The Annually Tax Preparation Excel Template for Freelancers streamlines annual tax filing by organizing income, expenses, and deductions in one easy-to-use spreadsheet. This template helps freelancers accurately calculate taxable income, ensuring compliance with tax laws and maximizing possible deductions. Its customizable format supports tracking multiple income sources and simplifies the entire tax preparation process, saving valuable time and reducing errors.

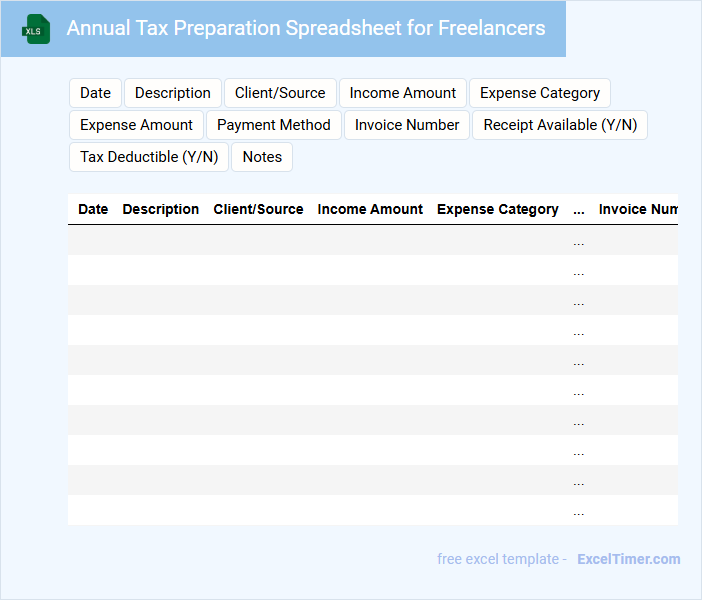

Annual Tax Preparation Spreadsheet for Freelancers

An Annual Tax Preparation Spreadsheet for freelancers typically includes detailed records of income, expenses, and tax deductions organized by month. It helps freelancers maintain accurate financial data throughout the year, simplifying the tax filing process. Including sections for estimated tax payments and invoicing details can improve usability.

This document is essential for tracking earnings from multiple clients and categorizing deductible expenses such as home office costs and supplies. The spreadsheet often contains formulas to automatically calculate totals and tax liabilities. Ensuring the spreadsheet is updated regularly and backs up important receipts is highly recommended.

Yearly Income & Expense Tracker for Freelance Tax Filing

A Yearly Income & Expense Tracker for Freelance Tax Filing is essential for organizing all financial transactions made throughout the year. It helps freelancers accurately report earnings and deductible expenses to comply with tax regulations.

This document typically contains detailed records of income sources, categorized expenses, and supporting receipts or invoices. Including a summary of tax-deductible items and estimated tax payments ensures smooth and error-free tax filing.

