The Annually Budget Planner Excel Template for Personal Finance helps organize and track yearly income and expenses efficiently. It provides customizable categories, easy-to-use formulas, and clear visual summaries to manage savings and expenditures. This tool is essential for maintaining financial discipline and achieving long-term monetary goals.

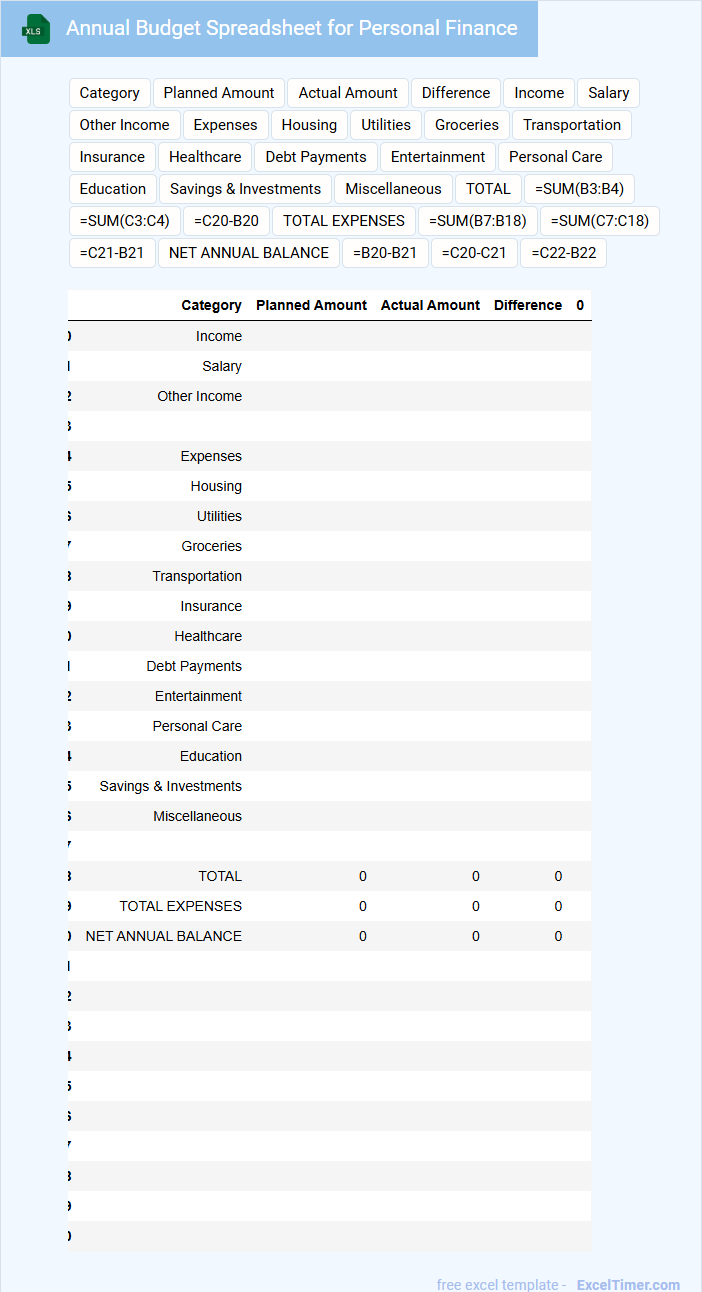

Annual Budget Spreadsheet for Personal Finance

An Annual Budget Spreadsheet for personal finance typically includes detailed income sources, monthly expenses, savings goals, and debt tracking. It helps individuals plan and manage their finances effectively throughout the year.

Key elements such as expense categories, income estimates, and periodic financial summaries ensure comprehensive financial oversight. Including visual aids like charts can enhance understanding and motivation.

Yearly Expense Tracker with Income Analysis

What information does a Yearly Expense Tracker with Income Analysis typically contain? This type of document usually includes detailed records of monthly income and expenses, categorized by type to help identify spending patterns. It also provides summary statistics and visualizations to highlight areas for potential savings and financial improvement.

Why is it important to include both income and expenses in the tracker? Tracking both allows for a comprehensive view of financial health, enabling better budget planning and informed decision-making. Including income analysis helps identify discrepancies, ensuring all earnings are accounted for and balanced against expenditures.

