![]()

The Annually Revenue Tracker Excel Template for Freelancers offers an organized and efficient way to monitor yearly income sources and track financial growth. It includes features like monthly income categorization, automatic total calculations, and visual charts to analyze trends over time. Using this template helps freelancers maintain clear financial records and plan for tax season with ease.

Annual Revenue Tracker Excel Template for Freelancers

An Annual Revenue Tracker Excel Template for freelancers is typically designed to record and monitor all income streams throughout the year. It helps in organizing financial data systematically for accurate tracking and planning.

This type of document usually contains monthly revenue entries, client details, project descriptions, and categorization of income sources. It is essential for freelancers to maintain clear and consistent records for tax reporting and business analysis.

Ensure the template includes customizable fields for additional expenses and a summary dashboard to visualize yearly earnings effectively.

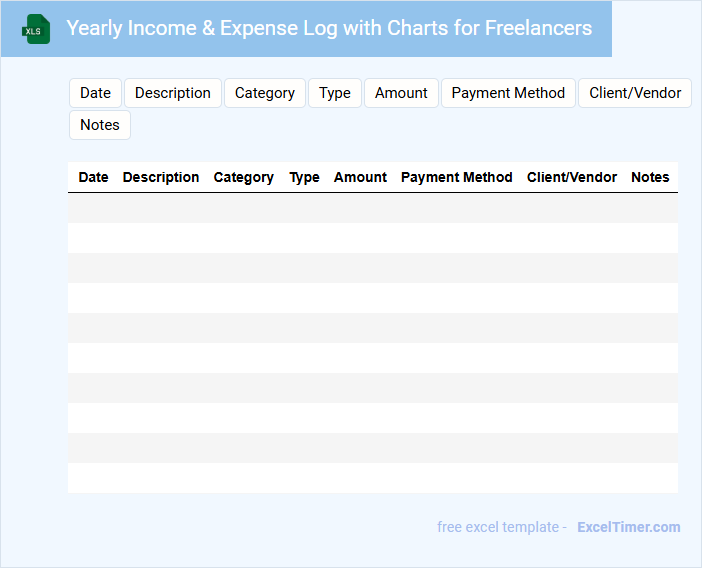

Yearly Income & Expense Log with Charts for Freelancers

A Yearly Income & Expense Log for freelancers is typically a detailed record of all earnings and expenditures throughout the year. This document helps in tracking financial health and identifying spending patterns. Incorporating charts enhances visualization, making financial analysis more intuitive and effective.

Freelance Business Annual Revenue Report Spreadsheet

The Freelance Business Annual Revenue Report Spreadsheet typically contains detailed entries of income streams categorized by client, project, and date. It captures essential financial data to help track growth and assess business health over the fiscal year.

This document is crucial for budgeting and tax preparation, providing clear visibility of revenue and facilitating strategic planning. Maintaining accurate and up-to-date records ensures reliable analysis and compliance with financial regulations.

Important to include are breakdowns of expenses, monthly revenue summaries, and projections to support informed decision-making.

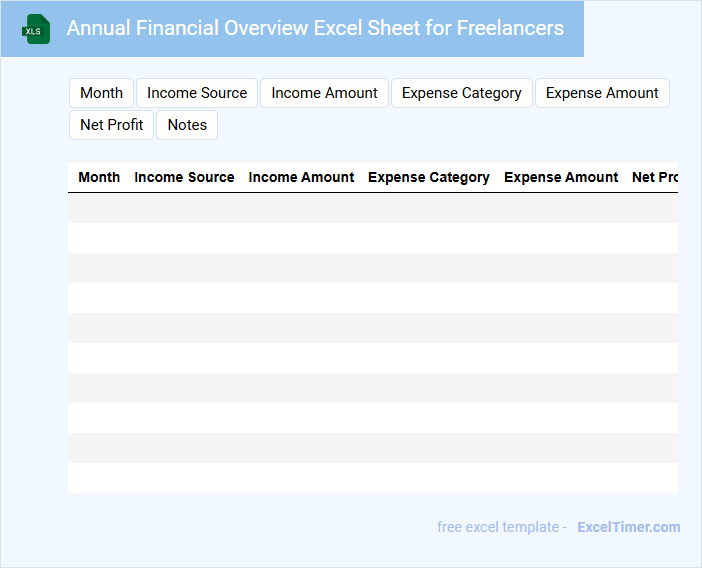

Annual Financial Overview Excel Sheet for Freelancers

An Annual Financial Overview Excel Sheet for freelancers typically contains detailed records of income, expenses, and profit and loss statements throughout the fiscal year. It helps freelancers track their financial performance, manage budgets, and prepare for tax filing effectively. A crucial aspect of this document is its ability to provide clear and organized financial insights enabling better decision-making and financial planning.