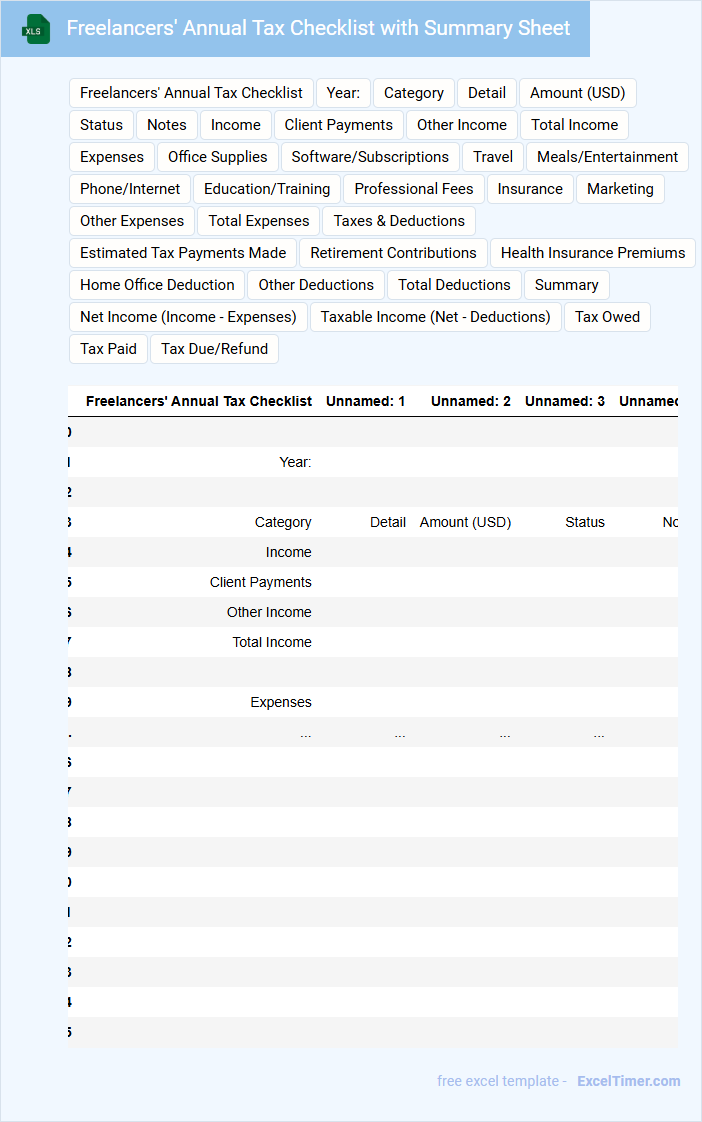

Freelancers' Annual Tax Checklist with Summary Sheet

This document typically contains a comprehensive list of tax-related items freelancers need to prepare for their annual tax filing. It also includes a summary sheet to help organize and review financial information efficiently.

- Gather all income records, including invoices and payment statements.

- Compile receipts and records of deductible expenses throughout the year.

- Verify estimated tax payments made and calculate any remaining balance due.

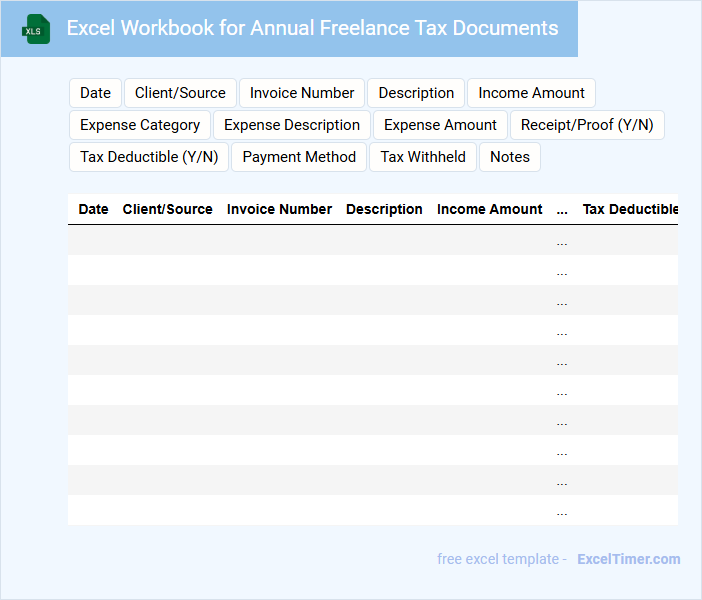

Excel Workbook for Annual Freelance Tax Documents

An Excel Workbook for Annual Freelance Tax Documents typically contains detailed financial records, including income, expenses, and deductions. It helps in organizing all essential tax-related data in one place for easy reference and accurate reporting. Key information like invoices, receipts, and payment dates are crucial for effective tax filing and audit preparation.

