The Annually Tax Deduction Planner Excel Template for Self-Employed helps freelancers and entrepreneurs systematically track deductible expenses throughout the year, ensuring accurate tax filing. It simplifies the organization of receipts, mileage, and business expenses, reducing the risk of missing critical deductions. This tool is essential for maximizing tax savings and maintaining financial clarity for self-employed individuals.

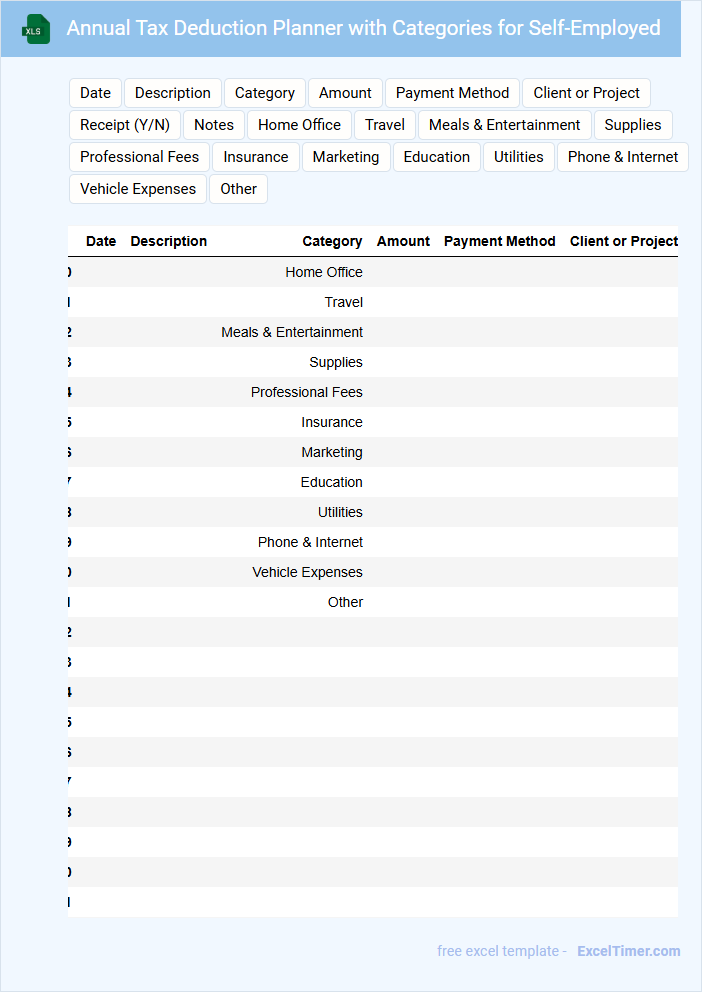

Annual Tax Deduction Planner with Categories for Self-Employed

What does an Annual Tax Deduction Planner with Categories for Self-Employed typically contain? It usually includes a detailed list of deductible expenses organized into relevant categories such as office supplies, travel, and professional services. This document helps self-employed individuals systematically track and optimize their tax deductions throughout the fiscal year.

Why is it important to use such a planner? Proper categorization ensures accurate record-keeping and simplifies tax reporting, minimizing errors and maximizing eligible deductions. Regularly updating the planner can prevent missed deductions and improve overall financial management.

Yearly Tax Deduction Tracker for Self-Employed Professionals

Yearly Tax Deduction Trackers for Self-Employed Professionals typically contain detailed records of all deductible expenses throughout the fiscal year. These documents help in organizing financial data efficiently for accurate tax filing and maximizing deductions.

- Include all business-related expenses such as office supplies and travel costs.

- Track estimated tax payments made during the year to avoid penalties.

- Record income and any additional sources relevant to self-employment.

