The Annual Budget Planner Excel Template for Small Businesses helps streamline financial management by organizing income, expenses, and forecasts in one easy-to-use spreadsheet. It enables small business owners to track cash flow, set realistic financial goals, and monitor budget performance throughout the year. Utilizing this template improves decision-making and supports sustainable business growth.

Annual Budget Tracker with Income & Expenses

An Annual Budget Tracker is a financial document designed to monitor income and expenses throughout the year. It typically contains categorized records of all sources of income alongside detailed expense entries to help maintain financial balance. This tool is essential for identifying spending patterns and making informed budget adjustments to achieve financial goals.

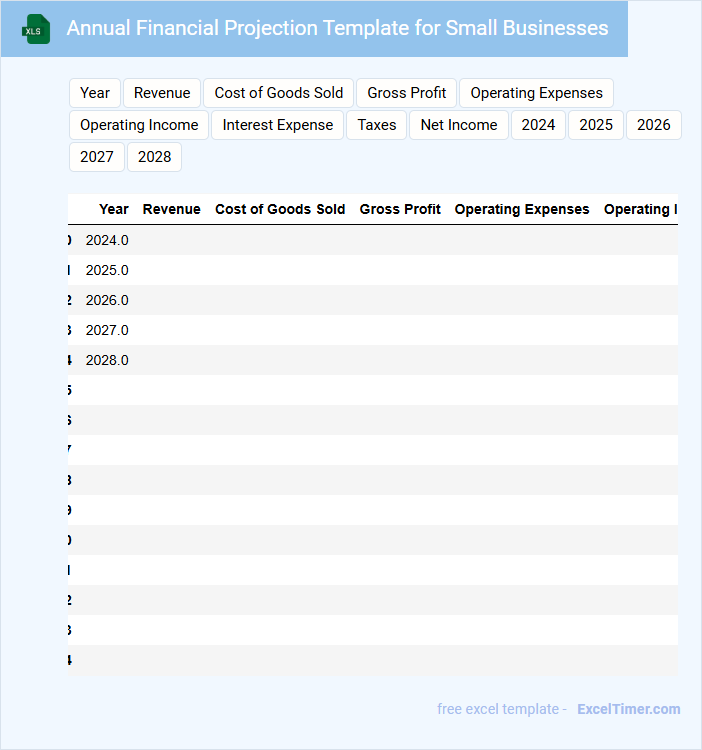

Annual Financial Projection Template for Small Businesses

What information does an Annual Financial Projection Template for Small Businesses usually contain? This type of document typically includes projected income statements, cash flow forecasts, and balance sheets for the upcoming year. It helps business owners anticipate revenue, expenses, and financial health to make informed strategic decisions.

What is an important aspect to consider when using this template? It is crucial to base projections on realistic assumptions about sales growth, costs, and market conditions. Accurate data inputs ensure the projections provide valuable insights for budgeting and securing funding.