Year-End Earnings Tracker Template with Monthly Breakdown

The Year-End Earnings Tracker Template is a structured document designed to monitor and analyze income over a 12-month period. It typically contains detailed monthly earnings, cumulative totals, and variance comparisons to previous years. This type of template helps in identifying income trends and making informed financial decisions.

For optimal use, ensure accuracy in monthly data entry and include columns for sources of income, deductions, and net earnings. Incorporating visual charts can enhance the understanding of income fluctuations over the year. Finally, updating the template regularly facilitates better year-end financial planning and goal setting.

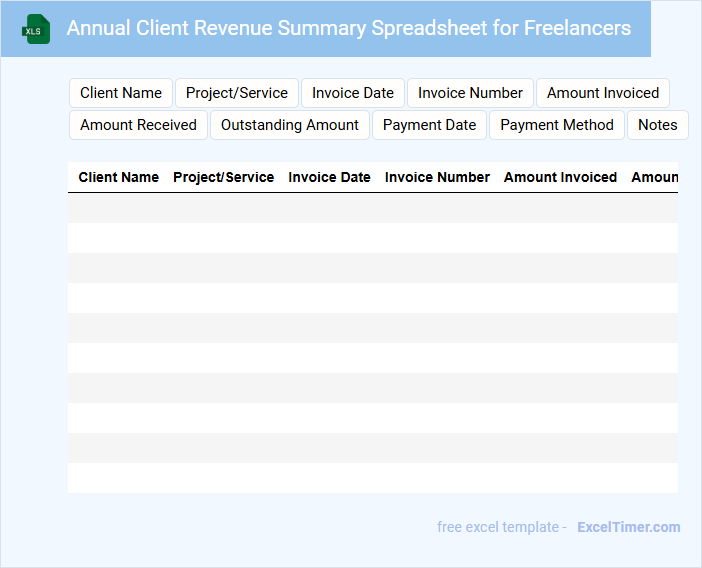

Annual Client Revenue Summary Spreadsheet for Freelancers

An Annual Client Revenue Summary Spreadsheet for freelancers typically contains detailed records of income earned from various clients throughout the year. It includes client names, payment dates, invoice amounts, and total revenues categorized by month or project. This document helps freelancers track earnings, manage taxes, and evaluate client profitability.

For optimal use, ensure the spreadsheet is regularly updated with accurate payment information and includes clear categorizations for different types of income. Incorporate formulas to automatically calculate totals and outstanding balances. Also, maintain backup copies to prevent data loss and facilitate financial reviews.

Freelancer Annual Income Tracker with Invoice Log

A Freelancer Annual Income Tracker with Invoice Log is a document used to record and manage income earned throughout the year alongside detailed invoice records. It helps freelancers keep their financial information organized for tax purposes and business analysis.

- Record each invoice with date, client name, and amount to track payments accurately.

- Summarize monthly and annual income for quick financial review and tax filing ease.

- Include payment status and notes to monitor overdue invoices and client communications.

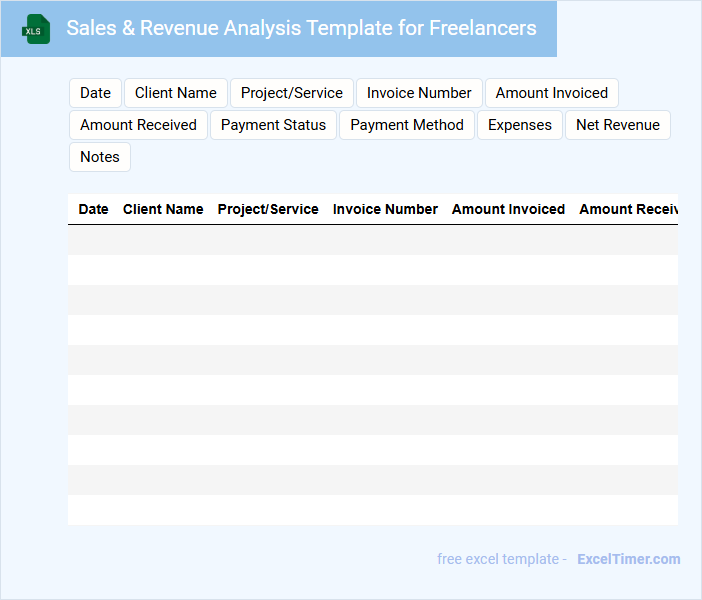

Sales & Revenue Analysis Template for Freelancers

A Sales & Revenue Analysis Template for Freelancers typically contains detailed records of income streams and sales performance over time, helping freelancers track their financial growth. It also includes metrics to evaluate client segments and project profitability.

