![]()

The Annually Investment Portfolio Tracker Excel Template for Individual Investors provides a streamlined way to monitor yearly investment performance and asset allocation. It offers customizable fields for tracking stocks, bonds, dividends, and capital gains, helping investors make informed decisions. This template simplifies portfolio management by consolidating financial data and visualizing trends over time.

Annual Investment Portfolio Tracker with Performance Analytics

An Annual Investment Portfolio Tracker with Performance Analytics typically contains a comprehensive overview of investment holdings, their yearly performance metrics, and detailed analytical insights to guide financial decisions.

- Portfolio Summary: A detailed list of all assets held, including stocks, bonds, and other investments, with their current values.

- Performance Metrics: Yearly returns, risk assessments, and comparisons against benchmark indices to evaluate investment success.

- Analytical Insights: Graphs and tables highlighting trends, asset allocation, and suggestions for portfolio rebalancing or diversification.

Excel Template for Tracking Annual Investment Returns

An Excel Template for Tracking Annual Investment Returns is typically designed to organize and analyze yearly financial performance data. It usually contains fields for inputting investment amounts, returns, dates, and relevant notes. This document helps investors visualize growth trends and make informed decisions based on historical returns.

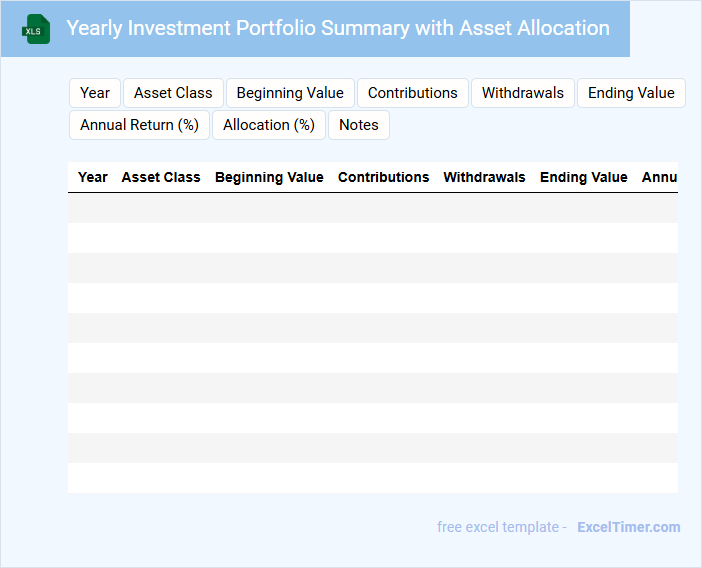

Yearly Investment Portfolio Summary with Asset Allocation

What does a Yearly Investment Portfolio Summary with Asset Allocation typically contain? This document usually provides a comprehensive overview of the portfolio's performance over the year, including gains, losses, and overall returns. It also details the distribution of assets across different categories, helping investors understand their investment diversification and risk exposure.

Why is asset allocation important in a yearly investment summary? Asset allocation is crucial because it illustrates how investments are spread among equities, bonds, cash, and other asset classes, impacting risk and potential returns. An optimized allocation aligned with an investor's goals and risk tolerance can enhance financial growth and stability over time.

Annual Portfolio Performance Tracker for Individual Investors

An Annual Portfolio Performance Tracker is a document that summarizes the yearly returns and activities of an individual investor's portfolio. It typically contains detailed records of asset allocations, gains, losses, and dividends received over the year. This tracker helps investors evaluate their investment strategies and make informed decisions for future allocations.

