The Annually Budget Excel Template for Nonprofits offers a streamlined way to manage annual financial planning, ensuring accurate tracking of income and expenses. This template supports nonprofits in maintaining transparency and accountability by organizing budget data efficiently. Utilizing this tool helps organizations allocate funds effectively and prepare for future financial needs.

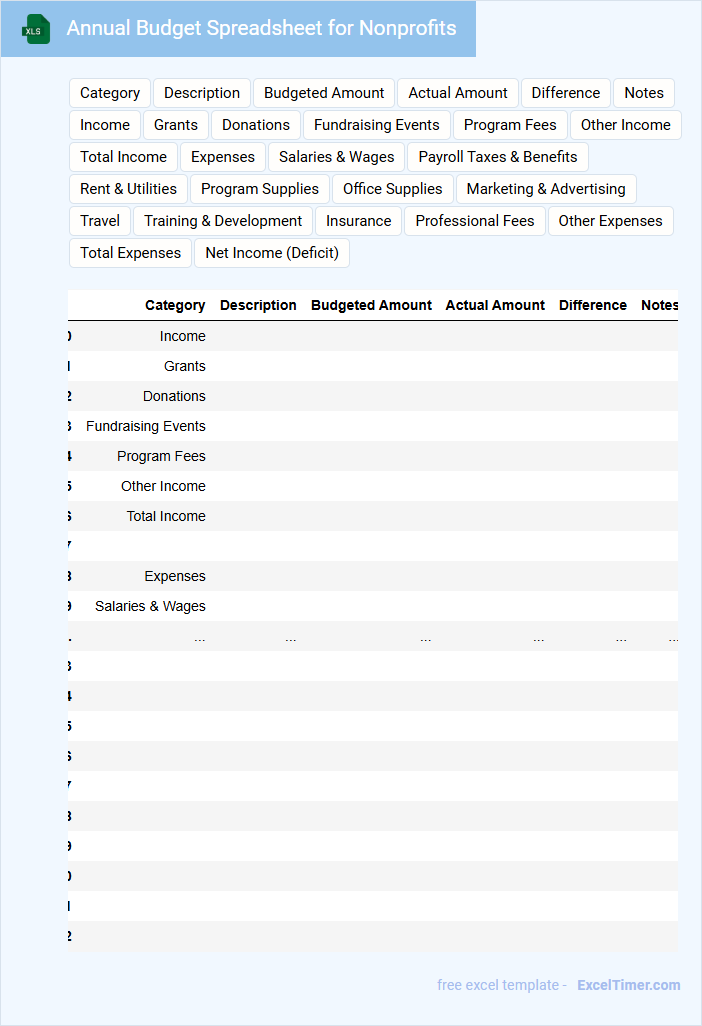

Annual Budget Spreadsheet for Nonprofits

An Annual Budget Spreadsheet for Nonprofits typically contains detailed financial plans that help manage income and expenses over the fiscal year.

- Income Sources: Track and categorize all expected donations, grants, and fundraising revenues.

- Expense Categories: Outline operational costs including salaries, programs, and administrative expenses.

- Financial Projections: Provide forecasts and monitor budget variances to ensure fiscal responsibility.