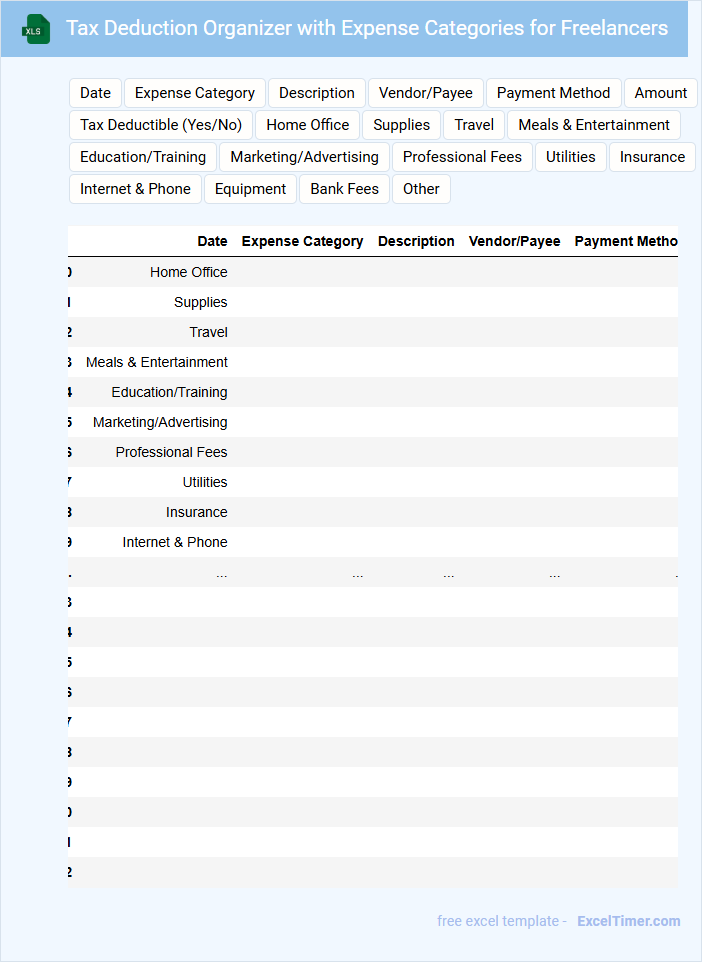

Tax Deduction Organizer with Expense Categories for Freelancers

A Tax Deduction Organizer for freelancers helps track and categorize expenses efficiently. It usually contains sections for income, business expenses, and tax-deductible costs. This document is essential for accurate tax filing and maximizing deductions.

Important elements to include are clearly defined expense categories like office supplies, travel, and software subscriptions. Also, maintaining detailed records with dates, amounts, and receipts ensures compliance with tax regulations. Regular updates prevent last-minute stress during tax season.

Annual Invoice & Payment Tracker for Freelance Professionals

The Annual Invoice & Payment Tracker is a crucial document for freelance professionals to systematically record all invoices issued and payments received throughout the year. It typically contains invoice numbers, dates, client details, payment status, and amounts. This tracker helps ensure accurate financial management and timely follow-ups on outstanding payments.

