The Annually Portfolio Performance Excel Template for Investors enables detailed tracking of investment returns and asset allocation throughout the year. It provides customizable charts and formulas to measure growth, risk, and diversification effectively. Accurate data input ensures investors make informed decisions based on clear, organized financial insights.

Annual Portfolio Performance Tracker for Investors

An Annual Portfolio Performance Tracker is a document that summarizes the yearly results of an investment portfolio, highlighting gains, losses, and overall returns. It typically contains detailed reports on asset allocation, individual investment performance, and benchmark comparisons. For investors, an important aspect is regularly updating this document to make informed decisions about future investment strategies.

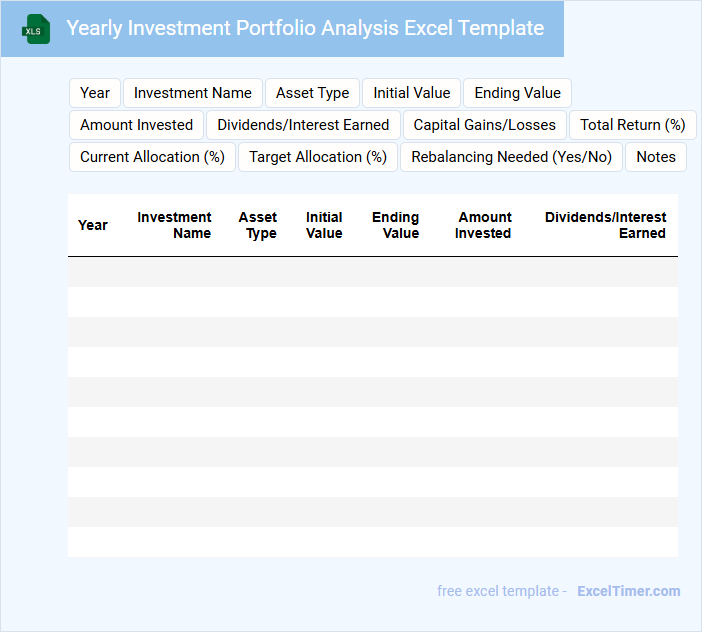

Yearly Investment Portfolio Analysis Excel Template

A Yearly Investment Portfolio Analysis Excel template typically contains comprehensive financial data summarizing annual investment performance. It includes asset allocation, returns by asset class, risk metrics, and comparison charts for trend analysis. This document helps investors or analysts systematically review gains, losses, and portfolio diversification for informed decision-making.

An important suggestion is to incorporate automated data input fields and dynamic charts to enhance usability and real-time insights. Additionally, including benchmark comparisons and clear risk indicators can improve the evaluation process. Ensuring the template is customizable for various asset types and time frames significantly boosts its practicality.

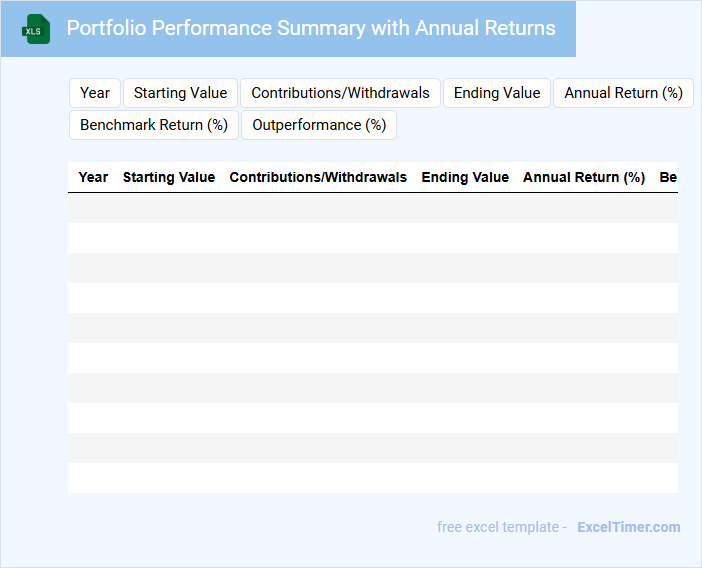

Portfolio Performance Summary with Annual Returns

A Portfolio Performance Summary typically contains detailed information about investment returns over specific periods, highlighting annual performance metrics. It provides insights into the portfolio's growth, risks, and comparisons with benchmark indices. Including visual aids like charts and tables can enhance understanding and clarity for stakeholders.

