The Annually Financial Report Excel Template for Consultants provides a structured and user-friendly format to track yearly financial performance efficiently. It includes customizable sections for income, expenses, and profit analysis, helping consultants make informed decisions based on accurate data. This template enhances financial transparency and simplifies the reporting process, saving valuable time for consulting professionals.

Annual Financial Report Template for Consultants

What information is typically included in an Annual Financial Report Template for Consultants? This type of document usually contains detailed financial statements such as the income statement, balance sheet, and cash flow statement that provide a clear overview of the consultant's financial performance over the year. It also includes a management discussion and analysis section to explain financial results and highlight significant achievements or challenges.

What is an important aspect to focus on when preparing this report? Accuracy and clarity are crucial, ensuring all financial data is correctly reported and easy to understand for stakeholders. Additionally, including key performance indicators and future financial projections helps consultants and clients make informed decisions.

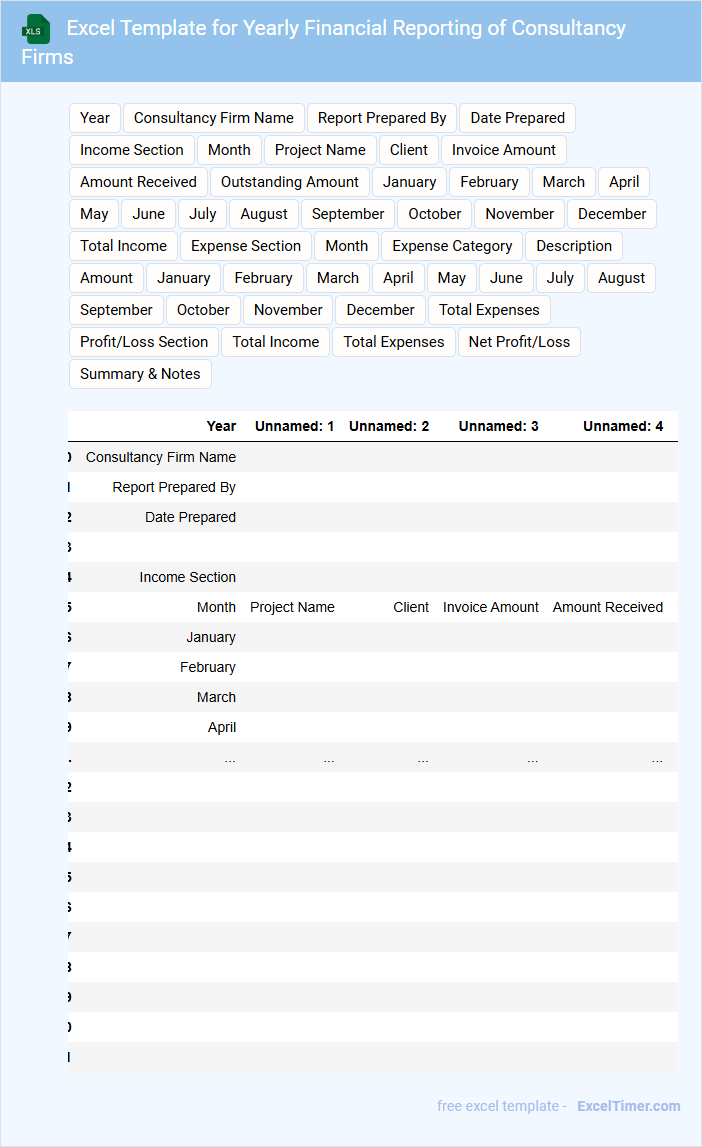

Excel Template for Yearly Financial Reporting of Consultancy Firms

This type of document typically contains structured spreadsheets designed to track and analyze annual financial data for consultancy firms.

- Comprehensive Revenue Tracking: Capture all income sources clearly to assess overall financial health.

- Expense Categorization: Organize costs to identify major spending areas and optimize budgeting.

- Year-End Summary Reports: Generate concise summaries to support strategic decision-making and regulatory compliance.

