![]()

The Annually Donation Tracker Excel Template for Churches efficiently organizes and records yearly contributions from church members, ensuring accurate financial management. It allows easy tracking of donation amounts, donor details, and dates, helping churches maintain transparency and accountability. This template supports budget planning and reporting by providing clear, organized data on annual giving trends.

Annual Donation Tracker for Church Members

An Annual Donation Tracker for church members is a document used to record and monitor charitable contributions throughout the year. It typically contains donor names, dates of donations, amounts given, and payment methods. This tracker helps maintain transparency, accountability, and provides accurate records for tax purposes.

Important elements to include are clear donor identification, organized monthly or quarterly entries, and a summary section showing total donations. Additionally, incorporating contact information and notes for special contributions or events can enhance record-keeping. Ensuring the tracker is easy to update and securely stored is essential for data integrity and privacy.

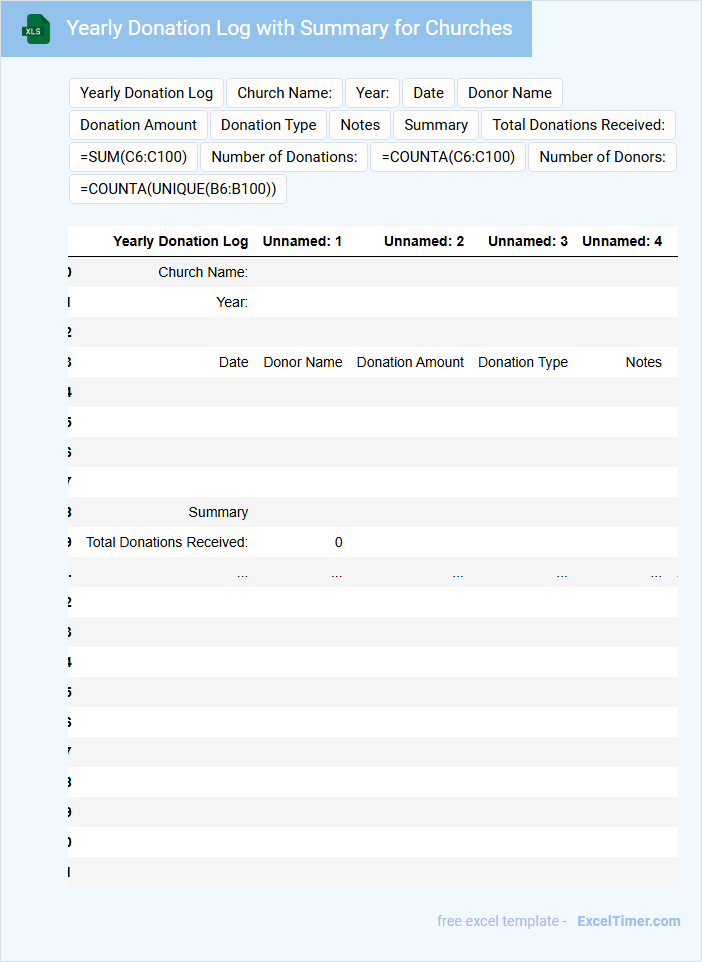

Yearly Donation Log with Summary for Churches

The Yearly Donation Log for churches typically contains detailed records of all financial contributions made by members throughout the year. It includes donor names, donation amounts, dates, and the purpose of each gift, ensuring transparency and accountability. This document is crucial for both financial tracking and providing accurate summaries for tax and reporting purposes.

An important aspect to ensure in a Yearly Donation Log is accuracy and clarity; every entry should be verifiable and easy to understand. Including a summary section that aggregates total donations by month and by donor enhances usability for church leaders and accountants. Additionally, maintaining donor confidentiality while allowing access to authorized personnel is essential for trust and compliance.