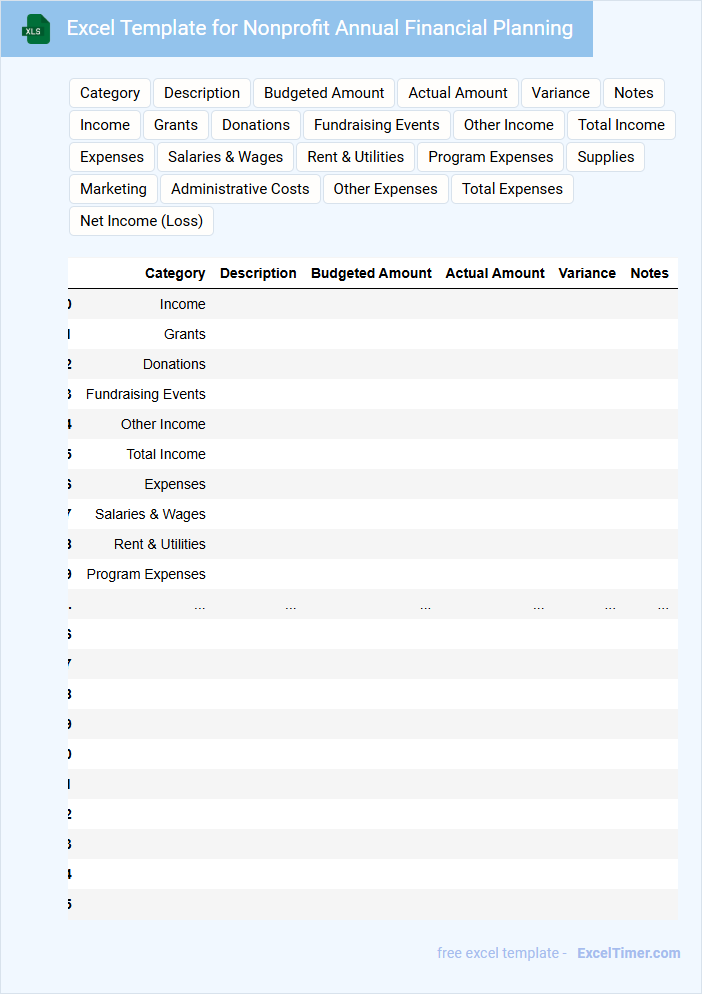

Excel Template for Nonprofit Annual Financial Planning

An Excel Template for Nonprofit Annual Financial Planning typically contains detailed budget outlines, income and expense tracking, and cash flow projections. It also includes sections for grant management and fundraising revenue forecasts.

This document helps nonprofits maintain transparency, ensure accurate financial reporting, and plan for sustainable growth. Including a dashboard summary for key financial indicators is highly recommended to simplify decision-making.

Yearly Budget Tracking Sheet for Nonprofit Organizations

The Yearly Budget Tracking Sheet for nonprofit organizations typically contains an organized record of all anticipated income and expenses throughout the fiscal year. This document helps track financial performance against projected goals to ensure accountability and transparency.

It is important to include detailed categories for revenue sources and expense types to accurately monitor funding allocation and spending. Regular updates and reviews of the budget sheet help nonprofits maintain financial health and support effective decision-making.