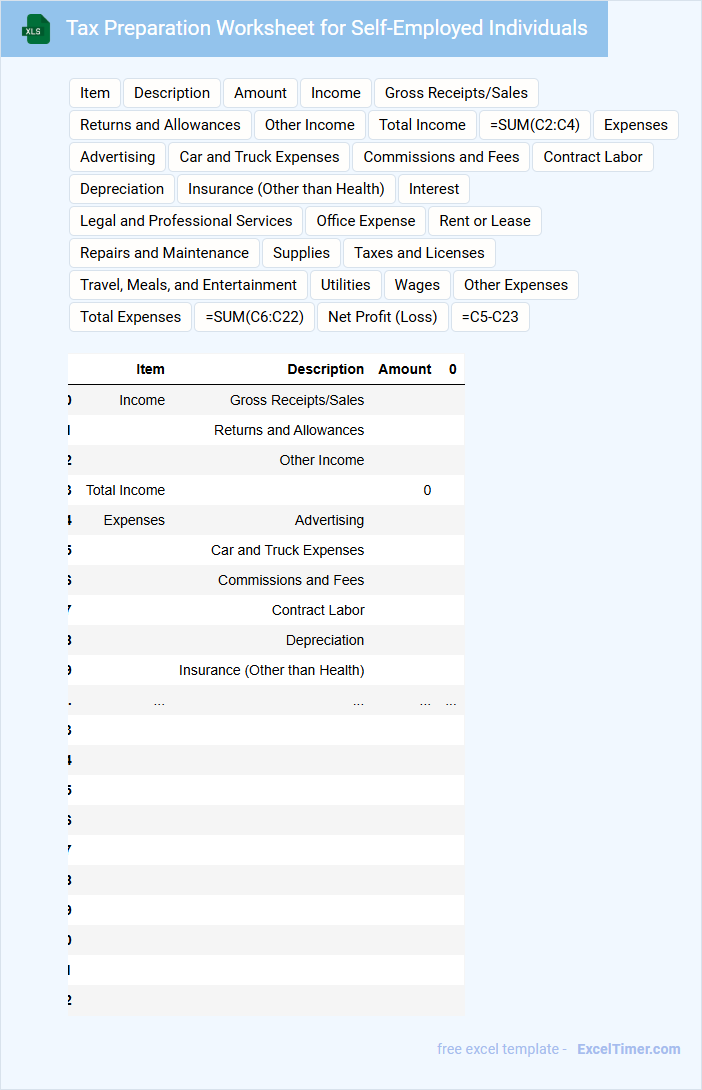

Tax Preparation Worksheet for Self-Employed Individuals

A Tax Preparation Worksheet for Self-Employed Individuals is a document that helps organize income, expenses, and deductions to accurately file taxes.

- Income Tracking: Record all sources of self-employment income including invoices and sales records.

- Expense Documentation: Keep detailed receipts and categorize expenses such as office supplies and travel for deductions.

- Estimated Taxes: Calculate quarterly estimated tax payments to avoid penalties and ensure compliance.