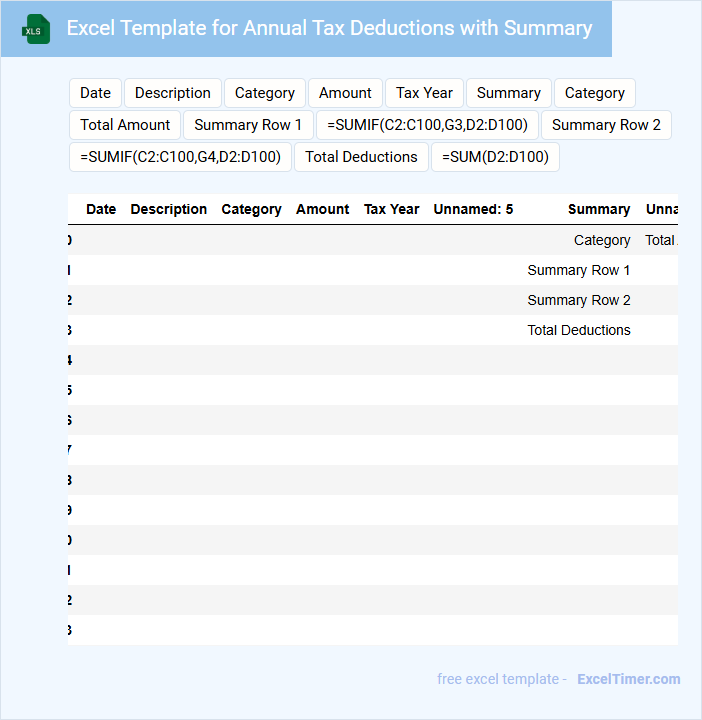

Excel Template for Annual Tax Deductions with Summary

What information does an Excel Template for Annual Tax Deductions with Summary typically contain? This type of document usually includes detailed records of all income, eligible tax deductions, and payments made throughout the fiscal year. It also features a summary section that consolidates critical data, making it easier for users to review their overall tax liability and ensure accurate filing.

What is an important consideration when using this template? It is essential to accurately input all relevant financial transactions and regularly update deduction categories to reflect current tax laws. Additionally, ensuring the summary section automatically recalculates totals helps maintain correctness and saves time during tax preparation.

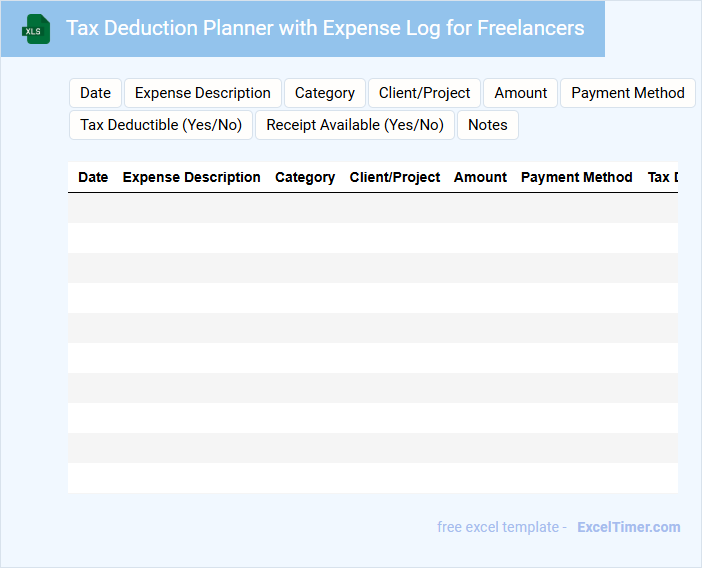

Tax Deduction Planner with Expense Log for Freelancers

What information is typically included in a Tax Deduction Planner with Expense Log for Freelancers? This document usually contains detailed records of income, categorized expenses, and potential deductions relevant to freelancing activities. It helps freelancers organize their financial data efficiently to maximize tax benefits.

For optimal use, it is important to consistently update the log with accurate dates, amounts, and descriptions of expenses. Additionally, including receipts and categorizing expenses according to tax guidelines ensures better clarity and easier tax filing.