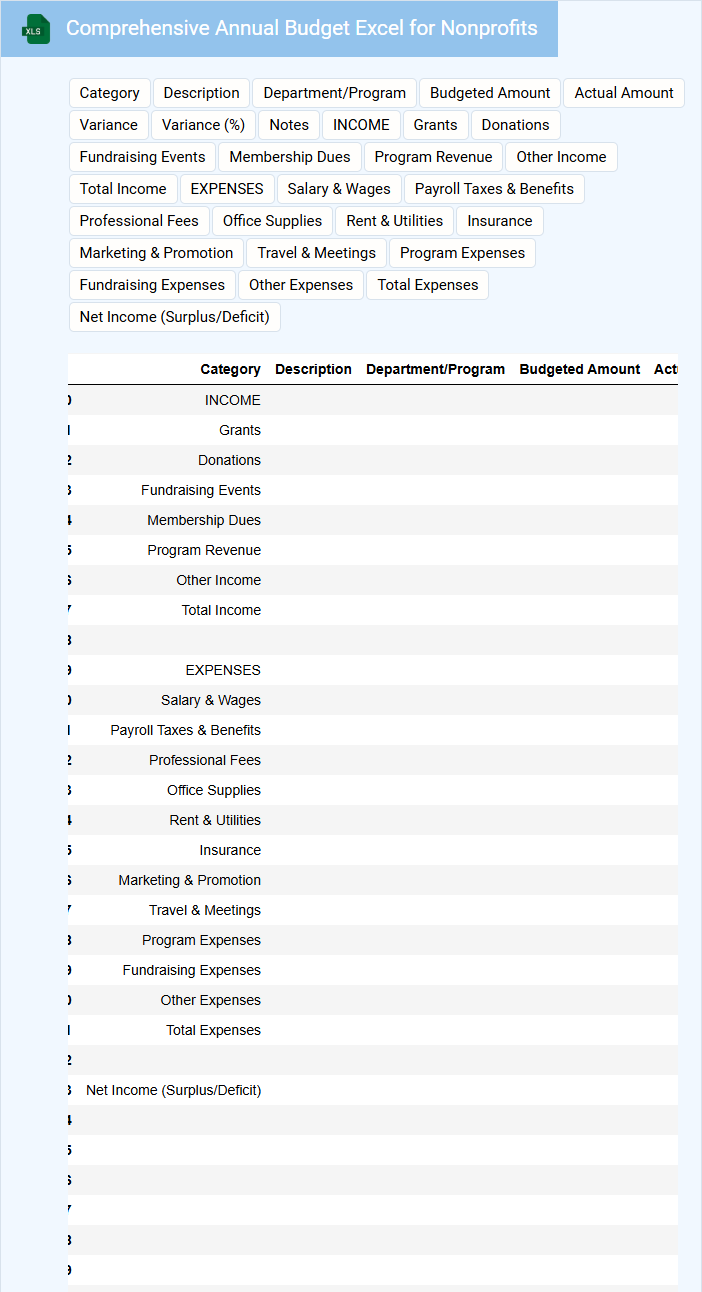

Comprehensive Annual Budget Excel for Nonprofits

A Comprehensive Annual Budget Excel for Nonprofits typically contains detailed financial planning and tracking tools tailored to nonprofit organizations' needs.

- Revenue Projections: Includes estimated income from donations, grants, and fundraising activities.

- Expense Categories: Breaks down operational, programmatic, and administrative costs for clear allocation.

- Cash Flow Monitoring: Helps ensure sufficient liquidity to meet ongoing organizational obligations.

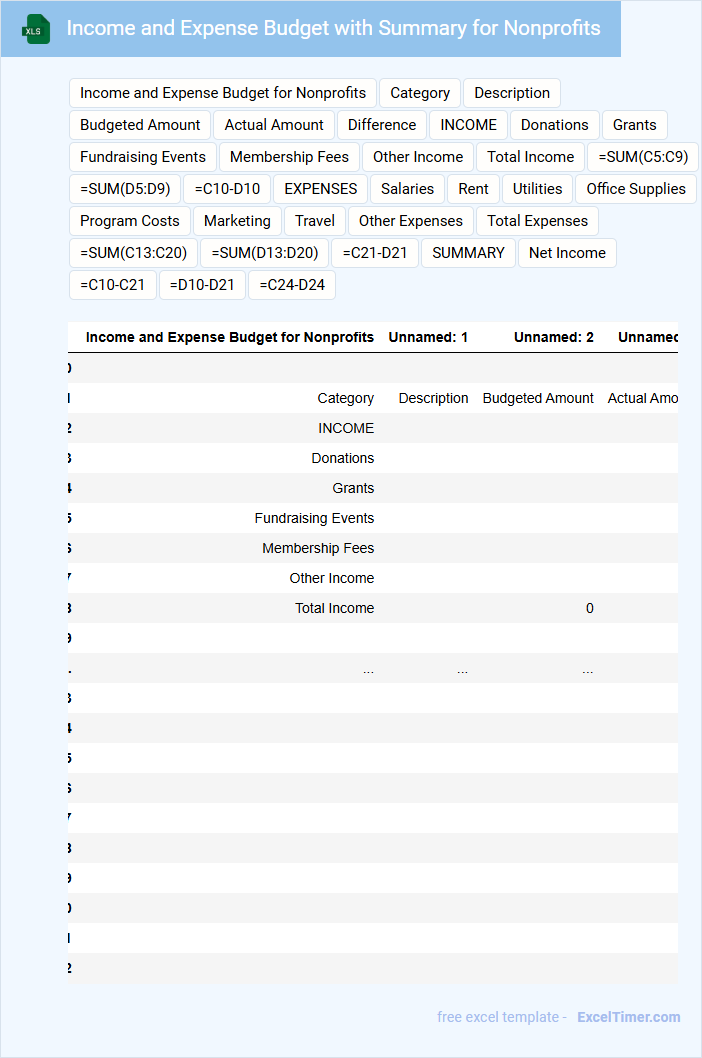

Income and Expense Budget with Summary for Nonprofits

An Income and Expense Budget for nonprofits typically includes detailed projections of expected revenues and planned expenditures to ensure financial sustainability. It also summarizes the overall budget position, helping organizations manage their resources effectively.

This document often contains funding sources, such as donations and grants, alongside categorized expenses like program costs and administrative fees. It is crucial to regularly review and update the budget to reflect actual performance and guide strategic decisions.