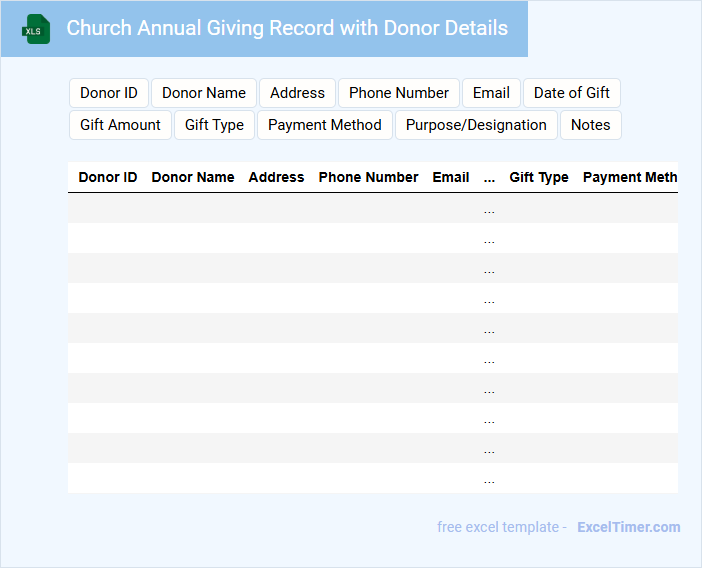

Church Annual Giving Record with Donor Details

The Church Annual Giving Record typically contains detailed information about the financial contributions made by donors throughout the year. It serves as a comprehensive ledger for tracking donations and managing church finances efficiently.

Key elements include donor names, contact details, amounts given, and dates of contributions. Maintaining accuracy and confidentiality in this record is crucial for transparent financial reporting and donor trust.

Donation Tracking Spreadsheet for Annual Church Contributions

A Donation Tracking Spreadsheet typically contains organized records of contributions received over a specified period, including donor names, dates, and amounts. It helps streamline the management of funds and ensures accurate financial reporting for the organization.

For an Annual Church Contributions spreadsheet, it is important to include categories such as donation purpose, payment methods, and pledge statuses. This structure facilitates clear donation tracking and supports transparency for both church leaders and congregants.

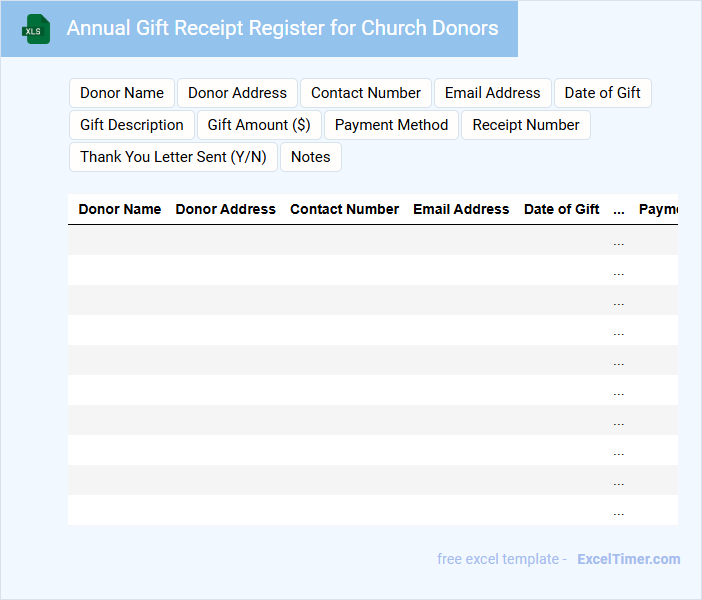

Annual Gift Receipt Register for Church Donors

What information is typically included in an Annual Gift Receipt Register for Church Donors? This document usually contains detailed records of all donations made by church members throughout the year, including donor names, donation dates, amounts, and payment methods. It helps churches maintain transparent financial records and provides donors with official receipts for tax and personal bookkeeping purposes.