Financial Performance Report with Annual Summary for Consultants

What information does a Financial Performance Report with Annual Summary for Consultants typically contain? This document usually includes detailed financial data such as revenues, expenses, profit margins, and budget comparisons over the fiscal year. It also summarizes key performance indicators to help consultants evaluate financial health and make strategic recommendations.

What is an important consideration when preparing this report? Ensuring accuracy and clarity in data presentation is crucial, as consultants rely on this information to advise clients effectively. Additionally, highlighting trends and providing actionable insights can significantly enhance the report's value.

Profit & Loss Annual Report Excel Template for Consulting Services

The Profit & Loss Annual Report Excel Template for Consulting Services typically contains detailed financial data, including revenues, expenses, and net profit over the fiscal year. It helps track the financial performance and provides clarity on the business's profitability.

This document also includes sections for cost analysis, client billing summaries, and expense categorization to ensure thorough financial management. Regularly updating the template ensures accurate forecasting and strategic decision-making for consulting firms.

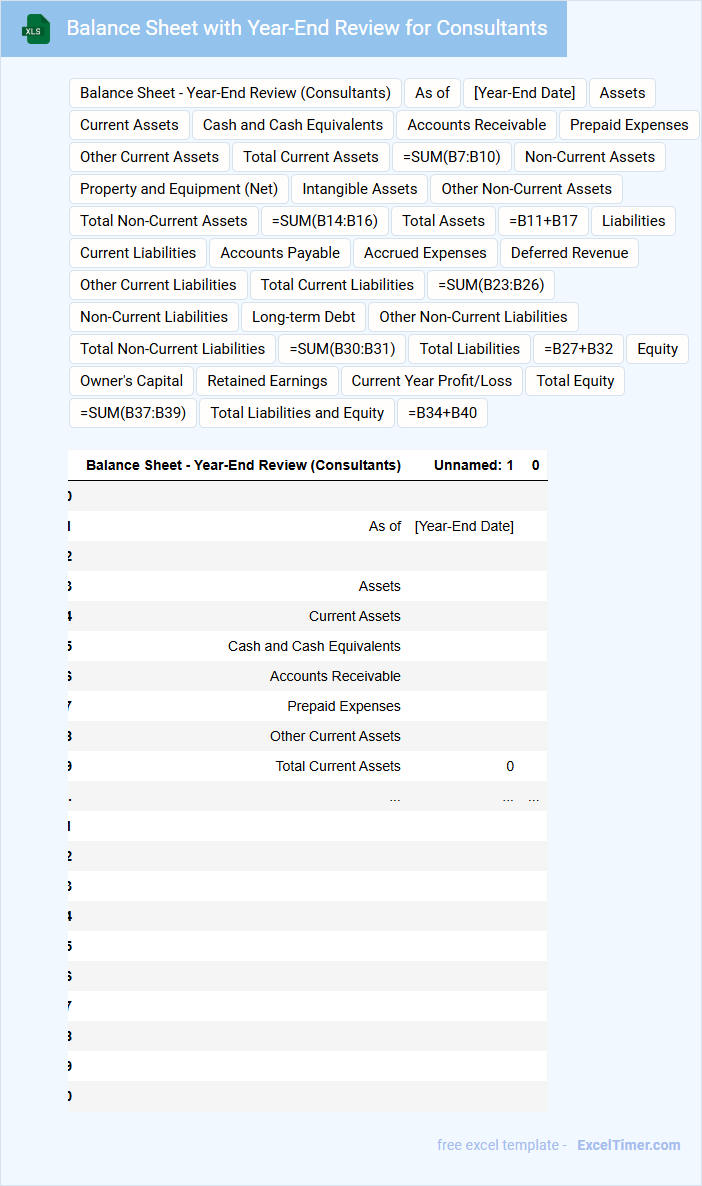

Balance Sheet with Year-End Review for Consultants

The Balance Sheet is a vital financial document that summarizes a company's assets, liabilities, and equity at a specific point in time. It provides a clear snapshot of the organization's financial health and stability, essential for consultants conducting a Year-End Review. Key components such as current assets, long-term liabilities, and shareholder equity help consultants assess financial performance and make informed recommendations.