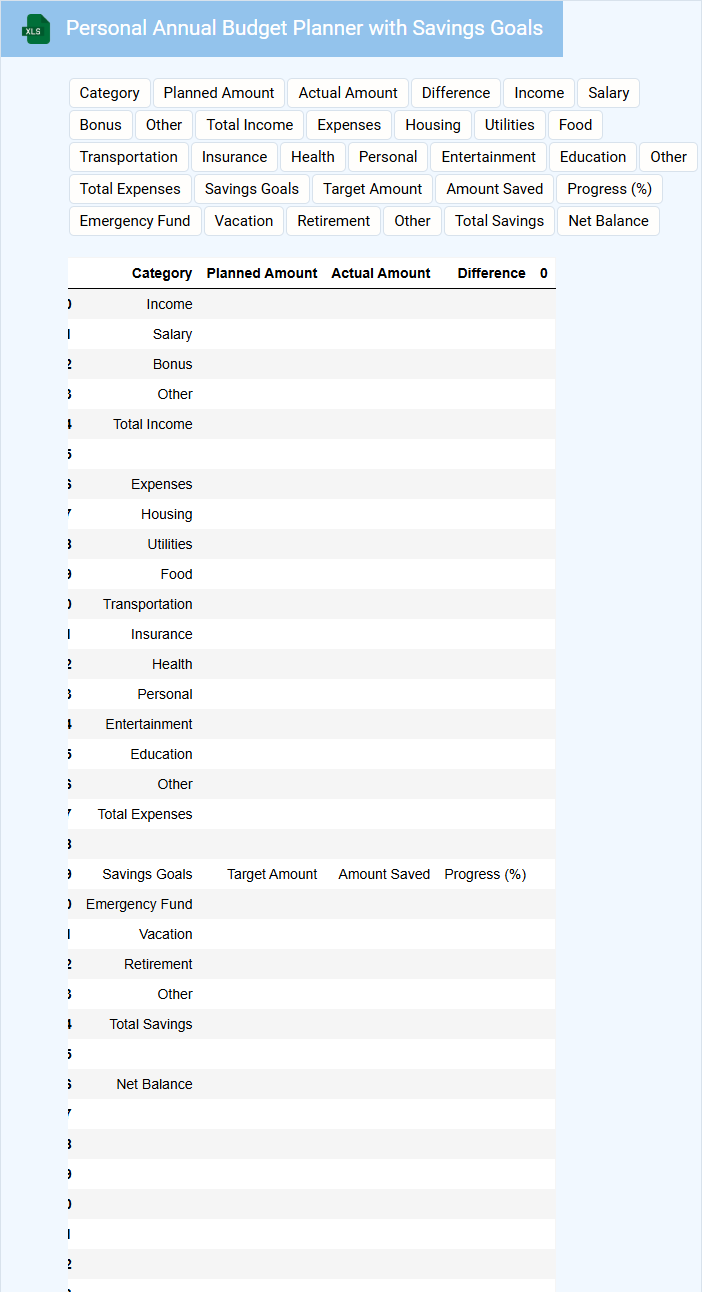

Personal Annual Budget Planner with Savings Goals

What does a Personal Annual Budget Planner with Savings Goals typically contain? This document usually includes detailed sections for tracking income, expenses, and savings targets throughout the year. It helps individuals organize their finances, monitor spending habits, and align their budgeting efforts with specific financial goals for effective money management.

What is an important consideration when using this planner? Consistently updating the planner with actual figures ensures accurate tracking and progress evaluation. Setting realistic savings goals and revisiting them regularly can enhance motivation and financial discipline over time.

