The Annually Tax Preparation Excel Template for Consultants streamlines the tax filing process by organizing income, expenses, and deductions in one easy-to-use spreadsheet. This template helps consultants ensure accuracy and compliance with tax regulations while saving time on calculations and record-keeping. Its customizable features enable users to track their financial data throughout the year, making tax preparation more efficient and less stressful.

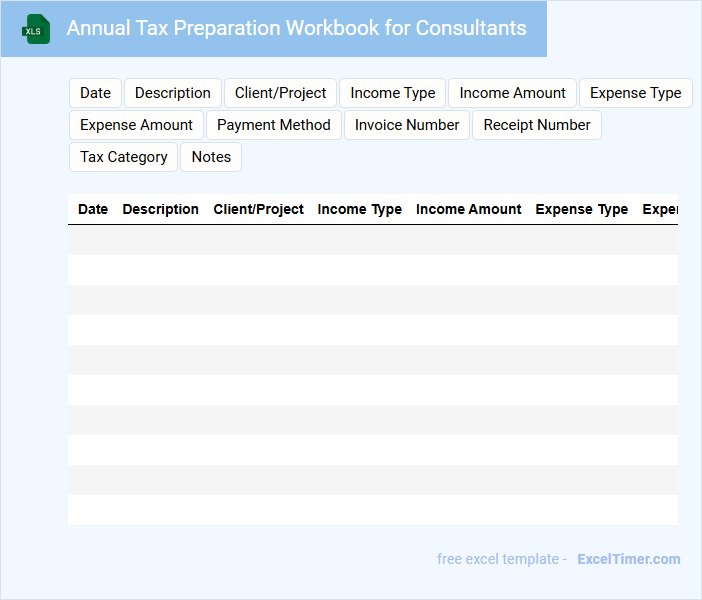

Annual Tax Preparation Workbook for Consultants

Annual Tax Preparation Workbook for Consultants is a comprehensive tool designed to organize and streamline the tax documentation process. It typically contains sections for income tracking, expense categorization, and necessary tax forms to ensure accuracy. Utilizing this workbook can significantly simplify the consultant's tax filing and maximize eligible deductions.

Income and Expense Tracker for Consultant Tax Preparation

An Income and Expense Tracker for Consultant Tax Preparation is a document used to systematically record all incoming revenue and outgoing costs related to consulting services. It typically contains categories for various income sources, deductible expenses, and summaries for tax reporting purposes. Maintaining accurate and organized entries in this tracker helps ensure compliance and maximizes tax benefits.