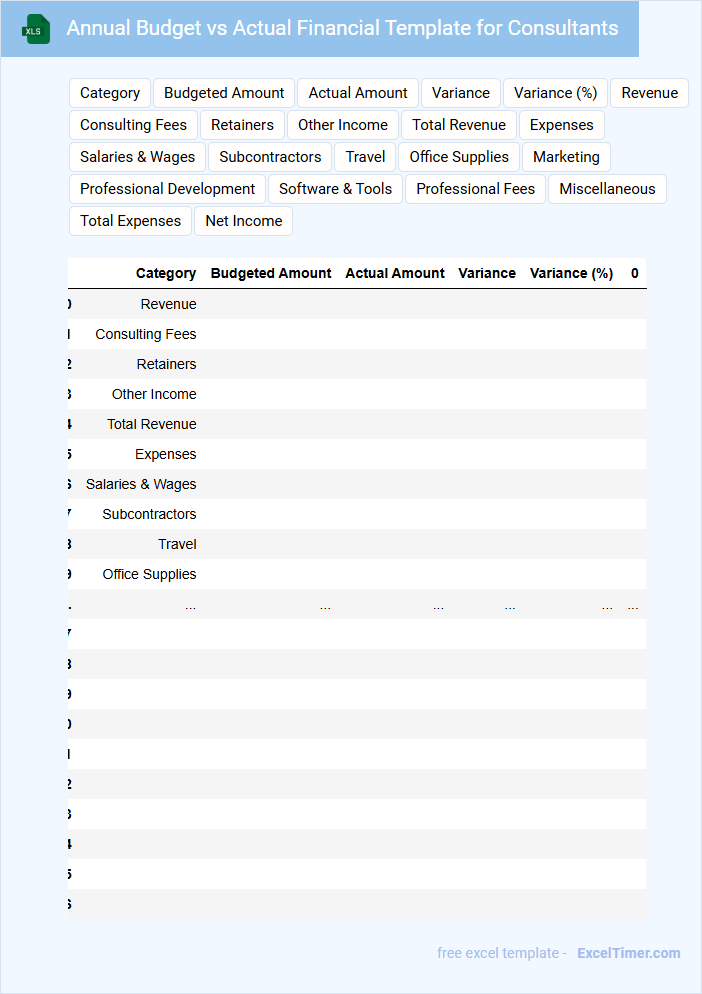

Annual Budget vs Actual Financial Template for Consultants

The Annual Budget vs Actual Financial Template for consultants is a document used to compare projected financial plans against actual performance. It highlights variances in income and expenses, helping to ensure financial accuracy and accountability.

This template typically contains sections for forecasting revenues, detailing expenses, and summarizing profit or loss over a fiscal year. A key suggestion is to regularly update the data to monitor financial health and make informed strategic decisions.