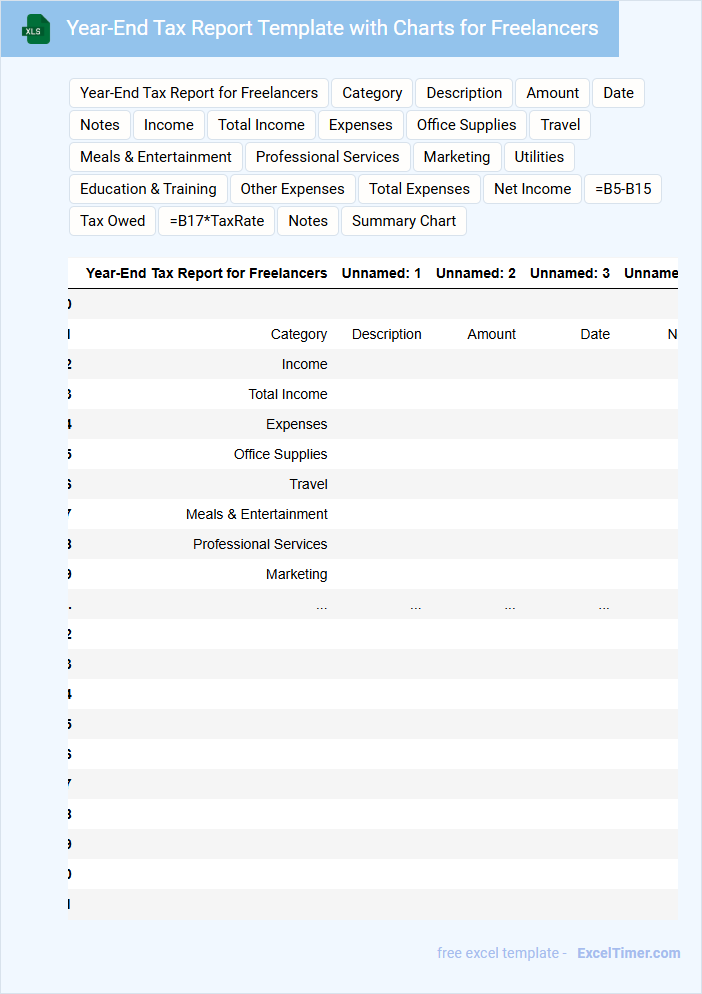

Year-End Tax Report Template with Charts for Freelancers

The Year-End Tax Report Template for freelancers typically contains detailed financial summaries, including income, expenses, and tax deductions. It often features charts that visualize earnings trends and expense categories, aiding in clear financial analysis. This template ensures freelancers are well-prepared for tax filing by organizing all necessary information efficiently.

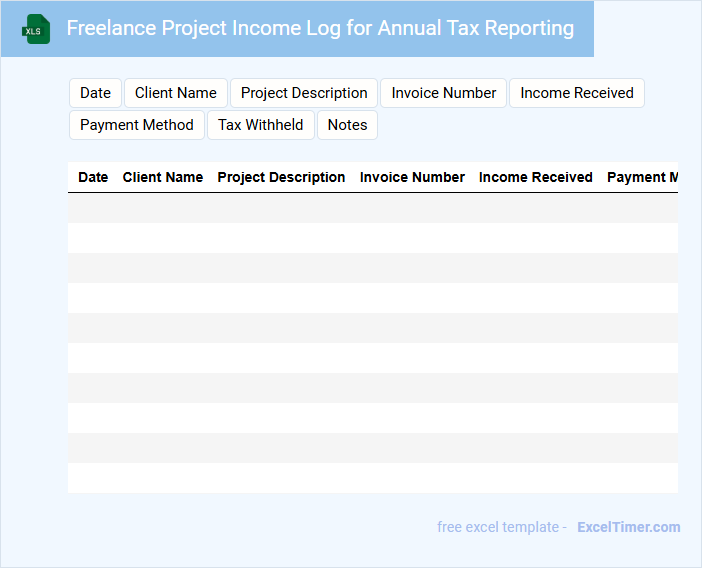

Freelance Project Income Log for Annual Tax Reporting

What information is typically contained in a Freelance Project Income Log for Annual Tax Reporting? This document usually records detailed income earnings from various freelance projects including dates, client names, payment amounts, and descriptions of work completed. It helps freelancers organize financial data systematically for accurate tax filing and income tracking.

What is an important suggestion when maintaining this log? Consistently updating the log with exact payment details and retaining all related invoices or receipts ensures thorough documentation. This practice supports clear tax reporting, simplifies audits, and improves financial management throughout the year.