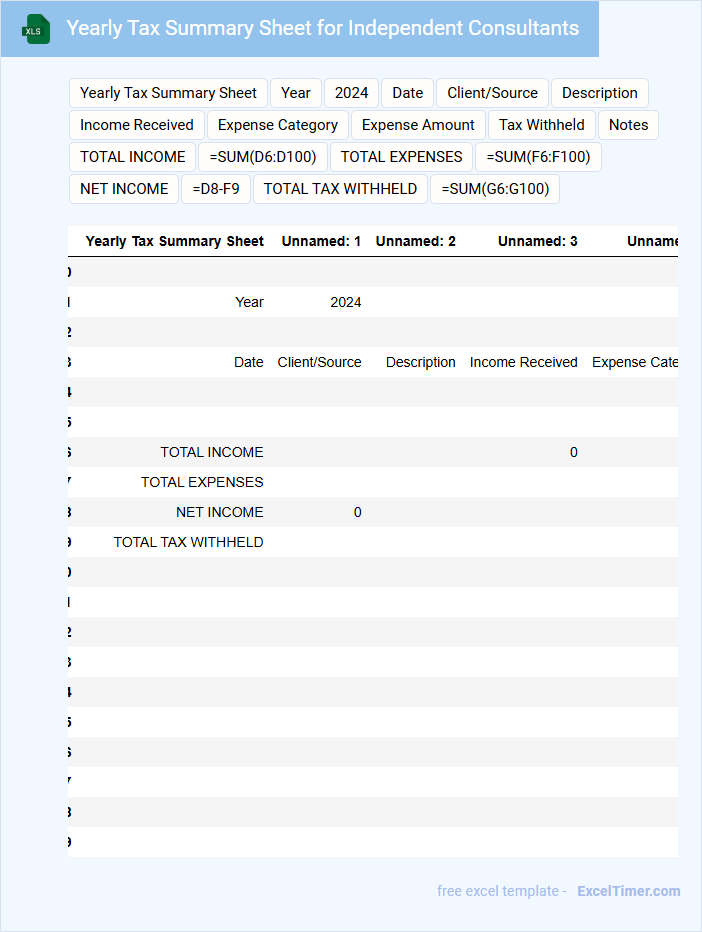

Yearly Tax Summary Sheet for Independent Consultants

A Yearly Tax Summary Sheet for Independent Consultants typically contains detailed records of income, expenses, and tax deductions relevant to the fiscal year. It helps consultants track their financial activities to ensure accurate tax filing and compliance. Including clear categorization of earnings and deductible expenses is crucial for maximizing tax benefits and minimizing errors.

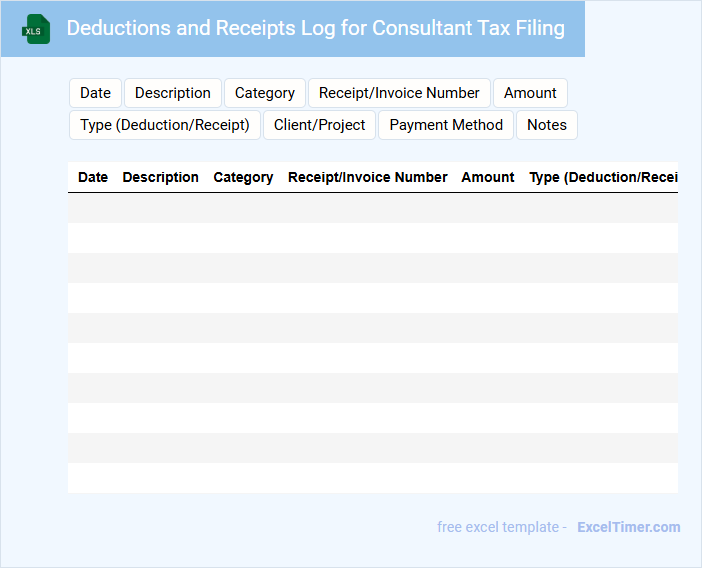

Deductions and Receipts Log for Consultant Tax Filing

What information is typically contained in a Deductions and Receipts Log for Consultant Tax Filing? This document usually includes detailed records of all deductible expenses and income receipts related to consultancy services. It helps ensure accurate tracking of financial transactions for tax reporting and compliance purposes.

Why is maintaining an accurate Deductions and Receipts Log important for consultants? Keeping precise records minimizes errors during tax filing, supports claims for deductions, and provides evidence in case of audits. Consultants should regularly update this log with dates, amounts, descriptions, and relevant supporting documents.