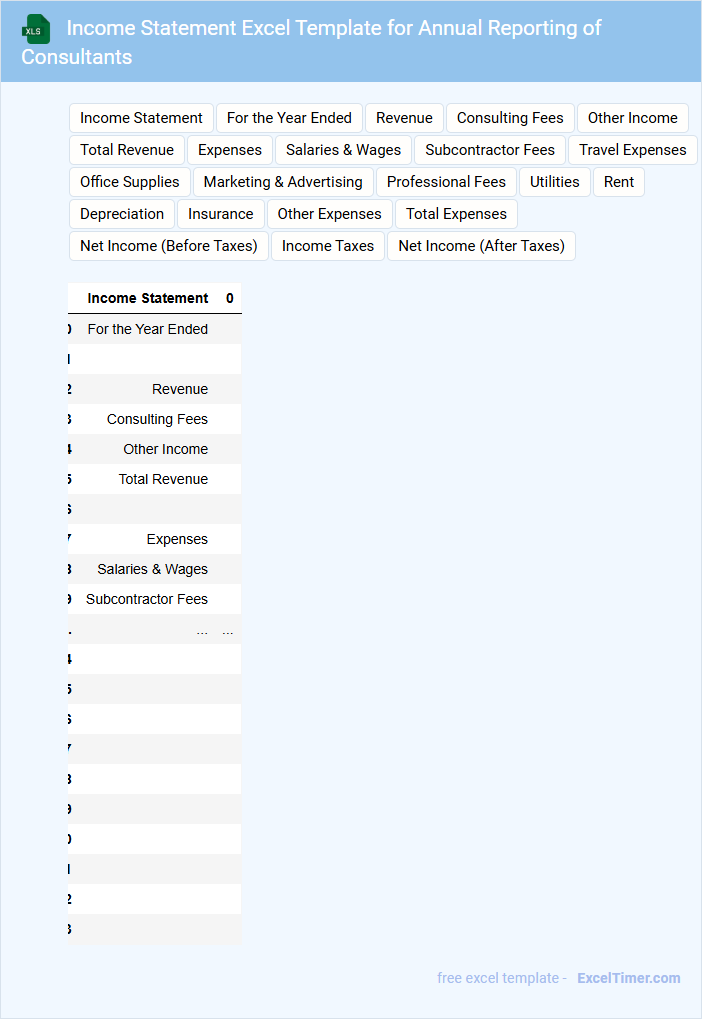

Income Statement Excel Template for Annual Reporting of Consultants

An Income Statement Excel Template for annual reporting is designed to systematically summarize revenues, expenses, and profits over a fiscal year for consultants. It provides a clear financial overview that helps in tracking the financial health and operational efficiency of consulting services.

This document usually contains detailed sections for gross income, operating expenses, and net profit, tailored to reflect consulting-specific revenue streams and cost structures. Accurate categorization and consistent updating are crucial for generating reliable annual financial reports.

When using this template, it is important to ensure all consultant fees and expense types are clearly documented, and formulas are correctly set to automate calculations without errors.

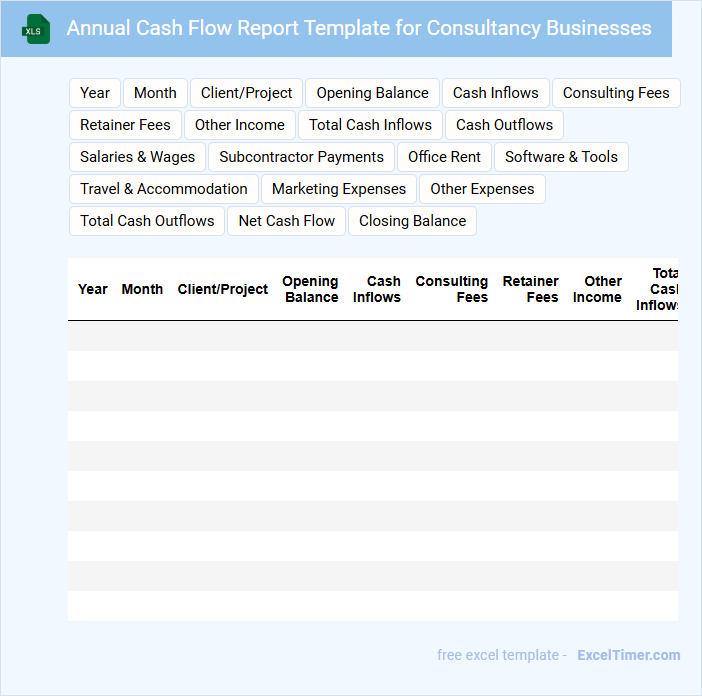

Annual Cash Flow Report Template for Consultancy Businesses

The Annual Cash Flow Report Template for consultancy businesses typically contains detailed records of all cash inflows and outflows over the fiscal year. It provides a clear overview of the company's financial health, helping identify trends in revenue and expenditures.

