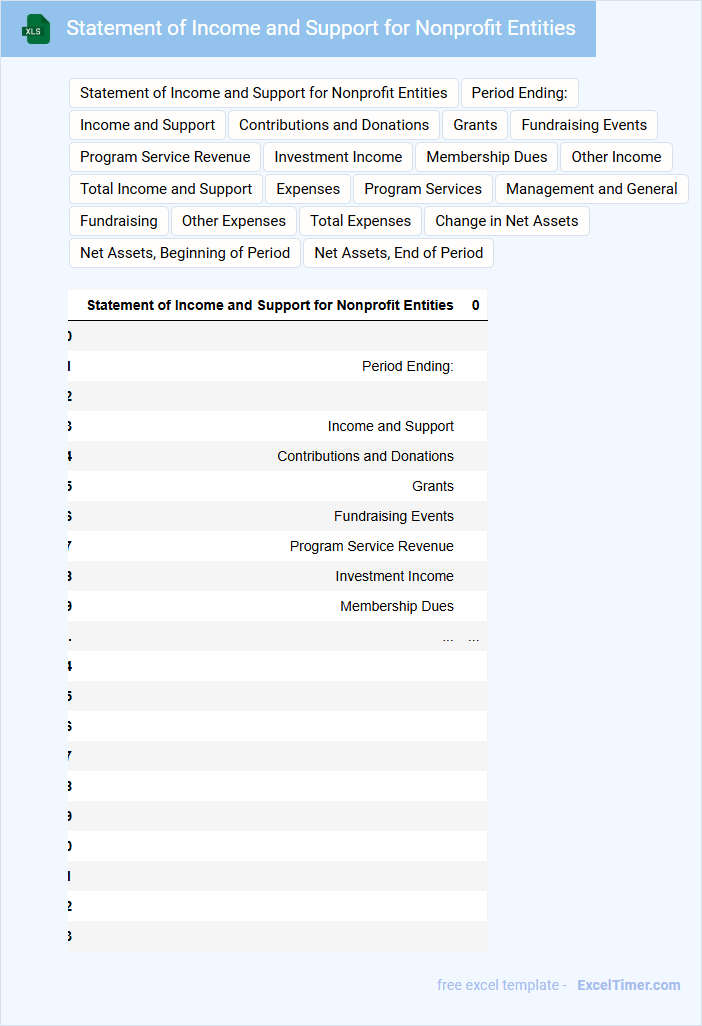

Statement of Income and Support for Nonprofit Entities

What information does a Statement of Income and Support for Nonprofit Entities typically contain? This document usually includes detailed records of the nonprofit's revenue streams, such as donations, grants, and fundraising events. It also outlines expenses and support activities, providing a clear financial overview essential for transparency.

Why is accuracy important in a Statement of Income and Support for Nonprofit Entities? Accurate reporting ensures accountability to donors and stakeholders, demonstrating responsible stewardship of funds. It also supports compliance with legal requirements and helps guide strategic financial planning.

Annual Income Report with Grant Tracking for Nonprofits

An Annual Income Report with Grant Tracking for nonprofits typically contains detailed financial information including total income, expenses, and specific grant allocations. It provides transparency and accountability to stakeholders by highlighting how funds are utilized throughout the year.

Additionally, this document tracks the status of various grants, helping organizations monitor deadlines and compliance requirements. Incorporating clear summaries and accurate data entries is essential for effective grant management and donor trust.

Comprehensive Income Statement for Nonprofit Management

A Comprehensive Income Statement for nonprofit management provides a detailed overview of all financial activities, including revenues, expenses, gains, and losses during a specific period. It helps stakeholders understand the overall financial performance beyond just net income.

Key components often include unrestricted and restricted revenue streams, operational expenses, and changes in net assets. Ensuring transparency and accurate categorization of funds is crucial for maintaining trust and compliance with regulations.