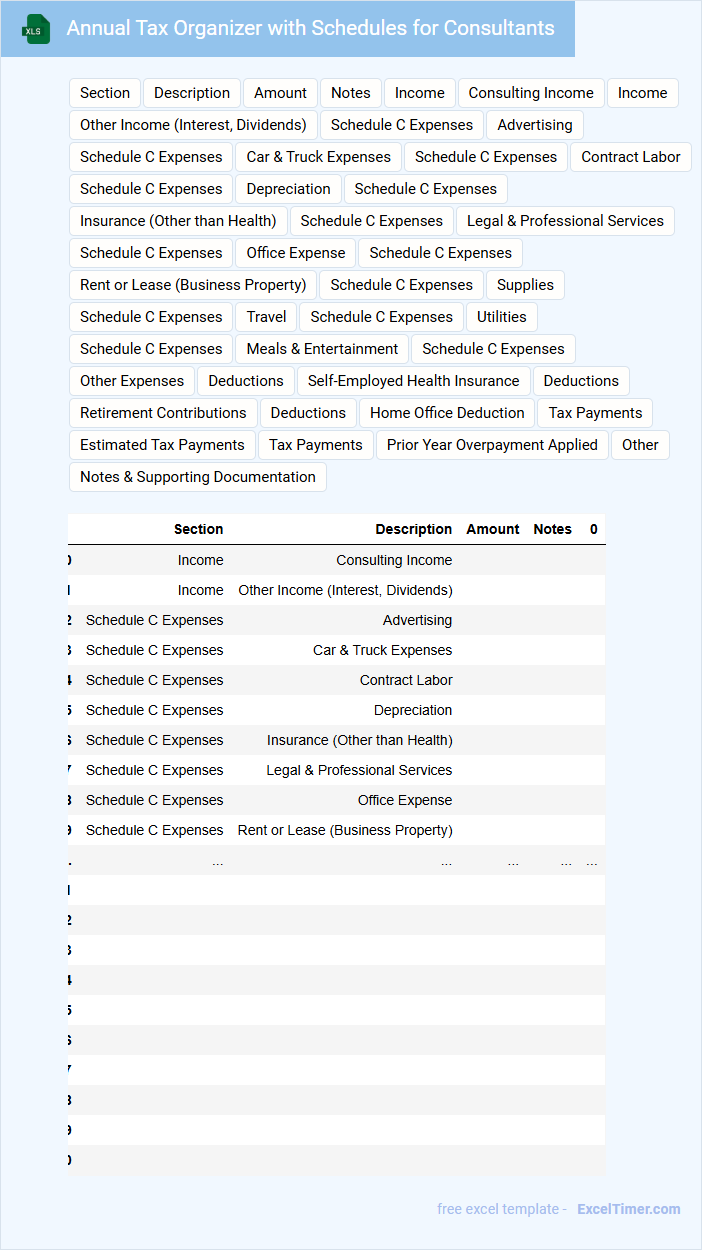

Annual Tax Organizer with Schedules for Consultants

The Annual Tax Organizer is a comprehensive document designed to gather all relevant financial information needed to prepare tax returns efficiently. It usually contains sections for income details, deductions, credits, and important receipts.

For Consultants, it is essential to include schedules detailing business expenses, client payments, and travel records. Organizing these documents clearly helps maximize tax benefits and ensures accuracy during filing.

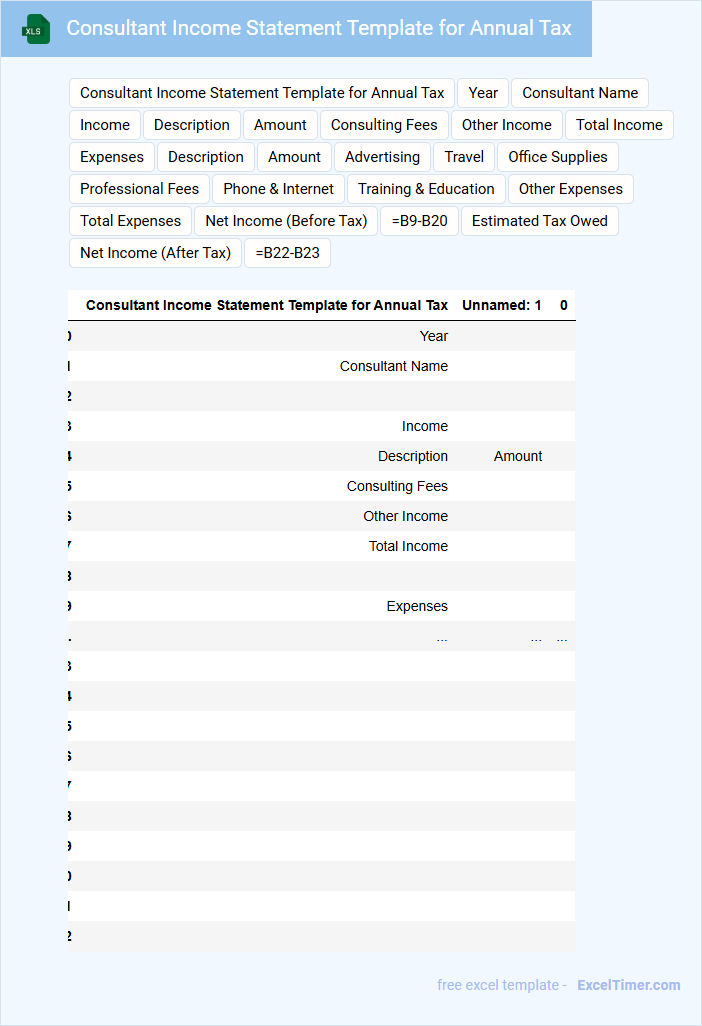

Consultant Income Statement Template for Annual Tax

What information is typically included in a Consultant Income Statement Template for Annual Tax? This type of document usually contains detailed records of all income earned and expenses incurred by a consultant throughout the fiscal year. It helps in accurately calculating net profit or loss, which is essential for filing annual tax returns.