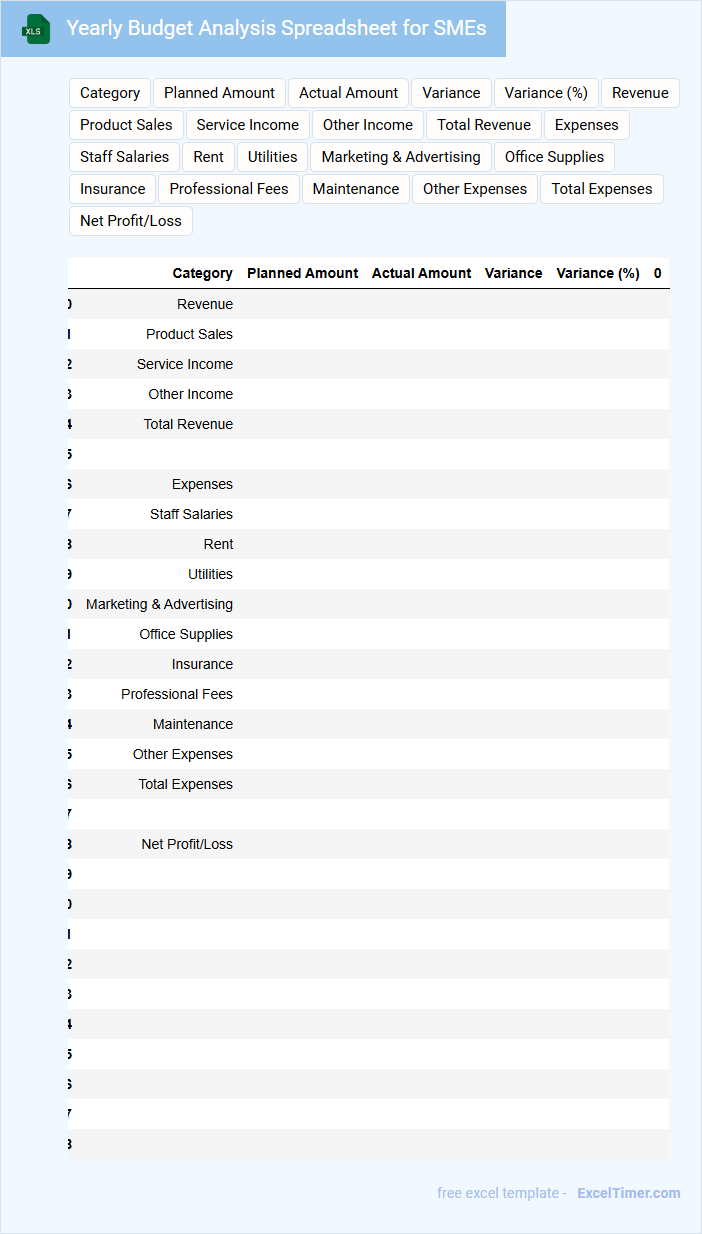

Yearly Budget Analysis Spreadsheet for SMEs

A Yearly Budget Analysis Spreadsheet for SMEs typically contains detailed income and expense records, categorized monthly to track financial performance. It includes comparison metrics to assess budget adherence and financial efficiency over the year.

Such documents often feature summaries of cash flow, profit margins, and expenditure trends vital for strategic planning. An important suggestion is to regularly update the spreadsheet with accurate data to ensure effective financial decision-making and forecasting.

Excel Template for Annual Expense Planning

An Excel Template for Annual Expense Planning typically contains detailed categories for various expense types, including fixed, variable, and unexpected costs. It helps users organize their financial data clearly and prepare a comprehensive budget for the upcoming year. Key features often include summary tables, graphs, and automated calculations to track and project expenses efficiently.

Important suggestions for this template include ensuring clear monthly categories, incorporating realistic forecasting based on past spending, and allowing flexibility for adjustments throughout the year. Including sections for notes or comments can improve accuracy and context. Additionally, enabling data validation and protection can prevent errors and maintain template integrity.