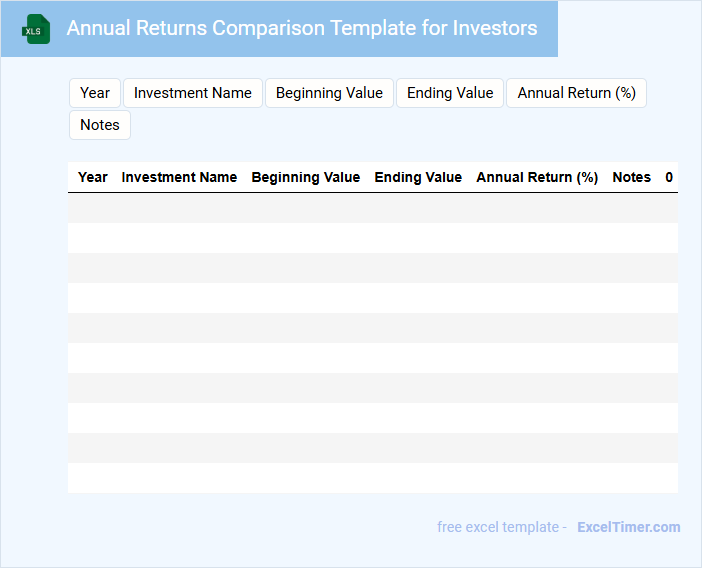

Annual Returns Comparison Template for Investors

Annual Returns Comparison Templates for Investors typically contain detailed financial performance data that allows investors to evaluate and compare the yearly returns of various investment options. This document facilitates informed decision-making by highlighting trends and growth patterns over multiple years.

- Include accurate and up-to-date financial data for each investment option.

- Present annual returns clearly using tables or graphs for easy comparison.

- Highlight key factors influencing returns such as market conditions or investment strategies.

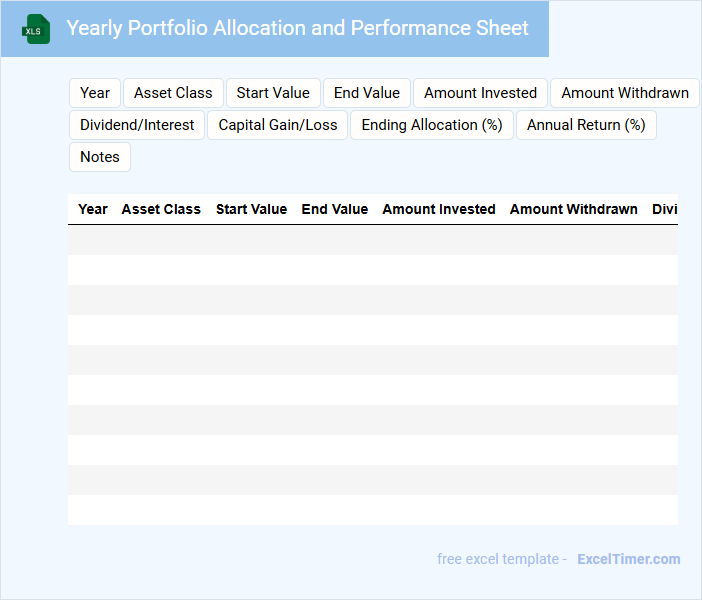

Yearly Portfolio Allocation and Performance Sheet

The Yearly Portfolio Allocation and Performance Sheet typically contains detailed records of an investor's asset distribution across various categories over the course of a year. It highlights the performance metrics of each asset class, showcasing returns, risks, and overall portfolio growth. This document serves as a crucial tool for evaluating investment strategies and making informed adjustments for future financial planning.

Key elements to include are initial and ending portfolio values, percentage allocation to different asset types, and comparative performance against benchmarks. It is important to regularly update this sheet to track progress and identify trends effectively. Including a summary analysis with actionable insights can significantly enhance decision-making for portfolio optimization.

Dividend Tracking with Annual Performance Report

Dividend Tracking with Annual Performance Report documents typically contain detailed records of dividend payments and an analysis of yearly investment returns.

- Dividend History: A clear record of all dividends received over the year.

- Performance Metrics: Key indicators reflecting annual financial growth or decline.

- Investment Insights: Analysis highlighting trends and future dividend projections.