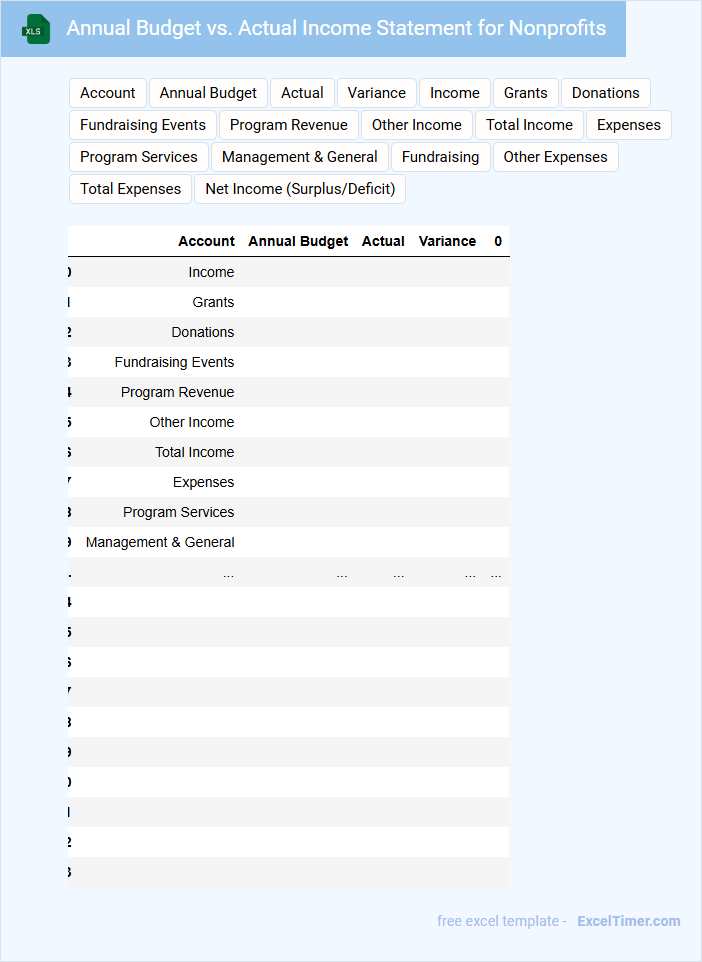

Annual Budget vs. Actual Income Statement for Nonprofits

An Annual Budget vs. Actual Income Statement for Nonprofits typically contains a detailed comparison between the projected financial goals and the actual financial performance throughout the fiscal year.

- Budgeted Amounts: The estimated income and expenses planned for the year, serving as financial targets.

- Actual Amounts: The real income received and expenses incurred, reflecting the organization's financial reality.

- Variance Analysis: The differences between budgeted and actual figures, highlighting areas of overperformance or shortfall.