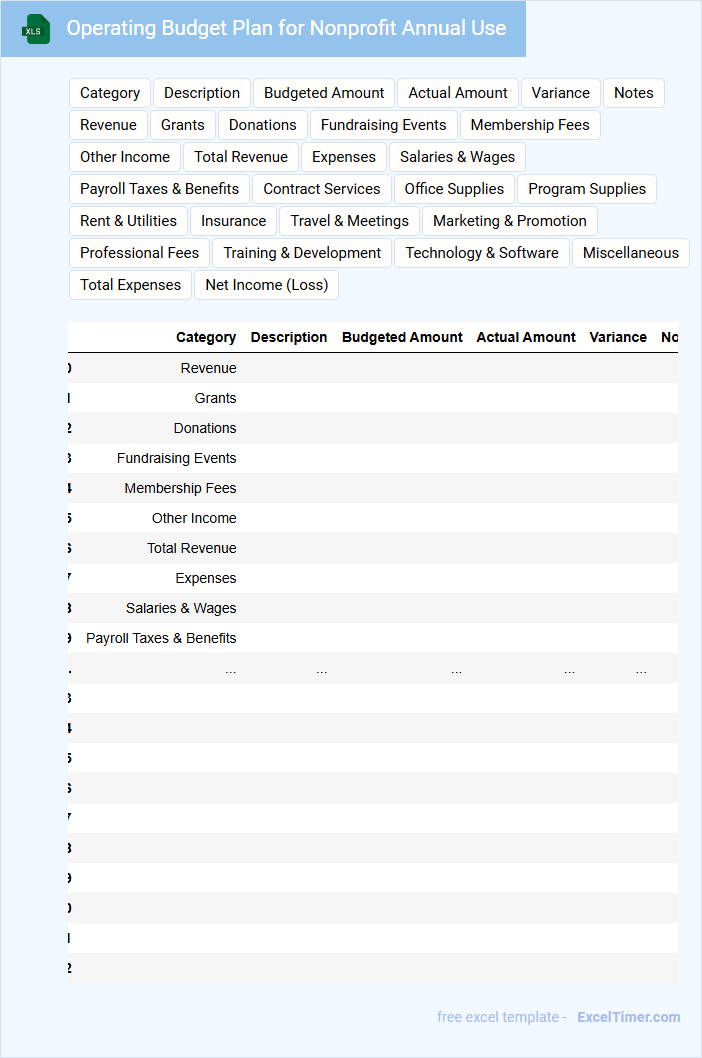

Operating Budget Plan for Nonprofit Annual Use

An Operating Budget Plan outlines the expected income and expenses for a nonprofit organization over a specific period, typically one year. It helps in managing financial resources effectively to support the organization's mission and activities.

This type of document usually contains detailed revenue projections, expense categories, and cash flow analysis. Clear assumptions and monitoring strategies are essential to ensure fiscal responsibility and adaptability throughout the year.

Annual Grant Allocation Tracking for Nonprofits

The Annual Grant Allocation Tracking document is essential for nonprofits to monitor the distribution and usage of funds received throughout the year. It typically contains detailed records of each grant, including amounts awarded, disbursement dates, and specific project allocations.

Maintaining accurate tracking ensures transparency and compliance with donor requirements, while also aiding in financial planning and reporting. Organizations should prioritize updating this document regularly to reflect any changes or additional funding.