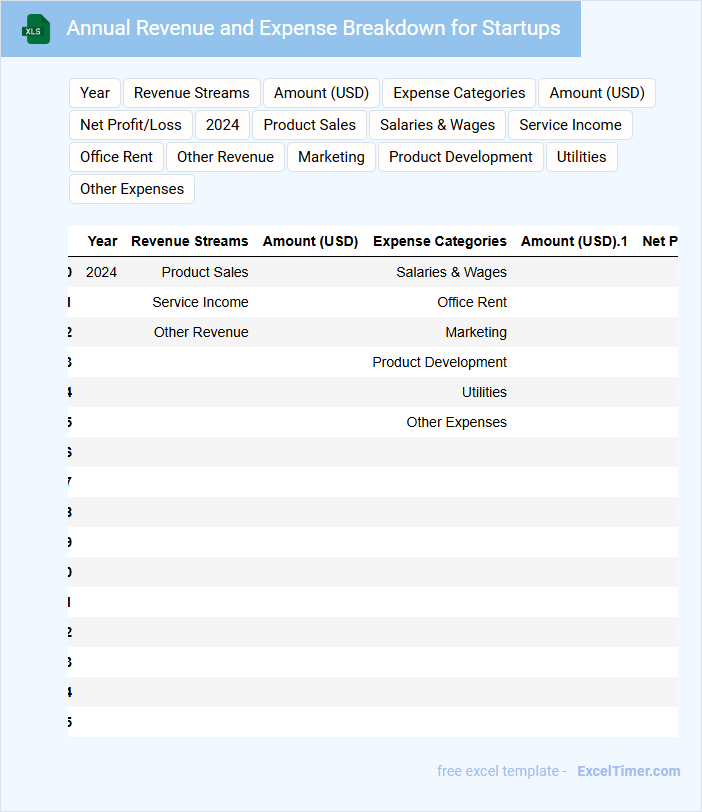

Annual Revenue and Expense Breakdown for Startups

What information does an Annual Revenue and Expense Breakdown for Startups typically include? This document usually contains detailed records of a startup's income sources and all incurred costs over the fiscal year. It provides insights into financial performance, helping stakeholders understand profitability and areas of expenditure.

Why is it important to track and analyze this breakdown annually? Regular analysis enables startups to manage cash flow effectively, plan budgets strategically, and identify opportunities for growth or cost-cutting. Ensuring accuracy and clarity in this document is crucial for informed decision-making and attracting potential investors.