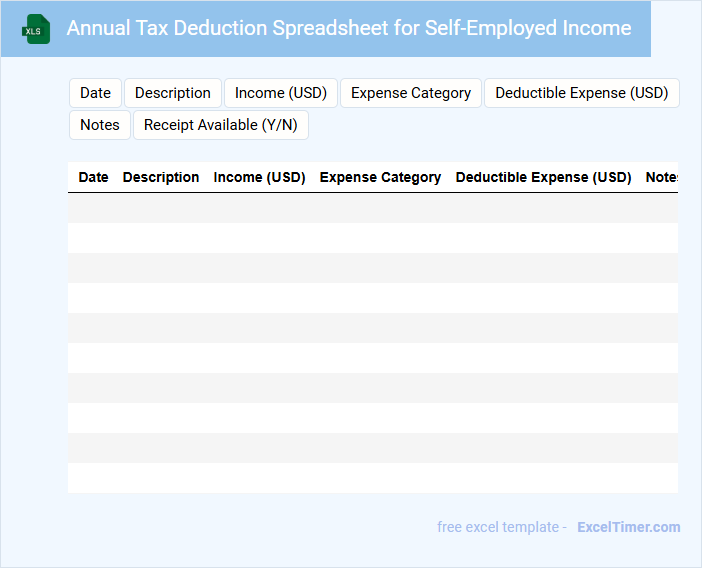

Annual Tax Deduction Spreadsheet for Self-Employed Income

An Annual Tax Deduction Spreadsheet for self-employed income is a detailed record used to track all deductible expenses throughout the fiscal year. It helps in calculating the total deductions applicable to reduce taxable income, ensuring accurate tax reporting.

This document typically contains categories such as business expenses, mileage, office supplies, and other relevant costs. For best results, regularly update the spreadsheet and keep all receipts organized for easy verification during tax filing.

Tax Deduction Tracker with Receipts for the Self-Employed

This document is a Tax Deduction Tracker specifically designed for self-employed individuals to organize and monitor their deductible expenses. It typically contains detailed entries for various categories of expenses alongside attached receipts for accurate record-keeping.

Maintaining such a tracker helps ensure compliance with tax regulations and maximizes potential deductions, ultimately reducing taxable income. It is important to regularly update and securely store all receipts to support claims during tax filing.

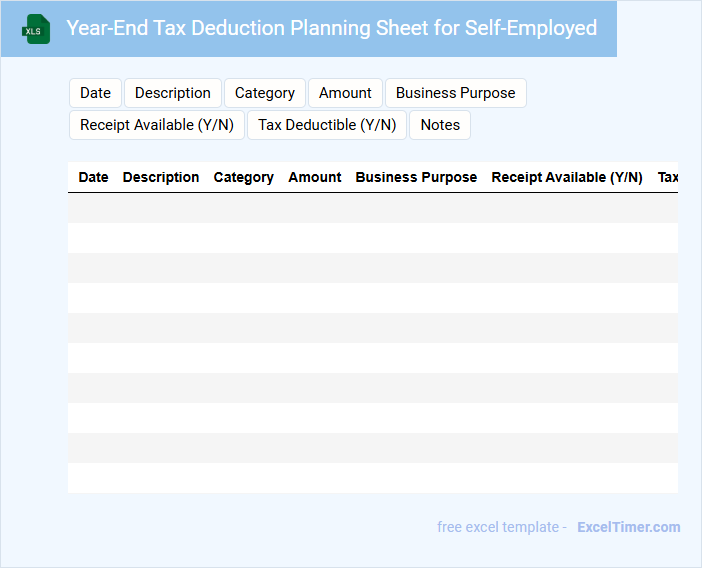

Year-End Tax Deduction Planning Sheet for Self-Employed

This Year-End Tax Deduction Planning Sheet for self-employed individuals typically contains detailed records of expenses, income, and potential deductions to optimize tax filings. It helps in organizing receipts, tracking deductible business expenses, and estimating tax liabilities before the fiscal year ends. Utilizing this document ensures comprehensive tax preparation and maximizes eligible savings.