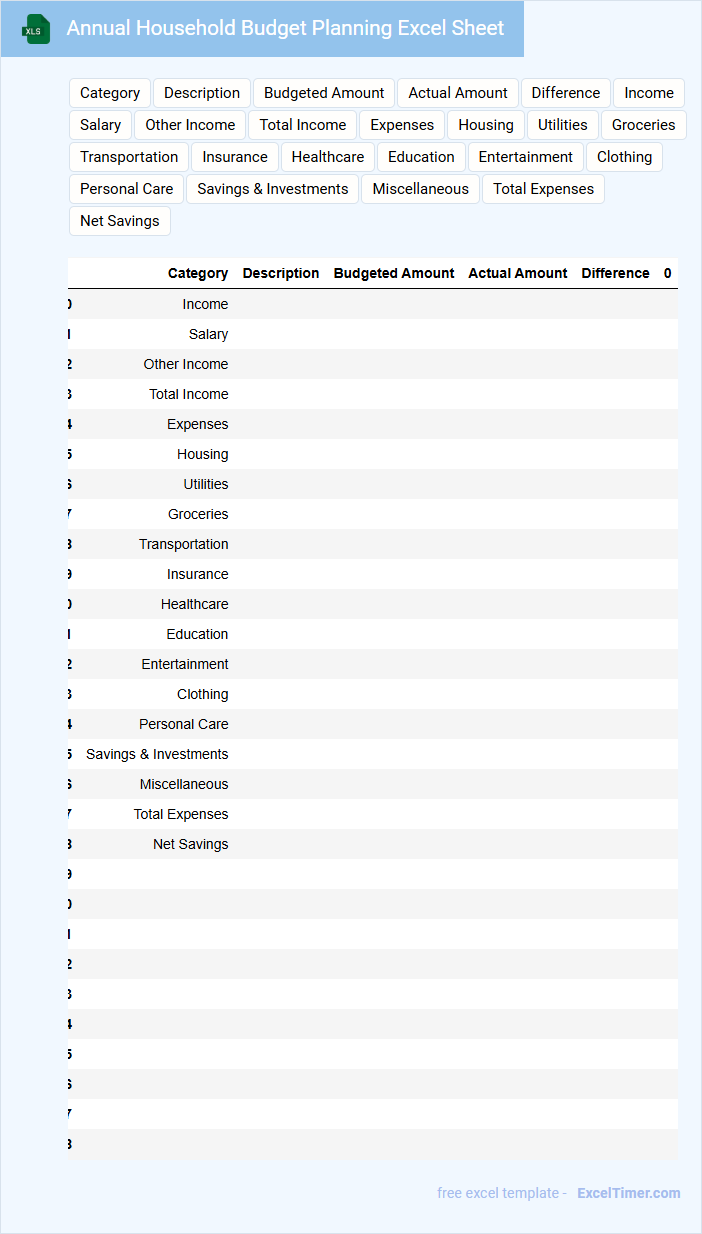

Annual Household Budget Planning Excel Sheet

An Annual Household Budget Planning Excel Sheet typically contains detailed financial data organized to track income, expenses, and savings over the year for effective money management.

- Income Tracking: It is essential to record all sources of income to have a clear overview of available funds.

- Expense Categorization: Segregate expenses into fixed and variable to identify spending patterns and control costs efficiently.

- Savings Goals: Setting realistic savings targets helps in planning for future financial stability and emergencies.

