![]()

The Annually Income and Expense Tracker Excel Template for Freelancers is designed to help freelancers efficiently monitor their financial activities throughout the year. It enables accurate recording of monthly income and expenses, facilitating better budgeting and tax preparation. Utilizing this template ensures a clearer financial overview and improved cash flow management for independent professionals.

Annual Income and Expense Tracker Excel Template for Freelancers

An Annual Income and Expense Tracker Excel Template for freelancers is a crucial tool for monitoring financial health throughout the year. It typically contains detailed entries for various sources of income and categorized expenses, allowing freelancers to have a clear overview of their cash flow. This document aids in budgeting, tax preparation, and financial planning by summarizing yearly financial data efficiently.

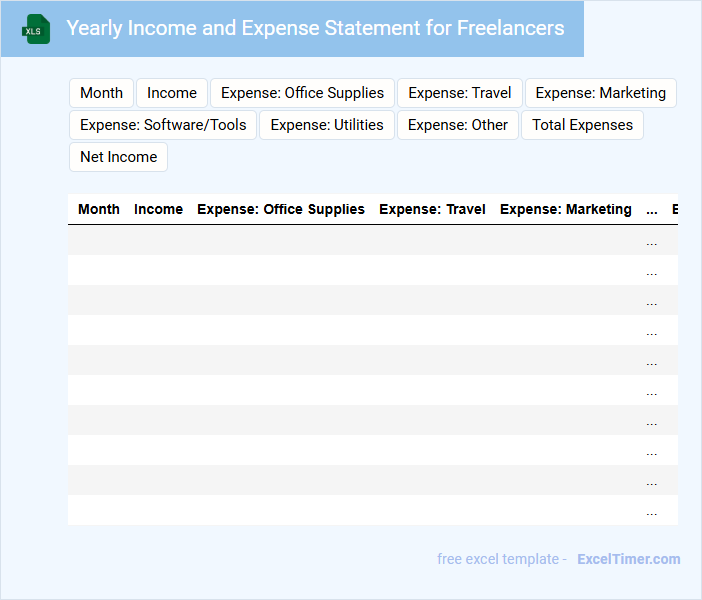

Yearly Income and Expense Statement for Freelancers

The Yearly Income and Expense Statement for freelancers typically contains a detailed summary of all income earned and expenses incurred throughout the year. It helps in tracking financial performance and preparing accurate tax returns. Essential elements include categorizing income sources and documenting deductible expenses.

Simple Yearly Income and Expense Log for Freelancers

A Simple Yearly Income and Expense Log for freelancers typically contains records of all earnings and expenditures throughout the year. This helps in tracking financial performance and managing tax obligations efficiently. Including detailed categories such as project income, office supplies, and travel costs is essential for clarity.

This document is crucial for freelancers to maintain organized financial records and prepare accurate tax returns. A well-maintained log can also assist in budgeting and identifying profitable areas for growth. Regular updates and receipts attachment are important practices to ensure accuracy and completeness.

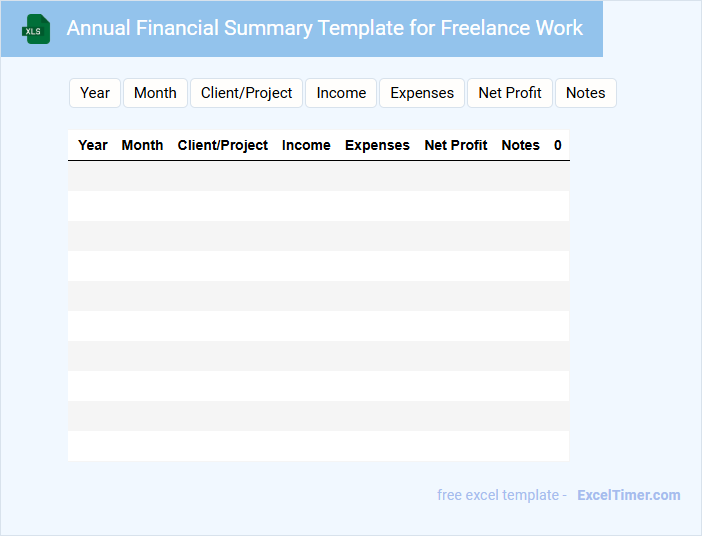

Annual Financial Summary Template for Freelance Work

An Annual Financial Summary Template for Freelance Work is a document that consolidates all income and expenses related to freelance projects over a year. It helps freelancers track financial performance and prepare for tax obligations efficiently.

- Include detailed income sources and dates to ensure accurate revenue tracking.