This document is essential for tracking liquidity, forecasting future cash positions, and ensuring sustainable operations. Important considerations include accurate categorization of consulting fees, expenses, and timely updates to reflect financial changes.

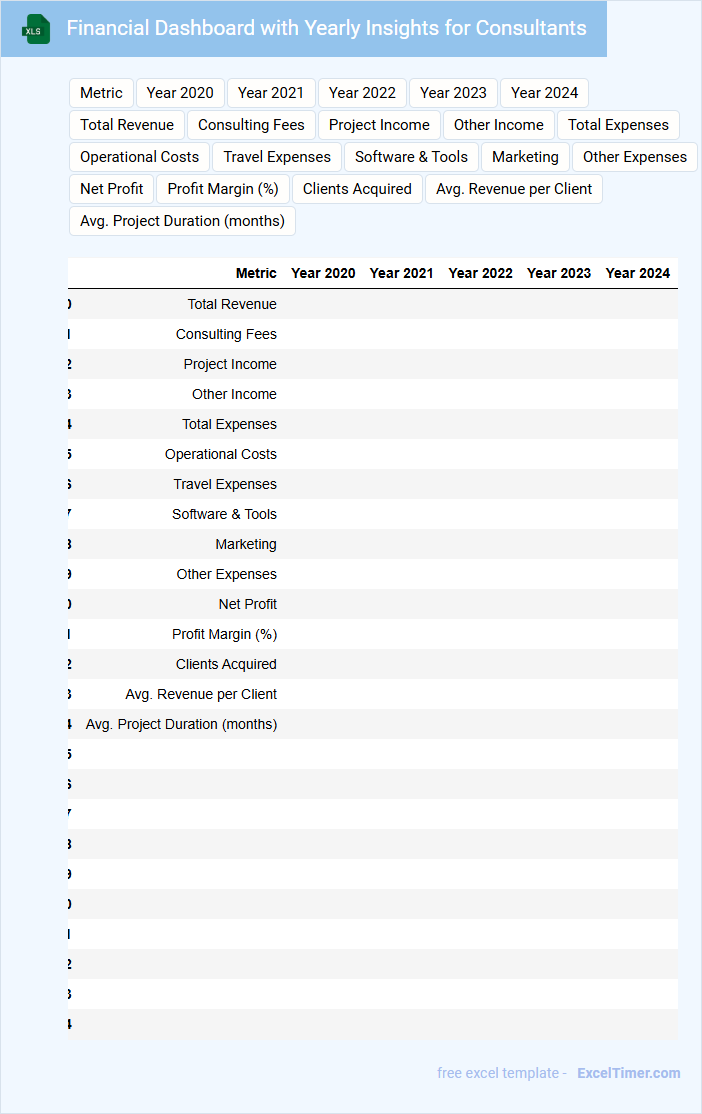

Financial Dashboard with Yearly Insights for Consultants

A Financial Dashboard with Yearly Insights for Consultants typically contains summarized financial data, performance metrics, and trend analyses to help consultants make informed decisions.

- Key Financial Metrics: Displays essential figures such as revenue, expenses, and profit margins to provide a clear financial overview.

- Yearly Trends and Comparisons: Highlights changes over the year to identify growth patterns or potential issues.

- Actionable Insights: Offers recommendations and visual cues to guide strategic planning and improve financial outcomes.