- Include clear categorization of revenue sources for accurate tracking.

- Incorporate visual charts to easily identify sales trends and patterns.

- Ensure regular updates to reflect real-time financial status.

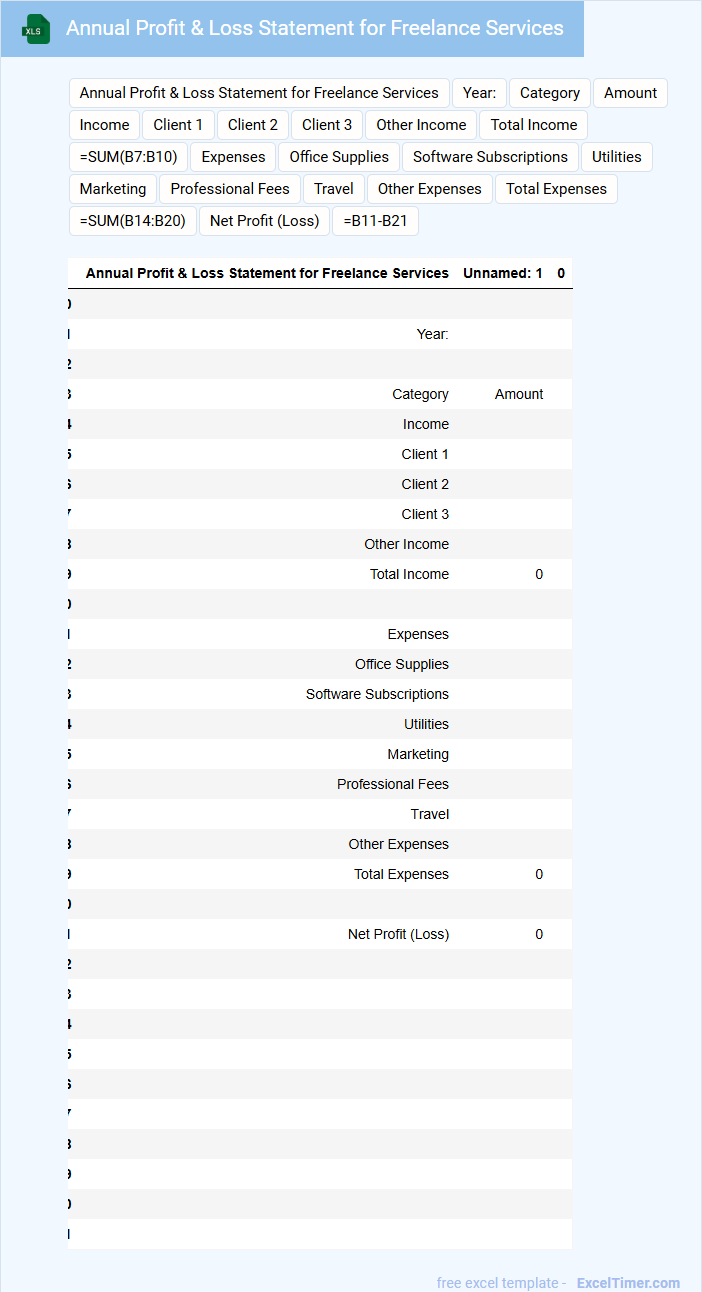

Annual Profit & Loss Statement for Freelance Services

An Annual Profit & Loss Statement for Freelance Services typically contains a detailed summary of income, expenses, and net profit over the fiscal year.

- Revenue Sources: Document all freelance income streams clearly to track total earnings accurately.

- Expense Categorization: List and categorize all business-related expenses to monitor deductions and budgeting efficiently.

- Net Profit Calculation: Calculate net profit by subtracting total expenses from total revenue to assess financial performance.

Freelancers’ Revenue and Expense Dashboard with Graphs

The Freelancers' Revenue and Expense Dashboard is a vital tool for tracking income and expenditures efficiently. It usually contains detailed summaries of various revenue streams and categorized expenses. Visual graphs help freelancers easily identify financial trends and make informed decisions.