- List all deductible expenses with receipts or proof to maximize tax benefits.

- Incorporate a summary section highlighting net profit and tax estimations for quick review.

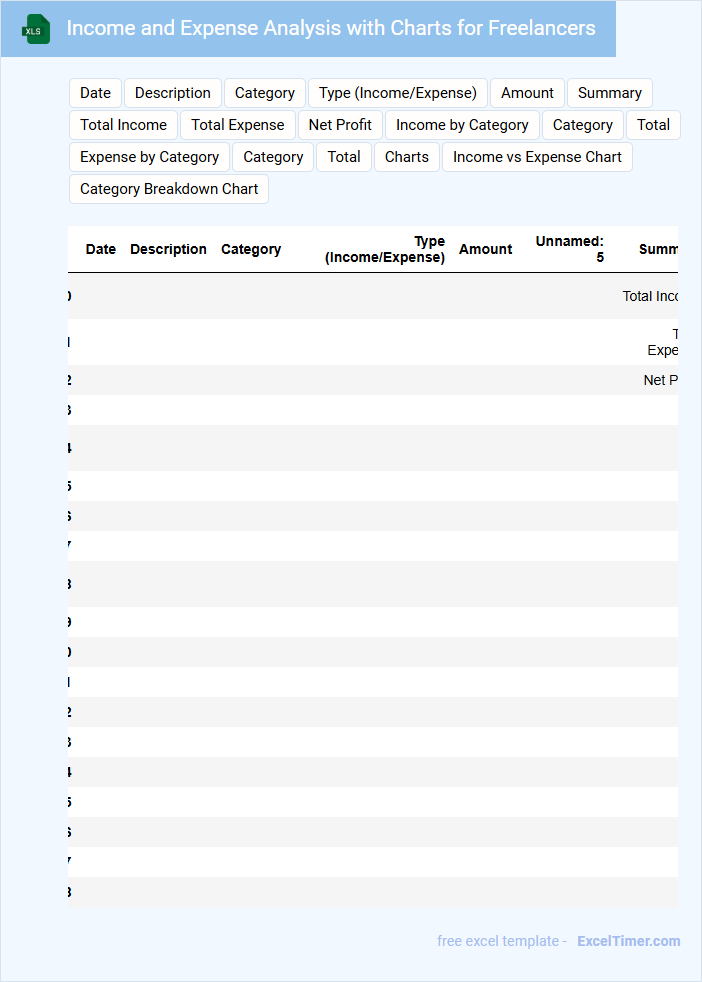

Income and Expense Analysis with Charts for Freelancers

An Income and Expense Analysis document for freelancers typically includes detailed records of earnings and expenditures over a specified period. It helps track financial performance and identify spending patterns for better budgeting.

This document often features charts and graphs to visually represent income trends and expense categories, making data easier to interpret. Including both monthly and project-based breakdowns is crucial for accurate analysis.

Freelancer Annual Budget and Expense Report Template

The Freelancer Annual Budget and Expense Report Template typically contains detailed records of income, expenditures, and budget allocations for the year. It helps freelancers track financial performance and manage cash flow effectively.

This document usually includes sections for categorizing expenses, monthly summaries, and comparison of actual spending versus budgeted amounts. Keeping it updated is crucial for accurate financial planning and tax preparation.

It is important to regularly review and adjust the budget based on project fluctuations and unexpected costs to maintain financial stability.

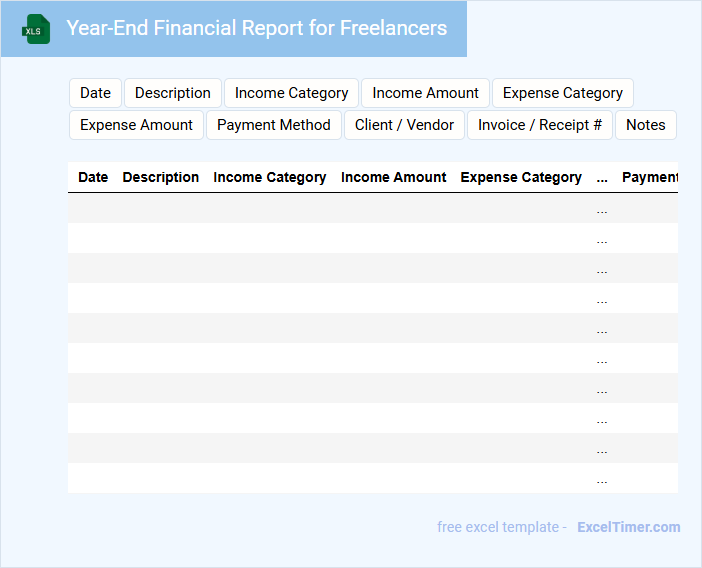

Year-End Financial Report for Freelancers

A Year-End Financial Report for Freelancers typically summarizes income, expenses, and tax obligations for the fiscal year.