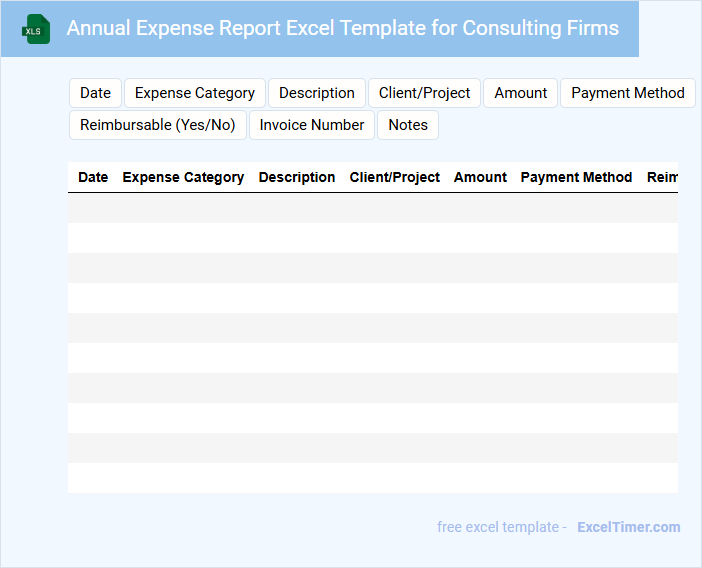

Annual Expense Report Excel Template for Consulting Firms

What is typically included in an Annual Expense Report Excel Template for Consulting Firms? This document usually contains detailed records of all business-related expenses categorized by type, date, and client project. It helps consulting firms track spending, manage budgets, and streamline financial reporting efficiently.

Why is accuracy and categorization important in this template? Accurate data entry ensures reliable financial analysis and compliance with accounting standards, while proper categorization aids in identifying cost-saving opportunities and preparing tax documentation with ease.

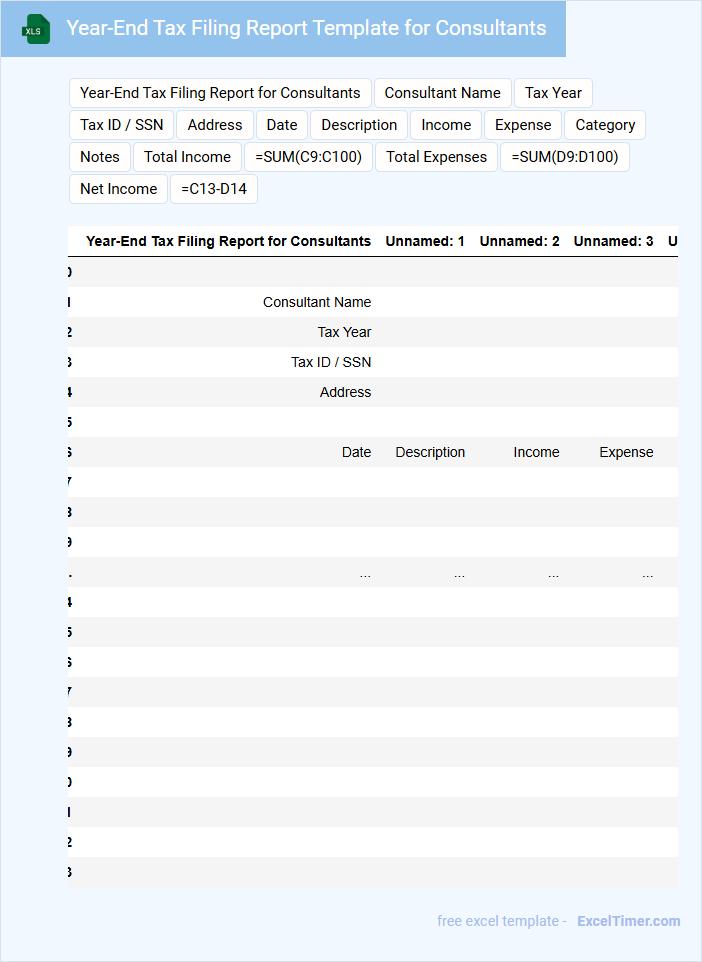

Year-End Tax Filing Report Template for Consultants

Year-End Tax Filing Report Template for Consultants is a structured document designed to summarize annual financial activities and tax-related information for independent consultants. It helps in organizing income, expenses, and deductions to streamline tax filing.

- Include a detailed summary of all income earned from various consulting projects.

- List all deductible business expenses categorized by type for accurate tax calculations.

- Provide a section for tax payments made and any outstanding tax obligations to track compliance.