Important elements to include are gross income, categorized expenses (such as travel, office supplies, and professional fees), and any tax deductions or credits applicable. Ensuring accuracy and completeness in these sections can simplify tax reporting and help maximize legitimate tax benefits.

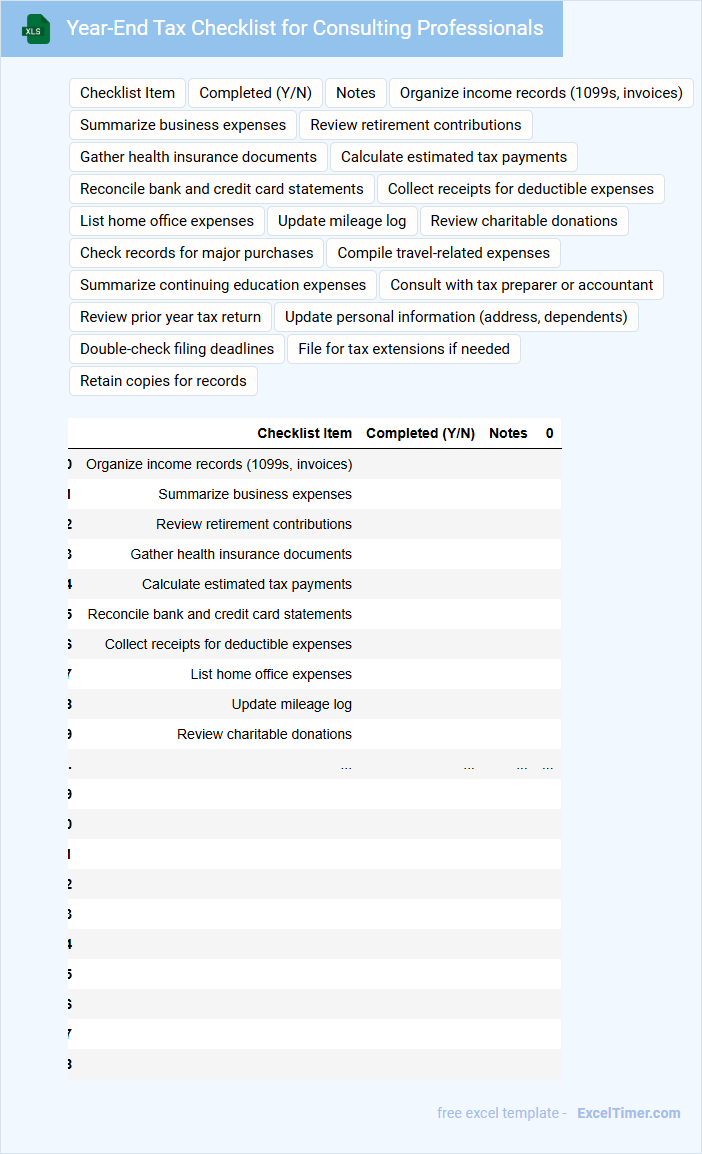

Year-End Tax Checklist for Consulting Professionals

This Year-End Tax Checklist for consulting professionals typically contains essential documents such as income statements, expense receipts, and deduction records. It serves as a comprehensive guide to ensure all financial transactions are accurately reported.

Important considerations include tracking business expenses, client invoices, and potential tax deductions to maximize savings. Staying organized and up-to-date throughout the year simplifies the filing process and reduces errors.