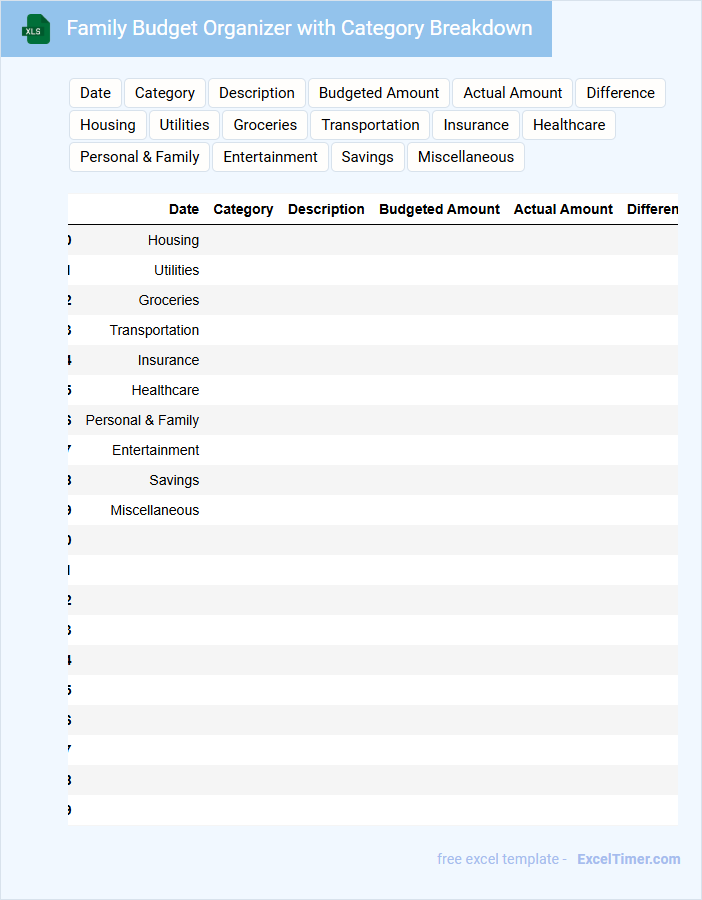

Family Budget Organizer with Category Breakdown

A Family Budget Organizer with Category Breakdown is a financial document designed to help households track income and expenses effectively. It typically contains sections for income sources, categorized expenses such as housing, food, transportation, and savings goals. This structure ensures families can identify spending patterns and make informed financial decisions.

Simple Annual Budget Template for Individuals

A Simple Annual Budget Template for individuals typically contains sections for tracking income, expenses, savings, and financial goals. It organizes monthly and yearly data to help users monitor their financial health efficiently.

Key components include fixed and variable expenses, sources of income, and a summary of net savings or deficits. Including a contingency fund and regular review points enhances effective budget management throughout the year.

One-Year Financial Planner with Monthly Tracking

A One-Year Financial Planner with Monthly Tracking is a document that helps individuals or businesses organize their finances over a twelve-month period. It typically includes budget forecasts, income and expense tracking, and savings goals. Monitoring these elements monthly ensures better financial discipline and goal achievement.

Personal Finance Tracker with Annual Overview

A Personal Finance Tracker with Annual Overview is a comprehensive document that helps individuals monitor their monthly income, expenses, and savings to manage their financial health effectively.

- Income Sources: Track all streams of income to get a clear picture of total earnings throughout the year.

- Expense Categories: Categorize expenses to identify spending patterns and control unnecessary costs.

- Annual Summary: Provide a yearly overview to evaluate financial progress and set future budgeting goals.

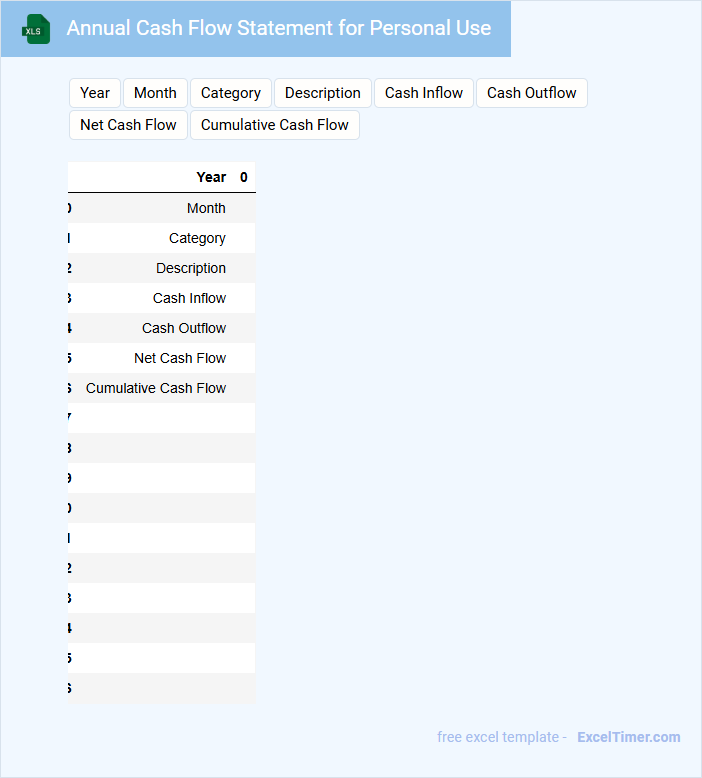

Annual Cash Flow Statement for Personal Use

An Annual Cash Flow Statement for personal use is a financial document that summarizes the inflows and outflows of cash over a year. It helps individuals track their spending, savings, and income sources efficiently.

This statement typically contains sections for income, expenses, investments, and savings changes. Regularly updating this document is crucial for maintaining financial health and planning future budgets.