- Income Summary: Detailed records of all earnings received throughout the year to track cash flow.

- Expense Documentation: Organized list of deductible expenses to maximize tax savings.

- Tax Preparedness: Clear calculations of tax liabilities and estimated payments to comply with regulations.

Annual Profit and Loss Tracker for Freelancers

An Annual Profit and Loss Tracker for freelancers is a financial document designed to monitor income and expenses over the course of a year. It helps freelancers gain clear insights into their overall profitability and cash flow trends.

This type of document typically contains detailed records of earnings, costs, taxes, and net profit summaries. Accurate categorization and regular updates are crucial for effective financial management and tax preparation.

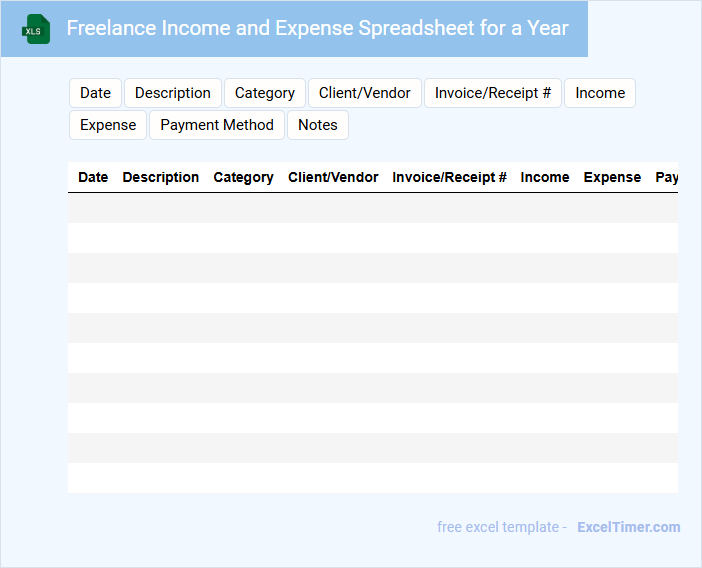

Freelance Income and Expense Spreadsheet for a Year

A Freelance Income and Expense Spreadsheet for a Year typically contains detailed financial records to help freelancers track their earnings and expenditures efficiently.

- Income Sources: Document all streams of revenue including client payments and project bonuses.

- Expense Categories: Categorize expenses such as office supplies, software subscriptions, and travel costs.

- Monthly Summary: Provide monthly breakdowns to analyze cash flow and prepare for tax obligations.

Yearly Cash Flow Tracker for Freelance Professionals

A Yearly Cash Flow Tracker for Freelance Professionals is a document that helps manage and monitor income and expenses over the course of a year. It provides a clear picture of financial health and helps in budgeting and planning for taxes.

- Include monthly income from all freelance projects and clients.

- Record all business-related expenses accurately for tax deductions.

- Track irregular payments and plan for periods of low cash flow.

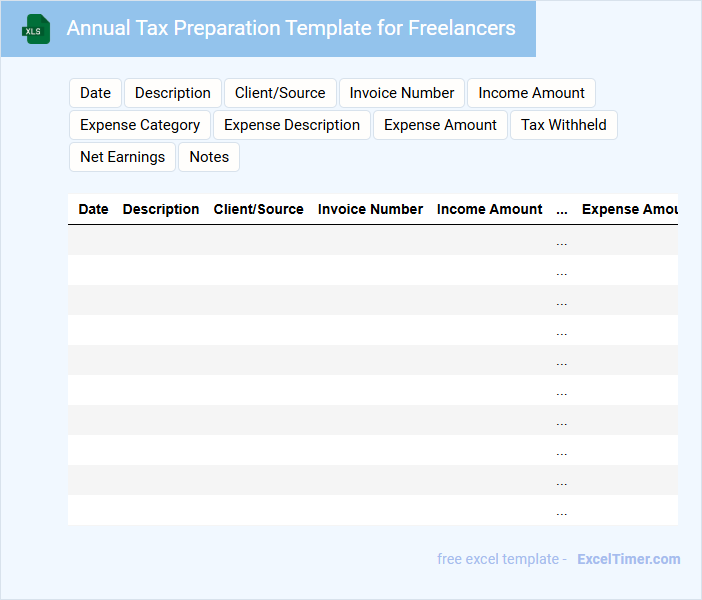

Annual Tax Preparation Template for Freelancers

An Annual Tax Preparation Template for freelancers typically contains sections for income tracking, expense categorization, and deductible items. It helps organize financial documents and receipts throughout the year to simplify tax filing.