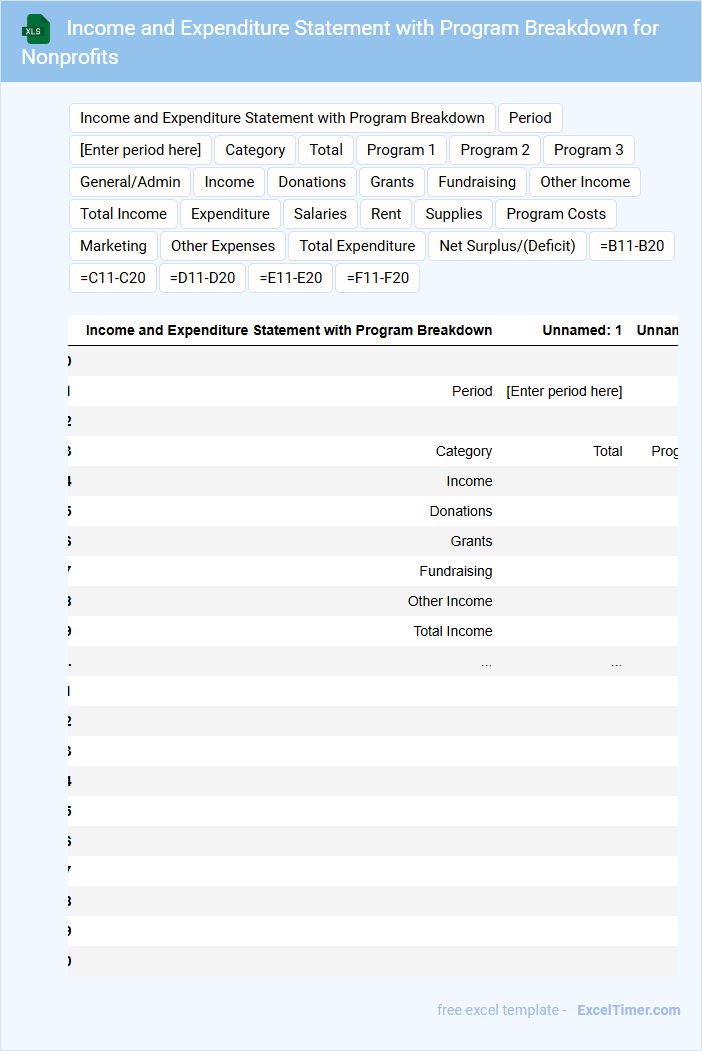

Income and Expenditure Statement with Program Breakdown for Nonprofits

An Income and Expenditure Statement with Program Breakdown for nonprofits is a financial document that details the organization's revenues and expenses categorized by specific programs. It helps stakeholders understand how funds are allocated across different initiatives and measures fiscal responsibility. Including detailed notes on restricted and unrestricted funds is crucial for transparency and compliance.

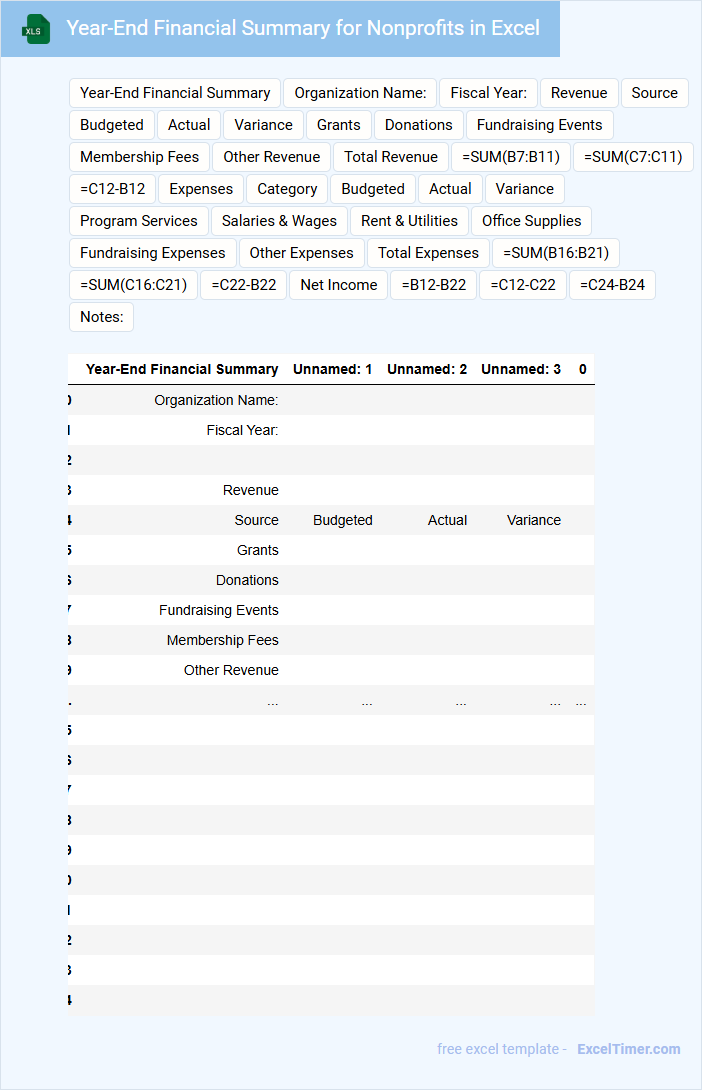

Year-End Financial Summary for Nonprofits in Excel

The Year-End Financial Summary for nonprofits typically contains a comprehensive overview of the organization's financial performance throughout the year. It includes detailed income statements, expense reports, and fund balance summaries to help assess fiscal health. This document is essential for transparency, accountability, and strategic planning for future operations.