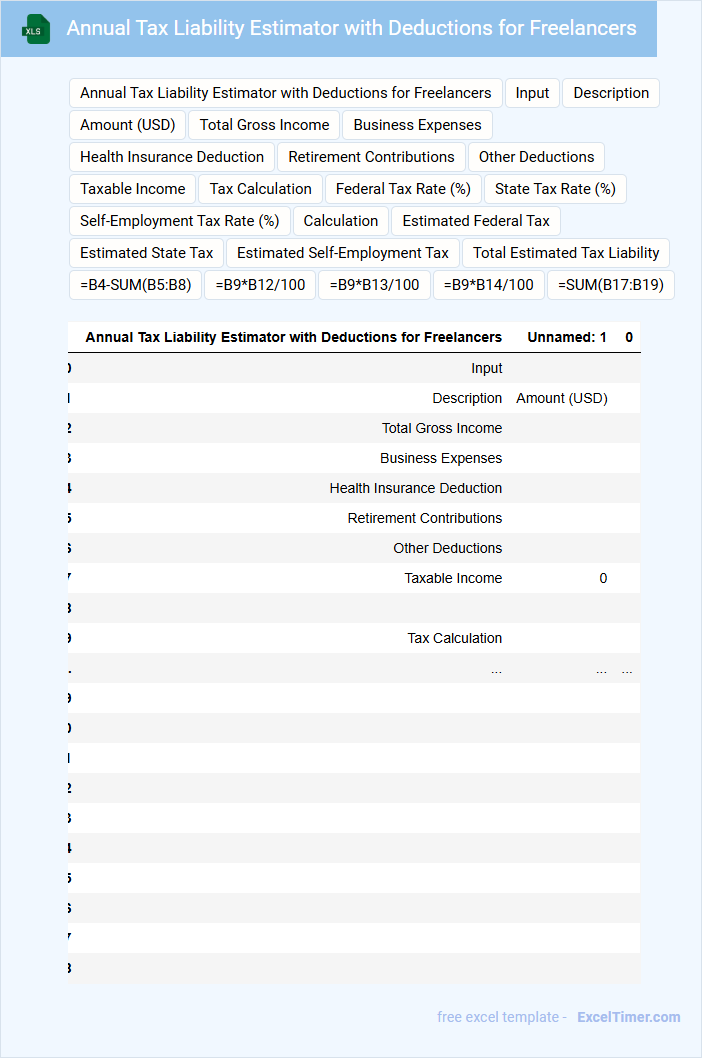

Annual Tax Liability Estimator with Deductions for Freelancers

This document typically contains an Annual Tax Liability Estimator designed to help freelancers calculate their yearly tax obligations accurately. It includes sections for income sources, deductible expenses, and potential tax credits. Additionally, it suggests keeping detailed records of all transactions and deductions to maximize tax savings.

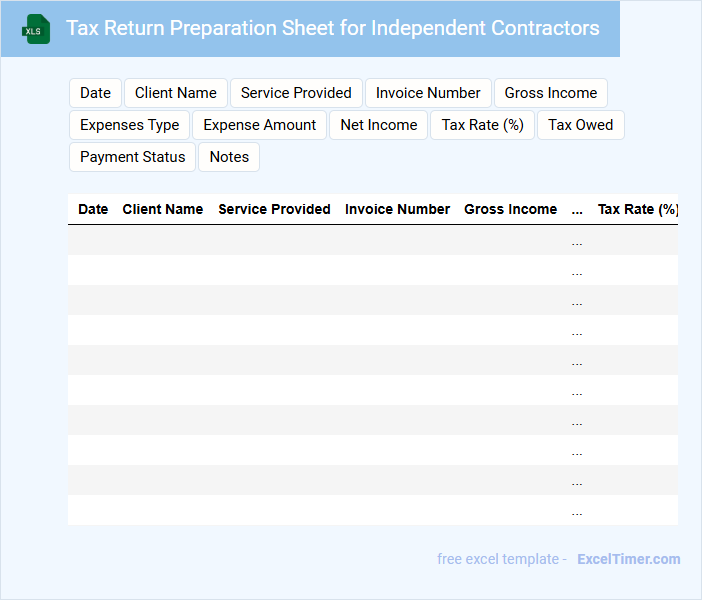

Tax Return Preparation Sheet for Independent Contractors

What information is typically included in a Tax Return Preparation Sheet for Independent Contractors? This document usually contains detailed records of income earned, expenses incurred, and relevant tax deductions specific to independent contractors. It helps in organizing financial data efficiently to ensure accurate tax filing and compliance with tax regulations.

Why is it important to maintain accurate and complete details in this sheet? Keeping precise records prevents errors and omissions, which can lead to audits or penalties. Additionally, it maximizes potential tax benefits by capturing all deductible expenses and income sources.