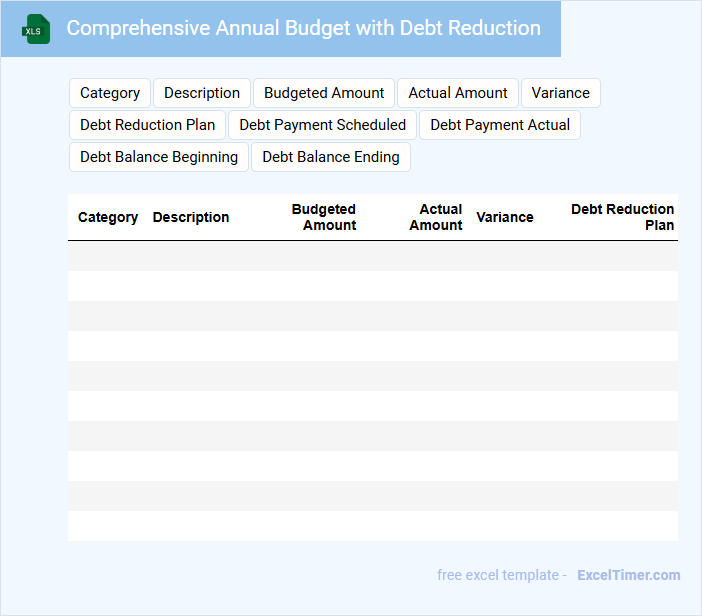

Comprehensive Annual Budget with Debt Reduction

A Comprehensive Annual Budget with Debt Reduction outlines a government's planned expenditures and revenues for the fiscal year, incorporating strategies to decrease outstanding debt. It serves as a financial roadmap ensuring fiscal responsibility and long-term economic stability.

- Include detailed revenue forecasts and expenditure plans to ensure accurate budgeting.

- Incorporate clear debt reduction targets with timelines to track progress effectively.

- Provide contingency plans for unexpected economic changes to maintain fiscal discipline.

Yearly Income and Expense Tracker for Couples

A Yearly Income and Expense Tracker for Couples is a document designed to record and monitor both partners' financial inflows and outflows over the course of a year. It typically contains detailed sections for various income sources, regular and irregular expenses, and savings goals. This tracker helps couples maintain transparency, manage their budget effectively, and plan for future financial stability together.

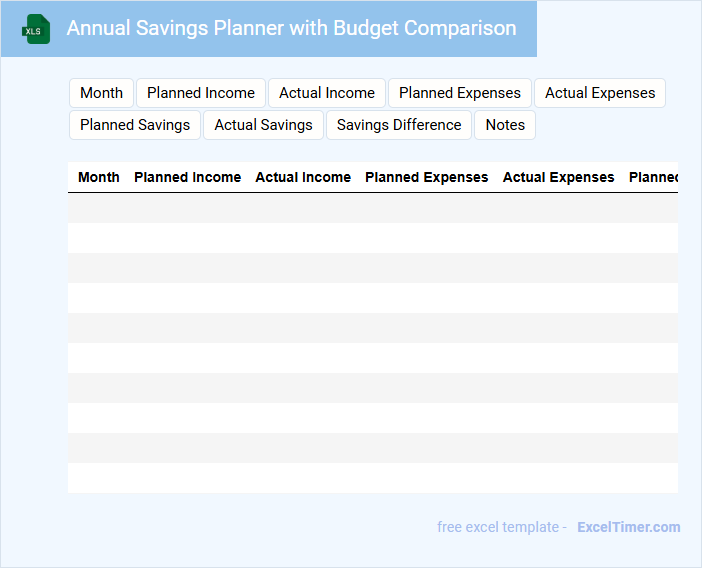

Annual Savings Planner with Budget Comparison

An Annual Savings Planner with Budget Comparison typically contains detailed records of income, expenses, and savings goals tracked over the year. It helps individuals or businesses visualize financial habits and identify areas for optimization by comparing planned budgets against actual spending. Including clear categories and timely updates is crucial for maintaining accuracy and achieving financial objectives efficiently.