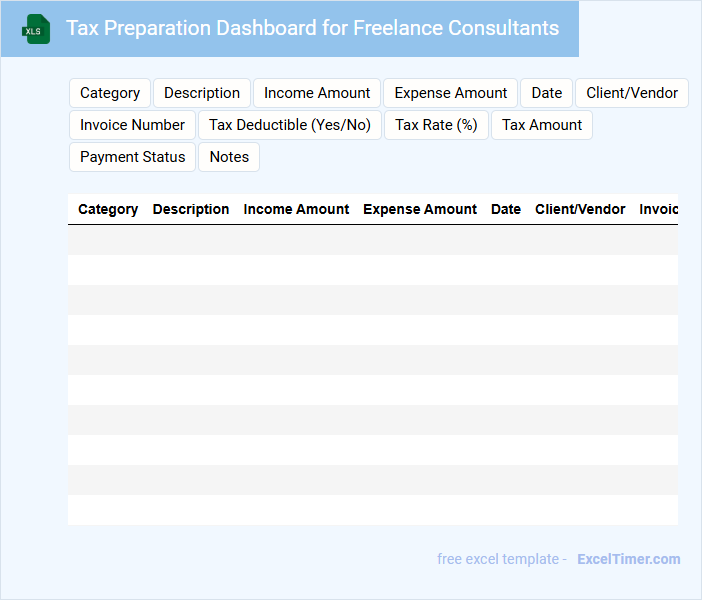

Tax Preparation Dashboard for Freelance Consultants

A Tax Preparation Dashboard for freelance consultants typically contains an overview of income streams, deductible expenses, and tax deadlines. It consolidates financial data to help users organize their earnings and track tax liabilities effectively. Key features often include transaction summaries, estimated tax calculations, and document upload sections for receipts and invoices.

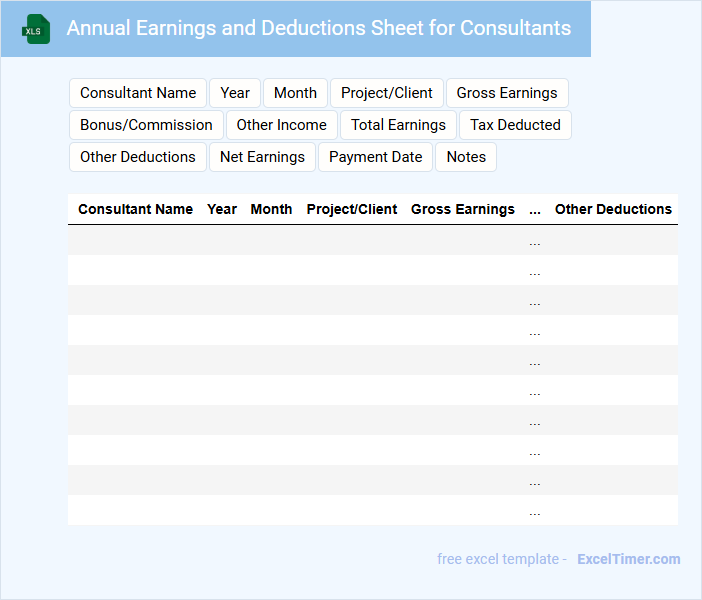

Annual Earnings and Deductions Sheet for Consultants

What information does an Annual Earnings and Deductions Sheet for Consultants typically contain? This document usually includes a detailed summary of a consultant's total yearly earnings and the various deductions applied, such as taxes and insurance contributions. It provides a clear overview of net income, helping both consultants and employers keep accurate financial records and ensure compliance with tax regulations.

What important elements should be included in this sheet? Key components include gross earnings, itemized deductions, tax withheld, and net pay. Additionally, clear identification details of the consultant and the fiscal year are essential for precise record-keeping and verification.