This type of document crucially includes spaces for estimated tax payments and summary of 1099 forms received from clients. Using it reduces errors and ensures compliance with tax regulations efficiently.

Important things to include are clear categories for business expenses, deadlines for quarterly tax payments, and a checklist for necessary tax forms and receipts.

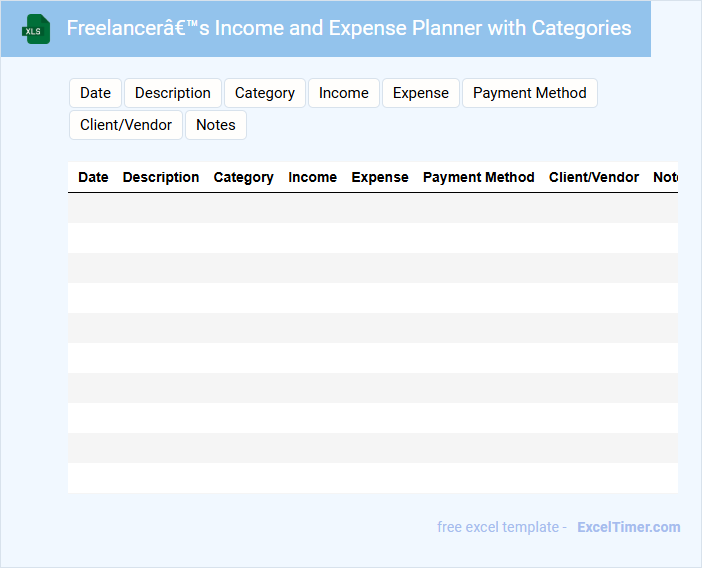

Freelancer’s Income and Expense Planner with Categories

A Freelancer's Income and Expense Planner is a vital document that helps track earnings and expenditures systematically. It typically includes categorized sections for income sources, business expenses, and personal costs to maintain clear financial records. Using such a planner assists freelancers in budgeting effectively and preparing for tax season with accurate data.

Important elements to include are detailed categories for different income streams, expense types like software subscriptions, equipment, and travel. Additionally, incorporating a date tracker and payment status helps monitor cash flow in real time. Regular updates and categorization enable better financial analysis and planning for future projects and tax obligations.

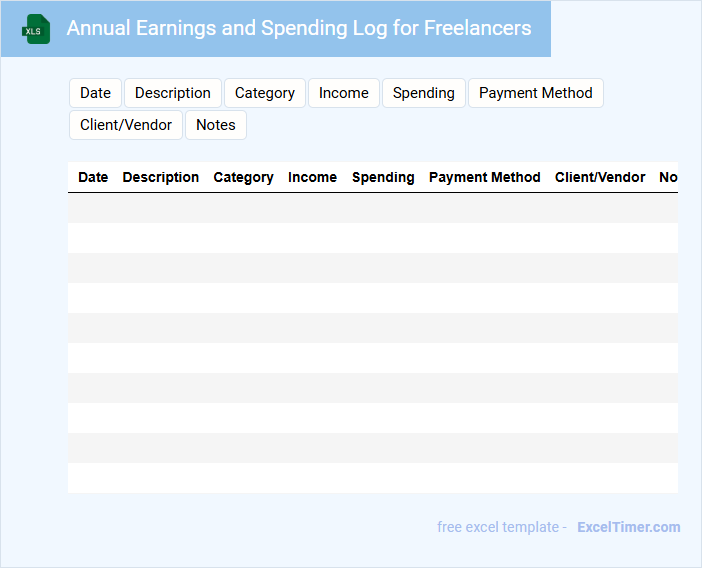

Annual Earnings and Spending Log for Freelancers

An Annual Earnings and Spending Log for freelancers is a vital document that records all income and expenses over the fiscal year. It provides a clear overview of financial health and helps in budgeting and tax preparation.

Such logs typically contain detailed entries of payments received, invoices issued, and categorized expenditures. Maintaining accurate and organized records ensures compliance and aids in financial planning.

It is important to regularly update the log and back up the data to avoid discrepancies and loss of information.

Excel Budget with Income and Expense Sheet for Freelancers

An Excel Budget with Income and Expense Sheet for freelancers typically contains detailed records of monthly earnings and expenditures, helping to monitor cash flow effectively. It includes categorized sections for income sources, fixed expenses, and variable costs to provide a clear financial overview.