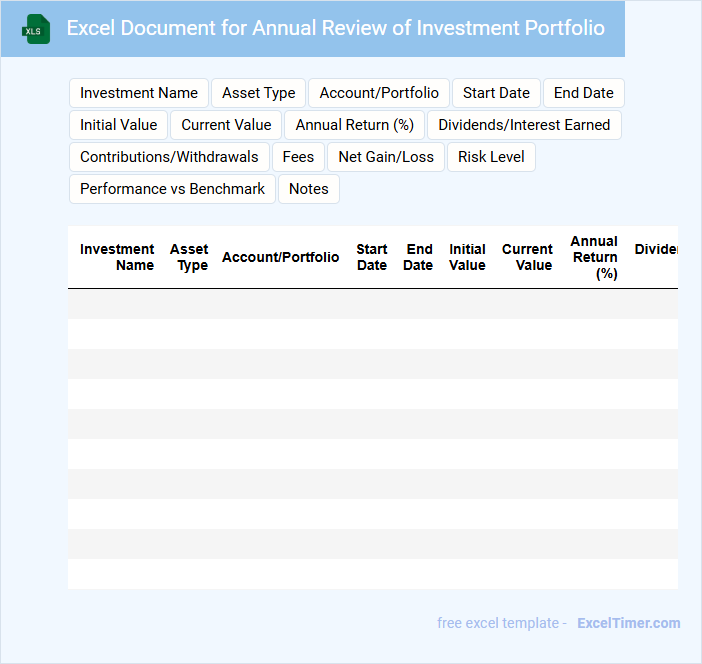

Excel Document for Annual Review of Investment Portfolio

An Excel Document for Annual Review of Investment Portfolio typically contains detailed financial data, including transactions, asset allocation, and performance metrics. It is designed to facilitate comprehensive analysis and tracking of investment gains and losses over the year.

The document usually includes charts, pivot tables, and summary statistics for easy visualization and interpretation. A key suggestion is to ensure data accuracy and timely updates for effective decision-making based on this report.

Personal Investment Tracker with Yearly Growth Analysis

This document typically contains detailed records of investment transactions, including dates, amounts, and types of assets. It tracks performance metrics to assess gains and losses over time for informed decision-making.

An important aspect is the yearly growth analysis, which highlights trends and evaluates portfolio progress. Including clear visualizations and summaries enhances understanding and strategic planning.

Annual Asset Allocation Tracker for Individual Investment Portfolios

An Annual Asset Allocation Tracker is a crucial document that outlines the distribution of assets within individual investment portfolios over a year. It typically contains categories such as stocks, bonds, real estate, and cash equivalents, helping investors monitor their portfolio balance. This document aids in assessing risk tolerance, ensuring diversification, and evaluating performance relative to financial goals.

Yearly Investment Income Tracker with Dividend Overview

A Yearly Investment Income Tracker with Dividend Overview is a document designed to record and monitor the income generated from investments throughout the year, with a particular focus on dividends received. It helps investors assess their portfolio's performance and plan for future financial goals.

- Include detailed records of each investment's dividend payments and dates.

- Summarize total income per investment type to identify the most profitable assets.

- Track dividend growth over time to evaluate the consistency and reliability of income streams.

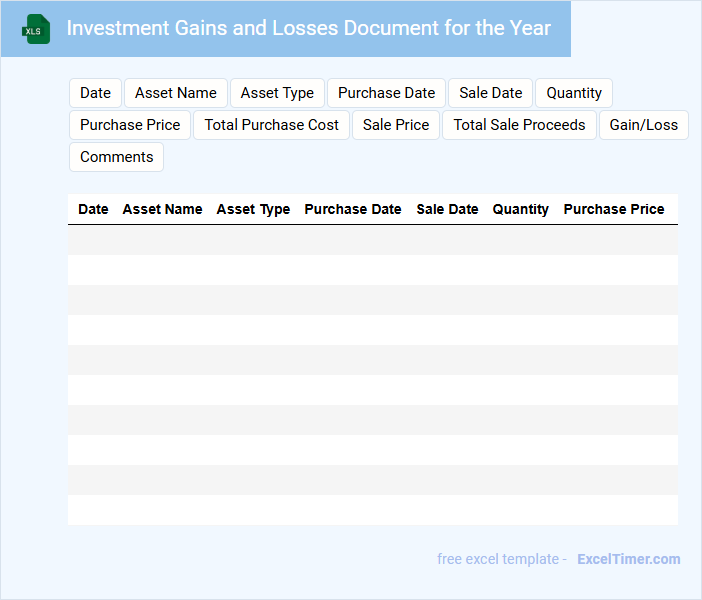

Annual Capital Gains Tracker for Individual Investors

An Annual Capital Gains Tracker for Individual Investors typically contains detailed records of asset sales, gains or losses realized, and tax implications throughout the fiscal year.

- Transaction Details: Includes dates, asset descriptions, purchase and sale prices to accurately calculate gains or losses.

- Summary of Gains and Losses: Provides a clear overview of total capital gains or losses categorized by short-term and long-term holdings.

- Tax Reporting Information: Ensures all relevant data is organized for seamless integration with tax filing requirements and optimization strategies.