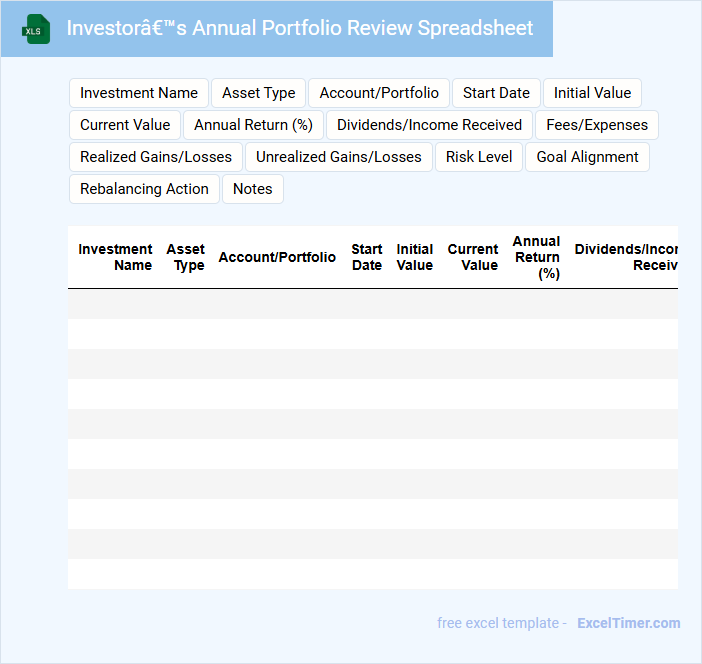

Investor’s Annual Portfolio Review Spreadsheet

An Investor's Annual Portfolio Review Spreadsheet typically contains a detailed summary of all investments, including asset allocation, returns, and transaction history. It helps investors track the performance of their portfolio over the year, highlighting key metrics such as gains, losses, and dividends.

Important components include a clear breakdown of individual securities, risk assessment, and comparison against benchmarks. Regularly updating this spreadsheet ensures accurate performance evaluation and informed decision-making for future investments.

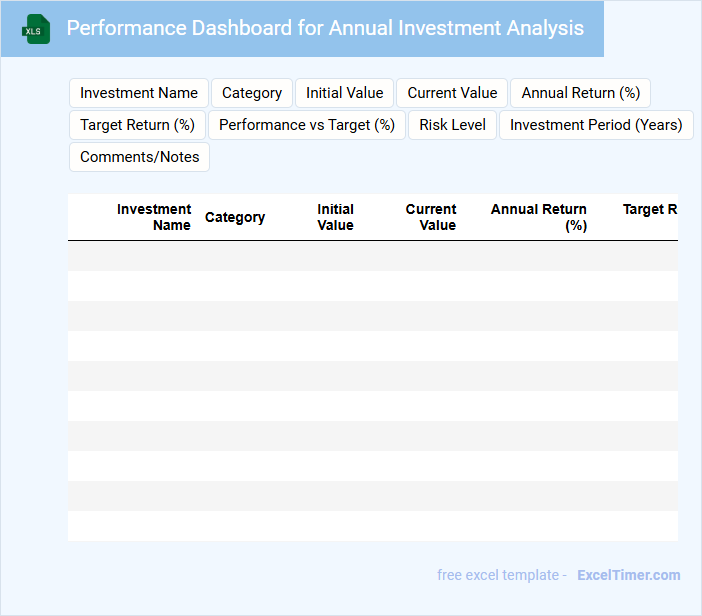

Performance Dashboard for Annual Investment Analysis

What information is typically included in a Performance Dashboard for Annual Investment Analysis? This document usually contains key financial metrics, investment performance trends, and comparative benchmarks to evaluate the overall portfolio effectiveness. It highlights returns, risk indicators, and allocation summaries to support informed decision-making and strategic planning.

What important aspects should be emphasized in this dashboard? Focus on clear visualization of data such as graphs and charts for quick insights, timely updates to reflect current market conditions, and customizable views allowing stakeholders to analyze specific segments or periods for comprehensive evaluation.