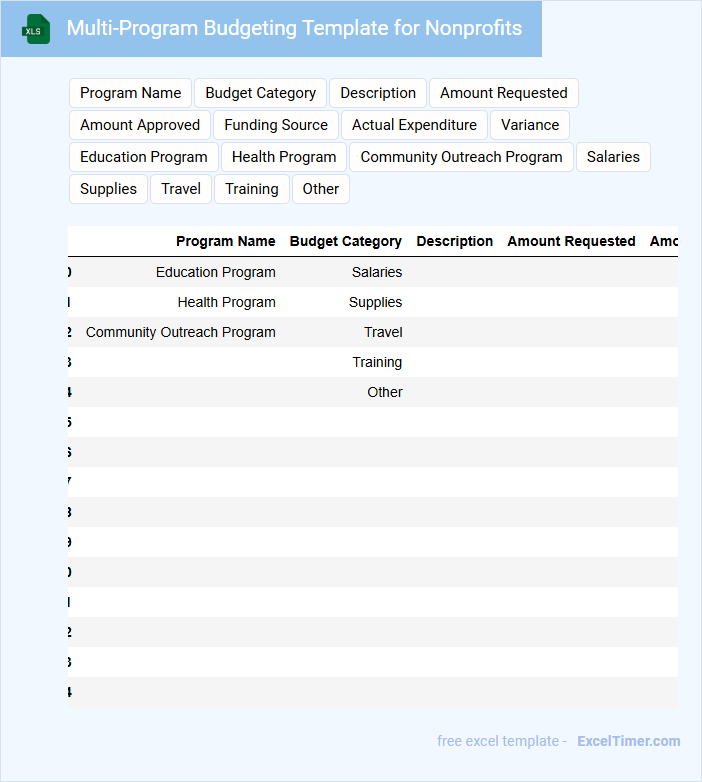

Multi-Program Budgeting Template for Nonprofits

A Multi-Program Budgeting Template for nonprofits typically contains detailed financial plans segmented by each program or service the organization offers. It includes sections for expected revenues, allocated expenses, and resources per program to ensure comprehensive financial oversight. Utilizing this template helps nonprofits effectively track funding sources and expenditures, enhancing transparency and accountability.

Important considerations include accurately forecasting income and expenses for each program, allowing for adjustments based on funding variability. Incorporating clear categories for indirect costs ensures that overhead is appropriately allocated across programs. Additionally, regularly updating the template to reflect actual performance will improve budget management and strategic decision-making.

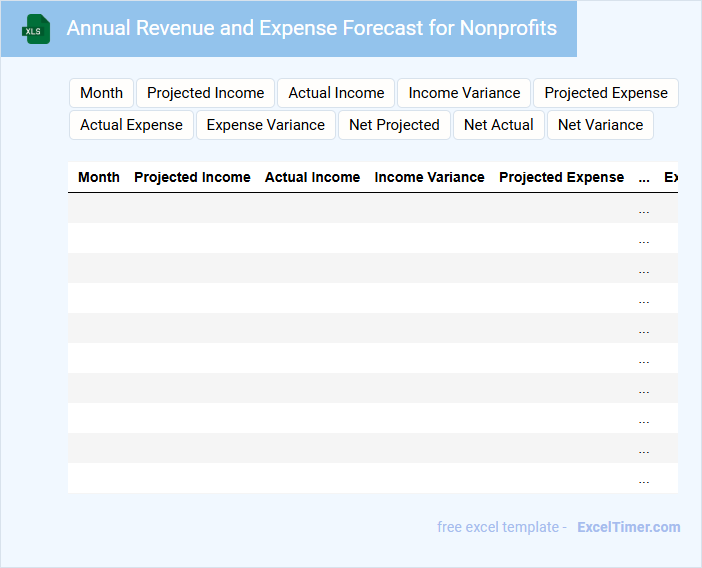

Annual Revenue and Expense Forecast for Nonprofits

An Annual Revenue and Expense Forecast for Nonprofits is a financial document projecting expected income and expenditures over the upcoming year. It helps organizations plan and allocate resources effectively to achieve their mission.

- Include detailed revenue sources such as donations, grants, and fundraising events.

- Outline anticipated expenses including program costs, administrative salaries, and operational overhead.

- Update forecasts regularly to reflect changes in funding or expenses and maintain financial stability.