Why is it important to accurately maintain an Annual Gift Receipt Register? Proper record-keeping ensures compliance with legal and tax regulations, strengthens trust between the church and its community, and simplifies the year-end reporting process. Key elements to focus on include accurate donor details, clear organization by date or donor, and timely issuance of receipts.

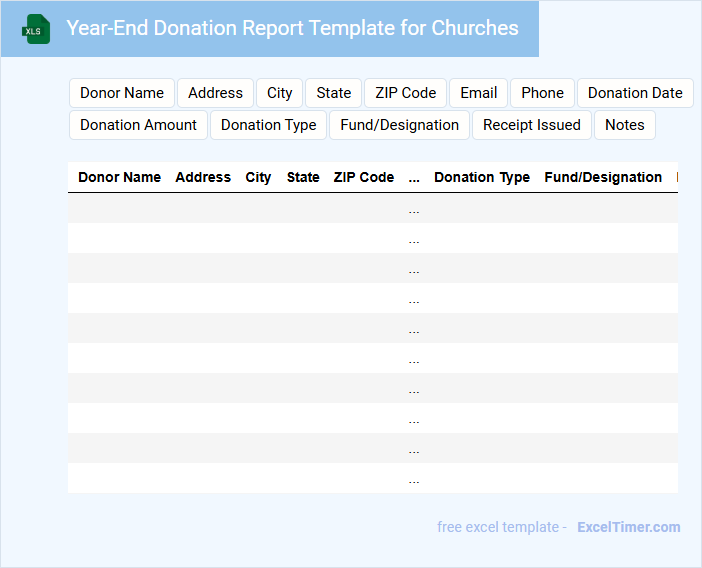

Year-End Donation Report Template for Churches

The Year-End Donation Report Template for Churches typically contains a detailed summary of all contributions received throughout the year. It highlights donor information, donation amounts, and the impact of these funds on church activities. This document is essential for transparent financial reporting and maintaining donor trust.

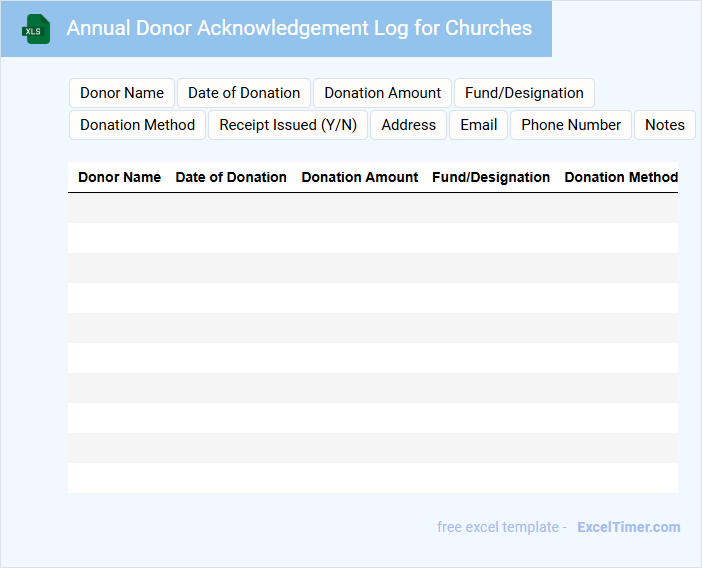

Annual Donor Acknowledgement Log for Churches

The Annual Donor Acknowledgement Log for churches is a crucial document that records all donations received throughout the year. It typically includes donor names, donation amounts, dates, and any special notes regarding the contributions. This log helps maintain transparency and provides a reliable reference for issuing tax receipts and expressing gratitude.

Excel Tracker for Yearly Church Donation Statements

An Excel Tracker for yearly church donation statements is a useful document designed to organize and record charitable contributions made by church members throughout the year. It typically contains detailed information such as donor names, donation amounts, dates, and types of donations. This tracker helps ensure accuracy in tax reporting and enhances financial transparency within the church community.