Expense Tracker with Receipts Log for Annual Tax Filing

An Expense Tracker with Receipts Log is a document designed to systematically record all financial expenditures throughout the year. It helps in categorizing expenses to ensure thorough and accurate financial management.

This type of document is essential for Annual Tax Filing as it consolidates all deductible expenses and supports claims with corresponding receipts. Maintaining organized entries prevents errors and simplifies the audit process.

For best results, regularly update the tracker and keep digital copies of all receipts for easy access and verification.

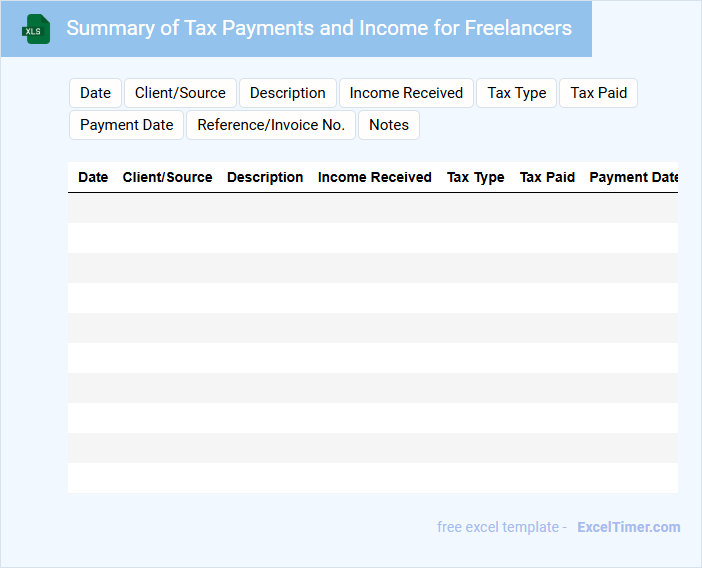

Summary of Tax Payments and Income for Freelancers

A Summary of Tax Payments and Income for Freelancers typically contains detailed records of earnings and taxes paid throughout a fiscal year. This document is essential for accurately reporting income to tax authorities and ensuring compliance with tax regulations. Freelancers should keep this summary organized to facilitate smooth tax filing and financial planning.

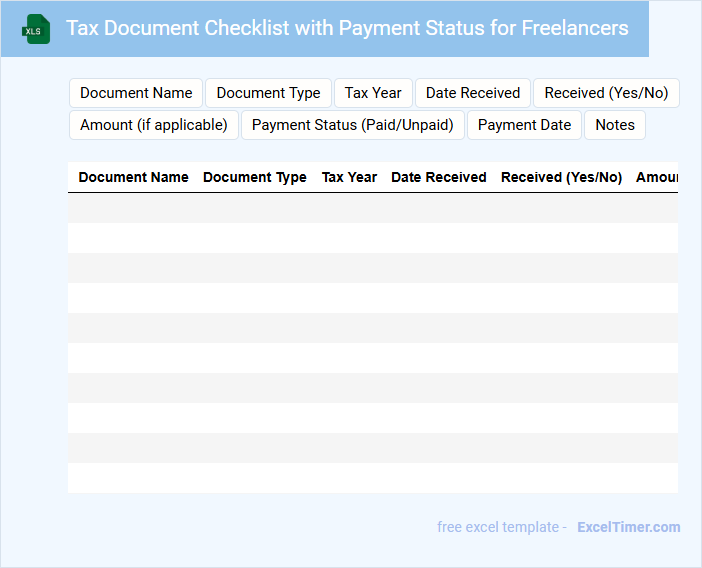

Tax Document Checklist with Payment Status for Freelancers

This Tax Document Checklist with Payment Status for Freelancers typically contains essential tax forms, payment records, and submission deadlines to ensure accurate and timely tax filing.