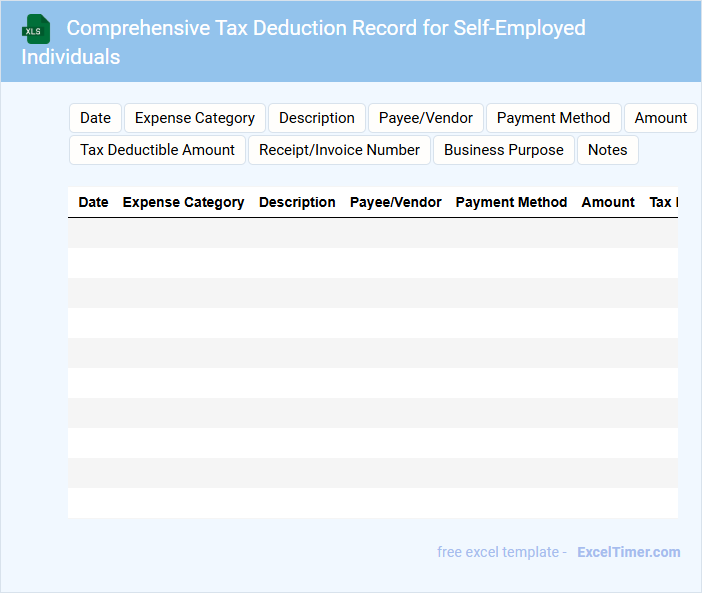

Comprehensive Tax Deduction Record for Self-Employed Individuals

A Comprehensive Tax Deduction Record for self-employed individuals typically contains detailed documentation of all expenses and income relevant for tax reporting purposes. This record serves as essential evidence for deductions to maximize tax return benefits and ensure compliance with tax laws. Keeping an organized and thorough record facilitates accurate tax filing and reduces the risk of audits.

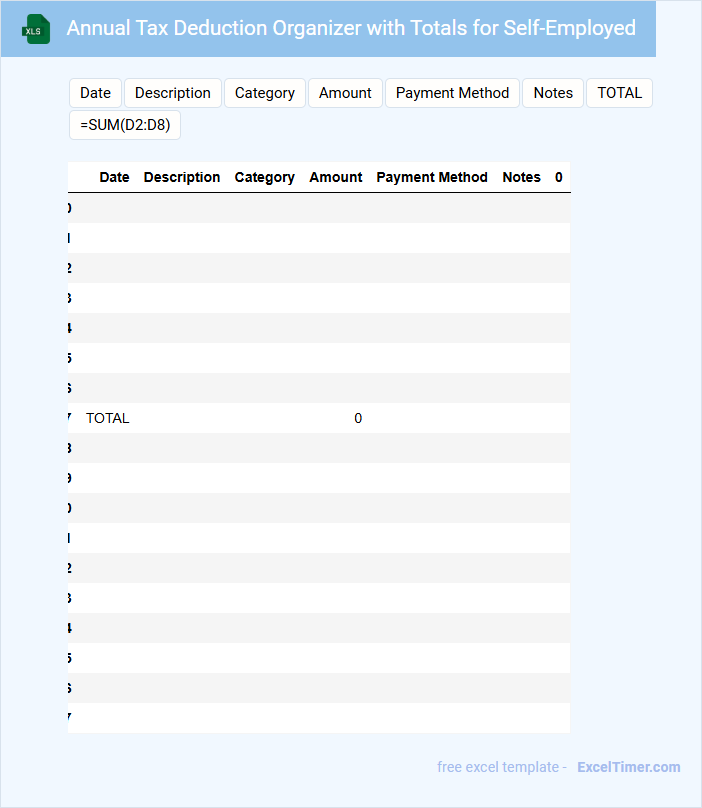

Annual Tax Deduction Organizer with Totals for Self-Employed

An Annual Tax Deduction Organizer for the self-employed is a comprehensive document designed to track and summarize all deductible expenses throughout the fiscal year. It typically includes categorized entries for business expenses, mileage logs, and receipts that support tax deductions. Keeping an accurate organizer helps simplify tax filing and ensures maximum allowable deductions are claimed.