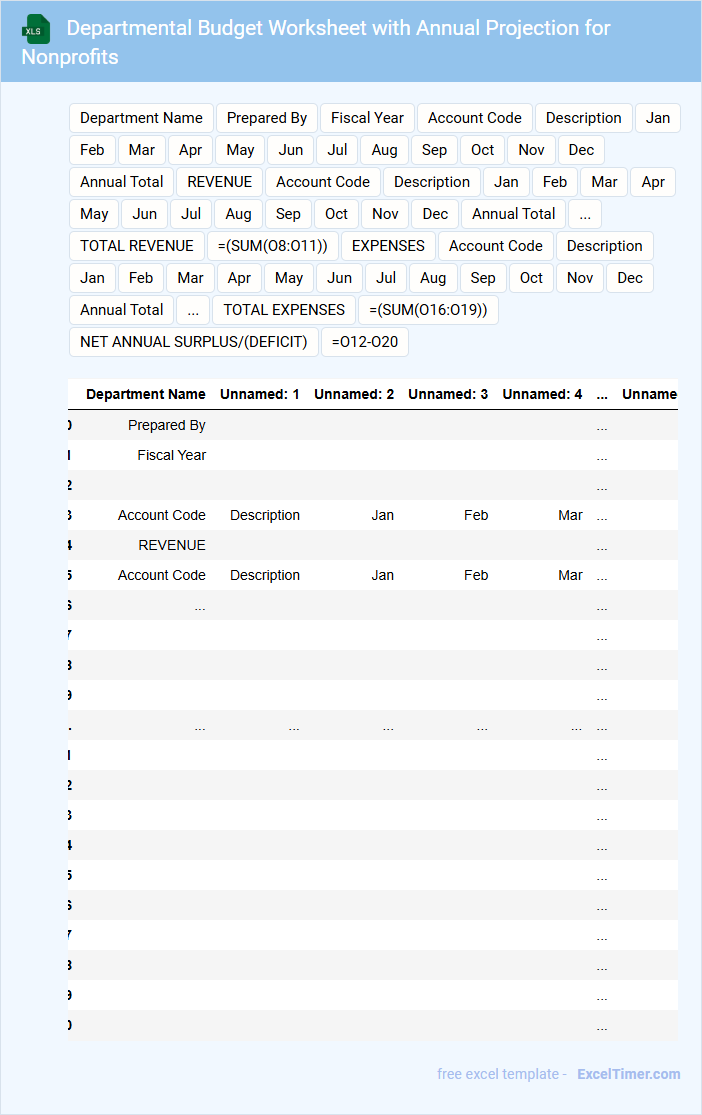

Departmental Budget Worksheet with Annual Projection for Nonprofits

A Departmental Budget Worksheet with Annual Projection for Nonprofits typically contains detailed financial plans including estimated income and expenses for each department over the fiscal year. It helps organizations allocate resources effectively and forecast future financial needs.

- Include all expected revenue sources and categorize expenses by department.

- Regularly update projections based on actual performance to ensure accuracy.

- Highlight key assumptions and potential risks affecting the budget.

Annual Fundraising and Expenditure Tracker for Nonprofits

What information does an Annual Fundraising and Expenditure Tracker for Nonprofits typically contain? This document usually includes detailed records of all funds raised throughout the year, categorized by source such as donations, grants, and events. It also tracks expenditures by program, administration, and fundraising costs to provide a clear financial overview.

Why is it important to keep an accurate and organized tracker? Maintaining precise records helps nonprofits ensure transparency and accountability to donors and stakeholders. It also aids in budgeting, forecasting, and strategic planning to maximize impact and sustain operations.

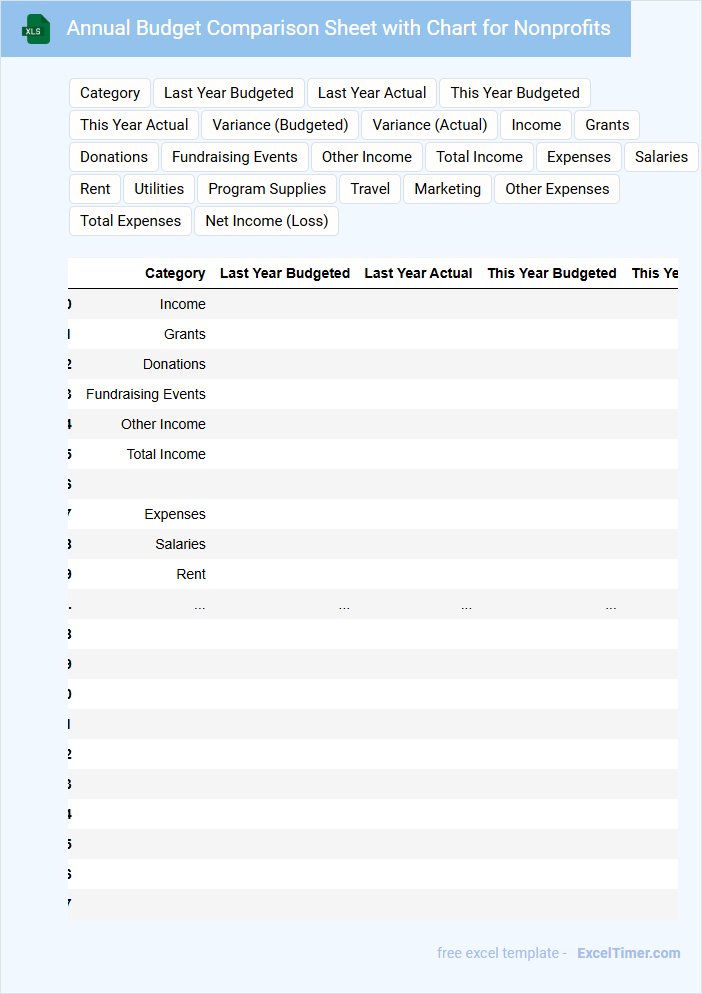

Annual Budget Comparison Sheet with Chart for Nonprofits

What information is typically included in an Annual Budget Comparison Sheet with Chart for Nonprofits? This document usually contains detailed yearly financial data that compares budgeted amounts against actual expenditures and revenues. It visually highlights variances and trends over time to assist nonprofits in financial planning and accountability.