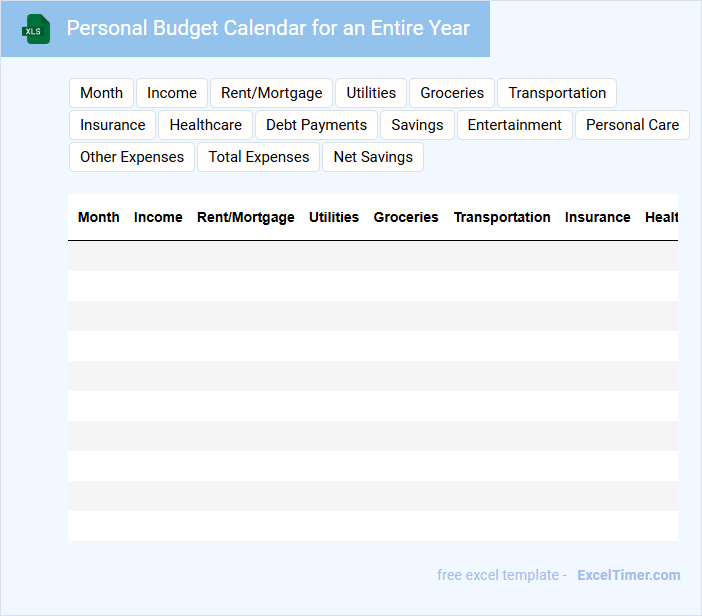

Personal Budget Calendar for an Entire Year

A Personal Budget Calendar is typically a document that outlines income and expenses on a monthly basis throughout an entire year. It helps individuals track their financial commitments and plan for future expenditures effectively.

For an entire year, this type of document usually contains sections for monthly income, fixed and variable expenses, savings goals, and debt repayments. Incorporating reminders for bill payments and review dates is an important feature to maintain financial discipline.

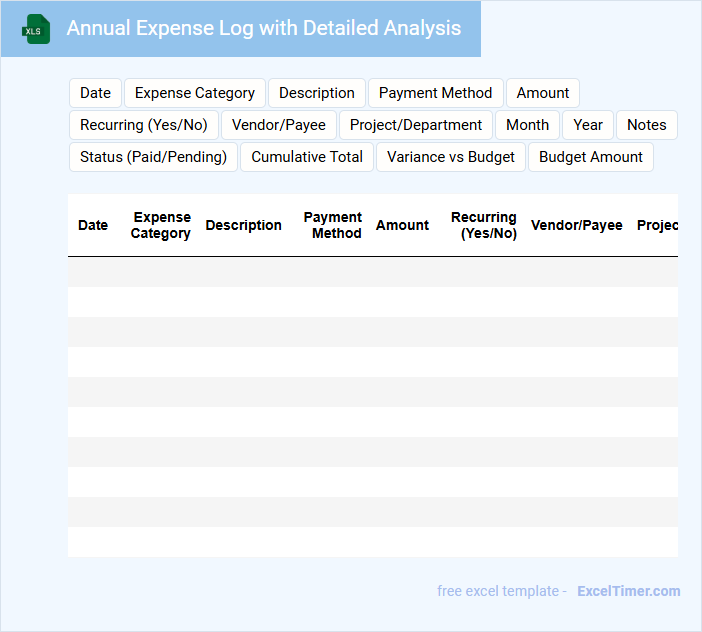

Annual Expense Log with Detailed Analysis

An Annual Expense Log with detailed analysis typically contains a comprehensive record of all expenses incurred throughout the year, categorized by type and date. It provides a clear overview of spending patterns and trends, helping users identify areas where costs can be optimized. Including detailed breakdowns and summaries ensures transparency and supports informed financial decision-making.