Important elements to include are detailed categories for expenses like office supplies, travel, and home office deductions, along with space to record dates and amounts. Keeping digital or physical copies of all receipts is crucial for verification in case of audits. Regularly updating the organizer throughout the year reduces last-minute stress and improves financial accuracy.

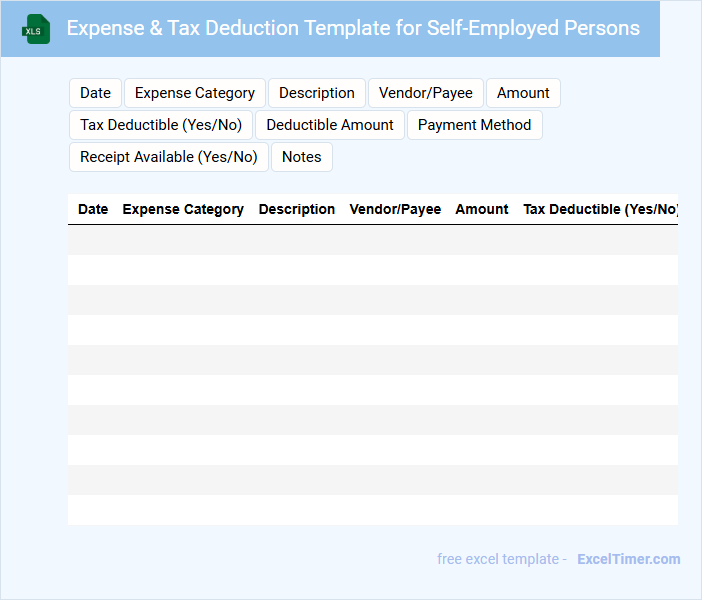

Expense & Tax Deduction Template for Self-Employed Persons

An Expense & Tax Deduction Template for self-employed persons typically contains detailed records of business expenses, income, and potential deductions. This document helps organize financial information essential for accurate tax reporting.

The template usually includes categories such as office supplies, travel costs, and home office deductions, tailored to the unique needs of independent workers. Maintaining organized records using this template can simplify tax filing and maximize allowable deductions.

It is important to consistently update the template with receipts and invoices to ensure compliance and optimize tax benefits.

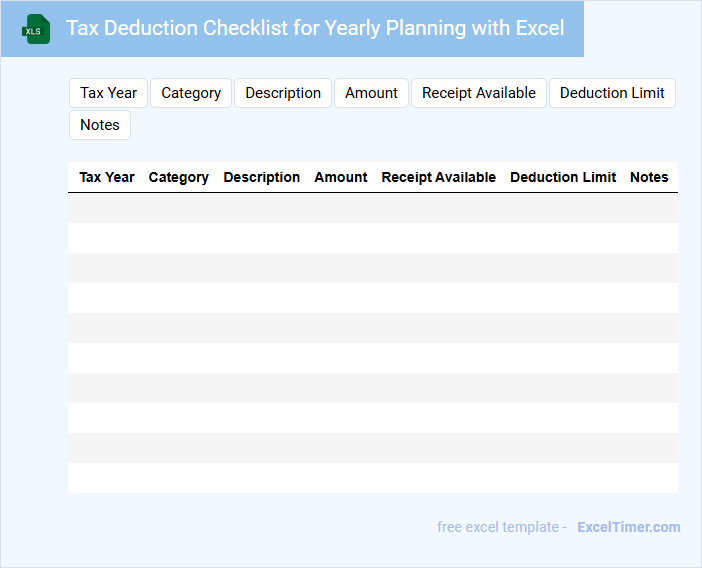

Tax Deduction Checklist for Yearly Planning with Excel

This document typically contains a structured overview of potential tax deductions categorized for efficient yearly financial planning using Excel.