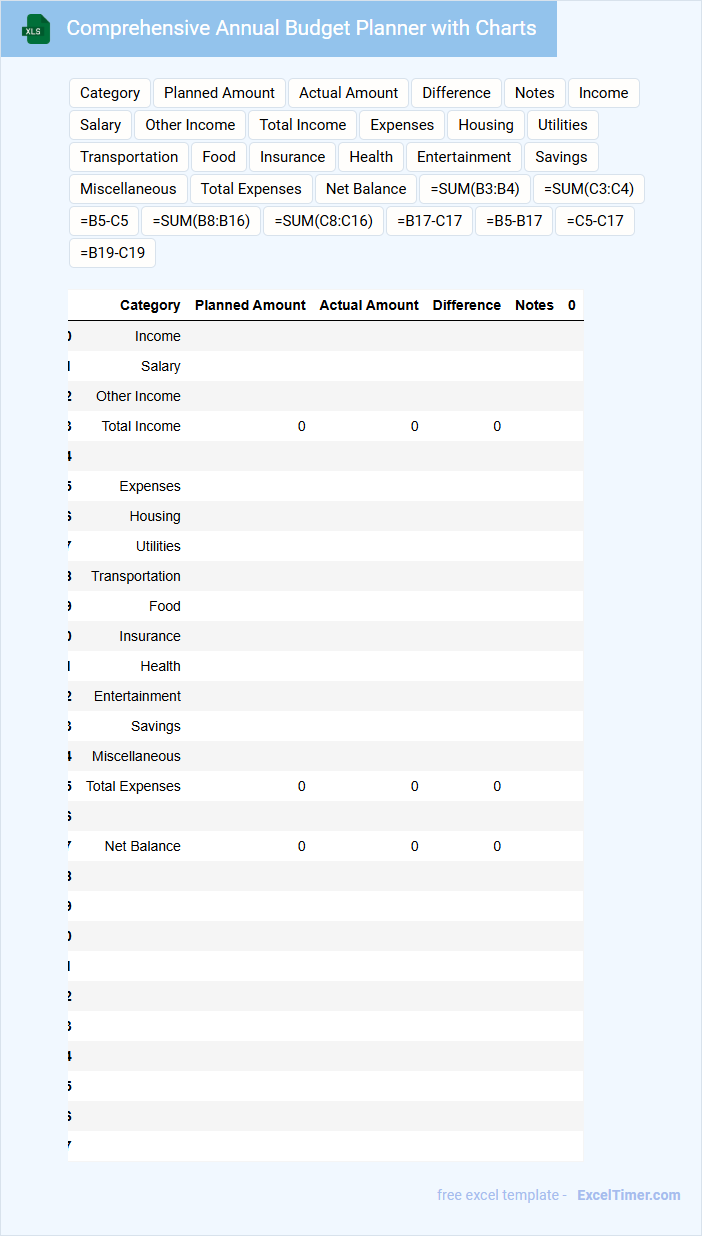

Comprehensive Annual Budget Planner with Charts

A Comprehensive Annual Budget Planner typically contains detailed financial projections and allocations for an entire year, helping individuals or businesses manage their income and expenses effectively. It often includes various charts such as pie charts, bar graphs, and line graphs to visualize spending patterns and budget comparisons. Key elements to focus on include clear categorization of expenses, accurate income forecasting, and regular updates to reflect any financial changes.

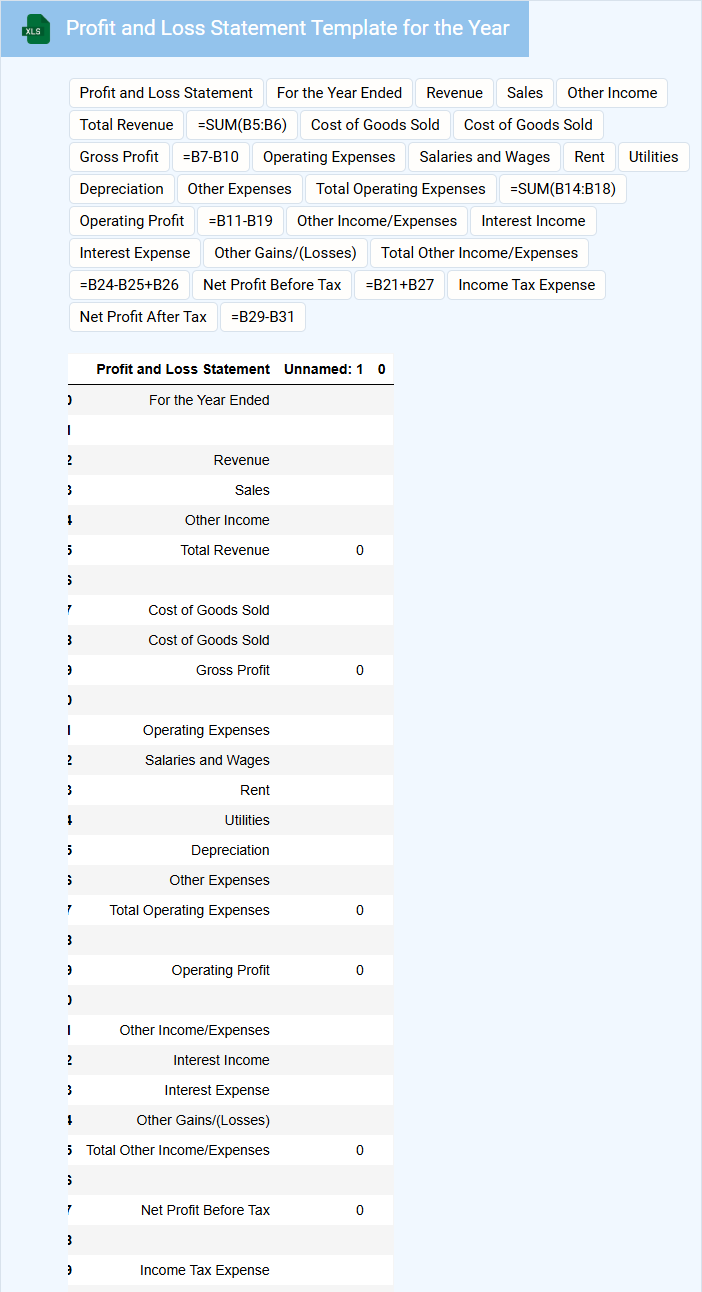

Profit and Loss Statement Template for the Year

A Profit and Loss Statement template typically contains detailed records of revenues, costs, and expenses incurred during a specific period, usually a fiscal year. It outlines the net profit or loss by subtracting total expenses from total income, providing clear insights into financial performance. For the year, it is crucial to ensure accuracy in categorizing income and expenses to maintain transparency and aid effective decision-making.