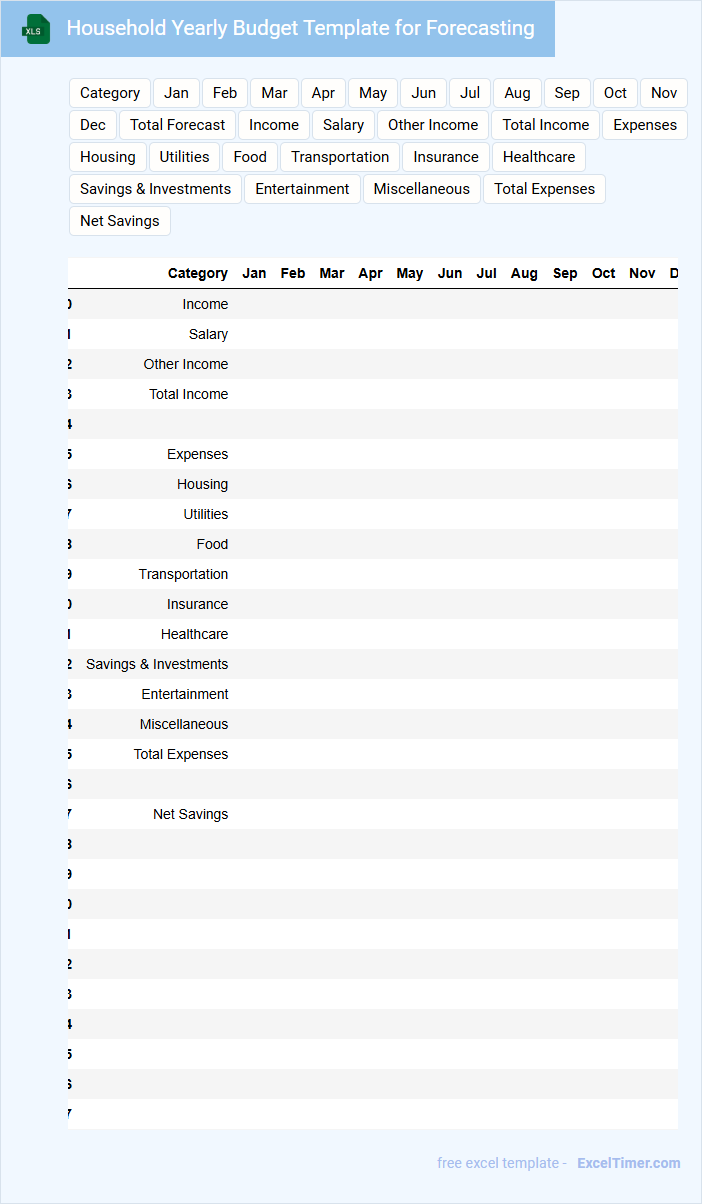

Household Yearly Budget Template for Forecasting

Household Yearly Budget Templates for Forecasting are essential tools designed to help individuals or families plan and manage their annual finances efficiently. They provide a structured overview of expected income and expenses throughout the year to facilitate better financial decisions.

- List all sources of income and categorize monthly and yearly expenses comprehensively.

- Include variable costs such as utilities and unexpected expenses for realistic forecasting.

- Review and update the budget regularly to reflect actual spending and financial changes.

What are the essential categories to include in an annual personal budget planner (e.g., income, savings, fixed expenses, variable expenses, investments)?

An annual personal budget planner should include essential categories such as income sources, savings goals, fixed expenses like rent or mortgage, variable expenses including groceries and entertainment, and investments for long-term growth. Tracking these categories ensures comprehensive financial management and aids in achieving financial goals. Detailed categorization enhances accuracy in forecasting and expense monitoring.

How does Excel facilitate automated tracking of monthly and yearly financial goals within an annual budget planner?

Excel enables automated tracking of monthly and yearly financial goals through built-in formulas, pivot tables, and conditional formatting. Users can input income, expenses, and savings data, which Excel dynamically calculates to compare actual spending against budgeted amounts. Visual dashboards and summary sheets provide real-time insights, helping to monitor financial progress and adjust goals efficiently.

What key Excel formulas and functions are most effective for calculating budget variances and summarizing yearly spending trends?

Key Excel formulas for calculating budget variances include SUMIFS for category totals, IF statements to identify overspending, and ABS for variance magnitude. Functions like YEAR, MONTH, and TEXT enable clear summarization of yearly spending trends by date. You can efficiently track and analyze your annual budget performance with pivot tables and conditional formatting for visual variance insights.

Which visualization tools (charts, graphs, conditional formatting) in Excel best present a clear overview of annual financial health?

Use Excel's Pie Charts to display expense categories, highlighting their proportion of the total budget. Incorporate Line Graphs to track income and expenses trends over the 12 months. Apply Conditional Formatting with color scales to quickly identify budget variances and highlight overspending periods.

How can you structure an Excel sheet to efficiently compare your planned annual budget versus actual expenditures by category?

Create an Excel sheet with columns for Budget Category, Planned Amount, Actual Expenditure, and Variance. Use formulas to calculate variance by subtracting Actual Expenditure from Planned Amount. Incorporate conditional formatting to highlight categories where spending exceeds the budget for quick visual analysis.