- Income Documentation: Gather and organize all sources of income such as salaries, dividends, and freelance earnings for accurate reporting.

- Deductible Expenses: List and track possible deductions including medical expenses, charitable donations, and business costs.

- Excel Utilization: Use Excel to create formulas and pivot tables to automate calculations and maintain an updated overview.

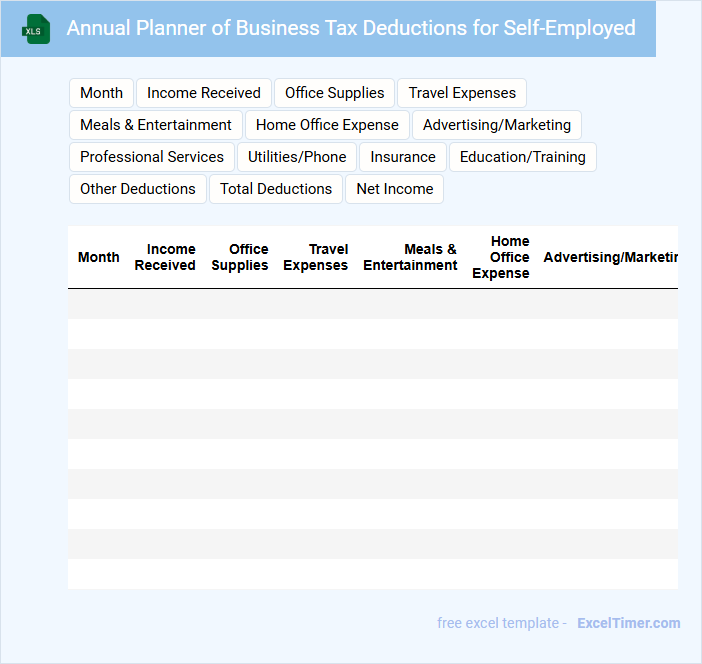

Annual Planner of Business Tax Deductions for Self-Employed

An Annual Planner of Business Tax Deductions for Self-Employed is a strategic document outlining key deductible expenses to optimize tax savings throughout the fiscal year.

- Expense Tracking: Maintain detailed records of all business-related expenses to ensure accurate deductions.

- Deadline Awareness: Mark important tax dates to avoid penalties and maximize filing benefits.

- Category Identification: Classify deductions into categories such as home office, travel, and supplies for organized reporting.

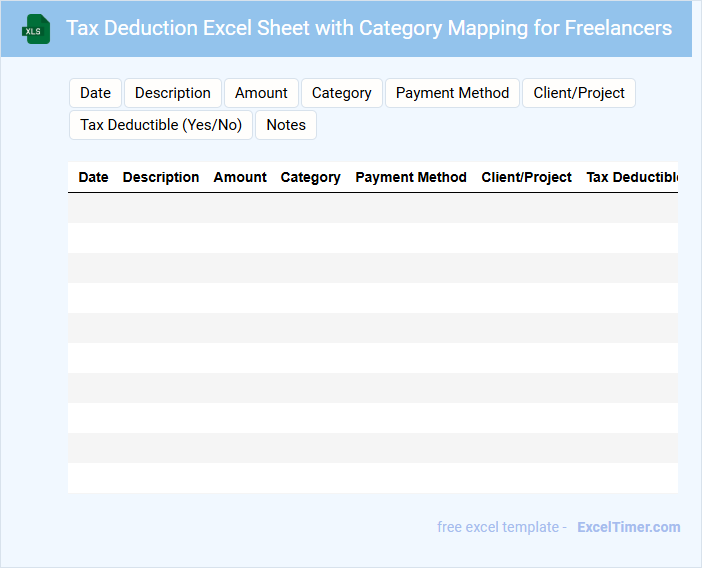

Tax Deduction Excel Sheet with Category Mapping for Freelancers

A Tax Deduction Excel Sheet for freelancers typically contains detailed records of income and categorized expenses to streamline tax filing. It helps track deductible expenses like office supplies, travel, and software subscriptions, thus maximizing tax savings. Including a clear category mapping ensures accurate classification and easier analysis during tax calculations.