Important elements to include are a clear breakdown of revenue sources, program expenses, administrative costs, and any significant financial changes or irregularities. It should also provide comparative data from previous years to identify trends and areas for improvement. Ensuring accuracy and clarity in the spreadsheet layout improves stakeholder understanding and decision-making.

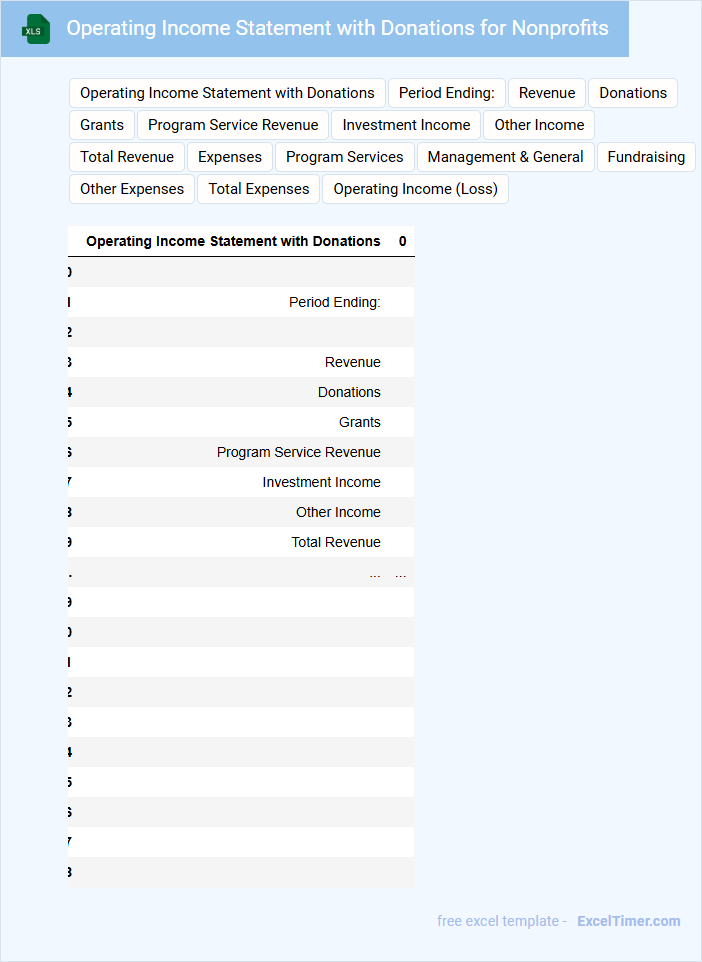

Operating Income Statement with Donations for Nonprofits

The Operating Income Statement for nonprofits is a financial document that outlines the organization's revenues and expenses over a specific period. It includes both operational income and donations received, providing a clear view of the nonprofit's financial health.

This statement helps stakeholders understand how effectively the organization manages resources and allocates funds. It is crucial to include detailed information about unrestricted and restricted donations to ensure transparency and proper financial reporting.