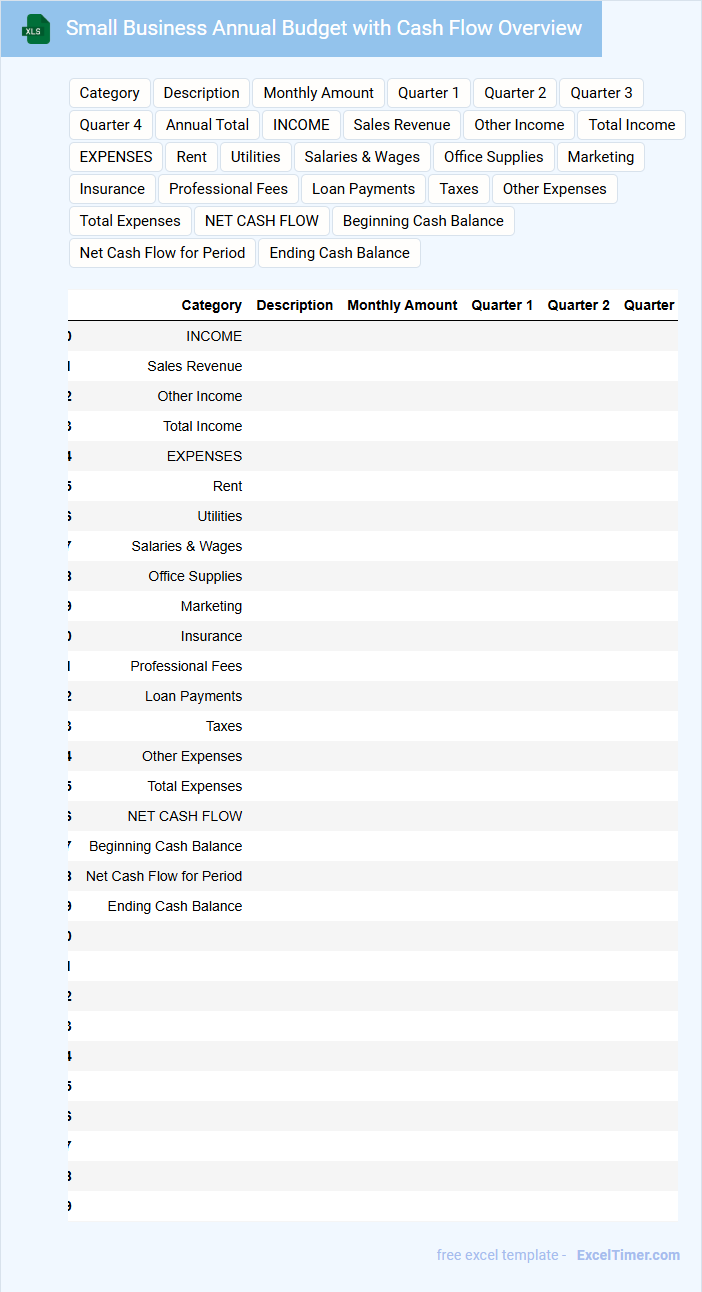

Small Business Annual Budget with Cash Flow Overview

A Small Business Annual Budget typically contains projected income, expenses, and profit margins for the fiscal year. It also includes detailed allocations for different departments and operational needs to ensure financial discipline.