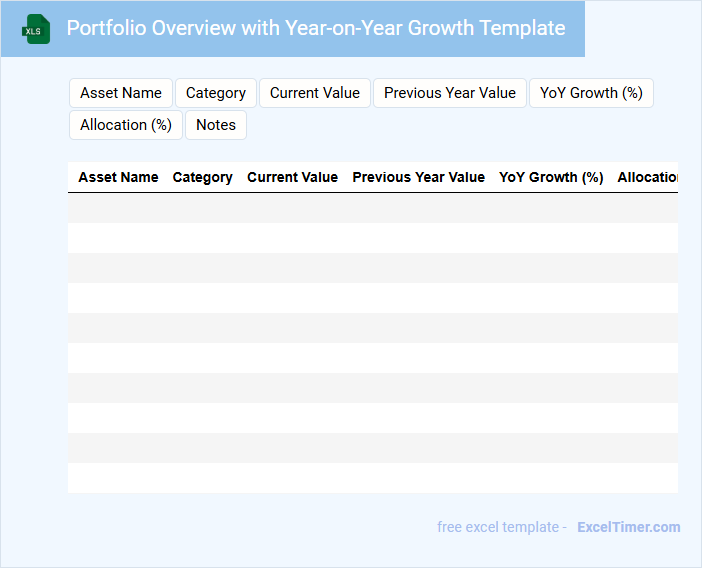

Portfolio Overview with Year-on-Year Growth Template

A Portfolio Overview with Year-on-Year Growth Template typically contains a summary of investment assets, performance metrics, and comparative growth data over multiple years. It highlights the changes in portfolio value, asset allocation, and key financial indicators to provide a clear picture of progress. This document is essential for tracking financial health and making informed investment decisions.

Important elements to include are consistent data series, clear visualization of growth trends, and annotations explaining significant fluctuations. Ensure the template is easy to update and interpret for both stakeholders and analysts. Additionally, incorporating benchmarks and future projections can enhance strategic planning and portfolio management.

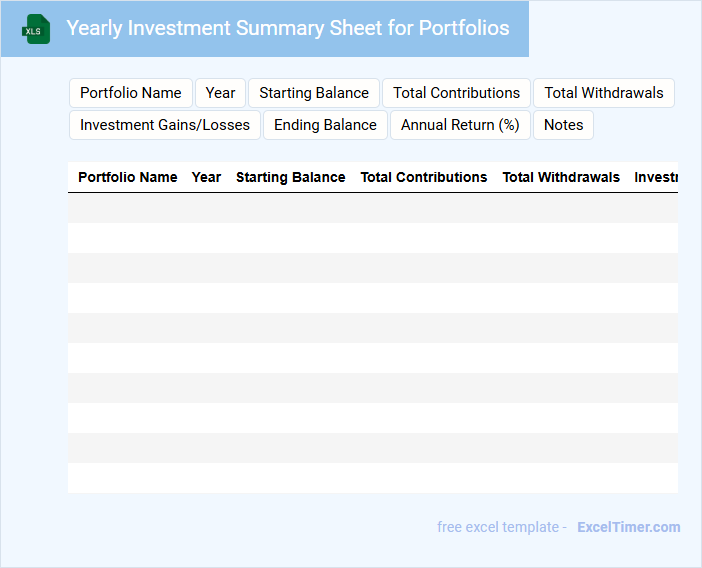

Yearly Investment Summary Sheet for Portfolios

The Yearly Investment Summary Sheet provides a comprehensive overview of an investor's portfolio performance over the past year. It typically contains detailed information on asset allocations, gains and losses, dividends received, and overall portfolio growth. This document serves as a crucial tool for assessing investment strategies and making informed financial decisions.

Important elements to include are a clear breakdown of each investment type, percentage changes compared to previous years, and a summary of fees or expenses incurred. Additionally, highlighting key performance indicators and market trends can enhance the document's usefulness. Ensuring accuracy and readability will help investors quickly grasp their portfolio's status and progress.