Investment Portfolio Tracker with Annual Comparison Charts

An Investment Portfolio Tracker document typically contains detailed records of various assets, including stocks, bonds, and mutual funds. It helps investors monitor performance, allocation, and returns over time.

Annual Comparison Charts provide visual insights into the portfolio's growth and benchmark against previous years. Including these charts aids in identifying trends and making informed decisions.

It is important to ensure data accuracy, regularly update values, and incorporate diversification metrics for comprehensive analysis.

Year-End Investment Portfolio Review for Individual Use

A Year-End Investment Portfolio Review typically contains a comprehensive analysis of all investments held over the past year, including performance metrics, asset allocation, and risk assessment. It often summarizes changes in market conditions that have impacted the portfolio and highlights areas for adjustment based on financial goals. Important considerations include reviewing diversification, identifying tax implications, and setting strategies for the upcoming year.

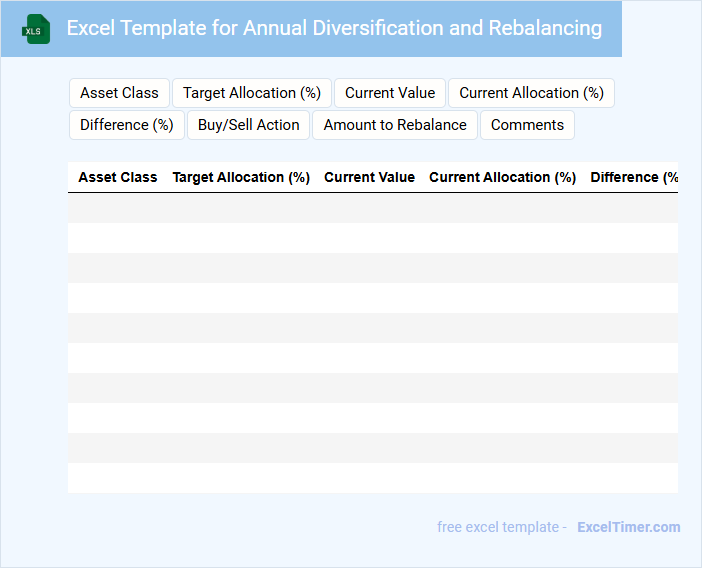

Excel Template for Annual Diversification and Rebalancing

An Excel Template for Annual Diversification and Rebalancing is typically designed to help investors monitor and adjust their portfolio allocations systematically. It contains sections for tracking asset classes, current portfolio values, target allocations, and deviations from desired weights. The template facilitates making informed decisions to maintain risk tolerance and optimize returns.

Important elements to include are an automated calculation of current portfolio percentages, comparative charts for target versus actual allocation, and alerts for when rebalancing thresholds are exceeded. Additionally, incorporating historical data can help analyze trends and improve future investment strategies. Clear instructions and customizable inputs enhance usability for different investment goals.

Investment Gains and Losses Document for the Year

An Investment Gains and Losses Document for the year typically contains detailed records of all financial transactions involving securities, including the purchase and sale dates, amounts, and the resulting profit or loss. This document helps investors track their portfolio's performance and is crucial for accurate tax reporting. It is important to ensure all entries are accurate and to keep supporting documents for each transaction.