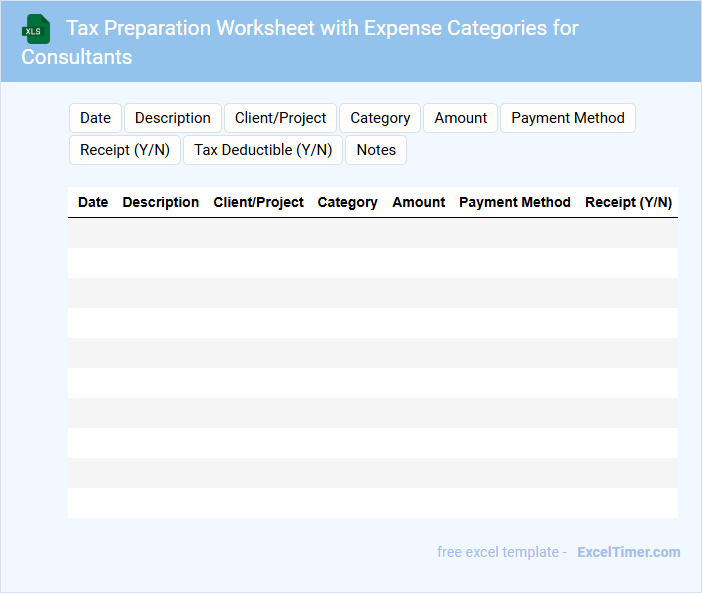

Tax Preparation Worksheet with Expense Categories for Consultants

A Tax Preparation Worksheet for consultants is typically a detailed document used to organize financial information for accurate tax filing. It usually contains categorized expense entries, income records, and receipt references. This helps ensure all deductible expenses are accounted for and simplifies the tax preparation process.

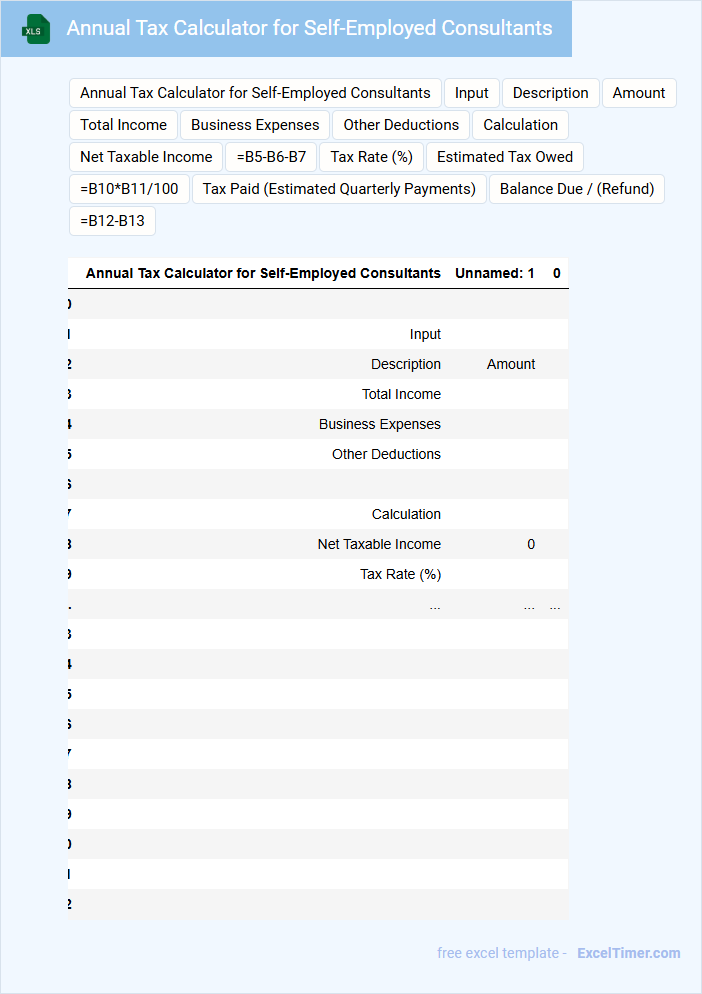

Annual Tax Calculator for Self-Employed Consultants

An Annual Tax Calculator for self-employed consultants typically contains detailed fields for reporting income, expenses, and deductible items. It helps in estimating the total tax liability based on various tax brackets and self-employment tax rates.

Important considerations include tracking all business-related receipts and understanding allowable deductions to minimize taxable income. Accurate data entry and regular updates throughout the year are crucial for precise tax estimation.

Personal Tax Preparation Spreadsheet for Consultants

This document typically contains detailed financial information and calculations to assist consultants in accurately preparing their personal tax returns.

- Income Tracking: Records all sources of income, including consulting fees and other earnings.

- Expense Categorization: Organizes deductible business expenses to maximize tax savings.