Important features to include are clear categorization of income and expenses, real-time data updates, and interactive graph displays. Incorporating monthly and yearly comparisons can enhance financial understanding. Additionally, notifications for due payments and budget limits help maintain financial discipline.

Yearly Billing and Payment Tracker for Freelancers

A Yearly Billing and Payment Tracker for freelancers typically contains detailed records of invoices sent, payments received, and outstanding balances. It helps in organizing financial transactions throughout the year to maintain clear cash flow management.

Important elements to include are client names, invoice numbers, amounts, payment due dates, and payment status. Regularly updating the tracker ensures timely follow-ups and accurate financial reporting.

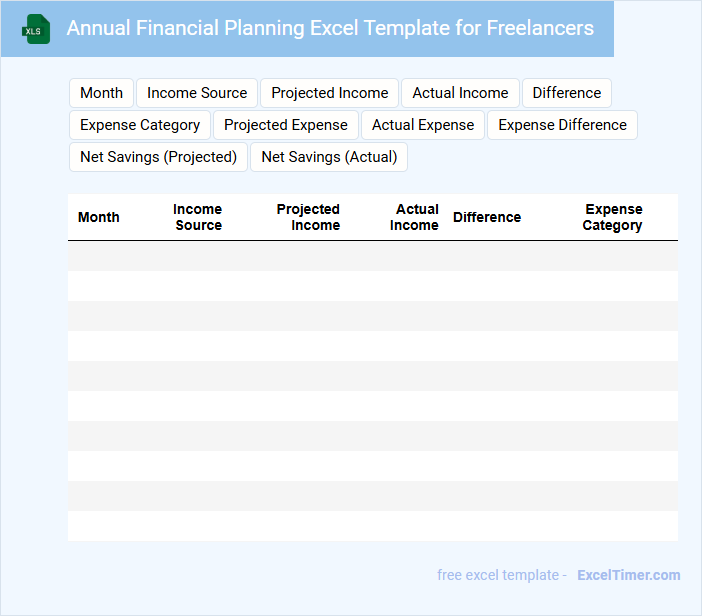

Annual Financial Planning Excel Template for Freelancers

An Annual Financial Planning Excel Template for freelancers typically contains sections for income tracking, expense management, and profit forecasting. It helps freelancers monitor their cash flow, budget for upcoming projects, and plan taxes effectively. This document streamlines financial organization, ensuring a clear overview of yearly earnings and expenditures.

Important elements to include are a detailed income log by client or project, categorized expense records, and a summary dashboard with key financial metrics. Additionally, embedding tax estimation and savings goals ensures comprehensive planning. Utilizing formulas for automatic calculations enhances accuracy and saves time during updates.

Income Tracker with Tax Estimator for Freelancers

An Income Tracker with Tax Estimator for Freelancers is a document designed to monitor earnings and calculate estimated taxes efficiently. It usually contains detailed records of invoices, payments, and categorized expenses to provide a clear financial overview.

Including a tax estimator helps freelancers anticipate their tax liabilities and avoid surprises at the end of the fiscal year. Regular updates and accurate data entry are crucial for maintaining the document's effectiveness.

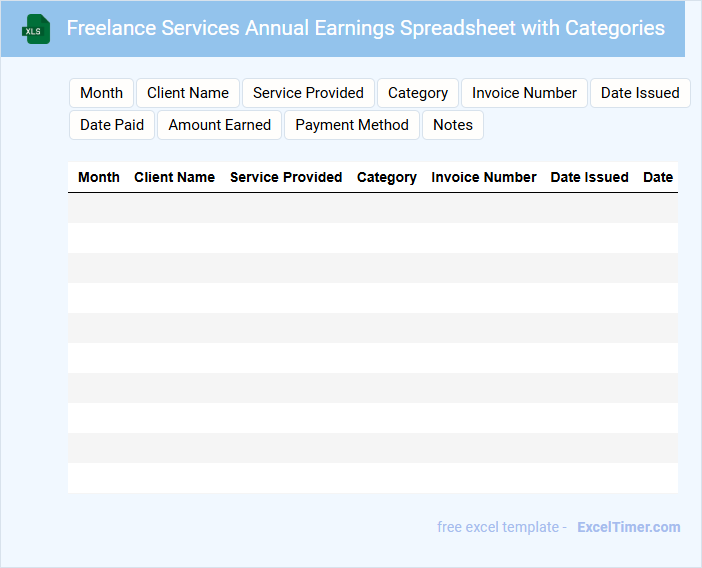

Freelance Services Annual Earnings Spreadsheet with Categories

What information is typically included in a Freelance Services Annual Earnings Spreadsheet with Categories? This document usually contains detailed records of earnings from various freelance services organized by categories such as project type, client, and payment date. It helps freelancers track income sources, monitor financial progress, and manage tax-related data efficiently.