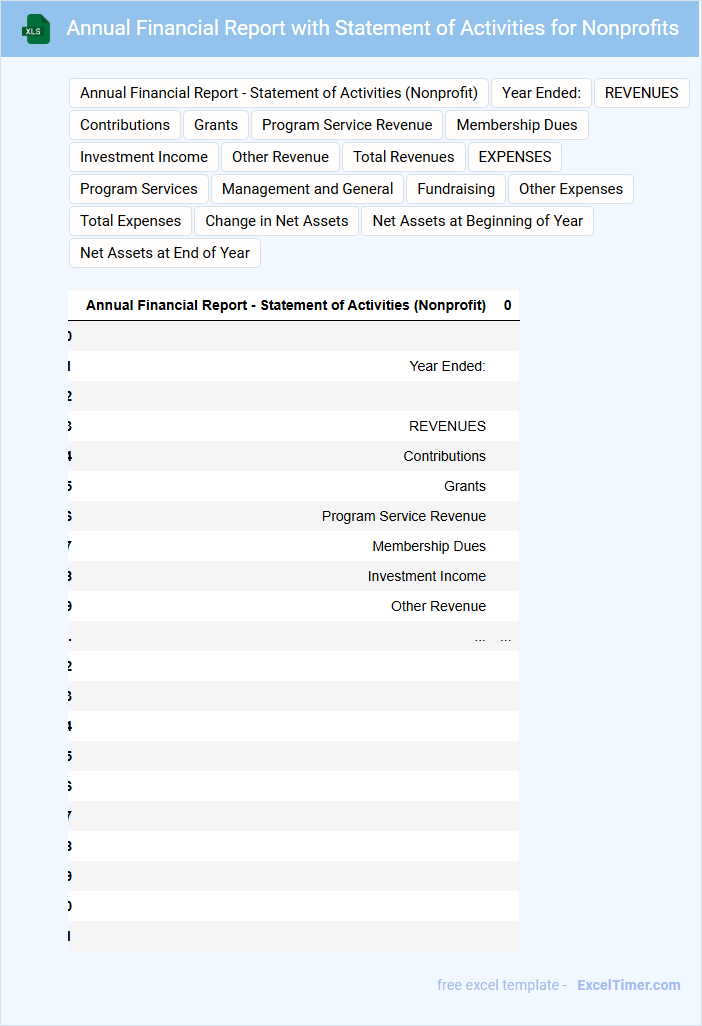

Annual Financial Report with Statement of Activities for Nonprofits

What information is typically included in an Annual Financial Report with Statement of Activities for Nonprofits? This document usually contains a detailed summary of the nonprofit's financial performance and changes in net assets during the fiscal year. It highlights revenue sources, expenses, and program service accomplishments to ensure transparency and accountability to stakeholders.

Why is it important to include a clear Statement of Activities in this report? The Statement of Activities provides a snapshot of how funds are raised and utilized, illustrating the organization's financial health and operational effectiveness. Including this helps donors, board members, and regulators understand where resources are allocated and supports informed decision-making.

What are the key revenue sources typically reported on a nonprofit's annually income statement?

Key revenue sources on a nonprofit's annual income statement typically include donations, grants, membership fees, and fundraising event income. Your statement may also report program service revenues and investment income. Accurate categorization of these sources is crucial for transparent financial reporting.

How are program and administrative expenses differentiated on the nonprofit income statement?

Program expenses on your nonprofit income statement represent costs directly related to mission-driven activities, while administrative expenses cover general management and operational support. Accurate categorization ensures transparent financial reporting and compliance with nonprofit standards. This distinction helps donors and stakeholders understand how funds are utilized toward your organization's goals.

Why is it important to indicate donor-restricted versus unrestricted funds in annual income statements?

Indicating donor-restricted versus unrestricted funds in annual income statements ensures transparent financial reporting and compliance with accounting standards for nonprofits. It helps stakeholders understand how resources are allocated and used according to donor intentions. Accurate classification supports effective fund management and builds donor trust.

How does the income statement reflect the organization's surplus or deficit for the year?

The Annual Income Statement for Nonprofits details total revenues and expenses incurred during the fiscal year, highlighting the financial outcome. It calculates the surplus when revenues exceed expenses, indicating funds available for future programs. A deficit occurs when expenses surpass revenues, signaling a need for financial adjustments.

What role do grants and contributions play in the overall financial picture presented on a nonprofit's annually income statement?

Grants and contributions serve as critical revenue streams in your nonprofit's annual income statement, often representing the largest portion of total income. These funds directly impact your organization's ability to cover operational expenses and enable program growth. Understanding their size and consistency helps assess financial sustainability and plan future budgets effectively.