What important aspects should nonprofits consider when preparing this document? It is essential to ensure accuracy in data entry and to clearly label categories for transparency. Additionally, incorporating a clear, easy-to-understand chart helps stakeholders quickly grasp financial performance and informs strategic decision-making.

Expense Category Breakdown for Nonprofit Annual Budgets

Expense Category Breakdown for Nonprofit Annual Budgets typically contains detailed allocations of funds across various expense categories essential for transparent financial management.

- Classification: Clearly categorize expenses into operational, programmatic, and administrative costs for better clarity.

- Allocation Accuracy: Ensure precise allocation of funds to each category to reflect true budgeting needs.

- Monitoring: Regularly track and review expense distributions to maintain budget adherence and financial health.

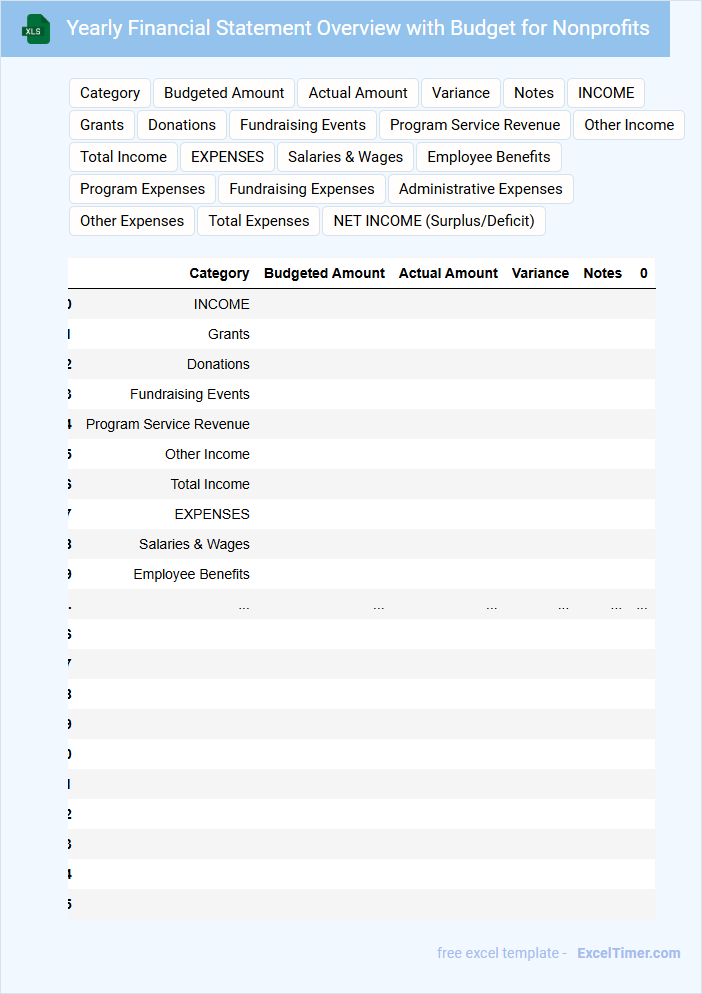

Yearly Financial Statement Overview with Budget for Nonprofits

The Yearly Financial Statement Overview for nonprofits typically contains detailed summaries of income, expenses, assets, and liabilities for the fiscal year. This document provides transparent insight into the organization's financial health and accountability.

The budget section outlines planned expenditures and revenue projections, helping guide future financial decisions and resource allocation. It is essential for strategic planning and ensuring the nonprofit meets its mission sustainably.

Accurate record-keeping and regular review of these statements are crucial for maintaining stakeholder trust and complying with regulatory requirements.