Alongside, a Cash Flow Overview highlights the timing of cash inflows and outflows, ensuring the business maintains sufficient liquidity to meet obligations. This helps identify potential cash shortages before they occur.

It is important to regularly update the budget and monitor cash flow trends to support informed decision-making and sustainable growth.

Master Annual Business Budget Excel Sheet

The Master Annual Business Budget Excel Sheet is a comprehensive financial document used to plan and track a company's yearly income, expenses, and cash flow. It typically contains detailed sections for revenue forecasts, expense allocations, and profit projections, allowing for effective financial management. This sheet serves as a critical tool for aligning business goals with fiscal strategy and ensuring resource optimization throughout the year.

When creating or reviewing this type of sheet, it is important to ensure accuracy in data entry to avoid budgeting discrepancies. Incorporating dynamic formulas and linked sheets can enhance usability and real-time updates. Additionally, regularly updating assumptions and reviewing actual performance against the budget helps maintain financial control and supports informed decision-making.

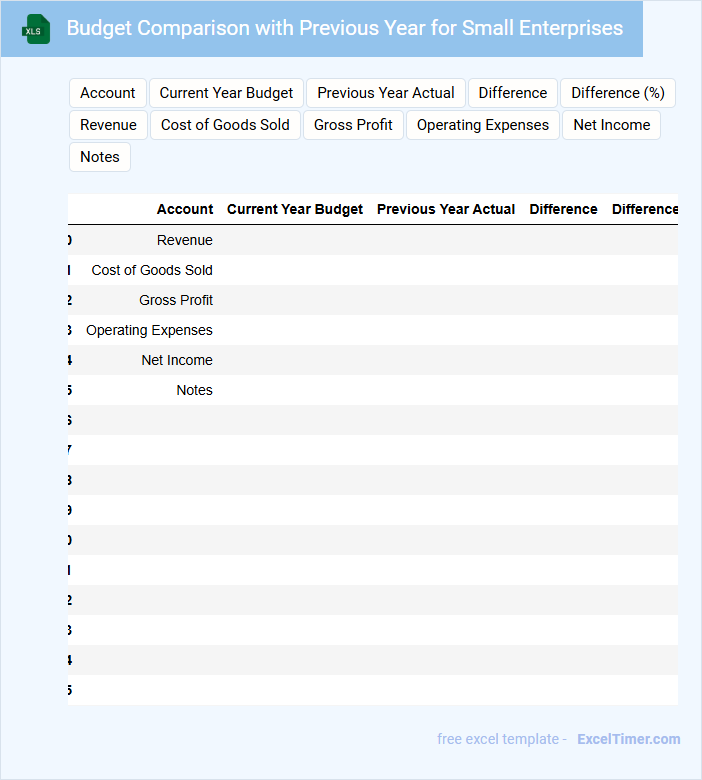

Budget Comparison with Previous Year for Small Enterprises

A Budget Comparison document for small enterprises typically contains a detailed analysis of the current year's budget against the previous year's figures. It highlights variances in revenue, expenses, and profitability to help identify trends and areas needing attention. This comparison aids decision-makers in planning and resource allocation for improved financial management.

Important aspects to focus on include ensuring accurate data collection, highlighting significant deviations with explanations, and incorporating visual aids like charts for clearer understanding. Emphasizing key cost drivers and revenue streams can help prioritize strategic initiatives. Regular updates and reviews of this document promote proactive financial control and business growth.