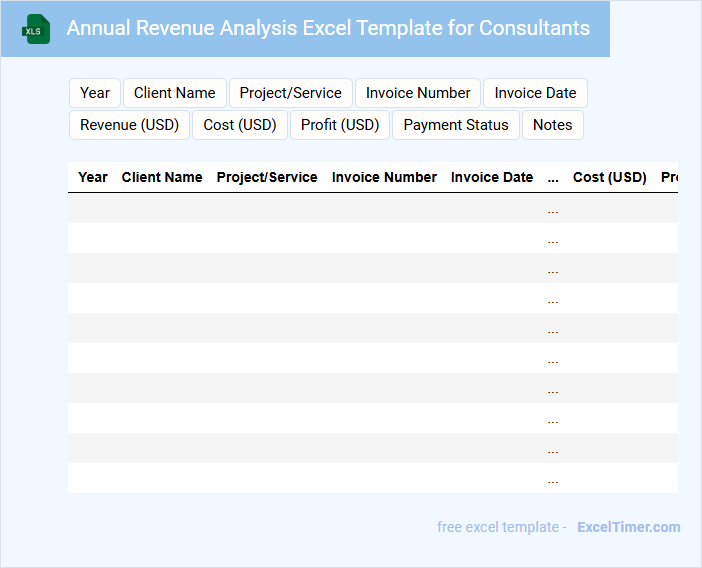

Annual Revenue Analysis Excel Template for Consultants

The Annual Revenue Analysis Excel Template is primarily designed to help consultants systematically track and evaluate their yearly income streams. It includes detailed sections for monthly revenues, client-specific earnings, and comparative growth metrics.

This template often contains pivot tables, charts, and automated calculations to simplify data interpretation and identify trends. Consultants benefit from clear visualization tools that enhance decision-making and financial planning.

For best results, ensure accurate data entry and regularly update the template to reflect changes in client projects and rates.

Financial Overview with Annual Breakdown for Consulting Practices

A Financial Overview with Annual Breakdown for Consulting Practices typically summarizes yearly financial performance and key metrics.

- Revenue Analysis: Detailed yearly revenue figures highlighting growth trends and client contributions.

- Expense Tracking: Comprehensive breakdown of operational costs to identify cost-saving opportunities.

- Profitability Metrics: Evaluation of profit margins and net income to assess overall financial health.

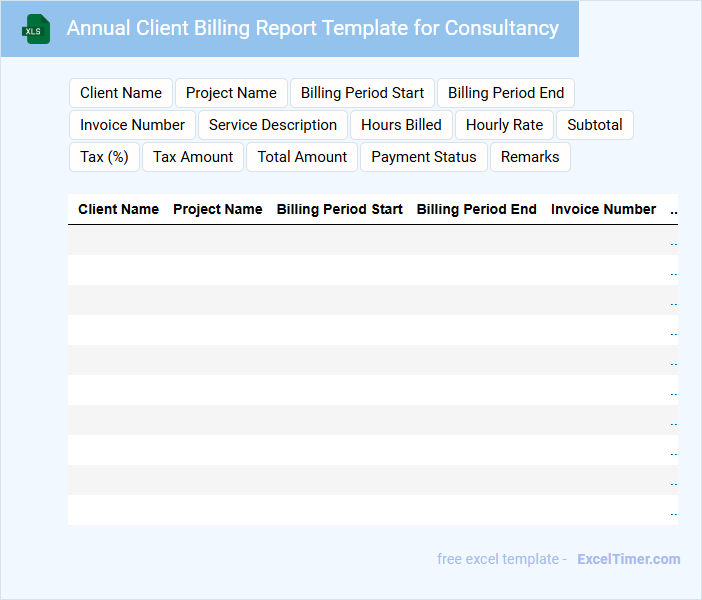

Annual Client Billing Report Template for Consultancy

An Annual Client Billing Report Template for consultancy typically contains detailed records of all client invoices and payments received throughout the year. It includes breakdowns of services provided, billing dates, amounts due, and payment statuses to ensure accurate financial tracking. Using this template helps consultants maintain transparency and efficiency in managing client accounts.