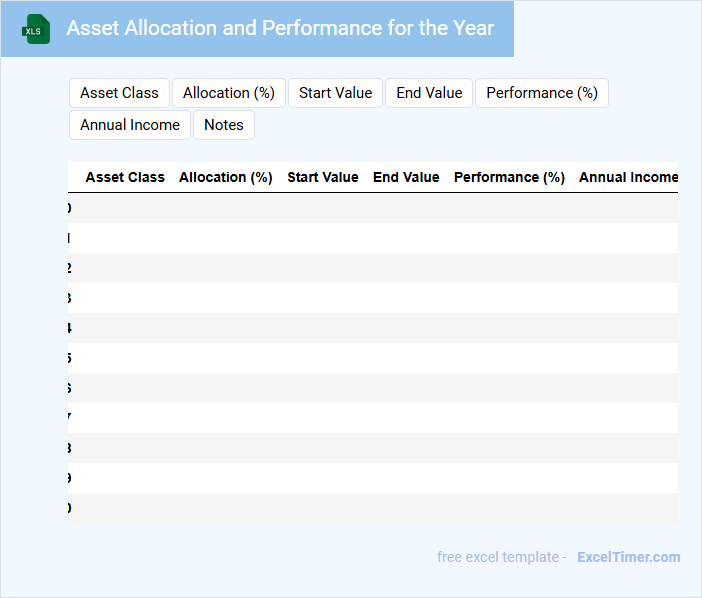

Asset Allocation and Performance for the Year

This document typically outlines the asset allocation strategy, detailing the distribution of investments across various asset classes such as stocks, bonds, and cash. It also provides a comprehensive overview of the investment performance for the year, highlighting key returns and benchmarks. Important considerations include risk assessment, diversification, and alignment with financial goals.

Portfolio Returns Tracker with Annual Benchmarks

A Portfolio Returns Tracker is a document designed to monitor and evaluate the performance of investment portfolios over time. It typically contains detailed records of returns, asset allocation, and comparisons against annual benchmarks. This helps investors identify trends, assess risk, and make informed decisions to optimize their investment strategies.

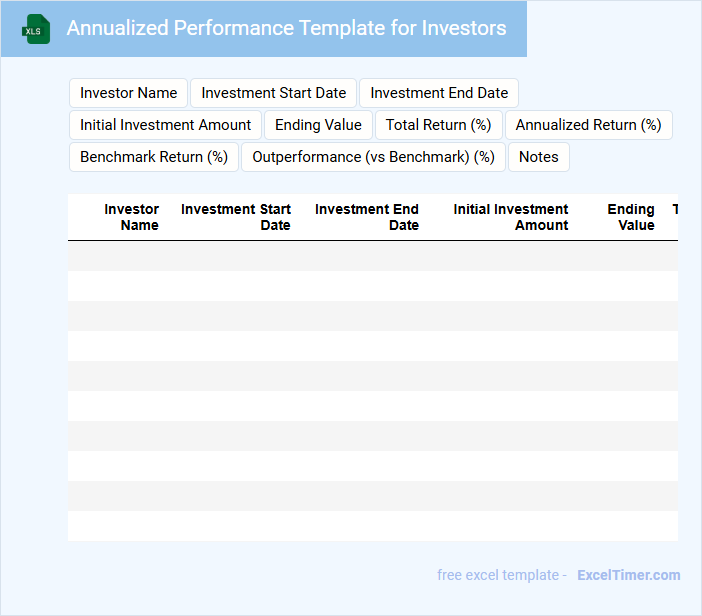

Annualized Performance Template for Investors

An Annualized Performance Template for investors typically contains detailed financial metrics that illustrate the yearly return rates of various investments. This document helps track growth and compare performance over standardized timeframes.

Key elements usually include historical returns, benchmarks, and cumulative gains presented clearly for easy analysis. Ensuring accuracy and regular updates is crucial for maintaining investor confidence and informed decision-making.

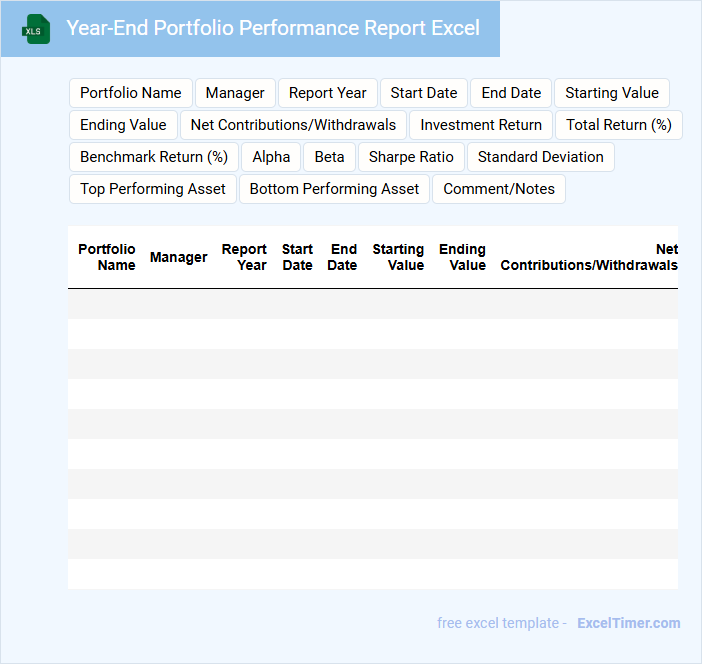

Year-End Portfolio Performance Report Excel

What information is typically included in a Year-End Portfolio Performance Report Excel? This document usually contains a detailed summary of an investment portfolio's annual performance, including metrics such as returns, asset allocation, and risk assessments. It helps investors and managers evaluate the effectiveness of their investment strategies over the year.