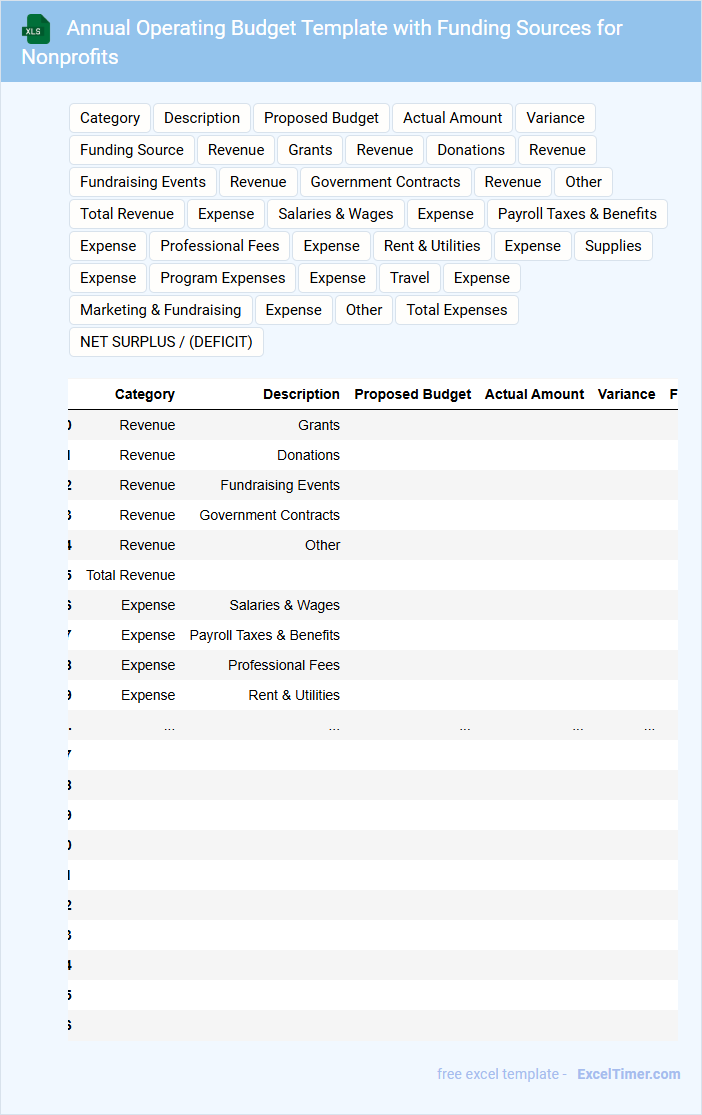

Annual Operating Budget Template with Funding Sources for Nonprofits

An Annual Operating Budget Template for nonprofits typically includes detailed projections of income and expenses, ensuring financial transparency and accountability. It outlines various funding sources such as grants, donations, and fundraising activities, helping organizations plan their resources effectively. Including contingency plans and regularly updating the budget is crucial to adapt to changing financial conditions.

What are the key components that must be included in an annual nonprofit budget spreadsheet?

An annual nonprofit budget spreadsheet must include revenue sources such as donations, grants, and fundraising events, alongside expense categories like program costs, administrative expenses, and fundraising expenses. It should detail fixed and variable costs, project cash flow, and allocate reserves for sustainability. Accurate tracking of restricted versus unrestricted funds ensures compliance and effective financial planning.

How do you project and document expected revenue sources for each fiscal year?

Project expected revenue sources by analyzing historical donation data, grant commitments, and fundraising event forecasts in the Excel budget template. Document each source clearly in dedicated columns labeled with fiscal year and revenue type for accuracy. Use formula-driven summaries to track and update projections regularly for nonprofit financial planning.

Which categories of expenses should be tracked to ensure accurate financial planning?

Track key expense categories such as program services, administrative costs, fundraising expenses, salaries, and operational overhead to ensure accurate financial planning. Your budget should also include rent, utilities, supplies, and marketing to capture all financial commitments. Monitoring these categories helps nonprofits maintain transparency and allocate resources efficiently throughout the year.

How should variances between actual and budgeted figures be highlighted and analyzed?

Highlight variances between actual and budgeted figures using color-coding, such as red for negative and green for positive discrepancies, to enhance visual identification. Analyze significant variances by categorizing them by expense or revenue type, identifying causes like overspending or unexpected donations. Use these insights to adjust future budget forecasts and improve financial planning accuracy for nonprofits.

What methods can be used within Excel to monitor fund allocation and grant restrictions?

Excel enables nonprofit organizations to monitor fund allocation and grant restrictions through tailored budget templates, pivot tables, and conditional formatting to track expenses against allocated funds. Utilizing data validation and custom formulas ensures compliance with grant conditions by highlighting overspending or unauthorized use. Automated dashboards and dynamic charts facilitate real-time visualization of budget performance and grant adherence.