- Tax Forms: Include all necessary IRS forms such as 1099-MISC or 1099-NEC received from clients.

- Payment Records: Maintain detailed records of all received payments including dates and amounts for accurate income reporting.

- Submission Deadlines: Track important tax filing dates to avoid penalties and ensure compliance with IRS regulations.

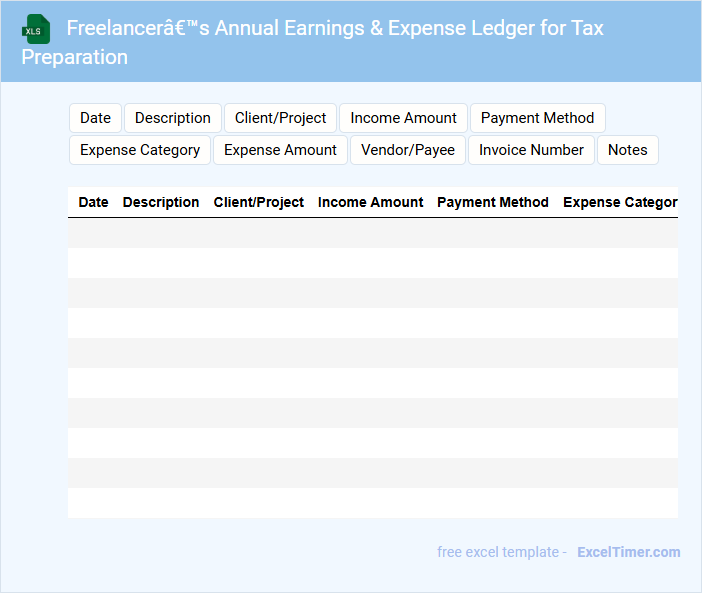

Freelancer’s Annual Earnings & Expense Ledger for Tax Preparation

The Freelancer's Annual Earnings & Expense Ledger is a comprehensive document detailing income and expenditures throughout the fiscal year. It is crucial for accurate tax preparation and financial tracking. Including categorized records ensures clarity and thoroughness during tax filing.

What key income sources must freelancers track for accurate annual tax preparation in Excel?

Freelancers must track primary income sources such as client payments, project-based earnings, and royalties in Excel for accurate annual tax preparation. Recording additional income like affiliate commissions, rental income from workspaces, and interest from business accounts ensures comprehensive reporting. Organized categorization of income streams supports precise tax calculations and compliance.

Which deductible business expenses should freelancers categorize and document in their Excel spreadsheet?

Freelancers should categorize and document deductible business expenses such as office supplies, software subscriptions, travel costs, and home office expenses in their Excel spreadsheet. Tracking client payments, mileage, and professional development fees also optimizes tax preparation accuracy. Your detailed records ensure maximum deductions and compliance during annual tax filing.

How can freelancers use Excel to estimate quarterly tax payments based on annualized income?

Freelancers can use Excel to estimate quarterly tax payments by inputting their annualized income and applying the appropriate tax rates for each quarter. Your Excel sheet can automatically calculate estimated tax liabilities, factoring in deductions and income fluctuations throughout the year. This method streamlines tax preparation and ensures timely, accurate quarterly payments.

What Excel methods help freelancers organize and summarize 1099 income for tax reporting?

Excel functions like PivotTables enable freelancers to quickly organize and categorize 1099 income by client and date. SUMIF and SUMIFS formulas help calculate total income from multiple sources efficiently for tax reporting. Conditional formatting highlights discrepancies and missing data, ensuring accurate annual tax preparation.

How does Excel assist in preparing supporting documentation for tax credits and deductions relevant to freelancers?

Excel streamlines organizing income and expense records, enabling freelancers to track deductible costs accurately. It facilitates categorizing transactions and calculating totals for tax credits like home office or equipment expenses. Customizable templates and formulas ensure precise documentation to support tax return claims efficiently.