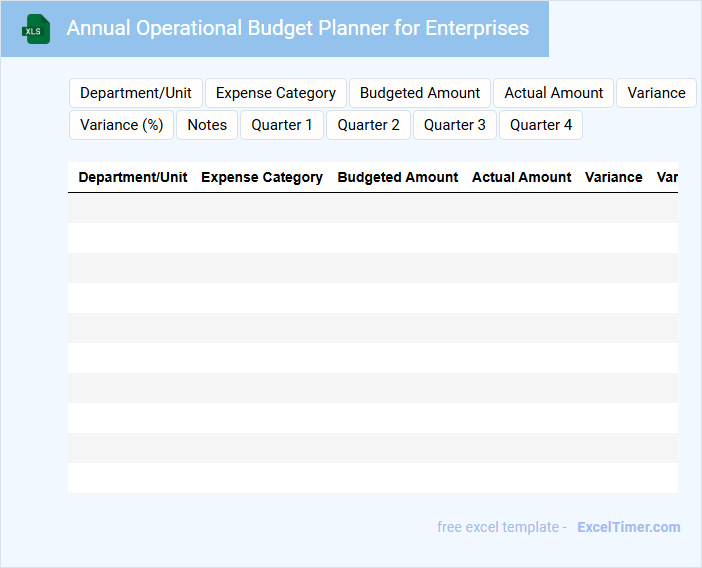

Annual Operational Budget Planner for Enterprises

An Annual Operational Budget Planner for enterprises typically contains detailed financial projections, including revenue forecasts, expense estimates, and cash flow analysis for the upcoming year. It serves as a vital tool for aligning resources with strategic goals and ensuring effective financial management. Key components often include departmental budgets, contingency plans, and performance metrics to track progress.

Important considerations for this document include accuracy in financial data, flexibility to accommodate unforeseen changes, and clarity to facilitate communication across departments. Incorporating regular review intervals and stakeholder input enhances its effectiveness. Prioritizing transparency and realistic assumptions ensures the planner supports informed decision-making and sustainable growth.

Cost Tracking and Annual Forecasting Template

A Cost Tracking and Annual Forecasting Template is a document used to monitor expenses and project financial performance over the year. It typically contains categorized cost data, budget comparisons, and future expenditure estimates. This template helps businesses maintain control over their finances and make informed decisions.

For optimal use, ensure regular updates of actual costs against projected figures to identify variances early. Include detailed categories for all expense types to enhance accuracy and clarity. Additionally, incorporate visual aids like charts to simplify data interpretation for stakeholders.

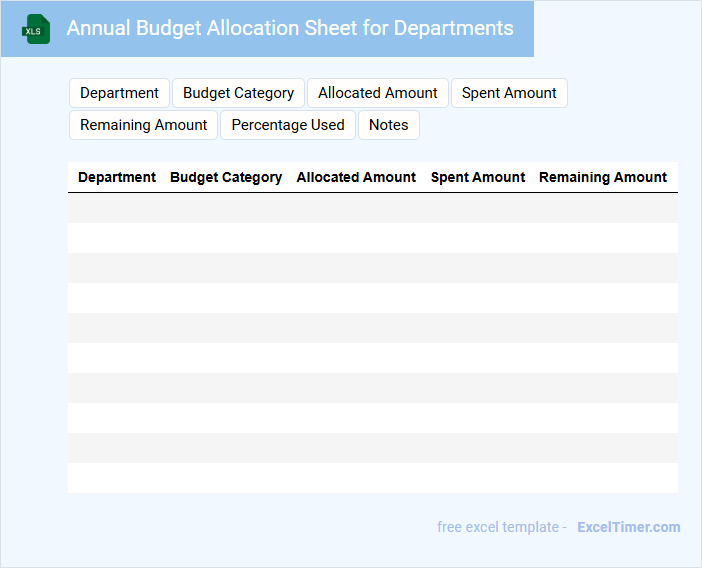

Annual Budget Allocation Sheet for Departments

An Annual Budget Allocation Sheet for departments typically contains detailed financial plans outlining the distribution of funds across various units within an organization. It includes projected expenses, revenue estimates, and designated budget limits for each department to ensure efficient resource management. Accurate and clear documentation in this sheet is crucial for informed decision-making and financial accountability throughout the fiscal year.