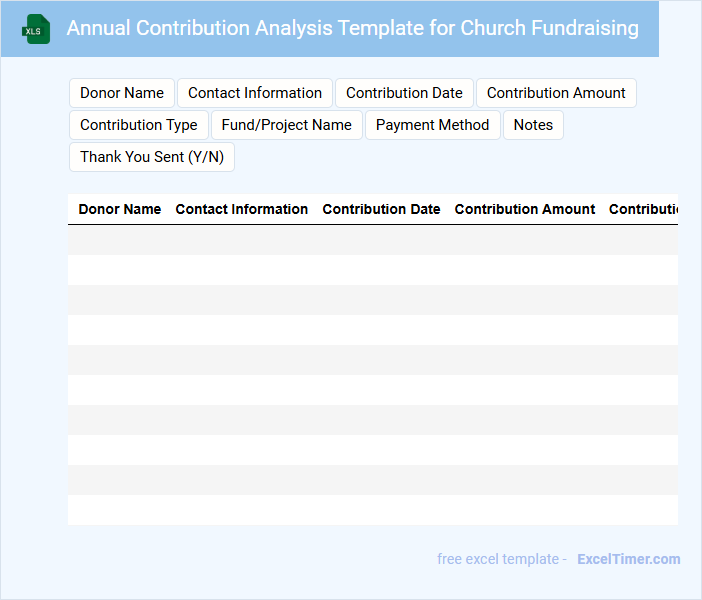

Annual Contribution Analysis Template for Church Fundraising

What information is typically included in an Annual Contribution Analysis Template for Church Fundraising? This document usually contains detailed records of individual and group donations made throughout the year, including donor names, amounts, dates, and fundraising campaign results. It helps churches track giving patterns, evaluate fundraising effectiveness, and plan for future financial needs.

What important factors should be considered when using this template? It is essential to ensure accuracy in data entry to maintain trustworthy records, and confidentiality to respect donor privacy. Additionally, the template should allow for clear categorization of funds and trends analysis to support strategic decision-making.

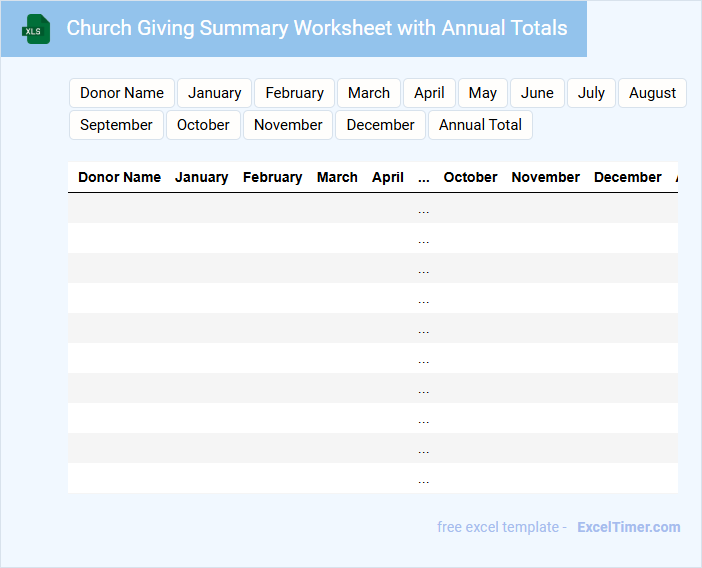

Church Giving Summary Worksheet with Annual Totals

The Church Giving Summary Worksheet is typically a financial document used to track individual or family contributions to a church over a specific period. It consolidates weekly or monthly donations into an annual total for clear overview and record-keeping.

This document helps church administrations maintain transparent financial records and prepare accurate annual reports. Ensure to include donor names, dates, amounts, and any special designations for donations to keep the summary comprehensive and organized.