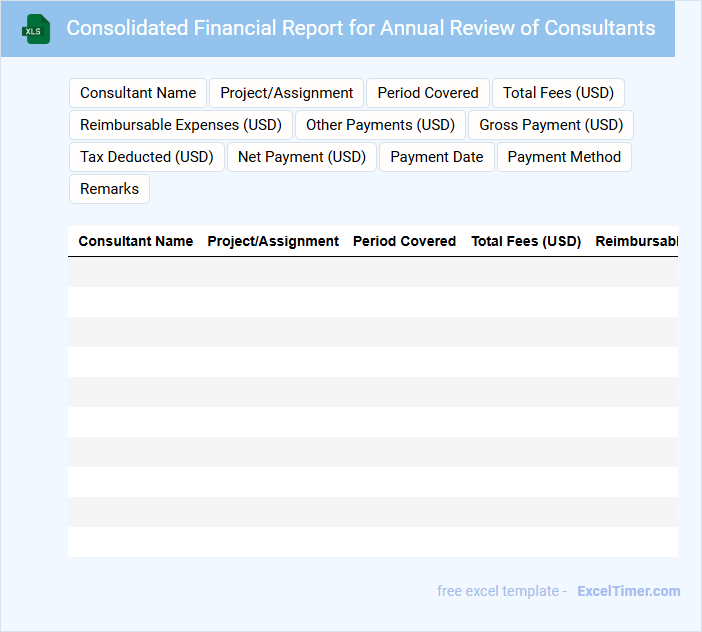

Consolidated Financial Report for Annual Review of Consultants

The Consolidated Financial Report for the Annual Review of Consultants provides a comprehensive overview of the financial performance and expenditures related to consulting services during the fiscal year. It includes aggregated financial statements, expense breakdowns, and payment summaries from all consulting contracts.

Such a document is crucial for assessing the overall cost-effectiveness and budget adherence of consulting engagements. Key recommendations include ensuring accuracy in data consolidation and highlighting any significant financial variances or compliance issues for review.

What are the key components that must be included in an annual financial report for consultants?

An annual financial report for consultants must include an income statement detailing revenue and expenses, a balance sheet outlining assets, liabilities, and equity, and a cash flow statement showing cash inflows and outflows. Key components also involve notes to the financial statements explaining accounting policies and any contingent liabilities. Accurate financial ratios and performance metrics tailored to consulting services enhance the report's analytical value.

How should revenue and expenses be categorized and presented in the report?

Revenue should be categorized by source, such as consulting fees, project bonuses, and retainer income, to provide clear insight into your financial performance. Expenses must be detailed by type, including salaries, software subscriptions, travel, and office supplies, to accurately track cost management. Presenting these categories in a structured income statement format enhances clarity and supports informed financial decision-making.

Which financial performance indicators are most relevant for a consultancy's annual review?

Key financial performance indicators for a consultancy's annual review include revenue growth rate, net profit margin, and billable utilization rate. Tracking days sales outstanding (DSO) and client acquisition costs helps evaluate cash flow efficiency and marketing effectiveness. Monitoring these metrics ensures accurate assessment of financial health and operational productivity.

What supporting documentation should accompany the annual figures in the Excel report?

Your annual financial report should include supporting documentation such as detailed invoices, expense receipts, bank statements, and contract agreements to verify the reported figures. Ensure backup files are organized and easily accessible within the Excel workbook for audit and review purposes. Including summarized notes on assumptions and accounting methods enhances clarity and compliance.

How should year-over-year changes be visually and numerically represented for clarity?

Year-over-year changes in an annual financial report for consultants should be visually represented using bar or line charts highlighting trends in revenue, expenses, and profit margins. Numerically, percentage change columns alongside absolute value differences provide clear comparison between fiscal years. Conditional formatting with color codes enhances quick identification of positive or negative performance shifts.