What important aspects should be considered when preparing this report? Ensuring accuracy of data input, including consistent formatting and reliable sources, is crucial. Additionally, incorporating clear visualizations like charts and graphs can enhance the comprehensibility of the portfolio's performance trends.

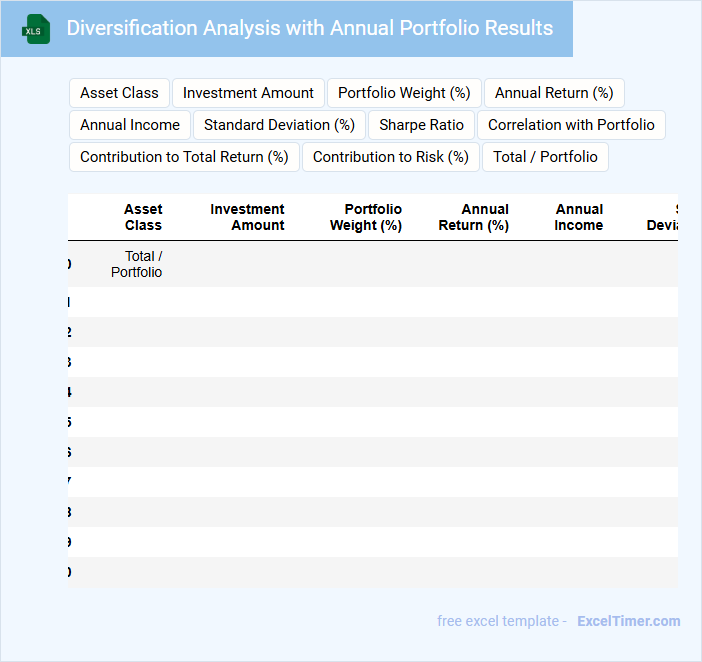

Diversification Analysis with Annual Portfolio Results

The Diversification Analysis document typically contains detailed evaluations of how a portfolio's assets are spread across different sectors, geographies, or asset classes to minimize risk. It includes annual portfolio results showcasing performance metrics, risk indicators, and return distributions over the year. This report helps investors understand the balance and effectiveness of their investment diversification strategies.

What is the annualized rate of return calculated in your Excel portfolio performance sheet?

The annualized rate of return in the Excel portfolio performance sheet represents the geometric average rate of return per year, accounting for compounding effects. It is calculated using the formula: \[(Ending\ Value / Beginning\ Value)^{(1/Number\ of\ Years)} - 1\]. This metric provides investors with a standardized measure to compare portfolio growth over multiple years.

How does your Excel document track year-over-year changes in portfolio value?

The Excel document tracks year-over-year changes in portfolio value by comparing annual closing balances and calculating percentage growth or decline. It uses formulas to summarize gains, losses, dividends, and contributions for each year, providing a clear performance overview. Dynamic charts visualize trends, enabling investors to assess portfolio growth and risk across multiple years.

Which metrics in your Excel file measure portfolio volatility or risk annually?

Your Excel file likely includes metrics such as annualized standard deviation and beta to measure portfolio volatility or risk annually. These metrics quantify fluctuations in portfolio returns and sensitivity to market movements, providing key insights into performance stability. Sharpe ratio may also be present to assess risk-adjusted returns for your investment portfolio.

Does your Excel sheet include diversification analysis for each year?

The Excel document provides an annual portfolio performance summary for investors, highlighting key metrics such as returns and volatility. It includes diversification analysis by breaking down asset allocation and sector exposure for each year. This detailed breakdown helps investors assess risk distribution and optimize portfolio balance over time.

How are dividends and capital gains accounted for in the annual portfolio performance summary?

Dividends in the annual portfolio performance summary are recorded as income reflecting distributions from investments, enhancing total returns. Capital gains are tracked as realized profits from asset sales, directly impacting the portfolio's net appreciation. Both metrics are integral to accurately assessing the portfolio's overall annual performance.