- Tax Liability Estimation: Calculates estimated taxes owed to facilitate timely payments and avoid penalties.

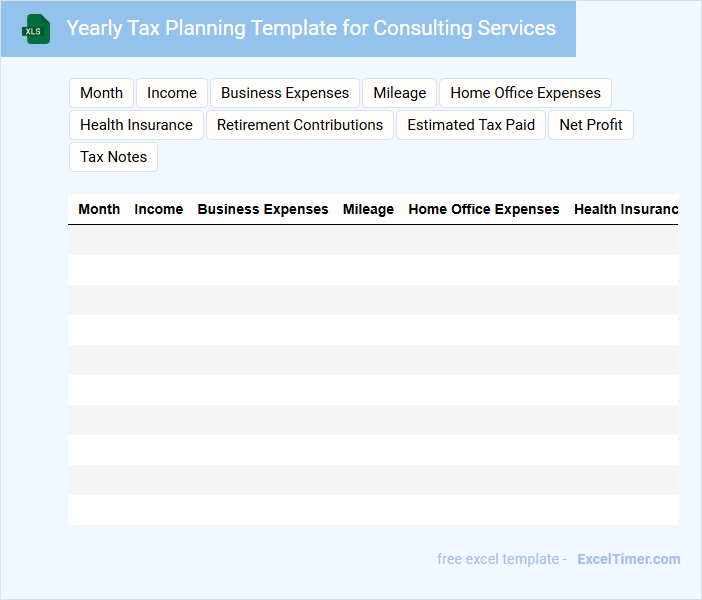

Yearly Tax Planning Template for Consulting Services

Yearly Tax Planning Templates for Consulting Services typically outline key financial data and strategic tax-saving measures tailored for consultants. This document helps in organizing income, expenses, and deductions to optimize tax liabilities throughout the fiscal year.

- Include all sources of consulting income and categorize expenses clearly for accurate tax reporting.

- Identify eligible tax deductions specific to consulting activities such as home office and travel expenses.

- Plan estimated tax payments and set aside funds to avoid penalties and ensure smooth cash flow.

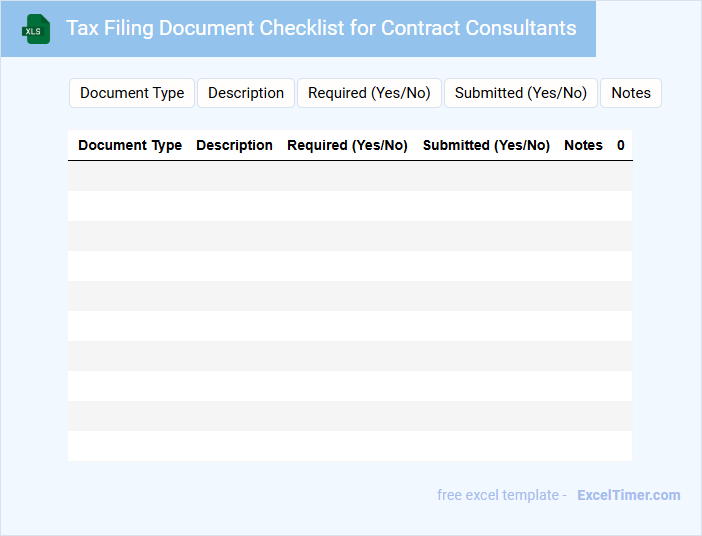

Tax Filing Document Checklist for Contract Consultants

A Tax Filing Document Checklist for contract consultants typically includes all necessary paperwork required to accurately report income and expenses for tax purposes. This document ensures that consultants gather essential items such as invoices, receipts, and relevant tax forms before filing. Keeping an organized checklist helps prevent missing important documents and ensures compliance with tax regulations.