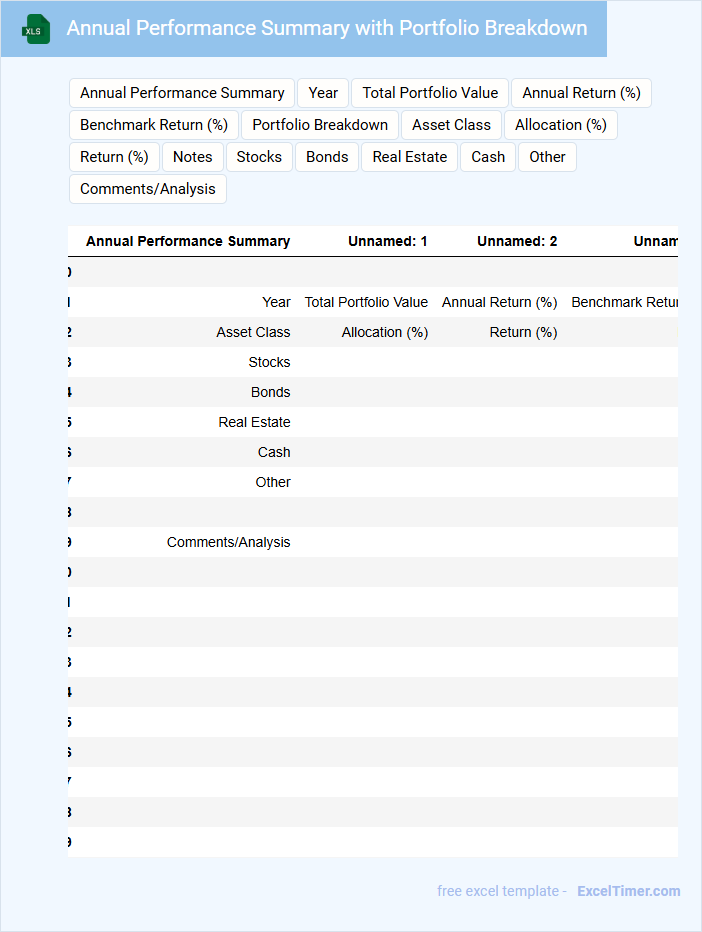

Annual Performance Summary with Portfolio Breakdown

The Annual Performance Summary provides a comprehensive review of an individual's or organization's yearly achievements and progress. It highlights key performance indicators, goals met, and areas for improvement to facilitate informed decision-making.

The Portfolio Breakdown details the distribution and performance of various assets or projects within the portfolio. It is essential to include clear data visualization and concise explanations to enhance understanding and strategic planning.

Excel Sheet for Tracking Annual Investment Contributions

An Excel Sheet for Tracking Annual Investment Contributions is typically used to record, monitor, and analyze yearly deposits made towards various investment accounts.

- Accurate Data Entry: Ensure all contribution amounts and dates are entered precisely to maintain reliable records.

- Clear Categorization: Organize investments by type or account for easier tracking and comparison across categories.

- Regular Updates: Frequently update the sheet to reflect any new contributions or changes in investment status.

What essential data columns should be included in an Annually Investment Portfolio Tracker for comprehensive individual investment analysis?

Essential data columns in an Annually Investment Portfolio Tracker should include: Investment Name, Ticker Symbol, Investment Type (e.g., stock, bond, mutual fund), Purchase Date, Purchase Price, Quantity Held, Current Market Price, Annual Dividends or Interest, Total Return Percentage, and Portfolio Allocation Percentage. Including columns for Fees and Taxes Paid, Annual Capital Gains or Losses, and Dividend Reinvestment Status enhances comprehensive analysis. Tracking these metrics allows individual investors to evaluate performance, risk, and diversification effectively.

How do you accurately calculate and display annualized return on investment (ROI) within the Excel document?

To accurately calculate and display annualized return on investment (ROI) in your Excel document, use the formula =((Ending Value / Beginning Value)^(1/Number of Years)) - 1. Apply this formula in a dedicated cell where you input your portfolio's initial and final values along with the investment duration in years. Format the result as a percentage to clearly track your portfolio's performance over time.

What methods can be implemented to categorize and visualize asset allocation by type, sector, or region in the tracker?

Implement data validation lists and pivot tables in Excel to categorize assets by type, sector, or region efficiently. Use dynamic charts like pie charts or stacked bar charts linked to pivot tables for clear visualization of portfolio allocation. Incorporate slicers and conditional formatting to enhance interactivity and highlight key allocation metrics.

How can you use Excel formulas to track and summarize dividend or interest income generated annually from each holding?

You can use Excel formulas such as SUMIF or SUMIFS to calculate the total dividend or interest income generated annually from each holding by summing income entries based on holding names and dates. Incorporate DATE or YEAR functions to filter income data within specific years for accurate annual summaries. This approach enables precise tracking and efficient analysis of your investment income in the portfolio tracker.

What safeguards or validation techniques should be used in the tracker to minimize manual entry errors and ensure portfolio data integrity?

Implement data validation rules such as dropdown lists for asset types and date pickers to reduce manual entry errors in Your Annual Investment Portfolio Tracker. Employ conditional formatting to highlight inconsistencies or outliers in portfolio values and formulas to automatically calculate returns and asset allocations. Integrate locked cells and password protection to prevent unintended changes, maintaining the integrity of Your investment data.