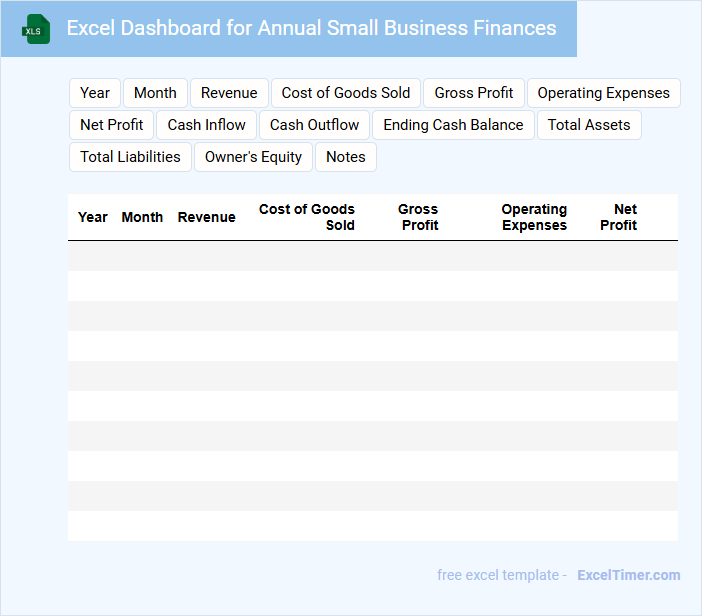

Excel Dashboard for Annual Small Business Finances

An Excel Dashboard for annual small business finances typically contains summarized financial data, key performance indicators, and visual charts to provide a clear overview of the company's financial status. This document helps business owners quickly assess profitability, track expenses, and monitor cash flow trends over the year. Including interactive elements like slicers or drop-down menus enhances usability and enables dynamic data analysis.

Projected Annual Income Statement with Detailed Categories

A Projected Annual Income Statement with Detailed Categories typically contains estimates of revenue, expenses, and profits organized into specific line items for accurate financial planning.

- Revenue Breakdown: Clearly categorize different sources of income to identify the contribution of each segment.

- Expense Classification: Detail fixed and variable expenses to monitor cost control and profitability.

- Profit Projections: Highlight expected gross and net profit margins to assess financial health and viability.

What are the essential categories to include in an annual budget planner for small businesses?

Essential categories in an annual budget planner for small businesses include revenue projections, fixed and variable expenses, payroll costs, marketing budgets, and cash flow estimates. You should also incorporate tax obligations, loan repayments, and contingency funds to ensure financial stability throughout the year. Tracking these categories enables accurate financial planning and informed decision-making.

How can you forecast monthly and yearly revenues effectively in an Excel budget document?

To forecast monthly and yearly revenues effectively in your Annual Budget Planner Excel document, use historical sales data and apply formulas such as SUMIFS and TREND for accurate projections. Incorporate seasonal trends and market fluctuations by analyzing past performance and adjusting assumptions accordingly. Utilize Excel charts and pivot tables to visualize revenue forecasts and monitor progress throughout the fiscal year.

Which Excel formulas or features are most useful for tracking expenses versus income?

Excel formulas like SUMIF and IFERROR, combined with features such as PivotTables and Conditional Formatting, are essential for tracking expenses versus income in your Annual Budget Planner. These tools allow you to categorize, analyze, and visualize financial data efficiently. Using these functionalities helps small businesses maintain accurate and dynamic budget oversight.

How can you use Excel to set and monitor financial goals throughout the budget year?

Use Excel's customizable templates in an Annual Budget Planner to set clear financial goals by inputting projected income, expenses, and savings targets. Leverage formulas and pivot tables to automatically track actual spending versus planned amounts, enabling real-time budget monitoring. Create charts and dashboards within Excel to visualize progress and adjust financial strategies throughout the budget year.

What methods can ensure data accuracy and minimize errors in your annual budget planner?

Using data validation and locked cells in your annual budget planner ensures input accuracy and prevents accidental changes. Incorporate built-in formulas and cross-check multiple data sources to minimize errors. Automate error alerts to promptly identify and correct inconsistencies.