This type of document is essential for managing irregular freelance income and ensuring financial stability. It is important to regularly update the sheet and categorize all transactions accurately to maintain an accurate budget forecast.

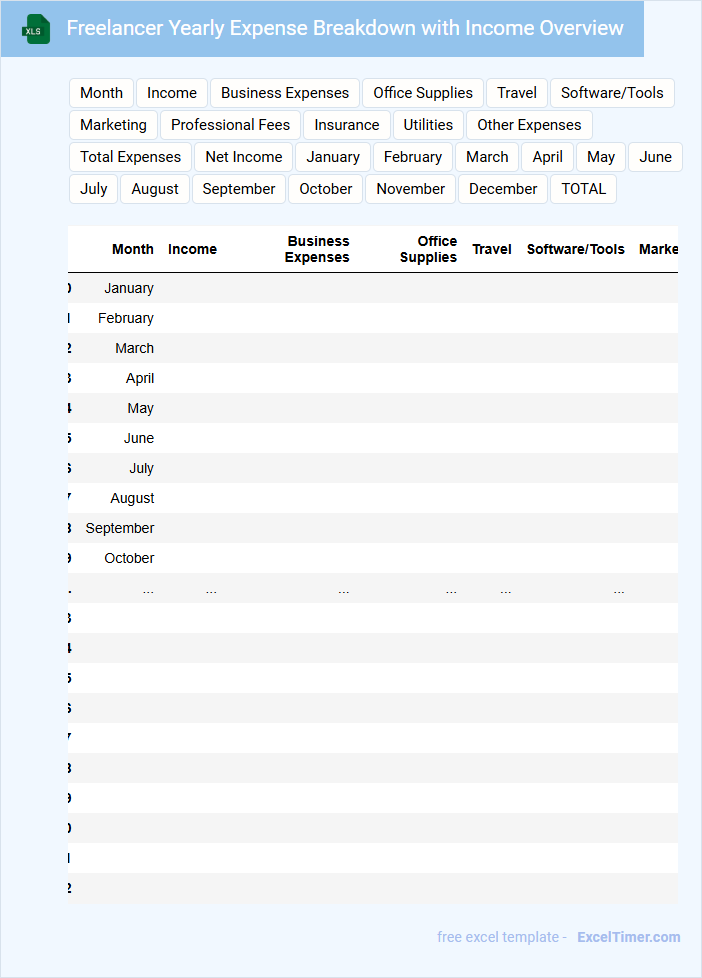

Freelancer Yearly Expense Breakdown with Income Overview

The Freelancer Yearly Expense Breakdown with Income Overview is a document that summarizes annual earnings and expenses for freelancers. It helps track financial performance by categorizing incomes and detailing business-related costs. This overview provides a clear picture of profitability and tax obligations.

What key columns should be included to track annual income and expenses for freelancers?

Your annual income and expense tracker for freelancers should include key columns such as Date, Client or Source, Description, Income Amount, Expense Category, Expense Amount, Payment Method, and Payment Status. Including a Tax Deductible column helps identify expenses eligible for deductions. These columns enable precise tracking and effective financial management throughout the year.

How can categories be used to organize different types of income and expenses in the tracker?

Categories in your Annual Income and Expense Tracker for Freelancers help organize various income streams and expense types by grouping similar entries together. This classification enables efficient tracking, analysis, and reporting of your financial data. Using categories simplifies budgeting and tax preparation by providing clear insights into where your money is coming from and going.

How do you automate the calculation of totals and net annual income within the document?

You can automate the calculation of totals and net annual income in the Excel Annually Income and Expense Tracker by using SUM formulas to add all income and expense entries. Implement formulas like =SUM(range) for total income and expenses, then calculate net annual income with a formula such as =Total Income - Total Expenses. This approach ensures real-time updates and accurate financial tracking throughout the year.

What methods can be used to visualize income versus expenses trends over the year?

Use line charts to display monthly income and expenses trends clearly, allowing seasonal patterns to emerge. Bar charts help compare total income and expenses side-by-side for each month, highlighting financial balance. Your Excel document can also utilize area charts for cumulative tracking and pivot tables for dynamic data analysis.

How can you ensure accuracy and consistency when entering data into an annual tracker for freelancers?

Ensure accuracy and consistency in an annual income and expense tracker for freelancers by using predefined categories and standardized data entry formats. Implement data validation rules and drop-down lists to minimize errors and maintain uniformity. Regularly reconcile entered data with receipts and invoices to verify correctness throughout the year.