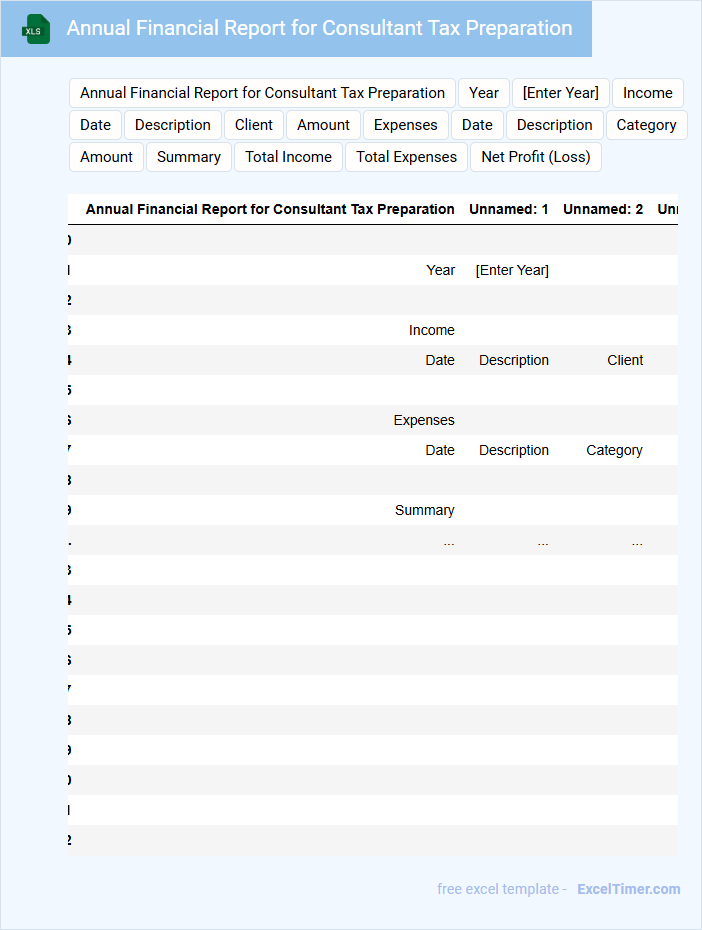

Annual Financial Report for Consultant Tax Preparation

What information is typically included in an Annual Financial Report for Consultant Tax Preparation? This document usually contains a comprehensive summary of the consultant's financial activities over the year, including income, expenses, assets, and liabilities. It provides detailed insights necessary for accurate tax preparation and helps ensure compliance with tax regulations.

What are the important considerations when preparing this report? It is crucial to maintain accurate and organized financial records, include all sources of income, and carefully document deductible expenses. Additionally, verifying that all data aligns with tax laws and consulting with a tax professional can optimize the report's accuracy and effectiveness.

What key income and expense categories should consultants track in their Excel document for annual tax preparation?

Consultants should track key income categories including client payments, project fees, and royalty earnings. Expense categories to record are business travel, office supplies, professional services, marketing costs, and software subscriptions. Accurately organizing these categories ensures precise annual tax preparation and compliance.

How should consultants organize client invoices and payment records for easy tax reporting in Excel?

You should create separate Excel sheets for client invoices and payment records, using consistent date and client name formats for easy cross-referencing. Include columns for invoice number, service description, payment date, and amount to streamline data retrieval during tax reporting. Employ Excel's filtering and pivot table features to quickly summarize annual income and outstanding payments for accurate tax preparation.

What essential tax-related deductions should consultants document each year in their Excel spreadsheet?

Consultants should document essential tax-related deductions such as business expenses, including office supplies, travel costs, and professional services, in their annual Excel tax preparation spreadsheet. Tracking home office expenses and mileage also helps maximize deductible amounts. Your organized record-keeping ensures accurate reporting and potential tax savings.

How can consultants use Excel to distinguish between business and personal expenses for accurate tax filing?

Consultants can use Excel to create separate spreadsheets or categorized columns that clearly distinguish business expenses from personal expenses. By inputting details such as date, amount, expense type, and payment method, you ensure precise tracking and organization for accurate tax preparation. This method aids in generating comprehensive reports that simplify tax filing and maximize eligible deductions.

What summary reports or pivot tables in Excel are necessary to streamline annual tax preparation for consultants?

Essential summary reports for annual tax preparation of consultants include income summaries by client, expense categories, and quarterly earnings to track taxable income accurately. Pivot tables should consolidate invoice data, categorize deductible expenses, and summarize payments received to identify tax deductions and liabilities efficiently. Detailed reports on billable hours and project-based earnings enhance financial insights and support precise tax calculations.