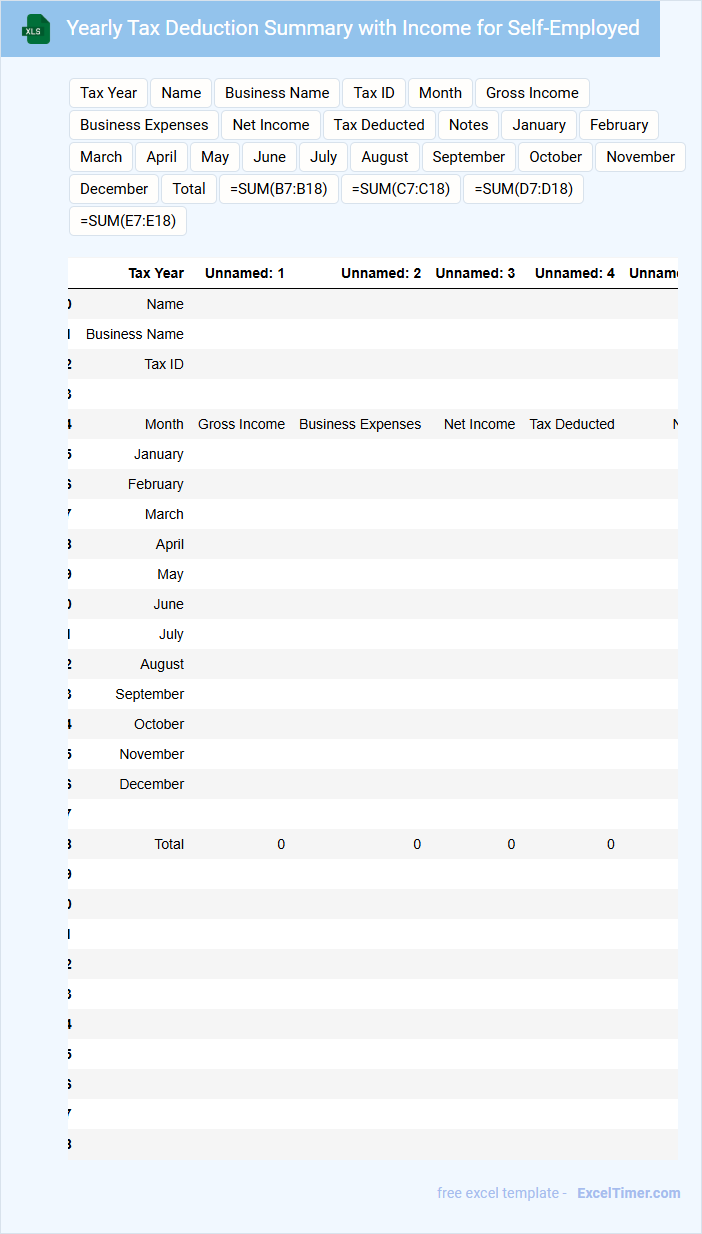

Yearly Tax Deduction Summary with Income for Self-Employed

What information is typically contained in a Yearly Tax Deduction Summary with Income for Self-Employed individuals? This document usually includes detailed records of all income earned and tax deductions claimed throughout the year. It summarizes earnings, expenses, and applicable deductions to help accurately calculate annual tax liability.

What important aspects should self-employed individuals consider when reviewing this summary? It is crucial to ensure all income sources are reported and legitimate business expenses are accurately documented. Keeping organized receipts and records throughout the year will simplify tax preparation and minimize errors or omissions.