Annual Church Pledge and Donation Tracker

The Annual Church Pledge and Donation Tracker is a document designed to monitor and record the financial commitments and contributions made by church members throughout the year. It typically includes pledge amounts, donation dates, and payment statuses to ensure accurate tracking and accountability. This tool helps church leadership manage budgets effectively and support their community outreach programs.

Important elements to include are member names, pledged amounts, actual donations received, and columns for recording installments or recurring payments. Additionally, a summary section highlighting total pledges versus actual donations can provide valuable insights for planning. Clear and organized entries promote transparency and strengthen donor relationships.

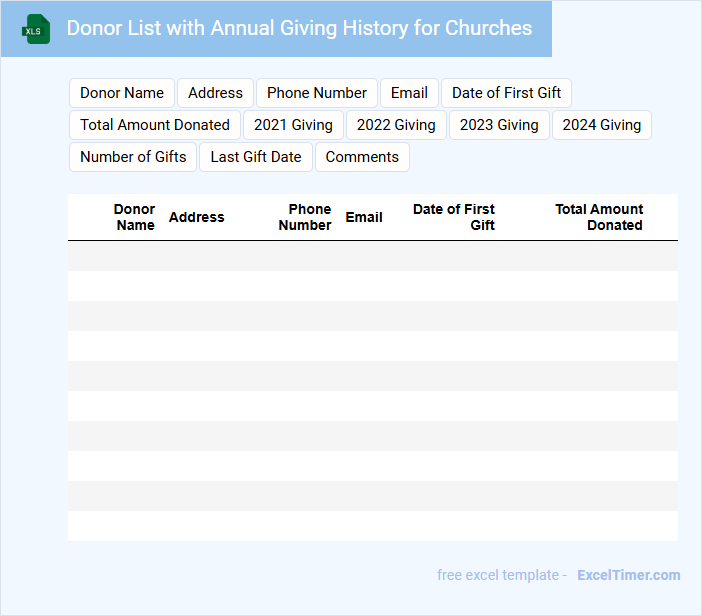

Donor List with Annual Giving History for Churches

A Donor List with Annual Giving History for churches typically contains detailed records of individuals and organizations who have contributed financially over the years. It includes donor names, contact information, giving amounts, and dates of contributions, allowing the church to track giving patterns and engage with supporters effectively. This document is essential for maintaining transparency, fostering donor relationships, and planning future fundraising strategies.