What important elements should be considered when creating this spreadsheet? It is essential to include clear category labels, accurate dates, payment statuses, and subtotals for each category to ensure clarity and easy analysis. Regular updates and backup copies are also crucial to maintain accurate and accessible financial records throughout the year.

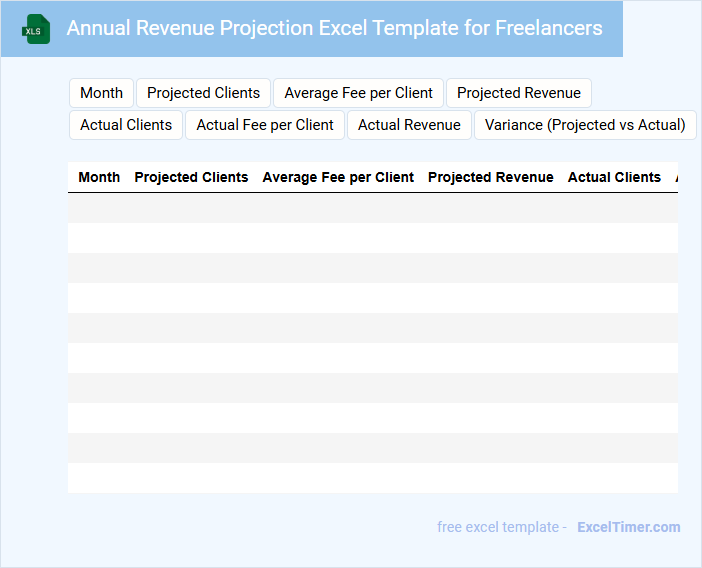

Annual Revenue Projection Excel Template for Freelancers

An Annual Revenue Projection Excel Template for Freelancers is a document designed to help freelancers estimate their yearly income based on various client projects and payment schedules. It typically includes detailed breakdowns of expected earnings, expenses, and net revenue to provide a comprehensive financial outlook.

- Include categories for different types of freelance services to accurately track income sources.

- Incorporate monthly and annual summaries to monitor cash flow effectively.

- Add sections for recurring expenses and tax deductions to ensure accurate profit calculations.

What key metrics should be included in an annual revenue tracker for freelancers?

An annual revenue tracker for freelancers should include key metrics such as total income, client payment dates, and project expenses to ensure accurate cash flow monitoring. Tracking average invoice value and payment frequency helps optimize financial planning and identify high-value clients. Your revenue tracker must also capture tax obligations and outstanding invoices to maintain financial compliance and improve collection efficiency.

How can you categorize sources of income to optimize financial analysis in your Excel tracker?

Categorize sources of income in your Excel Annual Revenue Tracker by client, project type, and payment frequency to enhance financial insights. Use distinct columns for categories like consulting, design, and licensing to track revenue streams clearly. Incorporate dropdown lists for consistent data entry and apply pivot tables to analyze income trends efficiently.

What formulas and functions can automate monthly and yearly revenue calculations?

Excel functions like SUM, SUMIF, and SUMPRODUCT automate monthly and yearly revenue calculations efficiently. Using SUMIF, you can total revenue based on specific months, while SUMPRODUCT helps calculate weighted values for detailed income analysis. Your Annually Revenue Tracker becomes dynamic and accurate with these formula integrations.

How should expenses and taxes be tracked to provide accurate net revenue insights?

Track expenses by categorizing costs such as software subscriptions, office supplies, and marketing fees with date and amount details. Record taxes by estimating quarterly payments based on income brackets and including deductions to reflect true liabilities. This method ensures precise calculation of net revenue by subtracting total expenses and taxes from gross income.

What visualizations (e.g., charts, graphs) best represent annual revenue trends for freelancers?

Line charts effectively display your annual revenue trends by showing fluctuations over time. Bar graphs provide a clear comparison of monthly or quarterly earnings within the year. Heat maps highlight peak income periods, helping freelancers identify seasonal patterns.