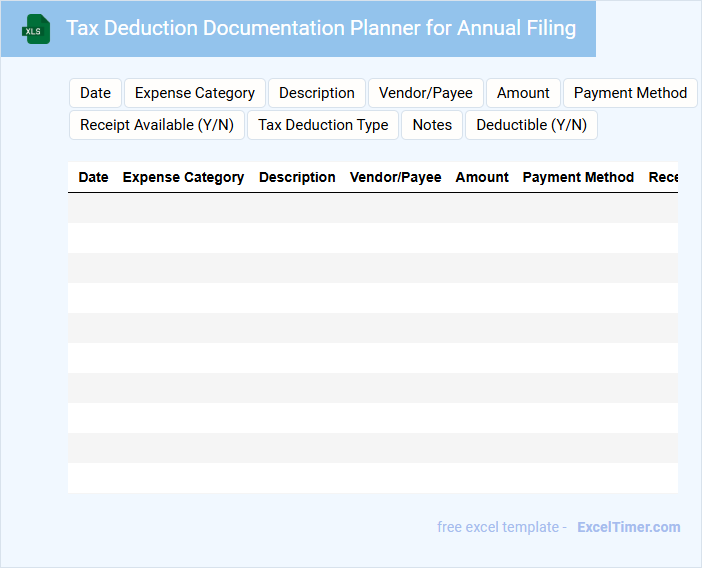

Tax Deduction Documentation Planner for Annual Filing

What information is typically included in a Tax Deduction Documentation Planner for Annual Filing? This document usually contains detailed records of all possible deductions such as receipts, invoices, and expense reports related to income, education, or medical costs. It helps organize and verify deductible expenses to maximize tax savings during the filing process.

Why is it important to keep thorough and accurate documentation for tax deductions? Maintaining precise records ensures compliance with tax regulations and supports claims in case of an audit. It is crucial to regularly update and categorize documents to avoid missing out on eligible deductions and to facilitate smooth filing.

What are the key columns required to track deductible expenses throughout the year in your Annually Tax Deduction Planner for self-employed individuals?

Key columns in an Annual Tax Deduction Planner for self-employed individuals include Date, Expense Category, Description, Amount, Payment Method, Vendor, Receipt Reference, and Tax Deductibility Status. Tracking these details ensures accurate documentation and maximizes eligible deductions for tax reporting. Including Project or Client Name as a column helps allocate expenses correctly to specific income sources.

How can you structure your Excel document to categorize and summarize annual income and expenses for accurate tax reporting?

Structure your Excel document with separate sheets for Income, Expenses, and Summary to clearly categorize data. Use tables with columns for date, description, category, and amount to organize entries by source and type. Incorporate formulas like SUMIFS and pivot tables to summarize annual totals, ensuring accurate tax deduction calculations for self-employed individuals.

What formulas or functions should be included to automatically calculate total deductions and taxable income?

Your Annually Tax Deduction Planner for Self-Employed should include the SUM function to calculate total deductions by adding all eligible expense categories. Use the formula =SUM(deductions_range) to aggregate expenses, ensuring accuracy in deduction totals. To determine taxable income, subtract total deductions from gross income with the formula =gross_income_cell - total_deductions_cell, providing an automatic update of your taxable income.

How can you include reminders for quarterly estimated tax payments within your annual tax deduction planner?

Include quarterly estimated tax payment reminders by setting specific dates aligned with IRS deadlines in your annual tax deduction planner. Use color-coded alerts or flags in your Excel sheet to highlight each payment due date clearly. This approach ensures you track and manage your self-employment tax obligations efficiently throughout the year.

What methods can you use in Excel to document and highlight deductible business expenses versus non-deductible expenses?

Use Excel tables to categorize expenses with columns for date, description, amount, and status (deductible or non-deductible). Apply conditional formatting rules to highlight deductible business expenses in green and non-deductible ones in red for quick visual differentiation. Implement data validation drop-down lists to ensure consistent labeling of expenses and leverage PivotTables to summarize total deductible amounts annually for tax planning.