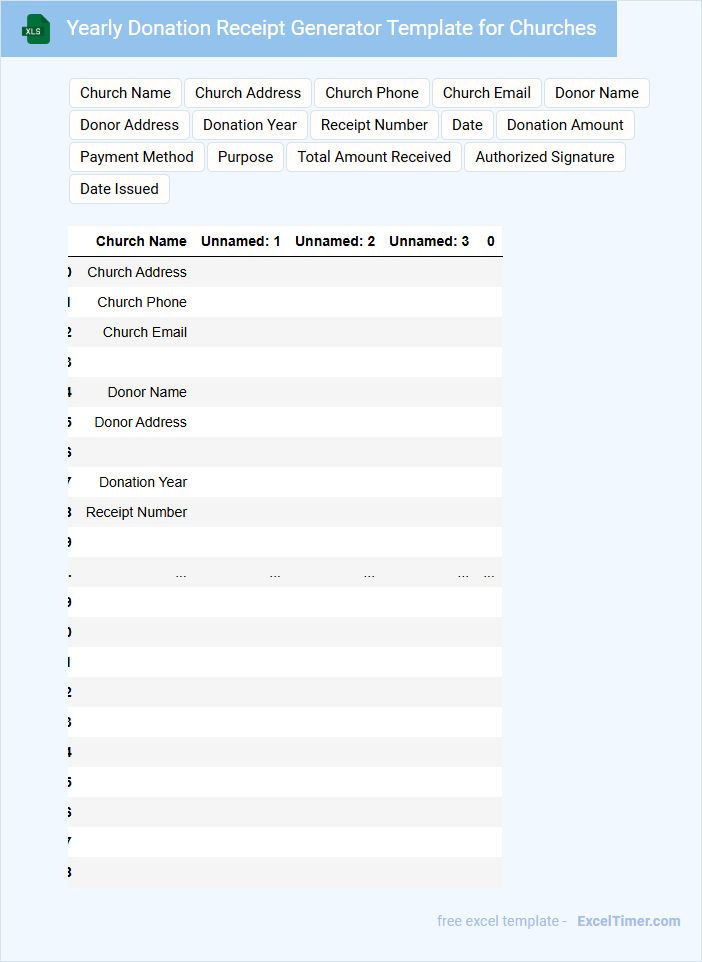

Yearly Donation Receipt Generator Template for Churches

What information does a Yearly Donation Receipt Generator Template for Churches usually contain? This type of document typically includes the donor's name, contact details, total amount donated during the year, and dates of donations. It also features church information and a statement confirming the tax-exempt status of donations to assist donors in tax filing.

What important elements should be included in the template? It is essential to have clear fields for donor identification, accurate donation totals, and correct church details to ensure compliance with tax regulations. Additionally, including a thank-you note or message of appreciation enhances donor relations and encourages future contributions.

Annual Charitable Contribution Tracker for Church Use

What information does an Annual Charitable Contribution Tracker for Church Use typically contain? This document usually includes detailed records of all charitable donations made by church members throughout the year, including dates, amounts, and donor details. It helps the church maintain accurate financial records and provides transparency for tax and reporting purposes.

What is an important consideration when using this tracker? Ensuring confidentiality and accuracy is crucial, as sensitive donor information must be protected and contributions recorded precisely to comply with legal and organizational standards.

Donation Record Spreadsheet for Annual Church Audits

A Donation Record Spreadsheet for Annual Church Audits is a document used to track all contributions made to the church throughout the year. It ensures transparency and accuracy in financial reporting during audits.

- Include donor names, donation dates, and amounts for detailed tracking.

- Ensure the spreadsheet is regularly updated and reconciled with bank statements.

- Use clear categories for different types of donations, such as cash, checks, and online payments.

How can data validation be used to ensure accurate donor information entry in an annually donation tracker for churches?

Data validation in an annually donation tracker for churches ensures accurate donor information by restricting input types, such as allowing only valid email addresses, phone numbers, or predefined donation categories. Dropdown lists limit entries to standardized options, reducing errors and maintaining data consistency. Custom formulas can enforce rules like positive donation amounts and correct date formats, enhancing data reliability for reporting and analysis.

What Excel formulas or functions efficiently sum up total annual donations by individual donor?

Use the SUMIF function in Excel to efficiently sum total annual donations by individual donor. For example, the formula =SUMIF(DonorRange, "DonorName", DonationRange) adds all donations made by a specific donor within the specified ranges. This function streamlines tracking annual contributions for churches by consolidating donor data accurately.

How can you automate monthly and annual reporting of donation trends using PivotTables in an annually donation tracker?

You can automate monthly and annual reporting of donation trends in your Annually Donation Tracker for Churches by creating PivotTables that summarize donation data by date and donor. Use date grouping features to organize donations by month and year, enabling quick trend analysis. Refresh the PivotTables regularly to update reports automatically as new data is added.

What methods in Excel can track pledge fulfillment versus actual donation amounts for each church member annually?

Excel's PivotTables efficiently summarize annual pledge fulfillment versus actual donation amounts for each church member. Use conditional formatting to highlight discrepancies between pledged and received donations to enhance your tracking accuracy. You can also apply formulas like SUMIF and VLOOKUP to dynamically compare pledged amounts with actual donations across the annual dataset.

How can conditional formatting highlight donors who meet or exceed their annual donation goals in the tracker?

Use Excel's conditional formatting with a formula comparing each donor's total annual donation to their set goal. Apply a rule that highlights cells or rows where the donation amount is greater than or equal to the goal. This visual aid quickly identifies donors who meet or exceed their annual donation targets.